|

시장보고서

상품코드

1443956

수중 펌프 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2024-2029년)Submersible Pumps - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

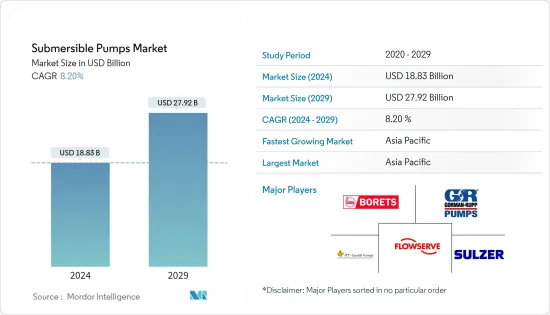

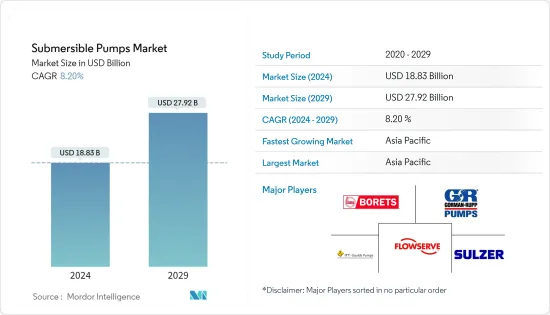

수중 펌프 시장 규모는 2024년 188억 3,000만 달러에 이를 것으로 추정됩니다. 2029년까지 279억 2,000만 달러에 달할 것으로 예상되며, 예측 기간(2024-2029년) 동안 8.20%의 연평균 복합 성장률(CAGR)을 나타낼 전망입니다.

주요 하이라이트

- 중기적으로 시장을 주도하는 주요 요인은 산업 전반의 폐수 처리에 대한 엄격한 규제, 석유 및 가스 및 광업 회복, 건설 산업의 성장, 산업 인프라의 급격한 증가입니다.

- 한편, 이 시장은 높은 유지 보수 및 운영 비용, 석유 및 가스 가격 변동과 같은 특정 과제에 직면해 있습니다. 이러한 요인들은 시장 성장의 장애물로 작용할 수 있습니다.

- 그럼에도 불구하고 북미와 유럽과 같은 선진 지역의 하수 및 수처리 시설은 노후화되어 운영 수명 주기가 끝나가고 있습니다. 이 시나리오를 극복하기 위해서는 오래된 인프라를 재설치하고 업그레이드하는 데 많은 투자가 필요합니다. 그러나 일부 신흥국에서는 식수에 대한 접근성이 충분하지 않아 새로운 물 인프라 구축이 막 시작되고 있습니다. 노후화된 인프라를 갱신하기 위한 이러한 노력은 수중 펌프 시장에 기회를 창출할 수 있습니다.

수중 펌프 시장 동향

석유 및 가스 산업이 시장을 독식할 것으로 예상

- 중장비 수중 펌프는 대량의 고형물을 효율적으로 처리할 수 있으며, 석유 및 가스 우물 시추에 사용됩니다. 현재 전 세계 생산 우물의 90% 이상이 자연 용출량이 감소한 후 생산을 최적화하기 위해 인공 리프트를 사용하고 있습니다. 수중 펌프에 대한 수요는 지난 몇 년동안 주로 산업 불황으로 인해 불안정했습니다. 그러나 원유 가격의 회복과 낮은 손익분기점 가격이 시장 조사 기간 동안 생산 활동을 주도하고 있습니다.

- 예를 들어, 석유수출국기구(OPEC)에 따르면 2022년 OPEC 원유 평균 가격은 배럴당 100.08달러로 2021년 69.89달러에서 크게 상승했습니다.

- 석유 및 가스 생산 시장은 현재 셰일 매장량을 개발하고 있는 미국이 주도하고 있으며, 100만 개 이상의 생산 우물이 존재하여 인공 리프트의 가장 큰 시장 중 하나입니다. 셰일 매장량 개발이 증가함에 따라 폐수 발생이 증가하고 있습니다. 물 부족과 폐수 처리에 대한 정부 규제로 인해 산업계는 생산된 물을 처리하도록 장려하고 있습니다. 이로 인해 현장에서 폐수를 끌어올리는 데 적용할 수 있는 수중 펌프에 대한 엄청난 수요 기회가 창출될 것으로 예상됩니다.

- 이 지역의 국영 석유 회사들은 석유 및 가스 산업에 대한 투자와 발전을 주도해 왔습니다. 인도, 중국, 인도네시아, 베트남 및 기타 국가에서 2025년까지 수많은 새로운 에틸렌 및 나프타 크래커 공장이 가동 될 것으로 예상됩니다. 예를 들어, 2022년 1월 롯데케미칼은 인도네시아에 에틸렌 크래커 공장을 건설한다고 발표했습니다. 이 크래커 공장의 생산 능력은 연간 1,000 킬로톤에 달할 것으로 예상되며, 이 프로젝트는 2025년까지 상업 가동을 시작할 예정입니다.

- 인구 증가와 급속한 도시화로 인해 휘발유, 등유, 액화 석유 및 가스 및 기타 석유 제품에 대한 수요가 날로 증가하고 있습니다. 따라서 기존 수요를 충족시키기 위해서는 새로운 정유소를 설립해야 하며, 이는 예측 기간 동안 수중 펌프 시장을 견인할 수 있습니다.

- 따라서 위의 요인에 따라 석유 및 가스 산업은 예측 기간 동안 가장 큰 시장 점유율을 차지할 것으로 예상됩니다.

아시아태평양이 가장 큰 시장이 될 것으로 예상

- 아시아태평양에서는 인도, 중국 등 국가에서 산업 활동이 증가하고 있으며, 이로 인해 원유, 화학제품 등 수요가 증가하고 있습니다. 중국은 아시아태평양(APAC) 예측 기간 동안 원유 정제 능력의 상당한 증가를 차지할 것으로 예상됩니다.

- 아시아태평양 대부분의 국가는 성장 단계에 있으며, 높은 인구 증가율로 인해 물 공급에 대한 수요가 증가하고 있습니다.

- 또한 인도, 방글라데시, 인도네시아 등의 국가에서 과도한 물 채취로 인해 수위가 낮아졌습니다. 이로 인해 수중 펌프에 대한 수요가 증가하고 있습니다.

- 세계 투자 보고서 2022에 따르면 2020-21년 인도의 총 FDI 유입액은 819억 7,300만 달러로 전년 대비 10% 증가했습니다. 따라서 높은 투자, 정책 및 다양한 산업은 예측 기간 동안이 지역의 수중 펌프 시장을 주도 할 수 있습니다.

- 인도에서는 관개가 태양열 펌프의 주요 응용 분야입니다. 이 때문에 인도는 태양열 수중 펌프의 거대한 시장이되었습니다. 인도 정부는 재생 가능 에너지 발전 용량을 확대하겠다는 야심 찬 목표를 세웠습니다. 2010년에 자와할랄랄네루 국립(JNN) 태양광 발전 임무를 시작하여 2022년까지 100GW의 태양광 발전량 목표를 달성하는 것을 목표로 하고 있습니다. 또한 2019년에는 이 미션의 일환으로 신재생에너지부(MNRE)가 2024년까지 태양열 펌프 도입을 촉진하는 것을 목표로 관개 및 식수용 태양열 펌프 프로그램을 재개했습니다. 따라서 정부의 지원으로 인도의 수중 펌프 시장은 예측 기간 동안 이 지역에서 성장할 것으로 예상됩니다.

- 따라서 이러한 발전을 바탕으로 아시아태평양은 예측 기간 동안 수중 펌프 시장을 독점할 것으로 예상됩니다.

수중 펌프 산업 개요

수중 펌프 시장은 여전히 세분화되어 있습니다. 주요 업체로는 Borets International Ltd, Gorman-Rupp Co, Flowserve Corporation, Grundfos Group, Sulzer Ltd 등이 있습니다.

지난 3월, Flowserve Corporation은 수처리 및 폐수 처리의 가장 어려운 문제를 해결하기 위해 Gradiant와 계약을 체결했습니다. 이번 제휴를 통해 Flowserve의 유량 제어 솔루션 및 제품 전문 지식과 Gradiant의 혁신적인 맞춤형 수처리 기술을 결합하여 고객에게 고유한 토탈 수처리 솔루션을 제공하게 됩니다. Flowserve는 또한 시장을 선도하는 수산업용 유량 제어 제품 및 솔루션으로 물 포트폴리오를 지속적으로 업그레이드하기 위해 노력하고 있습니다. 최근 축적된 제품으로는 H2O 수중 펌프, 담수화용 고효율 펌프 제품군, RedRaven IoT 플랫폼 등이 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간 애널리스트 지원

목차

제1장 서론

- 조사 범위

- 시장의 정의

- 조사의 전제조건

제2장 조사 방법

제3장 주요 요약

제4장 시장 개요

- 서론

- 2028년까지 시장 규모와 수요 예측(USD)

- 최근 동향과 발전

- 정부 정책과 규제

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 공급망 분석

- Porter의 Five Forces 분석

- 공급 기업의 교섭력

- 소비자의 교섭력

- 신규 진출업체의 위협

- 대체 제품 및 서비스의 위협

- 경쟁 기업간 경쟁도

제5장 시장 세분화

- 유형

- Borewell

- Openwell

- Non-clog

- 드라이브 유형

- 전기

- 유압

- 기타

- 헤드

- 50m 미만

- 50m-100m

- 100m 이상

- 최종사용자

- 물 및 폐수

- 석유 및 가스 산업

- 광업 및 건설업

- 기타

- 지역

- 북미

- 미국

- 캐나다

- 기타 북미

- 유럽

- 독일

- 프랑스

- 영국

- 기타 유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 기타 아시아태평양

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 중동 및 아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

- 남아프리카공화국

- 기타 중동 및 아프리카

- 북미

제6장 경쟁 구도

- 인수합병(M&A)/합작투자(JV)/협업/계약

- 유력 기업이 채택한 전략

- 기업 개요

- Baker Hughes Co.

- Schlumberger Limited

- Halliburton Co.

- Weir Group PLC

- Sulzer AG

- Grundfos Group

- The Gorman-Rupp Company

- Flowserve Corporation

- Atlas Copco AB

- Ebara Corporation

- Borets International Ltd

- ITT Goulds Pumps

- Franklin Electric Co. Inc.

- KSB AG

제7장 시장 기회와 향후 동향

LSH 24.03.13The Submersible Pumps Market size is estimated at USD 18.83 billion in 2024, and is expected to reach USD 27.92 billion by 2029, growing at a CAGR of 8.20% during the forecast period (2024-2029).

Key Highlights

- Over the medium term, the major factors driving the market are the strict regulations for wastewater treatment across industries, recovery in the oil and gas and mining industries, growth in the construction industry, and a surge in industrial infrastructure.

- On the other hand, this market faces certain challenges, such as high maintenance and operation costs and volatility in oil and gas prices. These factors act as a roadblock to the growth of the market.

- Nevertheless, wastewater and water treatment facilities in developed regions like North America and Europe are aging and shifting toward the end of their operational lifecycle. High investments are required in reinstalling and upgrading the old infrastructure to overcome this scenario. However, several emerging economies do not have adequate access to drinking water and have just started building new water infrastructure. Such initiatives to upgrade aging infrastructure are likely to create an opportunity for the submersible pumps market.

Submersible Pump Market Trends

The Oil and Gas Industry is Expected to Dominate the Market

- A heavy-duty submersible pump handles a lot of solids efficiently and is used during drilling oil and gas wells. Currently, more than 90% of producing wells in the world use an artificial lift to optimize production after the decline in natural drives. The demand for submersible pumps has been volatile in the past few years, mainly due to the downturn in the industry. However, the recovery in crude oil price and the low breakeven price is driving the production activity in the market studied period.

- For instance, according to the Organisation of the Petroleum Exporting Countries (OPEC), in 2022, the average OPEC oil price was USD 100.08 per barrel, a significant increase from USD 69.89 per barrel in 2021.

- The oil and gas production market is currently driven by the United States, which is exploiting its shale reserve, as well as one of the largest markets for artificial lift due to the presence of more than a million production wells. The increasing exploitation of shale reserves has resulted in increased production of wastewater. The lack of availability of water and government regulation on wastewater treatment are encouraging the industry to treat the produced water. This is expected to create tremendous demand opportunities for submersible pumps that find application in pumping wastewater from the field.

- National oil companies in the region have taken the lead in investing in and developing the oil and gas industry. A number of new ethylene and naphtha cracker plants are anticipated to come online by 2025 in India, China, Indonesia, Vietnam, and other countries. For instance, in January 2022, Lotte Chemicals announced the construction of an ethylene cracker plant in Indonesia. The cracker plant is likely to have a capacity of 1,000 kilometric ton per annum, and the project is expected to begin commercial operations by 2025.

- The demand for oil products such as gasoline, heating oil, and liquefied petroleum gas is increasing day by day with the growing population and rapid urbanization. Therefore, to meet the existing demand, there is a need for setting up new refineries, which, in turn, may drive the submersible pumps market during the forecast period.

- Therefore, based on the above-mentioned factors, the oil and gas industry is expected to have the largest market share during the forecast period.

Asia-Pacific is Expected to be the Largest Market

- In Asia-Pacific, countries like India and China are witnessing an increase in industrial activities, thereby inducing growth in demand for crude oil and chemicals, among others. China is expected to account for significant growth in crude oil refining capacity during the forecast period in Asia-Pacific (APAC).

- Most of the countries in Asia-Pacific are in a growing phase, and the high rate of population growth has led to the increased requirement for water supply.

- Moreover, excess water extraction in countries such as India, Bangladesh, Indonesia, and others resulted in a decline in the water level. This has translated into an increase in demand for submersible pumps.

- As per the World Investment Report 2022, India's total FDI inflows stood at USD 81,973 million during 2020-21 which represents a 10% increase over the previous year. Thus, high investments, policies, and various industries are likely to propel the submersible pumps market in the region during the forecast period.

- Irrigation is a major application area for solar pumps in India. This makes India a huge market for solar submersible pumps. The Government of India had set ambitious targets to expand the country's renewable energy generating capacity. In 2010, it launched the Jawaharlal Nehru National (JNN) Solar Mission, which aims to reach a target of 100 GW of solar PV by 2022. Furthermore, in 2019, as part of this mission, the Ministry of New and Renewable Energy (MNRE) relaunched the Solar Pumping Programme for Irrigation and Drinking Water, which sought to promote the adoption of solar pumps by 2024. Hence, due to government support, the submersible pumps market in India is expected to grow in the region during the forecast period.

- Therefore, based on such developments, Asia-Pacific is expected to dominate the submersible pumps market during the forecast period.

Submersible Pump Industry Overview

The market for submersible pumps remains to be fragmented. Some of the key players include (not in particular order) Borets International Ltd, Gorman-Rupp Co, Flowserve Corporation, Grundfos Group, and Sulzer Ltd., among others.

In March 2022, Flowserve Corporation signed an agreement with Gradiant to help handle the most challenging problems in water and wastewater treatment. This partnership is going to combine Flowserve's flow control solutions and product expertise with Gradiant's innovative, tailored water treatment technology to provide distinctive total water treatment solutions for customers. Flowserve also persists in upgrading its water portfolio with market-leading flow control products and solutions for the water industry. Recent accumulations include the H2O+ submersible pump, a suite of highly efficient pumps for desalination, and the RedRaven IoT platform.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Rapid Recovery in the Oil and Gas and Mining Industries

- 4.5.1.2 Surge in the Construction Industry

- 4.5.2 Restraints

- 4.5.2.1 High Maintenance and Operation Costs of Submersible Pump Restrain the Market

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Borewell Submersible Pump

- 5.1.2 Openwell Submersible Pump

- 5.1.3 Non-clog Submersible Pump

- 5.2 Drive Type

- 5.2.1 Electric

- 5.2.2 Hydraulic

- 5.2.3 Other Drive Types

- 5.3 Head

- 5.3.1 Below 50 m

- 5.3.2 Between 50 m to 100 m

- 5.3.3 Above 100 m

- 5.4 End User

- 5.4.1 Water and Wastewater

- 5.4.2 Oil and Gas Industry

- 5.4.3 Mining and Construction Industry

- 5.4.4 Other End Users

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 France

- 5.5.2.3 United Kingdom

- 5.5.2.4 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle-East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 South Africa

- 5.5.5.4 Rest of Middle-East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Baker Hughes Co.

- 6.3.2 Schlumberger Limited

- 6.3.3 Halliburton Co.

- 6.3.4 Weir Group PLC

- 6.3.5 Sulzer AG

- 6.3.6 Grundfos Group

- 6.3.7 The Gorman-Rupp Company

- 6.3.8 Flowserve Corporation

- 6.3.9 Atlas Copco AB

- 6.3.10 Ebara Corporation

- 6.3.11 Borets International Ltd

- 6.3.12 ITT Goulds Pumps

- 6.3.13 Franklin Electric Co. Inc.

- 6.3.14 KSB AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Upgradation of Aging Water and Wastewater Infrastructure to Create Market Opportunities