|

시장보고서

상품코드

1440151

세계 공기질 모니터링 시장 : 점유율 분석, 업계 동향과 통계, 성장 예측(2024-2029년)Air Quality Monitoring - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

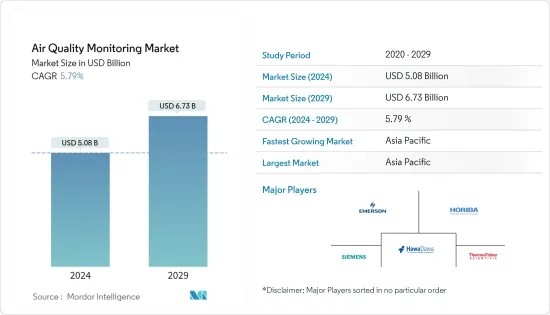

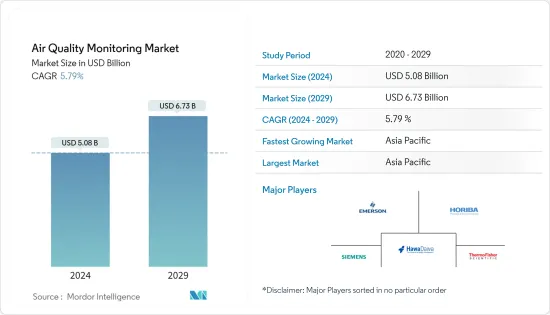

공기질 모니터링 시장 규모는 2024년 50억 8,000만 달러로 추정되고, 2029년까지 67억 3,000만 달러에 이를 것으로 예측되며, 예측 기간 동안 복합 연간 성장률(CAGR) 5.79%로 성장할 전망입니다.

락다운의 결과, 특히 운송부문과 산업부문에서 대기오염이 감소했기 때문에 시장은 확실히 COVID-19 감염의 유행 영향에 직면했습니다. 예를 들어 인도의 중앙공해방지위원회(CPCB)는 'JANTA 외출금지령과 록다운이 대기질에 미치는 영향'에 관한 보고서를 발표하고, 락다운에 의해 국가의 대기질이 대폭 개선된 것 가 밝혀졌습니다. 대기질 측정장치 수요는 다양한 분야에서 감소하고 있지만, 많은 국가에서 대기질에 대한 우려가 증가하고 산업화가 확대됨에 따라 시장은 가까운 미래에 가속화될 수 있지만 재생가능 에너지 등 보다 깨끗한 에너지원의 보급으로 시장은 더욱 가속화될 것으로 예상됩니다. 그리고 원자력 에너지는 제품 수요가 꾸준히 감소하고 있기 때문에 시장 성장을 방해할 것으로 예상됩니다.

옥외 공기 질 장비는 개방 공간에서 공기 질 기준에 관한 정부 정책에 따라 예측 기간 동안 가장 빠르게 성장하는 부문이 될 것으로 예상됩니다.

공기질 모니터링 시스템의 기술 발전은 디바이스와 용도의 기술 개발에 큰 기회를 만들어 냅니다. 예를 들어, 기능이 보다 인터랙티브하고, 데이터 통신 및 전달에 새로운 기술을 사용하는 최근 IoT 기반 장비가 유행하고 있습니다. 이를 차세대 공기질 모니터링 시스템이라고 하며, 이 분야의 많은 R&D 전문가들에게 조사 대상이 되고 있습니다.

아시아태평양은 신흥국가의 도시화율 상승과 산업활동으로 향후 수년간 시장을 독점할 것으로 예상됩니다.

공기질 모니터링 시장 동향

옥외 모니터 부문은 가장 빠르게 성장할 것으로 예상되는 부문

- 실외 공기질 모니터링 시스템은 운송 부문, 산업 부문, 건설 활동 및 기타 모든 외부 오염원으로 인한 대기 오염을 추적하기 위해 설치됩니다. 밀폐공간 외부의 공기에는 발생원 위에 점이 존재하기 때문에 실내 공기보다 유해한 오염물질이 많이 포함되어 있다고 생각됩니다.

- 미국 환경보호청에 따르면 2022년 PM 2.5 대기질의 계절 가중년 평균은 7.81을 차지했으며 2021년 8.54에 비해 낮았습니다.

- 미국 정부는 지난 10년간 국내 평균 PM 2.5 농도 수준을 입방 미터당 8.02마이크로그램으로 41% 줄이는 데 성공했습니다. 이 목표는 다양한 분야에서 대기질 기준의 규제 정책에 의해 달성되었으며, 궁극적으로 풀뿌리 수준에서도 공기질 모니터링 시스템의 고급 도입으로 이어졌습니다.

- 2022년 10월, 유럽 위원회는 EU 대기질 지령을 갱신하고 통합하는 입법 제안을 발표했습니다. 수정안의 일환으로 2050년까지 오염 제로를 달성하기 위해 2030년까지 EU 전체의 대기질 잠정기준을 설정하는 것이 계획되었습니다. 이러한 유형의 제안은 대기질 장비의 사용이 증가할 것으로 예상되며, 그 결과 공기질 모니터링 시장에 대한 수요를 창출합니다.

- 또한 2023년 2월 바레인 정부와 유틸리티,환경문제위원장은 쇼핑몰, 점포, 집합주택, 심지어 주택의 오염 측정도 포함하기로 결정했습니다.

- 이러한 유형의 개발은 예측 기간 동안 시장의 옥외 모니터 부문에 밀어 넣을 것으로 예상됩니다.

아시아태평양이 시장을 독점할 것으로 예상

- 아시아 국가에서는 대기 오염이 우려해야 할 수준에 도달하고 주민의 건강에 큰 악영향을 미칩니다. 현재의 상황은 주로 신흥 국가에서의 산업화의 진전에 의한 것이며, 이로 인해 각국에서 화학오염물질이 증가하고, 그 중 일부는 치사적인 것도 있습니다.

- 대기질과 오염 도시 순위에 따르면 2023년 5월 현재 세계에서 가장 오염된 도시 40개 중 20개 도시가 아시아태평양 도시입니다. 기타에도 중국, 일본, 인도에서는 높은 수준의 대기 오염이 기록됩니다. 이 지역의 국가들은 만연한 상황을 다루기 위해 모든 수단을 취하고 있습니다. 최근 몇 년간 많은 산업과 이 지역의 많은 지방 식민지와 지역이 공기질 모니터링 시스템을 설치하고 있습니다.

- 전자,IT부에 따르면 인도 전자,정보기술장관은 2023년 1월 MeitY가 지원하는 프로젝트를 통해 개발된 대기 품질 감시 시스템(AI-AQMS v1.0) 기술을 도입했습니다. 신기술 개발로 공기질 모니터링 효율이 향상될 것으로 예상되고 있으며, 국내에서 공기질 모니터링 시스템에 대한 수요가 증가하고 있습니다.

- 베트남 정부의 대기질 관리 국가 계획(2021-2025년)에는 지속적인 자동 배출 감시 장치의 설치에 의한 산업, 수송, 농업, 건설 활동 등의 발생원으로부터의 배출 규제가 포함되어 있습니다.

- 이러한 발전으로 아시아태평양은 예측 기간 동안 시장을 독점할 수 있습니다.

공기질 모니터링 산업 개요

공기질 모니터링 시장은 세분화되어 있습니다. 주요 기업로는(순차적), Siemens AG, Thermo Fisher Scientific Inc., Horiba Ltd, Emerson Electric Co., Hawa Dawa GmbH 등이 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 서론

- 조사 범위

- 시장의 정의

- 조사의 전제조건

제2장 조사 방법

제3장 주요 요약

제4장 시장 개요

- 소개

- 2028년까지 시장 규모와 수요 예측(금액)

- 최근 동향과 발전

- 정부의 정책과 규제

- 시장 역학

- 성장 촉진요인

- 대기오염을 규제하기 위한 정부의 지원 정책

- 세계 산업화 확대

- 억제요인

- 재생 가능 에너지나 원자력 발전 등의 보다 깨끗한 에너지원의 보급

- 성장 촉진요인

- 공급망 분석

- Porter's Five Forces 분석

- 공급기업의 협상력

- 소비자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 격렬

제5장 시장 세분화

- 제품 유형

- 실내 모니터

- 옥외 모니터

- 샘플링 방법

- 연속

- 매뉴얼

- 간헐

- 최종 사용자

- 주택 및 상업용

- 발전

- 석유화학제품

- 기타 최종 사용자

- 지역

- 북미

- 미국

- 캐나다

- 북미의 기타 지역

- 유럽

- 영국

- 스페인

- 독일

- 이탈리아

- 유럽의 기타 지역

- 아시아태평양

- 중국

- 일본

- 베트남

- 인도

- 나머지 아시아태평양

- 남미

- 브라질

- 아르헨티나

- 남미의 기타 지역

- 중동 및 아프리카

- 아랍에미리트(UAE)

- 남아프리카

- 사우디아라비아

- 이라크

- 기타 중동 및 아프리카

- 북미

제6장 경쟁 구도

- 합병과 인수, 합작사업, 협업 및 계약

- 유력 기업이 채용한 전략

- 기업 프로파일

- Siemens AG

- Thermo Fisher Scientific Inc.

- Horiba Ltd

- Emerson Electric Co.

- 3M Co.

- Hawa Dawa GmbH

- Honeywell International Inc.

- Teledyne Technologies Inc.

- TSI Inc.

- Merck KGaA

- Agilent Technologies Inc.

제7장 시장 기회와 미래 동향

- 공기질 모니터링 시스템에서의 기술 진보의 진전

The Air Quality Monitoring Market size is estimated at USD 5.08 billion in 2024, and is expected to reach USD 6.73 billion by 2029, growing at a CAGR of 5.79% during the forecast period (2024-2029).

The market had definitely faced the consequences of the COVID-19 pandemic, as the lockdowns resulted in less air pollution, particularly in the transport and industrial sector. For example, the Central Pollution Control Board (CPCB), India, published a report on "the Impact of JANTA CURFEW and lockdown on air quality, which revealed that the lockdown resulted in significant improvement in the air quality of the country. Thus, the demand for air quality measurement equipment got reduced in various sectors. The market is likely to get accelerated in the near future due to growing concerns about air quality and the expansion of industrialization in many countries. However, the penetration of cleaner sources of energy like renewables and nuclear energy is expected to hinder the market growth due to the steadily decreasing requirement for the product.

Outdoor air quality equipment is expected to be the fastest-growing segment during the forecast period due to government policies on air quality standards in open spaces.

The technological advancements in air quality monitoring systems create enormous opportunities for the techno-development of devices and their applications. For instance, the recent IoT-based equipment, which are more interactive in their functioning and use new technologies for communicating and delivering data, are in vogue these days. They are termed as the Next Generation Air Quality Monitoring Systems, which are becoming the subject of research for many R&D professionals in the area.

The Asia-Pacific region is expected to dominate the market in the coming years due to the growing rate of urbanization and the industrial activities in developing countries.

Air Quality Monitoring Market Trends

The Outdoor Monitor Segment is Expected to be the Fastest-growing Segment

- Outdoor air quality monitoring systems are installed to track the air pollution caused by the transport sector, industrial sector, construction activities, and all other external sources of pollution. The air outside the confined spaces is believed to have more harmful pollutants than indoor air due to the presence of the points above sources.

- According to the US Environmental Protection Agency, 2022, the seasonally-weighted annual average of PM 2.5 air quality accounted for 7.81, which was low compared to 8.54 in 2021.

- The US government successfully reduced the nation's average PM 2.5 concentration levels by 41% in the last decade to 8.02 micrograms per cubic meter. The targets were achieved by regulatory policies for air quality standards in various sectors, ultimately leading to the high deployment of air quality monitoring systems even at grassroots levels.

- In October 2022, the European Commission issued a legislative proposal to update and combine the EU Ambient Air Quality Directives. As part of the amendment, it was planned to set interim EU-wide air quality criteria by 2030 to reach zero pollution by 2050. With these types of proposals, the use of air quality devices is expected to increase, which, in turn, will create demand for the air quality monitoring market.

- Additionally, in February 2023, the Bahraini government and the public utilities and environmental affairs committee chairman decided to include measuring pollution in malls, stores, residential compounds, and even residences.

- Such kinds of developments are expected to give a boost to the outdoor monitor segment of the market during the forecast period.

Asia-Pacific is Expected to Dominate the Market

- Air pollution is at alarming levels in Asian countries, which is highly detrimental to the health of the inhabitants. The incumbent situation is mainly due to growing industrialization in developing countries, which has led to increased chemical pollutants in the nations, some of which are fatal too.

- According to the Air Quality and pollution city ranking, as of May 2023, out of the top 40 most polluted cities in the world, 20 are from Asia-Pacific. Apart from that, high levels of air pollution are recorded in China, Japan, and India. The countries in the region are leaving no stone unturned to cope with the prevailing state. Many industries and many local colonies or areas in the region have installed air quality monitoring systems in recent years.

- In January 2023, according to the Ministry of Electronics & IT, the Secretary of Electronics and Information Technology of India inaugurated the technology for Air Quality Monitoring System (AI-AQMS v1.0), developed through MeitY-supported projects. With the development of new technology, the efficiency of air quality monitoring is expected to increase, thus creating demand for air quality monitoring systems in the country.

- The Vietnamese government's National Plan for Air Quality Management (2021-2025) includes emission controls from sources like industries, transport, agriculture, and construction activities, by installing continuous automatic emissions monitoring equipment.

- The Asia-Pacific region will likely dominate the market during the forecast period due to such developments.

Air Quality Monitoring Industry Overview

The air quality monitoring market is fragmented. Some of the major players (in no particular order) include Siemens AG, Thermo Fisher Scientific Inc., Horiba Ltd, Emerson Electric Co., and Hawa Dawa GmbH.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Supportive Government Policies to Regulate Air Pollution

- 4.5.1.2 Expansion of Industrialization Across the World

- 4.5.2 Restraints

- 4.5.2.1 The Penetration of Cleaner Energy Sources Like Renewables and Nuclear Power

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Product Type

- 5.1.1 Indoor Monitor

- 5.1.2 Outdoor Monitor

- 5.2 Sampling Method

- 5.2.1 Continuous

- 5.2.2 Manual

- 5.2.3 Intermittent

- 5.3 End User

- 5.3.1 Residential and Commercial

- 5.3.2 Power Generation

- 5.3.3 Petrochemicals

- 5.3.4 Other End Users

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of the North America

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 Spain

- 5.4.2.3 Germany

- 5.4.2.4 Italy

- 5.4.2.5 Rest of the Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 Vietnam

- 5.4.3.4 India

- 5.4.3.5 Rest of the Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of the South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 South Africa

- 5.4.5.3 Saudi Arabia

- 5.4.5.4 Iraq

- 5.4.5.5 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Siemens AG

- 6.3.2 Thermo Fisher Scientific Inc.

- 6.3.3 Horiba Ltd

- 6.3.4 Emerson Electric Co.

- 6.3.5 3M Co.

- 6.3.6 Hawa Dawa GmbH

- 6.3.7 Honeywell International Inc.

- 6.3.8 Teledyne Technologies Inc.

- 6.3.9 TSI Inc.

- 6.3.10 Merck KGaA

- 6.3.11 Agilent Technologies Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Technological Advancements in Air Quality Monitoring Systems