|

시장보고서

상품코드

1441695

공정용 ISR : 시장 점유율 분석, 업계 동향과 통계, 성장 예측(2024-2029년)Airborne ISR - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

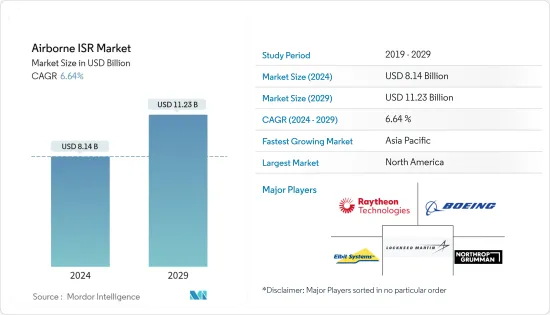

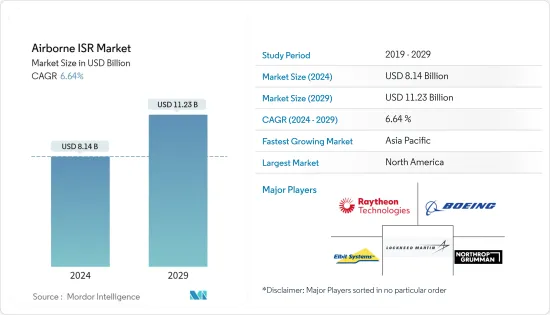

공정용 ISR 시장 규모는 2024년에 81억 4,000만 달러로 추정되며, 2029년까지 112억 3,000만 달러에 달할 것으로 예측되고 있으며, 예측 기간(2024-2029년) 중 6.64%의 CAGR로 성장합니다.

COVID-19 팬데믹과 그에 따른 봉쇄로 인해 여러 국가의 GDP가 급격하게 하락했습니다. 또한 전염병으로 인해 각국의 의료 시스템에 대한 대규모의 충동적인 지출이 필요했고, 이는 경제 자원 부족으로 이어졌습니다. 2020년 전 세계 군비 지출은 증가했지만, 이러한 요인으로 인해 각국은 향후 군 예산에 대해 보수적인 접근 방식을 취해야 하며, 이는 예측 기간 중 공정용 ISR 시장을 방해할 것으로 예상됩니다. COVID-19는 주요 ISR 프로그램공급망에 심각한 혼란을 일으켜 생산량을 감소시켰습니다. 공정용 ISR 산업에서 일부 개발 프로젝트의 지연도 관찰되었습니다. 이러한 요인들은 관련 시장 기업에게 부정적인 영향을 미치고 있습니다.

ISR의 사용량이 증가하고, 국경을 보호하기 위해 ISR 기술을 채택하는 국가가 증가함에 따라 공정용 ISR 시장은 성장할 것으로 예상됩니다. 급속한 기술 개발로 인해 방위 산업에서 파괴적인 기술들이 생겨나고 있습니다. 감시용 소형 무인 시스템의 사용이 증가함에 따라 ISR 임무에 사용되는 전자 부품에 대한 수요가 더욱 증가할 것으로 예상됩니다. 데이터의 정확성과 관리를 제공하기 위한 다단계 비교 분석과 첨단 데이터 통합은 공정용 ISR 시장에 새로운 시장 기회를 제공할 수 있습니다.

공정용 ISR 시장 동향

무인 부문은 예측 기간 중 가장 높은 성장률을 보일 전망

UAV는 ISR 임무의 진정한 툴로 부상하고 있으며, ISR 및 기타 임무를 위해 항공 자산을 조달하려는 국가들에게 저비용의 대안을 제공하기 때문에 전 세계에서 수요가 증가하고 있습니다. 새로운 기술과 플랫폼의 출현으로 미국, 러시아, 중국과 같은 국가의 전쟁 전략이 바뀌었습니다. UAV는 시각적으로 우수하고 특정 장소에서 선제공격과 감시를 수행할 수 있으므로 현재 전쟁 시나리오에서 널리 사용되고 있습니다. 각국이 비대칭 전쟁을 선호하는 경향이 있으므로 중요한 의사 결정 툴로 작용하는 중요한 정보를 수집하기 위해 무인 항공기가 대량으로 배치 될 것으로 예상됩니다. 따라서 일부 국가와 방산업체들은 항공기의 ISR 능력을 강화하기 위해 연구개발 투자를 크게 늘리고 있습니다. 예를 들어 2021년 11월 UAE 정부 소유의 EDGE 그룹은 최신 수직이착륙기 QX-5와 QX-6를 포함한 현지 개발 첨단 무인항공기(UAV) 제품 포트폴리오에 일련의 새로운 제품을 출시하였습니다.(VTOL) 드론은 정보, 감시, 정찰(ISR), 국경 보안 및 기타 군 작전을 위해 제작되었습니다. 따라서 전자전 채택이 증가함에 따라 UAV에 탑재된 우수한 ISR 장비에 대한 수요가 증가하여 공정용 ISR 시장의 무인 부문 성장을 가속할 것으로 예상됩니다.

2021년 북미가 시장을 독점

2021년 북미가 가장 큰 시장 점유율을 차지했습니다. 미국은 국방력 현대화에 관여하는 주요 투자자 중 하나입니다. 미국 정부와 미 국방부는 경쟁 환경에 침투하여 데이터를 수집 할 수있는 새로운 ISR 능력에 자금을 지원하기위한 자원을 제공하기 위해 여러 항공 플랫폼의 매각을 시작할 계획입니다. 공군은 ISR 임무를 수행하여 통합군 사령관에게 유리한 결정을 내리는 데 필요한 지식을 분석하고 정보를 제공하기 위해 ISR 임무를 수행하고 있습니다. 2021년 4월, 미국 요구사항 감시위원회는 항공기 제조 경쟁업체 두 곳이 개발한 설계를 검증하는 단축 능력 개발 문서(A-CDD)의 형태로 미래 공격정찰기 요구사항을 승인했습니다. 록히드마틴의 시콜스키와 벨은 시제품을 제작하고 2022년 11월부터 비행할 수 있도록 직접 경쟁에 참여하고 있습니다. 육군은 또한 수상 후 ARES(Airborne Reconnaissance Electronic Warfare System)라고 불리는 두 번째 기술 시범기를 가동할 준비를 하고 있습니다. 최근 수년간 미국에서는 다중 임무 해상 초계기에 대한 관심이 높아지고 있으며, 미국은 해상 감시 능력을 향상시키기 위해 해상 초계기 주문을 늘리고 있습니다. 이러한 발전은 예측 기간 중 이 지역 시장 성장을 가속할 것으로 예상됩니다.

공정용 ISR 산업 개요

공정용 ISR 시장은 매우 세분화되어 있으며, 여러 기업이 다양한 군를 위해 ISR 플랫폼과 하위 시스템을 개발하고 있습니다. Northrop Grumman Corporation, Boeing, Elbit Systems Ltd, Lockheed Martin Corporation, Raytheon Technologies Corporation은 이 시장의 유명한 업체 중 일부입니다. 그러나 일부 현지 기업은 지역 프로젝트에서 시장의 기존 기업과 협력하여 지역 최종사용자 방어력의 특정 요구 사항을 효과적으로 충족하는 소규모 하위 시스템을 설계하고 통합하고 있습니다. 공급업체는 자체 제조 능력, 세계 거점 네트워크, 제공하는 제품, R & D 투자 및 강력한 고객 기반을 기반으로 경쟁하고 있습니다. 치열한 경쟁 시장 환경에서 생존하고 성공하기 위해서는 항공기 탑재 ISR 통합업체에 최첨단 시스템을 제공해야 합니다. 많은 방산 OEM 업체들은 자사 공정용 ISR 플랫폼에 타사 EO/IR 장비를 통합하고 있으며, 다양한 플랫폼에서 이러한 시스템을 상호 통합하는 데 드는 연구개발비용을 최소화하기 위해 노력하고 있습니다.

기타 혜택

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

- USD 통화 환산율

제2장 조사 방법

제3장 주요 요약

- 시장 규모와 예측, 세계, 2018-2031년 의 시장 점유율, 2021년

- 용도별 시장 점유율, 2021년

- 지역별 시장 점유율, 2021년

- 시장의 구조와 주요 참여 기업

- 공정용 ISR 시장에 관한 전문가 의견

제4장 시장 역학

- 시장 개요

- 시장 촉진요인

- 시장 억제요인

- Porter's Five Forces 분석

- 구매자의 교섭력

- 공급 기업의 교섭력

- 신규 진출업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁의 강도

제5장 시장 세분화(금액별 시장 규모와 예측, 2018-2031년)

- 유형

- 유인

- 무인

- 용도

- 해상 패트롤

- 공정 지상 감시(AGS)

- 공중 조기 경보(AEW)

- 시그널 인텔리전스(SIGNIT)

- 지역

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 프랑스

- 독일

- 러시아

- 기타 유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 기타 아시아태평양

- 라틴아메리카

- 브라질

- 기타 라틴아메리카

- 중동 및 아프리카

- 사우디아라비아

- 아랍에미리트

- 기타 중동 및 아프리카

- 북미

제6장 경쟁 구도

- 벤더의 시장 점유율

- 기업 개요

- Lockheed Martin Corporation

- L3Harris Technologies Inc.

- BAE Systems PLC

- Raytheon Technologies Corporation

- Northrop Grumman Corporation

- The Boeing Company

- Saab AB

- Airbus SE

- General Dynamics Corporation

- Elbit Systems Ltd

- Teledyne FLIR LLC

- Textron Inc.

- Leonardo SpA

- Safran SA

- Israel Aerospace Industries(IAI)

- 기타 기업

- AeroVironment Inc.

- General Atomics

- BlueBird Aero Systems

- Aeronautics Group

제7장 시장 기회와 향후 동향

KSA 24.03.12The Airborne ISR Market size is estimated at USD 8.14 billion in 2024, and is expected to reach USD 11.23 billion by 2029, growing at a CAGR of 6.64% during the forecast period (2024-2029).

The COVID-19 pandemic and the resultant lockdowns resulted in a sudden dent in the GDPs of several countries. Also, the pandemic demanded huge and impulsive spending toward the healthcare systems in countries, leading to a scarcity of economic resources. Although the global military spending increased in 2020, this factor is expected to force countries to take a conservative approach toward their future military budgets, thereby hampering the airborne ISR market during the forecast period. The pandemic has resulted in severe disruptions in the supply chains of major ISR programs and has reduced production output. Delays in several developments projects in the airborne ISR industry have also been observed. These factors have negatively impacted players in the related market.

The airborne ISR market is expected to grow as ISR usage is increasing and more countries are adopting ISR technology for securing their borders. Rapid technological developments are breeding disruptive technologies in the defense industry. The increasing use of small unmanned systems for surveillance is further expected to generate demand for electronic components used in ISR missions. Advanced data integration with a multi-level comparative analysis to provide data accuracy and management may provide new market opportunities for the airborne ISR market.

Airborne ISR Market Trends

Unmanned Segment to Experience Highest Growth During the Forecast Period

UAVs have emerged as veritable tools for ISR missions and are, hence, in high demand globally as they provide low-cost alternatives to nations planning to procure aerial assets for ISR and other missions. The emergence of new technologies and platforms has transformed the warfare strategies of nations such as the US, Russia, and China. UAVs are being used extensively in current warfare scenarios due to their visual superiority and capability of performing pre-emptive strikes and surveillance on specific locations. With nations showing a preference for asymmetric warfare, it is expected that UAVs would be deployed in large numbers to collect crucial information that can act as a key decision-making tool. Hence, several nations and defense contractors are significantly increasing R&D investments to enhance their airborne ISR capabilities. For instance, in November 2021, UAE's government-owned EDGE Group launched a series of new additions to its product portfolio of locally developed advanced unmanned aerial vehicles (UAVs), including the QX-5 and QX-6 modern vertical take-off and landing (VTOL) drones that are built for intelligence, surveillance, and reconnaissance (ISR) applications, border security, and other military operations. Thus, the increasing adoption of electronic warfare is expected to drive the demand for superior ISR equipment aboard UAVs, thus, fueling the growth of the unmanned segment of the airborne ISR market.

North America Dominated the Market in 2021

North America held the largest market share by geography in 2021. The US is one of the leading investors involved in the modernization of its defense capabilities. The US government and US DoD are planning to begin divesting a few aerial platforms to provide resources to fund emerging ISR capabilities that can penetrate and collect data in the highly contested environment. The Air Force conducts ISR missions to analyze, inform, and provide joint force commanders with the knowledge needed to achieve advantageous decisions. In April 2021, the US Army's Requirements Oversight Council approved the requirements for its Future Attack Reconnaissance Aircraft in the form of an Abbreviated Capabilities Development Document (A-CDD) that validates the designs developed by the two companies competing to build the aircraft. Lockheed Martin's Sikorsky and Bell are in a head-to-head competition to build prototypes and fly them beginning in November 2022. The Army is also in the process of bringing online a second technology demonstrator called ARES or Airborne Reconnaissance and Electronic Warfare System after awarding a contract to L3Harris Technologies in November 2020. ARES is based on a Bombardier Global Express 6500 jet that will have a different signals intelligence package on it than Artemis. There has been significant interest in multi-mission maritime patrol aircraft in the US in recent years, which has led to the US placing more orders for maritime patrol aircraft in order to increase its maritime surveillance capabilities. Such developments are expected to drive market growth in the region during the forecast period.

Airborne ISR Industry Overview

The airborne ISR market is highly fragmented, with multiple players developing ISR platforms and subsystems for various armed forces. Northrop Grumman Corporation, Boeing, Elbit Systems Ltd, Lockheed Martin Corporation, and Raytheon Technologies Corporation are some of the prominent players in the market. However, several local players collaborate with the market incumbents on regional projects to design and integrate smaller subsystems that effectively serve the specific requirements of the regional end-user defense forces. Vendors are competing based on their in-house manufacturing capabilities, global footprint network, product offerings, R&D investments, and a strong client base. Vendors must provide state-of-the-art systems to airborne ISR integrators to survive and succeed in the intensely competitive market environment. A majority of the defense OEMs integrate third-party EO/IR equipment onboard their airborne ISR platforms and try to minimize R&D costs involved in the cross-integration of such systems onboard different platforms.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

- 1.3 Currency Conversion Rates for USD

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

- 3.1 Market Size and Forecast, Global, 2018 - 2031

- 3.2 Market Share by Type, 2021

- 3.3 Market Share by Application, 2021

- 3.4 Market Share by Geography, 2021

- 3.5 Structure of the Market and Key Participants

- 3.6 Expert Opinion on Airborne ISR Market

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Buyers/Consumers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size and Forecast by Value - USD billion, 2018 - 2031)

- 5.1 Type

- 5.1.1 Manned

- 5.1.2 Unmanned

- 5.2 Application

- 5.2.1 Maritime Patrol

- 5.2.2 Airborne Ground Surveillance (AGS)

- 5.2.3 Airborne Early Warnings (AEW)

- 5.2.4 Signals Intelligence (SIGNIT)

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 US

- 5.3.1.1.1 By Type

- 5.3.1.2 Canada

- 5.3.1.2.1 By Type

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.1.1 By Type

- 5.3.2.2 France

- 5.3.2.2.1 By Type

- 5.3.2.3 Gemany

- 5.3.2.3.1 By Type

- 5.3.2.4 Russia

- 5.3.2.4.1 By Type

- 5.3.2.5 Rest of Europe

- 5.3.2.5.1 By Type

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.1.1 By Type

- 5.3.3.2 India

- 5.3.3.2.1 By Type

- 5.3.3.3 Japan

- 5.3.3.3.1 By Type

- 5.3.3.4 South Korea

- 5.3.3.4.1 By Type

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.3.5.1 By Type

- 5.3.4 Latin America

- 5.3.4.1 Brazil

- 5.3.4.1.1 By Type

- 5.3.4.2 Rest of Latin America

- 5.3.4.2.1 By Type

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.1.1 By Type

- 5.3.5.2 United Arab Emirates

- 5.3.5.2.1 By Type

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.5.3.1 By Type

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Lockheed Martin Corporation

- 6.2.2 L3Harris Technologies Inc.

- 6.2.3 BAE Systems PLC

- 6.2.4 Raytheon Technologies Corporation

- 6.2.5 Northrop Grumman Corporation

- 6.2.6 The Boeing Company

- 6.2.7 Saab AB

- 6.2.8 Airbus SE

- 6.2.9 General Dynamics Corporation

- 6.2.10 Elbit Systems Ltd

- 6.2.11 Teledyne FLIR LLC

- 6.2.12 Textron Inc.

- 6.2.13 Leonardo SpA

- 6.2.14 Safran SA

- 6.2.15 Israel Aerospace Industries (IAI)

- 6.3 Other Companies

- 6.3.1 AeroVironment Inc.

- 6.3.2 General Atomics

- 6.3.3 BlueBird Aero Systems

- 6.3.4 Aeronautics Group