|

시장보고서

상품코드

1440435

카복시메틸셀룰로오스(CMC) : 시장 점유율 분석, 업계 동향과 통계, 성장 예측(2024-2029년)Carboxymethyl Cellulose (CMC) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

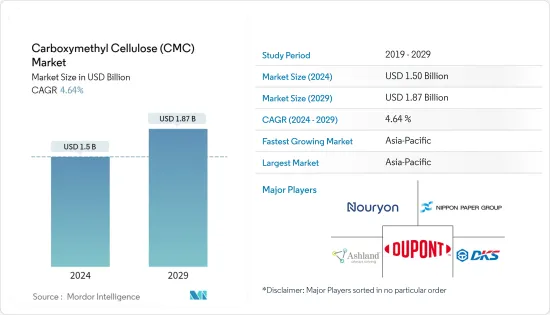

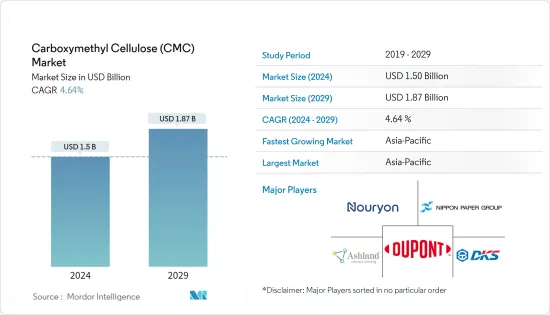

카복시메틸셀룰로오스(CMC) 시장 규모는 2024년에 15억 달러로 추정되며, 2029년까지 18억 7,000만 달러에 달할 것으로 예측되고 있으며, 예측 기간(2024-2029년) 중 4.64%의 CAGR로 성장합니다.

신종 코로나바이러스 감염증(COVID-19) 팬데믹은 카복시메틸셀룰로오스(CMC) 부문에 타격을 입혔습니다. 전 세계 봉쇄와 각국 정부의 엄격한 규제로 인해 대부분의 생산 기지가 폐쇄되어 치명적인 타격을 입었습니다. 그럼에도 불구하고 2021년이후 사업이 회복되고 있으며 향후 수년간 크게 증가할 것으로 예상됩니다.

주요 하이라이트

- 가공된 간편식 채택 증가와 석유 시추 활동의 급증은 조사 대상 시장의 성장을 가속하는 몇 가지 요인입니다.

- 반대로, 대체품의 가용성은 조사 대상 시장의 성장을 저해할 것으로 예상됩니다.

- 그럼에도 불구하고, 제약 부문의 상당한 성장은 예측 기간 중 유리한 성장 기회를 창출할 수 있습니다.

- 아시아태평양은 시장을 장악할 것으로 예상되며 예측 기간 중 가장 높은 CAGR을 보일 것으로 예상됩니다.

카복시메틸셀룰로오스(CMC) 시장 동향

음료 및 식품 분야에서의 활용 확대

- 음료 및 식품 용도는 2022년 카르복시 메틸 셀룰로오스(CMC) 시장에서 큰 매출 점유율을 차지했으며, CMC는 유제품, 음료, 드레싱 및 조미료, 아이스크림의 점도 조절제/ 증점제, 안정제 및 유화제로 널리 사용됩니다. CMC는 얼음의 결정 크기 성장을 제어하여 아이스크림에 부드럽고 크림 같은 질감을 부여하고 아이스크림을 안정화시킵니다. 그 안정화 특성은 유제품에도 활용되어 카제인과 수용성 복합체를 형성하여 우유의 산성화로 인한 침전을 방지합니다. 또한 CMC는 우수한 결합 특성과 점도 조절 특성으로 인해 베이커리 제품에서 글루텐을 대체할 수 있습니다.

- 선진국에서 가공식품의 대량 소비와 현 세대의 식습관 변화로 인해 식품 및 음료 분야에서 CMC에 대한 수요가 증가하고 있으며, 이는 편리한 식품에 대한 현 세대의 빠른 적응을 자극하고 있습니다. 또한 좋은 식습관에 대한 인식이 높아지고 건강에 대한 인식이 높아지면서 글루텐 프리 식품이 시장의 주류로 자리 잡았습니다.

- 인구가 계속 증가함에 따라 식품 및 음료 부문은 증가하는 식량 수요를 충족시키기 위해 확대되고 있으며, 이는 대상 산업의 성장을 가속하는 중요한 요소 중 하나가되었습니다. 예를 들어 미국 인구조사국에 따르면 2022년 미국 식품 및 음료 소매점의 연간 매출액은 약 9,470억 달러로 2021년 대비 7.6% 증가할 것으로 예상했습니다.

- 또한 StatCan에 따르면 2022년 6월 캐나다 식품 및 음료 매장 소매 매출은 약 12.1억 캐나다 달러(9.3억 달러)로 2022년 1월에 비해 1% 증가했다고 합니다.

- 세계 음료 및 식품 산업에 종사하는 기업은 시장에서의 입지를 강화하기 위해 몇 가지 비즈니스 전략을 채택하고 있습니다. 2023년 1월, 미국의 다국적 식품회사 펩시콜라는 하이데라바드에서 사업을 확장하고 향후 1년 반 내에 1,200명의 직원을 추가할 계획이라고 발표했습니다.

- 따라서 위의 요인을 고려할 때 CMC 수요는 곧 음료 및 식품 용도에서 크게 증가할 것으로 예상됩니다.

아시아태평양이 시장을 독점

- 아시아태평양은 2022년 세계 카복시메틸셀룰로오스 시장을 장악하고 매출에서 큰 시장 점유율을 차지했습니다. 예측 기간 중에도 그 우위를 유지할 것으로 예상됩니다.

- 식품 및 음료, 화장품, 의약품 분야에서 CMC에 대한 수요 증가는 아시아태평양 대상 산업의 성장을 가속하는 주요 요인입니다. 중국, 인도 등의 국가에서 가처분 소득 증가로 인한 다국적 요리 및 퍼스널케어 제품에 대한 지출 증가가 시장 성장을 가속하고 있습니다.

- 중국의 도시화, 가처분 소득 증가, 소셜미디어의 영향으로 미용 및 퍼스널케어 시장에서 고품질 프리미엄 브랜드 제품에 대한 수요가 급증하고 있습니다. 예를 들어 중국 국가통계국에 따르면 2022년 1월 중국 화장품 소매업 수입은 약 91억 8,000만 달러에 달했습니다. 2023년 1월에는 약 97억 6,000만 달러에 달했습니다. 중국 2, 3선 도시의 화장품 수요가 더욱 확대되면서 CMC 시장은 조만간 성장 모멘텀을 유지할 것으로 예상됩니다.

- 또한 인도 브랜드 주식 재단에 따르면 인도 국내 의약품 시장은 2021년에 420억 달러, 2024년까지 650억 달러, 2030년까지 1,200억-1,300억 달러로 확대될 것으로 예상된다고 합니다.

- 또한 인도는 세계 제약 분야에서 중요한 신흥 국가입니다. 예를 들어 IBEF에 따르면 인도는 세계에서 12번째로 큰 의약품 수출국입니다. 인도의 의약품은 200여 개국에 수출되고 있으며, 미국이 주요 시장입니다. 제네릭 의약품은 전 세계 수출량의 20%를 차지하며 세계 최대 제네릭 의약품 공급국이 되었습니다. 인도의 의약품 및 의약품 수출액은 '22년 246억 달러, '21년 244억 4,000만 달러에 달했습니다. 따라서 인도의 의약품 수출 증가는 카복시메틸셀룰로오스(CMC) 시장에 상승 재료가 될 것으로 예상됩니다.

- 또한 로레알- 유니버설 등록 문서 2022에 따르면 2022년 아시아태평양이 세계 화장품 시장의 42% 이상을 차지할 것으로 예상되며, 카복시메틸셀룰로오스(CMC) 시장이 확대될 것으로 예상됩니다.

- 위의 모든 요인은 예측 기간 중 아시아태평양의 카르복시 메틸 셀룰로오스(CMC) 시장의 성장을 가속할 수 있습니다.

카복시메틸셀룰로오스(CMC) 산업 개요

카복시메틸셀룰로오스(CMC) 시장은 본질적으로 세분화되어 있습니다. 이 시장의 주요 기업으로는 DuPont, Nouryon, Ashland, Nippon Paper, DKS 등이 있습니다.

기타 혜택

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 촉진요인

- 가공식품 및 편리한 식품의 채택이 증가

- 석유 시추 활동의 급증

- 기타 촉진요인

- 억제요인

- 시장에서 대체품의 가용성

- 기타 억제요인

- 업계의 밸류체인 분석

- Porter's Five Forces 분석

- 공급 기업의 교섭력

- 구매자의 교섭력

- 신규 진출업체의 위협

- 대체품 및 서비스의 위협

- 경쟁의 정도

제5장 시장 세분화(금액 기반 시장 규모)

- 용도

- 식품 및 음료

- 석유 및 가스

- 화장품·의약품

- 세제

- 종이 가공

- 기타 용도(광업, 페인트 및 코팅, 건설, 섬유 가공, 접착제, 세라믹)

- 지역

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 기타 아시아태평양

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 이탈리아

- 프랑스

- 기타 유럽

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카공화국

- 기타 중동 및 아프리카

- 아시아태평양

제6장 경쟁 구도

- 합병과 인수, 합병사업, 협업 및 계약

- 시장 점유율 분석(%)**/순위 분석

- 유력 기업이 채택한 전략

- 기업 개요

- Amtex Chemicals, LLC

- Ashland

- Chongqing Lihong Fine Chemicals Co.,Ltd

- Daicel Corporation

- DKS Co. Ltd.

- DuPont

- Foodchem International Corporation

- Jining Fortune Biotech Co.,Ltd.

- Lamberti SpA

- MIKEM

- Mikro Technik GmbH

- NIPPON PAPER INDUSTRIES CO., LTD.

- Nouryon

- USK Rheology Solutions

- Zibo Hailan Chemical Co., Ltd.

제7장 시장 기회와 향후 동향

- 제약 부문의 대폭적인 성장

- 기타 기회

The Carboxymethyl Cellulose Market size is estimated at USD 1.5 billion in 2024, and is expected to reach USD 1.87 billion by 2029, growing at a CAGR of 4.64% during the forecast period (2024-2029).

The COVID-19 pandemic harmed the carboxymethyl cellulose (CMC) sector. Global lockdowns and severe rules enforced by governments resulted in a catastrophic setback as most production hubs were shut down. Nonetheless, the business is recovering since 2021 and is expected to rise significantly in the coming years.

Key Highlights

- Increasing adoption of processed and convenient food and a surge in oil drilling activities are some factors driving the studied market's growth.

- Conversely, the availability of substitutes is expected to hinder the studied market's growth.

- Nevertheless, significant growth in the pharmaceutical sector is likely to create lucrative growth opportunities over the forecast period.

- The Asia-Pacific region is expected to dominate the market and will likely witness the highest CAGR during the forecast period.

Carboxymethyl Cellulose Market Trends

Growing Applications in the Food and Beverages Sector

- The food and beverages application segment accounted for a significant revenue share in the carboxymethyl cellulose (CMC) market in 2022. CMC is popularly used as a viscosity modifier/thickener, stabilizer, and emulsifier in milk products, drinks, dressings and seasonings, ice creams, frozen desserts, etc. CMC stabilizes ice creams by imparting a smooth and creamy texture by regulating ice crystal size growth. Its stabilizing property is also utilized in milk products where it forms soluble complexes with casein, thus preventing its precipitation upon the acidification of milk. Also, due to its excellent binding and viscosity-modifying properties, CMC is an alternative to gluten in bakery items.

- The large consumption of processed food in developed countries and the changing food habits stimulating fast adaptability to convenient food among the working generation boosted the demand for CMC in food and beverage applications. Furthermore, the growing awareness of good food habits and rising health consciousness made way for gluten-free foods in the market.

- As the population continues to grow, meeting the increasing demand for food is augmenting the food and beverages sector, which is one of the key factors driving the growth of the target industry. For instance, according to US Census Bureau, in 2022, annual sales of retail food and beverage stores in the United States amounted to approximately USD 947 billion, which showed an increase of 7.6% compared to 2021.

- Moreover, according to StatCan, retail sales of food and beverage stores in Canada amounted to approximately CAD 12.1 billion (USD 9.30 billion) in June 2022, which showed an increase of 1% compared to January 2022.

- The companies involved in the global food and beverages industry are adopting several business strategies to strengthen their position in the market. In January 2023, American multinational food company PepsiCo announced that it is planning to expand its operation in Hyderabad and add 1,200 employees within the next one and a half years.

- Therefore, considering the factors above, the demand for CMC will rise significantly in the food and beverages application segment shortly.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific dominated the global carboxymethyl cellulose market in 2022, with a significant market share in revenue. It is projected to maintain its dominance during the forecast period.

- Growing demand for CMC in food and beverage, cosmetics, and pharmaceutical applications is the primary factor driving the growth of the Asian-Pacific region's target industry. The increasing expenditure on multicuisine foods and personal care products due to the growing disposable income in countries like China and India fuels market growth.

- Due to urbanization, growing disposable income, and social media influence in China, the beauty and personal care market is experiencing a burgeoning demand for higher quality, premium brand products. For instance, according to the National Bureau of Statistics of China, in January 2022, the retail trade revenue of cosmetics in China amounted to about USD 9.18 billion. It reached about USD 9.76 billion in January 2023. As the demand for cosmetic products expands further in second-and third-tier cities of China, the CMC market is expected to maintain its growth momentum shortly.

- Moreover, according to the India Brand Equity Foundation, India's domestic pharmaceutical market stood at USD 42 billion in 2021 and is likely to reach USD 65 billion by 2024 and further expand to USD 120-130 billion by 2030.

- Moreover, India is a significant and rising country in the global pharmaceuticals sector. For instance, according to IBEF, India is the 12th largest exporter of medical goods globally. Indian drugs are exported to more than 200 countries, with the United States being the key market. Generic drugs account for 20% of the global export volume, making the country the largest provider of generic medicines globally. Indian drug and pharmaceutical exports stood at USD 24.60 billion in FY22 and USD 24.44 billion in FY21. Therefore, increasing the export of pharmaceutical products from the country is expected to create an upside for the carboxymethyl cellulose (CMC) market.

- Furthermore, according to L'Oreal - Universal Registration Document 2022, the Asia-Pacific accounts for over 42% of the global cosmetics market in 2022, which is expected to boost the carboxymethyl cellulose (CMC) market.

- All factors above are likely to fuel the growth of the Asia-Pacific carboxymethyl cellulose (CMC) market over the forecast time frame.

Carboxymethyl Cellulose Industry Overview

The Carboxymethyl Cellulose (CMC) Market is fragmented in nature. The major players in this market (not in a particular order) include DuPont, Nouryon, Ashland, NIPPON PAPER INDUSTRIES CO., LTD., and DKS Co. Ltd., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Adoption of Processed and Convenient Food

- 4.1.2 Surge in Oil Drilling Activities

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Availability of Substitutes in the Market

- 4.2.2 Other Restraints

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Application

- 5.1.1 Food and Beverages

- 5.1.2 Oil and Gas

- 5.1.3 Cosmetics and Pharmaceuticals

- 5.1.4 Detergents

- 5.1.5 Paper Processing

- 5.1.6 Other Applications (Mining, Paints and Coatings, Construction, Textile Processing, Adhesives, Ceramics)

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 Italy

- 5.2.3.4 France

- 5.2.3.5 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 South Africa

- 5.2.5.3 Rest of Middle-East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Amtex Chemicals, LLC

- 6.4.2 Ashland

- 6.4.3 Chongqing Lihong Fine Chemicals Co.,Ltd

- 6.4.4 Daicel Corporation

- 6.4.5 DKS Co. Ltd.

- 6.4.6 DuPont

- 6.4.7 Foodchem International Corporation

- 6.4.8 Jining Fortune Biotech Co.,Ltd.

- 6.4.9 Lamberti S.p.A.

- 6.4.10 MIKEM

- 6.4.11 Mikro Technik GmbH

- 6.4.12 NIPPON PAPER INDUSTRIES CO., LTD.

- 6.4.13 Nouryon

- 6.4.14 USK Rheology Solutions

- 6.4.15 Zibo Hailan Chemical Co., Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Significant Growth in the Pharmaceutical Sector

- 7.2 Other Opportunities