|

시장보고서

상품코드

1437595

항공기용 터빈 엔진 : 시장 점유율 분석, 업계 동향과 통계, 성장 예측(2024-2029년)Aircraft Turbine Engine - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

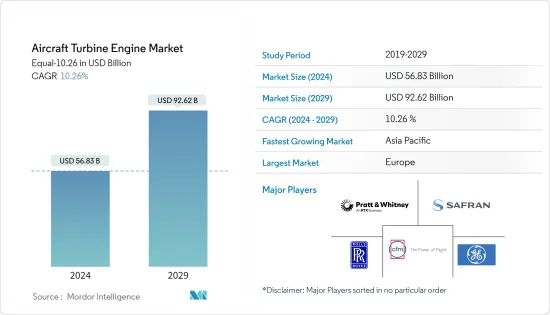

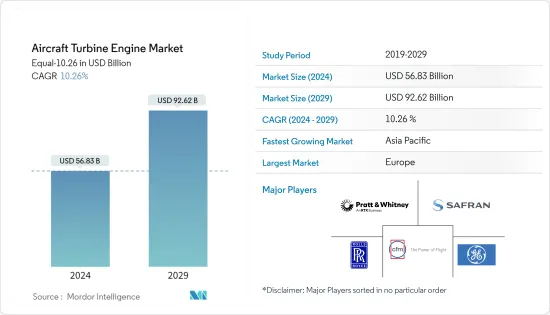

항공기용 터빈 엔진 시장 규모는 2024년에 568억 3,000만 달러로 추정되고 2029년까지 926억 2,000만 달러에 달할 것으로 예측되고 있으며, 예측 기간(2024-2029년) 중 10.26%의 CAGR로 성장합니다.

항공기 엔진에 대한 수요는 주로 항공기(비즈니스 제트기, 상용기, 군용기) 주문 증가 또는 기존 항공기의 엔진 교체에 의해 촉진됩니다. 항공기 OEM과 엔진 제조업체는 항공기 성능을 개선하고 항속거리를 연장하기 위해 광범위한 통합 노력을 기울이고 있습니다. 이러한 기술 연구 및 개발에 대한 투자는 예측 기간 중 시장 전망을 강화할 것으로 예상됩니다.

현재 항공사는 통합 매출 모델을 기반으로 운영되기 때문에 이익률이 상대적으로 낮습니다. 이 시나리오에서는 항공사가 새로운 항공기를 조달하고 거래를 완료하기 위해 많은 양의 현금을 지불하는 것이 어렵습니다. 그러나 항공기 및 엔진 리스 사업의 새로운 트렌드는 항공사가 항공기 금융 기관으로부터 리스 계약을 선택할 수 있다는 안도감을 제공하여 항공사에 재정적 구제책을 제공하고 공급 능력 증가에 대한 일시적인 접근을 허용합니다.

3D 프린팅과 세라믹 매트릭스 복합재료를 사용하여 항공기 엔진의 핵심 부품을 제작하는 것이 증가함에 따라 항공기 엔진 OEM의 제조 주기가 빠르게 변화할 것으로 예상됩니다. 또한 하이브리드 전기 제트 엔진과 같은 신기술은 시장 참여자들에게 현재의 비즈니스 기회를 증가시킬 것으로 예상됩니다.

항공기용 터빈엔진 시장 동향

상업 부문이 예측 기간 중 시장 점유율을 지배

상업 부문은 몇 가지 매력적인 요인으로 인해 항공기 터빈 엔진 시장에서 가장 큰 시장 점유율을 차지하고 있습니다. 소득 증가, 중산층 성장, 도시화 등의 요인으로 인해 전 세계 항공 여객 여행 증가는 상업용 항공기 엔진 산업의 강력한 기반이 되고 있습니다. 이러한 성장 추세는 앞으로도 계속될 것으로 예상되며, 특히 인도와 중국과 같은 국가에서 상당수의 사람들이 세계 중산층에 합류할 것으로 예상됩니다. 업계의 관점에서 볼 때, 비용과 항공 여행객의 편의성 요인으로 인해 협폭동체 항공기의 부상이 강조되고 있습니다. 이러한 변화는 전 세계 제트 여객기의 대부분을 차지하는 에어버스 A320 및 보잉 B737과 같은 항공기의 사용량 증가에 반영되어 있습니다. 단일 통로 항공기는 계속해서 시장을 독점할 것으로 예상되며, 이는 상업용 항공기용 터빈 제조업체에게 기회가 될 것입니다. 또한 상업용 터빈 엔진에 부과되는 엄격한 규제 및 규정 준수 기준은 다른 분야에는 독특한 진입장벽이 될 수 있습니다. 이러한 요건을 충족하기 위해서는 연구, 개발 및 제조에 많은 투자가 필요하며, 이는 대부분 기존 상업용 엔진 제조업체만이 할 수 있는 일입니다. 군용 엔진은 혹독한 전투와 광범위한 사용을 견디고 수십년간 사용할 수 있도록 설계되었습니다. 그 결과, 정부는 유지보수, 수리 및 업그레이드에 많은 투자를 하고 있으며, 이는 제조업체와 서비스 프로바이더에 지속적인 수입원을 창출하고 있습니다. 예를 들어 롤스로이스(Rolls-Royce plc)는 2022년 7월 세계 최대 규모의 항공 엔진 기술 시연기인 '울트라팬(UltraFan)'의 최종 제작 단계에 접어들며 미래의 지속가능한 항공 여행을 지원하는 기술을 제공했습니다. 시연기의 엔진은 팬 직경이 140인치에 달하며, 100% 지속가능한 항공 연료로 작동합니다. 새로운 엔진은 1세대 토렌트 엔진에 비해 연료 효율이 25% 향상되었습니다. 장기적으로 UltraFan 엔진의 25,000파운드에서 100,000파운드 추력까지 확장 가능한 기술은 새로운 와이드바디 및 좁은 바디의 민간 항공기에 동력을 공급할 수 있는 가능성을 제공합니다.

아시아태평양이 예측 기간 중 시장 점유율을 독식

LCC 모델의 지속적인 성공은 아시아태평양의 여객 운송량이 꾸준히 증가하는 데 기여하고 있습니다. 또한 다양한 기업의 항공기 제조 활동에 대한 투자를 촉진하여 이 지역의 항공기 및 엔진 제조업체의 성장에 큰 기회를 창출했습니다. 더 새롭고 개선된 버전의 항공기에 대한 수요가 증가함에 따라 항공기용 가스 터빈 엔진에 대한 수요도 동시에 증가했습니다. 많은 항공사는 엔진 OEM과 협력하여 우수한 MRO 및 애프터 서비스를 받기 위해 노력하고 있습니다. 예를 들어 에어버스는 이미 MRO 시장의 잠재력을 인식하고 인수, 합작투자(JV) 및 파트너십을 통해 아시아태평양에서의 입지를 가속화하는 데 주력하고 있습니다.

다른 국제 엔진 공급업체들은 이러한 개발이 예측 기간 중 지역 시장을 촉진하기 위해 엔진 및 관련 부품의 적절한 공급을 유지해야할 것입니다. 예를 들어 2023년 6월 인도와 미국은 인도 공군(IAF)을 위한 전투기 엔진을 생산하기 위해 힌두스탄 에어로노틱스(HAL)와 GE 에어로스페이스(GE Aerospace) 간의 계약을 발표했습니다. 이번 계약은 IAF의 능력과 역량을 향상시키기 위한 노력의 일환으로 이루어졌습니다. IAF는 경전투기(LCA) Mk1A에 이어 LCA Mk2를 추가로 도입하고, 다목적 전투기(MRFA) 114대를 조달하고 있습니다. GE의 F404 엔진은 인도의 유일한 국산 전투기인 LCA Tejas의 동력원으로 사용되고 있습니다. 현재 75대의 F404 엔진이 GE에 의해 생산되고 있으며, LCA Mk1A에 99대가 추가로 주문되어 있습니다. 현재 진행 중인 LCA Mk2 개발 프로그램에는 8개의 F414 엔진이 공급되고 있습니다.

항공기용 터빈엔진 산업 개요

항공기용 터빈 엔진 시장은 반통합형 시장으로 많은 세계 벤더가 존재한다는 특징이 있습니다. CFM International, General Electric Company, Pratt & Whitney(RTX Corporation), Rolls-Royce plc, Safran은 시장의 5대 주요 업체로 가용성, 품질, 가격 및 기술 측면에서 경쟁하고 있습니다. 경쟁하고 있습니다. 시장은 매우 경쟁이 치열하며, 모든 기업이 가장 큰 시장 점유율을 차지하기 위해 경쟁하고 있습니다. 기술적 문제로 인한 항공기 운항 중단, 높은 생산 비용, 엔진 납품 지연, 관세 및 수입 관세 변동 등이 시장 성장을 위협하는 주요 요인으로 작용하고 있습니다. 공급업체들은 치열한 경쟁 환경에서 살아남고 성공하기 위해 첨단 고품질 가스 터빈 엔진을 제공해야 합니다.

내부 제조 능력, 세계 네트워크, 제품 공급, R&D 투자, 강력한 고객 기반은 경쟁사 대비 우위를 점할 수 있는 중요한 영역입니다. 세계 경제 상황의 개선은 예측 기간 중 시장 성장을 가속할 것으로 예상되며, 이는 차세대 항공기 및 엔진을 도입하기에 이상적인 시기입니다. 제품 및 서비스 확장, 기술 혁신, 인수합병 증가로 인해 시장 경쟁 환경은 더욱 치열해질 것으로 보입니다. 예를 들어 2021년 11월 매트리얼라이즈와 프로포넌트는 항공우주 애프터마켓 공급망에서 3D 프린팅의 입지를 확대하기 위한 제휴를 발표했습니다. Proponent는 항공사, MRO, OEM 및 혁신적인 제품 포트폴리오에 전통적인 유통 서비스를 제공합니다. 프로포넌트는 전 세계 100여 개국의 약 6,000여개 항공기 고객에게 연간 5,400만 개의 부품을 공급하고 있습니다. 이들 기업은 엔진, 기체, 객실 인테리어, 조종석 등 애프터마켓 부품을 공급하고 있습니다.

기타 혜택

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 촉진요인

- 시장 억제요인

- Porter's Five Forces 분석

- 구매자의 교섭력

- 공급 기업의 교섭력

- 신규 진출업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁의 강도

제5장 시장 세분화

- 최종사용자

- 민간·상용 항공

- 군용 항공

- 항공기 유형

- 고정익

- 회전익

- 지역

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 프랑스

- 독일

- 러시아

- 기타 유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 싱가포르

- 기타 아시아태평양

- 라틴아메리카

- 브라질

- 기타 라틴아메리카

- 중동 및 아프리카

- 사우디아라비아

- 이집트

- 이스라엘

- 남아프리카공화국

- 기타 중동 및 아프리카

- 북미

제6장 경쟁 구도

- 벤더의 시장 점유율

- 기업 개요

- Safran

- Rolls-Royce plc

- General Electric Company

- Pratt &Whitney(RTX Corporation)

- Rostec State Corporation

- CFM international

- MTU Aero Engines AG

- Honeywell International Inc.

- Lycoming Engines(Avco Corporation)

제7장 시장 기회와 향후 동향

KSA 24.03.07The Aircraft Turbine Engine Market size is estimated at USD 56.83 billion in 2024, and is expected to reach USD 92.62 billion by 2029, growing at a CAGR of 10.26% during the forecast period (2024-2029).

The demand for aircraft engines is driven primarily by either an increase in the order book of aircraft (business jet, commercial, or military aircraft) or a replacement for the engines for the existing aircraft fleet. Aircraft OEMs and engine manufacturers are engaging in extensive integration efforts to enhance performance and extend the range of aircraft. The investments towards the R&D of such technologies are anticipated to bolster the market prospects during the forecast period.

Since modern-day airlines operate on a merged profit model, the profit margins are relatively low. This scenario makes it challenging for operators to procure a new fleet and pay significant amounts of cash to complete the transaction. However, due to the emerging dynamics of the aircraft and engine leasing business, airlines have access to the comfort of opting for lease agreements from aircraft financing entities, providing financial relief to airlines and granting them temporary access to increased capacity.

The manufacturing cycle of aircraft engine OEMs is expected to undergo rapid transformation due to the increasing use of 3D printing and ceramic matrix composites to construct critical components of an aircraft engine. Furthermore, emerging technologies such as a hybrid-electric jet engine are anticipated to enhance the current business opportunities for the market players.

Aircraft Turbine Engine Market Trends

Commercial Segment to Dominate Market Share During the Forecast Period

The commercial segment holds the largest market share in the aircraft turbine engine market due to several compelling drivers. The rise in global air passenger travel, attributed to factors such as rising incomes, the growth of the middle class, and urbanization, provides a strong foundation for the commercial aircraft engine industry. This growth trend is expected to continue, with a significant number of people joining the global middle class, especially from countries like India and China. The industry perspective emphasizes the rise of single-aisle aircraft, driven by cost and convenience factors for air travelers. This shift is reflected in the increasing usage of aircraft like Airbus' A320 and Boeing's B737, comprising a significant portion of the global passenger jet fleet. Single-aisle aircraft are expected to continue dominating the market, presenting opportunities for commercial aircraft turbine manufacturers. Additionally, the stringent regulatory and compliance standards imposed on commercial turbine engines create a unique barrier to entry for other segments. Meeting these requirements necessitates substantial investments in research, development, and manufacturing, which often only established commercial engine manufacturers can undertake. Military engines are designed to last for decades, withstanding the rigors of combat and extensive use. Consequently, governments are heavily invested in their maintenance, repair, and upgrade, resulting in a continuous revenue stream for manufacturers and service providers. For instance, in July 2022, Rolls-Royce plc entered the final build stage for the world's largest aero-engine technology demonstrator "UltraFan", offering technologies to support sustainable air travel for future. The demonstrator engine has a fan diameter of 140 inches and runs on 100% Sustainable Aviation Fuel. The new engine offers a 25% fuel efficiency improvement compared with the first generation of Trent engine. In the longer term, the UltraFan engine's scalable technology from 25,000 to 100,000 lb. thrust offers the potential to power new wide-body and narrow-body commercial aircraft.

Asia-Pacific to Dominate the Market Share During the Forecast Period

The ongoing success of the LCC model has contributed to steady growth in passenger traffic in Asia-Pacific. It has also created significant opportunities for the growth of aircraft and engine manufacturers in the region by stimulating various companies to invest in aircraft manufacturing activities. The rise in demand for newer and improved versions of aircraft has resulted in a simultaneous requirement for aircraft gas turbine engines. Numerous airline operators are trying to collaborate with engine OEMs to receive superior MRO and after-services. For instance, Airbus has already realized the potential of the MRO market and has put in efforts to accelerate its presence in Asia-Pacific through acquisitions, joint ventures (JVs), and partnerships.

Other international engine suppliers will be required to maintain an adequate supply of engines and associated components as these developments will promote the regional market during the forecast period. For instance, In June 2023, India and the US announced the agreement between Hindustan Aeronautics Limited (HAL) and GE Aerospace to produce fighter jet engines for the Indian Air Force (IAF). The deal takes place in the context of efforts by the IAF to improve its capabilities and capacities. The IAF is in the process of procuring 114 multi-role fighter jets (MRFA), along with acquiring additional numbers of Light Combat Aircraft (LCA) Mk1A, followed by LCA Mk2. GE's F404 engines are the engine used to power India's only indigenous fighter jet LCA Tejas. As of now, 75 F404 engines have been manufactured by GE and another 99 are on order with LCA Mk1A. In the ongoing development programme for LCA Mk2, 8 F414 engines have been supplied.

Aircraft Turbine Engine Industry Overview

The aircraft turbine engine market is semi-consolidated and characterized by the presence of many global vendors. CFM International, General Electric Company, Pratt & Whitney (RTX Corporation), Rolls-Royce plc, and Safran are five major companies in the market, which compete in terms of availability, quality, price, and technology. The market is highly competitive with all the players competing to gain the largest market share. Grounding of fleets due to technical issues, high production costs, delays in engine deliveries, and fluctuations in customs and import duties are the key factors posing a threat to the growth of the market. Vendors must provide advanced and high-quality gas turbine engines to survive and succeed in the intensely competitive market environment.

In-house manufacturing capabilities, a global footprint network, product offerings, R&D investments, and a strong client base are the key areas to have the edge over competitors. Improving global economic conditions is expected to fuel market growth during the forecast period, thereby making it an ideal time to adopt new-generation aircraft and engines. The competitive environment in the market is likely to intensify further due to an increase in product and service extensions, technological innovations, and mergers and acquisitions. For instance, In November 2021, Materialize and Proponent announced a partnership to expand the profile of 3D printing in aerospace aftermarket supply chains. Proponent offers traditional distribution services to airlines, MROs, Original Equipment Manufacturers, and Innovative Product Portfolios. Through its global coverage, the firm delivers 54 million parts a year to approximately 6,000 aircraft clients in more than 100 countries. These companies offer aftermarket parts, such as engines, airframes, cabin interiors, and cockpits.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Buyers/Consumers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 End-user

- 5.1.1 Civil and Commercial Aviation

- 5.1.2 Military Aviation

- 5.2 Aircraft Type

- 5.2.1 Fixed-wing

- 5.2.2 Rotorcraft

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 France

- 5.3.2.3 Germany

- 5.3.2.4 Russia

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Singapore

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Latin America

- 5.3.4.1 Brazil

- 5.3.4.2 Rest of Latin America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 Egypt

- 5.3.5.3 Israel

- 5.3.5.4 South Africa

- 5.3.5.5 Rest of Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Safran

- 6.2.2 Rolls-Royce plc

- 6.2.3 General Electric Company

- 6.2.4 Pratt & Whitney (RTX Corporation)

- 6.2.5 Rostec State Corporation

- 6.2.6 CFM international

- 6.2.7 MTU Aero Engines AG

- 6.2.8 Honeywell International Inc.

- 6.2.9 Lycoming Engines (Avco Corporation)