|

시장보고서

상품코드

1852087

일회용 바이오리액터 시장 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Single-use Bioreactor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

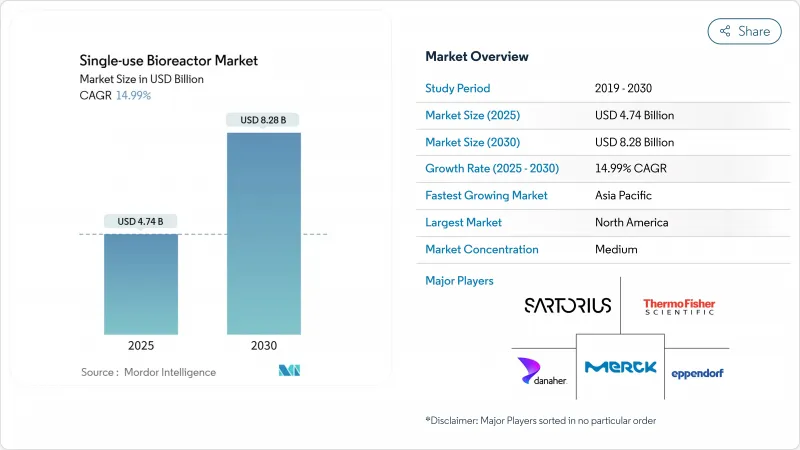

일회용 바이오리액터 시장 규모는 2025년에 47억 4,000만 달러로 추정되고, 2030년에는 82억 8,000만 달러에 이를 전망이며, CAGR 14.99%로 성장할 것으로 예측됩니다.

성장의 열쇠는 바이오파마가 유연하고 신속하게 전개 가능한 시설을 선호하고 있는 것, 무균성에 대한 규제 당국의 기대가 엄격하다는 점, 소량 생산을 요구하는 첨단 치료제가 급증하고 있다는 것입니다. 주요 CDMO의 생산 능력 향상, 플랫폼 기술을 중심으로 구성된 백신 프로그램 증가, 투자자의 모듈식 플랜트에 대한 의욕은 수익 전망을 강화합니다. 스테인레스 스틸 시스템보다 비용 효율적이고, 오염 위험이 낮으며, 턴 어라운드 시간이 짧기 때문에 채택이 계속 확대되고 있습니다. 바이오 기반 필름 및 순환 경제의 재활용 계획에 대한 지속가능성에 대한 노력도 조달 전략에 영향을 미칩니다.

세계의 일회용 바이오리액터 시장 동향 및 인사이트

증가하는 생물 제제 제조 수요

단일클론항체의 매출은 2024년에 2,040억 달러를 넘어, 제조업체는 고역가 다제품 포트폴리오를 다루는 일회용 능력을 추가할 필요가 있습니다. 후지필름지오신스의 세계적인 80억 달러 규모의 프로그램에서는 처리량 및 오염 제어를 양립시키는 2만 리터 라인을 복수 도입하고 있습니다. 맞춤형 치료는 GMP의 무균성을 유지하면서 일회용 형식을 허용하는 몇 주가 아니라 며칠 이내에 신속한 전환이 필요합니다. CDMO는 턴키 용량을 제공함으로써이 기회를 포착하고 중소규모 생명 공학 회사의 프로젝트 일정을 가속화하고 있습니다.

일회용 시스템의 비용 및 유연성의 이점

일회용 플랫폼은 반응기 세척, 밸리데이션 및 자본 집약적인 배관을 제거하고 그린필드 공장에서의 프로젝트 시작을 12-18개월 단축합니다. AGC Biologics는 2,000L의 일회용 트레인으로 전환한 후 코펜하겐 생산량을 두 배로 늘리고 연간 150개의 의약품 배치를 추가했습니다. 렌트슐러의 올디스포저블 설비는 20%의 생산능력 향상과 동시에 40%의 고정비 절감을 기록했습니다. 비용 이점은 임상 단계 및 초기 상업 단계에서 가장 설득력이 있지만 혼합 모델의 하이브리드 플랜트는 민첩성이 필요한 후기 단계 캠페인을 위해 일회용 리액터를 라인에 유지합니다.

높은 경상 소모품 비용

가방, 필터 및 튜브는 대량 생산, 단일 제품 플랜트의 스테인레스 스틸 작동 비용을 초과할 수 있습니다. 연간 사용량이 20,000L를 초과하면 경제적 변화가 자주 나타나며, 제조업체는 안정적인 상업 생산을 위해 하이브리드 또는 스테인레스 스틸 자산을 조타합니다. 현재 금형 벤더는 재활용 노력 및 재가공 가능한 폴리머를 제안하고 있지만, 여전히 소모품 비용에 비해 절약이 적습니다. 의약품 생산량이 증가함에 따라 CFO는 총 소유 비용을 재평가하고 이전 일회용으로의 전환을 뒤집을 수 있습니다.

부문 분석

일회용 바이오리액터 시스템은 2024년 매출의 41.45%를 차지했으며, 일회용 바이오리액터 시장의 핵심 제품으로서의 입지를 굳혔습니다. 그러나 규제 당국이 미립자와 바이러스의 클리어런스에 대한 모니터링을 강화하는 동안 여과 어셈블리는 CAGR 16.65%로 가장 빠른 성장을 기록합니다. 이 기세는 폐쇄형 무균 트레인으로 업스트림 및 다운스트림에 있어서 일회성의 광범위한 통합을 반영합니다. 배지 백은 리드 타임을 몇 주간 단축하는 레디 메이드 배지 제형을 가능하게 하고 꾸준히 성장하고 있습니다. 센서는 재사용 가능한 프로브에서 리액터 백에 직접 임베디드된 교정된 일회용 형식으로 전환하여 자동화를 강화합니다. 아사히카세이의 플라노바(TM) FG1 필터는 기존의 7배의 투과성을 가지며, 여과의 돌파구가 공정을 재설계하지 않고 더 높은 역가를 끌어낼 수 있음을 명확하게 보여줍니다.

10년에 걸친 확대로 보급률은 2020년의 약 35%에서 2030년에는 75%가 될 것으로 예측되고 있습니다. Thermo Fisher의 5L 다이너 드라이브 리액터는 생산성을 27% 향상시켜 5,000L까지 리니어로 스케일업하여 실험실에서 플랜트로의 교량과 기술 이전 사이클을 가속화합니다. 새로운 바이오 다층 필름은 산소와 CO2의 투과성을 유지하면서 매립 부담을 줄여줍니다. 이러한 기술 혁신의 총체로서, 일회용 바이오리액터 시장은 예측 기간 동안 두 자릿수 성장을 유지할 수 있습니다.

포유류 플랫폼은 단클론 항체의 차이니즈 햄스터 난소(CHO) 생산에 힘입어 2024년 매출의 62.34%를 차지했습니다. 그러나 효모 배양은 당쇄 최적화 균주가 저비용으로 포유류의 당쇄 패턴에 적합하기 때문에 CAGR 15.89%로 상승하고 있습니다. 박테리아 발효는 재조합 효소와 플라스미드 공급과의 연관성을 유지합니다. 줄기 세포 가공은 병렬로 성숙하고 자가 치료를 위한 무균성을 지키는 폐쇄 관류 양식에 의해 지원됩니다.

대웅바이오의 화성 공장은 CHO 이외의 다양화 및 바이오시밀러 수요를 캡처하기 위해 미생물 생산 능력을 추가했습니다. 최근 관류운전에서는 4,900만 세포/mL, 역가 5.2g/L을 달성하여 포유류 생산량 증가를 확고한 것으로 하고 있습니다. 따라서 틈새 세포 유형이 새로운 방식으로 점유율을 획득하더라도 포유류 계통으로 인한 일회용 바이오리액터 시장 규모는 상승할 것으로 보입니다.

지역 분석

북미는 CDMO와 제약 메이저가 일회용 능력을 확대했기 때문에 2024년 매출의 41.45%를 유지했습니다. 후지 필름 디오신스의 노스캐롤라이나에서 12억 달러의 증설과 노보 노르디스크의 클레이튼에서의 41억 달러의 증설은 이 지역의 민첩한 생물 제제 공급에 대한 헌신을 강조합니다. 산학 컨소시엄과 신뢰할 수 있는 벤처 자금이 지원 인프라를 완성하고 있습니다.

아시아태평양의 CAGR은 15.67%로 가장 빠릅니다. 중국의 생물 제제 제조 자립화 계획은 대규모 일회용 라인에 자금을 제공하고 인도는 확립된 제제의 전문 지식을 활용하여 바이오시밀러 의약품의 수출을 목표로 하고 있습니다. 한국의 Daewoong Bio는 GMP 미생물 스위트를 추가하고 더 높은 지역 전문성을 반영합니다. 기세를 유지하기 위해서는 인재육성 및 현지 시약 공급망이 계속 우선 과제입니다.

유럽에서는 지속가능성에 관한 법규제가 재활용 가능한 가방이나 바이오 기반 필름으로 생산자를 뒷받침하고 있어 꾸준히 전진하고 있습니다. 베링거 인겔하임의 8억 1,100만 달러를 투자한 비엔나 시설은 엔드 투 엔드 디지털 트윈과 스마트 센서를 통합하여 인더스트리 4.0 패러다임에 충실함을 보여줍니다. 독일의 렌트 슈러는 버퍼 미디어 인프라에 투자하여 공급 탄력성을 강화하고 세계 의약품 스폰서에 대한 유럽 아웃소싱의 매력을 높이고 있습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건 및 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 성장 촉진요인

- 높아지는 생물 제제 제조 수요

- 일회용 시스템의 비용 및 유연성의 장점

- 제조 위탁 증가

- 가속 백신 개발 스케줄

- 바이오 기반 일회용 재료의 지속가능성 이니셔티브

- 분산형 모듈식 바이오프로세스 시설

- 시장 성장 억제요인

- 높은 경상 소모품비

- 추출물 및 침출물의 규제 상 심사

- 일회용 플라스틱 폐기물을 둘러싼 환경 문제

- 대량 상업 생산에 있어서 스케일 업의 한계

- 규제 상황

- Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업 간 경쟁 관계

제5장 시장 규모 및 성장 예측

- 제품별

- 일회용 바이오리액터 시스템

- 미디어 가방

- 여과 어셈블리

- 기타 제품

- 셀 유형별

- 포유류

- 박테리아

- 효모

- 기타 셀 유형

- 분자 유형별

- 단일클론항체

- 백신

- 줄기세포

- 재조합 단백질

- 기타 분자 유형

- 바이오리액터 설계별

- 교반 탱크

- 웨이브 믹스

- 궤도 진탕

- 고정 침대

- 규모별

- 실험실 스케일(50L 미만)

- 파일럿 스케일(50-500 L)

- 상업 스케일(500-2,000 L)

- 대형 스케일(2000 L 초과)

- 최종 사용자별

- 바이오의약품 및 제약 제조업체

- CDMO 및 CRO

- 학술기관 및 연구기관

- 기타 최종 사용자

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 기타 아시아태평양

- 중동 및 아프리카

- GCC

- 남아프리카

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 경쟁 구도

- 시장 집중도

- 시장 점유율 분석

- 기업 프로파일

- ABEC

- Applikon(Getinge)

- Cellexus

- Celltainer

- Danaher(Cytiva & Pall)

- Eppendorf SE

- GE Healthcare

- Lonza

- Merck KGaA

- OmniBRx Biotechnologies

- Pall Corporation

- PBS Biotech

- Sartorius AG

- Thermo Fisher Scientific, Inc.

- Univercells

- WuXi Biologics

제7장 시장 기회 및 향후 전망

AJY 25.11.26The single-use bioreactor market size generated USD 4.74 billion in 2025 and is on course to reach USD 8.28 billion by 2030, reflecting a 14.99% CAGR.

Growth hinges on biopharma's preference for flexible, rapidly deployable facilities, stringent regulatory expectations for sterility, and the surge in advanced therapies that demand smaller batch runs. Capacity additions by leading CDMOs, rising vaccine programs structured around platform technologies, and investors' appetite for modular plants strengthen the revenue outlook. Cost efficiency over stainless-steel systems, lower contamination risk, and shorter turnaround times continue to widen adoption. Sustainability initiatives around bio-based films and circular-economy recycling schemes also influence procurement strategies.

Global Single-use Bioreactor Market Trends and Insights

Growing Biologics Manufacturing Demand

Monoclonal antibody sales surpassed USD 204 billion in 2024, compelling manufacturers to add disposable capacity that handles high-titer, multiproduct portfolios. Fujifilm Diosynth's global USD 8 billion program is installing multiple 20,000 L lines that marry throughput with contamination control. Personalized therapies deepen the need for quick changeovers that single-use formats enable within days instead of weeks, while maintaining GMP sterility. CDMOs seize the opportunity by offering turnkey capacity, which in turn accelerates project timelines for small and mid-sized biotech firms.

Cost And Flexibility Advantages of Single-Use Systems

Disposable platforms eliminate reactor cleaning, validation, and capital-intensive piping, trimming project start-up by 12-18 months in greenfield plants. AGC Biologics doubled Copenhagen's output and added 150 drug-product batches per year after migrating to 2,000 L single-use trains. Rentschler's all-disposable facility documented a 40% fixed-cost reduction alongside a 20% capacity lift. Cost advantages remain most compelling during clinical and early commercial phases, but mixed-model hybrid plants keep single-use reactors on line for late-stage campaigns that demand agility.

High Recurring Consumable Expenditure

Bags, filters, and tubing can exceed stainless-steel operating expenses in high-volume, single-product plants. Economic inflection often appears beyond 20,000 L annual utilization, steering manufacturers toward hybrid or stainless-steel assets for steady commercial runs. Tooling vendors now propose recycling initiatives and re-processable polymers, yet savings remain marginal against the consumable bill of materials. As drug volumes rise, CFOs reevaluate total cost of ownership, occasionally reversing earlier disposable migrations.

Other drivers and restraints analyzed in the detailed report include:

- Rising Contract Manufacturing Outsourcing

- Accelerated Vaccine Development Timelines

- Regulatory Scrutiny of Extractables and Leachables

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Single-use bioreactor systems delivered 41.45% of 2024 revenue, solidifying their status as the backbone of the single-use bioreactor market. Filtration assemblies, however, record the fastest 16.65% CAGR as regulators heighten scrutiny over particulate and viral clearance. This momentum reflects broader integration of upstream and downstream disposables into closed, sterile trains. Media bags post steady gains, enabling ready-made medium formulation that trims lead times by weeks. Sensors migrate from reusable probes to pre-calibrated single-use formats that embed directly in the reactor bag, enhancing automation. Asahi Kasei's Planova(TM) FG1 filter, seven-times more permeable than prior versions, underscores that filtration breakthroughs can unlock higher titers without process redesign.

The decade-long expansion shows penetration leaping from roughly 35% in 2020 to a projected 75% by 2030. Thermo Fisher's 5 L DynaDrive reactor lifts productivity 27% and scales linearly to 5,000 L, bridging lab to plant and accelerating tech-transfer cycles. New biobased multilayer films lessen landfill burden while preserving oxygen and CO2 permeability. Collectively, these innovations guarantee that the single-use bioreactor market will sustain double-digit expansion through the forecast horizon.

Mammalian platforms held 62.34% of 2024 turnover, anchored by Chinese hamster ovary (CHO) production of monoclonal antibodies. Yet yeast cultures are rising at a 15.89% CAGR as glyco-optimized strains match mammalian glycosylation patterns at lower cost. Bacterial fermentation maintains relevance for recombinant enzymes and plasmid supply. Stem-cell processing matures in parallel, supported by closed perfusion formats that safeguard sterility for autologous therapies.

Daewoong Bio's Hwaseong plant adds microbial capacity to diversify beyond CHO and capture biosimilar demand. Recent perfusion runs hit 49 million cells/mL and titers of 5.2 g/L, cementing mammalian output gains. The single-use bioreactor market size attributed to mammalian lines will therefore climb even as niche cell types carve share in emerging modalities.

The Single Use Bioreactor Market Report is Segmented by Product (Single-Use Bioreactor Systems, and More), Cell Type (Mammalian, and More), Molecule Type (Monoclonal Antibodies, and More), End User (Biopharma & Pharma Manufacturers, and More), Scale (Lab-Scale (<50 L, and More), Bioreactor Design (Stirred-Tank, and More), Geography (North America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 41.45% of 2024 revenue as CDMOs and pharma majors expanded disposable capacity. Fujifilm Diosynth's USD 1.2 billion North Carolina extension and Novo Nordisk's USD 4.1 billion Clayton site underscore the region's commitment to agile biologics supply. Academic-industry consortia and reliable venture funding round out supportive infrastructure.

Asia-Pacific exhibits the quickest 15.67% CAGR. China's biomanufacturing self-reliance plan funds large-scale single-use lines, while India leverages established formulation expertise to target biosimilar exports. South Korea's Daewoong Bio added GMP microbial suites, reflecting higher regional specialization. Talent development and local reagent supply chains remain priorities to sustain momentum.

Europe advances steadily as sustainability legislation pushes producers toward recyclable bags and bio-based films. Boehringer Ingelheim's USD 811 million Vienna facility integrates end-to-end digital twins and smart sensors, demonstrating adherence to Industry 4.0 paradigms. Germany's Rentschler invests in buffer-media infrastructure to shore up supply resilience, enhancing the appeal of European outsourcing for global drug sponsors.

- ABEC

- Applikon (Getinge)

- Cellexus

- Celltainer

- Danaher (Cytiva & Pall)

- Eppendorf

- GE Healthcare

- Lonza Group

- Merck

- OmniBRx Biotechnologies

- Pall

- PBS Biotech

- Sartorius

- Thermo Fisher Scientific

- Univercells

- Wuxi Biologics

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Drivers

- 4.1.1 Growing Biologics Manufacturing Demand

- 4.1.2 Cost and Flexibility Advantages of Single-Use Systems

- 4.1.3 Rising Contract Manufacturing Outsourcing

- 4.1.4 Accelerated Vaccine Development Timelines

- 4.1.5 Sustainability Initiatives For Bio-Based Single-Use Materials

- 4.1.6 Decentralized Modular Bioprocessing Facilities

- 4.2 Market Restraints

- 4.2.1 High Recurring Consumable Expenditure

- 4.2.2 Regulatory Scrutiny of Extractables And Leachables

- 4.2.3 Environmental Concerns Over Disposable Plastic Waste

- 4.2.4 Scale-Up Limitations In High-Volume Commercial Production

- 4.3 Regulatory Landscape

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product

- 5.1.1 Single-Use Bioreactor Systems

- 5.1.2 Media Bags

- 5.1.3 Filtration Assemblies

- 5.1.4 Other Products

- 5.2 By Cell Type

- 5.2.1 Mammalian

- 5.2.2 Bacterial

- 5.2.3 Yeast

- 5.2.4 Other Cell Types

- 5.3 By Molecule Type

- 5.3.1 Monoclonal Antibodies

- 5.3.2 Vaccines

- 5.3.3 Stem Cells

- 5.3.4 Recombinant Proteins

- 5.3.5 Other Molecule Types

- 5.4 By Bioreactor Design

- 5.4.1 Stirred-Tank

- 5.4.2 Wave-Mixed

- 5.4.3 Orbitally Shaken

- 5.4.4 Fixed-Bed

- 5.5 By Scale

- 5.5.1 Lab-Scale (<50 L)

- 5.5.2 Pilot-Scale (50-500 L)

- 5.5.3 Commercial-Scale (500-2 000 L)

- 5.5.4 Large-Scale (>2000 L)

- 5.6 By End User

- 5.6.1 Biopharma & Pharma Manufacturers

- 5.6.2 CDMOs/CROs

- 5.6.3 Academic & Research Institutes

- 5.6.4 Other End Users

- 5.7 Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 Europe

- 5.7.2.1 Germany

- 5.7.2.2 United Kingdom

- 5.7.2.3 France

- 5.7.2.4 Italy

- 5.7.2.5 Spain

- 5.7.2.6 Rest of Europe

- 5.7.3 Asia-Pacific

- 5.7.3.1 China

- 5.7.3.2 Japan

- 5.7.3.3 India

- 5.7.3.4 Australia

- 5.7.3.5 South Korea

- 5.7.3.6 Rest of Asia-Pacific

- 5.7.4 Middle East & Africa

- 5.7.4.1 GCC

- 5.7.4.2 South Africa

- 5.7.4.3 Rest of Middle East & Africa

- 5.7.5 South America

- 5.7.5.1 Brazil

- 5.7.5.2 Argentina

- 5.7.5.3 Rest of South America

- 5.7.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.3.1 ABEC

- 6.3.2 Applikon (Getinge)

- 6.3.3 Cellexus

- 6.3.4 Celltainer

- 6.3.5 Danaher (Cytiva & Pall)

- 6.3.6 Eppendorf SE

- 6.3.7 GE Healthcare

- 6.3.8 Lonza

- 6.3.9 Merck KGaA

- 6.3.10 OmniBRx Biotechnologies

- 6.3.11 Pall Corporation

- 6.3.12 PBS Biotech

- 6.3.13 Sartorius AG

- 6.3.14 Thermo Fisher Scientific, Inc.

- 6.3.15 Univercells

- 6.3.16 WuXi Biologics

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment