|

시장보고서

상품코드

1439747

HIV/AIDS 진단약 시장 : 점유율 분석, 산업 동향과 통계, 성장 예측(2024-2029년)Global HIV/AIDS Diagnostics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

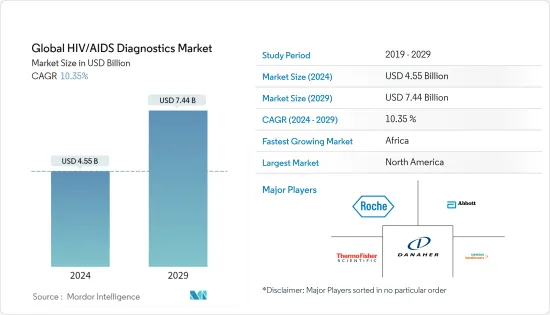

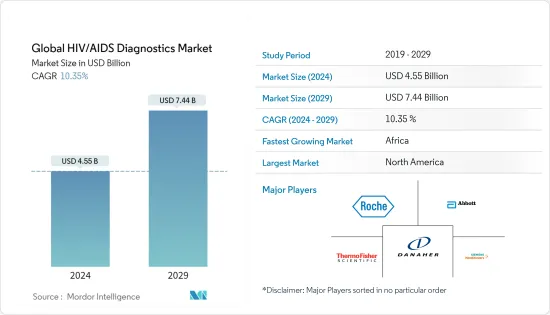

세계의 HIV/AIDS 진단약 시장 규모는 2024년에 45억 5,000만 달러로 추정되며, 2029년에는 74억 4,000만 달러에 달할 것으로 예측되며, 예측 기간 중(2024-2029년) CAGR은 10.35%로 성장할 전망입니다.

COVID-19로 인해 HIV 검사가 급감하고 그 결과 신규 HIV 진단 건수가 크게 감소했습니다.2022년 5월, "COVID Caused Drop-in HIV Testing, Diagnoses"라는 제목의 기사에 따르면 미국 질병예방통제센터(CDC)의 2020년 HIV 감시 보고서에서 COVID로 인한 혼란이 나타났다고 합니다. 미국의 COVID-19 대유행은 2020년 내내 HIV 검사 서비스 및 임상 서비스 이용에 혼란을 가져왔습니다. 이러한 혼란으로 인해 HIV 진단이 한 해 동안 급격히 감소했는데, 주요 원인은 보건소 방문 빈도 감소, 아웃리치 서비스 축소, 공중보건 의료진이 COVID-19 대응 활동으로 전환하면서 검사가 감소했기 때문이었습니다. 마찬가지로 캐나다 정부가 2021년 12월에 발표한 'HIV in Canada: 2020 Surveillance Highlights' 보고서에 따르면 COVID-19 팬데믹으로 인해 HIV 검사를 포함한 성병 및 혈액 감염에 대한 서비스 수요가 감소하고 있습니다. HIV 검사를 포함한 성병 및 혈액 감염 관련 서비스에 대한 수요가 감소하고 서비스 제공 능력도 감소했다고 밝혔습니다. 이는 2020년에 관찰된 HIV 신규 진단율에 영향을 미쳤을 가능성이 있습니다. 따라서 COVID-19 팬데믹은 시장 성장에 부정적인 영향을 미칠 것입니다. 그러나 향후 시장은 성장할 가능성이 높습니다.

HIV 유병률 증가, 새로운 노력과 제품 출시 등이 시장 성장의 주요 원인으로 꼽힙니다.2021년 11월 세계보건기구(WHO) 업데이트에 따르면 HIV는 여전히 전 세계 공중보건의 큰 문제로 지금까지 3,630만 명의 목숨을 앗아간 것으로 추정됩니다. 2020년 말 HIV 감염자 수는 3,770만 명(3,020만-4,510만 명)으로 추정되며, 이 중 3분의 2 이상(2,540만 명)이 WHO 아프리카에 있으며, 2020년에는 680만 명(480만-1,000만 명)이 HIV 관련 원인으로 사망하고 1,500만 명(100만-2,000만 명)이 HIV에 감염될 것으로 예상됩니다. 감염될 것입니다.

유엔에이즈계획(UNAIDS)과 같은 공공 기관의 구상이 증가하면서 시장에 대한 인식과 투자를 불러일으키고 있습니다.(UNAIDS)와 같은 공공 기관의 구상이 증가함에 따라 UNAIDS가 새롭게 제안한 세계 95-95-95 목표를 달성하고, 향후 10년간 HIV 관련 사망자 770만 명이라는 최악의 시나리오를 피하고, COVID-19 기간 중 HIV 감염 증가, HIV 서비스 중단, 공중보건 대응의 둔화를 피하기 위해 시장에 인식과 투자를 유도하고 있습니다. 서비스 중단으로 인한 HIV 감염 증가와 HIV에 대한 공중보건 대응이 둔화되는 것을 피하기 위한 것입니다. 이러한 구상은 인지도를 높이고 더 많은 진단 검사에 대한 수요를 증가시켜 시장 성장을 가속하고 있습니다.

또한 새로운 연구개발, 기술 혁신, 주요 업체들의 기술적으로 진보된 제품 출시가 시장 성장을 가속할 것으로 예상됩니다. 예를 들어 2021년 4월 알토나 진단은 인간 혈장에서 인간 면역 결핍 바이러스(HIV) 특이적 RNA를 검출하고 정량화하는 실시간 RT-PCR 기술을 기반으로 한 체외 진단 검사를 출시했습니다. 이 검사는 AltoStar HIV RT-PCR Kit 1.5로 명명되었습니다. 따라서 위의 요인으로 인해 조사 대상 시장은 조사 기간 중 괄목할 만한 성장을 보일 것으로 예상됩니다.

그러나 신흥 국가에서는 핵산 검사가 의무화되어 있지 않아 시장 성장에 걸림돌이 될 가능성이 높습니다.

HIV/AIDS 진단약 시장 동향

예측 기간 중 항체 검사 부문이 큰 시장 점유율을 차지할 것으로 예상

항체 검사는 혈액이나 타액에서 HIV 항체를 검출합니다. 박테리아나 바이러스가 체내에 침입하면 면역계는 항체를 생성하는데, HIV 항체 검사는 감염 후 3-12주 후에 양성 여부를 판단할 수 있습니다. 면역체계가 HIV에 대한 항체를 생성하는 데는 몇 주 또는 그 이상이 걸릴 수 있으므로 HIV 항체 검사는 키트를 사용하면 집에서 프라이버시를 유지하면서 검사할 수 있습니다.

시장 성장의 우위는 전 세계 HIV/AIDS 유병률 증가와 항원 검사의 효과에 기인하며, HIV.gov가 2022년 8월에 업데이트한 통계에 따르면 2021년 전 세계에서 약 1.5백만 명이 HIV에 감염된 것으로 추정됩니다. 또한 2020년에는 전 세계에서 약 3,840만 명의 HIV 감염자가 있었습니다. 이 중 3,670만 명은 성인이고, 1,700만 명은 어린이(15세 미만)였습니다. 또한 54%는 여성과 소녀였습니다. 출처에 따르면 HIV 감염자 대다수는 중저소득 국가에 거주하고 있으며, 2021년에는 아프리카 동부 및 남부에 2,060만 명(53%), 아프리카 서부 및 중부에 500만 명(13%), 아시아태평양에 600만 명(15%), 유럽 서부 및 중부, 북미에 230만 명(5%)이 거주할 것으로 예상했습니다. 있었습니다. 이 지역의 높은 HIV 감염률로 인해 진단약에 대한 수요가 증가하여 조사 대상 시장을 주도하고 있습니다.

영국 보건당국이 2021년 12월에 발표한 보고서 'HIV 검사, 신규 HIV 진단, 결과, HIV 서비스 이용자들의 치료 품질'에 따르면 2020년 영국에서 약 97,740명이 HIV에 감염된 것으로 추정되며, 2020년에는 약 4,640명이 감염된 것으로 추정됩니다. 4,660명이 감염 사실을 모르고 있는 것으로 추정됩니다. 따라서 영국 시장은 큰 성장 잠재력을 가지고 있습니다. 또한 정부의 구상과 프로그램 증가는 세계 시장을 촉진하고 있습니다. 예를 들어 2021년 12월 영국 정부는 2,300만 파운드 이상의 자금이 투입된 HIV 행동 계획을 발표했으며, 2025년까지 신규 HIV 감염을 80% 감소시키고 2030년까지 영국에서 감염과 사망을 없애는 것을 목표로 하고 있습니다. 이러한 전략적 프로그램에 따른 투자 증가는 영국의 진단 능력을 향상시키고 시장을 촉진할 것입니다. 제품 출시도 시장 성장 요인 중 하나입니다. 예를 들어 2020년 9월 로슈는 미국에서 Elecsys HIV Duo Immunoassay를 출시했습니다. 이 검사는 HIV p24 항원(바이러스)과 항HIV 항체(면역 반응에 의한)를 별도로 측정하여 급성 HIV 감염을 기존 방법보다 더 빨리 감지할 수 있습니다. 2022년 1월, Vela Diagnostics의 Sentosa SQ HIV-1 genotyping assay for HIV는 The Centers for Medicare & Medicaid(CDC)의 승인을 받았습니다. Centers for Medicare and Medicaid(CMS)로부터 보험급여를 받았습니다. 이를 통해 더 많은 검사 기관이 더 민감하고 HIV 환자의 임상 결과를 개선할 수 있는 새로운 기술로 전환하는 것을 주저했던 격차를 해소할 수 있게 되었습니다. 따라서 이러한 구상은 향후 이 지역 시장 성장을 증가시킬 것입니다.

따라서 위와 같은 요인들이 시장 성장을 증가시킬 것으로 예상됩니다.

북미 시장 독주, 예측 기간 중에도 마찬가지일 것으로 전망

북미는 예측 기간 중 전체 시장을 주도할 것으로 예상됩니다. 시장 성장의 주요 요인으로는 주요 기업의 존재, 이 지역의 높은 HIV/AIDS 유병률, 잘 구축된 의료 인프라 등을 들 수 있습니다.

2021년 6월 HIV.gov가 발표한 통계에 따르면 미국에서는 약 1,200만 명이 HIV(인체면역결핍바이러스)에 감염되어 있으며, 2019년에는 총 34,800명이 HIV에 감염되어 12.6명(인구 10만 명당)의 감염률을 보였다고 합니다. 이는 HIV 감염률이 높다는 것을 의미하며, 이는 진단 제품 수요 증가로 이어져 시장 성장의 원동력이 될 것으로 보입니다.

또한 2021년 10월 The Borgen Project가 발표한 기사에 따르면 2020년 UNAIDS는 멕시코의 HIV 감염자 34만 명을 보고했는데, 이는 2018년 보고된 멕시코의 23만 명보다 55% 증가한 수치입니다. 이 프로그램은 2020년까지 "멕시코, 브라질, 페루의 7,500명의 위험에 처한 사람들"을 지원하기 위해 2,600만 달러의 HIV 치료 자금을 받았습니다. 멕시코에서는 푸에르토 바야르타, 멕시코시티, 메리다, 과달라하라 등 멕시코 4개 도시에서 최대 3,000명을 무료로 치료하는 PrEP 프로그램이 시작되었습니다. 또한 환자들은 성병 검사, 상담 및 콘돔을 무료로 제공받았습니다. 따라서 이러한 구상은 이 지역 시장 성장을 가속할 것으로 보입니다.

또한 2021년 12월 미국 질병통제예방센터(CDC)는 두 개의 새로운 네트워크, 즉 Global Action in Healthcare Network(GAIHN)와 Global AR Laboratory and Response Network(GAIHN)를 설립했습니다. Global AR Lab &Response Network)의 설립을 통해 항균제 내성(AR) 및 감염성 질환(HIV 포함) 및 기타 의료 위협에 대응하기 위해 전 세계 약 30개 기관에 2,200만 달러를 지원했습니다. 이러한 투자 증가와 진단법을 지원하기 위한 세계 네트워크 구축이 시장을 주도할 것으로 보입니다.

HIV/AIDS 진단약 산업 개요

HIV/AIDS 진단약 시장은 적당한 경쟁 상태에 있으며, 복수의 대기업으로 구성되어 있습니다. Siemens Healthineers, F. Hoffmann-La Roche Ltd, Abbott Laboratories, Danaher Corporation, Thermo-Fisher Scientific Inc., Merck KGaA, Becton, Dickinson & Company, Hologic Inc., Bio-Rad Laboratories 등이 일례입니다.

기타 혜택 :

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 촉진요인

- 세계에서 HIV/에이즈의 유행 확대

- 정부 구상의 증가

- 시장 억제요인

- 신흥 국가에서 핵산검사의 의무화 부족

- Porter's Five Forces 분석

- 신규 진출업체의 위협

- 구매자/소비자의 교섭력

- 공급 기업의 교섭력

- 대체품의 위협

- 경쟁 기업간 경쟁 강도

제5장 시장 세분화

- 제품별

- 소모품

- 기구

- 소프트웨어 & 서비스

- 검사 유형별

- 항체 검사

- 바이러스량 검사

- CD4 검사

- 기타

- 최종사용자별

- 진단 연구소

- 병원

- 기타

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 기타 아시아태평양

- 중동 및 아프리카

- GCC

- 남아프리카공화국

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 경쟁 구도

- 기업 개요

- Siemens Healthineers

- F. Hoffmann-La Roche Ltd

- Abbott Laboratories

- Danaher Corporation

- Thermo-Fisher Scientific Inc.

- Merck KGaA

- Becton, Dickinson & Company

- Hologic Inc.

- Bio-Rad Laboratories

- OraSure Technologies

- Chembio Diagnostics, Inc.

- Omega Diagnostics Group PLC

제7장 시장 기회와 향후 동향

KSA 24.03.18The Global HIV/AIDS Diagnostics Market size is estimated at USD 4.55 billion in 2024, and is expected to reach USD 7.44 billion by 2029, growing at a CAGR of 10.35% during the forecast period (2024-2029).

COVID-19 caused a dramatic decline in HIV testing and, as a consequence, a much lower number of new HIV diagnoses. In May 2022, an article published titled "COVID Caused Drop-in HIV Testing, Diagnoses" stated that the Centers for Disease Control and Prevention (CDC) 2020 HIV surveillance report showed COVID disruptions. The COVID-19 pandemic in the United States led to disruptions in HIV testing services and access to clinical services throughout 2020. This disruption resulted in a steep, single-year decline in HIV diagnoses that is mostly attributed to declines in testing caused by less frequent visits to health centers, reduced outreach services, and shifting of public health staff to COVID-19 response activities. Similarly, in December 2021, a report published by the Government of Canada, titled "HIV in Canada: 2020 Surveillance highlights" stated that the COVID-19 pandemic resulted in a decreased demand for, and ability to provide, services related to sexually transmitted and bloodborne infections, including HIV testing. This may have had an impact on observed new diagnosis rates for HIV in 2020. Hence, the COVID-19 pandemic has a negative impact on market growth. However, in the future, the market is likely to grow.

Factors such as the increasing prevalence of HIV along with new initiatives and product launches are the primary reasons for the growth of the market. According to the World Health Organization (WHO) update in November 2021, HIV continues to be a major global public health issue, having claimed 36.3 million lives so far. There were an estimated 37.7 million (30.2-45.1 million) people living with HIV at the end of 2020, over two-thirds of whom (25.4 million) are in the WHO African Region. In 2020, 680,000 (480,000-1.0 million) people died from HIV-related causes and 1.5 million (1.0-2.0 million) people acquired HIV.

The increasing initiatives by public organizations such as United Nations Programme on HIV and AIDS. (UNAIDS) provides awareness and investments to the market. To reach the new proposed global 95-95-95 targets set by UNAIDS, to avoid the worst-case scenario of 7.7 million HIV-related deaths over the next 10 years, increasing HIV infections due to HIV service disruptions during COVID-19, and the slowing public health response to HIV. Such initiatives increase awareness which increases the demand for more diagnostic tests which increases the growth of the market.

Furthermore, the new research and developments, technological innovations, and the launch of technologically advanced products by key players are expected to boost the growth of the market. For instance, in April 2021, Altona Diagnostics launched an in-vitro diagnostic test based on real-time RT-PCR technology that detects and quantifies the human immunodeficiency virus (HIV) specific RNA in human plasma. The test was named as AltoStar HIV RT-PCR Kit 1.5. Therefore, due to the above-stated factors, the studied market is anticipated to witness notable growth during the study period.

However, the lack of mandates for nucleic acid tests in developing countries is likely to hinder market growth.

HIV/AIDS Diagnostics Market Trends

Antibody Test Segment Accounts for the Large Market Share Over the Forecast Period

The Antibody test detects HIV antibodies in blood or saliva. The immune system makes antibodies when bacteria or viruses enter the body. An HIV antibody test can determine if the person is positive after 3-12 weeks after infection. That's because it can take a few weeks or longer for the immune system to make antibodies to HIV. The patient can do an HIV antibody test in privacy at home with the kits.

The dominance in the market growth can be attributed to the increase in the prevalence of HIV/AIDS globally and the efficacy of antigen testing. As per the statistics updated in August 2022 by HIV.gov, an estimated 1.5 million individuals worldwide acquired HIV in 2021. Moreover, there were approximately 38.4 million people across the globe with HIV in 2020. Of these, 36.7 million were adults and 1.7 million were children (<15 years old). In addition, 54% were women and girls. As per the same source, the vast majority of people with HIV are in low- and middle-income countries. In 2021, there were 20.6 million people with HIV (53%) in eastern and southern Africa, 5 million (13%) in western and central Africa, 6 million (15%) in Asia and the Pacific, and 2.3 million (5%) in Western and Central Europe and North America. The high incidence rate of HIV in the country boosts the demand for its diagnostics, thus driving the studied market.

The report 'HIV testing, new HIV diagnoses, outcomes and quality of care for people accessing HIV services: 2021 report' published by the UK Health Security Agency in December 2021, stated that in 2020, an estimated 97,740 people were living with HIV in England and an estimated 4,660 in 2020 were unaware of their infection indicating that diagnostic services are not provided to the larger extent of the people. Therefore, the market in the country has great potential to grow. Furthermore, the rise in government initiatives and programs is boosting the global market. For instance, in December 2021, the Government launched an HIV action plan, supported by over GBP 23 million of funding, which aims to reduce new HIV infections by 80% by 2025 and end infections and deaths in England by 2030. Such rising investments aligned with strategic programs will increase the diagnostic capabilities in the country, thus propelling the market. Product launches are another factor in the market growth. For instance, in September 2020, Roche launched Elecsys HIV Duo immunoassay in the United States. Through separate measurements of the HIV p24 antigen (the virus) and anti-HIV antibodies (caused by immune reaction), this test can detect an acute HIV infection earlier than current methods. Hence, such innovations coupled with increasing HIV cases and government initiatives the market is likely to grow in the future. In January 2022, Vela Diagnostics's Sentosa SQ HIV-1 genotyping assay for HIV received reimbursement from The Centers for Medicare and Medicaid (CMS). This will allow more laboratories to bridge the gap that may have been deterring them from moving onto a newer technology that gives higher sensitivity and possibly better clinical outcomes to HIV patients. Hence, such initiatives would increase the market growth in the region in the upcoming period.

Hence, the above-mentioned factors are expected to increase the market growth.

North America Dominates the Market and Expected to do Same Over the Forecast Period

North America is expected to dominate the overall market, throughout the forecast period. The market growth is due to factors such as the presence of key players, the high prevalence of HIV/AIDS in the region, and established healthcare infrastructure are some of the key factors accountable for its large share.

According to Statistics published by HIV.gov in June 2021, approximately 1.2 million people in the United States have HIV (Human Immunodeficiency Virus) resulting in a total of 34,800 HIV infections in 2019 with a rate was 12.6 (per 100,000 people). This suggests that HIV incidences are high in the country, therefore increasing the demand for its diagnostics products, which will drive the studied market.

Additionally, in October 2021, an article published by The Borgen Project stated that in 2020, UNAIDS reported 340,000 people living with HIV, a 55% increase from 2018's report of 230,000 in Mexico. The program received Usd26 million in HIV treatment funding to assist '7,500 at-risk people in Mexico, Brazil, and Peru' until 2020. In Mexico, the PrEP program was open to assist up to 3,000 people with free treatments across four Mexican cities including Puerto Vallarta, Mexico City, Merida, and Guadalajara. Additionally, patients received STD testing, counseling, and condoms free of charge. Hence, such initiatives would increase market growth in the region.

Additionally, in December 2021, the Centers for Disease Control and Prevention (CDC) awarded USD 22 million to nearly 30 organizations around the world to combat antimicrobial resistance (AR) and infectious diseases (including HIV), and other healthcare threats through the establishment of two new networks namely the Global Action in Healthcare Network (GAIHN) and the Global AR Laboratory and Response Network (Global AR Lab & Response Network). Thus, increasing investments and the establishment of a global network for supporting diagnostics will drive the market.

HIV/AIDS Diagnostics Industry Overview

The HIV/AIDS diagnostics market is moderately competitive and consists of several major players. Some of the market players are Siemens Healthineers, F. Hoffmann-La Roche Ltd, Abbott Laboratories, Danaher Corporation, Thermo-Fisher Scientific Inc., Merck KGaA, Becton, Dickinson & Company, Hologic Inc., and Bio-Rad Laboratories among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Prevalence of HIV/Aids globally

- 4.2.2 Increasing Government Initiatives

- 4.3 Market Restraints

- 4.3.1 Lack of Mandates for Nucliec acid test in Developing Countries

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Product

- 5.1.1 Consumables

- 5.1.2 Instruments

- 5.1.3 Software & Services

- 5.2 By Test Type

- 5.2.1 Antibody Tests

- 5.2.2 Viral Load Tests

- 5.2.3 CD4 Tests

- 5.2.4 Others

- 5.3 By End User

- 5.3.1 Diagnostic Laboratories

- 5.3.2 Hospitals

- 5.3.3 Others

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle-East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle-East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Siemens Healthineers

- 6.1.2 F. Hoffmann-La Roche Ltd

- 6.1.3 Abbott Laboratories

- 6.1.4 Danaher Corporation

- 6.1.5 Thermo-Fisher Scientific Inc.

- 6.1.6 Merck KGaA

- 6.1.7 Becton, Dickinson & Company

- 6.1.8 Hologic Inc.

- 6.1.9 Bio-Rad Laboratories

- 6.1.10 OraSure Technologies

- 6.1.11 Chembio Diagnostics, Inc.

- 6.1.12 Omega Diagnostics Group PLC