|

시장보고서

상품코드

1685892

민간 항공우주 교육 및 시뮬레이션 시장 : 점유율 분석, 산업 동향, 성장 예측(2025-2030년)Civil Aerospace Training And Simulation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

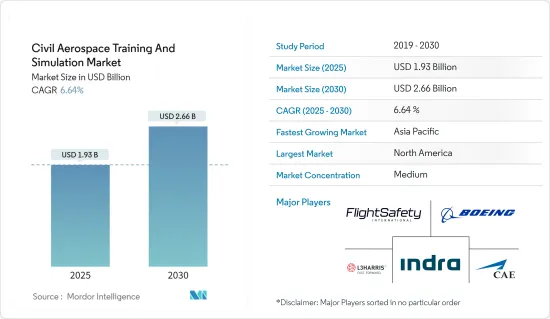

민간 항공우주 교육 및 시뮬레이션 시장 규모는 2025년에 19억 3,000만 달러, 2030년에는 26억 6,000만 달러에 달할 것으로 예측되고 있습니다. 예측기간(2025년-2030년) CAGR은 6.64%를 나타낼 전망입니다.

세계 항공사는 COVID-19 팬데믹이 출현하기 전에는 기체의 확대나 네트워크의 확장 계획을 적극적으로 추진하고 있었습니다. 항공사는 항공기 주문을 취소하거나 연기했으며, 팬데믹의 영향으로 인한 손실을 줄이기 위해 조종사를 일시적으로 해고했습니다. 2022년부터 회복되기 시작하여 COVID-19 이전 수준으로 돌아왔습니다. IATA, ICAO, 국제공항 평의회(ACI), 유엔 세계관광기관(UNWTO), 세계무역기구(WTO), 국제통화기금(IMF)의 최신 정보에 따르면, 2022년 국제항공 여객 수송량은 2021년에 비해 개선되고 있습니다.

항공 산업이 COVID-19 이전 수준으로 돌아가 민간 항공기의 보유수가 증가할 것으로 예상되므로 파일럿 수요도 증가할 것으로 예상됩니다. 그러나 일부 항공사는 조종사 부족으로 인해 여전히 3명의 조종사로 장거리 노선을 운항하고 있습니다.

민간 항공우주 교육 및 시뮬레이션 시장 동향

예측 기간 동안 전체 비행 시뮬레이터(FFS) 부문이 가장 높은 시장 점유율을 차지할 전망

풀플라이트 시뮬레이터(FFS) 부문이 시장을 독점하고 있으며, 앞으로도 이 경향이 계속될 것으로 예상됩니다., 항공우주산업과 항공산업 훈련생이 완전한 훈련체험을 받을 수 있습니다. CAE Inc.는 콴타스 그룹과 시드니에서 새로운 조종사 훈련 센터 개발 및 운영에 관한 15년 계약을 체결했다고 발표했습니다. CAE는 새로운 A320 풀 플라이트 시뮬레이터를 배치하고 콴타스 그룹으로부터 B787, A330, B737NG 풀 플라이트 시뮬레이터를 구입합니다.현재, 최신예의 FFS는 파일럿의 훈련 효율을 향상시키기 위해, 가상현실 등의 신기술과 통합되고 있습니다.

예를 들어, 2022년 4월, 멕시코 연방 민간 항공국은 아에로메히코의 두 번째 기회인 CAE 7000XR 보잉 737 MAX FFS에 인증을 받았습니다. 이 항공사는 여행 수요 증가와 보유기 증가에 따라 훈련 요건에 대응하기 위해 이 시뮬레이터를 취득했습니다. CAE의 사장은 MAX 풀 플라이트 시뮬레이터(FFS)를 배포할 목적으로 토론토 훈련 센터를 확장할 것이라고 발표했습니다.

이러한 개발은 예측기간 동안 FLR(Full Flight Simulator) 분야의 성장 궤도를 보완할 것으로 보입니다.

예측기간 동안 아시아태평양이 가장 높은 성장을 기록할 전망

아시아태평양의 여객 수송량 증가는 이 지역의 항공사와 항공기 운항사에 의한 새로운 항공기 조달을 촉진하고 있습니다. 회사는 예측 기간 동안 막대한 항공기 발주를 예정하고 있습니다. 보잉사에 따르면 아시아태평양에서는 향후 20년간 24만 4,000명 이상의 신규 파일럿 수요가 있으며, 중국에서만 12만 6,000명 수요가 있습니다.

이에 따라 중국에서는 민간항공비행훈련과 시뮬레이션에 관한 중요한 개발이 이루어지고 있습니다. MAX의 비행 시뮬레이터를 도입했다고 발표했습니다. 또한, 미국의 항공기 제조업체는 중국의 항공사의 운항을 보다 잘 지원하기 위해서, 상하이 푸동 국제 공항의 훈련 허브에 B737 MAX 비행 훈련 장치를 설치했습니다. Trainer(FNPT) 멀티 크루 코디네이션(MCC) 레벨 II 유형의 비행 시뮬레이터 훈련 장치(FSTD) 시뮬레이터 3대를 수주했습니다. II 시뮬레이터는 모두 2022년까지 CATC 플라야 그라지, HTC 하이데라바드, NIATAM 곤디아의 훈련 센터에서 사용 시작될 예정입니다. 2022년까지 완성 예정인 신우주 스테이션의 건설에 임하고 있어, 2030년까지 심우주 유인 우주 비행을 실시할 예정입니다.이러한 유인 우주 탐사 계획은 예측 기간 중에 우주 시뮬레이션과 훈련 솔루션 수요를 촉진할 것으로 예상됩니다.

민간 항공우주 교육 및 시뮬레이션 산업 개요

민간 항공우주 교육 및 시뮬레이션 시장은 부분적으로 통합되어 있습니다.

CAE Inc.는 세계의 프레즌스와 브랜드 이미지에 의해 민간 항공 시뮬레이터로 과반수의 점유율을 차지하고 있습니다.

마찬가지로 록히드 마틴과 보잉은 NASA의 유인 우주 탐사 프로그램을 지원하는 유명 기업입니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인

- 시장 성장 억제요인

- Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자·소비자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

제5장 시장 세분화

- 시뮬레이터 유형

- 풀 플라이트 시뮬레이터(FFS)

- 비행 훈련 장치(FTD)

- 기타 훈련 장치

- 용도

- 민간항공

- 우주

- 지역

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 기타 유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 기타 아시아태평양

- 라틴아메리카

- 브라질

- 기타 라틴아메리카

- 중동 및 아프리카

- 아랍에미리트(UAE)

- 사우디아라비아

- 튀르키예

- 기타 중동 및 아프리카

- 북미

제6장 경쟁 구도

- 벤더의 시장 점유율

- 기업 프로파일

- L3Harris Technologies, Inc.

- CAE Inc.

- The Boeing Company

- FlightSafety International Inc.

- Raytheon Technologies Corporation

- Indra Sistemas SA

- ALSIM EMEA

- ELITE Simulation Solutions AG

- Multi Pilot Simulations BV

- Lockheed Martin Corporation

제7장 시장 기회와 앞으로의 동향

- 파일럿 양성 분야에 있어서의 기술의 진보

The Civil Aerospace Training And Simulation Market size is estimated at USD 1.93 billion in 2025, and is expected to reach USD 2.66 billion by 2030, at a CAGR of 6.64% during the forecast period (2025-2030).

Airlines around the globe were aggressively pursuing fleet expansion and network expansion plans before the emergence of the COVID-19 pandemic. However, following the impact of the COVID-19 pandemic, the airlines have canceled and deferred aircraft orders as well as furloughed their pilots to mitigate the losses due to the impact felt by the pandemic. The aviation industry started recovering in 2022 and gradually returning to its pre-COVID-19 level. According to the latest updates from IATA, ICAO, the Airports Council International (ACI), the UN World Tourism Organization (UNWTO), the World Trade Organization (WTO), and the International Monetary Fund (IMF), the international air passenger traffic in 2022 has improved compared to that of 2021. With the recovery of the aviation industry in 2022, the orders and deliveries of commercial aircraft witnessed a gradual increase, which led to a simultaneous increase in demand for simulators and training devices.

As the aviation industry is expected to return to pre-COVID levels and the fleet of commercial aircraft is expected to increase, the demand for pilots is also expected to increase. Also, currently, many airlines are facing the issue of a pilot shortage, which is affecting their daily operations. Generally, flights longer than 12 hours require a team of four pilots. However, several airlines are still operating such long-haul routes with three pilots due to a shortage of pilots. The shortage of pilots is expected to drive demand for new simulation and training solutions.Also, the planned investments in human space exploration programs during the forecast period are anticipated to generate demand for simulators for astronauts and training solutions in the coming years.

Civil Aerospace Simulation and Training Market Trends

Full Flight Simulator (FFS) Segment Expected to Account for the Highest Market Share During the Forecast Period

The full flight simulator (FFS) segment dominated the market and is expected to continue in the coming years. The full flight simulator is generally equipped with a motion actuator that replicates flight movement, offering a real-life-like experience inside the simulator that will allow trainees in the aerospace and aviation industries to receive a complete training experience. With the lack of trained and experienced pilots, airlines and companies are working on pilot training programs, which increases the market for full-flight simulators. In August 2022, CAE Inc. announced that it had signed a 15-year contract with Qantas Group for the development and operation of a new pilot training center in Sydney. CAE will deploy a new A320 full-flight simulator and purchase B787, A330, and B737NG full-flight simulators from the Qantas Group. Currently, the new and advanced FFS is being integrated with new technologies, like virtual reality, to improve the efficiency of training pilots.

For instance, in April 2022, the Mexican Federal Civil Aviation Agency awarded certification to Aeromexico's second CAE 7000XR Boeing 737 MAX FFS. The airline acquired the simulator to cater to its training requirements as travel demand increased and its fleet grew. In May 2022, at the World Aviation Training Summit (WATS), CAE announced that it was expanding its Toronto Training Center for the purpose of deploying a CAE 7000XR Boeing 787 and a CAE 7000XR Boeing B737 MAX full-flight simulators (FFS). The president of CAE has said that this is to support Canadian airlines as international air travel is returning to normal levels after the COVID-19 pandemic.

Such developments in the market are likely to supplement the growth trajectory of the full flight simulator (FFS) segment over the forecast period.

Asia-Pacific is Anticipated to Register the Highest Growth During the Forecast Period

The increasing passenger traffic in the Asia-Pacific region is propelling the procurement of new aircraft by the airlines and aircraft operators in the region. Major airlines in the region, like China Eastern Airlines, China Southern Airlines, Air China, Indigo, Korean Air, and All Nippon Airways, have huge aircraft orders planned to be delivered during the forecast period. According to Boeing, there will be a demand for more than 244,000 new pilots in the Asia-Pacific region during the next two decades, with a demand for 126,000 pilots from China alone.

Accordingly, there have been significant developments concerning Civil Aviation Flight Training and Simulation in China. For instance, in April 2023, Boeing announced that they had brought its B737 MAX flight simulator to its Shanghai training center to fulfill the promise of improving pilot training for the aircraft in China after two fatal crashes in 2018 and 2019 led to it being grounded worldwide. Moreover, the United States plane maker has installed the B737 MAX Flight Training Device at its training hub at Shanghai Pudong International Airport to better support the operations of Chinese airlines. To increase the pilot training capacity in India, ALSIM was awarded a contract by the Airports Authority of India (AAI) in February 2021 to deliver three Flight Simulator Training Device (FSTD) simulators of EASA Flight Navigation and Procedure Trainer (FNPT) Multi Crew Coordination (MCC) level II types for single-aisle aircraft. All three FNPT II simulators are scheduled to enter service by 2022 at its training centers, namely, CATC Prayagraj, HTC Hyderabad, and NIATAM Gondia. Also, major countries in the region are accelerating their human space exploration programs. For instance, China is currently working to build its new space station, which is expected to be completed by 2022, and conducts deep-space human spaceflight by 2030. Such human space exploration plans are anticipated to propel the demand for space simulation and training solutions during the forecast period.

Civil Aerospace Simulation and Training Industry Overview

The civil aerospace training and simulation market is semi-consolidated. Some of the prominent players in the market for civil aerospace simulation and training are L3Harris Technologies Inc., The Boeing Company, CAE Inc., FlightSafety International, and Indra Sistemas S.A.

CAE Inc. has a majority share in commercial aviation simulators due to its global presence and brand image. In FY2021, the company delivered 36 full-flight simulators to its civil aviation customers, and in FY2022, the company delivered 30 FFS (a decrease of six simulators compared to the same period in FY2021).

Similarly, Lockheed Martin Corporation and The Boeing Company are some of the prominent companies that support NASA human space exploration programs. The increasing investments of the companies in developing new simulators with advanced features for training are anticipated to provide them with growth opportunities in the market in the coming years.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Simulator Type

- 5.1.1 Full Flight Simulator (FFS)

- 5.1.2 Flight Training Devices (FTD)

- 5.1.3 Other Training Devices

- 5.2 Application

- 5.2.1 Commercial Aviation

- 5.2.2 Space

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Latin America

- 5.3.4.1 Brazil

- 5.3.4.2 Rest of Latin America

- 5.3.5 Middle East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Turkey

- 5.3.5.4 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 L3Harris Technologies, Inc.

- 6.2.2 CAE Inc.

- 6.2.3 The Boeing Company

- 6.2.4 FlightSafety International Inc.

- 6.2.5 Raytheon Technologies Corporation

- 6.2.6 Indra Sistemas S.A.

- 6.2.7 ALSIM EMEA

- 6.2.8 ELITE Simulation Solutions AG

- 6.2.9 Multi Pilot Simulations BV

- 6.2.10 Lockheed Martin Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Advancements in the field of Pilot Training