|

시장보고서

상품코드

1434288

금속 임플란트 및 의료용 합금 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2024-2029년)Metal Implants and Medical Alloys - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

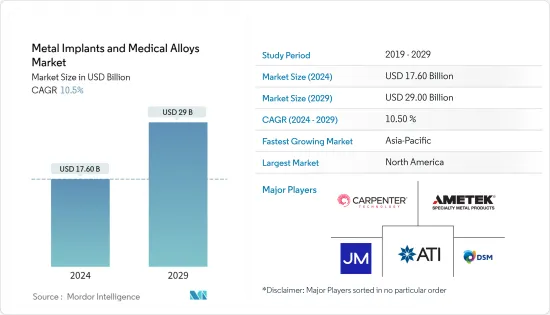

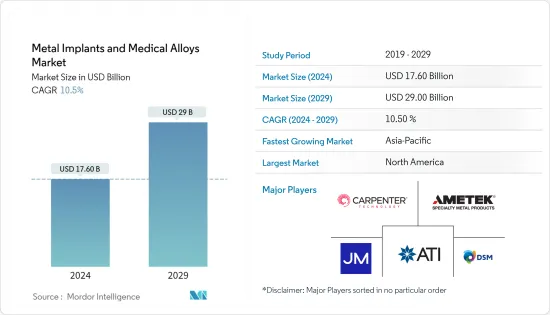

금속 임플란트 및 의료용 합금 시장 규모는 2024년 176억 달러로 추정되며, 2029년까지 290억 달러에 달할 것으로 예상되며, 예측 기간(2024-2029년) 동안 10.5%의 CAGR로 성장할 것으로 예상됩니다.

신종 코로나바이러스 감염증(COVID-19) 팬데믹의 출현은 금속 임플란트 시장의 성장에 영향을 미쳤으며, 헬스케어 산업은 여전히 공급망에 큰 혼란을 겪고 있습니다. 그 결과 여러 국가에서 여전히 의료 장비가 크게 부족합니다. 예를 들어, 2022년 4월 International Dental Journal에 게재된 연구에 따르면, 전염병 기간 동안 외래 환자 수가 감소하고 응급 환자 비율이 증가했다고 합니다.

또한 2021년 5월 영국 외과 저널(British Journal of Surgery)에 게재된 연구에 따르면, 신종 코로나바이러스 감염증(COVID-19)으로 인한 12주간의 대규모 병원 서비스 중단을 기준으로 2020년까지 전 세계적으로 약 2,840만 건의 대기 수술이 취소되거나 연기될 것으로 예상했습니다. 취소 또는 연기될 예정입니다. 신종 코로나바이러스 감염증(COVID-19) 팬데믹 상황에서 수술 및 외래 서비스 감소는 시장 성장을 저해했습니다. 그러나 제한이 해제된 이후 업계는 순조로운 회복세를 보이고 있습니다. 지난 2년간 시장 회복은 정형외과 질환의 높은 유병률, 신제품 출시, 금속 임플란트 및 의료용 합금에 대한 수요 증가에 의해 주도되었습니다.

골관절 질환의 유병률 증가와 노인 인구의 증가는 금속 임플란트 및 의료용 합금 시장의 성장을 촉진하고 있습니다. 예를 들어, 2021년 5월 류마톨로지 인터내셔널(Rheumatology International)지에 발표된 연구에 따르면, 1980년부터 2019년까지 전 세계 인구 10만 명당 류마티스 관절염 환자 수는 460명이며, 2021년에는 60세 이상 인구가 전 세계 인구의 20% 이상을 차지할 것으로 예상됩니다. 차지하게 될 것입니다. 2050년에는 골관절염 환자 수가 1억 3,000만 명에 달할 것으로 예상됩니다. 관절염의 유병률 증가와 관절염 증상으로 인한 부담 증가로 인해 금속 임플란트 및 의료용 합금에 대한 요구 사항이 증가하여 시장 성장을 촉진할 것으로 예상됩니다.

또한, 금속 임플란트 기술 발전의 증가는 시장 성장을 뒷받침할 것으로 예상됩니다. 예를 들어, 2022년 3월, 스트라이커는 유타에 본사를 둔 Total Joint Orthopedics Inc.(TJO)에서 새로운 임플란트 소재인 Aurum Technology를 사용한 Classic Knee 임플란트를 발표했습니다. 혁신적인 임플란트 코팅 방법인 Aurum은 미국 정형외과학회(AAOS)에서 정형외과 커뮤니티에 공개되었습니다. 따라서, 위의 모든 요인들이 숲 기간 동안 시장 성장을 촉진할 것으로 예상됩니다. 그러나 임플란트의 높은 비용과 규제 문제로 인해 산림 기간 동안 시장 성장을 억제 할 수 있습니다.

금속 임플란트 및 의료용 합금 시장 동향

치과 분야는 금속 임플란트 및 의료용 합금 시장에서 주요 시장 점유율을 차지할 것으로 예상

치과 임플란트는 턱뼈에 외과 적으로 이식 할 수있는 인공 치근입니다. 치과용 임플란트는 일반적으로 지르코늄과 티타늄으로 만들어진 두 가지 중요한 구성요소 인 픽스처와 어 버트먼트의 두 가지 주요 구성요소로 구성됩니다. 국내 치과 문제의 부담 증가와 노인 인구의 증가는 이 분야의 성장을 촉진하고 있습니다. 2022년 8월 국제 치과 저널에 게재된 연구에 따르면 중국 장쑤성에서는 충치와 치주 질환이 흔하며 구강 질환은 여전히 중국 지역 주민들에게 큰 문제가 되고 있습니다. 이 나라에서 치과 질환의 유병률이 높기 때문에 조사 기간 동안 치과 임플란트에 대한 수요가 증가할 것으로 예상됩니다.

또한, 노인 인구는 치과 질환에 걸리기 쉽기 때문에 이 부문의 성장에 기여할 것으로 보입니다. 2022년 세계 인구 추계에 따르면 2022년 11월 15일 세계 인구는 80억 명을 넘어설 것으로 예상됩니다. 유엔의 최신 예측에 따르면 세계 인구는 2030년 85억 명, 2050년 97억 명, 2100년 104억 명에 달할 것으로 예상됩니다. 따라서 노인 인구는 치과 질환의 영향을 크게 받고 있으며, 이는 부문의 성장을 촉진하고 있습니다.

또한, 주요 시장 기업들의 제품 출시가 이 분야의 성장을 촉진할 것으로 예상됩니다. 예를 들어, 2022년 6월 ZimVie Inc.는 FDA 승인을 받은 새로운 인코딩 응급 치유 어버트먼트가 장착된 T3 PRO 테이퍼 임플란트(T3 PRO tapered implant)를 미국에서 사용할 수 있다고 발표했습니다. T3 PRO는 ZimVie의 치과용 임플란트 제품군의 최신 멤버이며 T3 테이퍼 임플란트의 입증된 솔루션을 기반으로 제작되었습니다. 따라서 위의 모든 요인이 부문의 성장을 촉진할 것으로 예상됩니다.

북미는 시장에서 중요한 점유율을 차지할 것으로 예상되며, 예측 기간 동안에도 비슷한 점유율을 차지할 것으로 예상

북미는 노인 인구의 증가와 만성 질환의 유병률 증가, 주요 시장 기업의 제품 출시로 인해 세계 금속 임플란트 및 의료용 합금 시장에서 큰 시장 점유율을 차지할 것으로 예상됩니다.

질병관리본부(CDC)가 지난 10월 발표한 자료에 따르면, 2013년부터 2015년까지 5,850만 명이 관절염을 앓고 있으며, 2040년에는 18세 이상 성인 인구의 25.9%인 7,840만 명이 관절염을 앓을 것으로 예상하고 있습니다. 예상 성인 인구의 총합이 이 질환으로 진단될 가능성이 있습니다. 또한 2021년에 발간된 미국 건강 순위 고급 보고서에 따르면, 미국에 거주하는 노인의 수가 매우 많고 증가하고 있습니다. 2050년까지 미국 내 65세 이상 성인 인구는 8,570만 명에 달할 것으로 예상됩니다. 이러한 질병의 높은 유병률과 고령화로 인해 금속 임플란트의 채택이 증가하여 시장 성장을 촉진 할 수 있습니다.

연구 개발 활동의 성장은이 지역의 시장 성장을 지원할 수 있습니다. 예를 들어, 2021년 12월 CHU de Quebec-Universite Laval과 Investissement Quebec CRIQ는 캐나다 퀘벡 시티에 위치한 Investissement Quebec의 3D 해부학 재구성 연구소(LARA 3D)의 첫 번째 3D 프린팅 의료용 임플란트에 대한 캐나다 보건부의 승인을 발표했습니다. 3D 프린팅 의료용 임플란트에 대한 캐나다 보건부의 승인을 받았다고 밝혔습니다. 캐나다 기관이 캐나다에서 3D 프린팅 임플란트 의료기기 제조 허가를 받은 것은 이번이 처음입니다.

따라서 위의 요인으로 인해 조사 대상 시장은 이 지역의 조사 기간 동안 성장할 것으로 예상됩니다.

금속 임플란트 및 의료용 합금 산업 개요

금속 임플란트 및 의료용 합금 시장은 경쟁이 치열하고 여러 시장 플레이어로 구성되어 있습니다. 시장 점유율 측면에서 현재 소수의 대기업이 시장을 독점하고 있습니다. 현재 시장을 독점하고 있는 기업으로는 Carpenter Technology Corporation, Royal DSM, Johnson Matthey PLC, ATI Specialty Alloys & Components, Ametek Specialty Products, Aperam SA, QuesTek Innovations LLC, Fort Wayne Metals, Wright Medical Group, Zimmer Biomet Holdings Inc. 등이 있습니다.

기타 혜택

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간 애널리스트 지원

목차

제1장 서론

- 조사 가정과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인

- 고령자 인구 증가에 의한 정형외과 질환 유병률 증가

- 기술적으로 진보한 금속 임플란트 제품

- 시장 성장 억제요인

- 임플란트의 고비용

- 제품 인가 을 위한 규제 문제

- Porter's Five Forces 분석

- 신규 참여업체의 위협

- 구매자/소비자의 협상력

- 공급 기업의 교섭력

- 대체품의 위협

- 경쟁 기업 간의 경쟁 강도

제5장 시장 세분화

- 유형별

- 코발트 크롬

- 스테인리스강

- 티타늄

- 기타 유형

- 용도별

- 정형외과용

- 치과용

- 척추 고정

- 두개 안면

- 스텐트

- 기타 용도

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 기타 아시아태평양

- 중동 및 아프리카

- GCC

- 남아프리카공화국

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 경쟁 상황

- 기업 개요

- Carpenter Technology Corporation

- Royal DSM

- Johnson Matthey PLC

- ATI Specialty Alloys & Components

- Ametek Specialty Products

- Aperam SA

- QuesTek Innovations LLC

- G & S Titanium(Fort Wayne Metals)

- Stryker Medical Inc.(Wright Medical Group)

- Zimmer Biomet Holdings Inc.

- Karl Leibinger Medizintechnik(KLS Martin Group)

- Bioplate Inc

제7장 시장 기회와 향후 동향

ksm 24.03.06The Metal Implants and Medical Alloys Market size is estimated at USD 17.60 billion in 2024, and is expected to reach USD 29 billion by 2029, growing at a CAGR of 10.5% during the forecast period (2024-2029).

The emergence of the COVID-19 pandemic impacted the growth of the metal implants market, as the healthcare industry is still coping with the massive disruption in the supply chain. As a result, a massive shortage is still being experienced in medical devices in various countries. For instance, the study published International Dental Journal in April 2022 suggested that the number of outpatients decreased, and the proportion of emergency cases increased during the epidemic period.

Additionally, according to a study published in the British Journal of Surgery, in May 2021, based on 12 weeks of major hospital services disruption due to COVID-19, approximately 28.4 million elective surgeries worldwide will be canceled or postponed by 2020. Thus, the decline in surgical procedures and outpatient services hampered the market growth during the COVID-19 pandemic. However, since the restrictions were lifted, the industry has been recovering well. Over the last two years, the market recovery has been led by the high prevalence of orthopedic diseases, new product launches, and increased demand for metal implants and medical alloys.

The rising prevalence of degenerative joint diseases and the growing geriatric population are driving the growth of metal implants and the medical alloys market. For instance, according to the study published in Rheumatology International in May 2021, between 1980 and 2019, there were 460 cases of RA per 100,000 people worldwide, and people over the age of 60 will account for more than 20% of the world's population by 2050 which means the number of osteoarthritis sufferers will reach 130 million. The growing prevalence of arthritis and the increasing burden of arthritis conditions will increase the requirement for metal implants and medical alloys and hence are expected to boost the market growth.

Furthermore, growing technological advancement in metal implants is expected to support the growth of the market. For instance, in March 2022, Stryker presented a new implant material, the Klassic Knee implant with Aurum Technology, at Utah-based Total Joint Orthopedics Inc. (TJO). Aurum, a revolutionary implant coating method, is being unveiled to the orthopedic community at the American Academy of Orthopaedic Surgeons (AAOS). Thus, all the above-mentioned factors are expected to boost the market growth over the forest period. However, the high cost of the implant and regulatory issues may restrain the market growth over the forest period.

Metal Implants & Medical Alloys Market Trends

Dental Segment Expected to Hold a Major Market Share in the Metal Implants and Medical Alloys Market

Dental implants are artificial tooth roots that can be surgically implanted in the jawbone. Dental implants are made up of two key components: the fixture and the abutment, which are typically made of zirconium and titanium. The growing burden of dental problems in the country, as well as the growing senior population, are driving segment growth. According to the research study in International Dental Journal in August 2022, dental caries and periodontal disease were common in Jiangsu, China, and oral illnesses remained a major problem for local residents in China. As a result of the country's high prevalence of dental problems, the demand for dental implants is predicted to rise during the research period.

Additionally, the geriatric population is more prone to dental diseases, which is likely to contribute to the growth of the segment. According to the World Population Prospects 2022, on November 15, 2022, the world's population is expected to surpass 8 billion. According to the United Nations' most recent forecasts, the global population might reach 8.5 billion in 2030, 9.7 billion in 2050, and 10.4 billion in 2100. Thus, the geriatric population is highly affected by dental diseases, thereby boosting segment growth.

Furthermore, product launch by the key market players is expected to boost the segment growth. For instance, in June 2022, ZimVie Inc. announced the US availability of the new, FDA-cleared T3 PRO Tapered Implant with Encode Emergence Healing Abutment. The T3 PRO is the newest member of ZimVie's dental implant family, and it builds on the proven solutions of the T3 Tapered Implant. Thus, all the above-mentioned factors are expected to boost segment growth.

North America Expected to Hold a Significant Share in the Market and Expected to do Same in the Forecast Period

North America is expected to hold a major market share in the global metal implants and medical alloys market due to the increasing geriatric population and growing prevalence of chronic diseases and product launches by the key market players.

According to the Centers for Disease Control and Prevention (CDC) updated in October 2021, compared to the 58.5 million individuals with arthritis in 2013-2015, it is predicted that by 2040, 78.4 million adults aged 18 and older (or 25.9% of the anticipated total adult population) are likely to be diagnosed with the condition. Furthermore, according to America's Health Rankings Senior Report published in 2021, the number of older adults living in the United States is significant and growing; by 2050, it is anticipated that there will be 85.7 million adults in the country who are 65 or older. Such a high prevalence of this disease and the aging population are likely to increase the adoption of metal implants, thereby boosting market growth.

Growing research and development activity is likely to support the market growth in the region. For instance, in December 2021, CHU de Quebec-Universite Laval and Investissement Quebec CRIQ revealed Health Canada's clearance of the first 3D-printed medical implant by the 3D anatomical reconstruction laboratory (LARA 3D) at Investissement Quebec - CRIQ's facilities in Quebec City, Canada. This is the first time a Canadian organization has been granted permission to manufacture a 3D-printed implanted medical device in Canada.

Thus, due to the abovementioned factors, the studied market is expected to grow during the study period in the region.

Metal Implants & Medical Alloys Industry Overview

The metal implants and medical alloys market is competitive and consists of several market players. In terms of market share, a few major players are currently dominating the market. Some companies currently dominating the market are Carpenter Technology Corporation, Royal DSM, Johnson Matthey PLC, ATI Specialty Alloys & Components, Ametek Specialty Products, Aperam SA, QuesTek Innovations LLC, Fort Wayne Metals, Wright Medical Group, and Zimmer Biomet Holdings Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Elderly Population Increases the Prevalence of Orthopedic Disorders

- 4.2.2 Technologically Advanced Metal Implant Products

- 4.3 Market Restraints

- 4.3.1 High Cost of Implants

- 4.3.2 Regulatory Issues for the Approval of Products

- 4.4 Porter's Five Force Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD Million)

- 5.1 By Type

- 5.1.1 Cobalt Chrome

- 5.1.2 Stainless Steel

- 5.1.3 Titanium

- 5.1.4 Other Types

- 5.2 By Application

- 5.2.1 Orthopedic

- 5.2.2 Dental

- 5.2.3 Spinal Fusion

- 5.2.4 Craniofacial

- 5.2.5 Stent

- 5.2.6 Other Applications

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Carpenter Technology Corporation

- 6.1.2 Royal DSM

- 6.1.3 Johnson Matthey PLC

- 6.1.4 ATI Specialty Alloys & Components

- 6.1.5 Ametek Specialty Products

- 6.1.6 Aperam SA

- 6.1.7 QuesTek Innovations LLC

- 6.1.8 G & S Titanium (Fort Wayne Metals)

- 6.1.9 Stryker Medical Inc. (Wright Medical Group)

- 6.1.10 Zimmer Biomet Holdings Inc.

- 6.1.11 Karl Leibinger Medizintechnik (KLS Martin Group)

- 6.1.12 Bioplate Inc