|

시장보고서

상품코드

1439843

세계 디에틸렌글리콜(DEG) 시장 : 점유율 분석, 업계 동향과 통계, 성장 예측(2024-2029년)Diethylene Glycol (DEG) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

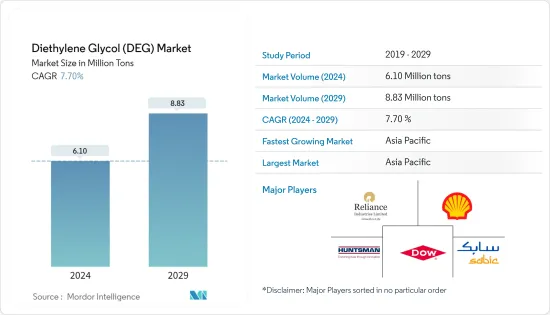

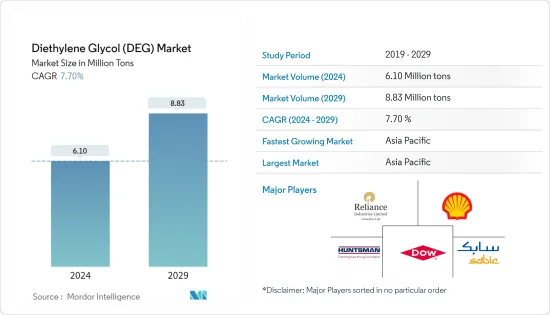

디에틸렌글리콜(DEG) 시장 규모는 2024년 610만 톤으로 추정되며, 2029년까지 883만 톤에 이를 것으로 예측되며, 예측기간(2024년-2029년) 동안 복합 연간 성장률(CAGR) 7.70%로 성장할 전망입니다.

COVID-19의 유행은 시장에 악영향을 미쳤습니다. 락다운이나 제한조치에 의해 제조시설이나 공장이 폐쇄되었기 때문입니다. 공급망과 운송의 혼란으로 인해 시장에 장애가 발생했습니다. 그러나 업계는 2021년 회복을 보였으며 조사 대상 시장 수요가 회복되었습니다.

주요 하이라이트

- 단기적으로는 인도나 중국 등 신흥 경제국의 건설 업계와 페인트 및 코팅업계로부터 수요 증가가 시장 성장을 가속하는 요인이 되고 있습니다.

- 반대로 독성과 원재료 가격 변동으로 인해 DEG 사용을 제한하는 규제는 조사 대상 시장의 성장을 억제하는 요인의 일부가 되었습니다.

- 그러나 PET 수지 및 섬유 산업에서 하류에서의 사용 증가로 인해 화학 산업에서 화학 중간체로서의 디에틸렌 글리콜 수요 증가는 미래 시장을 견인할 수 있는 큰 기회가 될 것입니다.

- 아시아태평양은 세계를 지배하고 있으며, 인프라 개발 촉진 및 급속한 산업화로 인해 가장 빠르게 성장하는 시장이 될 것입니다.

디에틸렌글리콜(DEG) 시장 동향

플라스틱 산업 수요 증가

- 디에틸렌 글리콜(DEG)은 에틸렌 옥사이드의 부분 가수분해에 의해 생성되는 유기 화합물입니다. 무색, 무취, 저휘발성, 저점도의 단맛이 있는 액체입니다.

- 종이, 코르크, 합성 스폰지용 가소제를 제조할 때의 원료로서 디에틸렌글리콜의 사용이 증가하고 있어 플라스틱 산업에 있어서의 디에틸렌글리콜 수요가 높아지고 있습니다. 예측 기간 동안 시장을 견인할 것으로 예상됩니다.

- 디에틸렌 글리콜은 폴리우레탄과 같은 플라스틱 재료의 제조에도 사용됩니다. 냉장고나 냉동고의 단열재로서 자동차 산업의 코팅재나 실란트재로서 사용되고 있습니다. 예를 들어 OICA에 따르면 2022년 미국의 자동차 생산 대수는 10,060,339대로 2021년에 비해 10% 증가했습니다. 그 결과, 자동차 생산 증가는 수요를 창출할 것으로 예상됩니다.

- 중국은 세계 시장에서 가장 큰 폴리 우레탄 원료 및 제품 생산 국가입니다. 예를 들어 중국국가통계국에 따르면 2021년 중국의 플라스틱 제품 총 생산량은 8,000만 톤에 달하고, 전년(2020년)에 비해 5.27% 증가했습니다. 따라서 국내 플라스틱 제품의 생산 증가는 국내 디에틸렌글리콜(DEG) 시장에 대한 수요를 창출할 것으로 예상됩니다.

- 위의 모든 요인들로 인해 디에틸렌 글리콜(DEG) 시장은 예측 기간 동안 빠르게 성장할 것으로 예상됩니다.

아시아태평양이 시장을 독점

- 중국과 인도와 같은 국가에서는 인프라 정비 및 급속한 산업화에 대한 정부 지출 증가로 이 지역의 디에틸렌 글리콜 수요가 증가하고 있습니다.

- 건설, 건축, 플라스틱, 자동차 등 다양한 최종 사용자 산업에서 폴리에스테르 수지 및 폴리우레탄과 같은 제품의 요구가 증가함에 따라 이 지역에서 디에틸렌 글리콜에 대한 수요가 증가할 것으로 예상됩니다. 그것은 그들의 생산을 위한 화학 중간체로 작동합니다. 또한 아시아태평양 국가에서 다양한 화학물질 생산 증가는 시장 성장에 영향을 미쳤습니다.

- 인도상공회의소 연합에 따르면 인도 정부는 농약산업을 세계 리더십을 발휘하는 톱 12산업 중 하나로 인식하고 있으며, 2025년까지의 예측기간에 8-10% 성장할 것으로 예측되고 있습니다.

- 중국국가도료공업협회에 따르면 중국에서는 건축 및 건설업과 자동차 제조의 지원을 받아 국내 도료 수요는 8% 증가할 전망이라고 합니다. 예를 들어 OICA에 따르면 2022년 중국의 자동차 생산 대수는 2,702만 615대로 2021년에 비해 3.3% 증가했습니다. 따라서 국내 자동차 생산 증가로 페인트 소비가 더 많이 예상되고 코팅으로 디에틸렌 글리콜(DEG) 시장에 호재가 생깁니다.

- 중국과 인도는 인구가 많은 상위 2개국이지만 여전히 발전도상입니다. 따라서 농약, 페인트, 코팅, 퍼스널케어 산업에서는 큰 성장이 예상되고 있습니다. 예를 들어, 2022년에는 인도의 주택 시장 전체에서 32만 8,000호가 넘는 주택 단위가 출시되었습니다. 이 나라에서는 주택 수요가 높음에도 불구하고, 주택 출시는 지난 몇 년간 비교적 높은 수준에 있습니다. 따라서 건축용 코팅 수요가 증가함에 따라 디에틸렌 글리콜 시장이 밀어올릴 것으로 예상됩니다.

- 위의 요인으로 인해 디에틸렌 글리콜(DEG) 시장은 조사 기간 동안 크게 성장할 것으로 예상됩니다.

디에틸렌글리콜(DEG) 산업 개요

디에틸렌 글리콜 시장은 매우 세분화되어 있습니다. 시장의 주요 기업에는 Reliance Industries Limited, SABIC, Dow, Huntsman International LLC 및 Shell 등이 포함됩니다(순차적).

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 성장 촉진요인

- 다양한 업계에서 플라스틱 수요가 높아진다

- 도료 및 코팅 수요 증가

- 기타 촉진요인

- 억제요인

- 디에틸렌글리콜의 독성

- 기타 억제요인

- 업계의 밸류체인 분석

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체 제품 및 서비스의 위협

- 경쟁도

제5장 시장 세분화(시장 규모(수량))

- 용도

- 가소제

- 퍼스널케어

- 화학 중간체

- 윤활제

- 기타 용도(용제 등)

- 최종 사용자 산업

- 플라스틱

- 농약

- 화장품 및 퍼스널케어

- 페인트 및 코팅

- 기타 최종 사용자 산업(섬유, 석유, 가스 등)

- 지역

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 기타 아시아태평양

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 이탈리아

- 프랑스

- 기타 유럽

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카

- 기타 중동 및 아프리카

- 아시아태평양

제6장 경쟁 구도

- 합병과 인수, 합작사업, 협업 및 계약

- 시장 점유율(%)**/랭킹 분석

- 유력 기업이 채용한 전략

- 기업 프로파일

- Crystal India

- Dow

- PTT Global Chemical Public Company Limited(GC Glycol Company Limited)

- Huntsman International LLC

- India Glycols Limited

- Indorama Ventures Public Company Limited

- Mitsubishi Chemical Corporation

- NIPPON SHOKUBAI CO., LTD

- Petroliam Nasional Berhad(PETRONAS)

- Reliance Industries Limited

- SABIC

- Shell

- Tokyo Chemical Industry Co., Ltd.

제7장 시장 기회와 미래 동향

- 화학 중간체로서의 디에틸렌글리콜 수요 증가

- 기타 기회

The Diethylene Glycol Market size is estimated at 6.10 Million tons in 2024, and is expected to reach 8.83 Million tons by 2029, growing at a CAGR of 7.70% during the forecast period (2024-2029).

The COVID-19 pandemic negatively impacted the market. It was because of the shutdown of the manufacturing facilities and plants due to the lockdown and restrictions. Supply chain and transportation disruptions further created hindrances for the market. However, the industry witnessed a recovery in 2021, thus rebounding the demand for the market studied.

Key Highlights

- Over the short term, increasing demand from the construction and paints and coatings industries in emerging economies such as India and China are factors driving the market's growth.

- On the flip side, regulations restricting DEG use due to its toxic nature and volatile prices of raw materials are some of the factors restraining the growth of the market studied.

- However, increasing demand for diethylene glycol as a chemical intermediate in the chemical industry due to increased downstream uses in PET resins and the textile industry are the major opportunities to drive the market in the future.

- The Asia-Pacific region dominates the world and will be the fastest-growing market due to increased infrastructure development and rapid industrialization.

Diethylene Glycol (DEG) Market Trends

Increasing Demand in the Plastics Industry

- Diethylene glycol is an organic compound produced by partial hydrolysis of ethylene oxide. It is a colorless, odorless, low volatility, and low viscosity liquid with a sweet taste.

- Increasing the use of diethylene glycol as raw material in producing plasticizers for paper, cork, and synthetic sponges, the demand for diethylene glycol is rising in the plastic industry. It is expected to drive its market during the forecast period.

- Diethylene glycol is also used for producing plastic materials like polyurethane. It is used for the insulation of refrigerators and freezers and as a coating and sealant material in the automobile industry. For instance, according to OICA, in 2022, automobile production in the United States amounted to 1,00,60,339 units, which showed an increase of 10% compared to 2021. As a result, an increase in automobile production is expected to create demand for Diethylene glycol (DEG).

- China is the largest polyurethane raw materials and product producer in the global market. For instance, according to the National Bureau of Statistics of China, in 2021, China's total production of plastic products amounted to 80 million metric tons, which showed an increase of 5.27% compared to the previous year (2020). Therefore, an increase in the production of plastic products in the country is expected to create demand for the Diethylene glycol (DEG) market in the country.

- Owing to all the factors mentioned above diethylene glycol market is expected to grow rapidly over the forecast period.

The Asia-Pacific Region to Dominate the Market

- In countries like China and India, the demand for diethylene glycol is increasing in the region due to increasing government spending on infrastructure development and rapid industrialization.

- The increasing need for products, such as polyester resins and polyurethanes, in various end-user industries, like construction and building, plastic, and automotive, is projected to boost the demand for diethylene glycol in the region. It acts as a chemical intermediate for their production. Moreover, the rising production of various chemicals in Asia-Pacific countries impacted the market growth.

- According to the Federation of Indian Chambers of Commerce and Industry, the Indian government recognizes the agrochemical industry as one of its top 12 industries to achieve global leadership, growing 8-10% through 2025. Thus, India's agrochemical sector is projected to grow during the forecast period.

- According to the China National Coatings Industry Association, in China, the demand for coatings in the country is likely to grow by 8% with the support of building and construction and automotive manufacturing. For instance, according to OICA, in 2022, automobile production in China amounted to 2,70,20,615 units, which showed an increase of 3.3% compared to 2021. Therefore, increasing the production of automobiles in the country is expected to consume more paints and coatings, creating an upside for the diethylene glycol (DEG) market.

- China and India are the top two largest populated countries, which are still developing. So, huge growth is expected in the agrochemicals, paints and coatings, and personal care industries. For instance, in 2022, over 328 thousand housing units were launched across India's residential market. Even though there is high demand for housing in the country, residential launches are on a comparatively high level over the past few years. Therefore, increasing demand for architectural coatings is expected to boost the diethylene glycol market.

- Owing to the abovementioned factors, the Diethylene glycol (DEG) market is projected to grow significantly during the study period.

Diethylene Glycol (DEG) Industry Overview

The diethylene glycol market is highly fragmented. Some of the major players in the market include (not in any particular order) Reliance Industries Limited, SABIC, Dow, Huntsman International LLC, and Shell, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rising Plastic Demand from Various Industries

- 4.1.2 Increasing Demand in Paints and Coatings

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Toxic Nature of Diethylene Glycol

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Application

- 5.1.1 Plasticizers

- 5.1.2 Personal Care

- 5.1.3 Chemical Intermediates

- 5.1.4 Lubricant

- 5.1.5 Other Applications (Solvent, etc.)

- 5.2 End-user Industry

- 5.2.1 Plastics

- 5.2.2 Agrochemicals

- 5.2.3 Cosmetic and Personal Care

- 5.2.4 Paints and Coatings

- 5.2.5 Other End-user Industries (Textiles, Oil and Gas, etc.)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/ Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Crystal India

- 6.4.2 Dow

- 6.4.3 PTT Global Chemical Public Company Limited (GC Glycol Company Limited)

- 6.4.4 Huntsman International LLC

- 6.4.5 India Glycols Limited

- 6.4.6 Indorama Ventures Public Company Limited

- 6.4.7 Mitsubishi Chemical Corporation

- 6.4.8 NIPPON SHOKUBAI CO., LTD

- 6.4.9 Petroliam Nasional Berhad (PETRONAS)

- 6.4.10 Reliance Industries Limited

- 6.4.11 SABIC

- 6.4.12 Shell

- 6.4.13 Tokyo Chemical Industry Co., Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Demand for Diethylene Glycol as a Chemical Intermediate

- 7.2 Other Opportunities