|

시장보고서

상품코드

1440380

장애인용 디바이스 : 세계 시장 점유율 분석, 업계 동향과 통계, 성장 예측(2024-2029년)Global Disability Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

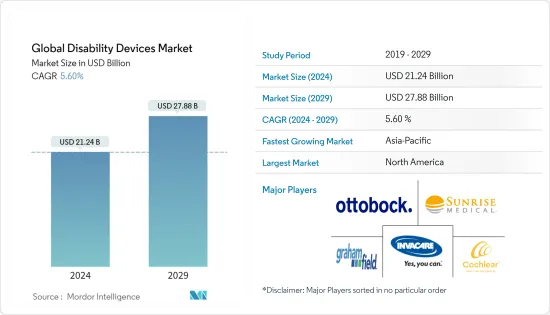

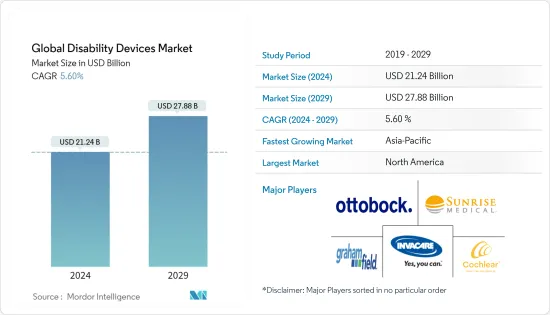

세계의 장애인용 디바이스 시장 규모는 2024년에 212억 4,000만 달러로 추정되며, 2029년까지 278억 8,000만 달러에 달할 것으로 예측되고 있으며, 예측 기간(2024-2029년) 중 5.60%의 CAGR로 성장합니다.

신종 코로나바이러스 감염증(COVID-19) 팬데믹은 장애인용 디바이스 시장에 큰 영향을 미치고 있습니다. 2020년 4월 유엔이 발표한 'COVID-19와 장애인의 권리: 지침'이라는 제목의 기사에 따르면 COVID-19 위기 동안 일상 생활 지원에 의존하는 장애인은 고립감을 느낄 수 있다고 합니다. 요양원과 정신병원에서 발생한 압도적인 사망자 수에서 알 수 있듯이, 시설에 거주하는 사람들은 특히 취약한 입장에 놓여 있습니다. 따라서 팬데믹 기간 중 장애인을 위한 서비스를 강화하기 위한 몇 가지 조치가 권장되었습니다. 예를 들어 세계보건기구(WHO)의 2020년 기사 'COVID-19 전염병 발생시 장애 고려사항'에 따르면 장애인이 언제든지 필요한 의료 서비스 및 공중보건 정보에 접근할 수 있도록 조치를 취해야 한다고 밝혔습니다. 19 전염병이 유행하는 동안에도 마찬가지입니다. 이는 팬데믹 단계에서 장애인용 디바이스에 대한 수요가 증가하여 시장 성장에 긍정적인 영향을 미칠 가능성이 높다는 것을 보여줍니다.

또한 시장의 성장은 장애에 대한 부담 증가와 장애에 대한 노력 증가 등의 요인에 기인한다고 볼 수 있습니다.

장애로 인한 부담이 증가함에 따라 여러 유형의 장애인용 디바이스에 대한 수요가 증가하고 있습니다. 예를 들어 세계보건기구(WHO)의 2021년 11월 최신 정보에 따르면 10억 명 이상이 장애를 겪고 있는 것으로 추정됩니다. 이는 전 세계 인구의 약 15%에 해당하며, 15세 이상 인구 중 최대 1억 9,000만 명(3.8%)이 심각한 기능 장애를 겪고 있으며, 많은 경우 의료 서비스를 필요로 한다고 밝혔습니다. 정보원은 장애인의 의료 서비스 접근성과 보장범위를 개선하기 위해 WHO는 회원국이 장애 문제에 대한 인식을 높이고 국가 및 준국가 보건 프로그램의 요소로 장애를 통합하도록 지도하고 지원하고 있다고 전했습니다. 이 정보원은 또한 WHO가 장애 관련 데이터와 정보의 수집 및 보급을 촉진하고 의료 서비스에서 장애 포용을 강화하기 위한 가이드라인을 포함한 규범적 툴을 개발하고 있다고 보고했습니다. 또한 장애인의 수가 급격히 증가하고 있다고 언급했습니다. 이는 인구 통계학적 추세와 만성 건강 상태 증가 등이 원인입니다. 따라서 환자 집단에서 장애인용 디바이스에 대한 수요는 향후 수년간 증가할 것으로 예상됩니다.

그러나 높은 기기 비용은 장애인용 디바이스 시장의 성장을 저해하는 주요 요인입니다.

장애인용 디바이스 시장 동향

이동보조기기 부문은 장애인용 디바이스 시장에서 주요 시장 점유율을 차지할 것으로 예상

기기 유형별로는 이동 보조기구 부문이 시장에서 큰 비중을 차지할 것으로 예상됩니다. 이동 보조기구는 보행을 돕거나 이동에 장애가 있는 사람들의 이동을 개선하기 위해 고안된 장비입니다. 보행 장애가 있는 사람들을 돕기 위해 사용할 수 있는 다양한 보행 보조기구가 있으며, 더 심각한 장애가 있거나 도보로 이동해야 하는 경우 휠체어나 이동성 스쿠터도 사용할 수 있습니다. 시중에서 구할 수 있는 이동 장비에는 지팡이, 목발, 휠체어, 보행기 등의 이동 장비가 있습니다.

시장내 이 부문의 성장을 가속하는 요인은 제품 출시 증가와 전 세계에서 장애에 대한 부담 증가에 따른 노력 증가입니다. 예를 들어 호주 보건 복지 연구소(AIHW)의 2020년 10월 최신 정보에 따르면 호주에서는 약 6명 중 1명(18%), 즉 약 440만 명이 장애를 가지고 있습니다.

또한 2021년 6월 국제항공운송협회(IATA)는 장애가 있는 여행자를 위한 휠체어 등 이동 보조기구의 운송 경로를 조사하고 개선하기 위해 세계 이동 보조기구 행동 그룹을 출범시켰습니다. 또한 연구개발은 이 부문의 성장에 기여하고 있습니다. 예를 들어 2021년 8월 인도 마드라스에 위치한 인도공과대학(IIT)은 인도 최초의 국산 전동 휠체어 차량을 개발하여 도로뿐만 아니라 험한 지형에서도 사용할 수 있도록 했습니다. 또한 일부 시장 참여자들도 전략적 구상을 구현하기 위해 노력하고 있으며, 이를 통해 이 부문의 성장에 기여하고 있습니다. 예를 들어 2021년 8월 Invacare Corporation은 후륜구동 전동 휠체어의 새로운 표준을 제시하는 Invacare AVIVA STORM RXT 전동휠체어 출시를 발표했습니다.

따라서 상기 동향으로 인해 이 부문은 예측 기간 중 성장할 것으로 예상됩니다.

북미는 시장에서 중요한 점유율을 차지할 것으로 예상되며, 예측 기간 중에도 비슷한 점유율을 차지

북미에서는 미국이 가장 큰 시장 점유율을 차지할 것으로 예상됩니다. 이는 잘 구축된 의료 인프라, 장애인의 부담 증가 시장 관계자의 전략적 노력 등의 요인에 기인하는 것으로 보입니다. 예를 들어 질병통제예방센터(CDC)의 2021년 8월 발표에 따르면 18세에서 64세 사이의 미국 성인 4명 중 1명 이상이 장애를 가지고 있습니다. 이들은 걷기, 계단 오르기, 청각에 심각한 어려움을 겪는 성인입니다. 보기. 집중하고, 기억하고, 결정을 내립니다. 따라서 이는 이 국가에서 장애인용 디바이스에 대한 수요가 매우 높다는 것을 보여줍니다.

또한 2022년 2월 백악관의 최신 정보에 따르면 행정부는 COVID-19 전염병이 장애인에게 심각한 영향을 미치고 장애인 커뮤니티에 새로운 구성원이 추가된 것을 인식하고 있습니다. 정부는 장애인 커뮤니티와 협력하고 협의하여 장애인의 고유한 요구를 해결하기 위해 몇 가지 중요한 조치를 취했습니다.

또한 2021년 8월, 보청기는 경도에서 중등도 난청을 가진 성인을 위해 개발된 최초의 FDA 승인 소비자 직접 판매 보청기인 새로운 SoundControl 보청기를 출시했습니다. 이러한 출시는 시장 성장에 더욱 기여할 것으로 예상됩니다.

따라서 위의 발전으로 인해 시장은 큰 폭의 성장을 이룰 것으로 예상됩니다.

장애인용 디바이스 산업 개요

장애인용 디바이스 시장은 여러 세계 및 국제 시장 기업이 존재하기 때문에 경쟁이 치열합니다. 주요 기업은 파트너십, 협약, 협업, 신제품 출시, 지역적 확장, 합병, 인수합병 등 다양한 성장 전략을 채택하여 시장 입지를 강화하기 위해 노력하고 있습니다. 시장 주요 기업으로는 Ottobock, Sunrise Medical, Invacare Corporation, GF Health Products, Cochlear Limited 등이 있습니다.

기타 혜택

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 촉진요인

- 증대하는 장애의 부담

- 장애에 관한 구상의 증가

- 시장 억제요인

- 디바이스의 고비용

- Porter's Five Forces 분석

- 신규 진출업체의 위협

- 구매자의 교섭력

- 공급 기업의 교섭력

- 대체품의 위협

- 경쟁 기업간 경쟁의 강도

제5장 시장 세분화(금액별 시장 규모)

- 디바이스 유형별

- 시각 보조구

- 보청기

- 이동 보조구

- 기타 디바이스 유형

- 최종사용자별

- 홈케어 환경

- 병원

- 외래 진료 센터

- 재활 센터

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 기타 아시아태평양

- 중동 및 아프리카

- GCC

- 남아프리카공화국

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 경쟁 구도

- 기업 개요

- Cochlear Limited

- MED-EL Medical Electronics.

- GF Health Products

- Ottobock

- Invacare Corporation

- Sunrise Medical

- Ottobock

- Demant A/S

- Pride Mobility Products

- Merits Health Products Co., Ltd.

- Meyra Group

- Sivantos, Inc.(Signia)

- ReSound

제7장 시장 기회와 향후 동향

KSA 24.03.12The Global Disability Devices Market size is estimated at USD 21.24 billion in 2024, and is expected to reach USD 27.88 billion by 2029, growing at a CAGR of 5.60% during the forecast period (2024-2029).

The COVID-19 pandemic has significantly impacted the disability devices market. As per an April 2020 published article titled "Covid-19 And The Rights Of Persons With Disabilities: Guidance" by the United Nations, during the COVID-19 crisis, people with disabilities who are dependent on support for their daily living may find themselves isolated and unable to survive during lockdown measures, while those living in institutions are particularly vulnerable, as evidenced by the overwhelming numbers of deaths in residential care homes and psychiatric facilities. Thus, several measures were recommended during the pandemic to enhance services for the disabled. For instance, as per a World Health Organization (WHO) 2020 article titled, "Disability considerations during the COVID-19 outbreak", actions need to be taken to ensure that people with disabilities can always access healthcare services and public health information they require, including during the COVID-19 outbreak. This indicates that the demand for disability devices is likely to increase during the pandemic phase, thus, having a positive impact on the market growth.

Furthermore, the growth of the market can be attributed to factors such as the growing burden of disability and the rising number of initiatives about disability.

The growing burden of disability is driving the demand for several types of disability devices. For instance, as per a November 2021 update by the WHO, more than 1 billion people are estimated to experience disability. As per the same source, this corresponds to about 15% of the world's population, with up to 190 million (3.8%) people aged 15 years and older having significant difficulties in functioning, often requiring health care services. As per the same source, to improve access to and coverage of health services for people with disabilities, WHO guides and supports the Member States to increase awareness of disability issues and promotes the inclusion of disability as a component in national and sub-national health programs. The source also reports that WHO facilitates the collection and dissemination of disability-related data and information and develops normative tools, including guidelines to strengthen disability inclusion within health care services. It also states that the number of people with disabilities is dramatically increasing. This is due to demographic trends and increases in chronic health conditions, among other causes. Thus, the demand for disability devices among the patient population is expected to increase over the coming period.

However, the high cost of devices is a major factor restraining the growth of the disability device market.

Disability Devices Market Trends

Mobility Aids Segment is Expected to Hold a Major Market Share in the Disability Devices Market

By device type, the mobility aids segment is expected to hold a major share of the market. A mobility aid is a device designed to assist in walking or otherwise improve the mobility of people with a mobility impairment. There are a variety of walking aids available to assist people with impaired walking ability, as well as wheelchairs or mobility scooters for more severe disabilities or longer journeys that would otherwise be undertaken on foot. The types of mobility devices available in the market include canes, crutches, wheelchairs, and walkers, among others types of mobility devices.

The factors boosting the growth of this segment in the market are the increasing number of product launches as well as the rising number of initiatives along with the growing burden of disability worldwide. For instance, as per an October 2020 update by the Australian Institute of Health and Welfare (AIHW), around 1 in 6 (18%) people in Australia, or about 4.4 million people, have a disability.

In addition, in June 2021, the International Air Transport Association (IATA) launched global mobility aids action group to examine and improve the transport journey of mobility aids, including wheelchairs, to improve the handling of such devices for travelers with disabilities. Furthermore, research and development are contributing to the segment's growth. For instance, in August 2021, the Indian Institute of Technology (IIT), Madras, India, developed India's first indigenous motorized wheelchair vehicle that can be used not only on roads but even on uneven terrain. Moreover, several market players are also engaged in the implementation of strategic initiatives, thereby contributing to the segment's growth. For instance, in August 2021, Invacare Corporation announced the launch of the Invacare AVIVA STORM RXT power wheelchair, establishing a new standard for rear-wheel-drive power mobility.

Thus, due to the above-mentioned developments, the segment is expected to witness growth over the forecast period.

North America is Expected to Hold a Significant Share in the Market and Expected to do Same in the Forecast Period

Within North America, the United States is expected to hold a significant market share. This can be attributed to factors such as well-established healthcare infrastructure, the growing burden of the disabled population, as well as strategic initiatives undertaken by the market players. For instance, as per an August 2021 article by the Centers for Disease Control and Prevention (CDC), more than 1 in 4 United States adults between 18 to 64 years of age has a disability. These are adults with serious difficulty walking or climbing stairs, hearing; seeing; concentrating, remembering, or making decisions. Thus, this indicates a significant demand for disability devices in the country.

Furthermore, according to a White House update from February 2022, the Administration recognizes that the COVID-19 pandemic has had a significant impact on disabled people and has resulted in new members of the disability community. The Administration has collaborated and consulted with the disability community and taken several key actions to address the unique needs of individuals with disabilities.

Moreover, in August 2021, Bose launched the new SoundControl Hearing Aids, the first Food and Drug Administration (FDA)-cleared, direct-to-consumer hearing aid developed for adults with perceived mild-to-moderate hearing loss. Such launches are expected to further contribute to the market's growth.

Thus, due to the above-mentioned developments, the market is expected to witness significant growth.

Disability Devices Industry Overview

The disability devices market is competitive with the presence of several global and international market players. The key players are adopting different growth strategies to enhance their market presence, such as partnerships, agreements, collaborations, new product launches, geographical expansions, mergers, and acquisitions. Some of the key players in the market are Ottobock, Sunrise Medical, Invacare Corporation, GF Health Products, and Cochlear Limited.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Burden of Disability

- 4.2.2 Rising Number of Initiatives Pertaining to Disability

- 4.3 Market Restraints

- 4.3.1 High Cost of Devices

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value- USD million)

- 5.1 By Device Type

- 5.1.1 Vision Aids

- 5.1.2 Hearing Aids

- 5.1.3 Mobility Aids

- 5.1.4 Other Devices Type

- 5.2 By End User

- 5.2.1 Home Care Settings

- 5.2.2 Hospitals

- 5.2.3 Ambulatory Care Centers

- 5.2.4 Rehabilitation Centers

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle-East and Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle-East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Cochlear Limited

- 6.1.2 MED-EL Medical Electronics.

- 6.1.3 GF Health Products

- 6.1.4 Ottobock

- 6.1.5 Invacare Corporation

- 6.1.6 Sunrise Medical

- 6.1.7 Ottobock

- 6.1.8 Demant A/S

- 6.1.9 Pride Mobility Products

- 6.1.10 Merits Health Products Co., Ltd.

- 6.1.11 Meyra Group

- 6.1.12 Sivantos, Inc. (Signia)

- 6.1.13 ReSound