|

시장보고서

상품코드

1439734

세계 혈관 실링 기기 시장 : 점유율 분석, 산업 동향 및 통계, 성장 예측(2024-2029년)Vessel Sealing Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

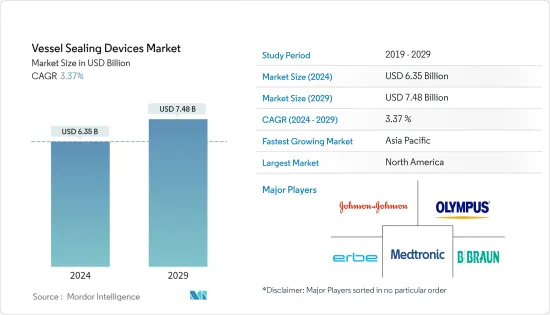

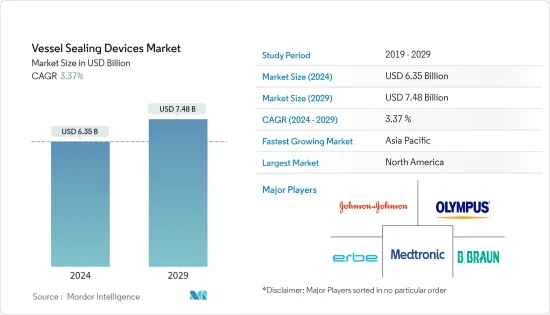

혈관 실링 기기 시장 규모는 2024년에 63억 5,000만 달러로 추정되고, 2029년까지 74억 8,000만 달러에 이를 것으로 예측되며, 예측 기간 동안 복합 연간 성장률(CAGR) 3.37%로 성장할 전망입니다.

시장은 중간 정도의 성장률로 COVID-19 감염성 유행의 영향을 받았습니다. 비즈니스 세계에서 COVID-19 감염의 유행은 전례 없는 경제적 불확실성을 초래합니다. 일부 기업은 감염 위험이 낮기 때문에 상대적으로 고립되어 있지만, 다른 많은 기업들은 유행의 영향을 피할 수 없으며 경제적 어려움에 직면하고 있습니다. 그러나 유행 중에 수술 건수가 감소하고 시장 성장이 방해되었습니다. British Journal of Surgery의 2020년 보고서에 따르면 신형 코로나바이러스 감염(COVID-19)의 영향으로 약 2,800만 건의 수술이 취소되거나 연기되어 시장에 큰 영향을 미쳤습니다.

시장을 견인하는 주요 요인은 수술 수가 증가하고 있다는 것입니다. 2020년 9월 월드저널에 게재된 Prashant Bhandarkar et al. 필요한 것으로 추정됩니다. 게다가 보고된 수술률은 인구 10만명당 저,중소득국(LMIC)의 295건에서 고소득국(HIC)의 23,000건까지 다양합니다. 따라서 수술 수 증가는 시장을 밀어 올릴 것으로 예상됩니다.

게다가 의료기기의 기술 진보로 실혈률과 감염률을 줄이고 수술시간을 단축하기 위한 수술 중 신뢰성이 높고 효율적인 기술에 대한 수요가 높아지고 있으며, 이것이 시장 성장의 주된 이유와 되어 있습니다. 예를 들어, 2020년 12월, 수술 장치 및 기구 공급업체인 Bolder Surgical은 소아 환자에게 저침습 수술을 안전하고 효과적으로 수행하는 CoolSeal Vessel Sealing 플랫폼을 도입했습니다. 병원과 정부의 이니셔티브으로 수술기구에 대한 투자 증가가 시장을 밀어 올리고 있습니다.

그러나 관련 장비 비용이 높고 장치 사용 후 발생하는 복잡성은 시장의 주요 단점이되었습니다.

혈관 실링 기기 시장 동향

복강경 부문이 시장의 주요 점유율을 차지

복강경 검사는 복부의 장기를 분석하는 데 사용되는 수술 진단 방법입니다. 작은 절개만 필요로 하는 저침습 수술입니다. 복강경이라는 도구를 사용하여 복부 장기를 관찰합니다. 혈관 밀폐 장치는 복강경 수술의 주요 부분을 차지합니다.

이 분야의 성장을 가속하는 주요 요인은 개복 수술에 대한 복강경 수술의 장점에 대한 인식 증가와 세계 복강경 수술의 수가 증가하고 있다는 것입니다.

그러나 복강경 수술에서 혈관 실링 기기의 안전성과 효율성은 많은 연구에서 보고되었으며, 이는 예측 기간 동안 시장을 활성화하는 데 도움이 될 것으로 보입니다. 예를 들어(2021년) 6월에 Surgical Innovation에 게재된 연구 "복강경하 비장 절제술에서 스테이플러 및 혈관 실링 기기 사용의 안전성 및 효능: 무작위 대조 시험"이라는 제목에 따르면, 혈관 실링 기기는 내시경 스테이플러보다 뛰어난 안전성과 효율성을 가지고 있습니다. 따라서, 혈관 실링 기기의 더 높은 안전성과 효능이 시장을 밀어 올리고 있습니다.

복강경 검사는 외과의사가 큰 피부 절개가 아닌 작은 절개를 통해 복부와 골반의 내부를 관찰할 수 있는 저침습 수술입니다. 편리성의 높이로부터, 저침습 수술의 인기가 높아지고 있습니다. 낮은 침습 수술(MIS)은 수술 후 통증이 적기 때문에 환자에게 처방되는 진통제의 복용량을 줄이고이 부문의 성장을 가속합니다.

북미가 시장을 독점하고 있으며 예측기간 동안도 마찬가지로 추이할 것으로 예상

북미는 예측 기간 동안 혈관 실링 기기 시장 전체를 지배할 것으로 예상됩니다. 가장 큰 점유율은 주로 주요 기업의 존재와 이 지역의 주요 시장 기업에 의한 1인당 건강 관리 지출 증가와 투자 및 제품 출시 확대로 인한 것입니다. 예를 들어(2021년) 6월, 존슨 엔드 존슨의 에시콘은 결장 직장, 비만 수술, 부인과 및 흉부 수술에 사용하기 위한 ENSEAL X1 곡선 조티쉬 실러를 출시했습니다.

또한, 이러한 첨단 기술을 이용한 수술의 장점에 대해, 국민들 사이에서 인식이 높아지고 있습니다. 미국의 선진에너지를 이용한 수술의 도입률의 높음, 식품의약국에 의한 새로운 기기의 승인수 증가, 미국에서 행해지는 저침습 수술의 비율 증가가 북미의 의료 수준의 향상을 뒷받침 하고 있습니다. 시장 점유율. 2021년 12월에 JAMA 네트워크에 게재된 미국의 아비바 S. 매팅리 BA1의 논문에 따르면, 2019년 1월 1일부터 2021년 1월 20일까지 총 13,108,567건의 수술이 이루어졌습니다. 했습니다. 2019년에는 6,651,921건의 절차가 있으며, 2020년에는 5,973,573건의 절차가 진행될 예정입니다. 따라서 국내 수술 건수 증가로 혈관봉지장치 수요가 높아지고 시장이 확대되고 있습니다.

미국암협회의 '2019-2021년 암치료와 생존에 관한 팩트 및 수치'에 따르면 2019년 1월 1일 시점에서 미국에서는 추정 1,690만명이 암의 기왕력이 있으며, 2030년 1월 1일 시점에서 암의 수는 인구 증가와 고령화로 생존자는 2,210만명 이상으로 증가할 것으로 예상됩니다. 이것은 북미 시장을 홍보하는 것을 목표로합니다.

따라서 수술 건수 증가와 의료기기의 기술 진보가 이 지역 시장을 밀어 올리고 있습니다.

혈관 실링 기기 산업 개요

혈관 실링 기기 시장은 적당한 경쟁이 있고 몇몇 주요 기업으로 구성됩니다. 시장 참가자로는 Medtronic PLC, B Braun Melsungen AG, Erbe Medical India Pvt. Ltd, Olympus Corporation, Ethicon US LLC (Johnson and Johnson), Boston Scientific Corporation, BOWA-electronic GmbH and Co. KG, CONMED Corporation, Bolder Surgical Holdings Inc. 등이 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인

- 외과 수술 건수 증가

- 혈관 실링 기기의 기술 진보

- 시장 성장 억제요인

- 혈관 실링 기기의 합병증

- 고액의 수술 비용

- Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자의 협상력

- 공급기업의 협상력

- 대체 제품의 위협

- 경쟁 기업간 경쟁 관계의 격렬

제5장 시장 세분화

- 제품

- 제너레이터

- 기기

- 액세서리

- 용도

- 일반 외과

- 복강경 수술

- 최종 사용자

- 병원과 전문 클리닉

- 외래수술센터(ASC)

- 지역

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 기타 아시아태평양

- 중동 및 아프리카

- GCC

- 남아프리카

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 경쟁 구도

- 기업 프로파일

- Medtronic PLC

- B Braun Melsungen AG

- Erbe Medical India Pvt. Ltd

- Olympus Corporation

- Ethicon US LLC(Johnson & Johnson)

- Boston Scientific Corporation

- BOWA-electronic GmbH &Co. KG

- OmniGuide Holdings Inc.

- CONMED Corporation

- Hologic(Bolder Surgical Holdings Inc.)

- XCELLANCE Medical Technologies

- LAMIDEY NOURY.FR.

제7장 시장 기회와 미래 동향

BJH 24.03.11The Vessel Sealing Devices Market size is estimated at USD 6.35 billion in 2024, and is expected to reach USD 7.48 billion by 2029, growing at a CAGR of 3.37% during the forecast period (2024-2029).

The market was impacted by the COVID-19 pandemic at a moderate growth rate. In the business world, the COVID-19 pandemic has created unprecedented economic uncertainty. While some businesses are relatively insulated due to low exposure, many others have been unable to avoid the pandemic's effects and are experiencing financial hardship. However, the number of surgeries declined during the pandemic, which hampered the market growth. According to a British Journal of Surgery report 2020, approximately 28 million surgeries have been canceled or postponed during COVID-19, substantially impacting the market.

The major factor driving the market is the increasing number of surgical processes. According to a research article by Prashant Bhandarkar et al., published in the World Journal of September 2020, estimated that about 5,000 surgeries are required to meet the surgical burden of diseases of 100,000 people in low- and middle-income countries (LMICs). Additionally, the reported rates of surgery vary from 295 in low- and middle-income countries (LMICs) to 23,000 in high-income countries (HIC) per 100,000 people. Thus, the increasing number of surgical procedures are expected to boost the market.

Additionally, technological advancements in medical devices are boosting the demand for reliable and efficient technologies during surgeries to decrease blood loss and infection rates and reduce operative time, which is the major reason for market growth. For instance, in December 2020, Bolder Surgical, a provider of surgical devices and instruments, introduced the CoolSeal Vessel Sealing platform, which performs minimally invasive surgery in pediatric patients safely and effectively. Rising investments in surgical instruments by hospitals and government initiatives are boosting the market.

However, the high cost of instruments involved and the complications arising after using the devices are the major drawbacks of the market.

Vessel Sealing Devices Market Trends

The Laparoscopic Segment Accounted for a Major Share of the Market

Laparoscopy is a surgical diagnostic method used to analyze the organs inside the abdomen. It is a minimally invasive procedure that requires only small incisions. It uses an instrument called a laparoscope to look at the abdominal organs. Vessel sealing devices are the major part of the laparoscopic surgeries performed.

The major factors driving the growth of the segment are the increasing awareness of the advantages of laparoscopic surgeries over open surgeries and an increasing number of laparoscopic surgeries across the world.

However, many studies have described the safety and efficiency of vessel sealing devices in laparoscopic surgeries That will help in fueling the market over the projecting period. For instance, as per the study published in Surgical Innovation in June 2021, the title "Safety and Efficacy of Using Staplers and Vessel Sealing Devices for Laparoscopic Splenectomy: A Randomized Controlled Trial", vessel sealing devices have great safety and effectiveness over endoscopic staplers. Thus, the higher safety and effectiveness of vessel sealing devices boost the market.

Laparoscopy is a minimally invasive surgical procedure that allows a surgeon to view the inside of the abdomen and pelvis through small incisions rather than large skin incisions. Because of their convenience, minimally invasive procedures are becoming increasingly popular. Because minimally invasive surgeries (MIS) cause less post-operative pain, patients are prescribed lower doses of pain relievers, thereby driving the segment growth.

North America Dominates the Market, and It is Expected to do the Same during the Forecast Period

North America is expected to dominate the overall vessel sealing devices market throughout the forecast period. The largest share is mainly due to the presence of key players and an increase in per capita healthcare spending and expansion in the investment and product launches made by the major market players in the region. For instance, in June 2021, Johnson and Johnson's Ethicon launched ENSEAL X1 Curved Jaw Tissue Sealer for use in colorectal, bariatric surgery, gynecological, and thoracic procedures.

Furthermore, there is a growing awareness among the population about the advantages of surgeries with such advanced technology. High adoption of surgical procedures with advanced energy in the United States, an increase in the number of approvals for new devices by the Food and Drug Administration, and a rise in the fraction of minimally invasive surgical procedures performed in the United States aid North America's high market share. According to the article published in the JAMA Network in December 2021, by Aviva S. Mattingly, BA1, in the United States, from January 1, 2019, to January 20, 2021, a total of 13,108,567 surgical procedures were performed. In 2019, there were 6,651,921 procedures, and in 2020, there will be 5,973,573 procedures. Thus, the increasing number of surgeries in the country drives the demand for vessel sealing devices, thereby boosting the market.

According to the American Cancer Society, Cancer Treatment and Survivorship Facts and Figures 2019-2021, on January 1, 2019, an estimated 16.9 million people in the United States had a history of cancer, and on January 1, 2030, the number of cancer survivors is expected to rise to more than 22.1 million, owing to population growth and aging. This is intended to drive the market in North America.

Thus, the increasing number of surgeries and technological advancements in medical devices boost the market in the region.

Vessel Sealing Devices Industry Overview

The vessel sealing devices market is moderately competitive, and it consists of several major players. Some of the market players are Medtronic PLC, B Braun Melsungen AG, Erbe Medical India Pvt. Ltd, Olympus Corporation, Ethicon US LLC (Johnson and Johnson), Boston Scientific Corporation, BOWA-electronic GmbH and Co. KG, CONMED Corporation, and Bolder Surgical Holdings Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Defination

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Number of Surgical Procedures

- 4.2.2 Technological Advancements in Vessel Sealing Devices

- 4.3 Market Restraints

- 4.3.1 Complications of Vessel Sealing Devices

- 4.3.2 High Cost of Surgeries

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 Product

- 5.1.1 Generators

- 5.1.2 Instruments

- 5.1.3 Accessories

- 5.2 Application

- 5.2.1 General Surgery

- 5.2.2 Laparoscopic Surgery

- 5.3 End User

- 5.3.1 Hospitals and Specialty Clinics

- 5.3.2 Ambulatory Surgical Centers

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle-East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle-East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Medtronic PLC

- 6.1.2 B Braun Melsungen AG

- 6.1.3 Erbe Medical India Pvt. Ltd

- 6.1.4 Olympus Corporation

- 6.1.5 Ethicon US LLC (Johnson & Johnson)

- 6.1.6 Boston Scientific Corporation

- 6.1.7 BOWA-electronic GmbH & Co. KG

- 6.1.8 OmniGuide Holdings Inc.

- 6.1.9 CONMED Corporation

- 6.1.10 Hologic (Bolder Surgical Holdings Inc.)

- 6.1.11 XCELLANCE Medical Technologies

- 6.1.12 LAMIDEY NOURY.FR.