|

시장보고서

상품코드

1639405

스마트 오피스 시장 전망 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Smart Office - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

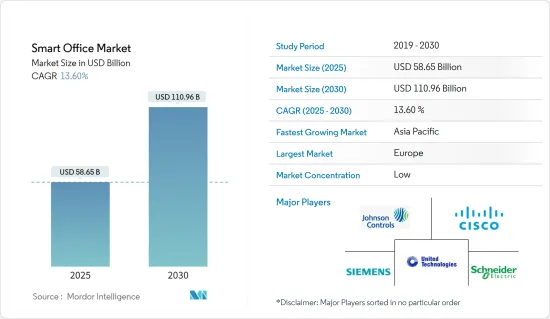

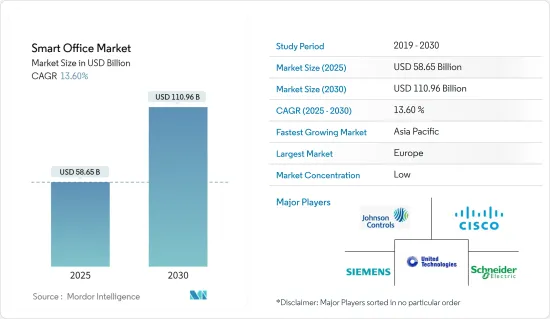

스마트오피스 시장 규모는 2025년에 586억 5,000만 달러로 추계되며, 예측기간(2025-2030년)의 연평균 성장율(CAGR)은 13.6%로, 2030년에는 1,109억 6,000만 달러에 달할 것으로 예측됩니다.

이 시장은 주로 지능형 오피스 솔루션에 대한 수요 증가, 에너지 효율을 위한 센서 네트워크, 우호적인 정부 규제, 혁신적인 오피스 제품의 IoT 발전, 직장에서의 안전 및 보안 시스템에 대한 필요성 증가와 같은 요인에 의해 주도되고 있습니다.

주요 하이라이트

- 스마트 시티의 개념은 에너지, 폐기물 및 인프라 부문에서 사물 인터넷과 함께 큰 전망을 보여주었습니다. 스마트 시티의 중요한 부분인 스마트 홈은 여러 가지 이점을 제공합니다. 현재 진행 중인 여러 스마트 시티 프로젝트와 지원은 2025년까지 완료될 것으로 예상됩니다. 전 세계적으로 약 30개의 스마트 시티가 건설될 것으로 예상되며, 이 중 50%가 북미와 유럽에 위치할 것으로 예상됩니다.

- OECD에 따르면 이러한 단계는 2010년부터 2030년까지 약 1조 8,000억 달러(도시 내 모든 인프라 프로젝트에 대해)가 투자될 것으로 예상되는 글로벌 투자로 뒷받침됩니다. 디지털화된 인프라에 대한 투자는 이러한 자산의 보안을 위한 수요를 견인할 것으로 예상됩니다.

- 게다가 전 세계적으로 인터넷 보급률이 높아짐에 따라 사업장에 보다 현대적인 인프라를 구축하는 것이 시장 성장을 촉진하는 요인으로 작용하고 있습니다. 예를 들어, 데이터에 따르면 2022년 4월 기준 50억 명 이상이 인터넷을 사용하며 이는 전 세계 인구의 63.1%를 차지합니다.

- COVID-19의 발생으로 기업들은 직장에 첨단 기술을 적용한 최신 시설을 제공할 수 있게 되었습니다. 기업들이 점점 더 스마트 하이브리드 근무 모델로 전환함에 따라 스마트 업무공간에 대한 수요도 증가하고 있습니다. 이러한 기업들은 물리적 공간과 가상 공간, 사람, 기술을 통해 업무를 원활하게 통합하여 더 빠르고 더 나은 결과물을 도출하는 데 집중하고 있습니다.

- 실내 공기질 모니터링은 팬데믹으로 인해 떠오르는 주요 관심사 중 하나입니다. AI 기반 재실 센서와 비콘은 업무 공간의 인원 수와 시간대별 공간 사용 현황에 대한 데이터를 수집합니다. 이러한 데이터가 메인 시스템과 연결되면 기본 기술은 작업 공간과 에너지를 효율적으로 사용하여 CO2 수준을 낮추고 동시에 배출량을 줄입니다. 스마트 공기청정기를 통해 기업들은 공기 중 바이러스의 위험을 최소화하는 동시에 직원들의 안전과 지속가능성 목표를 동시에 달성하고 있습니다.

스마트오피스 시장 동향

에너지 관리 시스템이 최대 점유율을 차지할 전망

- 에너지 관리 시스템은 집중력과 편의성이 향상되어 전 세계적으로 광범위하게 사용되고 있습니다. 또한 에너지 사용량 추적에 대한 사용이 확대되면서 여러 기업에서 에너지 관리 시스템을 도입하고 있습니다. 또한 고용주와 근로자의 생산성, 편의성, 효율성을 개선하는 데 도움이 됩니다.

- 기후 변화에서 건물의 역할에 대한 인식이 높아지면서 투자자와 소유주의 선호도가 변화하고 있으며, 특히 상업용 오피스 부문에서 경쟁력을 유지하기 위해 시설의 성능을 개선할 것을 촉구하고 있습니다. 예를 들어, 미국의 건물은 미국 전체 전력의 4분의 3을 소비하며 전체 온실가스 배출량의 39%를 책임지고 있습니다.

- 에너지 소비 최적화, 동적 요금제 활용, 수요 제어를 통해 전체 비용을 절감하기 위해 EMS를 도입하는 기업이 점점 더 많아지고 있습니다. 대규모 기업은 통신 네트워크, 최신 컴퓨터 장비, 데이터 장비, 광 전송 네트워크에 전력을 공급하는 등 다양한 작업을 수행하기 위해 다양한 형태의 에너지가 필요합니다.

- 코로나19 팬데믹의 확산으로 인해 선진국과 개발도상국 모두에서 엣지 AI와 같은 최신 혁신 기술이 큰 인기를 얻고 있습니다. 유연한 근무 환경과 순환 수업 일정의 인기는 지능형 빌딩 관리 운동의 성장에 기여했습니다. 빌딩 관리 시스템(BMS)은 거주자의 편안함을 개선하고 에너지 사용량을 줄이며 안전을 강화하기 위해 엣지 AI를 통해 주목받고 있습니다.

- 게다가전 세계 기술 리더들의 혁신이 예상 기간 동안 시장 확대를 지원할 것으로 예상됩니다. 예를 들어, 삼성전자는 주택 및 기타 구조물에서 삼성 스마트싱스의 사용을 확대하기 위해 2022년 4월 ABB와 협력 관계를 구축했습니다.

북미가 큰 점유율을 차지

- 북미 지역은 더 큰 기술 인프라로 인해 스마트 오피스의 글로벌 시장을 지배하고 있습니다. 따라서 북미의 선진국에서는 스마트 오피스 산업이 향후 몇 년 동안 유리한 발전 속도를 보일 것으로 예상됩니다. 예를 들어, 총 인프라 개발 측면에서 미국은 세계 경제 포럼에서 13위를 차지했습니다.

- 이 지역에서는 네트워크 모니터링이 널리 사용되고 있으며, 여러 시장 제조업체에서 네트워크 모니터링 및 보안 데이터를 기반으로 보안 및 출입 통제 솔루션을 제공하고 있습니다. CompTIA에 따르면, 2021년 미국에서는 54%의 참가자가 네트워크 모니터링을 보안 정책의 구성 요소로 간주하고 있습니다.

- 미국은 지능형 오피스를 비롯한 여러 산업에 통합된 사물 인터넷(IoT)을 비롯한 신흥 기술을 전 세계에서 가장 먼저 도입한 국가 중 하나입니다. 특히 사무실용 IoT 분야의 기술 발전과 보안 및 안전 시스템에 대한 필요성 증가로 인해 미국 내 시장 성장이 촉진될 것으로 예상됩니다.

- 또한 미국 소비자기술협회는 스마트폰의 IoT 소비자 디바이스 보급률이 증가하면서 미국 내 스마트 워크플레이스 시장이 확대되고 있다고 보고했습니다. 예를 들어, GSMA Intelligence는 2025년에 북미 지역에서 54억 개 이상의 IoT 연결이 이루어질 것으로 예측합니다.

- 스마트 빌딩 도입을 촉진하는 요소 중 하나는 혁신적인 기술을 통합할 때 오피스 부문에 우호적인 정부 규정입니다. 또한, 향후 시장 발전은 정부와 기업이 직원 친화적인 사무실 구조를 만들기 위해 더 많은 투자를 함으로써 뒷받침될 것으로 예상됩니다.

스마트 오피스 업계 개요

스마트 오피스 시장은 경쟁이 치열하며 몇몇 주요 업체로 구성되어 있습니다. 이러한 기업들은 전략적 협업 이니셔티브와 혁신을 활용하여 시장 점유율과 수익성을 높이고 있습니다. 주요 기업으로는 존슨 컨트롤스 인터내셔널 PLC, 시스코 시스템즈 잉크, 유나이티드 테크놀로지스 코퍼레이션, 지멘스 AG, 슈나이더 일렉트릭 SE 등이 있습니다.

2022년 10월, 기업이 혁신적이고 실제와 같은 협업 환경을 갖춘 대규모 가상 업무공간을 구축할 수 있도록 지원하는 선도적인 가상현실(VR) 오피스 공급업체인 Arthur는 가상 오피스 플랫폼에 '뉴 리얼리티'를 추가한다고 발표했습니다. 새로운 현실 업그레이드를 통해 Arthur의 가상 업무공간에서는 초기 세대의 혼합 현실(MR) 기능을 사용할 수 있습니다. 이러한 기능을 통해 사용자는 실제 책상과 컴퓨터를 VR로 옮기고 글로벌 패스스루 기능을 활용할 수 있습니다.

2022년 9월, 화웨이는 사우디아라비아 조직의 협력과 연결성에 혁명을 일으키기 위한 노력으로 HarmonyOS에서 작동하는 업계 최초의 지능형 장치인 차세대 HUAWEI IdeaHub S2를 발표했습니다. HUAWEI IdeaHub S2의 BYOM(Bring Your Own Meeting) 아키텍처는 언제 어디서나 창의적이고 지능적인 회의 경험을 제공하여 소비자 가치와 조직의 서비스 효과를 향상시킵니다.

2022년 9월, TD SYNNEX는 IAconnects MobiusFlow Click-to-Run on Azure를 제공하기 시작했습니다. 이는 스마트 빌딩을 운영하기 위한 하드웨어, 용도 및 인프라를 포함한 시스템 구축의 어려운 프로세스를 간소화합니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 산업 밸류체인 분석

- 업계의 매력도 - Porter's Five Forces 분석

- 공급기업의 협상력

- 소비자의 협상력

- 신규 참가업체의 위협

- 경쟁 기업간 경쟁 관계

- 대체품의 위협

제5장 시장 역학

- 시장 성장 촉진요인

- 오피스 공간에 있어서의 에너지 효율 중시의 고조

- 비즈니스 인프라의 급속한 개발

- 시장 성장 억제요인

- IoT와 스마트 디바이스에 대한 보안 우려

- 노후 빌딩의 개수 비용의 상승

- COVID-19의 업계에 대한 영향 평가

제6장 시장 세분화

- 제품별

- 보안 및 입퇴실 관리 시스템

- 에너지 관리 시스템

- 스마트 HVAC 제어 시스템

- 오디오, 비디오 회의 시스템

- 방화, 안전 제어 시스템

- 기타 제품

- 빌딩 유형별

- 리노베이션

- 신축 빌딩

- 지역별

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 인도

- 호주

- 기타 아시아태평양

- 라틴아메리카

- 브라질

- 멕시코

- 기타 라틴아메리카

- 중동 및 아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

- 남아프리카

- 기타 중동 및 아프리카

- 북미

제7장 경쟁 구도

- 기업 프로파일

- Johnson Controls International PLC

- Cisco Systems Inc.

- United Technologies Corp.

- Siemens AG

- Schneider Electric SE

- Koninklijke Philips NV

- Honeywell International Inc.

- ABB Ltd.

- Lutron Electronics Co. Inc.

- Crestron Electronics Inc.

제8장 투자 분석

제9장 시장의 미래

HBR 25.02.17The Smart Office Market size is estimated at USD 58.65 billion in 2025, and is expected to reach USD 110.96 billion by 2030, at a CAGR of 13.6% during the forecast period (2025-2030).

The market is primarily driven by factors such as the rise in demand for intelligent office solutions, sensor networks for energy efficiency, favorable government regulations, advancement of IoT in innovative office offerings, and the growing need for safety and security systems at the workplace.

Key Highlights

- The concept of smart cities marked a great prospect with the Internet of Things in the energy, waste, and infrastructure sectors. A smart home, a significant part of a smart city, offers several benefits. Several ongoing smart city projects and initiatives are expected to be completed by 2025. It is expected that there will be about 30 global smart cities, and 50% of these are expected to be located in North America and Europe.

- According to the OECD, these steps are supported by global investments, which are expected to be about USD 1.8 trillion from 2010-2030 (for all infrastructure projects in urban cities). The investment in digitized infrastructure is expected to drive the demand for securing those assets.

- Additionally, the construction of more modern infrastructure at business locations, which offers greater luxury, is influenced by the rising worldwide internet penetration, thus boosting the market growth. For instance, data reportal shows more than five billion people used the internet as of April 2022, making up 63.1% of the world's population.

- The COVID-19 outbreak has enabled companies to provide advanced and technologically updated facilities at the workplace. As companies increasingly shift to a smart hybrid working model, the demand for a smart workplace is witnessing growth. These companies are focusing on the seamless integration of work through physical and virtual space, people, and technology which thereby yields better and faster output.

- Monitoring indoor air quality is one key concern emerging from the pandemic. AI-driven occupancy sensors and beacons gather data about the number of people in the workplace, as well as how different spaces are being used at different times. As these are linked to the main system, the underlying technology ensures workspaces and energy are used efficiently, lowering CO2 levels and decreasing emissions simultaneously. With smart air purifiers, companies are minimizing the risk of airborne viruses while making workers feel safer and meeting their sustainability goals simultaneously.

Smart Office Market Trends

Energy Management System Expected to Hold Largest Share

- Energy Management Systems are extensively used around the world due to their improved focus and ease. Additionally, their expanding use for energy use tracking is gaining acceptance throughout several businesses. Additionally, it aids in improving both employers' and workers' productivity, convenience, and efficiency.

- The rising cognizance regarding a building's growing role in climate change is shifting investors' and owners' preferences, thus urging them to improve the performance of their facilities to stay competitive, specifically in the commercial office segment. For instance, buildings in the United States consume nearly three-quarters of the country's electricity and are responsible for 39% of all greenhouse gas emissions.

- Organizations are increasingly adopting EMS for optimization of energy consumption, utilization of dynamic pricing tariffs, and demand control, thus reducing overall costs. Large-scale companies require energy in various forms to perform diverse operations, including powering telecom networks, modern computer equipment, data equipment, and optical transport networks.

- Modern innovations like edge AI have become very popular in both developed and developing countries, primarily due to the COVID-19 pandemic's outbreak. The popularity of flexible work environments and revolving class schedules contributed to the growth of the intelligent buildings management movement. Building management systems (BMS) have also been highlighted by edge AI in order to improve occupant comfort, reduce energy usage, and boost safety.

- Additionally, rising innovations by technology leaders globally are anticipated to support market expansion during the projected period. For instance, Samsung Electronics established cooperation with ABB in April 2022 to expand the use of Samsung SmartThings in houses and other structures.

North America to Hold Significant Share

- The North American region dominates the global market for smart offices because of the greater technological infrastructure. As a result, in the developed nations of North America, the smart office industry is anticipated to show a favorable development rate in the years to come. For instance, in terms of total infrastructure development, the United States is ranked 13th by the World Economic Forum.

- The region is seeing widespread use of network monitoring, with several marketplace manufacturers providing security and entry control solutions based on networking monitoring and security data. As per CompTIA, 54% of participants in the United States see Network Monitoring as a component of their security policy in 2021.

- The United States is one of the early adopters of emerging technology across the world, including the internet of things (IoT), which is incorporated in several industries, including intelligent offices. The technological advancement in the IoT field, particularly for offices, coupled with the rising need for security and safety systems, is anticipated to propel market growth in the United States.

- Additionally, the Consumer Technology Association reports that the IoT consumer device penetration on smartphones is rising, which is expanding the market for smart workplaces in the United States. For instance, GSMA Intelligence predicts that in 2025, there will be more than 5.4 billion IoT connections in the North American region.

- One of the elements propelling the adoption of smart buildings is government rules favorable to the office sector when integrating innovative technology. Furthermore, future market development is anticipated to be supported by the government and companies making more significant investments in office structures to make them more employee-friendly.

Smart Office Industry Overview

The smart office market is highly competitive and consists of several major players. These companies leverage strategic collaborative initiatives and innovation to increase their market share and profitability. Major players include Johnson Controls International PLC, Cisco Systems Inc., United Technologies Corp., Siemens AG, and Schneider Electric SE.

In October 2022, Arthur, a leading virtual reality (VR) office supplier that allows businesses to establish large-scale virtual workplaces with innovative, truly realistic, and collaborative settings, announced the addition of 'New Realities' to its virtual office platform. In Arthur's virtual workplaces, the New Realities upgrade enables the initial generation of Mixed Reality (MR) functionality. These capabilities enable users to transport their actual desk and computer into VR and leverage the global passthrough functionality.

In September 2022, Huawei introduced its Next-Generation HUAWEI IdeaHub S2 - the sector's first intelligent device to operate on HarmonyOS - in an effort to revolutionize cooperation and connectivity for Saudi organizations. HUAWEI IdeaHub S2's Bring Your Own Meeting (BYOM) architecture enables it to provide creative and intelligent meeting experiences anytime and from any location, increasing consumer value and service effectiveness for organizations.

In September 2022, TD SYNNEX revealed the availability of IAconnects MobiusFlow Click-to-Run on Azure, which streamlines the difficult process of deploying a system that includes hardware, application, and infrastructure to operate smart buildings.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitute Products

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Focus on Energy Efficiency in Office Spaces

- 5.1.2 Rapidly Developing Business Infrastructure

- 5.2 Market Restraints

- 5.2.1 Security Concerns Related to IoT and Smart Devices

- 5.2.2 Higher Costs of Refurbishment of Old Buildings

- 5.3 Assessment of the Impact of COVID-19 on the Industry

6 MARKET SEGMENTATION

- 6.1 Product

- 6.1.1 Security and Access Control System

- 6.1.2 Energy Management System

- 6.1.3 Smart HVAC Control System

- 6.1.4 Audio-Video Conferencing System

- 6.1.5 Fire and Safety Control System

- 6.1.6 Other Products

- 6.2 Building Type

- 6.2.1 Retrofits

- 6.2.2 New Buildings

- 6.3 Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 United Kingdom

- 6.3.2.3 France

- 6.3.2.4 Spain

- 6.3.2.5 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Australia

- 6.3.3.4 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Mexico

- 6.3.4.3 Rest of Latin America

- 6.3.5 Middle East and Africa

- 6.3.5.1 Saudi Arabia

- 6.3.5.2 United Arab Emirates

- 6.3.5.3 South Africa

- 6.3.5.4 Rest of Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Johnson Controls International PLC

- 7.1.2 Cisco Systems Inc.

- 7.1.3 United Technologies Corp.

- 7.1.4 Siemens AG

- 7.1.5 Schneider Electric SE

- 7.1.6 Koninklijke Philips NV

- 7.1.7 Honeywell International Inc.

- 7.1.8 ABB Ltd.

- 7.1.9 Lutron Electronics Co. Inc.

- 7.1.10 Crestron Electronics Inc.

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET