|

시장보고서

상품코드

1433013

세계 창고용 훈증제 시장 : 점유율 분석, 산업 동향과 통계, 성장 예측(2024년-2029년)Warehouse Fumigants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

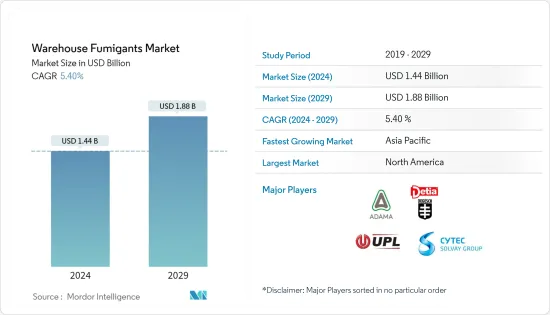

창고용 훈증제 시장 규모는 2024 년에 14 억 4,000만 달러로 추정되고, 2029년까지는 18 억 8,000만 달러에 달할 것으로 예측되며, 예측 기간 동안 복합 연간 성장률(CAGR) 5.40%로 성장할 전망입니다.

2018년 북미는 조사 대상 시장의 가장 규모가 큰 지역 부문이며 세계 시장의 약 33.8%의 점유율을 차지했습니다. 유형별로는 포스핀 기반 훈증제 제품 부문이 2018년에 26.3%의 최대 시장 점유율을 차지하고 예측 기간 동안도 가장 급성장하는 부문인 것을 계속할 것으로 예측되고 있습니다.

아시아태평양은 창고용 훈증제 시장에서 아직 최대의 잠재력을 발휘하지 않은 지역으로 여겨지고 있습니다. 이 시장을 견인하고 있는 것은 이 분야에서의 급속한 기술 진보, 포스트하베스트 로스에 대한 우려의 높아짐, 수확량 증가로 이어진 선진적 농법의 전환 등, 몇가지 요인입니다. 식물에 훈증제를 도입하면 질병을 뿌리에서 멀리하고 더 나은 수율을 창출하는 데 도움이 됩니다.

창고용 훈증제 시장 동향

해충 방제의 요구 증가

해충 제거 산업에서 곡물의 안전한 저장과 유통에 대한 가장 큰 자연 위협은 곤충의 침입입니다. 그러나 해충 방제에는 구조물이나 창고의 훈증에 비해 훈증과 같은 도구가 효과적이며 더욱 효과적입니다. 기온변화 등 기후 변화로 인해 곤충 개체수가 향후 증가하고 훈증제 사용에 대한 의존도가 높아질 것으로 예상됩니다. 일용품과 수출 자재의 해충을 없애기 위해 훈증은 일반적인 방법 중 하나이며 신흥 국가 전체에서 널리 채택됩니다. 세계적으로 포스핀과 메틸 브로마이드의 두 가지가 일반적인 훈증제이며 저장 제품을 보호하는 데 사용됩니다.

북미가 세계 시장을 독점

북미는 2018년에 33.8%의 점유율로 세계 창고용 훈증제 소비에 크게 공헌하고 있으며, 미국과 캐나다가 지역 시장의 약 80%를 차지하고 있습니다. 북미는 농업용 훈증제의 주요 시장으로, 미국과 캐나다의 주요 국가에서는 250개 이상의 허가 제품이 판매되고 있습니다. 이 지역에서 훈증제를 창고와 토양 모두에 사용하는 주요 품목은 옥수수, 쌀, 보리, 감자, 토마토, 밀, 딸기, 양배추 등입니다. 쿠바, 도미니카 공화국, 코스타리카, 자메이카 등 수출과 저장 능력이 매우 낮기 때문에 창고용 훈증제 사용에 관한 규제 금지 또는 엄격한 규제가 발효될 때까지 성장률과 시장 점유율은 일정하게 유지될 것으로 예상됩니다.

창고용 훈증제 산업 개요

2016년 이후 세계 창고용 훈증제 시장은 세분화된 형태가 되어 왔으며, 이 과정은 앞으로도 계속될 것으로 보입니다. 대기업이 채용한 전략 중 인수, 제휴, 확대가 점유율의 절반 이상을 차지하고 있습니다. 이러한 활발한 M&A 활동의 배경에 있는 주된 이유는 시장을 위해 기술적으로 선진적이고 사용하기 쉬운 훈증제를 개발하기 위해 양사의 신기술을 연계시키는 것입니다. 주요 인수 및 산업 제휴는 시장 침투와 포지셔닝을 깊게 하기 위한 전방 및 후방 통합을 목적으로 합니다.

기타 혜택:

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트,지원

목차

제1장 서론

- 조사의 성과

- 조사의 전제

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 성장 촉진요인

- 시장 성장 억제요인

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

시장 세분화

- 유형

- 브롬화메틸

- 불화 설프릴

- 포스핀

- 인산마그네슘

- 인화 알루미늄

- 기타

- 용도

- 상품 저장 보호

- 형상

- 고체

- 액체

- 가스

- 지역

- 북미

- 미국

- 캐나다

- 멕시코

- 기타 북미

- 유럽

- 독일

- 영국

- 프랑스

- 러시아

- 스페인

- 네덜란드

- 폴란드

- 이탈리아

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 기타 아시아태평양

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 아프리카

- 남아프리카

- 기타 아프리카

- 북미

제6장 경쟁 구도

- 가장 채용된 전략

- 시장 점유율 분석

- 기업 프로파일

- ADAMA Agricultural Solutions Ltd

- UPL Group

- Cytec Solvay Group

- Degesch America Inc.

- Douglas Products and Packaging Products LLC

- BASF SE

- Corteva Agriscience

- Reddick Fumigants, LLC

- Ikeda Kogyo Co., Ltd.

- Industrial Fumigation Company LLC

- Lanxess

- Nippon Chemical Industrial Co. Ltd

- Vietnam Fumigation Joint Stock Company

- Fumigation Services Pvt. Ltd

제7장 시장 기회와 앞으로의 동향

BJH 24.03.05The Warehouse Fumigants Market size is estimated at USD 1.44 billion in 2024, and is expected to reach USD 1.88 billion by 2029, growing at a CAGR of 5.40% during the forecast period (2024-2029).

In 2018, North America was the largest geographical segment of the market studied and accounted for a share of around 33.8% of the global market.By type, the phosphine-based fumigant product segment had the largest market share of 26.3% in 2018 and is expected to remain the fastest-growing segment during the forecast period.

Asia-Pacific has been identified as the region, which is yet to reach its maximum potential in the warehouse fumigant market. The market is driven by several factors, like rapid technological advancement in the sector, growing concerns over the post-harvest loss, and the shift in advance farming practices that led to increased yield. The introduction of fumigants to plants helps them keep the diseases away from their roots and to produce a better yield.

Warehouse Fumigants Market Trends

Increased Need for Pest Control

The largest natural threat to the safe storage and distribution of grains is insect infestation in the pest control industry. However, tools like fumigation are more effective in controlling pest infestations and are more effective, as compared to structural and warehouse fumigation. It is anticipated that due to climate changes, like an increase in temperature, the insect population is going to increase in the future, leading to increased dependence on the usage of fumigants. In order to control insects in commodities and export materials, fumigation is one of the general methods, which is adopted widely across emerging countries. Globally, phosphine and methyl bromide are the two common fumigants, which are used for stored product protection.

North America Dominates the Global Market

North America contributes a significant share of global warehouse fumigant consumption with a 33.8% share in 2018, with the United States and Canada accounting for around 80% of the regional market. North America is a major market for agriculture fumigants, with over 250 authorized products available in the main countries of the United States and Canada. The major commodities using fumigants for both warehouse and soil applications in the region are, corn, rice, barley, potato, tomato, wheat, strawberry, cabbage, etc. Due to very low export and storage capacities of countries like including Cuba, the Dominican Republic, Costa Rica, Jamaica and others, the growth rate, and market share are expected to remain constant until regulatory ban or stringent regulations on the usage of warehouse fumigants are brought into effect.

Warehouse Fumigants Industry Overview

The global warehouse fumigantsmarket has been getting into a fragmented shape since 2016, and this process is likely to continue in the future as well. Acquisitions, partnerships, and expansions account for more than half of the share among the strategies adopted by leading players. The main reason behind such intensive M&A activities, is the collaboration of new technology of the two companies, in order to develop technologically advanced and user-friendly fumigants for the market. The major acquisitions and industrial collaborations taking place are targeted toward forward and backward integration for deeper penetration and positioning in the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porter's Five Force Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Methyl Bromide

- 5.1.2 Sulfuryl Fluoride

- 5.1.3 Phosphine

- 5.1.4 Magnesium Phosphide

- 5.1.5 Aluminium Phosphide

- 5.1.6 Others

- 5.2 Application

- 5.2.1 Structural Fumigation

- 5.2.2 Commodity Storage Protection

- 5.3 Form

- 5.3.1 Solid

- 5.3.2 Liquid

- 5.3.3 Gas

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 US

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 UK

- 5.4.2.3 France

- 5.4.2.4 Russia

- 5.4.2.5 Spain

- 5.4.2.6 Netherlands

- 5.4.2.7 Poland

- 5.4.2.8 Italy

- 5.4.2.9 Rest of Europe

- 5.4.3 Asia Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Rest of Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 ADAMA Agricultural Solutions Ltd

- 6.3.2 UPL Group

- 6.3.3 Cytec Solvay Group

- 6.3.4 Degesch America Inc.

- 6.3.5 Douglas Products and Packaging Products LLC

- 6.3.6 BASF SE

- 6.3.7 Corteva Agriscience

- 6.3.8 Reddick Fumigants, LLC

- 6.3.9 Ikeda Kogyo Co., Ltd.

- 6.3.10 Industrial Fumigation Company LLC

- 6.3.11 Lanxess

- 6.3.12 Nippon Chemical Industrial Co. Ltd

- 6.3.13 Vietnam Fumigation Joint Stock Company

- 6.3.14 Fumigation Services Pvt. Ltd