|

시장보고서

상품코드

1849944

대사체학 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Metabolomics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

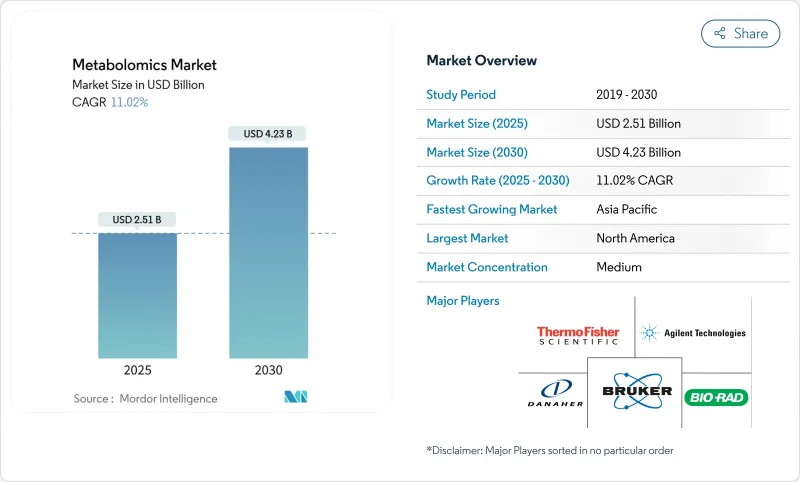

대사체학 시장 규모는 2025년에 25억 1,000만 달러로 추정되고, 예측 기간(2025-2030년)의 CAGR은 11.02%를 나타내, 2030년에는 42억 3,000만 달러에 이를 것으로 예상됩니다.

정밀의료 솔루션에 대한 지속적인 수요, 고해상도 질량 분석 플랫폼의 급속한 개선, 인공지능 파이프라인의 광범위한 배포가 대사체학 시장의 비즈니스 기회를 확대하는 주요 요인입니다. 제약 회사는 개발 기간을 단축하기 위해 메타볼롬 측정치를 초기 단계의 스크리닝에 통합하고 있으며, 병원은 일상 진단에 표적 메타볼롬 패널을 채용하기 시작했습니다. 규제의 조화, 특히 FDA의 Q2(R2) 분석 절차 검증 프레임워크는 임상 워크플로우에 이러한 측정 방법을 통합하는 데 실험실 책임자의 자신감을 깊게 합니다. 보완적인 '오믹스' 자산의 수십억 달러 규모 인수에서 볼 수 있는 경쟁 격화는 엔드 투 엔드 생명과학 툴킷에서 대사의 전략적 중요성을 더욱 돋보이게 합니다. 이러한 역학을 종합하면 견조한 자본 유입을 지원하고 장기적인 성장 궤도를 강화하고 대사체학 시장을 차세대 헬스케아이노베이션의 요점으로 확고하게 하고 있습니다.

세계의 대사체학 시장 동향과 인사이트

개인화/정밀의료에 대한 수요 증가

정밀 영양 및 개인화 치료에 대한 노력으로, 메타볼롬 측정 결과는 임상 판단 경로에 확실히 통합되었습니다. NIH는 다이어트-유전자-메타볼롬 상호작용 연구에 5년간 1억 5,600만 달러를 기록하여 환자별 개입에 대한 정책 수준의 헌신을 강조하고 있습니다. 바구니 및 종합적인 임상시험 디자인에서 순환 대사 산물 프로파일을 통해 환자를 계층화하는 것이 일상적으로 수행됩니다. 대사체학와 유전체 및 proteomics 레이어를 통합 하는 분자 초상화는 진단 특이성을 향상시키고, 부작용 발생률을 감소시키고, 평가된 치료법을 반응성이 높은 하위 집단으로 향합니다. 메타볼롬 데이터는 정적 유전자 바이오마커를 보완하는 실시간 약력학적 피드백을 제공하기 때문에 제약 스폰서는 메타볼롬 데이터를 높이 평가합니다. 현재 검증이 진행되고 있는 POC(Point-of-Care) 기기는 이러한 기능을 1차 케어 환경으로까지 확대해, 액세스 가능한 환자층을 확대해, 대사체학 시장 전체에서 적극적인 흡수의 기세를 강화할 것으로 기대됩니다.

오믹스 기반 신약 개발을 위한 공적 및 민간 연구 개발 자금 증가

장기적인 연구 예산에서 멀티오믹스 인프라에 대한 전용 프레임의 할당이 증가하고 있으며, 대사는 중요한 우선순위로 자주 언급됩니다. 선도적인 제약 회사는 현재 메타볼롬, transcriptome 및 proteomics 데이터 세트를 통합하기 위해 PandaOmics와 같은 AI 구동 주석 엔진을 통합하여 새로운 신약 개발 표적을 밝히고 있습니다. 유럽과 아시아태평양의 경쟁 보조금 프로그램도 희귀질환 연구를 위한 트랜스레이셔널 대사체학에 자금을 제공하고, 국경을 넘은 협업과 NGS와 연동된 화합물 스크리닝의 처리량을 뒷받침하고 있습니다. 벤처기업과 성장주 투자자들은 대사산물 라이브러리를 실용적인 치료 인사이트으로 전환하는 전문 플랫폼 기업들에게 자금을 제공하고 있으며, 대사체학 시장에 새로운 자본과 상업적 규율을 제공합니다. 이러한 자금 주입의 적층은 개발 리스크를 흡수하고 데이터 풍부한 서비스 시장 출시까지의 시간을 단축하고 있습니다.

고급 분석 장비의 자본 집약적 성질

최첨단 고분해능 질량 분석기는 50만-200만 달러로 판매되는 경우가 많으며, 정기적인 서비스 계약에 따라 연간 구매 비용의 10-15%가 늘어납니다. 소규모 연구기관에서는 이러한 자본 지출을 정당화하는데 어려움을 겪고 있으며, 광범위한 보급이 제한되어 자금력 있는 센터에 이용이 집중됩니다. 벤더 주최의 리스 모델과 협력적인 기간 시설 네트워크는 잠정적인 구제책을 제공하지만 예산의 역풍은 여전히 힘든 발판이 되고 있습니다. 그러나 3D 프린터로 제조된 모듈형 구성 요소는 제조 비용을 절감하기 때문에 대사체학 시장은 점차 비용 절감의 이점을 누리고 있습니다. 원격 근무 및 데이터 처리를 가능하게 하는 클라우드 연결 플랫폼은 현장 인프라 요구 사항을 더욱 완화하며, 이러한 제약의 엄격함은 시간이 지남에 따라 약간 완화됩니다.

부문 분석

바이오인포매틱스 툴 및 서비스 분야는 2024년 대사체학 시장 규모의 40.87%를 차지했고 2030년까지 11.87%의 연평균 복합 성장률(CAGR)을 나타낼 것으로 예상되고 있습니다. 이 리더십은 기록된 스펙트럼의 2% 미만만 큐레이션된 라이브러리와 일치시킬 수 있으며, 알고리즘에 의한 어노테이션이 이 분야의 주요 병목 현상이라는 인식에 근거합니다. 새로운 클라우드 네이티브 엔진은 후보가 되는 화합물의 동일성을 확률적인 신뢰성 점수로 순위를 매기면서 더 큰 규모의 저장소와 스펙트럼 데이터를 자동으로 상호 참조합니다. 멀티 테넌트 배포 모델은 계산 오버헤드를 분산하고 리소스에 제약이 있는 실험실 진입 장벽을 낮추고 대사체학 시장에서 사용 가능한 총 사용자 수를 더욱 확대합니다.

microbeMASST와 같은 정교한 파이프라인은 분류학적 메타데이터를 통합하여 이전에 보이지 않았던 미생물과 대사산물의 연관성을 밝혀내고 하류의 기능성 오믹스 연구를 촉진합니다. 사용자 인터페이스가 간소화됨에 따라 고급 코딩 경험이 없는 벤치 사이언티스트도 고차원 패스웨이 매핑을 수행할 수 있어 가설 생성이 가속화됩니다. 하드웨어 공급업체는 엔드 투 엔드로 기기에서 클라우드로 데이터 수집 및 자동 업로드 유틸리티를 제공함으로써 공생적인 수요를 강화하고 있습니다. 이러한 선순환으로 바이오인포매틱스는 백오피스의 지원 역할에서 주요 수익 엔진으로 승격하여 보다 광범위한 시장 세분화에서 이 분야의 지속적인 융성을 보장합니다.

바이오마커와 의약품은 2024년에 31.23%의 수익 점유율을 유지했지만, 개인화된 의료 워크플로우는 15.23%의 연평균 복합 성장률(CAGR)로 확대를 이끌어 환자별 개입의 전략적 중요성을 확인합니다. 영양학을 기반으로 하는 질병 예방에 대한 소비자의 관심은 치료에 맞춘 분석의 임상 도입과 함께 투자의 우선순위를 종합적인 프로파일 매칭 서비스로 재조합하고 있습니다. 독성학 프로그램은 비표적 대사체학 스크린을 활용하여 파이프라인의 초기 단계에서 패스웨이에서 벗어난 부채를 발견하고 후기 단계에서 소모 비용을 절약하고 개정 주기를 이끌고 있습니다. Neutrigenomics 애플리케이션은 생체 활성 화합물의 생체 이용률과 신진 대사 적응을 평가하고 대사체학 시장 전반의 웰빙 지향 이해 관계자의 공감을 얻을 수 있는 실용적인 식사 권장 사항을 제공합니다.

임상실은 대사성 질환, 만성 신장병, 종양 재발 모니터링을 위한 효과적인 패널을 도입하여 실사회에서의 유용성과 상환에 대한 대응력을 입증하고 있습니다. 수백 개의 분석물을 동시에 정량할 수 있는 멀티플렉스 분석의 시작으로 시료당 진단 수율이 향상되고 표적당 비용이 낮아지고 임상의의 채용이 증가합니다. 전자 의료 기록 시스템과의 통합으로 메타볼롬 데이터는 일상 진료에 더욱 통합되어 개인화된 의료가 대사체학 시장의 고성장 프론티어로서의 입지를 강화하고 있습니다.

지역 분석

북미는 2024년에 41.67%의 매출을 차지하며, NIH와 기업 수준의 연구개발비, 성숙한 규제 프레임워크, 서모피셔 사이언티픽의 20억 달러의 생산 능력 확대 계획으로 대표되는 현지 제조에 대한 재투자에 의해 강화되었습니다. 미국의 대사체학 시장 규모는 멀티오믹스 종양학 검사의 광범위한 전개, 대사 패널 상환의 신속한 잡기, 광범위한 산학 협력을 반영합니다. 캐나다의 Precision Health Initiative와 멕시코의 의약품 수출 능력 증가는 이 지역의 총 수익 점유율을 유지하고 추가적인 인상을 초래합니다. 캘리포니아 소비자 프라이버시 법(California Consumer Privacy Act)과 같은 데이터 프라이버시 법은 프라이버시를 강화하는 계산의 조기 채용을 촉진하고 안전하고 상호 운용 가능한 대사체학 데이터 플랫폼에서 북미의 리더십을 강화하고 있습니다.

아시아태평양은 2030년까지 연평균 복합 성장률(CAGR)이 13.78%로 가장 급성장하고 있는 지역으로, 중국의 하이엔드 질량 분석계 어셈블리의 현지화와 인도의 임상시험 인프라의 확대가 그 원동력이 되고 있습니다. 정밀의료를 대상으로 하는 정부의 자극책은 대내 직접 투자와 함께, 티아1 병원 전체의 생산 능력 확대를 지지합니다. 일본의 「기능성 표시 식품」의 틀은 대사체학에 대응한 기능성 표시 식품을 가능하게 해, 프리미엄 가격으로의 판매를 가능하게 하는 것으로, 상업적 관련성을 의약품으로부터 소비자 건강 분야로 확대합니다. 호주와 한국은 강력한 학술 생태계를 활용하여 다국적 기업이 후원하는 임상시험을 유치하고 지역 대사체학 시장의 발자취를 더욱 확대하고 있습니다.

유럽은 조정된 호라이즌 자금을 통한 연구 네트워크, 확립된 바이오 의약품 클러스터, 프라이버시를 보호하는 데이터 연계의 가속적인 도입을 통해 세계 수익의 상당 부분을 유지하고 있습니다. 독일은 엔지니어링의 강점이 지속적인 장비 혁신을 지원하고 영국은 대사 보건을 국민 보건 서비스의 시험 경로에 통합하는 트랜스 래셔널 메디슨 프로그램을 추진하고 있습니다. 프랑스는 멀티오믹스 종양학 검사에 대한 상환을 간소화하고 국내 실험실 수요를 자극합니다. 이탈리아와 스페인에서는 임상 연구의 아웃소싱이 증가하고 검사 건수가 증가하고 있습니다. 유럽 위원회는 환경 친화적이고 지속 가능한 농산물 공급망을 강조하고 식품의 진정성과 환경 모니터링에 대사를 적용하여 유럽 전역에 다양한 수익 채널을 제공합니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 지원

목차

제1장 서론

- 조사 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 맞춤형 의료/정밀의료 수요 증가

- 오믹스에 기초한 신약 개발을 위한 공적 및 민간의 연구개발 자금 확대

- 고분해능 MS 및 LC 플랫폼에서의 기술의 진보

- 의약품 파이프라인에서 멀티오믹스 워크플로우 통합의 채용 확대

- AI 구동형 대사물 어노테이션 플랫폼이 분석 시간을 단축

- 희귀 세포 프로파일링을 위한 단일 세포 및 공간 대사체학의 확장

- 시장 성장 억제요인

- 고급 분석 기기의 자본 집약성

- 메타볼롬의 전문지식을 가진 바이오인포매틱스 전문가의 부족

- 세계적으로 조화를 이룬 대사물 기준 표준의 부족

- 연합 임상 네트워크에서 데이터 프라이버시 장애물

- Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업 간 경쟁 관계

제5장 시장 규모와 성장 예측(달러)

- 제품 및 서비스별

- 분석 기기

- 분리 기술

- 액체 크로마토그래피

- 가스 크로마토그래피

- 모세관 전기영동

- 검출 기술

- 질량 분석법

- 핵자기 공명

- 기타 검출 기술

- 생물정보학 도구 및 서비스

- 분석 기기

- 용도별

- 바이오마커 및 신약 개발

- 독성학

- 영양유전체학

- 맞춤형 의학

- 임상 진단

- 환경 및 농업 연구

- 적응증별

- 종양학

- 심혈관 질환

- 신경계 질환

- 감염성 질환

- 대사 장애

- 최종 사용자별

- 학술 및 연구 기관

- 제약 및 바이오테크놀러지 기업

- 계약 연구 기관

- 병원 및 진단 실험실

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 기타 아시아태평양

- 중동 및 아프리카

- GCC

- 남아프리카

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 경쟁 구도

- 시장 집중도

- 시장 점유율 분석

- 기업 프로파일

- Thermo Fisher Scientific

- Agilent Technologies

- Danaher-SCIEX

- Waters Corporation

- Bruker

- Shimadzu Corporation

- PerkinElmer

- LECO Corporation

- Bio-Rad Laboratories

- Kore Technology

- Metabolon

- Biocrates Life Sciences

- Chenomx

- Metabolomic Discoveries

- Creative Proteomics

- Human Metabolome Technologies

- Metabolomics Australia

- Exalenz Bioscience

- Owlstone Medical

- AbsoluteIDQ

제7장 시장 기회와 향후 전망

KTH 25.11.04The Metabolomics Market size is estimated at USD 2.51 billion in 2025, and is expected to reach USD 4.23 billion by 2030, at a CAGR of 11.02% during the forecast period (2025-2030).

Sustained demand for precision-medicine solutions, rapid improvements in high-resolution mass-spectrometry platforms, and widespread deployment of artificial-intelligence pipelines are the primary forces widening the metabolomics market opportunity set. Pharmaceutical companies are embedding metabolomic readouts in early-stage screening to shorten development timelines, while hospitals are beginning to adopt targeted metabolite panels for routine diagnostics. Regulatory harmonization-most notably the FDA's Q2(R2) analytical-procedure validation framework gives laboratory directors greater confidence to integrate these assays into clinical workflows. Intensifying competition, manifested in multi-billion-dollar acquisitions of complementary "omics" assets, further highlights the strategic importance of metabolomics within end-to-end life-science toolkits. Collectively, these dynamics underpin robust capital inflows, reinforce the long-term growth trajectory, and solidify the metabolomics market as a cornerstone of next-generation healthcare innovation.

Global Metabolomics Market Trends and Insights

Rising Demand for Personalized/Precision Medicine

Precision-nutrition and individualized-therapy initiatives are firmly embedding metabolomic readouts into clinical-decision pathways. The NIH has earmarked USD 156 million over five years to study diet-gene-metabolome interactions, underscoring policy-level commitment to patient-specific interventions. Basket and umbrella clinical-trial designs routinely stratify patients by circulating metabolite profiles, which accelerates enrollment and enhances statistical power. Molecular portraits that integrate metabolomics with genomic and proteomic layers improve diagnostic specificity, reduce adverse-event rates, and direct evaluated therapies toward responsive sub-populations. Pharmaceutical sponsors value metabolomic data because it delivers real-time pharmacodynamic feedback that complements static genetic biomarkers. Point-of-care devices, currently undergoing validation, promise to extend these capabilities to primary-care settings, broadening the total accessible patient pool and reinforcing positive uptake momentum across the metabolomics market.

Escalating Public & Private R&D Funding for Omics-Based Drug Discovery

Long-cycle research budgets increasingly allocate dedicated lines to multi-omics infrastructure, with metabolomics frequently cited as a critical short-list priority. Large pharmaceutical enterprises now integrate AI-driven annotation engines, such as PandaOmics, to converge metabolomic, transcriptomic, and proteomic datasets, thereby illuminating novel druggable targets. Competitive grant programs in Europe and Asia-Pacific also fund translational metabolomics for rare-disease research, boosting cross-border collaboration and NGS-linked compound-screening throughput. Venture and growth-equity investors continue to fund specialist platform companies that convert metabolite libraries into actionable therapeutic insights, bringing fresh capital and commercial discipline to the metabolomics market. These cumulative injections of funding absorb development risk and accelerate time-to-market for data-rich services.

Capital-Intensive Nature of Advanced Analytical Instruments

State-of-the-art high-resolution mass spectrometers often sell for USD 500,000-2 million, with recurrent service contracts adding 10-15% of purchase cost annually. Smaller institutions struggle to justify such capital outlays, constraining broader diffusion and keeping usage concentrated among well-funded centers. Vendor-hosted leasing models and collaborative core-facility networks provide interim relief, yet budgetary headwinds remain a formidable drag. The metabolomics market nevertheless benefits from gradual cost compression as modular, 3D-printed components reduce manufacturing expense. Cloud-connected platforms that enable remote operation and data processing further alleviate on-site infrastructure requirements, slightly easing this restraint's severity over time.

Other drivers and restraints analyzed in the detailed report include:

- Technological Advances in High-Resolution MS and LC Platforms

- Growing Adoption of Multi-Omics Workflow Integration in Pharma Pipelines

- Shortage of Bioinformaticians with Metabolome Expertise

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The bioinformatics tools and services segment captured 40.87% of the metabolomics market size in 2024 and is projected to sustain an 11.87% CAGR through 2030, reflecting the data-centric orientation of modern metabolomics workflows. This leadership is anchored in the recognition that fewer than 2% of recorded spectra can be matched to curated libraries, turning algorithmic annotation into the field's primary bottleneck. Emerging cloud-native engines automatically cross-reference spectral data against ever-larger repositories while ranking putative compound identities with probabilistic confidence scores. Multi-tenant deployment models distribute computational overhead and lower entry barriers for resource-constrained laboratories, further expanding total addressable users inside the metabolomics market.

Sophisticated pipelines such as microbeMASST now integrate taxonomic metadata, unlocking previously invisible microbial-metabolite linkages and fuelling downstream functional-omics investigations. As user interfaces simplify, bench scientists without advanced coding experience can execute high-dimensional pathway mapping, which in turn accelerates hypothesis generation. Hardware vendors reinforce symbiotic demand by offering end-to-end instrument-to-cloud data capture and automated upload utilities. This virtuous cycle elevates bioinformatics from a back-office support role to a primary revenue engine, ensuring the segment's continued prominence within the broader metabolomics market.

Biomarker and drug discovery maintained 31.23% revenue share in 2024; however, personalized-medicine workflows will lead expansion at a 15.23% CAGR, confirming the strategic importance of patient-specific interventions. Consumer interest in nutrition-based disease prevention, alongside clinical adoption of treatment-tailoring assays, is realigning investment priorities toward comprehensive profile-matching services. Toxicology programs leverage untargeted metabolomic screens to uncover off-pathway liabilities earlier in the pipeline, saving late-stage attrition cost and guiding revision cycles. Nutrigenomics applications assess bioactive-compound bioavailability and metabolic adaptation, delivering actionable dietary recommendations that resonate with wellness-oriented stakeholders across the metabolomics market.

Clinical laboratories implement validated panels for metabolic disorders, chronic kidney disease, and oncology recurrence monitoring, demonstrating real-world utility and reimbursement readiness. The rise of multiplex assays capable of quantifying hundreds of analytes simultaneously enhances diagnostic yield per sample, lowering per-target cost and increasing clinician adoption. Integration with electronic health-record systems further embeds metabolomic data into routine care, reinforcing personalized medicine's status as the high-growth frontier of the metabolomics market.

The Metabolomics Market Report Segments the Industry Into by Product & Service (Analytical Instruments [Separation Techniques, and More], and More), Application (Biomarker and Drug Discovery, Toxicology, and More), Indication (Oncology, and More), End User (Academic & Research Institutes, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America preserved 41.67% revenue leadership in 2024, fortified by robust NIH and enterprise-level R&D spending, mature regulatory frameworks, and local manufacturing reinvestment exemplified by Thermo Fisher Scientific's USD 2.0 billion capacity expansion plan. The metabolomics market size for the United States reflects widespread deployment of multi-omics oncology tests, fast catch-up of metabolic-panel reimbursement, and extensive academic-industry partnerships. Canada's precision-health initiatives and Mexico's growing pharmaceutical export capacity provide incremental lift, sustaining the region's aggregate revenue share. Data-privacy legislation such as the California Consumer Privacy Act drives early adoption of privacy-enhancing computation, reinforcing North American leadership in secure, interoperable metabolomics data platforms.

Asia-Pacific represents the fastest-growing territory at a 13.78% CAGR through 2030, driven by China's localization of high-end mass-spectrometer assembly and India's scaling clinical-trial infrastructure. Government stimulus packages covering precision medicine, coupled with inward foreign-direct investment, underpin capacity build-out across Tier-1 hospitals. Japan's Foods with Function Claims framework enables metabolomics-supported functional-food labels that command premium shelf pricing, extending commercial relevance beyond pharma into consumer-health sectors. Australia and South Korea leverage strong academic ecosystems to attract multinational-sponsored trials, further enlarging the regional metabolomics market footprint.

Europe maintains a substantial portion of global revenue through coordinated Horizon-funded research networks, established biopharmaceutical clusters, and accelerated adoption of privacy-preserving data federations. Germany's engineering prowess undergirds continued instrumentation innovation, while the United Kingdom pushes translational medicine programs that embed metabolomics into National Health Service pilot pathways. France streamlines reimbursement for multi-omics oncology tests, stimulating domestic laboratory demand. Italy and Spain add volume via growing clinical-research outsourcing assignments. The European Commission's emphasis on green and sustainable agrifood supply chains triggers additional metabolomics market applications in food authenticity and environmental surveillance, providing diversified revenue channels across the continent.

- Thermo Fisher Scientific

- Agilent Technologies

- Danaher - SCIEX

- Waters Corporation

- Bruker

- Shimadzu

- PerkinElmer

- LECO

- Bio-Rad Laboratories

- Kore Technology

- Metabolon

- Biocrates Life Sciences

- Chenomx

- Metabolomic Discoveries

- Creative Proteomics

- Human Metabolome Technologies

- Metabolomics Australia

- Exalenz Bioscience

- Owlstone Medical

- AbsoluteIDQ

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Demand for Personalized / Precision Medicine

- 4.2.2 Escalating Public & Private R&D Funding for Omics-Based Drug Discovery

- 4.2.3 Technological Advances in High-Resolution MS And LC Platforms

- 4.2.4 Growing Adoption of Multi-Omics Workflow Integration in Pharma Pipelines

- 4.2.5 AI-Driven Metabolite-Annotation Platforms Shortening Analysis Time

- 4.2.6 Expansion of Single-Cell & Spatial Metabolomics for Rare-Cell Profiling

- 4.3 Market Restraints

- 4.3.1 Capital-Intensive Nature of Advanced Analytical Instruments

- 4.3.2 Shortage of Bioinformaticians with Metabolome Expertise

- 4.3.3 Lack of Globally Harmonised Metabolite Reference Standards

- 4.3.4 Data-Privacy Hurdles in Federated Clinical Metabolomics Networks

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitutes

- 4.4.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Product & Service

- 5.1.1 Analytical Instruments

- 5.1.1.1 Separation Techniques

- 5.1.1.1.1 Liquid Chromatography

- 5.1.1.1.2 Gas Chromatography

- 5.1.1.1.3 Capillary Electrophoresis

- 5.1.1.2 Detection Techniques

- 5.1.1.2.1 Mass Spectrometry

- 5.1.1.2.2 Nuclear Magnetic Resonance

- 5.1.1.2.3 Other Detection Techniques

- 5.1.2 Bioinformatics Tools & Services

- 5.1.1 Analytical Instruments

- 5.2 By Application

- 5.2.1 Biomarker & Drug Discovery

- 5.2.2 Toxicology

- 5.2.3 Nutrigenomics

- 5.2.4 Personalized Medicine

- 5.2.5 Clinical Diagnostics

- 5.2.6 Environmental & Agricultural Research

- 5.3 By Indication

- 5.3.1 Oncology

- 5.3.2 Cardiovascular Diseases

- 5.3.3 Neurological Disorders

- 5.3.4 Infectious Diseases

- 5.3.5 Metabolic Disorders

- 5.4 By End User

- 5.4.1 Academic & Research Institutes

- 5.4.2 Pharmaceutical & Biotechnology Companies

- 5.4.3 Contract Research Organizations

- 5.4.4 Hospitals & Diagnostic Laboratories

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Thermo Fisher Scientific

- 6.3.2 Agilent Technologies

- 6.3.3 Danaher - SCIEX

- 6.3.4 Waters Corporation

- 6.3.5 Bruker

- 6.3.6 Shimadzu Corporation

- 6.3.7 PerkinElmer

- 6.3.8 LECO Corporation

- 6.3.9 Bio-Rad Laboratories

- 6.3.10 Kore Technology

- 6.3.11 Metabolon

- 6.3.12 Biocrates Life Sciences

- 6.3.13 Chenomx

- 6.3.14 Metabolomic Discoveries

- 6.3.15 Creative Proteomics

- 6.3.16 Human Metabolome Technologies

- 6.3.17 Metabolomics Australia

- 6.3.18 Exalenz Bioscience

- 6.3.19 Owlstone Medical

- 6.3.20 AbsoluteIDQ

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment