|

시장보고서

상품코드

1434285

LED 농업 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2024-2029년)LED Farming - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

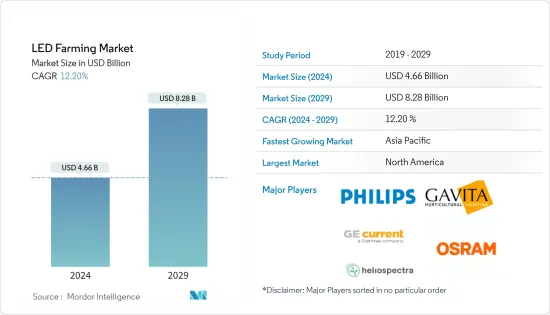

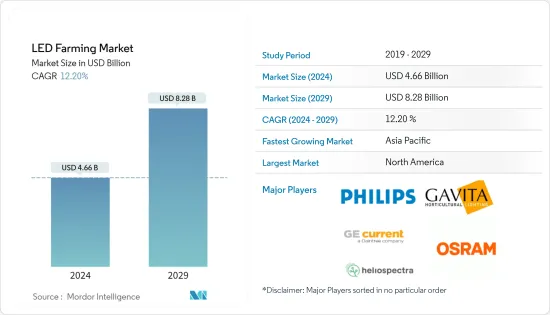

LED 농업 시장 규모는 2024년 46억 6,000만 달러로 추정되며, 2029년까지 82억 8,000만 달러에 달할 것으로 예상되며, 예측 기간(2024-2029년) 동안 12.20%의 CAGR로 성장할 것으로 예상됩니다.

주요 하이라이트

- 수직 농업의 관점에서 환경 제어 농업(CEA)의 출현은 LED 농업 시장에서 중요한 역할을했습니다. 신뢰성 향상, 에너지 효율성, 제품 다양화 및 장기적인 비용 절감은 수직 농장에서 LED 조명의 보급을 촉진하는 중요한 기능입니다.

- 2019년 세계 LED 농업 시장에서 북미가 가장 큰 시장 규모를 차지했고, 실내 농장과 상업용 온실이 그 뒤를 이었습니다. 뉴욕, 시카고, 밀워키, 토론토, 밴쿠버와 같은 도시에 도시 인구가 집중되면서 신선 식품에 대한 새로운 수요를 충족시키기 위해 컨테이너 운송 실내 농장 및 건물 기반 농장의 설립이 추진되고 있습니다.

- LED 농업 시장은 상당히 세분화되어 있으며, 기존 기업과 신생 기업이 시장에서 더 강력한 발판을 마련하기 위해 동등하게 경쟁하고 있습니다. 시장 주요 기업으로는 Koninklijke Philips NV, Gavita International BV, General Electric Company, OSRAM Opto Semiconductors GmbH, Heliospectra AB, Hortilux Schreder BV, Illumitex 등이 있습니다.

LED 농업 시장 동향

LED농업 시장을 선도하는 수직농법

수직농업의 시작과 함께 발광다이오드(LED) 기술의 혁명적인 트렌드가 시작되었습니다. 환경 관리 농업(CEA)에서는 저렴하고 효율적인 LED 조명이 농업 기술 시장을 주도하면서 대마와 같은 고가 작물만 재배하던 것에서 마이크로 그린, 채소 등 다양한 품종으로 빠르게 전환되고 있습니다. 미국 에너지부에 따르면 2010년부터 2014년까지 LED 가격은 90% 하락했고, 효율은 두 배로 증가했다고 합니다. 경험적 관찰에 따르면 LED는 고압 나트륨(HPS) 램프와 메탈 할라이드(MH) 램프보다 에너지 효율이 40%-70% 더 높아 수직형 농장에 더 적합하다는 것이 밝혀졌습니다. 유럽연구협회에 따르면, 2016년 전 세계 수직농업 총수입 중 조명이 35.8%(2억 6,800만 달러 상당)를 차지해 가장 큰 비중을 차지했습니다. 이는 LED 조명이 수직 농업에서 매우 중요한 역할을 하고 있다는 것을 의미하며, 앞으로 더 많은 기대를 모으고 있습니다. 예측 기간 동안 이 부문의 급속한 성장세를 확인할 수 있습니다.

북미 - LED 농업의 가장 큰 시장

2019년 세계 LED 농업 시장에서 가장 큰 점유율을 차지한 지역은 북미였습니다. 미국은 이 지역에서 창출된 총 수익의 가장 큰 부분을 차지했습니다. 미국에서는 농지 부족과 이에 따른 농작물 생산성 향상에 대한 필요성이 대두되고 있습니다. 미국 농무부(USDA)의 추산에 따르면, 2015년 앨라배마주와 조지아주에서 농업 목적으로 사용되는 토지 면적이 10만 에이커 감소했으며, 전체 토지 면적에서 농지가 차지하는 비율은 2015년의 44.58%에서 꾸준히 감소했습니다. 2016년 현재 미국의 상업적 규모의 수직 농장의 총 수는 20개에 육박하고 있으며, 농업 기술 분야에 대한 투자 증가로 인해 더욱 증가할 것으로 예상되며, 이는 LED 농업 시장을 촉진할 것으로 예상됩니다. 농업 조사국은 LED 조명을 사용하여 미국에서 토마토 생산량을 늘리고 다른 보호된 환경에서 생산 품질을 향상시키는 프로젝트도 진행하고 있습니다. 또한 "농장에서 식탁까지 신선하게"라는 소비 지향으로 인해 모듈 식 농장, Goodleaf Farms, Nova Scotia의 True Leaf, Ecoburn Gardens와 같은 캐나다의 여러 기업이 국내 식량 위기에 대처하기 위해 도시 농업으로 눈을 돌리고 있습니다. 때때로.

LED 농업 산업 개요

이 시장은 경쟁이 치열하며, 소수의 국제적으로 확립된 플레이어뿐만 아니라 일부 지역 플레이어도 농업용 LED 조명 신흥 시장에서 더 높은 시장 점유율을 차지하기 위해 경쟁하고 있습니다. 시장 주요 기업으로는 Koninklijke Philips NV, Gavita International BV, General Electric Company, OSRAM Opto Semiconductors GmbH, Heliospectra AB, Hortilux Schreder BV, Illumitex 등이 있습니다. 인수합병, 혁신, 제품 포트폴리오 다각화 및 투자는 종합적인 R&D 접근 방식으로 진화하는 시장에 진입하기 위해 이들 기업이 가장 많이 채택하는 전략 중 일부입니다. 예를 들어, 헬리오스펙트라(Heliospectra)는 2019년 5월 새로운 모듈형 LED 조명 시리즈 MITRA를 출시했습니다. 이 제품은 상업용 온실, 실내 및 수직 농장을 위해 최대 2.7mol/J의 고휘도 광 출력과 전기 효율을 제공하며, 2018년 오스람은 플루언스를 인수했습니다. Bioengineering은 텍사스에 본사를 둔 상품 작물 생산용 LED 조명 공급업체로, 유럽, 중동 및 아프리카에서의 확장을 강화하기 위해 노력하고 있습니다.

기타 혜택

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간 애널리스트 지원

목차

제1장 서론

- 조사 성과

- 조사 가정

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인과 시장 성장 억제요인 서론

- 시장 성장 촉진요인

- 시장 성장 억제요인

- 업계의 매력 - Porter's Five Forces 분석

- 신규 참여업체의 위협

- 구매자/소비자의 협상력

- 공급 기업의 교섭력

- 대체품의 위협

- 경쟁 기업 간의 경쟁 강도

제5장 시장 세분화

- 용도

- 수직농법

- 실내 농업

- 상업 온실

- 잔디 및 조경

- 파장

- 청색 파장

- 적색 파장

- 원적색 파장

- 작물 유형

- 과일 및 야채

- 화훼

- 기타

- 지역

- 북미

- 미국

- 캐나다

- 멕시코

- 기타 북미

- 유럽

- 독일

- 영국

- 프랑스

- 러시아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 기타 아시아태평양

- 남미

- 브라질

- 아르헨티나

- 남미외

- 중동 및 아프리카

- 아랍에미리트

- 남아프리카공화국

- 이집트

- 기타 중동 및 아프리카

- 북미

6장 : 경쟁 상황

- 가장 많이 채용되고 있는 전략

- 시장 점유율 분석

- 기업 개요

- Koninklijke Philips N.V.

- Gavita International B.V.

- General Electric Company

- OSRAM Opto Semiconductors GmbH

- Heliospectra AB

- Hortilux Schreder B.V.

- Illumitex

- LumiGrow

- Smart Grow Systems, Inc.

- Hubbell

제7장 시장 기회와 향후 동향

ksm 24.03.06The LED Farming Market size is estimated at USD 4.66 billion in 2024, and is expected to reach USD 8.28 billion by 2029, growing at a CAGR of 12.20% during the forecast period (2024-2029).

Key Highlights

- The advent of Controlled Environment Agriculture (CEA) in terms of vertical farming has had a significant role to play in the LED farming market. Increased reliability, energy-efficiency, diversified products, and reduced long-term costs are the key features driving the penetration of LED lighting in vertical farms.

- North America held the largest market size in the global LED farming market in 2019, followed by indoor farms and commercial greenhouses. The onset of the urban populationdwelling across cities, such as New York, Chicago, and Milwaukee, Toronto, and Vancouver, has propelled the establishment of indoor farms in shipping containerized form or building-based farms to cater to the emerging need for fresh grown foods.

- The market for LED farming is fairly fragmented with the well-established players and emerging companies equally vying for a stronger foothold in the market. Some of the key players in the market includeKoninklijke Philips N.V., Gavita International B.V., General Electric Company, OSRAM Opto Semiconductors GmbH, Heliospectra AB, Hortilux Schreder B.V., and Illumitex, among others.

LED Farming Market Trends

Vertical Farming to Lead the LED Farming Market

The onset of vertical farming has embarked on a revolutionary trend for the light-emitting diode (LED) technology. A rapid transition has been witnessed in Controlled Environment Agriculture (CEA) from only high-value crops such as cannabis to a wide-ranging variety such as microgreens and vegetables owing to the affordable and efficient LED lights thrusting the agricultural technology market. According to the US Department of Energy, the price of LEDs dropped by 90% whole their efficiency increased double-fold between the period 2010-2014. Empirical observations have revealed that LEDs are 40% to 70% more energy-efficient and suitable for vertical farms than high-pressure sodium (HPS) lights or metal halide (MH) lamps. According to the European Research Council, lighting contributed the largest share of 35.8% valued at USD 268.0 million to the total revenue of vertical farming, globally, in 2016. This signifies that LED lights have played a pivotal role in vertical farming and is further expected to witness a rapid growth in this segment during the forecast period.

North America - The Largest Market in LED Farming

North America accounted for the largest share in the global LED farming market in 2019. The United States contributed the largest portion of the total revenue generated in the region. The US has been surfaced with farmland scarcity and the subsequent need for higher productivity of crops. According to the United States Department of Agriculture (USDA) estimates, the amount of land used for agricultural purposes fell by 100,000 acres in Alabama and Georgia in 2015 while the percentage of agricultural land in the total land area fell steadily from 44.58% in 2015 to 44.36% in 2017. As of 2016, the total number of commercial-scale vertical farms in the US approached 20 and is further expected to rise with increased investment in the agricultural technology sector, thus, giving a boost to the LED farming market. The Agricultural Research Service has also undertaken a project to increase tomato production in the US and the quality of production in other protected environments using LED lights. Moreover, a "fresh-from-farm-to-table" consumption preference has encouraged several Canadian players such as Modular Farms, Goodleaf Farms, Nova Scotia's TruLeaf, and Ecobain Gardens, to turn to urban agriculture to answer food shocks in the country from time to time.

LED Farming Industry Overview

The market is highlycompetitive witha few internationally established players as well as several regional players vying for a higher market share in the emerging market for LED lights in farming. The key players in the market include Koninklijke Philips N.V., Gavita International B.V., General Electric Company, OSRAM Opto Semiconductors GmbH, Heliospectra AB, Hortilux Schreder B.V., and Illumitex, among others. Mergers and acquisitions, innovation, diversification of product portfolios, and investments are some of the most adopted strategies of these players for penetrating the evolving market with an all-encompassing Research & Development approach. For instance, Heliospectra launched thenew modular LED lighting series, MITRA,in May 2019, which provides high-intensity light output and electrical efficacy of up to 2.7 μmol/J forcommercial greenhouses, indoor, and vertical farms.In 2018, OSRAM acquired Fluence Bioengineering, a Texas-based leading provider of LED lighting for commercial crop production, in a bid to enhance its outreach in Europe, the Middle East, and Africa regions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.4 Market Restraints

- 4.5 Industry Attractiveness - Porter's Five Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Vertical farming

- 5.1.2 Indoor Farming

- 5.1.3 Commercial Greenhouse

- 5.1.4 Turf and Landscaping

- 5.2 Wavelength

- 5.2.1 Blue Wavelength

- 5.2.2 Red Wavelength

- 5.2.3 Far Red Wavelength

- 5.3 Crop Type

- 5.3.1 Fruits & Vegetables

- 5.3.2 Herbs & Microgreens

- 5.3.3 Flowers & Ornamentals

- 5.3.4 Other Crop Types

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 US

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 UK

- 5.4.2.3 France

- 5.4.2.4 Russia

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 UAE

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 South Africa

- 5.4.5.4 Egypt

- 5.4.5.5 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Koninklijke Philips N.V.

- 6.3.2 Gavita International B.V.

- 6.3.3 General Electric Company

- 6.3.4 OSRAM Opto Semiconductors GmbH

- 6.3.5 Heliospectra AB

- 6.3.6 Hortilux Schreder B.V.

- 6.3.7 Illumitex

- 6.3.8 LumiGrow

- 6.3.9 Smart Grow Systems, Inc.

- 6.3.10 Hubbell