|

시장보고서

상품코드

1686231

자동차용 안전벨트 프리텐셔너 시장(2025-2030년) : 시장 점유율 분석, 산업 동향, 성장 예측Automotive Seat Belt Pretensioner - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

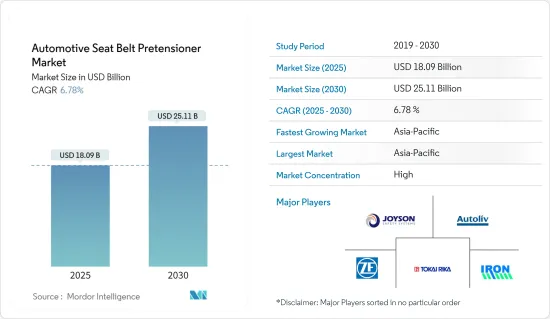

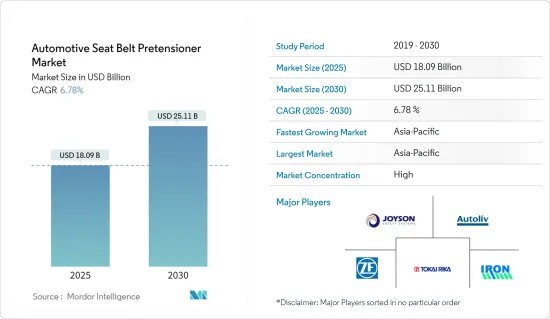

자동차용 안전벨트 프리텐셔너 시장 규모는 2025년에 180억 9,000만 달러로 추정되며, 예측 기간(2025-2030년) 동안 CAGR 6.78%로 성장하여 2030년에는 251억 1,000만 달러에 달할 것으로 예측됩니다.

주요 하이라이트

- 자동차용 안전벨트 프리텐셔너 시장은 탑승자의 안전에 대한 의식이 고조되고 자동차 안전 표준에 대한 정부의 엄격한 규제로 인해 수년 동안 큰 성장을 이루고 있습니다. 프리텐셔너는 충돌 시에 안전벨트를 감아 탑승자를 고정시켜 상해 위험을 최소화하는 장치입니다.

- 그러나 COVID-19의 대유행은 안전벨트 프리텐셔너 시장을 포함한 자동차 산업에 큰 영향을 주었습니다.

- 게다가 봉쇄 조치나 여행 제한에 의한 공급 체인의 혼란이 안전벨트 프리텐셔너를 포함한 자동차 부품의 생산과 판매에 영향을 주었습니다.

- 그러나 각국이 규제를 완화하고 자동차 산업이 생산을 재개하면서 안전벨트 프리텐셔너 시장은 회복의 조짐을 보이기 시작했습니다. 자동차 내 첨단 안전장비의 채용 확대가 안전벨트 프리텐셔너 수요를 한층 더 높이고 있습니다.

- 또, 안전벨트 프리텐셔너의 성능과 효율의 향상을 목표로 한 연구 개발이 진행되고 있어 시장 성장의 원동력이 될 것으로 기대됩니다.

자동차용 안전벨트 프리텐셔너 시장 동향

승용차 부문이 시장의 대부분을 차지할 전망

- 오랜 세월 동안, 프리텐셔너는 승용차 탑승자의 안전성 향상에 중요한 역할을 해 왔습니다.

- 탑승자의 안전에 대한 의식이 높아지고 세계의 교통사고 증가에 의해 자동차의 첨단 안전기능에 대한 수요가 높아지고 있습니다. 안전 규제를 준수하고 보다 안전한 자동차를 요구하는 소비자 수요에 대응하기 위해 자동차 제조업체는 안전벨트 프리텐셔너를 차종에 표준 장비 또는 옵션 장비로서 적극적으로 도입하고 있습니다.

- 게다가 기술의 진보는 보다 세련된 안전벨트 프리텐셔너 시스템의 개발로 이어졌습니다.

- 또한 자동차 제조업체는 안전벨트 프리텐셔너, 안전벨트 포스 리미터, 조정 가능한 상단 앵커, 안전벨트 높이 조절기와 같은 기타 안전 기능을 통해 전체 승객의 편안함과 편의성을 향상시키는 것에 주력하고 있습니다. 이러한 통합 시스템은 종합적인 안전 패키지를 제공하여 보다 나은 운전 경험에 기여합니다.

아시아태평양이 예측 기간 동안 가장 빠른 성장을 이룰 전망

- 아시아태평양은 지역 내 자동차 판매 증가에 의해 수량 및 금액으로 최대의 점유율을 차지할 것으로 예상됩니다.

- 교통사고 사망자수 증가에 의해 이 지역의 각국 정부는 예방 조치를 강구하여 운전자와 동승자 모두가 안전벨트를 착용하도록 의무화하였습니다.

- 2018년 한국은 전좌석 안전벨트 의무화를 발표하였으며 이에 따르면 여행 중인 승객은 모두 안전벨트를 착용해야 합니다. 위반 시에는 3만원의 벌금이 부과되며 13세 미만에게는 2배의 벌금이 부과됩니다.

자동차용 안전벨트 프리텐셔너 산업 개요

이 시장은 비교적 통합되어 있으며 5개사 정도가 시장 점유율의 50% 이상을 차지하고 있습니다.

안전벨트 프리텐셔너에 대한 수요가 높아짐에 따라, 여러 업체가 업계의 대기업과 제휴하여 향후 발매되는 차종용으로 부품을 조달하고 있습니다. 2021년 12월 출시된 BMW의 I4 차종에는 Dingerkus사의 시트 프리텐셔너 시스템이 탑재되어 있습니다.

이 외에도 세계의 거의 모든 국가에서 안전 기준이 강화됨에 따라 일부 자동차 제조업체가 안전벨트 프리텐셔너를 도입하고 있습니다.

예를 들면, 르노 인디아는 2021년 6월, 최소 기능 모델로 가장 기본적인 안전 사양을 테스트했습니다.

이 시장의 주요 기업으로는 Joyson Safety Systems, Autoliv Inc., Tokai Rika Co. Ltd, Iron Force Industrial 등이 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 성장 촉진요인

- 승용차 부문이 시장의 대부분을 차지할 전망

- 기타

- 시장 성장 억제요인

- 공급망의 혼란

- 기타

- 업계의 매력 - Porter's Five Forces 분석

- 공급자의 협상력

- 소비자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

제5장 시장 세분화

- 기술별

- 리트랙터 프리텐셔너

- 버클식 프리텐셔너

- 시트 유형별

- 리어

- 프런트

- 차량 유형별

- 승용차

- 상용차

- 최종 사용자별

- OEM

- 애프터마켓

- 지역별

- 북미

- 미국

- 캐나다

- 기타 북미

- 유럽

- 독일

- 영국

- 프랑스

- 러시아

- 스페인

- 기타 유럽

- 아시아태평양

- 인도

- 중국

- 일본

- 한국

- 기타 아시아태평양

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 중동 및 아프리카

- 아랍에미리트(UAE)

- 사우디아라비아

- 기타 중동 및 아프리카

- 북미

제6장 경쟁 구도

- 벤더의 시장 점유율

- 기업 프로파일

- ZF Friedrichshafen AG

- Autoliv Inc.

- Ashimori Industry Co. Ltd

- Joyson Safety Systems

- ITW Automotive Products GmbH

- Continental AG

- Hyundai Mobis Co. Ltd

- Special Devices Inc.

- Iron Force Industrial Co. Ltd

- Tokai Rika Co. Ltd

- Hasco Co. Ltd

제7장 시장 기회와 미래 동향

CSM 25.04.25The Automotive Seat Belt Pretensioner Market size is estimated at USD 18.09 billion in 2025, and is expected to reach USD 25.11 billion by 2030, at a CAGR of 6.78% during the forecast period (2025-2030).

Key Highlights

- The automotive seat belt pre-tensioner market has experienced significant growth over the years due to the increasing importance of occupant safety and stringent government regulations on vehicle safety standards. A pre-tensioner is a device that rolls up the seat belt and tightens around the occupant in the event of a collision, minimizing the risk of injury. These devices have become an important part of modern vehicles and contribute to the overall safety of occupants.

- However, the COVID-19 pandemic had a major impact on the automotive industry, including the seat belt pre-tensioner market. The global pandemic led to temporary closures of manufacturing plants and reduced car production and sales as economic uncertainty and travel restrictions reduced consumer demand. This led to a significant drop in demand for automotive seatbelt pre-tensioners in the early stages of the pandemic.

- In addition, supply chain disruptions due to lockdown measures and travel restrictions have affected the production and sales of auto parts, including seat belt pre-tensioners. Border closures and international trade restrictions have further impacted the availability of raw materials and components, exacerbating the challenges for manufacturers.

- However, as countries began to ease regulations and the automotive industry resumed operations, the seat belt pre-tensioner market began to show signs of recovery. The resumption of manufacturing activity, stagnant demand, and a gradual recovery in consumer confidence supported the market recovery. In addition, increased focus on occupant safety in post-pandemic scenarios and increased adoption of advanced safety features in vehicles have further increased the demand for seat belt pretensioners. Automakers are integrating advanced technologies such as pyrotechnic seatbelt pre-tensioners and electric seatbelt pre-tensioners to improve occupant protection and meet stringent safety regulations.

- In addition, ongoing research and development activities aimed at improving the performance and efficiency of seat belt pre-tensioners are expected to drive market growth. Manufacturers are focused on developing lightweight, cost-effective belt tensioner systems that provide greater safety and passenger comfort.

Automotive Seat Belt Pretensioner Market Trends

Passenger Car Segment Expected to Hold Majority Share in the Market

- Over the years, pre-tensioners played a key role in improving the safety of passenger car occupants. Integrated into the seatbelt system, these devices are designed to instantly retract and tighten the seatbelt in the event of a crash or sudden deceleration, reducing the forward movement of the occupant and minimizing impact. Increased risk of injury.

- The growing awareness of passenger safety and the increase in traffic accidents worldwide are increasing the demand for advanced safety functions in vehicles. Governments and regulators have also introduced stringent safety standards, mandating the installation of seat belt pre-tensioners in passenger vehicles. To comply with safety regulations and meet consumer demand for safer vehicles, automakers are aggressively incorporating seatbelt pretensioners as standard or optional equipment into their vehicle models.

- Additionally, advances in technology have led to the development of more sophisticated seat belt tensioner systems. For instance, pyrotechnic pretensioners, which use small gunpowder to activate the pre-tensioner mechanism, are growing in popularity due to their effectiveness and reliability.

- In addition, automakers are focusing on improving overall occupant comfort and convenience with other safety features such as seatbelt pre-tensioners and seatbelt force limiters, adjustable top anchors, and seatbelt height adjusters. Leading to the integration of These integrated systems offering a comprehensive safety package and contributing to a better driving experience. Regionally, the passenger car seat belt pre-tensioner market recorded significant growth in various regions. For instance,

Asia-Pacific to Witness Fastest Growth over the Forecast Period

- Asia-Pacific is expected to occupy the largest share by volume and value due to the growing vehicle sales in the region. Countries such as China, South Korea, Japan, and India are the major manufacturers of automotive seatbelt pretensioners. The increasing number of premium vehicles and strict road safety norms are expected to drive the Asia-Pacific automotive seatbelt pretensioner market during the forecast period.

- Increasing fatalities due to road accidents have forced governments across the region to take preventive measures and make seatbelts mandatory for both drivers and passengers.

- In 2018, South Korea introduced Universal Seatbelt Law, according to which every passenger traveling will have to wear a seatbelt. Violation of the law will attract a penalty of KRW 30,000, and those younger than 13 will be fined twice as high. Owing to the above-mentioned factors, the automotive seatbelt pretensioner market is expected to experience a boost in the Asia-Pacific region.

Automotive Seat Belt Pretensioner Industry Overview

The market is said to be relatively consolidated, with about five players accounting for more than 50% of the market share. These companies have been expanding their businesses with new products to have an edge over their competitors.

Owing to increased demand for seatbelt pretensioners, several manufacturers are partnering with major players in the industry to source components for their upcoming vehicle models. For instance, in December 2021, BMW launched its new I4 at the BMW World event at corporate HQ in Munich. The new I4 equips a seat pretensioner system from Gedia Gebrueder Dingerkus.

Apart from these, several automobile manufacturers have been introducing seatbelt pretensioners in the wake of increased safety standards in virtually every country of the world.

For instance, Renault India, in June 2021, tested its most basic safety specifications in models that were offered with bare minimum features. The Triber model, for instance, showed significant improvements with improved chest and head protection for rear-seat passengers. The vehicle offers optimum head and body protection with the help of the proper positioning of center seat belts.

Some of the key players in the market are Joyson Safety Systems, Autoliv Inc., Tokai Rika Co. Ltd, and Iron Force Industrial Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Passenger Car Segment Expected to Hold Majority Share in the Market

- 4.1.2 Others

- 4.2 Market Restraints

- 4.2.1 Disturbances in Supply Chain

- 4.2.2 Others

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Technology

- 5.1.1 Retractor Pretensioner

- 5.1.2 Buckle Pretensioner

- 5.2 By Seat Type

- 5.2.1 Rear

- 5.2.2 Front

- 5.3 By Vehicle Type

- 5.3.1 Passenger Cars

- 5.3.2 Commercial Vehicles

- 5.4 By End-user Type

- 5.4.1 OEM

- 5.4.2 Aftermarket

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Russia

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 India

- 5.5.3.2 China

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 ZF Friedrichshafen AG

- 6.2.2 Autoliv Inc.

- 6.2.3 Ashimori Industry Co. Ltd

- 6.2.4 Joyson Safety Systems

- 6.2.5 ITW Automotive Products GmbH

- 6.2.6 Continental AG

- 6.2.7 Hyundai Mobis Co. Ltd

- 6.2.8 Special Devices Inc.

- 6.2.9 Iron Force Industrial Co. Ltd

- 6.2.10 Tokai Rika Co. Ltd

- 6.2.11 Hasco Co. Ltd