|

시장보고서

상품코드

1433793

세계 하이엔드 가속도계 시장 : 시장 점유율 분석, 산업 동향,통계, 성장 예측(2024-2029년)High-end Accelerometer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

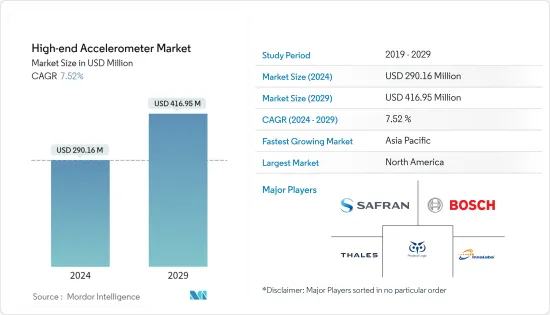

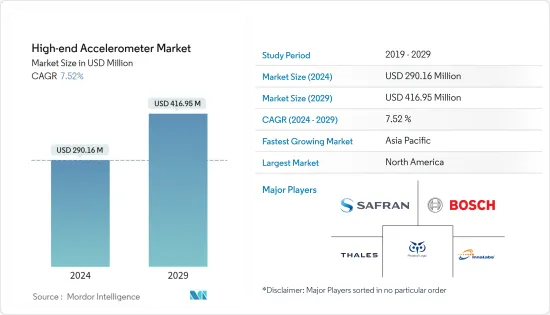

하이엔드 가속도계 시장 규모는 2024년에 2억 9,016만 달러로 추정되고, 2029년까지 4억 1,695만 달러에 이를 것으로 예측되며, 예측 기간(2024년-2029년) 동안 복합 연간 성장률(CAGR) 7.52%를 나타낼 전망입니다.

하이엔드 가속도계 시장은 COVID-19 팬데믹의 초기 단계에서 공급망의 어려움을 목격했습니다. 2020년 상반기에는 일부 업계 수요도 감소했습니다. 자동차와 제조 등의 산업은 큰 영향을 받았습니다. 그러나 COVID-19 팬데믹은 하이엔드 가속도계를 비롯한 많은 새로운 용도을 위한 MEMS 센서의 범위를 확대했습니다.

주요 하이라이트

- MEMS 기술 채택 증가는 성능 지표를 희생하지 않고 디바이스의 크기와 전력 소모를 스케일링함으로써 하이엔드 가속도계의 용도 기반을 확장하는 데에도 중요한 역할을 합니다.

- 하이엔드 가속도계는 고속 철도 및 자율 주행 차량의 내비게이션 시스템에서도 사용되고 있습니다. 자동차의 강제적인 성능을 평가하기 위한 충격,진동 시험에 널리 사용되고 있습니다.

- 자동차 용도용 하이엔드 가속도계는 산업 등급 용도보다 중요한 바이어스 안정 범위를 갖추고 있으며 작동 범위는 대상 최종 용도에 따라 다릅니다. 예를 들어, 충돌 회피 시스템의 경우 작동 범위는 최대 40g이 될 수 있습니다.

- 절단 및 밀링과 같은 하이 엔드 산업 응용 분야의 자동 기계의 고속 작동 중에 진동 레벨이 증가하면 중요한 재료가 손상되어 정확도가 떨어질 것으로 예상됩니다. 이러한 경우, 보다 정교한 기계 제어를 실현하기 위해서는 더 높은 안정성이 필요합니다. 그러므로, 이러한 용도는 하이엔드 가속도계를 크게 채택합니다.

하이엔드 가속도계 시장 동향

네비게이션 애플리케이션이 큰 점유율을 잡아

- 하이엔드 가속도계는 기존 GPS 엔진, 압력 센서, 우주 용도 플랫폼 안정화와의 긴밀한 결합 등 차세대 네비게이션 및 유도 시스템에 필수적입니다.

- 네비게이션 용도을 위한 MEMS 기반 관성 가속도 센서의 인센티브는 기존의 매크로 스케일 접근법을 대체하는 소형, 저비용, 경량, 고감도 대안을 실현할 것으로 기대합니다. 저비용, 고감도의 MEMS 가속도 센서의 제조에 성공함으로써, 현재의 기술로는 실현 불가능한, 소비자 유저와 군사 유저 모두에게 새로운 용도이 탄생했습니다.

- 예를 들어, 군사 및 소비자용 용도의 개인용 핸드헬드 네비게이터와 협곡, 시가지, 건물 및 동굴 내와 같은 GPS를 사용할 수 없는 네비게이션 용도에서는 하이엔드 가속도계가 사용됩니다.

- 최근 2019년 9월, 고급 MEMS 센서 솔루션을 설계 및 제조하는 Sensonor는 최신 관성 IMU, STIM318 IMU의 출시를 발표했습니다. 고정밀 전술 등급 IMU인 이 새로운 솔루션은 가속도 센서의 성능을 향상시키고 방어 및 상업 시장에서 까다로운 유도 및 내비게이션 용도을 지원하도록 설계되었습니다. 또한, STIM318은 광섬유 자이로(FOG)를 경쟁적으로 대체함으로써 STIM300(Sensonor의 IMU)을 이미 사용하는 용도 및 기타 많은 용도에 추가 기능을 제공할 수 있습니다.

북미가 가장 큰 점유율을 차지

- 북미에서는 이 지역의 기업들이 고도로 혁신적인 가속도 센서 도입을 위해 투자를 하고 있으며, 새로운 고성능 가속도 센서의 개발이 증가하고 있습니다. 미국 국방부의 고성능 장비 구매에 대한 지출 증가는 이 나라의 하이엔드 가속도계의 성장을 가속하는 주요 요인이 되고 있습니다.

- 미국은 세계 최대의 국방 예산을 가지고 있습니다. 이에 따라, 이 나라는 레이저 유도 폭탄이나 순항 미사일 등의 정밀 유도 무기(PGM)에도 주력하고 있으며, 이들은 광범위한 감기 피해를 회피하면서 높은 정밀도를 제공하는 미국군의 선택 무기가 되고 있다 합니다. 이러한 용도는 GPS 없이 장시간 유도를 위한 전술 IMU를 개선하기 위해 고성능, 컴팩트한 폼 팩터, 내구성이 높은 가속도 센서가 필요합니다.

- 미군은 Northrop Grumman이 개발한 항행 등급 관성 측정 장비를 사용합니다. 이 소형 유닛은 MEMS 기술을 기반으로 하며, 가속도와 각도 운동을 감지하여 내비게이션을 가능하게 하며 차량 제어 시스템이 유도를 위해 사용하는 데이터 출력을 제공합니다.

하이엔드 가속도계 산업 개요

하이엔드 가속도계 시장은 여러 대형 기업으로 구성되어 있으며 시장 점유율 관점에서 볼 때 현재 시장을 독점하고 있는 대기업은 거의 없습니다. 시장에서 탁월한 점유율을 가진 이러한 선도 기업들은 해외로 고객 기반을 확대하는 데 주력하고 있습니다. 이러한 기업들은 시장 점유율을 확대하고 수익성을 높이기 위해 전략적 협력 이니셔티브를 활용합니다.

- 2020년 12월 - TDK Corporation은 안전 이외의 자동차 용도을 위한 InvenSense IAM-20680HP 고성능 자동차 모놀리식 6축 MotionTracking 센서 플랫폼을 발표했습니다. 여기에는 IAM-20680HP IMU MEMS 센서와 DK-20680HP 개발자 키트가 포함됩니다. InvenSense의 IAM-20680HP는 3축 자이로스코프와 3축 가속도 센서를 얇은 3 x 3 x 0.75mm(16핀 LGA) 패키지로 결합하여 AEC-Q100 Grade 2를 기반으로 자동차 인증을 받았습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 업계의 매력도 - Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자/소비자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

- 산업 밸류체인 분석

- 시장 성장 촉진요인

- MEMS 기술 채용 확대

- 방위 및 항공우주 분야로의 성장의 경사

- 네비게이션 시스템의 기술 진보

- 시장 성장 억제요인

- 운영의 복잡성과 유지 보수 비용의 높이

- COVID-19가 시장에 미치는 영향의 평가

제5장 시장 세분화

- 용도별

- 전술 용도

- 네비게이션 용도

- 산업용도

- 자동차 용도

- 지역별

- 북미

- 유럽

- 아시아태평양

- 세계 기타 지역

제6장 경쟁 구도

- 기업 프로파일

- Secret SA

- Safran Colibrys

- Physical Logic Ltd

- Innalabs Limited

- Sensonor AS

- Tronics Microsystems(EPCOS)

- Bosch GmbH

- Thales Group

- Analog Devices Inc.

- Honeywell International Inc.

- STMicroelectronics NV

- TE Connectivity Ltd

제7장 투자 분석

제8장 시장 기회와 앞으로의 동향

BJH 24.03.08The High-end Accelerometer Market size is estimated at USD 290.16 million in 2024, and is expected to reach USD 416.95 million by 2029, growing at a CAGR of 7.52% during the forecast period (2024-2029).

The high-end accelerometer market witnessed supply chain difficulties in the initial phase of the COVID-19 pandemic. The demand from some industries was also down during the first half of 2020. Industries like automotive and manufacturing were significantly affected. However, the COVID-19 pandemic has also expanded the scope of MEMS sensors, like high end accelerometers, for many new applications.

Key Highlights

- The increasing adoption of MEMS technology has also played a significant role in expanding the application base for high-end accelerometers by scaling down the size and power consumption of these devices, without compromising on the performance metrics.

- High-end accelerometers are also being increasingly used in navigation systems for high-speed trains and autonomous vehicles. These devices are widely used for performing shock and vibrational test for evaluating the performance of automobiles in duress.

- High-end accelerometers for automotive applications possess a bias stability range more significant than that of industrial grade applications, and the working range is dependent on the intended end-applications. For instance, the working range could be as high as 40g for crash avoidance systems.

- The increased vibration levels of automated machinery in high-end industrial applications during high-speed operations, such as cutting or milling, are expected to damage critical materials and reduce precision. Such cases require higher stability to have higher machine control. Thus, high-end accelerometers are being adopted significantly for these applications.

High-End Accelerometer Market Trends

Navigational Applications to Hold a Major Share

- High sensitivity accelerometers are crucial for the next generation navigation and guidance systems, including tight coupling to existing GPS engines, pressure sensors, and platform stabilization for space applications.

- The incentive for a MEMS-based inertial accelerometer for navigational applications is based upon the hopes of realizing a small, low cost, lightweight, and highly-sensitive alternative to existing macro-scale approaches. The successful fabrication of a low cost, high-sensitivity MEMS accelerometer results in new applications for both consumer and military users that aren't feasible with current technologies.

- For instance, personal handheld navigators for military and consumer applications, as well as GPS-denied navigation applications, such as in valleys, urban areas, and within buildings and caves, utilize high-end accelerometers.

- Recently, in September 2019, Sensonor, a designer and manufacturer of advanced MEMS sensor solutions, announced the launch of its latest inertial IMU - the STIM318 IMU. A high-accuracy tactical-grade IMU, the new solution is designed to offer increased accelerometer performance to support demanding guidance and navigation applications within the defense and commercial markets. Furthermore, the STIM318 can deliver additional capability to applications already using the STIM300 (Sensonor's IMU) and many other applications by competitively replacing the fiber-optic gyros (FOGs).

North America to Account for the Largest Share

- The North American region is witnessing growth in the development of new high-performance accelerometers, as companies in the region are investing toward introducing advanced and innovative accelerometers. The increased spending by the US defense department to acquire high performance equipment is the major factor driving growth of high-end accelerometers in the country.

- The United States has the world's largest defense budget. With this rise, the country also focusses on precision guided munitions (PGMs), such as laser-guided bombs and cruise missiles, that have become the weapons of choice for the US military, providing a high degree of accuracy, while avoiding widespread collateral damage. These applications demand high performance, compact form factor, ruggedized accelerometers to improve tactical IMUs for long-duration guidance without GPS.

- The US military uses a navigation-grade inertial measurement unit developed by Northrop Grumman. This miniaturized unit is based on MEMS technology to enable navigation by sensing acceleration and angular motion, and providing data outputs used by vehicle control systems for guidance.

High-End Accelerometer Industry Overview

The high-end accelerometer market consists of some major players, and in terms of market share, few of the major players currently dominate the market. These major players with prominent share in the market are focusing on expanding their customer base across foreign countries. These companies are leveraging on strategic collaborative initiatives to increase their market share and increase their profitability.

- December 2020 - TDK Corporation introduced the InvenSense IAM-20680HP high-performance automotive monolithic 6-axis MotionTracking sensor platform for non-safety relevant automotive applications, which includes the IAM-20680HP IMU MEMS sensor and the DK-20680HP developer kit. InvenSense's IAM-20680HP combines a 3-axis gyroscope and a 3-axis accelerometer in a thin 3 x 3 x 0.75mm (16-pin LGA) package and is automotive qualified based on AEC-Q100 Grade 2.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness- Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Market Drivers

- 4.4.1 Increasing Adoption of MEMS Technology

- 4.4.2 Inclination of Growth Toward Defense and Aerospace

- 4.4.3 Technological Advancements in Navigation Systems

- 4.5 Market Restraints

- 4.5.1 Operational Complexity Coupled With High Maintenance Costs

- 4.6 Assessment of Impact of Covid-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Application

- 5.1.1 Tactical Applications

- 5.1.2 Navigational Applications

- 5.1.3 Industrial Applications

- 5.1.4 Automotive Applications

- 5.2 Geography

- 5.2.1 North America

- 5.2.2 Europe

- 5.2.3 Asia Pacific

- 5.2.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Secret SA

- 6.1.2 Safran Colibrys

- 6.1.3 Physical Logic Ltd

- 6.1.4 Innalabs Limited

- 6.1.5 Sensonor AS

- 6.1.6 Tronics Microsystems (EPCOS)

- 6.1.7 Bosch GmbH

- 6.1.8 Thales Group

- 6.1.9 Analog Devices Inc.

- 6.1.10 Honeywell International Inc.

- 6.1.11 STMicroelectronics NV

- 6.1.12 TE Connectivity Ltd