|

시장보고서

상품코드

1443961

세계 자동차용 캐리어 시장 : 점유율 분석, 산업 동향과 통계, 성장 예측(2024-2029년)Car Rack - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

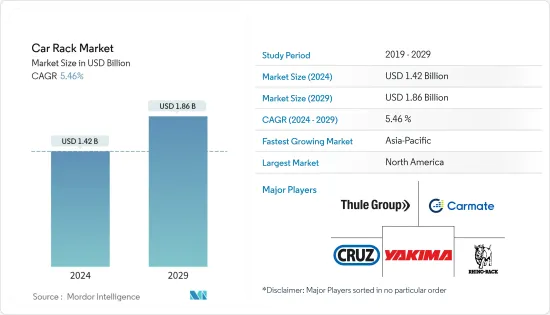

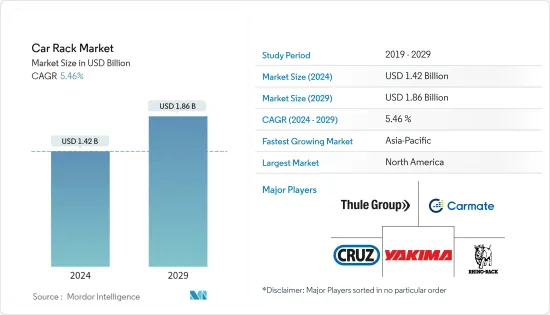

자동차용 캐리어 시장 규모는 2024년에 14억 2,000만 달러로 추계되고, 2029년에는 18억 6,000만 달러에 이르고, 시장 추계·예측 기간(2024-2029년)의 CAGR은 5.46%로 성장할 것으로 예상됩니다.

COVID-19 팬데믹의 발생은 자동차용 전동 유압 파워 스티어링 산업에 악영향을 미치는 제조 정지, 락다운, 무역 제한으로 이어졌습니다. 또한 여행 제한과 야외 어드벤처 활동 감소로 인해 자동차용 캐리어 수요가 크게 감소했습니다. 그 결과, 자동차 루프랙 사업의 대소기업은 큰 타격을 받았습니다. COVID-19 이후에는 정기적 인 레크리에이션 활동과 건강 증진을위한 수요가 증가하고 산악 자전거와 스키 여행의 필요성이 증가 할 수 있으며 신뢰할 수있는 더 많은 사이클 캐리어와 옥상 마운트 수요가 증가하고 시장 가치가 증가할 수 있습니다. 또한 제조업체는 자동차 산업의 중요한 섹터 고객과의 지속성을 유지하기 위해 미래의 비즈니스 불확실성을 줄이기 위해 지속적인 계획을 실시했습니다.

향후 5년간은 수하물 공간의 증설 수요와 밀레니얼 세대에서의 레저 활동과 관광에 대한 매력 증가가 시장의 성장을 견인하는 주요 요인이 되고 있습니다. 제품 유형(저품질의 랙에서는 녹이나 부식이 발생한다)과 가격 설정의 어려움(건재/원재료, 루프랙의 유형, 브랜드 등의 제품 비용 등, 가격에 영향을 주는 요인)이 시장의 성장을 제한할 수 있습니다.

보다 실용성이 뛰어난 컴팩트 SUV의 인트로덕션보다 차량 능력이 향상되고 오프로드 주행을 위한 유능한 자동차가 증가하고 있기 때문에 이러한 요인은 루프랙의 용도를 대폭 개선하게 되어, 자동차용 캐리어 시장을 견인하고 있습니다.

주요 시장 기업은 급성장하는 자동차 캐리어 시장에 대응하기 위해 합작 투자, 신제품 출시, 생산 능력 확대에 힘쓰고 있습니다.

주요 하이라이트

- 2022년 10월: Yakima Products Inc.는 자동차용 특수 제품을 소매업체에 판매하는 선도적인 유통업체 Meyer Distributing과 제휴하여 Meyer Distributing 네트워크를 통해 Yakima 제품을 자동차 소매업체에 판매한다고 발표했습니다.

- 2022년 4월: Polaris Inc.는 Rhino-Rack과 제휴하여 Polaris 오플로더 및 어드벤처 차량용 수납 제품을 제공합니다.

지리적으로는 북미가 자동차용 캐리어 시장의 가장 규모가 큰 지역임이 확인되었습니다. 이는 야외 어드벤처 활동에 대한 강한 선호, 모터 홈 및 라이프 스타일 픽업 트럭과 같은 레저 차량의 깊은 침투, 자동차 스토리지의 대규모 OEM의 존재 때문입니다. 유럽과 아시아태평양은 아웃도어 활동과 관광 증가 추세, SUV와 같은 라이프 스타일 차량의 채용 증가로 다음과 같은 최대 시장이 되고 있습니다.

자동차용 캐리어 시장 동향

지붕 부문은 예측 기간 동안 급성장할 것으로 예상

자동차용 캐리어 시장의 루프랙 분야는 캠핑카와 오프로드 차량의 이용 증가에 따라 예측 기간 동안 중요성이 증가할 것으로 예상됩니다. 오프로드 자동차 사용자와 SUV 판매량이 증가함에 따라 루프 랙 요구가 증가할 것으로 예상됩니다.

2021년에는 SUV가 세계 승용차 총 판매 대수의 약 45.9%를 차지해 전년 대비 4% 증가했습니다. 이는 오프로드 용도의 높은 가능성과 장거리 이동을 위한 루프 플랙의 세계 사용 증가를 보여줍니다. 또한 2021년에는 2억대의 SUV가 가동될 것으로 추정되며, 이러한 차량과 루프럭의 여행용 잠재력의 높이를 보여주고 있습니다.

RV 협회에 따르면 캠핑카 판매량은 2021년 60만대를 넘어섰습니다. 캠핑카는 일반적으로 수납력을 높이기 위해 랙이 장착되어 있습니다. 캠핑카 이용자는 일용품을 담은 캠핑카로, 흔히 한적한 장소로의 장기의 야외 휴가에 나가기를 선호하기 때문입니다. 이러한 캠핑카의 판매 증가는 자동차 캐리어의 판매 증가로 이어지고 있습니다.

또한 여러 OEM 제조업체가 탑승자의 편안함과 지붕의 실용성을 높이기 위한 다양한 기술을 자체 모델에 도입하고 있습니다. 예를 들면

- 2022년 10월: 독일 캠핑카 전문 제조업체 Ququq는 VW iD 버즈 전용으로 설계된 수하물 랙으로 구성된 세계 최초의 캠핑카 키트를 출시했습니다. 가격은 3,000달러 이하로 경쟁력이 있습니다.

이와 같이 위의 모든 요인이 겹쳐져 향후 5년간의 루프랙의 성장을 견인할 것으로 예측됩니다.

북미가 자동차용 캐리어 시장 개척의 주요 역할을 한다.

북미의 자동차용 캐리어 시장은 예측 기간 동안 전체 시장을 지배할 것으로 예측됩니다. 미국 시장의 성장을 가속하는 주요 요인으로는 관광 분야(렌터카 및 택시 서비스)에서 차량 수요 증가, 레저용 차량 수요 증가(소비자 레저 여행 수요 증가), 공부 및 직업 등 미국 내 각 도시로 전출하는 젊은이의 많음 등을 들 수 있습니다.

미국에서의 레저 여행의 비율은 2021년의 관광 총수의 86% 이상으로 평가되고 있어 고품질의 루프 플랙이 자동차에 탑재되는 큰 가능성을 나타내고 있습니다. 캐나다 시민들이 선호하는 야외 활동 3위와 5위에는 자전거와 하이킹이 선정되어 있으며, 일반적으로 다양한 장비와 자전거를 설치하기 위한 표준 자동차용 루프랙이 필요합니다. 이것은 캐나다에서 자동차용 캐리어 용품의 요구를 더욱 강화하고 있습니다.

유행의 영향으로 사용자 수는 감소했지만 캐나다 관광 패키지 휴가 및 휴가 임대 부문에서는 2021 년에 사용자 수의 급증이 관찰되어 여행 요구를 위해 자동차용 캐리어 장비 한 다목적 차량의 요구가 높아질 것으로 예상됩니다.

이 지역에는 Yakima, Allen Group, Saris Group 등 유명한 루프랙 제조업체가 존재하기 때문에 루프락의 이용은 예측 기간 동안 가장 높을 것으로 예상됩니다. 따라서 이러한 요인이 예측기간 중 북미 자동차용 캐리어 시장을 밀어올릴 것으로 예상됩니다.

또, 자동차용 캐리어 OEM 각사에 의한 신제품의 발매도 시장을 견인할 것으로 보입니다. 예를 들면

- 2022년 10월: Lucid Motors는 Lucid Air Luxury EV용 새로운 Lucid Air Crossbars 액세서리를 출시했습니다. 이 액세서리는 165Ib의 하중을 지원할 수 있는 새로운 알루미늄 루프 수납 시스템을 포함하고 있으며, 현재 주문 가능하며 출하는 2022년 4분기부터 시작됩니다.

이상으로부터, 북미는 향후 5년간, 자동차용 캐리어의 세계 최대 시장으로 계속할 것으로 보입니다.

자동차용 캐리어 산업 개요

자동차 캐리어 시장은 여러 대형 및 현지 기업에 의해 적당히 통합되어 있습니다. 주요 시장 기업로는 Thule Group AB, Yakima Products Inc., Rhino-Rack USA LLC, Car Mate Mfg., Cruzber 등이 있습니다. 제조업체 각사는 공간이 적고, 디자인면에서도 실용적인, 자동차에 설치하기 위한 다양한 혁신적인 디자인에 주목하고 있습니다. 제조업체 각사는 시장에서의 지위를 강화하기 위해 제품 개발, 제휴, 소매 확대 등 다양한 성장 전략에 주력하고 있습니다. 예를 들면

- 2022년 9월, Hyundai Mobis는 Hyundai Tucson, Creta, Venue, Kona electric SUV 고객을 위한 새로운 투어링 액세서리, 루프 박스, 루프 바구니, 오토바이 캐리어을 발표했습니다. 이 액세서리는 Thule Group AB와 공동으로 개발되었습니다.

- 2022년 10월, Carmate는 자동차 루프에 가방으로 착탈 가능한 새로운 수납 루프 박스 "Inno"를 발표했습니다. 이 루프탑 박스의 용량은 160리터로, 길이 900mm까지의 의자나 테이블을 수납할 수 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트·지원

목차

제1장 서론

- 조사의 전제조건

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 성장 촉진요인

- 시장 성장 억제요인

- 업계의 매력도 - Porter's Five Forces 분석

- 신규 진입업자의 위협

- 구매자/소비자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

제5장 시장 세분화(시장 규모 : 금액)

- 용도 유형별

- 루프 랙

- 루프 박스

- 사이클 캐리어

- 스키 랙

- 워터 스포츠 캐리어

- 지역별

- 북미

- 미국

- 캐나다

- 기타 북미

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 기타 유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 기타 아시아태평양

- 세계 기타 지역

- 브라질

- 남아프리카

- 기타 국가

- 북미

제6장 경쟁 구도

- 벤더의 시장 점유율

- 기업 프로파일

- Thule Group

- Yakima Products Inc.

- Allen Sports

- Rhino-Rack USA LLC

- Cruzber SA

- ACPS Automotive GmbH

- Malone Auto Racks

- Kuat Car Racks

- Car Mate Mfg Co. Ltd

- Saris

제7장 시장 기회와 앞으로의 동향

JHS 24.03.15The Car Rack Market size is estimated at USD 1.42 billion in 2024, and is expected to reach USD 1.86 billion by 2029, growing at a CAGR of 5.46% during the forecast period (2024-2029).

The outbreak of the COVID-19 pandemic led to manufacturing shutdowns, lockdowns, and trade restrictions which negatively affected the automotive electro-hydraulic power steering industry. Furthermore, the traveling restrictions and the fall in the number of outdoor adventure activities massively dented the demand for car racks. Consequently, the small or large companies in the car roof rack business suffered significantly. Post-COVID-19, with the increasing demand for regular recreational activities and health benefits, the need for mountain biking and ski trips may increase, which may increase the demand for more car racks and rooftop mounts that are dependable, thus increasing the market value. Furthermore, the manufacturers are implementing contingency plans to mitigate future business uncertainties to retain continuity with clients in the critical sectors of the automobile industry.

Over the next five years, the demand for additional baggage space and the growing attraction for leisure activities and tourism amongst the millennial generation are the primary reasons driving the market's growth. Quality (rust and corrosion in low-quality racks) and pricing difficulties (factors impacting the price, such as product expenses like building material/raw material, roof rack type, and brand) may limit the market's growth.

The introduction of more compact SUVs with greater practicality increased vehicular capabilities, and an increased number of competent automobiles for off-roading are driving the car rack market, as these factors will substantially improve the application of roof racks.

Key market players are engaging in joint ventures, new product launches, and capacity expansions to address the rapidly growing car rack market. for instance

Key Highlights

- October, 2022: Yakima Products Inc. announced a tie-up with Meyer Distributing, a major distributor of specialty automotive products to retailers, to distribute Yakima's products through Meyer Distributing's network to automotive retailers.

- April, 2022: Polaris Inc. partnered with Rhino-Rack to offer storage products for Polaris' off-roaders and adventure vehicles.

Geographically, North America has been identified as the largest region for the car rack market due to a strong preference for outdoor adventure activities, deep penetration of leisure vehicles like motorhomes and lifestyle pickup trucks, and the presence of sizeable automotive storage OEMs. Europe and Asia-Pacific are the following biggest markets due to the growing trend of outdoor activities and tourism and the rising adoption of lifestyle vehicles like SUVs.

Car Rack Market Trends

Roof Rack Segment is Expected to Grow at a Faster rate During the Forecast Period

The roof rack segment of the car rack market is expected to gain significance over the forecast period, owing to the increasing use of campers and off-road vehicles. With rising off-road vehicle users and SUV sales, the need for roof racks is expected to increase.

In 2021, SUVs accounted for about 45.9% of the total passenger car sales worldwide, growing by 4% from the previous year, indicating the high potential for off-road applications and increased use of roof racks for long-distance traveling across the world. Also, an estimated 200 million SUVs were in operation in 2021, indicating the high potential for these vehicles and roof racks for traveling.

According to RV Industry Association, sales of camper vehicles crossed 600000 units in 2021. Camper vans are generally outfitted with racks to increase their storage capacity since campers prefer to take their camper vehicles on long outdoor vacations, often to remote locations, stuffed with daily necessities. This increase in the sales of camper vehicles is also leading to a rise in the sales of car racks.

Several OEMs also implement various techniques for passenger comfort and roof rack utility in their models. For instance,

- October, 2022 : German camper specialist Ququq launched the world's first camper kit consisting of a luggage rack specially designed for VW I.D. Buzz. The equipment is priced competitively under USD 3000.

Thus the confluence of all the above factors is predicted to drive the growth of the roof rack period in the next five years.

North America to Play Key Role in Development of Car Rack Market

The car rack market in North America is expected to dominate the overall market during the forecast period. Some of the major factors driving the growth of the US market are the growing demand for vehicles from the tourism sector (car rental and taxi services), increasing demand for recreational vehicles (rising demand for recreational travels among consumers), and a large number of young people moving out to different cities in the United States for studies and work.

The share of leisure trips in the United States was valued at more than 86% of the total tourism in 2021, indicating the huge potential for quality roof racks to be mounted on vehicles. Bicycling and hiking have been voted as the third and fifth most popular outdoor activities preferred by Canadian citizens, which usually require standard car roof racks to mount various equipment and bicycles. This factor further increases the need for car rack equipment in the country.

Although there was a decline in the number of users due to the pandemic, the packaged holidays and vacation rentals segment of Canadian tourism observed a steep rise in the users in 2021, pointing toward an expected increase in the need for multipurpose vehicles equipped with car racks for traveling needs.

With the presence of renowned roof rack manufacturers like Yakima, Allen Group, and Saris Group in the geography, the use of roof racks is expected to be the highest during the forecast period. Therefore, such factors are expected to boost the North American car rack market during the forecast period.

The market is also expected to be driven by the launching of new products by car rack OEMs. For instance

- October, 2022: Lucid Motors launched new Lucid Air Crossbars accessories for Lucid Air Luxury EVs. The accessories include a new aluminum roof storage system capable of support 165 Ib. of load and are available for order now, with shipping beginning in Q4 2022.

Thus, North America is likely to remain the world's largest market for car racks over the next five years due to the above factors.

Car Rack Industry Overview

The car rack market is moderately consolidated with several major and local players. Some of the major market players are Thule Group AB, Yakima Products Inc., Rhino-Rack USA LLC, Car Mate Mfg. Co. Ltd, and Cruzber. Manufacturers are looking at different and innovative designs to be installed onto vehicles that consume less space and are more practical in design aspects. They are focusing on various growth strategies, such as product developments, partnerships, and retail expansion to strengthen their position in the market. For instance,

- September, 2022, Hyundai Mobis introduced new touring accessories Roof Box, Roof Basket, and Bike Carrier for Hyundai Tucson, Creta, Venue, and Kona electric SUV customers in India. These accessories have been developed in association with Thule Group AB.

- October, 2022, Carmate introduced a new storage roof box called Inno which can be attached and removed as a suitcase to the roof of the vehicle. The rooftop box has a capacity of 160 liters and can accommodate chairs and tables of up to 900mm in length.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in USD Billion)

- 5.1 By Application Type

- 5.1.1 Roof Rack

- 5.1.2 Roof Box

- 5.1.3 Bike Car Rack

- 5.1.4 Ski Rack

- 5.1.5 Watersport Carrier

- 5.2 By Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 United Kingdom

- 5.2.2.3 France

- 5.2.2.4 Italy

- 5.2.2.5 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 India

- 5.2.3.3 Japan

- 5.2.3.4 Rest of Asia-Pacific

- 5.2.4 Rest of the World

- 5.2.4.1 Brazil

- 5.2.4.2 South Africa

- 5.2.4.3 Other Countries

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Thule Group

- 6.2.2 Yakima Products Inc.

- 6.2.3 Allen Sports

- 6.2.4 Rhino-Rack USA LLC

- 6.2.5 Cruzber SA

- 6.2.6 ACPS Automotive GmbH

- 6.2.7 Malone Auto Racks

- 6.2.8 Kuat Car Racks

- 6.2.9 Car Mate Mfg Co. Ltd

- 6.2.10 Saris