|

시장보고서

상품코드

1436133

스마트 냉장고 : 세계 시장 점유율 분석, 업계 동향 및 통계, 성장 예측(2024-2029년)Global Smart Refrigerator - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

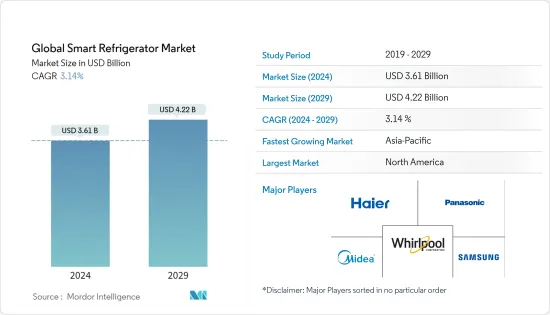

세계의 스마트 냉장고 시장 규모는 2024년 36억 1,000만 달러로 추정되고, 2029년까지 42억 2,000만 달러에 이를 것으로 예측되며, 예측 기간(2024-2029년) 동안 3.14%의 연평균 복합 성장률(CAGR)로 성장할 전망입니다.

사물인터넷(IoT) 사용 증가와 급속한 도시화로 세계의 스마트 커넥티드 냉장고 업계의 성장이 추진되고 있습니다. 게다가 사람들의 가처분소득 증가 및 소비전력 감소 등 스마트 커넥티드 냉장고의 효율성 향상이 시장 성장을 가속할 것으로 예상되었습니다. 스마트 냉장고는 검색 엔진, 스마트 스피커 및 기타 스마트 기술과의 연결을 제공하여 사용자 편의성과 효율성을 향상시키고 시장 동향을 지원합니다. 소비자의 라이프스타일 변화와 가처분소득 증가를 뒷받침하는 첨단 스마트홈 제품 구매로의 전환으로 시장 수요가 증가할 것으로 보입니다. 지능형 가전을 쉽게 얻을 수 있어 신흥 국가의 소비자 지식이 늘어나 제품 수요가 높아질 것입니다. 또한, 새로운 주택에서 건축의 발전과 미관을 지원하는 지능형 제품의 필요성에 따라 시장 전망도 바뀌고 있습니다.

스마트 냉장고의 성장은 주로 기업이 신형 COVID-19의 영향으로부터 회복하면서 영업을 재개하고 새로운 정상에 적응하고 있기 때문에 이전에는 사회적 거리 확보, 원격 근무 및 상업시설 폐쇄와 같은 제한적인 봉쇄 조치가 취해져 운영상의 과제를 초래했습니다.

세계 경제, 주로 선진국에서 도시화가 진행되고 있는 가운데, IoT나 스마트 디바이스 수요가 높아지고 있습니다. 인도와 같은 국가에서는 노동 인구가 종속 인구를 초과합니다. 이에 따라 의존률이 50% 미만으로 감소하고, 가처분 소득이 증가하고, 결국 스마트 냉장고 시장을 밀어올리게 됩니다.

스마트 냉장고 시장 동향

에너지 효율이 높은 냉장고에 대한 수요 증가가 시장을 견인합니다.

스마트 냉장고 제조업체는 이산화탄소 배출량을 줄이고 소비자의 광열비를 절약할 수 있도록 에너지 사용량이 적은 모델을 개발하기 위해 서두르고 있습니다. 에너지 효율적인 가전의 상승은 가전제품에 관한 정부의 규칙 및 가전제품의 진보 모두로 거슬러 올라갈 수 있습니다. 에너지 효율적인 가전제품은 가능한 한 최소한의 에너지로 작동하도록 제작되었습니다. 이미 80개국 이상에서 에너지 효율적인 가전제품 규정 및 라벨이 제정되었습니다.

식품 소매업체는 광열비 절감을 목표로 하며 조금씩 절약할 수 있는 것이 중요합니다. 가격 경쟁의 격화는 영업 비용이 경쟁력과 수익성에 직접적인 영향을 미칩니다는 것을 의미합니다. 그리고 대부분의 슈퍼마켓은 인건비에 이어 에너지가 가장 큰 부담입니다. 식품 소매업에서는 에너지의 대부분이 냉동에 소비되기 때문에 AKVP 전동 팽창 밸브와 하이 엔드 케이스 컨트롤러와 같은 효율적인 새로운 구성 요소는 일반적으로 우수한 투자가 됩니다.

IoT를 활용한 스마트 가전의 소개, 스마트 가전 업계는 재구성되고 있습니다. 최근 몇 년동안 스마트 냉장고에는 많은 개선이 추가되어 지속가능성이 향상되었습니다.

소매액에 관해서는 2022년에 아시아가 냉장고 가전 소매액으로 최대가 되었고, 북미, 유럽이 이어졌습니다.

아시아태평양이 시장을 견인합니다.

아시아태평양 시장은 호환성과 사용 편의성으로 스마트 커넥티드 냉장고의 인기가 높아지기 때문에 예측 기간 동안 가장 빠른 속도로 확대될 것으로 예상됩니다. 또한, 시장 확대는 도시화의 진행 및 중간층 인구의 확대에 의해 촉진되고 있습니다. 이 지역에 중요한 시장 진출 기업이 존재하는 것은 고객 기반을 확대하기 위한 혁신적인 제품 개발을 지원하는 데에도 도움이 됩니다. 이 지역의 제품 수요는 중국과 인도와 같은 신흥 경제 국가에서의 인터넷 보급 증가 및 기술 진보에 의해 촉진될 것으로 예상됩니다. 인도의 IoT 보급률의 평균은 1자리이지만 세계 평균 보급률은 2자리입니다. 이것은 아시아태평양의 성장하는 경제에서 스마트 냉동기 산업이 번창하는 큰 기회를 창출합니다.

아시아태평양에는 가장 가격에 민감한 고객이 있으며 기업은 스마트 냉장고 판매를 늘리기 위해 블랙 프라이데이 특별 판매, 휴일 판매 및 추가 온라인 판매와 같은 프로모션 기법을 사용해야 합니다.

스마트 냉장고 산업 개요

이 시장에는 사소한 점유율을 둘러싼 많은 기업이 세분화되어 있습니다. 기업은 특히 개발 경제 국가에서 수요 증가에 부응하기 위해 제품 혁신을 통한 제품 라인 확대에 주력하고 있습니다. 스마트 냉장고 시장의 주요 기업으로는 Samsung、LG Electronics, Whirlpool Corporation, Haier Group, Robert Bosch GmbH, Siemens AG, GE Appliances, AB Electrolux, Panasonic Corporation 등이 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제 조건 및 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학 및 인사이트

- 시장 개요

- 시장 성장 촉진요인

- 시장 성장 억제요인

- 업계의 밸류체인 분석

- 업계의 매력-Porter's Five Forces 분석

- 구매자의 협상력

- 공급기업의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 격렬

- 시장에서의 혁신의 인사이트

- 시장에 대한 COVID-19의 영향

제5장 시장 세분화

- 유형별

- 프렌치 도어

- 사이드 바이 사이드 도어

- 트리플 도어

- 더블 도어

- 싱글 도어

- 최종 사용자별

- 주택

- 상업

- 지역별

- 북미

- 남미

- 유럽

- 아시아태평양

- 중동 및 아프리카

제6장 경쟁 구도

- 시장 집중도 개요

- 기업 프로파일

- Whirlpool

- Samsung

- Haier

- Electrolux

- LG

- Panasonic

- Robert Bosch GmbH

- Siemens AG

- General Electric Co.

- Midea

제7장 시장 기회 및 미래 동향

제8장 면책사항 및 출판사에 대해서

AJY 24.03.08The Global Smart Refrigerator Market size is estimated at USD 3.61 billion in 2024, and is expected to reach USD 4.22 billion by 2029, growing at a CAGR of 3.14% during the forecast period (2024-2029).

An increase in the use of the Internet of Things (IoT) and rapid urbanization drive the growth of the global smart connected refrigerator industry. Moreover, the rise in disposable income of people and the increase in efficiency of smart connected refrigerators, such as the use of less electricity, were expected to boost market growth. The smart refrigerator offers connectivity with search engines, smart speakers, and other smart technologies, providing enhanced convenience and efficiency to the users and supporting market trends. The changing consumer lifestyles and shift toward purchasing advanced smart home products, supported by increased disposable income, will boost market demand. The easy availability of intelligent appliances and the growing knowledge of consumers in developing countries will support product demand. Moreover, the architectural developments in new residences and the need for intelligent products to support aesthetics are transforming the market outlook.

The growth in Smart Refrigerator Machines is mainly due to the companies resuming their operations and adapting to the new normal while recovering from the COVID-19 impact, which had earlier led to restrictive containment measures involving social distancing, remote working, and the closure of commercial activities that resulted in operational challenges.

With growing urbanization in the world economy, mostly in developed countries, there is an increasing demand for IoT (the Internet of Things) and smart devices. Countries like India, where the working population has grown larger than the dependent population. This reduces the dependency rate to less than 50% and increases disposable income, which ultimately boosts the smart refrigerator market.

Smart Refrigerator Market Trends

Rising Demand For Energy Efficient Refrigerators Driving the Market

Smart refrigerator makers are working quickly to make models that use less energy so they can reduce their carbon footprint and save consumers money on their energy bills.The rise of energy-efficient appliances can be traced to both government rules about electric home appliances and advances in technology.Energy-efficient appliances are made to do their job with the least amount of energy possible.Over 80 countries already have energy-efficient appliance regulations and labeling.

As food retailers look to reduce energy bills, every incremental savings counts. Increasing price competition means operating costs have an immediate impact on competitiveness and profitability-and, after staff, energy is the biggest bill most supermarkets have. In food retail, most of that energy is spent on refrigeration, so efficient new components, like the AKVP electric expansion valve and high-end case controllers, are usually a good investment.

The introduction of smart appliances that utilize IoT is reshaping the smart appliance industry.In the past few years, there have been a number of improvements to smart refrigerators, which have made them better at being sustainable.

In terms of retail value, Asia had the largest retail value of refrigerator appliances in 2022, followed by North America and Europe.

Asia Pacific Region Driving The Market

The Asia-Pacific market is expected to expand at the fastest rate over the forecast period, as smart connected refrigerator machines have gained popularity owing to their compatibility and user-friendliness features. Furthermore, the market expansion is fueled by rising urbanization and an expanding middle-class population. The presence of important market participants in the region also helps to support the development of innovative products to expand the customer base. Product demand in this region is expected to be fueled by rising internet penetration and technological improvements in developing economies such as China and India. In India, the average rate of IoT penetration is in the single digits, whereas the global average rate is in the double digits. This creates a huge opportunity for the smart refrigerator machine industry to flourish in Asia Pacific's growing economies.

The Asia-Pacific region has the most price-sensitive customers, forcing companies to use promotional techniques like Black Friday specials, holiday sales, and additional online deals to boost sales of smart refrigerators.

Smart Refrigerator Industry Overview

This market has many companies fragmented over minor shares. Companies are focusing on expanding their product lines through product innovation, particularly in developing economies, to meet the rising demand. Some of the major players in the smart refrigerator market are Samsung, LG Electronics, Whirlpool Corporation, Haier Group, Robert Bosch GmbH, Siemens AG, GE Appliances, AB Electrolux, Panasonic Corporation, and others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Buyers

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Insights of Technology Innovations in the Market

- 4.7 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 French Doors

- 5.1.2 Side-by-Side Doors

- 5.1.3 Triple Doors

- 5.1.4 Double Doors

- 5.1.5 Single Door

- 5.2 By End-Users

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.3 By Geography

- 5.3.1 North America

- 5.3.2 South America

- 5.3.3 Europe

- 5.3.4 Asia Pasific

- 5.3.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Whirlpool

- 6.2.2 Samsung

- 6.2.3 Haier

- 6.2.4 Electrolux

- 6.2.5 LG

- 6.2.6 Panasonic

- 6.2.7 Robert Bosch GmbH

- 6.2.8 Siemens AG

- 6.2.9 General Electric Co.

- 6.2.10 Midea*