|

시장보고서

상품코드

1852185

수의 서비스 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Veterinary Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

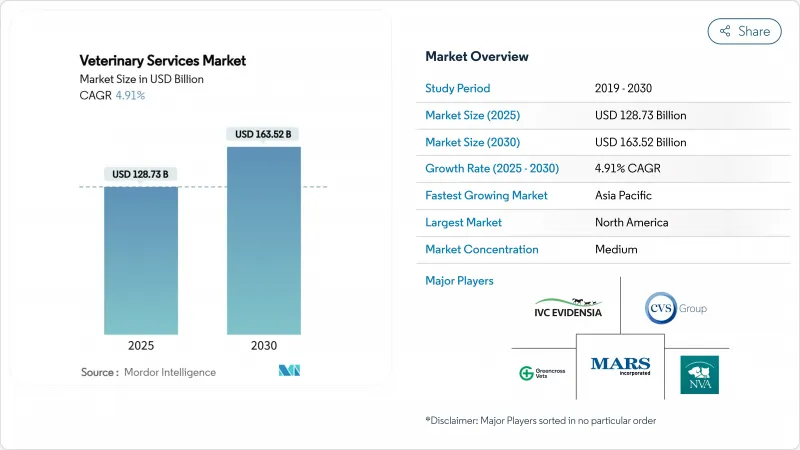

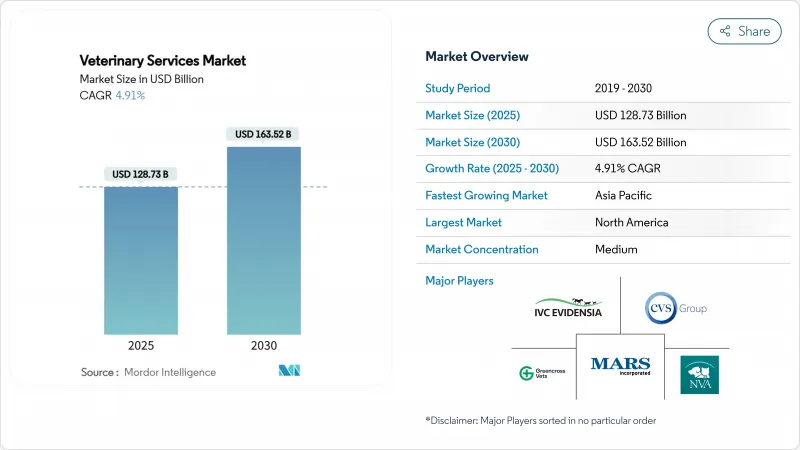

수의 서비스 시장 규모는 2025년에 1,287억 3,000만 달러로 평가되었고, 2030년에 1,635억 2,000만 달러에 이를 것으로 예측되며, CAGR은 4.91%를 나타낼 전망입니다.

건강한 반려동물 주인의 지출, 빠른 기술 채택 및 지속적인 기업 인수합병은 수의 서비스 시장을 확장 경로로 유지합니다. 예방의학은 가정이 단발성 치료에서 지속적 관리로 전환함에 따라 수요를 포착하고 있으며, 인공지능은 진단 처리량을 높이고 바쁜 임상의들을 지원합니다. 사모펀드 및 전략적 인수자들은 규모의 경제, 데이터 자산, 인재 풀 확보를 위해 인수 통합 활동을 가속화하고 있습니다. 반려동물 관리 외부의 수요도 증가하고 있습니다 : 인수공통전염병 감시, 가축 생산성 의무화, 원헬스 정책 프레임워크가 수의 서비스 시장의 수익 기반을 확대하고 있습니다.

세계의 수의 서비스 시장 동향 및 인사이트

반려동물 사육률 상승과 동물의 인간화

반려동물 소유 가구는 2011년 5,600만 가구에서 2025년 9,400만 가구로 증가했으며, Z세대가 현재 가장 빠르게 성장하는 신규 소유자 집단입니다. 이 인구 집단은 과거 인간 의학에서만 제공되던 종양학, 심장학, 행동 치료를 기대합니다. 고액 자산가 고객들은 유전체 검사, 영양 상담, 전문가와의 24시간 원격 상담이 포함된 컨시어지 플랜도 구매합니다. 이러한 프리미엄화는 수의 서비스 시장 전반에 걸쳐 현금 흐름 가시성을 강화하는 동시에 장비 업그레이드와 전문가 교육의 정당성을 부여합니다.

인수 공통 감염 및 만성 동물 질병의 발생률 증가

2024년 H5N1 인플루엔자 사태는 미국 내 800개 이상의 낙농 가축군에 영향을 미쳤으며, 동물 접촉으로 인한 인간 감염 사례 66건이 확인되었습니다. 반려동물의 수명 연장으로 만성 질환이 증가하고 있습니다 : 2024년 개 73%, 고양이 64%가 치과 질환 진단을 받았습니다. 이러한 이중 압박은 수의 서비스 시장 내 실험실, 영상진단, 생물안전성 관련 지출의 지속적 증가를 뒷받침합니다.

전 세계 수의사 부족 및 번아웃 현상

2032년까지 수의사 70,092명이 부족할 것으로 전망되는 반면 졸업생은 52,926명에 불과하며, 평균 40만 달러에 달하는 학생 부채로 인해 이 격차는 더욱 심화되고 있습니다. 번아웃 비율은 40%를 초과하며 자살 위험도 여전히 높아 수의 서비스 산업의 진료 인력 구성에 부담을 주고 있습니다. 농촌 지역이 가장 큰 타격을 입어, 2025년 기준 미국 243개 카운티가 부족 지역으로 분류되었습니다.

부문 분석

예방 및 웰니스 케어는 2024년 매출의 31.34%를 차지하며 수의 서비스 시장의 핵심을 이루었습니다. 정기 구독형 웰니스 플랜과 연간 건강 검진은 예측 가능한 마진을 창출하는 한편, 약국 자동 재주문 서비스는 고객 충성도를 높입니다. 원격의료 수의 서비스 시장 규모는 2025년 3억 6,917만 달러에서 2034년 19억 6,000만 달러로 연평균 6.54% 성장할 전망입니다. AI 기반 영상 진단은 처리량을 높이고 급증 수요 대응 능력을 지원합니다. 최소 침습적 수술 기법이 회복 기간을 단축함에 따라 수술 수요는 안정화되고 있습니다. 치과 시술은 건당 평균 170-350달러로 수익성이 높으며, 개 73%가 생애 최소 한 번 이상의 치료가 필요합니다.

진단 실험실은 병원과의 교차 판매를 통해 수익을 창출하고, 전자 처방 플랫폼은 약물 복용 순응도를 개선합니다. 응급 및 중환자 치료 센터는 인력 제약에 직면하여, 기업 그룹들이 원격 중환자실 대시보드로 연결된 24시간 허브를 개설하도록 촉진하고 있습니다. 재활, 침술, 수중 치료는 반려동물의 노화에 따라 주목받으며 수의 서비스 시장의 평생 지출을 연장하고 있습니다.

반려동물은 2024년 매출의 63.23%를 차지했으며, 2030년까지 가장 빠른 6.74%의 연평균 성장률(CAGR)을 기록할 것입니다. 개는 계속해서 최대 하위 부문으로, 종양학 및 심장학 서비스는 인간 치료 프로토콜을 반영합니다. 밀레니얼 세대와 Z세대 사이에서 도시 고양이 소유가 증가하며 고양이 전용 클리닉 수요를 촉진합니다. 말 의학은 틈새 시장으로 남아 있지만, 절름발이 진단 및 스포츠 부상 재활에 대해 높은 평균 거래 가치를 유지합니다.

H5N1 유행성 조류 인플루엔자 발생으로 공중보건 위험이 부각된 후 생산동물 서비스 통합 수요가 증가했습니다. 소 사육업자들은 실시간 모니터링 및 백신 준수 감사 서비스를 구매하고 있습니다. 돼지 및 가금류 생산자들은 종합 생물안전 패키지를 확대하며, 양식업 사업체들은 전문 건강 관리 계획을 요청하여 수의 서비스 시장의 폭을 넓히고 있습니다. 소비자들이 단백질 공급원을 다양화함에 따라 소형 반추동물에 대한 관심이 증가하며 고객 기반이 더욱 확대되고 있습니다.

지역 분석

북미는 2024년 글로벌 매출의 42.45%를 유지했습니다. 성숙한 보험 보급률, 강력한 전자상거래 약국 채널, 그리고 원헬스 정책 통합이 프리미엄 가격 탄력성을 유지합니다. 다국적 체인점들은 미국 도시 중심부에 집중되어 있으며, 캐나다 운영사들도 유사한 통합을 보이지만 공중보건 의무에 맞춰 서비스를 조정합니다. 멕시코의 중산층 확대는 반려동물 사료 시장의 두 자릿수 성장을 촉진하며, 이는 하류 서비스 기회 신호로 해석됩니다.

유럽은 꾸준한 성장세를 보입니다. 영국 왕립수의외과학회는 인증 절차를 간소화하여 수의사들의 국경 간 이동성을 높였습니다. 독일과 프랑스는 동물 및 인간 역학 데이터를 연계하는 감시 플랫폼에 투자 중입니다. EQT의 VetPartners 인수는 회원국 간 클리닉 플랫폼 확장을 목표로 한 자본 유입을 시사합니다. 원격의료 및 처방 데이터 상호운용성을 위한 규제 조화는 수의 서비스 시장 전반에서 운영 시너지 효과를 창출하는 데 도움이 됩니다.

아시아태평양은 CAGR 5.65%에서 가장 급속히 확대되는 지역입니다. 중국의 반려동물 의료비는 2024년 1조 620억 위안에 달했고, 시장 분산에도 불구하고 계속 증가하고 있습니다. 인도의 반려동물 사료 시장은 연평균 15.37% 성장하며 영양 상담, 피부과 등 부가 서비스 수요를 주도합니다. 일본의 초고령화 개 인구는 노인 의료 수요를 촉진하는 반면, 한국은 소동물 영상진단을 위한 AI 알고리즘 개발을 선도합니다. 호주의 동물병원 통합 움직임은 높은 규제 준수 시장 진출을 노리는 유럽 투자자들의 관심을 끌고 있습니다. 이러한 역학 관계가 종합적으로 해당 지역 수의 서비스 시장 규모를 확대하고 있습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 반려동물 사육 증가와 동물의 인간화

- 인수 공통 감염 및 만성 동물 질병 증가

- 가축 생산성 향상 및 식품 안전 요구 사항 증가

- 반려동물 보험 상환 모델의 확대

- AI 기반 분류 및 진단으로 진료 역량 강화

- 시장 성장 억제요인

- 전 세계 수의사 부족 및 번아웃 현상

- 첨단 시술 및 장비 비용 상승

- 국경 간 원격 수의 진료에 대한 규제 불명확성

- 소비자 가격 민감도로 인한 진료 지연

- 규제 상황

- Porter's Five Forces 분석

- 신규 진입업자의 위협

- 구매자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

제5장 시장 규모와 성장 예측

- 서비스별

- 수술

- 영상 진단 & 실험실

- 예방의료와 웰니스 케어

- 응급 의료

- 텔레헬스 & 가상 케어

- 재활 및 물리치료

- 치과

- 약국 및 처방전 관리

- 동물 유형별

- 반려동물

- 개

- 고양이

- 말

- 생산/사육 동물

- 소 및 버팔로

- 돼지

- 가금류

- 소형 반추동물

- 수산 양식

- 반려동물

- 제공자 소유 구조별

- 독립 진료소

- 기업형 동물병원 체인

- 이동형/방문 진료 서비스

- 대학병원 및 전문병원

- 제공방법별

- 원내(오프라인 매장)

- 모바일/농장

- 원격 진료 플랫폼

- 지리

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 기타 아시아태평양

- 중동 및 아프리카

- GCC

- 남아프리카

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 경쟁 구도

- 시장 집중도

- 시장 점유율 분석

- 기업 프로파일

- Mars Inc.(VCA, Banfield, BluePearl)

- National Veterinary Associates(NVA)

- CVS Group PLC

- IVC Evidensia

- Greencross Ltd

- Ethos Veterinary Health

- Idexx Laboratories

- Zoetis Services

- Elanco Animal Health Services

- Southern Veterinary Partners

- Thrive Pet Healthcare

- VetCor

- PetVet Care Centers

- Mission Veterinary Partners

- BlueRiver Pet Care

- FirstVet AB

- CityVet Inc.

- Armor Animal Health

- Kremer Veterinary Services

- I-Med Animal Referral Centers

제7장 시장 기회와 장래의 전망

HBR 25.11.27The veterinary services market size is valued at USD 128.73 billion in 2025 and is forecast to reach USD 163.52 billion by 2030, advancing at a 4.91% CAGR.

Healthy pet-owner spending, rapid technology adoption, and sustained corporate buy-outs keep the veterinary services market on an expansion path. Preventive medicine captures demand as households shift from episodic to continuous care, while artificial intelligence raises diagnostic throughput and supports busy clinicians. Private-equity and strategic buyers accelerate roll-up activity to secure scale economies, data assets, and talent pools. Demand also grows outside companion care: zoonotic-disease surveillance, livestock productivity mandates, and One-Health policy frameworks widen the revenue base of the veterinary services market.

Global Veterinary Services Market Trends and Insights

Rising Pet Ownership & Humanisation of Animals

Pet ownership reached 94 million U.S. households in 2025, up from 56 million in 2011, and Generation Z now represents the fastest-growing cohort of new owners. This demographic expects oncology, cardiology, and behavioural therapies once reserved for human medicine. High-net-worth clients also purchase concierge plans that bundle genomic screening, nutrition counselling, and 24/7 tele-access to specialists. Such premiumisation strengthens cash-flow visibility across the veterinary services market while justifying equipment upgrades and specialist training.

Increasing Incidence of Zoonotic & Chronic Animal Diseases

The 2024 H5N1 influenza episode affected more than 800 U.S. dairy herds, with 66 confirmed human infections traced to animal exposure. Companion pets live longer, which increases chronic conditions: 73% of dogs and 64% of cats were diagnosed with dental disease in 2024. These dual pressures support sustained laboratory, imaging, and bio-security spending within the veterinary services market.

Global Shortage & Burnout of Veterinarians

Forecasts show a deficit of 70,092 veterinarians by 2032 versus only 52,926 graduates, a shortfall aggravated by student debt that averages USD 400,000. Burnout exceeds 40%, and suicide risk remains elevated, pressuring clinic rosters in the veterinary services industry. Rural zones suffer most, with 243 U.S. counties classified as shortage areas in 2025.

Other drivers and restraints analyzed in the detailed report include:

- Growing Livestock Productivity & Food-Safety Requirements

- AI-Enabled Triage & Diagnostics Boosting Clinic Capacity

- Escalating Cost of Advanced Procedures & Equipment

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Preventive and wellness care captured 31.34% of 2024 revenue, anchoring the veterinary services market. Subscription wellness plans and annual health screens generate predictable margins, while pharmacy auto-refills deepen client stickiness. The veterinary services market size for tele-health is set to climb from USD 369.17 million in 2025 to USD 1.96 billion by 2034, a 6.54% CAGR. AI-enhanced imaging lifts throughput and supports surge capacity. Surgical demand stabilises as minimally-invasive techniques cut recovery time. Dental procedures remain lucrative, averaging USD 170-350 per case, and 73% of dogs need at least one intervention during their lifetime.

Diagnostic laboratories enjoy cross-selling with clinics, and e-prescribing platforms streamline drug compliance. Emergency and critical-care centres face labour constraints, prompting corporate groups to open 24-hour hubs linked by tele-ICU dashboards. Rehabilitation, acupuncture, and hydro-therapy gain traction as pets age, extending lifetime spending in the veterinary services market.

Companion animals constituted 63.23% of revenue in 2024 and will post the fastest 6.74% CAGR through 2030. Dogs continue as the largest sub-segment, with oncology and cardiology services mirroring human care protocols. Urban cat ownership rises among millennials and Generation Z, pushing demand for feline-only clinics. Equine medicine remains niche but commands high average transaction values for lameness diagnostics and sports-injury rehabilitation.

Production animals demand service integration after the H5N1 dairy-herd outbreak highlighted public-health risks. Cattle operators now purchase real-time monitoring and vaccine-compliance audits. Swine and poultry producers expand comprehensive bio-security packages, and aquaculture ventures request specialised health plans, both adding breadth to the veterinary services market. Small ruminants gain attention as consumers diversify protein sources, further widening the client base.

The Veterinary Services Market Report is Segmented by Service (Surgery, Diagnostic Imaging & Laboratory, and More), Animal Type (Companion Animals and Production/Farm Animals), Provider Ownership Structure (Independent Practices, and More), Delivery Mode (Mobile / On-Farm, and More), Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 42.45% of global revenue in 2024. Mature insurance penetration, robust e-commerce pharmacy channels, and One-Health policy integration sustain premium-price elasticity. Multinational chains cluster around U.S. urban centres, and Canadian operators observe similar consolidation but tailor offerings to public-health mandates. Mexico's rising middle class fuels double-digit pet-food growth, a signal of downstream service opportunity.

Europe shows steady uptake. The United Kingdom's Royal College of Veterinary Surgeons streamlines accreditation, facilitating cross-border clinician mobility. Germany and France invest in surveillance platforms that link animal and human epidemiological data. EQT's acquisition of VetPartners indicates capital inflows aiming at clinic platform scaling across member states. Regulatory harmonisation for tele-medicine and prescription data interoperability aids clinic groups in capturing operational synergies across the veterinary services market.

Asia-Pacific is the fastest-expanding zone at 5.65% CAGR. China's pet-medical spend hit 1,062 billion yuan in 2024 and keeps rising despite fragmentation. India's pet-food market is growing at 15.37% CAGR and pulls ancillary services such as dietetic consults and dermatology. Japan's super-aging dogs spur demand for geriatric care, while South Korea pioneers AI algorithms for small-animal imaging. Australia's clinic roll-ups attract European buyers hunting for exposure to a high-compliance market. Collectively, these dynamics enlarge the veterinary services market size for the region.

- Mars Inc. (VCA, Banfield, BluePearl)

- National Veterinary Associates (NVA)

- CVS Group

- IVC Evidensia

- Greencross Ltd

- Ethos Veterinary Health

- IDEXX

- Zoetis Services

- Elanco Animal Health Services

- Southern Veterinary Partners

- Thrive Pet Healthcare

- VetCor

- PetVet Care Centers

- Mission Veterinary Partners

- BlueRiver Pet Care

- FirstVet

- CityVet

- Armor Animal Health

- Kremer Veterinary Services

- I-Med Animal Referral Centers

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Pet Ownership & Humanisation of Animals

- 4.2.2 Increasing Incidence of Zoonotic & Chronic Animal Diseases

- 4.2.3 Growing Livestock Productivity & Food-Safety Requirements

- 4.2.4 Expansion of Pet-Insurance Reimbursement Models

- 4.2.5 AI-Enabled Triage & Diagnostics Boosting Clinic Capacity

- 4.3 Market Restraints

- 4.3.1 Global Shortage & Burnout of Veterinarians

- 4.3.2 Escalating Cost of Advanced Procedures & Equipment

- 4.3.3 Regulatory Ambiguity on Cross-Border Tele-Veterinary Care

- 4.3.4 Consumer Price-Sensitivity Causing Deferred Care

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Service

- 5.1.1 Surgery

- 5.1.2 Diagnostic Imaging & Laboratory

- 5.1.3 Preventive & Wellness Care

- 5.1.4 Emergency & Critical Care

- 5.1.5 Tele-health & Virtual Care

- 5.1.6 Rehabilitation & Physiotherapy

- 5.1.7 Dentistry

- 5.1.8 Pharmacy & Prescription Management

- 5.2 By Animal Type

- 5.2.1 Companion Animals

- 5.2.1.1 Dogs

- 5.2.1.2 Cats

- 5.2.1.3 Horses & Equine

- 5.2.2 Production / Farm Animals

- 5.2.2.1 Cattle & Buffalo

- 5.2.2.2 Swine

- 5.2.2.3 Poultry

- 5.2.2.4 Small Ruminants

- 5.2.2.5 Aquaculture Species

- 5.2.1 Companion Animals

- 5.3 By Provider Ownership Structure

- 5.3.1 Independent Practices

- 5.3.2 Corporate Clinic Chains

- 5.3.3 Mobile / House-call Practices

- 5.3.4 University & Referral Hospitals

- 5.4 By Delivery Mode

- 5.4.1 In-Clinic (Brick & Mortar)

- 5.4.2 Mobile / On-farm

- 5.4.3 Tele-consultation Platforms

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 Mars Inc. (VCA, Banfield, BluePearl)

- 6.3.2 National Veterinary Associates (NVA)

- 6.3.3 CVS Group PLC

- 6.3.4 IVC Evidensia

- 6.3.5 Greencross Ltd

- 6.3.6 Ethos Veterinary Health

- 6.3.7 Idexx Laboratories

- 6.3.8 Zoetis Services

- 6.3.9 Elanco Animal Health Services

- 6.3.10 Southern Veterinary Partners

- 6.3.11 Thrive Pet Healthcare

- 6.3.12 VetCor

- 6.3.13 PetVet Care Centers

- 6.3.14 Mission Veterinary Partners

- 6.3.15 BlueRiver Pet Care

- 6.3.16 FirstVet AB

- 6.3.17 CityVet Inc.

- 6.3.18 Armor Animal Health

- 6.3.19 Kremer Veterinary Services

- 6.3.20 I-Med Animal Referral Centers

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment