|

시장보고서

상품코드

1910598

FMCG 물류 시장 : 점유율 분석, 업계 동향 및 통계, 성장 예측(2026-2031년)FMCG Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

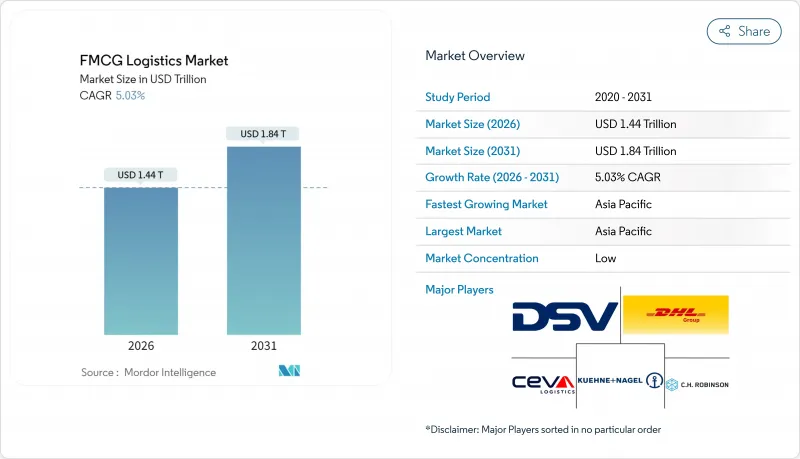

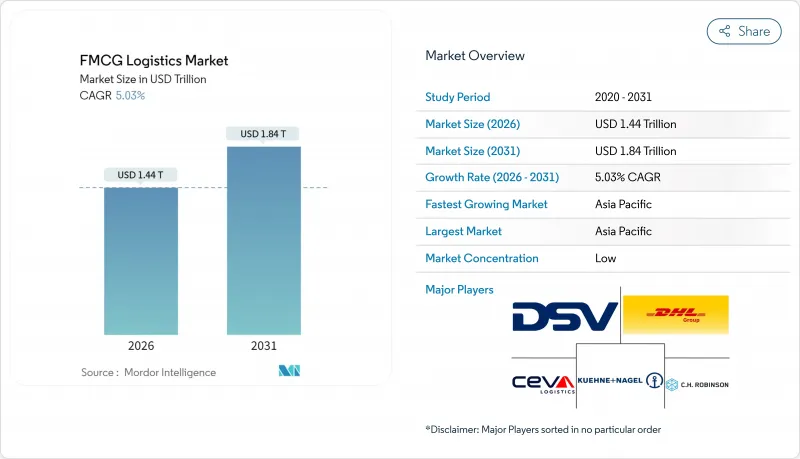

세계의 FMCG 물류 시장은 2025년 1조 3,700억 달러에서 2026년 1조 4,400억 달러로 성장하고, 2026년부터 2031년까지 연평균 복합 성장률(CAGR) 5.03%로 성장을 지속하여 1조 8,400억 달러에 달할 것으로 예측되고 있습니다.

견조한 전자상거래의 보급, 급속한 도시화, 중산계급의 소비확대가 유통모델을 변화시켜 기업은 엔드 투 엔드의 가시성과 신속한 풀필먼트를 실현하는 기술을 활용한 지속가능성을 중시한 밸류체인으로 이행하고 있습니다. 운송 서비스는 계속 가치 창조의 주류를 차지하고 있지만, 브랜드가 수요에 가까운 장소에서 커스터마이즈를 요구하는 가운데, 공동 포장이나 라벨링 등의 부가가치 서비스가 기세를 늘리고 있습니다. 콜드체인 확장은 냉동 식품 및 건강 관리 분야의 성장을 가속하고 디지털 시각화 플랫폼은 폐기물과 품절을 줄이는 예측형 의사 결정을 가능하게 합니다. 경쟁의 격화와 최근의 대형 합병은 규모의 경제를 뒷받침하는 한편, FMCG 물류 시장에 있어서는 지역 특화 기업이 로컬인 라스트 마일의 기동력에 있어서 우위성을 유지하고 있습니다.

세계의 FMCG 물류 시장 동향과 통찰

전자상거래 가속화와 라스트 마일 기대

온라인 판매의 급성장으로 배송 시간 단축과 주문 패턴의 세분화가 진행되고 있으며, FMCG 물류 시장은 도시 지역에서의 마이크로풀필먼트나 당일 배송으로의 전환을 강요받고 있습니다. 브라질에서는 2024년 상반기에 FMCG 온라인 판매가 13.6% 증가했으며, 건강 및 뷰티는 17.8%, 식품은 26.2% 증가했습니다. 공급자는 소비자가 정확성과 지속가능성의 양립을 기대하면서 포워드 허브에서의 재고 배치, 전기 밴의 도입, 실시간 추적 시스템의 전개를 진행하고 있습니다. 루트 최적화 플랫폼과 역물류 능력에 대한 투자가 유입되어 대량의 B2B 보충과 증가하는 소비자 직접 판매량의 밸런스 조정을 지원하고 있습니다. 이러한 변화는 FMCG 물류 시장에서 라스트 마일의 우수성을 파트너에 의존하는 자산 경량화 브랜드에 있어서 경쟁상의 이해관계를 내포하고 있습니다.

FMCG에 3PL/계약 물류 침투

브랜드 기업은 3PL에 아웃소싱하여 고정 물류 비용을 변동비로 전환하는 움직임을 가속화하고 있습니다. 이를 통해 여러 지역에 걸친 규모의 경제와 전문적 지견의 활용이 가능해집니다. McLane과 Circle K의 2025년 계약은 재고 가시성과 차량 최적화를 통합한 운송 및 유통 솔루션의 매력을 보여줍니다. 계약물류 사업자는 공동포장, 판촉용 번들, 옴니채널 반품 대응으로 차별화를 도모해 장기간에 걸쳐 견고한 관계를 구축하고 있습니다. 이 모델은 FMCG 기업이 자본을 구속하지 않고 자동화, 컴플라이언스 시스템 및 분석 도구를 신속하게 도입할 수 있도록 합니다. 이 메커니즘은 FMCG 물류 시장이 서비스 풍부한 생태계로 진화하는 흐름을 가속화하는 것입니다.

연료 가격의 변동성

디젤 비용의 변동은 운송 예산을 압박하며 연료비는 세계적으로 트럭 운송 운영비의 약 25%를 차지하고 있습니다. 과금 계산 및 헤지 계약에서 일부 영향은 완화되지만, 타이밍 차이는 운송 회사와 FMCG 화주 간의 요금 협상 마찰을 초래합니다. 환율 변동은 국경을 넘는 운송경로의 비용 계산을 복잡하게 하고, 루트 최적화 소프트웨어의 채용 확대, LNG 등의 대체 연료의 도입, 공주행 거리를 삭감하는 네트워크 재설계를 촉진하고 있습니다. 따라서 가격 불확실성은 FMCG 물류 시장 전체에서 투자 의욕을 억제하고 이익률을 저하시키고 있습니다.

부문 분석

운송 부문은 2025년 수익의 66.35%를 차지하며 광대한 유통망을 통한 고회전 상품 이동에서 기초적인 역할을 부각하고 있습니다. 도로화물 운송은 네트워크의 핵심을 담당하고, 제조 거점, 지역 배송 센터, 라스트 마일 거점을 연결하는 한편, 해상 및 철도 운송은 대륙간의 운송을 지지하고 있습니다. 경쟁 차별화는 현재 멀티모달 통합, 지속가능한 차량 업데이트 및 운송 변동을 줄이는 데이터가 풍부한 경로 계획에 의존하고 있습니다. 부가가치 서비스는 규모가 작지만, 4.74%의 연평균 복합 성장률(CAGR)로 확대하고 있습니다. 이는 브랜드 기업이 수요 거점 근처에서 공동 포장, 라벨링, 키트화를 요구하고 리드 타임과 마케팅 리스크의 축소를 도모하기 때문입니다. 핵심 운송 업무와 맞춤형 서비스를 결합하여 공급자는 FMCG 물류 시장에서 점유율 확대 기회를 얻고 있습니다.

옴니채널 활동의 활성화로 주문 프로파일의 복잡화가 진행되고, 구성의 연기나 반품 관리의 요구가 높아지고 있습니다. 창고 내 자동 분류 시스템, 협력 로봇 및 품질 보증 셀에 대한 투자는 처리 속도를 높이고 불일치 오류를 줄일 수 있습니다. 운송, 보관 및 커스터마이즈를 일괄계약으로 제공할 수 있는 사업자는 고객의 정착율을 높이면서 월렛 점유율을 확대합니다. 결과적으로 운송 부문은 기반이 지속되지만 고수익 성장은 고객 친밀도를 높이고 FMCG 물류 시장에서 장기 수요를 고정화하는 서비스 계층으로 전환하고 있습니다.

상온 네트워크는 2025년 가치의 63.40%를 차지해 표준 온도에서 안전하게 운송되는 건조 식품, 가정용품, 퍼스널케어 제품의 우위성을 반영합니다. 통합된 취급 프로토콜과 높은 용적 이용률을 통한 규모의 경제성은 고밀도 경로 계획 및 단위 비용 절감을 가능하게 합니다. 사업자는 재고 회전 알고리즘과 오염 관리를 선호하며 고회전 SKU에서 제품 품질을 유지하고 있습니다. 랙 설계 및 실시간 상태 모니터링의 동시 인프라 업그레이드는 가동률 향상과 폐기물 감소를 추진합니다.

한편 냉동물류는 2031년까지 연평균 복합 성장률(CAGR) 4.45%를 기록해 냉동수송을 필요로 하는 가공식품과 API 기반 의약품에 대한 소비자 수요를 견인합니다. 고층 냉동고, 자동 팔레트 셔틀, 텔레매틱스가 장착된 냉동 컨테이너(도어 투 도어에서 -18℃ 유지)에 대한 투자가 집중되고 있습니다. 에너지 절약 냉매 및 재생에너지 시설은 운영 비용 절감과 ESG 목표 달성에 기여합니다. 냉장 및 초저온 카테고리는 각각 유제품, 신선식품, 생물제제의 틈새 수요를 지원하고 다층적인 서비스 구성을 강화함으로써 FMCG 물류 시장 전체에서 공급자의 수익원을 확대합니다.

지역별 분석

아시아태평양은 2025년 세계 수익의 36.20%를 차지했으며 2031년까지 연평균 복합 성장률(CAGR) 4.63%에서 가장 빠른 지역적 기세를 유지할 것으로 예상합니다. 급속한 도시화, 급성장하는 중산계급, 디지털 결제의 보급이 현대적인 유통과 전자상거래 모두에 대한 수요를 가속화하고 있습니다. 고속철도회랑, 항만확장, 고속도로 개량으로 수송시간 단축, 물류비용 절감 등으로 투자유입이 촉진되고 있습니다. Nestle Malaysia가 5,600만 달러를 투자한 포트클랑 허브는 지역 수출과 국내 유통을 동시에 담당하기 위한 브라운필드와 그린필드의 용량 확대 조류를 상징하고 있습니다.

북미에서는 첨단 인프라와 디지털 시각화 툴의 조기 도입, 지속가능성 파일럿 사업이 융합하고 있습니다. Mondelez India를 위한 GreenLine의 LNG 트럭 도입은 미국과 캐나다 간의 운송 루트에서 전개되는 유사한 탄소 삭감 이니셔티브를 반영하고 있습니다. 유럽에서는 CBAM(탄소 보더 조정 메커니즘)이나 순환형 경제 지령으로 대표되는 규제 환경이, 사업자에 대해서 저배출형 차량으로의 갱신이나 창고 전기화를 촉구하고 있습니다. 조밀한 크로스 보더 운송은 브렉시트 후 혼잡과 새로운 제재 조치의 복잡화를 피하기 위해 완벽한 서류 관리와 통관 업무의 실시간 통합이 요구됩니다.

남미에서는 브라질의 2024년 상반기 전자상거래 매출액 286억 6,000만 달러가 보여주는 바와 같이, 온라인 수요 증가가 보세창고와 혼잡한 도시간선 도로를 우회하는 라스트 마일용 크라우드소싱형 차량 수요를 견인하고 있습니다. 한편, 중동 및 아프리카에서는 자유무역 지역, 공항 중심 물류 파크, 신선식품 및 백신 수송을 지원하는 기증자 자금에 의한 콜드체인 회랑과 관련하여 점진적이면서 꾸준한 물류 능력 증강이 진행되고 있습니다. 지역 분산화는 단독 경제 사이클에 대한 의존 위험을 줄이는 반면, FMCG 물류 시장에서 성공을 거두기 위해서는 서비스 모델이 현지 인프라 격차 및 규제 다양성을 수용할 수 있는 유연성을 제공해야 합니다.

기타 혜택:

- 엑셀 형식 시장 예측(ME) 시트

- 애널리스트에 의한 3개월간의 지원

자주 묻는 질문

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 전자상거래 가속과 라스트 마일에 대한 기대

- FMCG에 3PL/계약 물류 침투

- 콜드체인 네트워크 구축

- 엔드 투 엔드의 디지털 시각화 플랫폼

- 지방 소비 주도형 허브 앤 스포크 재설계

- 탄소세에 의한 배송 센터 네트워크의 통합

- 시장 성장 억제요인

- 연료 가격의 변동성

- 크로스 보더 규제 복잡성

- Tier 2/3 창고에서의 노동력 부족

- 3PL/4PL 사업자간 데이터 상호 운용성의 갭

- 가치/공급망 분석

- 규제 상황

- 기술의 전망

- Porter's Five Forces

- 신규 참가업체의 위협

- 구매자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

- 특집 - 전자상거래가 FMCG 물류에 미치는 영향

- 주목점 - 계약 물류 및 통합 물류 수요 동향

제5장 시장 규모와 성장 예측

- 서비스별

- 교통기관

- 도로

- 철도

- 항공

- 해운

- 창고 보관 및 배송

- 부가가치 서비스 및 기타

- 교통기관

- 온도관리별

- 냉장(0-5℃)

- 냉동(-18-0℃)

- 앰비언트

- 냉동품/초저온품(-20℃ 미만)

- 제품 카테고리별

- 식품 및 음료

- 퍼스널케어

- 가정용품

- 일반용 의약품 및 헬스케어

- 기타

- 유통 채널별

- 온라인

- 오프라인

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 남미

- 브라질

- 페루

- 칠레

- 아르헨티나

- 기타 남미

- 아시아태평양

- 인도

- 중국

- 일본

- 호주

- 한국

- 동남아시아(싱가포르, 말레이시아, 태국, 인도네시아, 베트남, 필리핀)

- 기타 아시아태평양

- 유럽

- 영국

- 독일

- 프랑스

- 스페인

- 이탈리아

- 베네룩스(벨기에, 네덜란드, 룩셈부르크)

- 북유럽 국가(덴마크, 핀란드, 아이슬란드, 노르웨이, 스웨덴)

- 기타 유럽

- 중동 및 아프리카

- 아랍에미리트(UAE)

- 사우디아라비아

- 남아프리카

- 나이지리아

- 기타 중동 및 아프리카

- 북미

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율 분석

- 기업 프로파일

- DHL Group

- Kuehne Nagel

- DSV

- CH Robinson

- Ceva Logistics

- XPO Logistics

- Rhenus Logistics

- FM Logistic

- Hellmann Worldwide Logistics

- Penske Logistics

- Kenco Logistics

- JD Logistics

- FedEx Supply Chain

- Nippon Express

- Yusen Logistics

- Geodis

- GXO Logistics

- Savino Del Bene

- ID Logistics Group

- Brimich Logistics

제7장 시장 기회와 미래 전망

SHW 26.01.26The FMCG Logistics Market is expected to grow from USD 1.37 trillion in 2025 to USD 1.44 trillion in 2026 and is forecast to reach USD 1.84 trillion by 2031 at 5.03% CAGR over 2026-2031.

Robust e-commerce uptake, rapid urbanization, and rising middle-class consumption are reshaping distribution models, pushing companies toward technology-enabled, sustainability-minded supply chains that deliver end-to-end visibility and faster fulfillment. Transportation services continue to dominate value creation, while value-added offerings such as co-packing and labeling gain momentum as brands seek customization closer to demand. Cold-chain build-outs unlock growth in frozen and healthcare categories, and digital visibility platforms foster predictive decision-making that lowers waste and stockouts. Intensifying competition and recent megamergers encourage scale economies even as regional specialists retain an edge in localized, last-mile agility within the FMCG logistics market.

Global FMCG Logistics Market Trends and Insights

E-commerce Acceleration and Last-Mile Expectations

Faster online growth compresses delivery windows and fragments order profiles, forcing the FMCG logistics market to pivot toward urban micro-fulfillment and same-day drops. Brazil's FMCG online sales rose 13.6% in H1 2024, with health & beauty up 17.8% and food up 26.2%. Providers are staging inventory in forward hubs, layering in electric vans, and rolling out real-time tracking to satisfy consumers who now expect precision and sustainability together. Investment flows into route-optimization platforms and reverse-logistics capabilities that help balance bulk B2B replenishment with escalating direct-to-consumer volumes. These shifts embed competitive stakes for asset-light brands that rely on partners for last-mile excellence within the FMCG logistics market.

3PL / Contract-Logistics Penetration in FMCG

Brands increasingly convert fixed logistics costs to variable spend by outsourcing to 3PLs, unlocking scale and specialized expertise across multiple geographies. McLane's 2025 agreement with Circle K illustrates the appeal of integrated transportation and distribution solutions that bundle inventory visibility and fleet optimization. Contract logistics players differentiate through co-packing, promotional bundling, and omnichannel returns, creating sticky, multi-year relationships. The model relieves FMCG firms from capital commitments while ensuring rapid deployment of automation, compliance systems, and analytics an arrangement that accelerates the FMCG logistics market evolution toward service-rich ecosystems.

Fuel-Price Volatility

Diesel cost swings weigh on transport budgets, with fuel accounting for roughly 25% of trucking operating expenses worldwide. Surcharge formulas and hedging contracts cushion some exposure, yet timing gaps often spark rate tensions between carriers and FMCG shippers. Currency shifts complicate cost calculations on cross-border lanes, prompting greater adoption of route-optimization software, alternative fuels such as LNG, and network redesigns that slash empty miles. Price unpredictability therefore tempers investment appetites and erodes margins across the FMCG logistics market.

Other drivers and restraints analyzed in the detailed report include:

- Cold-Chain Network Build-Out

- End-to-End Digital Visibility Platforms

- Cross-Border Regulatory Complexity

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Transportation generated 66.35% of 2025 revenue, underscoring its foundational role in moving high-turnover goods through sprawling distribution webs. Road freight anchors the network, bridging manufacturing hubs, regional DCs, and last-mile nodes, while sea and rail support bulk intercontinental moves. Competitive differentiation now hinges on multi-modal integration, sustainable fleet upgrades, and data-rich route planning that trims transit variance. Value-added services, though smaller, expand at a 4.74% CAGR as brands seek co-packing, labeling, and kitting near demand centers to shrink lead times and marketing risks. This blend of core haulage with tailored services positions providers to capture greater share of the FMCG logistics market.

Intensifying omnichannel activity propels order-profile complexity, boosting needs for postponed configuration and returns management. Investments in automated sortation, collaborative robots, and quality-assurance cells inside warehouses translate into faster throughput and reduced mismatch errors. Providers capable of bundling transport, storage, and customization in a single contract deepen stickiness while growing wallet share. Consequently, the transportation segment remains the backbone, but high-margin growth tilts toward service layers that raise customer intimacy and lock in long-term demand within the FMCG logistics market.

Ambient networks retained 63.40% of 2025 value, reflecting the dominance of dry groceries, household goods, and personal-care items that travel safely at standard temperatures. Scale efficiencies stem from uniform handling protocols and high cube utilization, allowing dense route planning and lower unit costs. Operators prioritize inventory rotation algorithms and contamination controls to preserve product integrity across high-velocity SKUs. Parallel infrastructure upgrades in racking design and real-time condition monitoring drive uptime gains and shrink waste.

Conversely, frozen logistics logs a 4.45% CAGR to 2031, riding consumer appetite for convenience foods and API-based pharmaceuticals requiring sub-zero transit. Investment pours into high-bay freezers, automated pallet shuttles, and telematics-equipped reefers that maintain <-18 °C thresholds door-to-door. Energy-efficient refrigerants and renewable-powered facilities help offset operating costs and meet ESG targets. Chilled and ultra-low categories sustain niche demand for dairy, fresh produce, and biologics, respectively, reinforcing a tiered service mix that broadens provider revenue channels across the FMCG logistics market.

The FMCG Logistics Market Report is Segmented by Service (Transportation, Warehousing & Distribution, Value-Added Services), Temperature Control (Chilled, Frozen, and More), Product Category (Food & Beverage, Personal Care, and More), Distribution Channel (Online, Offline), and Geography (North America, South America, Asia-Pacific, Europe, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific generated 36.20% of 2025 global revenue and sustains the fastest regional momentum at a 4.63% CAGR to 2031. Rapid urbanization, burgeoning middle classes, and digital payment ubiquity accelerate demand for modern trade and e-commerce alike. High-speed rail corridors, port expansions, and highway upgrades cut transit times and reduce logistics costs, propelling investment inflows. Nestle Malaysia's USD 56 million Port Klang hub underscores the wave of brownfield and greenfield capacity designed to serve regional exports and domestic distribution simultaneously.

North America combines advanced infrastructure with early adoption of digital visibility tools and sustainability pilots. LNG-powered truck deployments such as GreenLine's fleet for Mondelez India mirror similar carbon-cutting initiatives across U.S. and Canadian lanes. Europe's regulatory environment, led by CBAM and circular-economy directives, nudges providers toward low-emission fleet renewals and warehouse electrification. Dense cross-border traffic demands impeccable documentation and real-time customs integration to avert post-Brexit congestion and emerging sanctions complexities.

South America's rising online propensity, evidenced by Brazil's USD 28.66 billion H1 2024 e-commerce haul, drives demand for bonded warehouses and last-mile crowdsourced fleets that bypass congested urban arterials. Meanwhile, Middle East & Africa witness incremental but steady capacity additions tied to free-trade zones, airport-centric logistics parks, and donor-funded cold-chain corridors supporting fresh produce and vaccines. Collectively, geographic diversification mitigates exposure to any single economic cycle, but service models must flex to local infrastructure gaps and regulatory heterogeneity to thrive in the FMCG logistics market.

- DHL Group

- Kuehne + Nagel

- DSV

- C.H. Robinson

- Ceva Logistics

- XPO Logistics

- Rhenus Logistics

- FM Logistic

- Hellmann Worldwide Logistics

- Penske Logistics

- Kenco Logistics

- JD Logistics

- FedEx Supply Chain

- Nippon Express

- Yusen Logistics

- Geodis

- GXO Logistics

- Savino Del Bene

- ID Logistics Group

- Brimich Logistics

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 E-commerce acceleration and last-mile expectations

- 4.2.2 3PL / contract-logistics penetration in FMCG

- 4.2.3 Cold-chain network build-out

- 4.2.4 End-to-end digital visibility platforms

- 4.2.5 Rural consumption-led hub-and-spoke redesign

- 4.2.6 Carbon-tax-driven DC network consolidation

- 4.3 Market Restraints

- 4.3.1 Fuel-price volatility

- 4.3.2 Cross-border regulatory complexity

- 4.3.3 Tier-2/3 warehouse labour shortages

- 4.3.4 Data-interoperability gaps across 3PL/4PLs

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Spotlight-Impact of E-commerce on FMCG Logistics

- 4.9 Spotlight-Contract and Integrated Logistics Demand

5 Market Size and Growth Forecasts

- 5.1 By Service (Value)

- 5.1.1 Transportation

- 5.1.1.1 Road

- 5.1.1.2 Rail

- 5.1.1.3 Air

- 5.1.1.4 Sea

- 5.1.2 Warehousing and Distribution

- 5.1.3 Value-added Services and Others

- 5.1.1 Transportation

- 5.2 By Temperature Control (Value)

- 5.2.1 Chilled (0-5 °C)

- 5.2.2 Frozen (-18-0°C)

- 5.2.3 Ambient

- 5.2.4 Deep-Frozen / Ultra-Low (less than-20 °C)

- 5.3 By Product Category (Value)

- 5.3.1 Food and Beverage

- 5.3.2 Personal Care

- 5.3.3 Household Care

- 5.3.4 OTC and Healthcare

- 5.3.5 Others

- 5.4 By Distribution Channel (Value)

- 5.4.1 Online

- 5.4.2 Offline

- 5.5 By Geography (Value)

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Peru

- 5.5.2.3 Chile

- 5.5.2.4 Argentina

- 5.5.2.5 Rest of South America

- 5.5.3 Asia-Pacific

- 5.5.3.1 India

- 5.5.3.2 China

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 South East Asia (Singapore, Malaysia, Thailand, Indonesia, Vietnam, and Philippines)

- 5.5.3.7 Rest of Asia-Pacific

- 5.5.4 Europe

- 5.5.4.1 United Kingdom

- 5.5.4.2 Germany

- 5.5.4.3 France

- 5.5.4.4 Spain

- 5.5.4.5 Italy

- 5.5.4.6 BENELUX (Belgium, Netherlands, and Luxembourg)

- 5.5.4.7 NORDICS (Denmark, Finland, Iceland, Norway, and Sweden)

- 5.5.4.8 Rest of Europe

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab of Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 South Africa

- 5.5.5.4 Nigeria

- 5.5.5.5 Rest of Middle East And Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 DHL Group

- 6.4.2 Kuehne + Nagel

- 6.4.3 DSV

- 6.4.4 C.H. Robinson

- 6.4.5 Ceva Logistics

- 6.4.6 XPO Logistics

- 6.4.7 Rhenus Logistics

- 6.4.8 FM Logistic

- 6.4.9 Hellmann Worldwide Logistics

- 6.4.10 Penske Logistics

- 6.4.11 Kenco Logistics

- 6.4.12 JD Logistics

- 6.4.13 FedEx Supply Chain

- 6.4.14 Nippon Express

- 6.4.15 Yusen Logistics

- 6.4.16 Geodis

- 6.4.17 GXO Logistics

- 6.4.18 Savino Del Bene

- 6.4.19 ID Logistics Group

- 6.4.20 Brimich Logistics

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment