|

시장보고서

상품코드

1685876

에틸벤젠 - 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Ethylbenzene - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

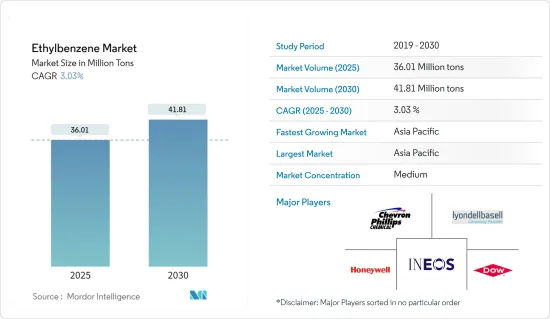

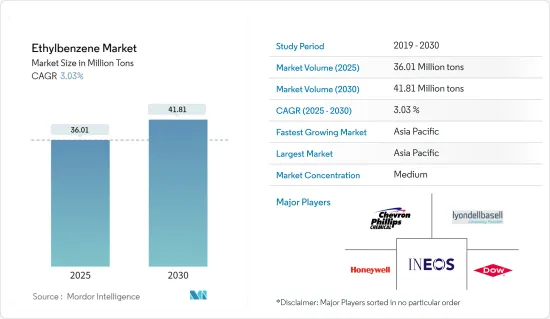

에틸벤젠 시장 규모는 2025년에 3,601만 톤, 2030년에는 4,181만 톤에 달할 것으로 예측됩니다. 예측기간(2025년-2030년) CAGR은 3.03%를 나타낼 전망입니다.

시장은 2020년에 COVID-19에 의해 부정적인 영향을 받았습니다. 그러나 2021-2022년 기간 동안 시장이 크게 회복되었고, 페인트 및 코팅용 용제 및 시약 등 에틸벤젠계 폴리머나 기타 제품 수요가 부활했습니다.

주요 하이라이트

- 다양한 최종 사용자 산업으로부터의 스티렌 수요 증가와 천연 가스 회수에 있어서의 에틸벤젠의 사용량 증가가 시장의 성장을 견인할 것으로 예상됩니다.

- 한편, 에틸벤젠의 사용에 관한 엄격한 규정이 시장의 성장을 둔화시킬 가능성이 높습니다.

- 도료나 코팅제, 접착제, 세정제 등 다양한 제품의 생산에 있어서의 용제나 시약으로서의 에틸벤젠의 용도는 시장에 새로운 성장 기회를 가져올 가능성이 높습니다.

- 아시아태평양이 세계 시장을 석권해, 중국이나 한국 등의 나라들이 최대의 소비국이 되고 있습니다.

에틸벤젠 시장 동향

스티렌 생산이 시장을 독점

- 스티렌 생산은 에틸벤젠 시장 수요에 긍정적인 영향을 미칠 것으로 보입니다. 스티렌은 아크릴로니트릴-부타디엔-스티렌, 폴리스티렌, 스티렌-부타디엔 엘라스토머와 라텍스, 스티렌-아크릴로니트릴 수지, 불포화 폴리에스테르 등 여러 산업용 중합체의 전구체입니다.

- 앞서 언급한 스티렌계 폴리머, 엘라스토머, 수지는 일렉트로닉스, 포장, 농업, 석유화학, 건축 등 다양한 최종 사용자 산업에서 광범위하게 쓰이고 있습니다. 폴리스티렌은 주로 일회용품, 포장 및 저가의 소비자 제품에 사용됩니다.

- 세계은행에 따르면 2021년 스티렌계 폴리머 수출 상위국은 네덜란드(6억 2,010만 910달러), 튀르키예(2억 9,183만 2,220달러), 벨기에(2억 4,861만 9,880달러), 그리스(2억 4,847만1,970달러)였습니다.

- OEC에 따르면 2022년 9월 중국의 스티렌계 폴리머 수출은 7,390만 달러였습니다. 2021년 9월부터 2022년 9월까지 중국의 스티렌계 폴리머 수출은 5,200만 달러에서 7,390만 달러로 2,190만 달러(42.1%) 증가했습니다.

- 세계은행에 따르면 미국의 스티렌계 폴리머(팽창성 폴리스티렌)의 1차 형태의 수출은 1억 9,868만 6,760달러, 수량은 97,729,500Kg이었습니다.

- 인도의 고리형 탄화수소 스티렌 수입량은 2021-22년도에 907.04킬로톤으로 인도내 수요 증가에 따라 소비량이 증가할 것으로 보입니다.

- 스티렌 수요는 고무 타이어 수요 증가에 따라 지속적으로 성장하고 있습니다. European Rubber Journal의 연차 세계 부문 조사에 따르면 중국의 주요 공급업체 매출은 2021년 전년 대비 30% 증가한 15억 6,100만 달러에 달했습니다. 내년은 더욱 증가할 것으로 예상됩니다.

- 따라서 앞서 언급한 요인은 향후 수년간 시장에 큰 영향을 줄 것으로 예상됩니다.

아시아태평양이 시장을 독점

- 아시아태평양이 세계 시장 점유율을 독점하고 있습니다. 중국, 인도, 일본 등의 나라에서는 건설업이나 포장업이 성장하여 도료나 코팅제, 염료, 향료, 잉크, 합성 고무 등의 용제나 시약으로서의 용도가 증가하고 있기 때문에 이 지역에서는 에틸벤젠의 사용량이 증가하고 있습니다.

- 에틸벤젠은 주로 스티렌 생산에 사용되며, 또한 가공되어 폴리스티렌이 되어 포장용 제품의 주원료가 됩니다. 인도에서 포장 자재의 수출은 2018-19년의 8억 4,400만 달러에서 2021-22년에는 11억 1,900만 달러로 증가했습니다.

- 공공 인프라, 재생 가능 에너지, 인프라, 상업 프로젝트에 대한 투자가 증가함에 따라 건설 부문은 향후 수년간 완만한 페이스로 성장을 기록할 것으로 예상되며, 이에 따라 소비자와 투자자의 신뢰가 함께 향상되고 나아가 예측 기간 중에 에틸벤젠 수요를 자극합니다.

- 중국국가통계국에 따르면 2021년 중국 건설기업의 부가가치액은 전년대비 2.1% 증가한 8조138억 위안(1조2,484억 2,000만 달러)이며, 이로써 건설산업으로부터의 페인트 및 코팅제와 에틸벤젠계 폴리머 수요가 높아져 나아가 연구시장 수요를 증대시켰습니다.

- 자동차용 경량 재료 수요는 전기자동차 부문으로부터 수요 증가에 따라 이 기간에 증가하고 있습니다.

- 2021년 중국에서 판매된 승용차는 2,148만 1,537대로 2020년 2,017만 7,731대에 비해 약 6% 증가했으며, 대시보드 등 자동차 부품 제조에 사용되는 원재료 수요 급증으로 이어져 조사 대상 시장 수요에 긍정적인 영향을 주었습니다.

- 인도의 승용차 시장은 2020-21년도의 243만 3,473대에 대해, 2021-22년도의 추정 판매 대수는 308만 2,279대와, 27%라는 경이적인 성장을 나타냈습니다.

- 전자정보기술산업협회(JEITA)에 따르면 디지털화의 진전이 수요를 끌어올려 수출이 확대되는 가운데 일본의 전자 및 IT기업의 2021년 세계 생산액은 전년대비 8% 증가한 37조 3,000억엔에 이르렀습니다.

- 따라서 앞서 언급한 요인은 향후 수년간 시장에 큰 영향을 줄 것으로 예상됩니다.

에틸벤젠 산업 개요

에틸 벤젠 시장은 그 특성상 부분적으로 단편화되어 있습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 성장 촉진요인

- 스티렌 수요 증가

- 천연가스 회수에 사용 증가

- 억제요인

- 에틸벤젠의 사용에 관한 엄격한 규제

- 기타 억제요인

- 산업 밸류체인 분석

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁도

- 기술 스냅샷

- 생산 공정

- 무역 분석

- 가격지수

- 규제 정책 분석

제5장 시장 세분화

- 용도

- 스티렌

- 아크릴로니트릴-부타디엔-스티렌

- 스티렌-아크릴로니트릴 수지

- 스티렌 부타디엔 엘라스토머와 라텍스

- 불포화 폴리에스테르 수지

- 가솔린

- 디에틸벤젠

- 천연가스

- 페인트

- 아스팔트와 나프타

- 스티렌

- 최종 사용자 산업

- 포장

- 일렉트로닉스

- 건설

- 농업

- 자동차

- 기타 최종 사용자 산업

- 지역

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 기타 아시아태평양

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 이탈리아

- 프랑스

- 러시아

- 기타 유럽

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카

- 기타 중동?아프리카

- 아시아태평양

제6장 경쟁 구도

- M&A, 합작사업, 제휴, 협정

- 시장 점유율(%)**, 랭킹 분석

- 주요 기업의 전략

- 기업 프로파일

- Carbon Holdings Limited(카이로)

- Changzhou Dohow Chemical Co. Ltd

- Chevron Phillips Chemical Company LLC

- Cos-Mar Company

- Dow

- Guangdong Wengjiang Chemical Reagent Co., Ltd.

- Honeywell International Inc

- INEOS

- J&K Scientific Ltd.

- LyondellBasell Industries Holdings BV

- LLC'Gazprom neftekhim Salavat'

- PJSC "Nizhnekamskneftekhim"

- ROSNEFT

- Shanghai Myrell Chemical Technology Co., Ltd.

- Sibur-Khimprom CJSC

- TCI Chemicals(India) Pvt. Ltd.

- Versalis SpA

- Westlake Chemical Corporation

제7장 시장 기회와 앞으로의 동향

- 용매나 시약으로서의 용도의 확대

The Ethylbenzene Market size is estimated at 36.01 million tons in 2025, and is expected to reach 41.81 million tons by 2030, at a CAGR of 3.03% during the forecast period (2025-2030).

The market was negatively impacted by COVID-19 in 2020. However, the market recovered significantly in the 2021-22 period, and the construction and automotive manufacturing activities have reinstated the demand for ethylbenzene-based polymer and other products, including automotive dashboards, exterior panels, styrene-acrylic emulsions, solvents and reagents for paints and coatings, and others. The pandemic had increased the demand for packaging from the food and e-commerce industries, thereby stimulating the demand for the market studied.

Key Highlights

- The increasing demand for styrene from various end-user industries and the increasing usage of ethylbenzene in the recovery of natural gas are expected to drive the market's growth.

- On the other hand, strict rules about using ethylbenzene are likely to slow the growth of the market that was studied.

- Ethylbenzene application as a solvent and reagent in the production of various products, such as paints and coatings, adhesives, and cleaning materials, will likely provide new growth opportunities for the market.

- Asia-Pacific dominated the market across the world, with the largest consumption coming from countries such as China and South Korea.

Ethylbenzene Market Trends

Styrene Production to Dominate the Market

- Styrene production will have a positive influence on ethylbenzene market demand. Styrene is a precursor to several industrial polymers, including acrylonitrile-butadiene-styrene, polystyrene, styrene-butadiene elastomers and latex, styrene-acrylonitrile resins, and unsaturated polyester.

- The aforementioned styrene-based polymers, elastomers, and resins find a wide range of applications in various end-user industries, such as electronics, packaging, agriculture, petrochemicals, and construction. Polystyrene is majorly used in disposables, packaging, and low-cost consumer products.

- According to World Bank, in 2021, the top exporters of styrene polymers were the Netherlands (USD 620,100.91 thousand), Turkey (USD 291,832.22 thousand), Belgium (USD 248,619.88 thousand), and Greece (USD 248,471.97 thousand).

- According to OEC, in September 2022 China's styrene polymers exports accounted for USD 73.9 million. Between September 2021 and September 2022 the exports of China's styrene polymers have increased by USD 21.9 million (42.1%) from USD 52 million to USD 73.9 million.

- According to the World Bank, United States exports of styrene polymers (expansible polystyrene) in primary forms was USD 198,686.76 thousand and a quantity of 97,729,500 Kg.

- The cyclic hydrocarbon styrene imports in India stood at 907.04 kilotons in FY2021-22, and the consumption is likely to increase as per the rising demand in the country.

- The demand for styrene is continuously growing due to an increased demand for rubber tires. According to the European Rubber Journal's annual global sector survey, sales among leading Chinese suppliers increased by 30% year-on-year in 2021 to reach USD 1,561 million. It is further expected to increase in the upcoming year

- Therefore, the aforementioned factors are expected to significantly impact the market in the coming years

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region dominated the global market share. With growing construction and packaging industries and increasing applications as solvents and reagents in paints and coatings, dyes, perfumes, inks, and synthetic rubber in countries such as China, India, and Japan, the usage of ethylbenzene has been increasing in the region.

- Ethylbenzene is mainly used for the production of styrene, which further gets processed to form polystyrene, a major raw material for packaging products. According to the India Brand Equity Foundation, India is emerging as a key exporter of packaging materials in the global market. The export of packaging materials from India grew to USD 1,119 million in 2021-22 from USD 844 million in 2018-19. This increase in the demand for packaging within the country is stimulating the demand for the market studied.

- With increasing investments in public infrastructure, renewable energy, infrastructure, and commercial projects, the construction sector is expected to record growth at a moderate pace over the next few years, thereby improving both consumer and investor confidence and, in turn, stimulating the demand for ethylbenzene over the forecast period.

- According to the National Bureau of Statistics of China, in 2021, the value added of construction enterprises in China was CNY 8,013.8 billion (USD 1,248.42 billion), up by 2.1 percent over the previous year, thereby enhancing the demand for paints and coatings and ethylbenzene-based polymers from the construction industry, which in turn stimulates the demand for the studied market.

- The demand for lightweight automotive materials has increased during this period, owing to the increased demand from the electric vehicle segment. Ethylbenzene-based polymers, including acrylonitrile-butadiene-styrene and others, are used for manufacturing various automotive exterior and interior parts, including dashboards, exterior panels, bumpers, and others.

- In 2021, around 2,14,81,537 passenger cars were sold in China compared to 2,01,77,731 passenger cars sold in 2020, witnessing an increase of about 6%, thus leading to a surge in the demand for raw materials used to produce automotive parts such as dashboards, among others, which in turn positively impacted the demand for the market studied.

- The Indian passenger vehicle market saw a staggering 27% growth, as the sales estimated for FY2021-22 are 30,82,279, compared to 24,33,473 in FY 2020-21.

- According to the Japan Electronics and Information Technology Industries Association (JEITA), with the advance of digitalization boosting demand and expanding exports, global production by Japanese electronics and IT companies grew by 8% year on year in 2021, reaching JPY 37,300 billion. This growth in the electronics segment will enhance the demand for the ethylbenzene market in the coming years.

- Therefore, the aforementioned factors are expected to have a significant impact on the market in the coming years.

Ethylbenzene Industry Overview

The ethylbenzene market is partially fragmented in nature. The major companies include LyondellBasell Industries Holdings B.V., INEOS, Honeywell International Inc, Chevron Phillips Chemical Company LLC, and Dow, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Styrene

- 4.1.2 Increasing Use in Recovery of Natural Gas

- 4.2 Restraints

- 4.2.1 Strict Regulations on the Use of Ethylbenzene

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Technological Snapshot

- 4.5.1 Production Process

- 4.6 Trade Analysis

- 4.7 Price Index

- 4.8 Regulatory Policy Analysis

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Application

- 5.1.1 Styrene

- 5.1.1.1 Acrylonitrile-Butadiene-Styrene

- 5.1.1.2 Styrene-Acrylonitrile Resins

- 5.1.1.3 Styrene-Butadiene Elastomers and Latex

- 5.1.1.4 Unsaturated Polyester Resins

- 5.1.2 Gasoline

- 5.1.3 Diethylbenzene

- 5.1.4 Natural Gas

- 5.1.5 Paint

- 5.1.6 Asphalt and Naphtha

- 5.1.1 Styrene

- 5.2 End-user Industry

- 5.2.1 Packaging

- 5.2.2 Electronics

- 5.2.3 Construction

- 5.2.4 Agriculture

- 5.2.5 Automotive

- 5.2.6 Other End-User Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Russia

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Carbon Holdings Limited (Cairo)

- 6.4.2 Changzhou Dohow Chemical Co. Ltd

- 6.4.3 Chevron Phillips Chemical Company LLC

- 6.4.4 Cos-Mar Company

- 6.4.5 Dow

- 6.4.6 Guangdong Wengjiang Chemical Reagent Co., Ltd.

- 6.4.7 Honeywell International Inc

- 6.4.8 INEOS

- 6.4.9 J&K Scientific Ltd.

- 6.4.10 LyondellBasell Industries Holdings B.V.

- 6.4.11 LLC 'Gazprom neftekhim Salavat'

- 6.4.12 PJSC "Nizhnekamskneftekhim"

- 6.4.13 ROSNEFT

- 6.4.14 Shanghai Myrell Chemical Technology Co., Ltd.

- 6.4.15 Sibur-Khimprom CJSC

- 6.4.16 TCI Chemicals (India) Pvt. Ltd.

- 6.4.17 Versalis S.p.A.

- 6.4.18 Westlake Chemical Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing use in applications as solvent and reagents