|

시장보고서

상품코드

1849996

PET(양전자 방출 단층촬영) : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Positron Emission Tomography - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

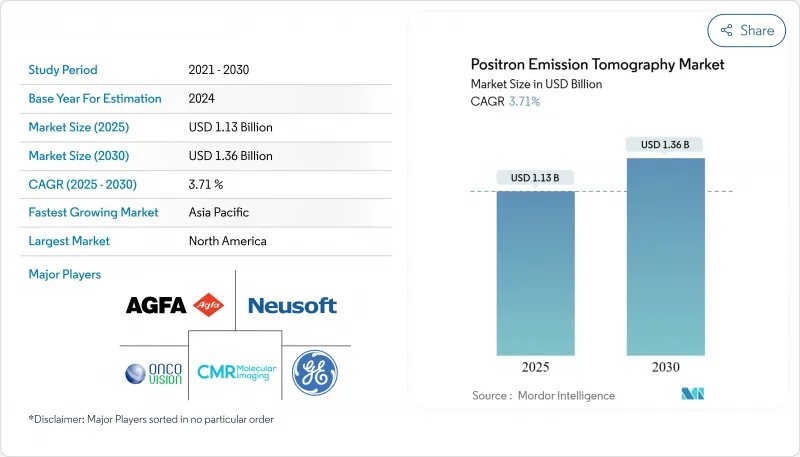

PET(양전자 방출 단층촬영) 시장 규모는 2025년에 11억 3,000만 달러로 평가되었고, 2030년에 13억 6,000만 달러로 확대될 것으로 예측되며, CAGR은 3.71%를 나타낼 전망입니다.

고감도 분자 영상에 대한 견고한 수요와 정밀 종양학 분야의 가속화된 도입이 꾸준한 확장을 설명합니다.

양전자 방출 단층촬영 시장 규모는 의료 시스템이 분자 영상을 정밀 종양학, 치매 치료, 허혈성 심장 질환 프로토콜에 필수적이라고 간주함에 따라 소폭 상승하고 있습니다. 성숙한 병원들은 10년 된 스캐너를 전신용 장비로 교체하고 있습니다. 이 장비의 194cm 축 방향 시야는 검출기 감도를 10배로 높여 1분 이내 전신 스캔을 가능하게 하며 추적자 투여량을 80% 절감합니다. 한편 신흥 경제국들은 양허성 대출을 활용해 최초의 사이클로트론을 구축함으로써 장비 주문 기반이 되는 동위원소 공급을 확보하고 있습니다. 공급업체들은 외래 환자 체인에 대한 초기 자본 노출을 최소화하는 사용량 기반 서비스 계약을 구성하여 도입을 촉진합니다.

인공지능 통합은 두 번째 성장 축을 창출합니다. 클라우드 기반 알고리즘은 이제 PET/CT에서 6가지 암 유형을 몇 초 만에 식별하여 방사선과 의사 병목 현상을 해소하고 진단 신뢰도를 높입니다. 공급업체들은 소프트웨어 번들 스캐너가 추가 인력 없이 처리량 향상을 가능케 한다고 판단하며, 이는 영상 검사 보험급여를 안정적으로 유지해야 하는 압박과 부합합니다. 결과적으로 구매팀은 검출기 성능과 알고리즘 업데이트 로드맵을 결합한 수명주기 가치 지표를 평가하며 경쟁 입찰 구조를 재편하고 있습니다.

세계의 PET(양전자 방출 단층촬영) 시장 동향 및 인사이트

암과 신경퇴행성 질환의 세계적 부담 증가

암 발병률은 계속 상승 중이며 그 수치는 충격적입니다. 미국에서만 미국암협회는 2022년 신규 암 진단 건수를 191만 8,030건으로 추정하고 있으며, 그 내역은 유방암 29만5,060건, 전립선암 26만8,490건, 대장암 15만1,030건입니다. 구조적 이상보다 먼저 대사 변화를 탐지하는 PET의 강점은 조기 병기 결정 및 치료 모니터링에 필수적인 도구로 자리매김하게 합니다. 신경학 분야에서는 푸단대학교 연구진이 파킨슨병에서 α-시누클레인 응집체를 시각화하는 추적자를 검증하여 조기 개입에 대한 기대를 높였습니다. 이러한 기능에 대한 임상적 친숙도가 높아짐에 따라 스캐너 활용률은 지속적으로 높게 유지되며, 병원의 주기적인 기술 업데이트 의지를 뒷받침하고 있습니다.

증가하는 기술 발전

194cm 길이의 uEXPLORER와 같은 전신 스캐너는 감도를 10배 향상시켜 1분 이내에 전신 촬영을 가능하게 하며, 추적자 투여량을 80% 이상 절감합니다. 의료 제공자들은 이러한 이점이 추가 인력 투입 없이 환자 처리량 증가로 이어져 장비 업그레이드의 경제적 타당성을 높인다고 분석합니다. 또한 NeuroEXPLORER는 1.64mm 공간 분해능을 달성하여 기존 검출 한계치 미만의 뇌 구조물 시각화를 가능케 합니다. 이러한 플랫폼과 AI 종양 탐지 도구의 통합은 보고서 처리 시간을 단축시키며, 이는 의료 시스템이 자본 예산 승인 시 점차 정량화하는 운영상의 이점입니다.

방사성 동위 원소의 반감기 단축

18F의 110분 반감기는 운송 거리를 제한하여 농촌 시장의 서비스 공백을 초래합니다. 해결책으로는 GE 헬스케어의 MINItrace Magni와 같은 소형 사이클로트론부터 반감기 3.33시간의 61Cu-PSMA와 같은 신형 추적자까지 다양하며, 이는 유통 반경을 확대합니다. 의료 제공자들은 이러한 발전이 중앙 집중식 생산에 대한 의존도가 점차 완화될 수 있다는 초기 증거로 해석하며, 동위원소 공급업체 간 경쟁 역학이 재편될 수 있다고 전망합니다.

부문 분석

풀 링 스캐너는 2024년 양전자 방출 단층촬영(PET) 시장의 71% 점유율을 차지하며, 이들의 시장 규모 우위는 타의 추종을 불허하는 감도와 전신 커버리지에서 비롯됩니다. 의료 기관들은 고가의 초기 비용에도 불구하고, 복잡한 종양학 사례를 지원하기 위한 프리미엄 화질에 의존하며 이는 구매 논리를 강화합니다. 논리적 귀결로서, 연구 명성을 추구하는 시설들은 거의 예외 없이 풀 링 디자인을 선택합니다.

부분 링 시스템은 소형 설치 공간이 필요한 신경학 및 정형외과 하위 전문 분야를 대상으로 2030년까지 4.5%의 연평균 성장률(CAGR)을 보일 전망입니다. 비용 절감과 집중된 시야 범위는 손익분기점 시술 건수를 낮추는 효과를 가져와, 이러한 장비를 외래 수술 센터에 매력적으로 만듭니다. 전용 뇌 PET의 부상은 동일한 네트워크 내에서 전문 하드웨어가 주력 전신 시스템과 공존할 수 있음을 보여줍니다. 이는 기존 자산을 잠식하지 않으면서 수익원을 다각화합니다.

PET/CT는 2024년 양전자 방출 단층촬영 시장 규모의 81%를 차지합니다. 대사적, 해부학적 세부 정보의 융합이 표준화된 암 병기 결정 프로토콜의 기반이 되기 때문입니다. 이 방식은 대규모 설치 기반의 혜택을 받아 공급업체의 서비스 수익을 뒷받침합니다.

소아과 등 방사선에 민감한 환자군이 저선량 옵션으로 이동함에 따라 PET/MRI는 4.9% CAGR로 가장 빠른 성장률을 기록하고 있습니다. 위암에 대한 우수한 연조직 대비도를 입증하는 증거는 그 가치 제안을 더욱 공고히 합니다. 따라서 병원들은 PET/MRI를 임상 결과와 ESG 연계 방사선 노출 목표를 동시에 진전시키는 투자로 평가합니다.

PET(양전자 방출 단층촬영) 시장 보고서는 제품 유형별(풀 링 PET 스캐너, 부분 링 PET 스캐너), 용도별(심장병학, 신경학, 종양학, 기타 용도), 최종사용자별(병원, 진단센터, 기타 최종사용자), 지역별(북미, 유럽, 아시아태평양, 중동 및 아프리카, 남미)로 업계를 분류합니다.

지역별 분석

북미는 2024년 양전자 방출 단층촬영 시장 점유율 38.9%를 차지하며 여전히 최대 지역 기여자로 남아 있습니다. 미국 고정 PET 사이트는 전년 대비 10.2%의 스캔 증가율을 기록했으며, 시스템당 평균 1,495건의 연구를 수행했습니다. 위스콘신주에서 Omni Legend PET/CT의 국내 생산은 국내 공급망을 선호하는 정책적 추진력을 강조합니다. 정책적 함의는 현지 생산이 부품 공급망에 영향을 미치는 지정학적 충격으로부터 시장을 완충한다는 점입니다.

아시아태평양 지역은 정부 인프라 투자와 만성질환 부담 증가에 힘입어 2030년까지 5.2%의 가장 빠른 지역별 연평균 성장률(CAGR)을 기록할 전망입니다. 중국의 의료용 동위원소 중장기 개발 계획은 국내 추적자(tracer) 혁신을 촉진하며, 중산대학 암센터는 이미 3만 건 이상의 전신 PET/CT 검사를 수행했습니다. 이러한 검사량 밀도는 규모의 경제가 방사성 의약품 가격을 조만간 하락시켜 인접 시장의 접근성을 높일 수 있음을 시사합니다.

유럽은 GE 헬스케어가 주도하는 2,530만 유로 규모의 Thera4Care 컨소시엄과 같은 연구 협력에 기반한 꾸준한 수요를 창출합니다. 그러나 자체 추적자 생산을 규율하는 이질적인 규정들은 규정 준수 부담을 야기하여 공급업체 전략을 분열시키고 있습니다. PRISMAP 방사성 핵종 생산 연합은 공급을 조화시키기 위해 노력 중이며, 센터들이 예상되는 동위원소 가용성에 맞춰 구매를 조정함에 따라 그 진전은 스캐너 조달 일정에 영향을 미칠 것으로 보입니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 전 세계적으로 증가하는 암 및 신경퇴행성 질환 부담

- 기술 발전 가속화

- 사이클로트론 및 중앙 집중형 방사성 의약품 네트워크 확장

- 방사성 의약품 분야에서 PET 분석 수요 증가

- 영상 유도 중재술로의 전환

- 전립선암 치료용 68Ga-PSMA PET에 대한 정부 보험 적용(호주, 독일)

- 시장 성장 억제요인

- 방사성 동위원소의 짧은 반감기

- 엄격한 규제 가이드

- 사하라 이남 아프리카 지역의 제한된 숙련된 핵의학 인력

- 신형 알파 방출 추적자 FDA 승인 절차 지연

- 가치/공급망 분석

- 규제 전망

- 기술의 전망

- Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

제5장 시장 규모와 성장 예측

- 제품 유형별

- 풀 링 PET 스캐너

- 부분 링 PET 스캐너

- 모달리티별

- 독립형 PET

- PET/CT

- PET/MRI

- 방사성 추적자/동위원소별

- 18F-플루오로데옥시글루코스(18F-FDG)

- 68Ga 기반 트레이서(DOTATATE, PSMA)

- 82Rb와 13N-암모니아(심장)

- 64Cu 및 지르코늄 89면역 PET

- 용도별

- 종양

- 심장병

- 신경

- 염증과 기타

- 최종 사용자별

- 병원

- 진단 이미지 센터

- 기타

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 호주

- 기타 아시아태평양

- 중동

- GCC

- 남아프리카

- 기타 중동

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율 분석

- 기업 프로파일

- GE HealthCare

- Siemens Healthineers AG

- Koninklijke Philips NV

- Canon Medical Systems Corp.

- United Imaging Healthcare Co. Ltd.

- Mediso Ltd.

- CMR Naviscan Corporation

- Bruker Corporation

- Positron Corporation

- Spectrum Dynamics Medical Ltd.

- Agfa HealthCare NV

- Segami Corporation

- SOFIE Biosciences, Inc.

- Eckert & Ziegler Strlzg AG

- Neusoft Medical Systems Co. Ltd.

- Hitachi Ltd.

- Hyperfine, Inc.

제7장 시장 기회와 장래의 전망

HBR 25.11.14Positron Emission Tomography Market Size in 2025 stands at USD 1.13 billion, and it is projected to advance to USD 1.36 billion by 2030, reflecting a compound annual growth rate (CAGR) of 3.71 %.

Robust demand for high-sensitivity molecular imaging and accelerating adoption in precision oncology explain the steady expansion.

The Positron Emission Tomography market size edges upward because health systems view molecular imaging as indispensable for precision oncology, dementia care, and ischemic-heart disease protocols. Mature hospitals are swapping decade-old scanners for total-body units whose 194 cm axial field of view multiplies detector sensitivity tenfold, enabling whole-body scans in under a minute and slashing tracer dose by 80 % . Emerging economies, meanwhile, use concessional loans to establish their first cyclotrons, ensuring isotope supply that underpins equipment orders. Vendors reinforce uptake by structuring pay-per-use service contracts that minimize upfront capital exposure for outpatient chains.

Artificial-intelligence integration creates a second growth pillar. Cloud-hosted algorithms now identify six cancer types on PET/CT in seconds, relieving radiologist bottlenecks and raising diagnostic confidence . Providers infer that software-bundled scanners unlock throughput gains without extra staff, which aligns with pressure to keep imaging reimbursements flat. As a result, procurement teams assess lifetime-value metrics that combine detector performance with algorithm update road maps, reshaping competitive bids.

Global Positron Emission Tomography Market Trends and Insights

Rising Global Burden of Cancer and Neurodegenerative Diseases

Cancer incidence keeps climbing, and the numbers are stark. In the United States alone, the American Cancer Society estimated 1,918,030 new cancer diagnoses for 2022, encompassing 290,560 new breast-cancer cases, 268,490 prostate-cancer cases, and 151,030 colorectal-cancer diagnoses . PET's strength in detecting metabolic changes ahead of structural abnormalities positions it as an indispensable tool for early staging and therapy monitoring. On the neurology front, researchers at Fudan University validated tracers that visualize a-synuclein aggregates in Parkinson's disease, raising expectations for earlier interventions. Increasing clinical familiarity with these capabilities keeps scanner utilization rates high and underpins hospital commitments to periodic technology refreshes.

Growing Technological Advancements

Total-body scanners such as the 194 cm-long uEXPLORER deliver ten-fold sensitivity improvements, enabling whole-body acquisitions in under one minute while cutting tracer dose by more than 80%. Providers infer that such gains translate into higher patient throughput without additional staff hours, boosting economic justification for upgrades. Furthermore, the NeuroEXPLORER achieves 1.64 mm spatial resolution, allowing visualization of brain structures previously below detection thresholds. Integration of these platforms with AI tumor-detection tools is shortening report turnaround times, an operational benefit that health systems increasingly quantify when approving capital budgets.

Shorter Half-Life of Radioisotopes

The 110-minute half-life of 18F limits transport distances, creating service gaps in rural markets. Solutions range from compact cyclotrons like GE HealthCare's MINItrace Magni to newer tracers such as 61Cu-PSMA with a 3.33-hour half-life, which broaden distribution radii. Providers interpret these developments as early evidence that dependency on centralized production may gradually loosen, reshaping competitive dynamics among isotope suppliers.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Demand for PET Analysis in Radiopharmaceuticals

- Shift Towards Image-Guided Interventions

- Government Reimbursement for 68Ga-PSMA PET in Prostate Cancer

- Stringent Regulatory Framework

- Limited Skilled Nuclear Medicine Workforce

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Full-ring scanners hold 71% Positron Emission Tomography market share in 2024, and their market size advantage stems from unmatched sensitivity and whole-body coverage. Sites count on premium image quality to support difficult oncology cases, which reinforces the purchasing rationale despite higher upfront costs. A logical corollary is that facilities aiming for research prestige almost invariably opt for full-ring designs.

Partial-ring systems exhibit a 4.5% CAGR through 2030 as they target neurologic and orthopedic subspecialties needing compact footprints. Cost savings and focused field-of-view translate into lower break-even procedure volumes, making these units attractive to ambulatory surgical centers. The rise of dedicated brain PET iterates how specialized hardware can coexist with flagship whole-body systems inside the same network, diversifying revenue sources without cannibalizing existing assets.

PET/CT accounts for 81% of the Positron Emission Tomography market size in 2024 because its fusion of metabolic and anatomical detail underpins standardized cancer staging protocols. The modality benefits from a large installed base, which supports service revenue for vendors.

PET/MRI posts the fastest growth at 4.9% CAGR as radiation-sensitive cohorts like pediatrics gravitate toward lower dose options. Evidence showing superior soft-tissue contrast for gastric cancers further consolidates its value proposition. Hospitals thus weigh PET/MRI as an investment that simultaneously advances clinical outcomes and ESG-linked radiation-exposure objectives.

The Positron Emission Tomography Market Report Segments the Industry Into by Product Type (Full Ring PET Scanners, Partial Ring PET Scanners), by Application (Cardiology, Neurology, Oncology, Other Applications), by End-User (Hospitals, Diagnostic Centers, Other End-Users), and by Geography (North America, Europe, Asia-Pacific, Middle East and Africa, South America).

Geography Analysis

North America remains the largest regional contributor, holding 38.9 % Positron Emission Tomography market share in 2024. U.S. fixed PET sites recorded a 10.2 % year-on-year scan increase, averaging 1,495 studies per system. Domestic manufacturing of the Omni Legend PET/CT in Wisconsin underscores policy momentum favoring on-shore supply chains. A policy-induced inference is that localized production buffers the market against geopolitical shocks affecting component flow.

Asia-Pacific posts the fastest regional CAGR at 5.2 % through 2030, buoyed by government infrastructure investments and rising chronic-disease burdens. China's Mid- and Long-Term Development Plan for medical isotopes catalyzes domestic tracer innovation, and Sun Yat-sen University Cancer Center has already logged over 30,000 total-body PET/CT studies. Such volume density suggests that economies of scale may soon tilt radiopharmaceutical pricing downward, enhancing affordability for neighboring markets.

Europe delivers steady demand anchored by research collaborations like the €25.3 million Thera4Care consortium led by GE HealthCare. However, heterogeneous rules governing in-house tracer production create compliance overheads that fragment supplier strategies. The PRISMAP radionuclide-production alliance aims to harmonize supply, and its progress will likely influence scanner-procurement timelines as centers align purchases with anticipated isotope availability.

- GE Healthcare

- Siemens Healthineers

- Koninklijke Philips

- Canon

- United Imaging Healthcare Co. Ltd.

- Mediso

- CMR Naviscan

- Bruker

- Positron

- Spectrum Dynamics Medical Ltd.

- Agfa HealthCare NV

- Segami

- SOFIE Biosciences, Inc.

- Eckert & Ziegler Strlzg AG

- Neusoft Medical Systems Co. Ltd.

- Hitachi

- Hyperfine, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising global burden of cancer and neurodegenerative diseases

- 4.2.2 Growing technological advancements

- 4.2.3 Expansion of cyclotron and centralized radiopharmacy networks

- 4.2.4 Increasing demand for PET analysis in radiopharmaceuticals

- 4.2.5 Shift towards image-guided interventions

- 4.2.6 Government Reimbursement for 68Ga-PSMA PET in Prostate Cancer (Australia, Germany)

- 4.3 Market Restraints

- 4.3.1 Shorter half life of radioisotopes

- 4.3.2 Stringent regulatory guide

- 4.3.3 Limited Skilled Nuclear Medicine Workforce in Sub-Saharan Africa

- 4.3.4 Delayed FDA Approval Pathways for Novel Alpha-Emitter Tracers

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter-s Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Product Type (Value)

- 5.1.1 Full-Ring PET Scanners

- 5.1.2 Partial-Ring PET Scanners

- 5.2 By Modality

- 5.2.1 Stand-Alone PET

- 5.2.2 PET/CT

- 5.2.3 PET/MRI

- 5.3 By Radiotracer / Isotope

- 5.3.1 18F-Fluorodeoxyglucose (18F-FDG)

- 5.3.2 68Ga-Based Tracers (DOTATATE, PSMA)

- 5.3.3 82Rb & 13N-Ammonia (Cardiac)

- 5.3.4 64Cu & Zirconium-89 Immuno-PET

- 5.4 By Application

- 5.4.1 Oncology

- 5.4.2 Cardiology

- 5.4.3 Neurology

- 5.4.4 Inflammation & Other

- 5.5 By End-User

- 5.5.1 Hospitals

- 5.5.2 Diagnostic Imaging Centers

- 5.5.3 Others

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Australia

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 GE HealthCare

- 6.4.2 Siemens Healthineers AG

- 6.4.3 Koninklijke Philips N.V.

- 6.4.4 Canon Medical Systems Corp.

- 6.4.5 United Imaging Healthcare Co. Ltd.

- 6.4.6 Mediso Ltd.

- 6.4.7 CMR Naviscan Corporation

- 6.4.8 Bruker Corporation

- 6.4.9 Positron Corporation

- 6.4.10 Spectrum Dynamics Medical Ltd.

- 6.4.11 Agfa HealthCare NV

- 6.4.12 Segami Corporation

- 6.4.13 SOFIE Biosciences, Inc.

- 6.4.14 Eckert & Ziegler Strlzg AG

- 6.4.15 Neusoft Medical Systems Co. Ltd.

- 6.4.16 Hitachi Ltd.

- 6.4.17 Hyperfine, Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment