|

시장보고서

상품코드

1435205

고무 첨가제 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2024-2029년)Rubber Additives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

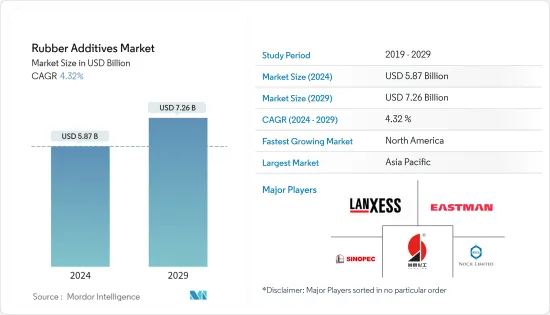

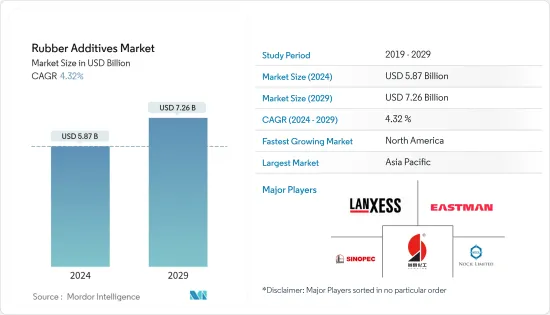

고무 첨가제 시장 규모는 2024년 58억 7,000만 달러로 추정되며 2029년까지 72억 6,000만 달러에 달할 것으로 예상되며, 예측 기간(2024-2029년) 동안 4.32%의 CAGR로 성장할 것으로 예상됩니다.

신종 코로나바이러스 감염증(COVID-19) 팬데믹은 자동차 제조 및 공급망 중단으로 인해 고무 첨가제 시장에 영향을 미쳤습니다. 전 세계적으로 봉쇄 조치가 도입되면서 운송이 지연되어 수출입 활동에 지장을 초래했습니다. 그러나 규제가 단계적으로 해제된 이후 이 부문은 순조롭게 회복되고 있습니다. 전기자동차 판매 증가와 전자제품 수요 증가가 지난 2년간 시장 회복을 주도했습니다.

주요 하이라이트

- 고무 및 타이어 산업의 성장과 건설 산업의 비타이어 부문의 수요 증가는 조사 대상 시장의 수요를 촉진하는 중요한 요인입니다.

- 반면, 폐기와 관련된 환경 문제가 시장 성장을 저해할 것으로 예상됩니다.

- 최종 제품의 내구성을 향상시키는 고성능 고무를 생산하기 위한 새로운 첨가제 개발은 향후 기회가 될 수 있습니다.

- 아시아태평양은 고무 첨가제 시장을 독점하고 있으며, 인도, 중국, 일본이 소비를 주도하고 있습니다.

고무첨가제 시장 동향

시장을 독식하는 타이어 부문

- 조사 기간 동안 타이어 산업은 고무 첨가제 시장에서 가장 큰 점유율을 차지했습니다. 천연 고무는 주로 부타디엔 고무 및 스티렌 부타디엔 고무와 같은 합성 고무와 결합하여 타이어 제조에 사용됩니다.

- 고품질 타이어 제조 기술의 발전으로 타이어 시장은 계속 성장하고 있습니다. 장치 자동화 및 빅데이터 도입의 증가는 시장 성장을 촉진하고 있습니다. 또한 비용 효율적이고 고품질의 타이어를 생산하기 위해 일부 제조업체는 자동화 된 원스텝 타이어 제조 공정을 사용하고 있습니다.

- 미국 타이어 제조업체 협회(USTMA)에 따르면 2021년 미국 타이어 총 출하량은 3억 3,520만 개, 2022년에는 3억 4,210만 개가 될 것으로 예상됩니다.

- 중국은 세계 최대의 타이어 생산국이자 소비국입니다. 중국의 모든 분야에는 300개 이상의 크고 작은 타이어 제조업체가 있습니다. 중국의 타이어 산업은 금액과 생산량 측면에서 세계 최대 규모입니다. 중국 고무 산업 협회의 타이어 산업에 따르면 상위 38 개 회원사는 2021년에 총 5억 2,922 만 개의 타이어를 생산하여 전년 대비 11.28 % 증가했습니다.

- 또한, 프랑스 타이어 제조업체인 미쉐린에 따르면, 2022년 이후 유럽과 북미에서 주문이 포화상태에 이르면서 트럭 및 버스용 타이어 시장은 신차 장착 상태에서 호조세를 이어갔습니다. 북미에서는 2024년 시행될 새로운 배기가스 규제에 대비한 차량용 타이어 구매가 수요를 뒷받침했습니다.

- 위의 모든 사실과 요인을 고려할 때 타이어 응용 분야에서 고무 첨가제의 사용과 수요는 예측 기간 동안 증가할 것으로 예상됩니다.

아시아태평양이 시장을 독점

- 예측 기간 동안 아시아태평양이 우세할 것으로 예상됩니다. 중국, 인도, 한국과 같은 국가에서는 자동차 응용 분야에서 고무 첨가제의 사용이 가속화되고 전기 및 전자 응용 분야에서의 사용이 증가함에 따라이 지역의 고무 첨가제 소비가 증가하고 있습니다.

- 고무 첨가제는 고무 및 관련 제품 가공에 널리 사용됩니다. 자동차 분야의 타이어 제조에서 고무에 대한 수요가 증가함에 따라 고무 첨가제 시장이 주도하고 있습니다. 국내 자동차 산업의 회복과 다른 고무 기반 산업의 재개는 가까운 장래에 조사 대상 시장을 이끌 것으로 예상됩니다.

- 중국은 세계 최대 천연고무 소비국으로 세계 소비량의 37%를 차지하지만, 국내 생산에 적합한 토지가 부족해 필요한 양의 일부만 생산할 수 있습니다. 그 결과 중국 정부는 중국 기업들이 고무 생산에 투자하도록 장려하기 시작했습니다. 따라서 고무 첨가제는 천연 고무와 합성 고무의 가공에 모두 사용되기 때문에이 나라에서 고무 첨가제의 잠재력이 있습니다.

- 2005년 이래 중국은 세계 최대의 타이어 생산국이자 소비국이 되었습니다. 타이어 생산과 소비는 매우 건전한 성장을 보였지만 지난 몇 년 동안, 특히 지난 2 년 동안 타이어 시장은 국내 및 국내에서 사업을 운영하는 외국 기업에게 매우 까다로워졌습니다. 그러나 자동차 생산과 다양한 최종사용자 산업에서 고무 첨가제의 사용이 계속 확대됨에 따라 소비량은 예측 기간 동안 증가할 것으로 예상됩니다.

- 국제자동차건설기구(OICA)에 따르면 세계 경제의 불확실성에도 불구하고 2021년에는 7%, 2022년에는 3%의 자동차 생산량 증가를 기록했다고 합니다.

- 또한 협회에 따르면, 인도, 호주, 한국의 자동차 생산량은 2022년 각각 24%, 13%, 9%의 연간 증가율을 기록할 것으로 예상했습니다.

- 국가통계국에 따르면 중국의 전자정보제조업은 2022년 안정적인 성장을 기록해 생산과 투자 면에서 강력한 확장세를 보였습니다. 공업정보화부에 따르면 이 기간 동안 이 분야 대기업의 부가가치는 전년 대비 7.6% 증가해 전체 산업보다 4% 더 높았습니다. 이로 인해 전선 사용이 증가했습니다.

- 인도의 전자 산업은 세계에서 가장 빠르게 성장하는 산업 중 하나입니다. 최근 전자정보기술부는 인도의 전자제품 제조에 관한 비전 문서 2권을 발표하면서 2025-26년까지 전자제품 제조 산업이 3,000억 달러에 달할 것으로 예상된다고 밝혔습니다.

- 위의 모든 요인은 예측 기간 동안 아시아태평양 고무 첨가제 시장의 성장을 촉진 할 수 있습니다.

고무 첨가제 산업 개요

세계 고무 첨가제 시장은 본질적으로 부분적으로 통합되어 있으며, 상위 5개 기업이 전체 시장의 40% 이상을 점유하고 있습니다. 주요 기업들은 제품 개발을 위한 혁신적인 기술을 개발하고, 시장 점유율을 확대하기 위해 인수 합병을 추진하고, 시장에서의 효율성과 전문성을 높이기 위해 공급망을 최적화하는 등 연구 개발 활동에 집중하고 있습니다. 조사 대상 시장의 주요 기업으로는 중국선신화학지주유한공사, 라인케미(랑세스), 이스트만화학, 중국석유화공집단(Sinopec), NOCIL LIMITED 등이 있습니다.

기타 혜택

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간 애널리스트 지원

목차

제1장 서론

- 조사 가정

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 성장 촉진요인

- 타이어 고무 산업의 성장

- 건설 업계의 비타이어 부문 수요 확대

- 기타 촉진요인

- 성장 억제요인

- 고무 약품에 관한 환경 제약

- 기타 저해요인

- 업계 밸류체인 분석

- Porter's Five Forces 분석

- 구매자의 교섭력

- 공급 기업의 교섭력

- 대체품의 위협

- 신규 참여업체의 위협

- 경쟁 정도

제5장 시장 세분화(금액 기준 시장 규모)

- 유형

- 활성제

- 가황 억제제

- 가소제

- 기타 유형

- 용도

- 타이어

- 컨베이어 벨트

- 전기 케이블

- 기타 용도

- 필러

- 카본블랙

- 탄산칼슘

- 실리카

- 기타 필러

- 지역

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 기타 아시아태평양

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 기타 유럽

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카공화국

- 기타 중동 및 아프리카

- 아시아태평양

제6장 경쟁 상황

- M&A, 합작투자, 제휴, 협정

- 시장 점유율(%)**/순위 분석

- 주요 기업의 전략

- 기업 개요

- BASF SE

- Behn Meyer

- China Petrochemical Corporation(SINOPEC)

- China Sunsine Chemical Holdings Limited

- Eastman Chemical Company

- Emery Oleochemicals

- Kemai Chemical Co. Ltd

- MLPC International(Arkema Group)

- NOCIL LIMITED

- PUKHRAJ ZINCOLET

- Rhein Chemie(Lanxess)

- Sumitomo Chemical Co. Ltd

- Thomas Swan & Co. Ltd

제7장 시장 기회와 향후 동향

- 전기자동차의 수요 확대

- 바이오 기반 고무 첨가제 개발

The Rubber Additives Market size is estimated at USD 5.87 billion in 2024, and is expected to reach USD 7.26 billion by 2029, growing at a CAGR of 4.32% during the forecast period (2024-2029).

The COVID-19 pandemic affected the rubber additives market as automotive manufacturing and supply chains were halted. The introduction of lockdowns across the world caused transportation delays and hindered import-export activities. However, the sector is recovering well since restrictions were gradually lifted. An increase in electric vehicle sales and growing demand for electronic appliances have led the market recovery over the last two years.

Key Highlights

- The growing rubber and tire industry along with increasing demand from the non-tire segment of the construction industry are the key attributes driving the demand for the market studied.

- On the flipside, environmental concerns related to its disposal are expected to hinder the growth of the market.

- The development of new additives to produce high-performance rubbers that increase the durability of the end product is likely to act as an opportunity in the future.

- Asia-Pacific region dominated the market for rubber additives with India, China, Japan driving the consumption.

Rubber Additives Market Trends

Tire Segment to Dominate the Market

- The tire industry accounts for the largest share of the rubber additives market during the study period. Natural rubber in combination with synthetic rubbers like butadiene rubber or styrene butadiene rubber is majorly used in tire manufacturing.

- The tire market continues to grow due to technological advances in manufacturing high-quality tires. Increasing device automation and big data adoption is boosting the market growth. Additionally, for cost-effective and high-quality tire production, some manufacturers are using an automated, one-step tire manufacturing process.

- According to the United States Tire Manufacturers Association (USTMA), total U.S. tire shipments of 342.1 million units in 2022, compared to 335.2 million units in 2021.

- China is the world's largest tire producer and consumer. There are more than 300 large, medium, and small tire manufacturers in all segments of China. China's tire industry is the largest in the world in terms of value and volume. According to China Rubber Industry Association's Tire Industry, the top 38 member companies produced a total of 529.22 million tires in 2021, an increase of 11.28% from previous year.

- Furthermore, according to the French tire manufacturing giant Michelin, in original equipment, the truck and bus tire market continued to perform well in Europe and North America against a backdrop of saturated order books since 2022. In North America, demand was supported by purchases of vehicles in anticipation of a new emissions standard coming into force in 2024.

- Considering all the above facts and factors, the usage and demand of rubber additives for tire applications are expected to grow in the forecast period.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific is expected to dominate through the forecast period. With the accelerating usage of rubber additives in automotive and increasing application in electrical and electronucs applications in countries such as China, India, and South Korea, the consumption of rubber additives is growing in the region.

- Rubber additives are widely used in the processing of rubber and its allied products. The growing demand for rubber in tire manufacturing in the automotive sector has been driving the market for rubber additives. The recovering automotive industry and resuming of other rubber-based industries in the country are expected to drive the market studied in the near future.

- China is the world's largest consumer of natural rubber, accounting for 37% of global consumption, but lacks suitable land to produce only a fraction of what it needs domestically. As a result, the Chinese government began encouraging Chinese companies to invest in rubber production. Thus, there is a potential for rubber additives in the country as they are used both to process natural and synthetic rubber.

- Since 2005, China has been the world's largest tire producer and consumer. Although tire production and consumption have enjoyed a very healthy growth, the last few years, especially the last two years, the market has been very tough for domestic and foreign companies operating in the country. However, as the automotive production and usage of rubber additives in different end-user industies constinues to expand, the consumption is projected to increase during the forecast period.

- According to the Organisation Internationale des Constructeurs d'Automobiles (OICA), despite the global economic unceratinities prevailing, the country's motor vehicle production registered an increase of 7% in 2021 and 3% in 2022.

- In addition, according to the association, motor vehicle production in India, Australia, and South Korea registered annual increases of 24%, 13%, and 9%, respectively, in 2022.

- According to the National Statistics Bureau, China's electronic information manufacturing sector recorded steady growth in 2022, signaling strong expansion in terms of production and investment. According to the Ministry of Industry and Information Technology, the added value of large companies in this sector increased by 7.6% year-on-year in this period, making the industry 4% higher than all industries. This is boosting the usage of electric cables.

- The Indian electronics industry is one of the fastest growing industries in the world. Recently, the Ministry of Electronics and Information Technology released Volume 2 of its vision document on electronics manufacturing in India, stating that the electronics manufacturing industry is anticipated to reach USD 300 billion by 2025-26.

- All factors above are likely to fuel the growth of rubber additives market in Asia-Pacific over the forecasted time frame.

Rubber Additives Industry Overview

The global rubber additives market is partially consolidated in nature, with top 5 players together accounting for more than 40% of the total market. Major players are also focusing on R&D activities, developing innovative techniques for the development of the product, engaging in mergers and acquisitions in order to increase their market share and optimizing supply chain to increase its efficacy and specialization in the market. The key players in the market studied include China Sunsine Chemical Holdings Limited, Rhein Chemie (LANXESS), Eastman Chemical Company, China Petrochemical Corporation (Sinopec), and NOCIL LIMITED, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growth in the Tire and Rubber Industry

- 4.1.2 Growing Demand from the Non-Tire Segment in the Construction Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Environmental Constraints Pertaining to Rubber Chemicals

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Buyers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of Substitute Products

- 4.4.4 Threat of New Entrants

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Activators

- 5.1.2 Vulcanization Inhibitors

- 5.1.3 Plasticizers

- 5.1.4 Other Types

- 5.2 Application

- 5.2.1 Tires

- 5.2.2 Conveyor Belts

- 5.2.3 Electric Cables

- 5.2.4 Other Applications

- 5.3 Fillers

- 5.3.1 Carbon Black

- 5.3.2 Calcium Carbonate

- 5.3.3 Silica

- 5.3.4 Other Fillers

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 Behn Meyer

- 6.4.3 China Petrochemical Corporation (SINOPEC)

- 6.4.4 China Sunsine Chemical Holdings Limited

- 6.4.5 Eastman Chemical Company

- 6.4.6 Emery Oleochemicals

- 6.4.7 Kemai Chemical Co. Ltd

- 6.4.8 MLPC International (Arkema Group)

- 6.4.9 NOCIL LIMITED

- 6.4.10 PUKHRAJ ZINCOLET

- 6.4.11 Rhein Chemie (Lanxess)

- 6.4.12 Sumitomo Chemical Co. Ltd

- 6.4.13 Thomas Swan & Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Demand From Electric Vehicles

- 7.2 Development of Bio-based Rubber Additives