|

시장보고서

상품코드

1850395

Organ on chip 시장 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Organ-on-chip - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

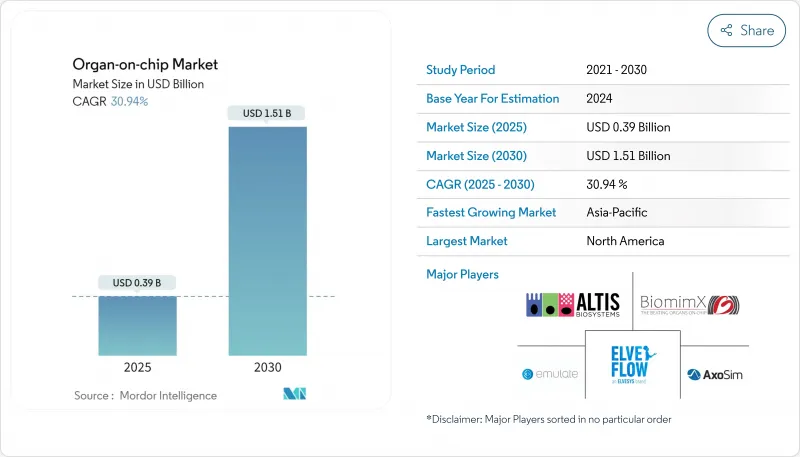

Organ on chip 시장 규모는 2025년에 3억 9,000만 달러로 추정되고, 예측 기간(2025-2030년) CAGR 30.94%로 성장할 전망이며, 2030년에는 15억 1,000만 달러에 달할 것으로 예측됩니다.

규제 당국이 마이크로피지올로지 시스템을 검증하고, 제약회사가 연구개발 자금을 동물실험을 하지 않는 방향으로 휘두르며, 3D 프린팅이 디바이스 제조 비용을 낮추면서 수요가 높아지고 있습니다. 초기 상업 견인력은 북미에서 가장 강했으며 FDA 근대화법 2.0과 ISTAND 파일럿 프로그램에 의해 승인까지의 기간이 단축되었습니다. 아시아태평양은 대규모 공공 지출을 배경으로 가장 빠르게 확대되고 유럽은 국경을 넘어 도입을 용이하게 하는 표준화 로드맵의 혜택을 받고 있습니다. 기업이 인공지능을 통합하고, 공동 개발 계약을 체결하며 자동화된 생산 라인을 확대함에 따라 경쟁 정보는 치열해지고 있습니다.

세계의 Organ on chip 시장 동향 및 인사이트

동물실험 불필요한 전임상시험 의무화로의 세계적 이동

FDA는 2025년 10월 단일클론항체의 강제적인 동물실험을 단계적으로 폐지하기로 결정하였으며, FDA 근대화법 2.0과 함께 인간과 관련된 시험상 도입이 가속화되고 있습니다. 개발자가 동물실험 이외의 데이터를 제출할 수 있도록 하는 FDA의 시험 프로그램은 제약 그룹이 사내 프로토콜을 개정하고 스크리닝 예산을 장기 칩으로 돌려보내도록 촉구하고 있습니다. 유럽에서는 규제 당국이 동물실험에 대한 규제를 강화하는 움직임이 병렬로 진행되고 있습니다. 이러한 정책적인 움직임은 안정적인 수요층을 형성하고, 개발 업무 수탁기관 간 조달 틀을 촉진하며, 플랫폼 벤더의 판매 사이클을 단축합니다. 칩과 AI 대응 애널리틱스를 결합한 기업은 2025년 이후 컴플라이언스 마감일에 따른 턴키 패스를 제공하므로 가장 혜택을 받게 됩니다. 따라서 동물 자유 의무화는 Organ on chip 시장의 중기 수익 전망을 좌우합니다.

더 나은 모델이 필요한 만성 및 복잡한 질병의 높은 부담

대사 증후군, 비알코올성 지방간 질환, 신경퇴행성 질환 등의 만성 질환은 전 세계의 이환율에서 차지하는 비율이 확대되고 있습니다. Hesperos사의 다장기 칩을 이용한 2024년의 연구에서는 NAFLD의 진행이 재현되어 동물 모델에서는 놓치는 치료 창이 부각되었습니다. 인간의 병태생리를 모방하는 이 능력은 GO-NO-GO의 연구개발 결정을 지원하고 임상에서의 소모 비용을 감소시킵니다. 고령화가 진행되고, 공적 보험 제도가 충실하고 있는 시장에서는 특히 수요가 현저하며, 환자의 결과에 직접 도움이 되는 트랜스레이셔널 연구가 우선되게 되어 있습니다. 이러한 의료 제도가 더 높은 예측 타당성을 추구하게 되면, 장기 칩은 필수적인 도구로서 상승하고 Organ on chip 시장의 장기적인 기세를 유지합니다.

기술적 복잡성 및 기술 격차가 폭넓은 보급 방해

마이크로플루이딕스 플랫폼의 작동에는 세포 생물학, 엔지니어링 및 센서 통합과 같은 분야에 걸친 전문 지식이 필요합니다. 2024년 5월에 Frontiers in Lab-on-a-Chip Technology 잡지에 게재된 총설은 소규모 실험실을 조사하고 훈련된 인력과 표준화된 프로토콜에 대한 접근이 제한되어 있음을 밝혔습니다. 다장기 시스템은 각 모듈에 엄격한 흐름 제어 및 동기화된 데이터 캡처가 필요하기 때문에 부담을 증가시킵니다. 이 격차를 메우기 위해 업계 단체는 모듈형 장치, 자동화된 미디어 교환, 클라우드 기반 분석을 제안합니다. 그러나 이러한 도구가 주류가 될 때까지, 특히 일류의 연구 거점 이외에서는 그 복잡성이 보급을 막을 것으로 보입니다.

부문 분석

폐 칩은 호흡기 독성, 감염성 연구 및 에어로졸 전달 연구에서의 유용성으로부터 2024년 Organ on chip 시장 점유율의 34.8%를 차지했습니다. POSTECH의 연구자들이 고충실도의 3D 바이오프린트 폐포 구조를 발표함으로써 모델의 관련성이 강화되어 백신 제조업체로부터 자금이 모이게 되었습니다. 이 플랫폼은 기도 생체 메카닉을 모방하고 섬모 박동 빈도와 같은 끝점을 허용하며 면역 세포층을 통합합니다. COVID-19에 이어 규제 당국이 호흡기 약물의 안전성을 우선시하기 때문에 조달은 안정적입니다. 이와 병행하여 하트 온 칩 디바이스는 2030년까지의 CAGR이 가장 빠른 33.4%에 달하는 기세이며, 부정맥 스크리닝이나 암 치료 화합물의 심독성 시험이 그 원동력이 되고 있습니다. 힘을 감지하는 마이크로와이어를 내장한 자동 제조는 작업 시간을 단축하고 학술 핵심 시설에 폭넓은 전개를 촉진합니다.

뇌 및 중추신경계의 하위 부문은 신경변성 연구에서 설치류 모델을 대체하는 것을 연구자가 요구하고 있기 때문에 기세가 증가하고 있습니다. 신장과 간을 기반으로 한 칩은 강력한 지위를 차지합니다. 후자는 ISTAND에 의해 검증된 인간 Live-Chip의 혜택을 받고 있으며, 대사 후보 물질의 안전 패키지를 지원합니다. 혈관계, 상피계, 면역계를 연결하는 다장기 어레이는 다음 프론티어가 됩니다. 즉시 사용할 수 있는 모듈식 플레이트를 제공하는 공급업체는 스폰서가 전신 약리학 연구로 전환함에 따라 증가하는 주문을 획득할 수 있는 위치에 있습니다.

지역 분석

북미는 Organ on chip 시장의 2024년 매출액의 42.8%를 차지했으며, FDA의 ISTAND 프레임워크, 풍부한 벤처 풀, 아이비 리그 대학과 주요 제약회사의 콜라보레이션이 이를 뒷받침했습니다. 미국은 대부분의 초기 단계 칩 테스트를 실시하고 캐나다는 폴리머 마이크로 패브리케이션에 대한 전문 지식을 제공하고 수탁 제조 업체에 공급하고 있습니다. 메디케어의 '커버리지 위즈 에비던스(증거가 있다면 보험 적용)' 패러다임 하에서의 상환 시험도 병원을 거점으로 하는 트랜스레이셔널 스터디를 더욱 뒷받침하고 있습니다.

아시아태평양은 2030년까지 연평균 복합 성장률(CAGR)이 35.3%로 가장 빠릅니다. 중국은 마이크로플루이딕스 툴에 보조금을 지급하는 국가 보조금을 활용하고, 위탁 연구 생태계는 다국적 아웃소싱에 대응할 수 있는 속도로 확대하고 있습니다. 일본의 독립행정법인 의약품 의료기기 종합기구는 마이크로피지올로지 데이터 제출에 관한 지침을 발표하고 국내 개발자에게 국내 승인에 대한 루트를 제공합니다. 한국의 컨소시엄은 칩 제조를 세포 및 유전자 치료에서 국가적 이니셔티브와 연계시켜 시너지 수요를 창출하고 있습니다.

유럽은 Horizon Europe의 보조금과 통합된 학술 네트워크를 통해 견조한 점유율을 유지하고 있습니다. 2024년 7월에 발표된 CEN/CENELEC의 로드맵은 실험실 간의 비교 가능성을 촉진하는 재료 적격성, 멸균, 세포의 무결성에 관한 패스웨이를 매핑하고 있습니다. 프랑스와 독일은 나노 스케일 엔지니어링과 1차 인간 세포 뱅크를 결합한 산업 클러스터에 자금을 제공합니다. 이 지역의 엄격한 동물 복지 규칙은 특히 안전 약리학 및 화장품에서 생체 내 분석을 칩 모델로 대체하는 것을 가속화합니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건 및 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 동물실험을 사용하지 않는 전임상시험의 의무화를 위한 세계의 이행

- 만성 질환 및 복합 질환의 부담이 크고, 보다 뛰어난 모델이 필요

- 정밀의료와 환자 유래 칩 수요 증가

- 약물 독성의 조기 검출 및 신제품 출시의 필요성

- 전략적 투자 및 파트너십을 통한 상업화 가속화

- 미세 가공 및 3D 바이오프린팅에 있어서 기술의 진보

- 시장 성장 억제요인

- 기술적인 복잡성 및 스킬 갭이 광범위한 도입 방해

- 마이크로플루이딕스 인프라에서 고액의 자본 비용 및 운영 비용

- 한정적인 규제 검증 및 통일 가이드라인

- 자동화 마이크로유체 툴체인에 대한 고액의 설비투자

- 규제 상황

- Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업 간 경쟁 관계

제5장 시장 규모 및 성장 예측

- 장기 유형별

- 간

- 심장

- 폐

- 신장

- 장

- 뇌와 중추신경계

- 피부

- 다장기 및 기타 복잡한 시스템

- 용도별

- 창약 및 리드 화합물의 특정

- ADME 및 독성 스크리닝

- 질병 모델

- 정밀의료 및 맞춤형 치료

- 기타 용도

- 최종 사용자별

- 제약 및 바이오테크놀러지 기업

- 수탁연구기관

- 학술연구기관

- 화장품 및 퍼스널케어 업계

- 기타 최종 사용자

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 기타 아시아태평양

- 중동 및 아프리카

- GCC

- 남아프리카

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율 분석

- 기업 프로파일

- Emulate Inc.

- MIMETAS BV

- CN Bio Innovations

- TissUse GmbH

- Hesperos Inc.

- AxoSim Technologies

- Altis Biosystems

- InSphero AG

- Nortis Inc.

- Kirkstall Ltd

- Netri SAS

- BiomimX SRL

- Bi/ond BV

- Organovo Holdings Inc.

- Allevi Inc.(3D Systems)

- Elveflow(Elvesys)

- Hurel Corporation

- Valo Health(Tara Biosystems)

- SynVivo(CFD Research)

- BioChip Technologies GmbH

제7장 시장 기회 및 향후 전망

AJY 25.11.19The Organ-on-chip Market size is estimated at USD 0.39 billion in 2025, and is expected to reach USD 1.51 billion by 2030, at a CAGR of 30.94% during the forecast period (2025-2030).

Demand is rising as regulators validate microphysiological systems, pharmaceutical firms redirect R&D funds toward animal-free testing, and 3D printing lowers device fabrication costs. Early commercial traction is strongest in North America, where the FDA Modernization Act 2.0 and the ISTAND Pilot Program have shortened approval timelines. Asia-Pacific is set for the fastest expansion on the back of heavy public spending, while Europe benefits from standardization roadmaps that ease cross-border adoption. Competitive intensity is growing as companies integrate artificial intelligence, strike co-development deals, and scale automated production lines.

Global Organ-on-chip Market Trends and Insights

Global Shift Toward Animal-Free Preclinical Testing Mandates

The FDA's decision in October 2025 to phase out compulsory animal studies for monoclonal antibodies, coupled with the FDA Modernization Act 2.0, is accelerating uptake of human-relevant test beds. The agency's pilot program that lets developers submit non-animal data has prompted pharmaceutical groups to revise internal protocols and divert screening budgets to organ chips. Europe is moving in parallel as regulators tighten restrictions on animal research. These policy moves create a stable demand floor, drive procurement frameworks among contract research organizations, and shorten sales cycles for platform vendors. Firms that combine chips with AI-enabled analytics stand to benefit most because they offer a turnkey path that aligns with post-2025 compliance deadlines. The animal-free mandate therefore anchors medium-term revenue visibility in the organ-on-chip market.

High Burden of Chronic & Complex Diseases Requiring Better Models

Chronic disorders such as metabolic syndrome, non-alcoholic fatty liver disease, and neurodegenerative conditions account for an expanding share of global morbidity. A 2024 study using Hesperos' multi-organ chip replicated NAFLD progression and highlighted therapeutic windows that animal models miss. This ability to mimic human pathophysiology supports go-no-go R&D decisions and lowers clinical attrition costs. Demand is especially pronounced in markets with aging populations and sizable public insurance schemes, which now prioritize translational research that directly benefits patient outcomes. As these health systems push for higher predictive validity, organ chips emerge as indispensable tools, sustaining long-term momentum in the organ-on-chip market.

Technical Complexity & Skill Gap Hindering Broad Adoption

Operating microfluidic platforms demands cross-disciplinary expertise in cell biology, engineering, and sensor integration. A May 2024 review in Frontiers in Lab-on-a-Chip Technology surveyed smaller laboratories and found limited access to trained personnel and standardized protocols. Multi-organ systems exacerbate the burden because each module requires tight flow control and synchronized data capture. To bridge the gap, industry groups advocate modular devices, automated media exchange, and cloud-based analytics. Yet, until these tools become mainstream, complexity will temper uptake, particularly outside tier-one research hubs.

Other drivers and restraints analyzed in the detailed report include:

- Rising Demand for Precision Medicine & Patient-Derived Chips

- Need for Early Detection of Drug Toxicity and New Product Launches

- High Capital & Operating Costs of Microfluidic Infrastructure

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Lung chips commanded 34.8% of the organ-on-chip market share in 2024 due to their utility in respiratory toxicity, infectious-disease research, and aerosol delivery studies. The launch of high-fidelity 3D-bioprinted alveolar constructs by POSTECH researchers has strengthened model relevance and drawn funding from vaccine makers. These platforms mimic airway biomechanics, enable endpoints such as ciliary beat frequency, and integrate immune cell layers. With regulatory agencies prioritizing respiratory-drug safety following COVID-19, procurement remains steady. In parallel, heart-on-chip devices are on track for the fastest 33.4% CAGR through 2030, driven by arrhythmia screening and cardiotoxicity testing for oncology compounds. Automated fabrication that embeds force-sensing microwires reduces hands-on time and encourages broader deployment across academic core facilities.

The brain and central-nervous-system subsegment is gaining momentum as researchers seek alternatives to rodent models in neurodegenerative research. Kidney- and liver-based chips hold strong positions; the latter benefits from the ISTAND-validated human Liver-Chip, which anchors safety packages for metabolic candidates. Multi-organ arrays linking vascular, epithelial, and immune components represent the next frontier. Vendors that offer ready-to-use, modular plates stand to capture incremental orders as sponsors move toward systemic pharmacology studies.

The Organ-On-Chip Market Report Segments the Industry Into by Organ Type (Liver, Heart, Lung, and More), Application (Drug Discovery and Lead Identification, and More), End User (Pharmaceutical and Biotechnology Companies, Academic and Research Institutes, and More) and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 42.8% of 2024 revenue for the organ-on-chip market, buoyed by the FDA's ISTAND framework, deep venture pools, and collaborations between Ivy League universities and big pharma. The United States hosts most early-stage chip trials, while Canada supplies polymer microfabrication expertise that feeds contract manufacturers. Reimbursement pilots under Medicare's coverage-with-evidence paradigm further encourage hospital-based translational studies.

Asia-Pacific is on course for the swiftest 35.3% CAGR through 2030. China leverages state grants that subsidize microfluidic tooling, and its contract research ecosystem scales at speed to handle multinational outsourcing. Japan's Pharmaceuticals and Medical Devices Agency has issued guidance on microphysiological data submissions, giving local developers a route to domestic approval. South Korean consortia align chip production with national initiatives in cell and gene therapy, creating synergistic demand.

Europe maintains a robust share powered by Horizon Europe grants and a consolidated academic network. The CEN/CENELEC roadmap published in July 2024 maps pathways for material qualification, sterilization, and cell integrity that foster cross-lab comparability. France and Germany finance industry clusters that pair nanoscale engineering with primary human-cell banks. The region's stringent animal-welfare rules accelerate substitution of in vivo assays with chip models, especially in safety pharmacology and cosmetics.

- Emulate

- Mimetas

- CN Bio Innovations

- TissUse

- Hesperos

- AxoSim Technologies

- Altis Biosystems

- InSphero

- Nortis

- Kirkstall Ltd

- Netri SAS

- BiomimX

- Bi/ond BV

- Organovo

- Allevi Inc. (3D Systems)

- Elveflow (Elvesys)

- Hurel

- Valo Health (Tara Biosystems)

- SynVivo (CFD Research)

- BioChip Technologies GmbH

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Global Shift Toward Animal-Free Preclinical Testing Mandates

- 4.2.2 High Burden of Chronic & Complex Diseases Requiring Better Models

- 4.2.3 Rising Demand for Precision Medicine & Patient-Derived Chips

- 4.2.4 Need for Early Detection of Drug Toxicity and New Products Launches

- 4.2.5 Strategic Investments & Partnerships Accelerating Commercialization

- 4.2.6 Technological Advances in Microfabrication & 3D Bioprinting

- 4.3 Market Restraints

- 4.3.1 Technical Complexity & Skill Gap Hindering Broad Adoption

- 4.3.2 High Capital & Operating Costs of Microfluidic Infrastructure

- 4.3.3 Limited Regulatory Validation & Harmonized Guidelines

- 4.3.4 High CapEx for Automated Microfluidic Tool-chains

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Organ Type

- 5.1.1 Liver

- 5.1.2 Heart

- 5.1.3 Lung

- 5.1.4 Kidney

- 5.1.5 Intestine

- 5.1.6 Brain & CNS

- 5.1.7 Skin

- 5.1.8 Multi-Organ & Other Complex Systems

- 5.2 By Application

- 5.2.1 Drug Discovery & Lead Identification

- 5.2.2 ADME/Toxicology Screening

- 5.2.3 Disease Modeling

- 5.2.4 Precision Medicine & Personalized Therapy

- 5.2.5 Other Applications

- 5.3 By End User

- 5.3.1 Pharmaceutical & Biotechnology Companies

- 5.3.2 Contract Research Organizations

- 5.3.3 Academic & Research Institutes

- 5.3.4 Cosmetics & Personal Care Industry

- 5.3.5 Other End Users

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East & Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East & Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Emulate Inc.

- 6.4.2 MIMETAS BV

- 6.4.3 CN Bio Innovations

- 6.4.4 TissUse GmbH

- 6.4.5 Hesperos Inc.

- 6.4.6 AxoSim Technologies

- 6.4.7 Altis Biosystems

- 6.4.8 InSphero AG

- 6.4.9 Nortis Inc.

- 6.4.10 Kirkstall Ltd

- 6.4.11 Netri SAS

- 6.4.12 BiomimX SRL

- 6.4.13 Bi/ond BV

- 6.4.14 Organovo Holdings Inc.

- 6.4.15 Allevi Inc. (3D Systems)

- 6.4.16 Elveflow (Elvesys)

- 6.4.17 Hurel Corporation

- 6.4.18 Valo Health (Tara Biosystems)

- 6.4.19 SynVivo (CFD Research)

- 6.4.20 BioChip Technologies GmbH

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment