|

시장보고서

상품코드

1443940

금속 마감재 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2024-2029년)Metal Finishing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

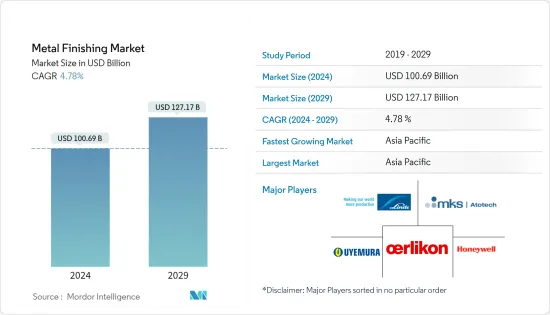

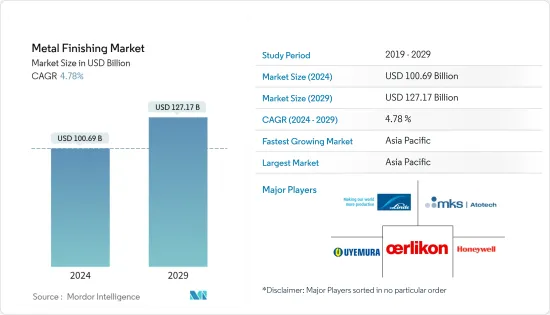

금속 마감재 시장 규모는 2024년 1,006억 9,000만 달러에 이를 것으로 추정됩니다. 2029년까지 1,271억 7,000만 달러에 달할 것으로 예상되며, 예측 기간(2024-2029년) 동안 4.78%의 연평균 복합 성장률(CAGR)을 나타낼 전망입니다.

코로나19 팬데믹은 시장에 악영향을 끼쳤습니다. 봉쇄 및 제한 조치로 인해 제조 시설과 공장이 중단되었기 때문입니다. 공급망과 운송의 혼란으로 인해 시장에 더 많은 장애가 발생했습니다. 그러나 2021년에는 업계가 회복세를 보이며 조사 대상 시장 수요가 회복세를 보였습니다.

주요 하이라이트

- 단기적으로는 내구성, 내마모성 및 오래 지속되는 금속 제품에 대한 수요 증가가 시장 성장을 가속하는 요인 중 일부입니다.

- 한편, 일부 금속 마감용 화학물질에 대한 환경 규제와 금속을 플라스틱으로 대체하는 사례가 증가하면서 시장 성장을 저해할 것으로 예상됩니다.

- 그러나 기존 솔벤트 기반 기술에서 새로운 기술로의 전환은 예측 기간 동안 시장 기회를 제공할 수 있습니다.

- 아시아태평양은 자동차, 건설, 전자, 하드웨어 등 최종 사용자 산업의 강력한 수요로 인해 세계 시장을 장악했습니다.

금속 마감재 시장 동향

자동차 부문이 시장을 독식합니다.

- 금속 마감 시장 수요는 자동차 산업이 독점했습니다. 금속 마감은 차량의 금속 부품에 보호 층을 만드는 데 사용되는 가장 일반적인 방법 중 하나입니다.

- 금속 마감은 엔진, 기타 후드 아래 부품, 파워 스티어링 시스템, 브레이크 부품 및 시스템, 공조 부품 및 시스템, 섀시 하드웨어, 공조 부품, 연료 시스템과 같은 차량 부품에 사용됩니다.

- 금속 마감에는 페인트와 세라믹 도장도 포함됩니다. 많은 크고 작은 자동차 부품은 접촉면이 매끄럽고 응력이 감소하고 버나 결함이 없어야 합니다. 이를 통해 자동차 엔진은 마찰과 열이 적은 표면을 구현하여 더 많은 마력을 생성하고 전반적인 성능을 향상시킬 수 있습니다.

- 미국은 세계 주요 자동차 산업 중 하나이며 전체 국내총생산(GDP)에 최소 3% 이상 기여하고 있습니다. 미국은 2022년에 승용차와 상용차를 포함한 자동차를 1,006만 대 가까이 생산할 것으로 예상되며, 이는 2021년에 비해 10% 증가한 수치입니다. 따라서 국내 자동차 생산 증가는 자동차에 대한 상향 수요를 창출할 것으로 예상됩니다. 금속 마감재 시장.

- 인도네시아에서는 자동차 배기가스, 자동차 안전, 자동차 운전 보조 시스템, 소매 및 전자상거래 분야에서 빠르게 성장하는 물류에 대한 규제 강화로 인해 소형 상용차에 대한 수요가 크게 증가하고 있습니다. 예를 들어, OICA에 따르면 2022년 국내 소형 상용차 생산량은 약 1,60,171대로 2021년 대비 1% 증가할 것으로 예상됩니다. 이로 인해 금속 마감재 시장에 대한 수요가 증가할 것으로 예상됩니다. 이 나라의 소형 상용차 시장.

- 또한 필리핀에서는 전자상거래를 통한 상품 수요 증가로 인해 물류에 소형 상용차 사용이 촉진되어 국내 소형 상용차 시장 성장의 길을 열어주고 있습니다. 많은 전자상거래 및 물류 기업이이 나라에서 성장하고 있으며, 이는 소형 상용차 시장의 성장을 더욱 촉진하고 있습니다. 예를 들어, 2022년 국내 소형 상용차 생산량은 50,560대에 달하고, 2021년 대비 68% 증가했습니다.

- 또한 말레이시아의 이동제한령 완화로 인해 많은 경제 부문이 국내 사업을 재개할 수 있게 됨에 따라 경기 체감도가 개선되어 상용차를 포함한 신차 생산에 기여했습니다. 사업을 운영하기 위해 필요합니다. 예를 들어, 2022년 말레이시아의 소형 상용차 생산량은 52,085대로 2021년 대비 48% 증가했습니다. 따라서 이는 말레이시아의 소형 상용차에서 금속 마감재에 대한 수요를 뒷받침할 것으로 예상됩니다.

- 금속 마감재 시장은 보다 기술적으로 발전된 자동차의 등장으로 장기적으로 성장할 가능성이 있습니다.

아시아태평양이 시장을 독점

- 아시아태평양에서는 자동차 산업 투자 및 생산 증가, 전기 및 전자 장비 생산 증가, 중장비 수요 급증 등이 금속 마감재 시장을 이끄는 주요 요인 중 일부입니다. 다국적 기업이 이 지역의 산업 부문을 주도하고 있습니다.

- 중국은 금속 마감재 시장에서 아시아태평양에서 가장 큰 시장 점유율을 차지하고 있습니다. 국내 투자 및 건설 활동 증가로 인해 금속 마감재 시장 수요는 예측 기간 동안 증가할 것으로 예상됩니다. 중국은 지난 몇 년동안 세계 인프라에 대한 주요 투자 국가 중 하나이며 상당한 기여를 하고 있습니다. 예를 들어, 중국 국가통계국(NBS)에 따르면 2022년 중국의 건설 공사 생산액은 27조 6,300억 위안(4조 1,085억 8,100만 달러)에 달하고, 2021년 대비 6.6% 증가할 것으로 예상했습니다.

- 또한 중국은 국내 승용차 생산에 기여하는 다른 요인들 중에서도 물류 및 공급망 개선, 기업 활동 증가, 국내의 풍부한 소비 촉진 조치로 인해 가장 큰 승용차 생산국 중 하나이기도 합니다. 예를 들어, OICA에 따르면 2022년 중국의 승용차 생산량은 23,836,083대로 2021년 대비 11% 증가할 것으로 예상됩니다. 따라서 국내 승용차 생산량이 증가함에 따라 금속 마감재 시장 수요는 상승세를 보이고 있습니다.

- 인도에서는 자동차 배기가스, 자동차 안전, 자동차 운전 보조 시스템, 소매 및 전자상거래 분야에서 빠르게 성장하는 물류에 대한 규제 강화로 인해 새로운 첨단 소형 상용차(LCV)에 대한 수요가 크게 증가하고 있습니다. 예를 들어, OICA에 따르면 2022년 인도의 소형 상용차 생산량은 2021년 대비 27% 증가한 61만 7,398대에 달할 것으로 예상되며, 2020년 대비 60% 회복된 것으로 나타났습니다.

- 또한 인도의 자동차 산업에 대한 투자 증가와 발전으로 인해 비금속 소비가 증가할 것으로 예상됩니다. 예를 들어, 타타자동차는 2022년 4월 향후 5년간 승용차 사업에 30억 8,000만 달러를 투자할 계획을 발표했습니다. 따라서 자동차 생산 및 자동차 산업에 대한 투자 증가로 인해 국내 자동차 및 운송 산업의 금속 마감재 시장에 대한 수요가 증가할 것으로 예상됩니다.

- 구리, 주석, 니켈, 알루미늄은 전자 산업에서 자주 사용되는 금속입니다. 아시아 지역은 세계 최대의 전기 및 전자기기 생산국이며 중국, 일본, 한국, 싱가포르, 말레이시아 등이 세계를 지배하고 있습니다.

- 일본 전자정보기술협회(JEITA)에 따르면 2022년 12월 일본 국내 가전제품 출하액은 1,252억 엔(9억 6,404만 달러)에 달했습니다. 한편, 3월은 2022년 가전제품 출하액이 약 1,255억 엔(9억 6,635만 달러)로 가장 높은 달이었으나, 5월은 864억 엔(6억 6,528만 달러)으로 가장 저조한 달로 나타났습니다. 따라서 이 나라에서 가전제품 출하량이 증가함에 따라 금속 마감재 시장 수요가 증가할 것으로 예상됩니다. 따라서 이 지역에 대한 이러한 긍정적인 추세와 투자로 인해 아시아태평양이 세계 시장을 장악할 것으로 예상됩니다.

금속 마감 산업 개요

금속 마감재 시장은 매우 세분화되어 있습니다. 이 시장의 주요 기업으로는 OC Oerlikon Management AG, MKS Atotech, Linde plc, C. Uyemura, Honeywell International Inc. 등이 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 업계 밸류체인 분석

- Porter의 Five Forces 분석

- 공급 기업의 교섭력

- 바이어의 교섭력

- 신규 진출업체의 위협

- 대체 제품 및 서비스의 위협

- 경쟁 정도

제5장 시장 세분화

- 유형

- 무기 금속 마무리

- 클래딩

- 사전 처리 및 표면 처리

- 소모품 및 예비품

- 전기도금

- 아연도금

- 무전해 도금

- 화성 피막

- 용사 분체 코팅

- 양극 산화 처리

- 전해 연마

- 유기 금속 마무리

- 하이브리드 금속 마무리

- 무기 금속 마무리

- 용도

- 자동차

- 가전제품

- 하드웨어

- 항공우주

- 중기

- 일렉트로닉스

- 건설

- 기타 용도

- 지역

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 기타 아시아태평양

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 기타 유럽

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카공화국

- 기타 중동 및 아프리카

- 아시아태평양

제6장 경쟁 구도

- 인수합병(M&A)/합작투자(JV)/협업/계약

- 시장 점유율(%)**/순위 분석

- 유력 기업이 채택한 전략

- 기업 개요

- AE Aubin Company

- ALMCOGROUP

- Auromex Co., Ltd.

- C. Uyemura Co., Ltd.

- DuPont

- Grind Master

- Guyson Corporation

- Honeywell International Inc.

- Linde plc

- MKS|Atotech

- OC Oerlikon Management AG

- OTEC Precision Finish, Inc.

- Plating Equipment Ltd

- POSCO

- Quaker Chemical Corporation

- sequa gGmbH

- TIB Chemicals AG

제7장 시장 기회와 향후 동향

LSH 24.03.13The Metal Finishing Market size is estimated at USD 100.69 billion in 2024, and is expected to reach USD 127.17 billion by 2029, growing at a CAGR of 4.78% during the forecast period (2024-2029).

.

The COVID-19 pandemic negatively impacted the market. This was because of the shutdown of the manufacturing facilities and plants due to the lockdown and restrictions. Supply chain and transportation disruptions further created hindrances for the market. However, the industry witnessed a recovery in 2021, thus rebounding the demand for the market studied.

Key Highlights

- Over the short term, the increasing demand for durable, wear-resistant, and long-lasting metal products are some of the factors driving the market's growth.

- On the other hand, the environmental restrictions on some metal finishing chemicals and increasing metal replacement with plastics are expected to hinder the market's growth.

- However, the shift from traditional solvent-borne technologies to newer technologies will likely provide market opportunities during the forecast period.

- Asia-Pacific dominated the global market, with robust demand from end-user industries such as automotive, construction, electronics, and hardware.

Metal Finishing Market Trends

Automotive Segment to Dominate the Market

- The automotive industry dominated the demand for the metal finishing market. Metal finishing is one of the most common methods used to provide a protective layer on the metal components of vehicles.

- Metal finishing is used in vehicle parts such as engines, other under-the-hood components, power steering systems, brake parts and systems, air conditioning components and systems, chassis hardware, climate control components, and fuel systems.

- Metal finishing also includes the application of paints or ceramics. Many small and large automobile parts require their contact surfaces to be smooth, stress-relieved, and without burrs or defects. This enables the automotive engines to achieve a surface with less friction and heat, generating more horsepower and overall better performance.

- The United States is one of the major automotive industries in the world, contributing at least 3% to the country's overall gross domestic product (GDP). The country produced close to 10.06 million units of automobiles, including passenger and commercial vehicles, in 2022, which showed an increase of 10% compared to 2021. Therefore, increasing the production of automobiles in the country is expected to create an upside demand for the metal finishing market.

- In Indonesia, the increasing regulations on vehicle emissions, vehicle safety advancement, driver-assist systems in vehicles, and rapidly growing logistics in the retail and e-commerce sectors have significantly driven the demand for light commercial vehicles. For instance, according to OICA, in 2022, around 1,60,171 units of light commercial vehicles were produced in the country, which showed an increase of 1% compared to 2021. This is expected to create an upside demand for the metal finishing market from the country's light commercial vehicle market.

- Moreover, in the Philippines, the increased demand for goods through e-commerce is pushing the use of light commercial vehicles in logistics, paving the way for light commercial vehicle market growth in the country. Many e-commerce and logistics companies are growing in the country, further boosting the light commercial vehicle market's growth. For instance, in 2022, light commercial vehicle production in the country amounted to 50,560 units, which shows an increase of 68% compared to 2021.

- Furthermore, due to the relaxation of movement control orders in Malaysia, many economic sectors were allowed to re-open businesses in the country, which helped to improve business confidence and contributed to the production of new vehicles, including commercial vehicles, which are much-needed for running businesses. For instance, in 2022, light commercial vehicle production in Malaysia amounted to 52,085 units, which shows an increase an 48% compared to 2021. Therefore, this is expected to support the demand for metal finishing from the country's light commercial vehicles.

- The metal finishing market has the potential for growth in the long term with the emergence of more technologically developed cars.

Asia-Pacific Region to Dominate the Market

- In the Asia-Pacific region, the increasing investments and production in the automotive industry, rising production of electricals and electronics, and surging demand for heavy equipment are some of the major factors driving the market for metal finishing. Multinational companies drive the industrial sector in this region.

- China holds the largest Asia-Pacific market share for the metal finishing market. The demand for the metal finishing market is expected to rise throughout the forecast period due to rising investments and construction activity in the country. China is a huge contributor, as it has been one of the leading investors in infrastructure worldwide over the past few years. For instance, according to the National Bureau of Statistics (NBS) of China, in 2022, the output value of construction works in China amounted to 27.63 trillion yuan (USD 4108.581 billion), an increase of 6.6% compared with 2021.

- Moreover, China is also one of the largest producers of passenger cars due to the improving logistics and supply chains, increased business activity, and the country's raft of pro-consumption measures, among other factors contributing to the passenger car production in the country. For instance, according to OICA, in 2022, passenger car production in China amounted to 2,38,36,083 units, which showed an increase of 11% compared to 2021. Therefore, increasing the production of passenger cars in the country is expected to create an upside demand for the metal finishing market.

- In India, increasing regulations on vehicle emissions, vehicle safety advancement, driver-assist systems in vehicles, and rapidly growing logistics in the retail and e-commerce sectors have been significantly driving the demand for new and advanced Light commercial vehicles (LCVs). For instance, according to OICA, in 2022, light commercial vehicle production in India amounted to 6,17,398 units, showing an increase of 27% compared to 2021 and a recovery of 60% compared to 2020.

- Furthermore, increased investments and advancements in the automobile industry in India are expected to increase the consumption of base metals. For instance, in April 2022, Tata Motors announced plans to invest USD 3.08 billion in its passenger vehicle business over the next five years. Therefore, increasing automobile production and investment in the automobile industry is expected to have an upside demand for the metal finishing market from the country's automotive and transportation industry.

- Copper, tin, nickel, and aluminum are common metals the electronics industry uses. The Asian region is the largest producer of electrical and electronics globally, with countries such as China, Japan, South Korea, Singapore, and Malaysia dominating globally.

- In Japan, according to JEITA (Japan Electronics and Information Technology Association), domestic shipments of consumer electronics in Japan reached a value of JPY 125.2 billion (USD 964.04 million) in December 2022. While March was the strongest month for consumer electronics shipments during 2022, with around JPY 125.5 billion (USD 966.35 million), May was the weakest, with the value falling to JPY 86.4 billion (USD 665.28 million). Therefore, increasing consumer electronics shipments from the country is expected to increase demand for the metal finishing market.

- Hence, with such favorable trends and investments in the region, Asia-Pacific is expected to dominate the global market.

Metal Finishing Industry Overview

The Metal Finishing market is highly fragmented. The major players in this market (not in a particular order) include OC Oerlikon Management AG, MKS Atotech, Linde plc, C. Uyemura Co., Ltd, and Honeywell International Inc., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Automotive Production in Africa

- 4.1.2 Increasing Requirement for Durable, Wear-resistant, and Long-lasting Metal Products

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Environmental Restrictions on Some Chemicals

- 4.2.2 Increasing Replacement of Metal with Plastics

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size by Value)

- 5.1 Type

- 5.1.1 Inorganic Metal Finishing

- 5.1.1.1 Cladding

- 5.1.1.2 Pretreatment/Surface Preparation

- 5.1.1.3 Consumables and Spares

- 5.1.1.4 Electroplating

- 5.1.1.5 Galvanization

- 5.1.1.6 Electro-less Plating

- 5.1.1.7 Conversion Coatings

- 5.1.1.8 Thermal Spray Powder Coating

- 5.1.1.9 Anodizing

- 5.1.1.10 Electro-polishing

- 5.1.2 Organic Metal Finishing

- 5.1.3 Hybrid Metal Finishing

- 5.1.1 Inorganic Metal Finishing

- 5.2 Application

- 5.2.1 Automotive

- 5.2.2 Appliances

- 5.2.3 Hardware

- 5.2.4 Aerospace

- 5.2.5 Heavy Equipment

- 5.2.6 Electronics

- 5.2.7 Construction

- 5.2.8 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 A.E. Aubin Company

- 6.4.2 ALMCOGROUP

- 6.4.3 Auromex Co., Ltd.

- 6.4.4 C. Uyemura Co., Ltd.

- 6.4.5 DuPont

- 6.4.6 Grind Master

- 6.4.7 Guyson Corporation

- 6.4.8 Honeywell International Inc.

- 6.4.9 Linde plc

- 6.4.10 MKS | Atotech

- 6.4.11 OC Oerlikon Management AG

- 6.4.12 OTEC Precision Finish, Inc.

- 6.4.13 Plating Equipment Ltd

- 6.4.14 POSCO

- 6.4.15 Quaker Chemical Corporation

- 6.4.16 sequa gGmbH

- 6.4.17 TIB Chemicals AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Shift from Traditional Solvent-borne Technologies to Newer Technologies

- 7.2 Other Opportunities