|

시장보고서

상품코드

1692537

시스템 온칩(SoC) : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)System On Chip (SoC) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

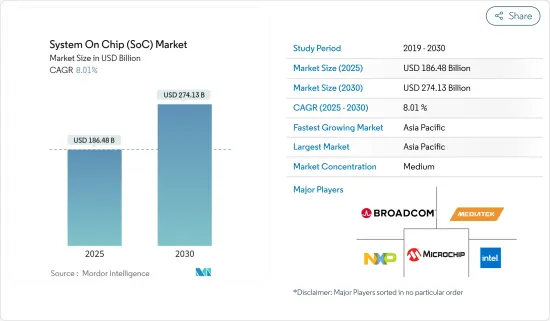

시스템 온칩(SoC) 시장 규모는 2025년에 1,864억 8,000만 달러로 추정되며, 예측 기간(2025-2030년)의 CAGR은 8.01%로, 2030년에는 2,741억 3,000만 달러에 달할 것으로 예측됩니다.

시스템 온 칩(SoC) 기술은 현대 기술의 필수 요소로 자리 잡으며 전자 기기의 설계 및 제조 방식을 혁신적으로 변화시켰습니다. 기본적으로 시스템 온 칩 또는 SoC는 CPU, 메모리, 입력 및 출력 포트, 보조 스토리지 등 컴퓨터의 모든 구성 요소를 단일 칩에 통합합니다.

주요 하이라이트

- 5G와 6G, 소프트웨어 탑재 차량, 비지상파 네트워크(NTN), 디지털 헬스케어 등 빠르게 진화하는 기술, 무한한 상상력, 산업 전반의 발명으로 인해 SoC가 소비자 시장에 빠르게 진입할 수 있는 길이 크게 열리고 있습니다. SoC는 작고 전력 효율이 높기 때문에 태블릿과 휴대폰과 같은 전자 기기에 오랫동안 통합되어 왔습니다.

- 오늘날 SoC는 사물 인터넷 디바이스 및 기타 디바이스에서 점점 더 많이 사용되고 있습니다. 소비자들의 스마트하고 전력 효율적인 기기에 대한 수요 증가와 다양한 산업 분야에서 IoT를 기하급수적으로 채택하는 것은 반도체 시장 기업들의 성장을 촉진하는 요인이 될 것으로 예상되며, 따라서 SoC 시장의 성장을 촉진할 것으로 보입니다.

- 전자 산업의 또 다른 중요한 트렌드는 사물 인터넷(IoT)의 증가입니다. 스마트 기기에 대한 수요가 증가함에 따라 IoT는 일상 생활의 필수적인 부분이 되었습니다.

- 기술이 계속 발전함에 따라 여러 산업에서 자동화 및 디지털화를 채택하고 있으며, 이에 따라 새로운 시장에 진입할 수 있는 새로운 기회를 제공하지만 시스템 온 칩(SoC)과 관련된 초기 연구 및 개발 비용이 많이 듭니다. 다양한 제품에 대한 SoC의 커스터마이징이 증가함에 따라 기업은 다양한 R&D 프로젝트에 동시에 집중해야 하므로 프로젝트 비용이 증가합니다.

- COVID-19가소비자 가전제품에 대한 수요가 증가하면서 소비자 소비 패턴이 바뀌었지만, 자동차 업계의 전기자동차로의 전환도 칩에 대한 필요성을 높이고 있습니다. 예를 들어, 일반적인 가솔린 엔진 자동차는 약 50-150개의 반도체 칩을 사용하지만 전기자동차는 최대 3,000개의 반도체 칩을 사용할 수 있습니다.

시스템 온칩 시장 동향

상당한 점유율을 차지할 소비자 가전 부문

- SoC의 통합은 효율성 향상, 에너지 사용량 감소, 소형화를 촉진하여 스마트폰에서 다양한 상호 연결된 장치에 이르는 수많은 소비자 가전용에 필수적인 요소로 자리 잡았습니다. 소비자 가전은 용도에 따라 SoC에 대한 수요가 크게 증가할 것으로 예상됩니다. 이는 주로 소비자의 가처분 소득 증가로 인해 스마트폰의 채택이 증가하고 있기 때문입니다

- 프리미엄 스마트폰, 지능형 스피커, 태블릿, 웨어러블 및 기타 디바이스와 같은 가전제품에는 엣지 AI 칩이 광범위하게 사용되고 있습니다. 이러한 칩은 네트워크 엣지에서 AI 알고리즘의 연산 능력과 효율성을 강화하여 보다 신속한 실시간 의사 결정이 가능하도록 특별히 제작되었습니다.

- 또한 인터넷과 스마트폰 사용자의 확대, 클라우드 컴퓨팅 및 IoT 지원 플랫폼의 광범위한 활용, 스마트 인프라에 무선 센서의 광범위한 배치가 시장 성장을 주도하고 있습니다. 시장에서 IoT 및 스마트 기기의 수가 계속 증가함에 따라 이러한 기기의 다양한 용도로 인해 SoC 칩에 대한 수요도 비슷한 속도로 증가할 것으로 예상됩니다.

- 여러 국가에서 소비자 가전 산업에 대한 투자가 증가함에 따라 시장 기회는 더욱 확대될 것으로 예상됩니다. 전 세계 여러 정부는 전자제품 제조 시설을 설립하고 생산 역량을 강화하기 위해 자국에 대한 신규 투자를 지속적으로 장려하고 있습니다. 모바일 보급률 증가, 인터넷 연결성 향상, 커넥티드 디바이스의 인기 증가는 가전제품의 성장을 견인할 것으로 예상됩니다.

- 에릭슨의 발표에 따르면 전 세계 스마트폰 모바일 네트워크 가입 건수는 2022년에 64억 건에 육박했으며 2028년에는 77억 건을 넘어설 것으로 예상됩니다. 중국, 인도, 미국이 가장 많은 스마트폰 모바일 네트워크 가입자를 보유한 국가로 부상하고 있다는 점은 주목할 만합니다. 에릭슨의 보고서는 2022년에 판매량이 정체기에 도달했지만 스마트폰의 평균 판매 가격이 상승하면서 향후 몇 년 동안 시장이 강화될 것으로 예상된다고 강조합니다.

아시아태평양이 시장을 독점할 전망

- 아시아태평양은 현재 세계 반도체 시장을 지배하고 있으며, 정부 정책의 지원을 받고 있기 때문에 연구 대상 시장을 지배할 것으로 예상됩니다.

- 모든 산업에서 기술적으로 진보된 디바이스에 대한 수요가 증가함에 따라 시장에서 SoC 디바이스에 대한 수요는 더욱 증가할 것으로 예상됩니다.

- 또한 중국 정부의 '중국 제조 2025' 이니셔티브는 전력 전자 제품 시장을 확대하는 데 도움이 되고 있습니다. 또한 업계에서는 이 지역의 전력 전자 제품에 대한 새로운 자금이 유입되고 있습니다. 예를 들어, 주요 와이드 밴드갭 화합물 반도체 제조업체인 IIVI Incorporated는 중국 내 SiC 웨이퍼 마감 제조 시설의 규모를 늘렸습니다.

- 이에 따라 이 회사는 차세대 5G 컴팩트 매크로, 베이스밴드 장치, 매시브 MIMO 라디오 등 5G 구축을 위한 차세대 제품에 전력을 공급하는 것을 목표로 하고 있습니다.

시스템 온칩 산업 개요

시스템 온 칩(SoC) 시장은 국내 및 글로벌 기업의 존재로 인해 반통합 상태입니다. 주요 업체들은 제품 출시, 계약, 인수 등 다양한 전략을 사용하여 시장에서의 입지를 넓히고 있습니다. 시장의 주요 업체는 Broadcom Inc., Intel Corporation, MediaTek Inc., Microchip Technology Inc. 및 NXP Semiconductors NV입니다.

- 2023년 9월, GlobalFoundries와 Microchip Technology는 Microchip의 자회사인 SST(Silicon Storage Technology)를 통해 SST ESF3 3세대 임베디드 SuperFlash 기술 NVM 솔루션을 발표했습니다. 28SLPe 파운드리 프로세스에서 생산이 가능합니다. GF의 고객은 이 솔루션이 제공하는 탁월한 성능, 탁월한 신뢰성, 폭넓은 IP 옵션, 비용 효율성에 만족하고 있다고 표명하고 있습니다.

- 2023년 5월, STM은 STM32 MCU와 BLE SoC용 안테나 매칭을 갖춘 싱글 칩 IC를 발표했습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 산업의 매력 - Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

- 산업 밸류체인 및 공급 체인 분석

- COVID-19의 부작용 및 기타 거시 경제 요인이 시장에 미치는 영향

제5장 시장 역학

- 시장 성장 촉진요인

- IoT 및 AI와 같은 신기술의 채택 증가

- 5G에 대한 투자 증가 및 5G 스마트 폰에 대한 수요 증가

- 시장 성장 억제요인

- 높은 연구개발 초기비용

제6장 시장 세분화

- 유형별

- 아날로그

- 디지털

- 혼합

- 최종 사용자 산업별

- 소비자 가전

- 통신

- 자동차

- 컴퓨팅 및 데이터 스토리지

- 산업용

- 기타

- 지역별

- 북미

- 유럽

- 아시아태평양

- 기타

제7장 경쟁 구도

- 기업 프로파일

- Broadcom Inc.

- Intel Corporation

- Mediatek Inc.

- Microchip Technology Inc.

- NXP Semiconductors NV

- Qualcomm Incorporated

- Samsung Electronics Co. Ltd

- STMicroelectronics NV

- Toshiba Corporation

- Apple Inc.

- Taiwan Semiconductor Manufacturing Company Limited(TSMC)

- Texas Instruments Incorporated

제8장 투자 분석

제9장 시장 기회와 앞으로의 동향

HBR 25.05.13The System On Chip Market size is estimated at USD 186.48 billion in 2025, and is expected to reach USD 274.13 billion by 2030, at a CAGR of 8.01% during the forecast period (2025-2030).

System-on-chip (SoC) technology has become an integral part of modern technology, revolutionizing the way electronic devices are designed and manufactured. Basically, a system-on-a-chip, or SoC, integrates all the components of a computer onto a single chip, including CPU, memory, input and output ports, and secondary storage.

Key Highlights

- Rapidly evolving technologies, including 5G and 6G, software-packed vehicles, non-terrestrial networks (NTN), and digital healthcare, endless imagination, and invention across industries have been significantly paving the way for SoC to enter the consumer market rapidly. SoCs have long been incorporated into electronic devices such as tablets and mobile phones because they are compact and power-efficient.

- Today, SoCs are increasingly being used in the Internet of Things devices and other devices. The rising demand for smart and power-efficient devices by consumers and exponential adoptions of IoT by various industry verticals are expected to be driving factors for the players in the semiconductor market, thus boosting the growth of the SoC market.

- Another important trend in the electronics industry is the increase of the Internet of Things (IoT). With the rise in demand for smart devices, IoT has become an essential part of everyday life. Thus, businesses are primarily using this technology to develop new products and services. SoCs will also play a pivotal role in the advancement of flexible electronics, enabling new form factors for wearable and implantable devices.

- As technology continues to evolve, several industries are adopting automation and digitization, thereby bringing new opportunities to the key players for entering new markets but with high initial research and development costs associated with the system on a chip (SoC). Owing to the increasing customization of SoC for various products, the players need to focus on various R&D projects simultaneously, increasing their project costs. Such factors are expected to hamper the market growth over the forecast period.

- While COVID-19 changed consumer spending patterns by increasing the demand for consumer electronics, the automotive industry's move toward electric vehicles is also boosting the need for chips. For instance, a typical gasoline engine car uses about 50 to 150 semiconductor chips, but an electric vehicle can use up to 3,000 semiconductor chips. The growing emphasis on electric vehicle manufacturing is certain to consume vastly more semiconductor chips in the future, thus driving the role of SoC in the global market.

System On Chip Market Trends

Consumer Electronics Segment to Occupy a Significant Share

- The incorporation of SoCs facilitates improved efficiency, decreased energy usage, and compactness, rendering SoCs essential for numerous consumer electronics applications ranging from smartphones to various interconnected devices. Consumer electronics is projected to witness a significant demand for SoCs based on their application. This is primarily attributed to the increasing adoption of smartphones due to the growing disposable incomes of consumers.

- Consumer electronics such as premium smartphones, intelligent speakers, tablets, wearables, and other devices extensively employ edge AI chips. These chips are specifically crafted to augment the computational capabilities and effectiveness of AI algorithms at the network's edge, enabling quicker and real-time decision-making capabilities. The rising demand for AI chip technology is anticipated to propel market expansion throughout the projected timeframe. Furthermore, the escalating adoption of AI technology and the proliferation of IoT-connected consumer devices are poised to amplify the growth of the market.

- Moreover, the market growth is primarily driven by the expanding presence of the internet and smartphone users, the widespread utilization of cloud computing and IoT-enabled platforms, and the extensive deployment of wireless sensors in smart infrastructure. As the market continues to witness a rise in the number of IoT and smart devices, the demand for SoC chips is also anticipated to grow at a comparable rate due to their diverse applications in these devices. As a result, several vendors in the market are constantly investing in introducing significant products catering to the rising demand for connectivity in consumer electronics.

- The increasing investments in the consumer electronics industry across several countries are expected to enhance the market opportunities. Several governments across the world are constantly encouraging new investments into the country to set up electronics manufacturing facilities and aiming to enhance their production capabilities. The increasing mobile penetration, increasing internet connectivity, and the growing popularity of connected devices are expected to drive the growth of consumer electronics. Such significant capabilities preferred in several consumer electronics devices such as Mobile devices, PCs, Tablets, Audio Devices, and others are expected to drive the market.

- As stated by Ericsson, the worldwide tally of smartphone mobile network subscriptions came close to 6.4 billion in 2022 and is estimated to exceed 7.7 billion by 2028. It is worth mentioning that China, India, and the United States emerge as the countries with the most significant number of smartphone mobile network subscriptions. Ericsson's report emphasizes that although the sales reached a plateau in 2022, the increasing average selling price of smartphones is expected to strengthen the market in the coming years. These remarkable developments are set to enhance the market's prospects.

Asia-Pacific Expected to Dominate the Market

- The Asia-Pacific region is anticipated to dominate the market studied because it currently dominates the global semiconductor market, which is further supported by government policies. According to SIA, China, Japan, Taiwan, and South Korea account for about 75% of the world's semiconductor production collectively, and other countries like Vietnam, Thailand, Malaysia, and Singapore also make significant contributions to the region's market dominance.

- With the increasing demand for technologically advanced devices in every industry, the demand for SoC devices in the market is expected to increase further. Furthermore, the increasing applications of a wide range of sensors in the automotive and smartphone market are expected to increase the demand for sensors further.

- Furthermore, the government's Made in China 2025 initiative is helping to expand the power electronics market. Additionally, the industry is bringing in fresh funding for power electronics in the area. For instance, a significant manufacturer of wide-bandgap compound semiconductors, IIVI Incorporated, increased the size of its SiC wafer finishing manufacturing facility in China.

- In line with this launch, the company aims to power its next-generation products for 5G build-out, including the next-generation 5G Compact Macro, baseband units, and Massive MIMO radios.

System On Chip Industry Overview

The system-on-chip (SoC) market is semi-consolidated due to the presence of domestic and global players. Major players use various strategies, such as product launches, agreements, and acquisitions, to increase their footprints in the market. The key players in the market are Broadcom Inc., Intel Corporation, MediaTek Inc., Microchip Technology Inc., and NXP Semiconductors NV.

- In September 2023, GlobalFoundries and Microchip Technology, through Microchip's subsidiary Silicon Storage Technology (SST), have recently unveiled the SST ESF3 third-generation embedded SuperFlash technology NVM solution. This cutting-edge solution is now available for production in the GF 28SLPe foundry process. Customers of GF have expressed their satisfaction with the remarkable performance, exceptional reliability, wide range of IP options, and cost efficiency offered by this solution. It has proven to be the perfect fit for advanced MCUs, intricate smart cards, and IoT chips used in both consumer and industrial applications.

- In May 2023, STM launched single-chip ICs with antenna matching for STM32 MCUs and BLE SoCs. STMicroelectronics revealed its latest line of single-chip antenna-matching ICs that facilitate innovation speed for Bluetooth LE System of Chips and two STM32 microcontrollers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain/Supply Chain Analysis

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Adoption of Emerging Technologies Like IoT and AI

- 5.1.2 Increasing Investments in 5G and Growing Demand for 5G Smartphones

- 5.2 Market Restraints

- 5.2.1 High Initial Costs of R&D

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Analog

- 6.1.2 Digital

- 6.1.3 Mixed

- 6.2 By End-user Industry

- 6.2.1 Consumer Electronics

- 6.2.2 Communications

- 6.2.3 Automotive

- 6.2.4 Computing and Data Storage

- 6.2.5 Industrial

- 6.2.6 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Broadcom Inc.

- 7.1.2 Intel Corporation

- 7.1.3 Mediatek Inc.

- 7.1.4 Microchip Technology Inc.

- 7.1.5 NXP Semiconductors NV

- 7.1.6 Qualcomm Incorporated

- 7.1.7 Samsung Electronics Co. Ltd

- 7.1.8 STMicroelectronics NV

- 7.1.9 Toshiba Corporation

- 7.1.10 Apple Inc.

- 7.1.11 Taiwan Semiconductor Manufacturing Company Limited (TSMC)

- 7.1.12 Texas Instruments Incorporated