|

시장보고서

상품코드

1851187

유황 비료 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Sulfur Fertilizer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

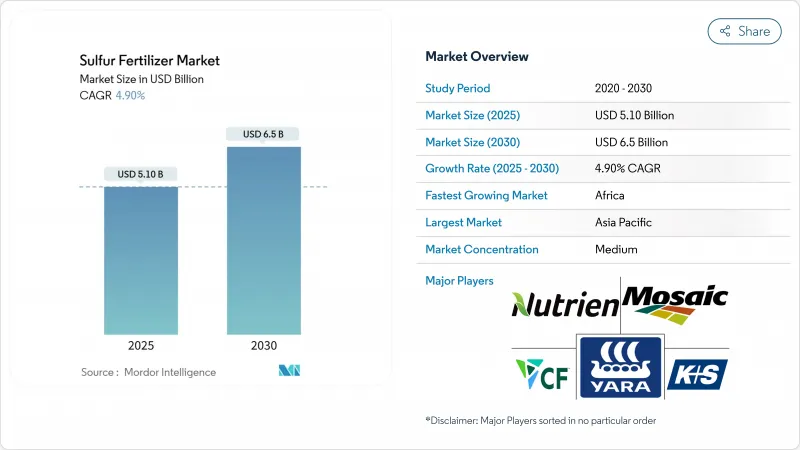

유황 비료 시장은 2025년에 51억 달러에 달하고, 2030년에는 65억 달러에 달할 것으로 예상되며, 예측 기간 동안 CAGR은 4.9%를 나타낼 전망입니다.

이는 대기 중의 황 침착량이 1990년대 이후 70% 이상 격감하여 토양이 고갈되어 작물이 황의 시용에 점점 반응하게 되었기 때문입니다. 아시아태평양은 중국의 연간 비료 사용량 4,890만 톤과 인도의 정밀 시비 프로그램 확대를 배경으로 소비를 선도하고 있습니다. 아프리카는 인프라 개선과 식량 안보 노력을 통해 균형 잡힌 영양소 도입이 가속화되었기 때문에 이 지역에서 가장 빠르게 성장하고 있습니다. 업계의 기세는 현재 비료 제조에 사용되는 전체 원소 유황의 60% 이상을 공급하고 있는 정유소의 탈황 스트림에 의해 더욱 지지되고 있지만, 정유 마진이 축소할 때마다 공급이 엄격해질 가능성이 있습니다.

세계의 유황 비료 시장 동향과 인사이트

토양의 유황 부족

토양 검사에 의하면 대기질 규제에 의해 황산염 에어로졸이 제거되었기 때문에 유황 수준은 지난 30년간 30-50% 떨어졌으며, 황은 질소, 인, 칼륨에 이어 네 번째로 수율을 제한하는 영양소가 되고 있습니다. 헥타르당 30-45킬로그램의 황을 공급받은 작물에서는 밀의 수율이 15-25% 증가하여 곡물 단백질도 증가했습니다. 유기물이 부족한 집약적 작물지역이 가장 피해를 입기 쉽고, 현재는 농가는 장소별 검사 키트에 의해 시즌 개시 전에 부족분을 파악할 수 있습니다. 이 기능은 잠재적인 영양 부족을 측정 가능한 수요로 전환하기 때문에 유황 비료 시장의 주요 원동력이 되었습니다. 현재 상업용 옥수수 농장의 수율 모니터는 잎의 황이 0.2% 미만이 되면 최대 18%의 수율 하락을 기록하고 있으며 대규모 경영에 있어 경제적인 위기임을 분명히 보여주고 있습니다. 기후 패턴이 강우 분포를 변경함에 따라 침출 손실은 잔류 황을 더욱 감소시키고 매년 보급이 현실적으로 필요합니다.

오일 작물의 제작 면적과 수율 증가

카놀라와 대두와 같은 오일 작물은 곡물보다 단위 질소당 2-3배의 황을 필요로 하기 때문에 세계의 작부 면적이 확대됨에 따라 비료 수요가 증가하고 있습니다. 미주리 대학의 농장 시험에서는 황안을 100파운드 투입하면 대두가 1에이커당 8.1부셸 증가하고, 투입 비용을 공제하면 1에이커당 80달러의 이익 증가가 된다고 보고되었습니다. 이 경제성은 성숙시장에서도 지속적인 도입을 촉진하고 황 생산량의 안정적인 풀스루를 강화합니다. 세계의 카놀라 제작 면적은 2030년까지 180만 헥타르 확대될 것으로 예측되고 있으며, 캐나다와 호주에서는 고유황 혼합물에 대한 수요가 높아지고 있습니다. 고단백질의 바이오 품종은 황의 흡인량도 많아 종자의 유전학과 비료 전략을 직접 연결하고 있습니다.

다 영양 특수 비료와의 경쟁

농부들은 여러 결핍증에 대응하는 단일 패스 혼합 비료를 선호하고 있으며, 유황 단체 수요를 줄일 수 있습니다. 공급업체는 유황을 보다 광범위한 양분 패키지에 통합함으로써 대응하고 있지만, 가격 경쟁과 처방의 복잡성은 소규모 생산자에게 장벽이 되고 있습니다. 주요 유통업체는 황을 포함한 미량 영양소 팩을 저렴하게 조합하여 판매하고 있으며, 황 단품의 판매는 감소하고 있습니다. 유황 비료 공급업체는 관련성을 유지하기 위해 턴키 농작물 영양 프로그램을 제공하는 공동 마케팅 파트너십을 찾고 있습니다. 이러한 변화는 유황 단체의 금리를 줄이고 중소기업의 통합을 촉진할 수 있습니다.

부문 분석

2024년에는 황안, 황가칼, 과인산단일비료 등의 황산비료가 세계 매출의 51%를 차지했습니다. 원소상 유황은 규모는 작지만 분석이 높기 때문에 운임이 저렴하고 산화가 제어되어 정밀 프로그램에 적합하기 때문에 CAGR 6.7%로 급성장하고 있습니다. 미분화 및 페이스트화 기술로 산화의 시간 지연이 단축되어 단기간의 작물에도 적용할 수 있게 되었습니다. 초기 성장을 위한 황산염과 서방형을 위한 단체 황을 결합한 분할 적용 전략은 유황 비료 시장에서 수요가 제로섬이 아니라 보완적임을 분명히 보여줍니다.

요소 유황의 동향은 농장 통과를 제한하기 위해 더 높은 양분 밀도를 필요로 하는 가변 속도 애플리케이터 및 원격 감지 맵의 보급으로 이어집니다. 유황 코팅 우레아와 유황 벤토나이트가 주류 블렌드가 됨에 따라 균일한 입자 크기와 예측 가능한 산화를 보장할 수 있는 생산자가 점유율을 확대하게 됩니다.

고체 제품은 2024년에 70%의 점유율을 유지했는데, 이는 효율적인 저장과 넓은 에이커에 걸친 전통적인 살포기와의 호환성에 의해 지원되었기 때문입니다. 처리량과 보존성이 중시되는 협동조합의 혼합 플랜트에서는 입상 및 프릴 형태가 주류를 차지하고 있습니다. 그러나 액체 유황은 고가치 원예에서 관개와 엽면 살포 프로그램의 강점을 살려 CAGR 7.2%를 나타낼 전망입니다..

티오황산암모늄(12-0-0-26S)은 액체 황의 대표격으로, 질소 용액이나 농약과의 탱크 혼합이 가능하므로, 싱글 패스로 효율을 올릴 수 있습니다. 생산자는 마이크로 관개에서의 균질성과 중요한 생식 단계에서 식물의 신속한 흡수를 높이 평가합니다. 벤더는 지역별로 터미널을 건설하여 운송 시간을 단축하고 있기 때문에 고형 비료와의 납품 비용 격차가 축소되어 유황 비료 시장 전체에서 대응 가능한 면적이 확대되어야 합니다.

지역 분석

2024년 유황 비료 시장은 아시아태평양이 37%의 점유율로 선도했습니다. 중국의 비료 집약도는 여전히 세계 표준을 상회하고 있으며, 과잉 질소를 억제하는 노력이 수율을 유지하면서 손실을 줄이는 균형 잡힌 NPK-S 요법의 채용에 박차를 가하고 있습니다. 인도에서는 정밀 살포기로의 이동과 토양 건전성 카드에 대한 국고 보조금이 황을 표준 관행으로 밀어 올리고 있습니다. 동남아시아 국가들은 팜유전과 벼의 이모작을 통해 수요를 높이고 있으며, 일본과 같은 선진국은 고가치 농산물을 위한 초저염화물 옵션을 모색하고 있습니다. 2030년까지의 CAGR 5.6%라는 지역 성장은 기후 변화를 배려한 농업 목표에 따른 정책에 의해 지원되고 있습니다.

아프리카는 CAGR 6.4%로 가장 빠르게 성장하는 지역입니다. 토양 조사에 따르면 사하라 이남의 많은 지역에서는 황이 부족하고 있으며, 정부는 현재 비료 보조금과 균형 잡힌 영양을 촉진하는 개선 보급 서비스를 결합하고 있습니다. 에티오피아에서는 GERD 후에 국내 복합 비료 공장이 건설되어 수입 의존도가 저하될 예정입니다. 남아프리카의 상업 농장에서는 알칼리성 토양 관리에 원소 유황의 혼합 비료를 이미 활용하고 있습니다. 유통면에서의 과제는 여전히 남아 있지만, 도너 지원에 의한 회랑 프로젝트와 민간조합 허브가 라스트원 마일의 개선을 목표로 유황 비료 시장 전망을 밝게 하고 있습니다.

북미에서는 CAGR이 4.1%로 안정되어 있으며, 미국은 매년 820만 톤의 회수 유황을 정유소에서 인산염과 황안 생산으로 돌리고 있습니다. 캐나다산 유황에 대한 최근의 관세조치에 의해 단기적으로는 수급이 박박하지만, 풍부한 국내 가스와 정유소 네트워크가 공급을 지지합니다. 정밀 농학, 커버 크롭 채택, 지속가능성 인증은 수요 증가를 촉진합니다. 유럽의 CAGR은 3.2%로, 엄격한 수질 규제와 농작물의 단백질 수준을 유지할 필요성의 균형이 잡혀 있으며, 방출 제어형 유황이 매력적입니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 토양 중의 유황 결핍

- 오일 씨앗의 제작 면적과 수율 증가

- 지속가능한 농업에 대한 정부의 인센티브

- 방출 제어형 유황 코팅 우레아의 채용

- 탈황 장치로부터의 회수 황의 이용 가능성 증가

- AI 기반 정밀 영양 응용 플랫폼

- 시장 성장 억제요인

- 다영양 특수 비료와의 경쟁

- 원소상 유황 원료 가격의 변동성

- 황산염의 지하수에의 용출에 의한 환경 위험

- 신흥 시장에서의 프릴드 엘리멘탈 설퍼의 유통 병목

- 규제 상황

- 기술의 전망

- Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업 간 경쟁 관계

제5장 시장 규모와 성장 예측

- 유형별

- 황산염 비료

- 황산암모늄

- 황산칼륨

- 황산칼슘(석고)

- 단일 과인산석회

- 원소 황

- 미분화 황

- 알갱이/정제 유황

- 미량 원소 황산염

- 황산아연

- 황산마그네슘

- 기타

- 기타(유황 코팅 요소, 유황 벤토나이트)

- 황산염 비료

- 형태별

- 고체

- 액체

- 용도별

- 토양 시비

- 비료관개

- 엽면 살포

- 제어 방출/코팅 과립

- 작물 유형별

- 곡물 및 잡곡

- 지방종자 및 콩류

- 과일 및 채소

- 잔디 및 관상식물

- 기타

- 유통 채널별

- 농장 직접 판매

- 소매 딜러

- 협동조합

- 온라인 플랫폼

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 기타 북미

- 유럽

- 독일

- 영국

- 프랑스

- 러시아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 기타 아시아태평양

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 중동

- 사우디아라비아

- 아랍에미리트(UAE)

- 기타 중동

- 아프리카

- 남아프리카

- 이집트

- 기타 아프리카

- 북미

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율 분석

- 기업 프로파일

- Nutrien Ltd.

- Yara International ASA

- The Mosaic Company

- KS AG

- Israel Chemicals Ltd.

- Haifa Chemicals Ltd.

- Nufarm Limited

- Koch Industries Inc.

- CF Industries Holdings Inc.

- OCP SA

- BASF SE

- Sinochem Holdings Corp. Ltd.

- Saudi Arabian Fertilizer Company(SAFCO)(Saudi Basic Industries Corporation(SABIC))

- Tiger-Sul Products LLC(Tessenderlo Group)

- TogliattiAzot PJSC(Uralchem Group)

제7장 시장 기회와 향후 전망

KTH 25.11.12The sulfur fertilizers market reached USD 5.1 billion in 2025 and is projected to climb to USD 6.5 billion by 2030, advancing at a 4.9% CAGR during the forecast period.

Gains stem from the sharp decline in atmospheric sulfur deposition, which has fallen more than 70% since the 1990s, leaving soils depleted and crops increasingly responsive to applied sulfur. The Asia-Pacific region leads consumption on the back of China's 48.9 million metric tons annual fertilizer use and India's expanding precision fertilization programs. Africa represents the fastest-growing regional opportunity as infrastructure upgrades and food-security initiatives accelerate balanced nutrient adoption. Industry momentum is further supported by refinery desulfurization streams that now provide more than 60% of all elemental sulfur used in fertilizer manufacturing, although supply can tighten whenever refining margins compress.

Global Sulfur Fertilizer Market Trends and Insights

Sulfur Deficiency in Soil

Soil tests indicate sulfur levels have fallen 30-50% during the past three decades as air-quality rules removed sulfate aerosols, making sulfur the fourth most yield-limiting nutrient after nitrogen, phosphorus, and potassium. Crops that receive 30-45 kilograms of sulfur per hectare show wheat yield gains of 15-25% together with higher grain protein. Intensively cropped regions with low organic matter are the most vulnerable, and site-specific test kits now allow farmers to map deficiencies before the season begins. This capability is a primary engine for the sulfur fertilizers market because it converts latent nutrient shortages into measurable demand. Yield monitors on commercial corn farms now record site yield drops of up to 18% when leaf sulfur falls below 0.2%, underscoring the economic stakes for large operations. As climate patterns shift rainfall distribution, leaching losses further lower residual sulfur, making annual supplementation a practical necessity.

Rising Oilseed Acreage and Yields

Oilseed crops such as canola and soybean require two to three times more sulfur per unit of nitrogen than cereals, which intensifies fertilizer demand as the global planted area expands. University field trials in Missouri report 8.1 bushel-per-acre soybean gains from 100 pounds of ammonium sulfate, yielding a USD 80 per-acre profit lift after input costs. The economics encourage continued adoption even in mature markets, reinforcing a stable pull-through on sulfur volumes. Global canola acreage is projected to expand by 1.8 million hectares by 2030, amplifying demand for high-sulfur blends in Canada and Australia. Biotech cultivars with higher protein ceilings also pull more sulfur, linking seed genetics directly to fertilizer strategy.

Competition from Multi-Nutrient Specialty Fertilizers

Farmers increasingly favor single-pass blends that address multiple deficiencies, which can dilute standalone demand for sulfur. Suppliers are responding by embedding sulfur into broader nutrient packages, but pricing competition and formulation complexity raise barriers for smaller producers. Large distributors bundle mix and match micronutrient packs that include sulfur at lower incremental cost, eroding standalone sales. To stay relevant, sulfur fertilizer suppliers are exploring co-marketing alliances that offer turnkey crop nutrition programs. Such shifts could compress standalone sulfur margins and push consolidation among smaller players.

Other drivers and restraints analyzed in the detailed report include:

- Government Incentives for Sustainable Agriculture

- Adoption of Controlled-Release Sulfur-Coated Urea

- Volatility in Elemental Sulfur Prices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024, sulfate fertilizers such as ammonium sulfate, potassium sulfate, and single superphosphate delivered 51% of global revenue, reflecting their immediate plant availability and ease of blending. Elemental sulfur, though smaller, is growing faster at a 6.7% CAGR as its higher analysis lowers freight costs and its controlled oxidation fits precision programs. Micronized and pastilled innovations shorten oxidation lag, extending applicability to short-season crops. Split-application strategies combine sulfate for early growth and elemental sulfur for sustained release, underscoring complementary rather than zero-sum demand within the sulfur fertilizers market.

The elemental trend plays into the wider adoption of variable-rate applicators and remote-sensing maps, which rely on higher nutrient density to limit field passes. As sulfur-coated urea and sulfur-bentonite enter mainstream blends, producers that can guarantee uniform particle size and predictable oxidation stand to gain share.

Solid products retained a 70% share in 2024, backed by efficient storage and compatibility with conventional spreaders across broad acres. Granulated and prilled formats dominate cooperative blending plants where throughput and shelf life matter. Yet liquid sulfur is advancing at a 7.2% CAGR on the strength of fertigation and foliar programs in high-value horticulture.

Ammonium thiosulfate (12-0-0-26S) typifies liquid momentum, allowing tank mixing with nitrogen solutions and pesticides for single-pass efficiency. Growers appreciate the uniformity in micro-irrigation as well as quicker plant uptake during critical reproductive stages. Vendors are building regional terminals to shorten hauls, which should reduce delivered cost gaps versus solids and widen addressable acreage across the sulfur fertilizers market.

The Sulfur Fertilizers Market Report is Segmented by Type (Sulfate Fertilizer, Elemental Sulfur, and More), Form (Solid and Liquid), Mode of Application (Soil Application, Fertigation, and More), Crop Type (Cereals and Grains, Oilseeds and Pulses, and More), Distribution Channel (Direct-To-Farm, Retail, and More) and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific led the sulfur fertilizers market with a 37% share in 2024. China's fertilizer intensity remains above global norms, and efforts to curb excess nitrogen spur the adop-tion of balanced NPK-S regimens that sustain yields while reducing losses. India's shift toward precision spreaders and state subsidies for soil health cards pushes sulfur deeper into standard practice. Southeast Asian nations are raising demand through palm oil estates and double-cropped rice, whereas developed economies such as Japan seek ultra-low chloride options for high-value produce. Regional growth of 5.6% CAGR through 2030 is anchored by policy alignment with climate-smart agriculture goals.

Africa is the fastest-growing region at 6.4% CAGR. Soil surveys indicate sulfur scarcity in many sub-Saharan zones, and governments now couple fertilizer subsidies with extension services that promote balanced nutrition. Ethiopia's domestic complex under construction post-GERD will cut import reliance, while South Africa's commercial farms already leverage elemental sulfur blends to manage alkaline soils. Distribution challenges persist, yet donor-backed corridor projects and private blending hubs aim to improve last-mile reach, brightening prospects for the sulfur fertilizers market.

North America posts a steady 4.1% CAGR as the United States channels 8.2 million metric tons of recovered sulfur each year from refineries into phosphate and ammonium sulfate production. Recent tariffs on Canadian sulfur inject short-term tightness, but abundant domestic gas and refinery networks anchor supply. Precision agronomy, cover-crop adoption, and sustainability certifications fuel incremental demand. Europe, at 3.2% CAGR, balances stringent water-quality directives with the need to uphold crop protein levels, making controlled-release sulfur variants attractive.

- Nutrien Ltd.

- Yara International ASA

- The Mosaic Company

- K+S AG

- Israel Chemicals Ltd.

- Haifa Chemicals Ltd.

- Nufarm Limited

- Koch Industries Inc.

- CF Industries Holdings Inc.

- OCP S.A.

- BASF SE

- Sinochem Holdings Corp. Ltd.

- Saudi Arabian Fertilizer Company (SAFCO) (Saudi Basic Industries Corporation (SABIC))

- Tiger-Sul Products LLC (Tessenderlo Group)

- TogliattiAzot PJSC (Uralchem Group)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Sulfur deficiency in soil

- 4.2.2 Rising oilseed acreage and yields

- 4.2.3 Government incentives for sustainable agriculture

- 4.2.4 Adoption of controlled-release sulfur-coated urea

- 4.2.5 Increasing availability of recovered sulfur from desulfurization units

- 4.2.6 AI-based precision nutrient application platforms

- 4.3 Market Restraints

- 4.3.1 Competition from multi-nutrient specialty fertilizers

- 4.3.2 Volatility in elemental sulfur feedstock prices

- 4.3.3 Environmental risk of sulfate leaching into groundwater

- 4.3.4 Distribution bottlenecks for prilled elemental sulfur in emerging markets

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value, USD)

- 5.1 By Type

- 5.1.1 Sulfate Fertilizers

- 5.1.1.1 Ammonium Sulfate

- 5.1.1.2 Potassium Sulfate

- 5.1.1.3 Calcium Sulfate (Gypsum)

- 5.1.1.4 Single Superphosphate

- 5.1.2 Elemental Sulfur

- 5.1.2.1 Micronized Sulfur

- 5.1.2.2 Prilled/Pastilled Sulfur

- 5.1.3 Sulfate of Micronutrients

- 5.1.3.1 Zinc Sulfate

- 5.1.3.2 Magnesium Sulfate

- 5.1.3.3 Others

- 5.1.4 Others (Sulfur-coated Urea, Sulfur Bentonite)

- 5.1.1 Sulfate Fertilizers

- 5.2 By Form

- 5.2.1 Solid

- 5.2.2 Liquid

- 5.3 By Mode of Application

- 5.3.1 Soil Application

- 5.3.2 Fertigation

- 5.3.3 Foliar Spray

- 5.3.4 Controlled-Release/Coated Granules

- 5.4 By Crop Type

- 5.4.1 Cereals and Grains

- 5.4.2 Oilseeds and Pulses

- 5.4.3 Fruits and Vegetables

- 5.4.4 Turf and Ornamentals

- 5.4.5 Others

- 5.5 By Distribution Channel

- 5.5.1 Direct-to-Farm

- 5.5.2 Retail Dealers

- 5.5.3 Cooperatives

- 5.5.4 Online Platforms

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.1.4 Rest of North America

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Russia

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Rest of South America

- 5.6.5 Middle East

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 United Arab Emirates

- 5.6.5.3 Rest of Middle East

- 5.6.6 Africa

- 5.6.6.1 South Africa

- 5.6.6.2 Egypt

- 5.6.6.3 Rest of Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Nutrien Ltd.

- 6.4.2 Yara International ASA

- 6.4.3 The Mosaic Company

- 6.4.4 K+S AG

- 6.4.5 Israel Chemicals Ltd.

- 6.4.6 Haifa Chemicals Ltd.

- 6.4.7 Nufarm Limited

- 6.4.8 Koch Industries Inc.

- 6.4.9 CF Industries Holdings Inc.

- 6.4.10 OCP S.A.

- 6.4.11 BASF SE

- 6.4.12 Sinochem Holdings Corp. Ltd.

- 6.4.13 Saudi Arabian Fertilizer Company (SAFCO) (Saudi Basic Industries Corporation (SABIC))

- 6.4.14 Tiger-Sul Products LLC (Tessenderlo Group)

- 6.4.15 TogliattiAzot PJSC (Uralchem Group)