|

시장보고서

상품코드

1639368

실험실용 화학제품-시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Laboratory Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

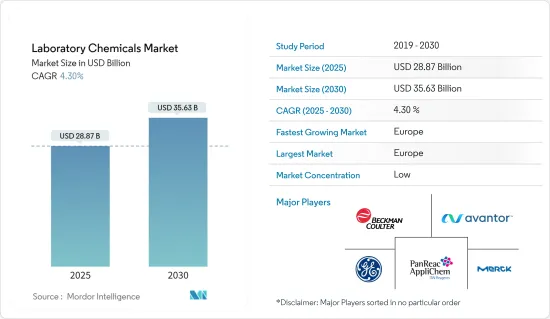

실험실용 화학제품 시장 규모는 2025년에 288억 7,000만 달러로 추정됩니다. 예측 기간(2025-2030년)의 CAGR은 4.3%로, 2030년에는 356억 3,000만 달러에 달할 것으로 예측됩니다.

COVID-19의 발생은 2020년 시장에 부정적인 영향을 미쳤습니다. 그러나 그 후 시장은 팬데믹 전의 수준에 이르고 있어 예측기간 중에는 안정된 성장이 예상됩니다.

주요 하이라이트

- 실험실용 화학제품 시장은 생물 및 화학 과학 분야에서 R&D 활동의 활성화와 폐수 처리에 있어서의 사용량 증가가 견인하고 있습니다.

- 그러나 실험실 약품의 대체품을 사용할 수 있다는 것은 시장 성장을 방해할 가능성이 높습니다.

- 세포 배양, 재조합 DNA, 바이오 치료 등의 기술의 진보나 나노 재료의 개발은 향후 시장의 선호가 될 것으로 예측됩니다.

- R&D 활동의 활성화로 인해 유럽이 시장을 독점할 것으로 예상됩니다.

실험실용 화학제품 시장 동향

더 높은 잠재적 성장을 확인하는 산업용

- 실험실 화학은 브롬화에서 수많은 저온 반응에 이르기까지 다양한 산업 공정에서 널리 사용됩니다.

- 가장 일반적인 실험실 화학 공정은 산 클로라이드 제조, 카르복실화, 이온 교환 반응, 니트로화, 스즈키 커플링, 윌리엄슨 에테르 합성 등을 포함합니다.

- 이들 화학물질은 재결정 및 증류 공정에서 다양한 시판품을 제조하는 데 필수적입니다.

- 농업 생산량 증가는 세계 시장에서 황산 수요를 밀어 올리고 있습니다. 2026년까지 칼로리의 가용량은 후발 개발도상국에서는 평균 2,450kcal에 이르며, 다른 개발도상국에서는 하루 3,000kcal을 초과할 것으로 예상됩니다. 이것은 세계 시장에서 농작물 수요를 증가시킬 것으로 예상되며, 따라서 농업 연구 수요를 증가시킬 수 있기 때문에 화학제조에 있어서의 실험실용 화학제품의 요구를 끌어올리게 됩니다.

- 현재 미국은 세계 최대의 의료기기 산업입니다. 미국 상무부 국제무역국(ITA)의 프로그램인 SelectUSA에 의하면, 동국의 의료기기 시장은 세계 최대의 의료기기 시장이며, 그 시장 규모는 1,560억 달러로, 2023년에는 2,080억 달러에 달 그렇다고 추정됩니다.

- 미국 CMS(Office of the Actuary)가 발표한 데이터에 따르면 의료 지출은 예측 기간 동안 크게 증가할 전망입니다.

- 노동·산업의 안전과 재해 방지는 마찬가지로 지속가능하고 환경에 위험이 적은 새로운 화학제품을 배합하기 위한 연구개발 부문에 대한 투자 증가로 이어지고 있습니다.

- 따라서 산업 부문 수요 증가는 실험실용 화학제품 수요를 증가시킬 것으로 예상됩니다.

유럽이 시장을 독점할 전망

- 이탈리아 산업은 수년간 크게 변화하여 국제 시장을 지향하고 경쟁을 강화해 왔습니다.

- 이탈리아는 세계 최대의 화학 시장을 가지고 있습니다. 이 나라의 화학제품 매출액은 유럽연합(EU) 내에서 3위를 차지하며, 지역 내 화학제품 매출액의 11% 이상을 차지하고 있습니다. 주요 화학제품 생산국인 동시에 이탈리아는 국제적인 주요 화학제품 수출국이기도 합니다.

- 이탈리아는 주로 미들 하이테크 부문(의약품, 기계, 화학 공업 등)에 중점을 두었습니다. 전통적인 분야에서도 이탈리아 산업은 강력한 기술 혁신에 주력하고 있으며, 이는 특허 출원 건수의 급증으로도 분명합니다.

- 이탈리아 제약산업은 최근 생산, 투자, 무역에서 현저한 성장을 이루고 있습니다. CDMO(개발업무 수탁기관)는 이탈리아 제약산업의 주요 구조이며, 생산단계를 제3자 시설에 위탁함으로써 기능하여 높은 생산성장을 가능하게 하고 있습니다.

- 독일 의약품 시장은 세계 주요 제약 회사에 의해 유망한 하위 부문으로 인식되고 있으며, 세계 시장에서의 지위를 강화하기 위해 독일로 진출하고 있습니다.

- 2022년 8월 세계 제약 기업인 Bayer는 독일 레버쿠젠에 2억 8,698만 달러를 투자하여 Solida-1 제약 시설 개발을 진행하고 있습니다. 2024년에 가동될 예정인 이 시설은 암과 심혈관 질환 치료의 생산을 전문으로 합니다.

- 아일랜드는 세계 의약품 생산량의 5% 이상을 차지하는 유력한 제약 거점입니다. 수년간의 아일랜드 제약 부문의 성장은 세계 최대의 제약 회사 9개 회사의 존재에 의해 두드러지며, 아일랜드가 세계적으로 팔고 있는 의약품 상위 10개 중 7개를 생산하고 있습니다. 게다가 지난 10년간 약 80억 달러가 새로운 시설 설립에 투자되었으며, 제약 부문은 그 혜택을 누리고 있습니다.

- 이탈리아에는 메나리니, 키에시, 안젤리니, 브래코, 레콜다티, 알파 시그마 등 주요 기업을 비롯하여 5,000개 이상의 제약 기업이 있습니다. 시장 수요의 완만하고 지속적인 상승에 대응해, 이들 기업은 지난 10년간 생산액의 지속적인 성장을 유지해 왔습니다.

- 이탈리아 제조업 부문은 세제 우대 조치를 뒷받침하며, 특히 인더스트리 4.0 기술과 관련된 다양한 생산 공장을 개조하기 시작했습니다.

- 이러한 개발은 예측 기간 동안 실험실용 화학제품에 대한 수요가 높아질 것으로 기대됩니다.

실험실용 화학제품 산업 개요

연구소용 화학 시장은 세계 진출 기업과 지역 기업이 존재하고 부분적으로 분할된 것으로 추정됩니다. 실험실 화학 시장에서 인정받는 주요 기업으로는 ITW Reagents Division, Merck KGaA, Beckman Coulter Inc., General Electric, Avantor Inc. 등이 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 성장 촉진요인

- 생물화학 부문에서 R&D 활동 확대

- 폐수 처리에 있어서 이용 증가

- 기타 촉진요인

- 억제요인

- 실험실용 화학제품의 대체품 이용가능성

- 기타 억제요인

- 산업 밸류체인 분석

- Porter's Five Forces 분석

- 공급기업의 협상력

- 소비자의 협상력

- 신규 진입업자의 위협

- 대체품의 위협

- 경쟁도

제5장 시장 세분화(가치별 시장 규모)

- 유형

- 분자 생물학

- 사이토카인 및 케모카인 검사

- 탄수화물 분석

- 면역화학

- 세포/조직 배양

- 환경 검사

- 생화학

- 기타

- 용도

- 공업용

- 학술/교육

- 정부기관

- 의료(제약)

- 지역

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 기타 아시아태평양

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 이탈리아

- 프랑스

- 스페인

- 기타 유럽

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카

- 기타 중동 및 아프리카

- 아시아태평양

제6장 경쟁 구도

- 인수합병, 합작사업, 제휴, 협정

- 시장 점유율(%)**/랭킹 분석

- 주요 기업의 전략

- 기업 프로파일

- Avantor Inc.

- BD BioScience

- Beckman Coulter Inc.

- BiosYnth SRL

- Carlo Erba Reagents SRL

- GE Healthcare

- ITW Reagents Division

- Merck KGaA

- Meridian Life Science Inc.

- Mitsubishi Rayon Co. Ltd

- Morphisto GmbH

- PerkinElmer Inc.

- R&D Systems

- Sigma-Aldrich Corp.

- UJIFILM Wako Chemicals

제7장 시장 기회와 앞으로의 동향

- 세포 배양, 재조합 DNA, 바이오 치료 등의 기술 진보

- 나노 재료 개발을 위한 연구 활동의 활성화

The Laboratory Chemicals Market size is estimated at USD 28.87 billion in 2025, and is expected to reach USD 35.63 billion by 2030, at a CAGR of 4.3% during the forecast period (2025-2030).

The COVID-19 outbreak negatively impacted the market in 2020. However, the market has since reached pre-pandemic levels and is expected to grow steadily during the forecast period.

Key Highlights

- The laboratory chemicals market is driven by growing R&D activities in the field of biological and chemical sciences and increasing usage in wastewater treatment.

- However, the availability of substitutes for laboratory chemicals is likely to hinder the market's growth.

- Advancements in technologies, such as cell culture, recombinant DNA, and biotherapeutics, and the development of nanomaterials are projected to act as an opportunity for the market in the future.

- Due to increasing research and development activities, Europe region is expected to dominate the market.

Laboratory Chemicals Market Trends

Industrial Application to Witness the Higher Potential Growth

- Laboratory chemicals are extensively used in various industrial processes, ranging from bromination to numerous cryogenic reactions.

- Some of the most common laboratory chemical processes include acid chloride preparations, carboxylation, ion-exchange reactions, nitration, Suzuki coupling, and Williamson's ether synthesis.

- These chemicals are essential to manufacture various commercial products in re-crystallization and distillation processes.

- Increasing agricultural output is boosting the demand for sulphuric acid in the global market. By 2026, calorie availability is projected to reach 2,450 kcal on average in least-developed countries and exceed 3,000 kcal per day in other developing countries. This is expected to increase the demand for crops in the global market, which, in turn, may increase the demand for agricultural research, thus, driving up the need for laboratory chemicals in chemical manufacturing.

- Currently, the United States is the largest medical device industry in the world. According to SelectUSA, a program by The International Trade Administration (ITA), US Department of Commerce, the medical devices market in the country is the largest medical devices market in the world, which is valued at USD 156 billion and is estimated to reach USD 208 billion by 2023.

- As per data published by the United States; CMS (Office of the Actuary), healthcare expenditure is expected to increase significantly during the forecast period.

- Occupational and industrial safety and disaster prevention have led to increasing investments in the R&D department to formulate new chemicals that are equally sustainable and less hazardous to the environment.

- Hence, growing demand from the industrial sector is expected to increase the demand for laboratory chemicals.

Europe Region is Expected to Dominate the Market

- The Italian industry has changed significantly over the years, orienting itself toward international markets and strengthening its competitiveness.

- Italy has one of the world's largest chemical marketplaces. The country has the third-largest chemical revenue in the European Union, accounting for above 11% of regional chemical sales. Aside from being a major chemical producer, Italy is also a major chemical exporter internationally.

- Its focus has been mainly on medium to high-technology sectors (such as pharmaceuticals, mechanics, and the chemical industry). Even in the traditional sectors, the Italian industry focused on strong innovation, as evidenced by the sharp increase in patent applications.

- The Italian pharmaceutical industry has grown considerably in production, investments, and trade over recent years. CDMO (Contract Development Manufacturing Organization) is the main structure of the Italian pharmaceutical industry, which functions by outsourcing production stages to third-party facilities, thereby enabling high production growth.

- The pharmaceutical market in Germany is identified as a top-prospect sub-sector by world-leading pharmaceutical manufacturing companies, which are expanding into the country to strengthen their position in the global market. For instance,

- In August 2022, the critical global pharmaceutical player, Bayer, is undergoing the development of the Solida-1 pharmaceutical production facility at its site in Leverkusen in, Germany, for an investment of USD 286.98 million. The facility, which is expected to come on stream in 2024, shall be dedicated to producing drugs for treating cancer and cardiovascular diseases.

- Ireland is a prominent pharmaceutical location contributing to more than 5% of global pharmaceutical production. The growth in Ireland's pharmaceutical sector over the years is marked by the presence of 9 of the world's largest pharmaceutical companies, enabling the country to produce 7 of the top 10 selling drugs globally. Further, the sector has benefitted from around USD 8 billion investment in setting up new facilities over the 10 years.

- Italy boasts over 5,000 pharmaceutical companies, with top players including Menarini, Chiesi, Angelini, Bracco, Recordati, and Alfasigma, among others. Responding to the gradual and continuous rise in market demand, these companies have maintained continued growth in production value through the last decade.

- The Italian manufacturing sector has started renovating various production plants, particularly concerning Industry 4.0 technologies, supported by tax incentives.

- All such developments are expected to boost the demand for laboratory chemicals during the forecast period.

Laboratory Chemicals Industry Overview

The laboratory chemicals market is estimated to be partially fragmented, with the presence of global and local players. Major recognized players in the laboratory chemicals market (not in any particular order) include ITW Reagents Division, Merck KGaA, Beckman Coulter Inc., General Electric, and Avantor Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing R&D Activities in the Field of Biological and Chemical Sciences

- 4.1.2 Increasing Usage in Wastewater Treatment

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Availability of Substitutes for Laboratory Chemicals

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Molecular Biology

- 5.1.2 Cytokine and Chemokine Testing

- 5.1.3 Carbohydrate Analysis

- 5.1.4 Immunochemistry

- 5.1.5 Cell/Tissue Culture

- 5.1.6 Environmental Testing

- 5.1.7 Biochemistry

- 5.1.8 Other Types

- 5.2 Application

- 5.2.1 Industrial

- 5.2.2 Academia/Educational

- 5.2.3 Government

- 5.2.4 Healthcare (Pharmaceutical)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Spain

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Avantor Inc.

- 6.4.2 BD BioScience

- 6.4.3 Beckman Coulter Inc.

- 6.4.4 BiosYnth SRL

- 6.4.5 Carlo Erba Reagents SRL

- 6.4.6 GE Healthcare

- 6.4.7 ITW Reagents Division

- 6.4.8 Merck KGaA

- 6.4.9 Meridian Life Science Inc.

- 6.4.10 Mitsubishi Rayon Co. Ltd

- 6.4.11 Morphisto GmbH

- 6.4.12 PerkinElmer Inc.

- 6.4.13 R&D Systems

- 6.4.14 Sigma-Aldrich Corp.

- 6.4.15 UJIFILM Wako Chemicals

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Advancement in Technologies, such as Cell Culture, Recombinant DNA, and Biotherapeutics

- 7.2 Increasing Research Activities for Development of Nanomaterials