|

시장보고서

상품코드

1850019

스마트 무기 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Smart Weapons - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

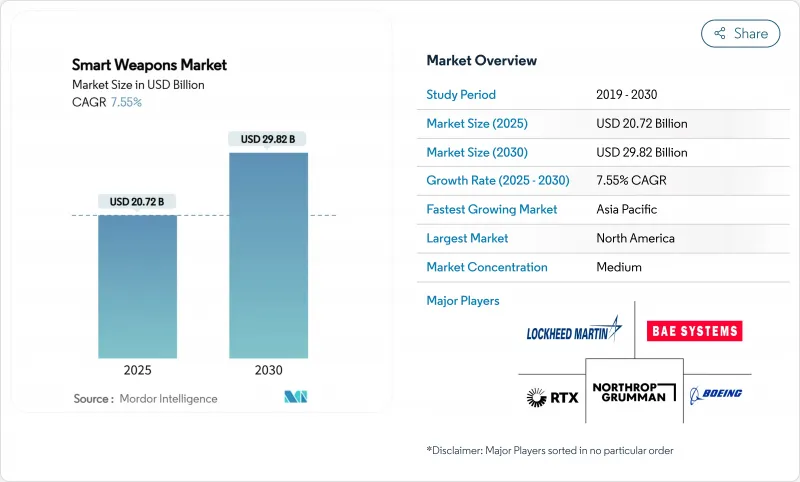

스마트 무기 시장 규모는 2025년에 207억 2,000만 달러로 추정되며, 2030년에는 298억 2,000만 달러에 이르고, CAGR 7.55%를 나타낼 것으로 예측됩니다.

방위 예산 증가, 대량 화력보다 정밀도를 우선하는 작전 방침의 전환, 진화하는 방공·전자전의 위협을 무력화하는 경쟁이 이 확대를 지지하고 있습니다. NATO가 GDP의 2%라는 세출 기준을 웃도도록 집단적으로 추진하고 있는 것과 유럽 연합(EU)의 8,000억 유로(9,377억 2,000만 달러) 규모의 유럽 재군비 계획에 의해 계약자가 단기적인 예산 사이클에서 피할 수 있도록, 복수년에 걸친 주문량여가 확보. 동시에 일본의 레일건 계획부터 필리핀의 350억 달러의 근대화 계획에 이르기까지 아시아태평양의 재군비는 수요원을 다양화해 수출 규제된 서브시스템을 둘러싼 경쟁을 격화시키고 있습니다. 인플레이션에 연동한 계약의 급등, 반도체 부족, 원재료 가격의 급등은 코스트 플러스 조달 모델을 시도하고 있습니다. 그러나 이들은 또한 업그레이드 사이클을 단축하는 모듈 설계와 이중 사용 센서 에코시스템을 자극합니다. 모든 지역에 걸쳐, 시가지에서의 전투에서 감싸 피해를 최소화하는 정치적 중요성이, 멀티 모드 가이던스와 AI 대응의 표적 식별 기술의 도입을 가속화해, 정밀 유도탄을 장래의 전력 구조 계획에 통합하고 있습니다.

세계의 스마트 무기 시장 동향과 인사이트

주요 경제권에서 국방비 증가

NATO 회원국은 냉전 후 처음으로 GDP 방위비의 2% 기준을 돌파해 정밀 유도탄 재고의 전년 대비 수요를 밀어 올렸습니다. 독일의 885억 달러의 예산 증가와 그리스의 270억 달러의 재군비 계획은 스마트 미사일, 활공 폭탄, 스탠드오프 능력에 대규모 할당을 지시하고 있습니다. EU의 ReArm Europe 이니셔티브는 여러 미국에 걸쳐 생산량을 확대하여 단가를 낮추는 공동 조달 로트를 맡고 있습니다. 이러한 동기화된 지출로 원청업체는 사이클 생산에서 라인 레이트 생산으로 전환하여 리드 타임을 단축하고 새로운 생산 도구의 감가상각을 완화할 수 있습니다. 반면에 용량 스트레스가 발생합니다. 여러 관련 프로그램에서 유사한 서브 시스템을 병렬로 주문하면 고체 시커공급 체인과 추진제 믹스에 핀치 포인트가 생겨 일정 초과 위험이 높아집니다.

감기 피해를 최소화하는 정밀 공격의 중시

최근 분쟁의 도시 지역의 특징은 무차별 사격을 엄격히 처벌하고 있으며, 지휘관은 HIMARS와 GMLRS 로켓과 같은 시스템에 의해 제공되는 90% 이상의 단발 명중률로 방향타를 자르고 있습니다. 정밀도 요구 사항은 정밀도를 넘어 확장되었으며, MBDA의 Spear 3 협력 표적 미사일이 강조하는 것처럼 코스 도중 재조준 및 비행 중 중단 기능을 포함합니다. 정치적 영향을 피하기 위해, 플래너는 더 작고 살상력이 높은 탄두와 지역 포화보다 폭풍 집중에 최적화된 퓨징 프로파일을 지정합니다. 이러한 윤리와 작전의 융합에 의해 분대 공격용 런처로부터 장거리 극초음속 무기에 이르기까지, 모든 계층에 정밀 유도탄이 포함됩니다.

엄격한 수출 규제 및 ITAR 준수 벽

미국의 국제 무기 거래 규제는 시커 알고리즘과 AI 소프트웨어의 라이선스 취득 기간을 최대 18개월까지 연장해, 해외 바이어의 납품을 늦추고 보유 비용을 부풀려 가고 있습니다. 스위스의 F-35A 조달에서는 6억 5,000만 달러의 추가 비용이 발생했습니다. 유럽의 OEM은 연구 개발을 둘러싸고 ITAR 프리 제품 라인을 구축하고 있습니다. MBDA의 네트워크형 활공무기 '오케스트라이크'가 그 대표예로, 소블린에 의한 업그레이드권을 확보하고, 재수출의 제약을 회피하고 있습니다. 규제의 발판은 국내용과 수출용의 이중 설계를 강하게 함으로써 스마트 무기 시장을 분단하고 규모의 경제를 제한하고 있습니다.

부문 분석

스마트 미사일은 공대공, 육상 공격, 대함의 각 용도에 적응할 수 있기 때문에 2024년 스마트 무기 시장의 42.17%를 차지했습니다. RTX사의 AIM-9X사이드 와인더와 록히드 마틴사의 JASSM-ER는 라인 레이트 생산을 유지하는 반복 주문 프로그램의 예입니다. 전투 사후보고는 최신 시커와 결합했을 때의 PK율이 항상 90% 이상인 것으로 밝혀지고 있으며, 예산의 우선순위화가 강화되고 있습니다. 스마트 폭탄은 감기 피해의 역치가 심한 근접 항공 지원과 관련성을 유지하고 유도 로켓은 대량의 제압 사격을 충족합니다.

지향성 에너지 무기는 2030년까지 연평균 복합 성장률(CAGR)로 가장 빠른 9.82%를 나타낼 전망입니다. DragonFire 레이저 테스트는 몇 킬로미터의 거리에서 5센티미터 이하의 추적 정확도를 입증하며, 한 번 배포하면 샷당 비용은 거의 0이 됩니다. 미국 해군 플랫폼에서 테스트된 고출력 마이크로파 포드는 운동탄을 사용하지 않고 무인 항공기 무리를 무력화했습니다. 산업화 장애물(주로 전력 밀도와 열 관리)은 선박이 장착된 통합 전력 시스템이 성숙함에 따라 후퇴하고 있습니다.

위성/GNSS 유도는 세계 커버리지와 키트당 낮은 증가 비용으로 2024년에는 32.65%의 점유율을 유지했습니다. 부드러운 조건에서 3m 이하의 CEP는 싸움이 없는 교전에 매력적입니다. 레이저 유도는 지표가 많은 환경에서 틈새 적성을 유지하고 레이더 시커는 함정과 타격 임무에서 전천후 성능을 지원합니다. 적외선 이미지는 열이 많은 대상에 대한 수동 터미널 호밍에 여전히 중요합니다.

AI를 통합한 멀티모드 지침은 2030년까지 연평균 복합 성장률(CAGR)이 10.23%를 나타낼 전망입니다. 서브의 AI를 탑재한 그리펜의 출격은 뉴럴 에이전트가 적외선, MW 레이더, 옵티컬 플로우를 밀리 세컨드 단위로 블렌딩하고, GNSS가 정지하고 있는 중에도 락을 유지하는 방법을 나타내고 있습니다. MEMS IMU와 낮은 SWaP-C RF 칩이 이 수렴을 추진하여 대포 활공 키트가 순항 미사일 수준의 자율성을 발휘할 수 있도록 하고 있습니다. 복수의 탄약이 착탄 순서를 정해, 사이사이즈를 삭감해, 협격 궤도에 의해 방어를 포화시키는 협동 표적 프로토콜.

지역 분석

북미는 2024년 스마트 무기 시장 점유율의 36.80%를 차지했으며, 미국은 49억 4,000만 달러를 정밀 타격 미사일로, 69억 달러를 소구경 폭탄 생산 라인에 충당했습니다. 캐나다의 다국적 미사일 프로그램 참여와 스탠드오프 무기 최적화 프로젝트는 대륙 수요를 더욱 지원합니다. 시커 공장에서 탄두 파운드리까지의 수직 통합을 특징으로 하는 성숙한 산업 기반이 이 지역을 최악공급 체인 쇼크로부터 지키고 있지만, 반도체 부족이 전략적 비축을 촉진하고 있습니다.

우크라이나 후 유럽의 궤도는 어려워지고 있습니다. 독일은 예산을 180% 증가한 885억 달러로 증액하고 유럽 연합 수준의 ReArm Europe 펀드가 MBDA와 서브 최종 조립 공장의 확장을 맡고 있습니다. 독불의 FC/ASW 개발이나 BAE 주도의 레이저 실증 실험에 상징되는 바와 같이, 유럽 대륙은 기술 주권에 중점을 두고 있어 미국의 수출 허가에의 의존을 얇게 하고 있습니다. 동쪽 국가의 동맹국은 정밀 로켓포의 발주를 가속시키고 있으며, 폴란드에서 발트해까지 분산된 생산 오프셋을 낳고 있습니다.

아시아태평양은 2030년까지 연평균 복합 성장률(CAGR)이 가장 빠른 9.24%를 나타낼 전망입니다. 중국의 A2/AD 에스컬레이션은 일본 레일건과 극초음속 미사일 카운터, 인도 QRSAM 롤아웃, 필리핀의 350억 달러 계획에 따른 미사일 구매에 박차를 가하고 있습니다. 대만은 AIM-120D와 국산 스카이소드-2 주문을 서두르고 있습니다. 동시에 호주의 AUKUS 기둥은 미국과 영국과의 장거리 공격 협력을 보장합니다. 한국의 KF-21 전투기와 정밀 활공탄의 수출은 경쟁압력과 공급망의 다양화를 가져옵니다. 한화의 호주 유도 로켓 공장 투자 등 지역 산업 파트너십은 현지 공동 생산으로의 전환을 시사합니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 주요 경제국 전체에서 방위비가 증가

- 감아 피해를 최소한으로 억제하기 위한 정밀 공격에 중점

- 대등 및 근사 대등한 적에 대항하기 위한 근대화

- 멀티 모드 유도 기술의 획기적인

- 5G 대응의 협조형 군집 무기의 출현

- MEMS 센서에 의한 소형화에 의해 비용 효율적인 스케일업이 가능

- 시장 성장 억제요인

- 엄격한 수출 규제와 ITAR 규정 준수 장벽

- 높은 개발 비용과 고가의 유닛 취득

- GNSS 스푸핑과 전자전 방해에 대한 취약성

- 자율형 치사 시스템에 대한 윤리적 및 법적 모니터링 강화

- 밸류체인 분석

- 규제 상황

- 기술의 전망

- Porter's Five Forces 분석

- 구매자의 협상력

- 공급기업의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업 간 경쟁 관계

제5장 시장 규모와 성장 예측

- 제품별

- 스마트 미사일

- 스마트 폭탄

- 유도 로켓 및 발사체

- 로이팅 탄약

- 지향성 에너지 무기

- 기술별

- 위성/GNSS 유도

- 레이저 유도

- 레이더 유도

- 적외선/영상 유도

- 다중 모드 및 AI 기반 유도

- 플랫폼별

- 지상

- 공중

- 해상

- 최종 사용자별

- 군대

- 국토 안보

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 영국

- 독일

- 프랑스

- 기타 유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 기타 아시아태평양

- 남미

- 브라질

- 기타 남미

- 중동 및 아프리카

- 중동

- 사우디아라비아

- 아랍에미리트(UAE)

- 기타 중동

- 아프리카

- 남아프리카

- 기타 아프리카

- 북미

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율 분석

- 기업 프로파일

- Lockheed Martin Corporation

- RTX Corporation

- The Boeing Company

- BAE Systems plc

- Northrop Grumman Corporation

- Israel Aerospace Industries Ltd.

- Rafael Advanced Defense Systems Ltd.

- Rheinmetall AG

- MBDA

- Safran SA

- Thales Group

- Saab AB

- L3Harris Technologies, Inc.

- Elbit Systems Ltd.

- Hanwha System (Hanwha Group)

- AeroVironment, Inc.

제7장 시장 기회와 향후 전망

KTH 25.11.04The smart weapons market size is estimated at USD 20.72 billion in 2025 and is expected to reach USD 29.82 billion by 2030, advancing at a 7.55% CAGR.

Escalating defense budgets, shifting operational doctrines favoring precision over mass firepower, and the race to neutralize evolving air-defense and electronic-warfare threats are sustaining this expansion. NATO's collective push to exceed the 2% of GDP spending benchmark and the European Union's EUR 800 billion (USD 937.72 billion) ReArm Europe program are securing multi-year order backlogs that shield contractors from short-term budget cycles. Simultaneously, Asia-Pacific rearmament-spanning Japan's railgun program to the Philippines' USD 35 billion modernization plan-is diversifying demand sources and sharpening competition for export-controlled subsystems. Inflation-linked contract escalations, semiconductor shortages, and raw-material price surges are testing cost-plus procurement models. Yet, they also stimulate modular designs and dual-use sensor ecosystems that shorten upgrade cycles. Across all regions, the political premium on minimizing collateral damage in urban combat zones is accelerating the fielding of multi-mode guidance and AI-enabled target-discrimination technologies, locking precision-guided munitions into future force-structure planning.

Global Smart Weapons Market Trends and Insights

Rising Defense Expenditures Across Leading Economies

NATO members surpassed the 2% of GDP defense-spending benchmark for the first time since the Cold War, propelling year-on-year demand for precision-guided inventories. Germany's USD 88.5 billion budget increase and Greece's USD 27 billion rearmament plan are directing sizeable allocations toward smart missiles, glide bombs, and standoff capabilities. The EU's ReArm Europe initiative is underwriting joint procurement lots that cut unit prices by scaling production volumes across multiple states. This synchronized spending allows prime contractors to shift from cyclical to line-rate manufacturing, trimming lead times and easing amortization of new production tooling. The flip side is capacity stress: parallel orders for similar subsystems from several allied programs create pinch points in solid-state seeker supply chains and propellant mixes, raising the risk of schedule overruns.

Emphasis on Precision Strike to Minimize Collateral Damage

The urban character of recent conflicts has severely punished indiscriminate fires, steering commanders toward more than 90% single-round hit probabilities delivered by systems such as HIMARS and GMLRS rockets. Precision requirements have expanded beyond accuracy, encompassing mid-course retargeting and in-flight abort features, as highlighted by MBDA's Spear 3 collaborative targeting missile that shifts aimpoints if civilians re-enter the strike zone. To avoid political fallout, planners specify smaller, more lethal warheads and fuzing profiles optimized for blast focusing rather than area saturation. This ethical-operational convergence embeds precision-guided munitions at every echelon from squad assault launchers to long-range hypersonic weapons.

Restrictive Export Regulations and ITAR Compliance Barriers

The US International Traffic in Arms Regulations extends licensing phases up to 18 months for seeker algorithms and AI software, delaying deliveries and inflating holding costs for overseas buyers. Switzerland's F-35A procurement saw USD 650 million in additional expenses tied partly to compliance overheads. European OEMs are ring-fencing R&D to create ITAR-free product lines-a prime example of MBDA's Orchestrike networked glide weapons-to secure sovereign upgrade rights and bypass re-export constraints. The regulatory drag fragments the smart weapons market by forcing dual designs for domestic and export configurations, limiting economies of scale.

Other drivers and restraints analyzed in the detailed report include:

- Modernization to Counter Peer and Near-Peer Adversaries

- Breakthroughs in Multi-Mode Guidance Technologies

- High Development Costs and Expensive Unit Acquisition

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Smart missiles commanded 42.17% of the smart weapons market in 2024 through their adaptability across air-to-air, land-attack, and anti-ship roles. RTX's AIM-9X Sidewinder and Lockheed Martin's JASSM-ER exemplify repeat-order programs that sustain line-rate production. Combat after-action reports reveal consistently more than 90% PK rates when paired with modern seekers, reinforcing budget prioritization. Smart bombs maintain relevance for close-air-support where collateral-damage thresholds are tight, while guided rockets satisfy high-volume suppression fires; loitering munitions bridge ISR and immediate strike, reducing sensor-to-shooter latency.

Directed-energy weapons are registering the fastest 9.82% CAGR to 2030. DragonFire laser trials demonstrated sub-5 cm tracking precision at multi-kilometer ranges, offering near-zero cost per shot once deployed. High-power microwave pods tested aboard US Navy platforms neutralized drone swarms without expending kinetic rounds, signaling a doctrinal shift toward layered, non-depletable defenses. Industrialization hurdles-chiefly power density and thermal management-are receding as shipboard integrated power systems mature.

Satellite/GNSS guidance retained a 32.65% share in 2024, thanks to global coverage and low incremental cost per kit. CEPs below 3 m under benign conditions keep it attractive for uncontested engagements. Laser guidance upholds niche suitability for designator-rich environments, while radar seekers underpin all-weather performance in naval and strike roles. Infrared imaging remains crucial for passive terminal homing against heat-rich targets.

Multi-mode guidance integrating AI exhibits a 10.23% CAGR to 2030. Saab's AI-empowered Gripen sorties illustrate how neural agents blend IR, MMW radar, and optical flows in milliseconds, sustaining lock amidst GNSS outages. MEMS IMUs and low-SWaP-C RF chips drive this convergence, allowing artillery glide kits to exhibit cruise-missile-level autonomy. Cooperative targeting protocols, where multiple munitions negotiate impact sequencing, cut salvo size, and saturate defenses through pincer trajectories.

The Smart Weapons Market Report is Segmented by Product (Smart Missiles, Smart Bombs, Guided Rockets and Projectiles, Loitering Munitions, and Directed Energy Weapons), Technology (Satellite/GNSS Guidance, Laser Guidance, and More), Platform (Land, Airborne, and Naval), End-User (Military and Homeland Security), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America captured 36.80% of the smart weapons market share in 2024 as the US obligated USD 4.94 billion to Precision Strike Missile and USD 6.9 billion to Small Diameter Bomb production lines. Canada's involvement in multinational missile programs and its Stand-Off Weapons Optimization Project further anchors continental demand. A mature industrial base featuring vertical integration from seeker fabs to warhead foundries shields the region from the worst supply-chain shocks, yet semiconductor scarcity is prompting strategic stockpiles.

Europe's trajectory is steepening post-Ukraine. Germany's 180% budget hike to USD 88.5 billion and the union-level ReArm Europe fund are underwriting expanded final-assembly halls for MBDA and Saab. The continent's focus on technological sovereignty, epitomized by Franco-German FC/ASW development and BAE-led laser demonstrators, is diluting reliance on US export licensing. Eastern-flank allies are accelerating orders for precision rocket artillery, creating distributed production offsets from Poland to the Baltic.

Asia-Pacific posts the fastest 9.24% CAGR to 2030. China's A2/AD escalation is catalyzing Japanese railgun and hypersonic counters, Indian QRSAM rollouts, and Philippine missile purchases under a USD 35 billion plan. Taiwan is expediting orders for AIM-120D and indigenous Sky Sword-2 variants. At the same time, Australia's AUKUS pillar ensures long-range strike cooperation with the US and UK. South Korea's exports of the KF-21 fighter and precision glide bombs are adding competitive pressure and supply-chain diversification. Regional industrial partnerships-such as Hanwha's investment in Australian guided-rocket plants-signal a shift toward local co-production.

- Lockheed Martin Corporation

- RTX Corporation

- The Boeing Company

- BAE Systems plc

- Northrop Grumman Corporation

- Israel Aerospace Industries Ltd.

- Rafael Advanced Defense Systems Ltd.

- Rheinmetall AG

- MBDA

- Safran SA

- Thales Group

- Saab AB

- L3Harris Technologies, Inc.

- Elbit Systems Ltd.

- Hanwha System (Hanwha Group)

- AeroVironment, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising defense expenditures across leading economies

- 4.2.2 Emphasis on precision strike to minimize collateral damage

- 4.2.3 Modernization to counter-peer and near-peer adversaries

- 4.2.4 Breakthroughs in multi-mode guidance technologies

- 4.2.5 Emergence of 5G-enabled cooperative swarming munitions

- 4.2.6 Miniaturization via MEMS sensors enabling cost-efficient scale-up

- 4.3 Market Restraints

- 4.3.1 Restrictive export regulations and ITAR compliance barriers

- 4.3.2 High development costs and expensive unit acquisition

- 4.3.3 Susceptibility to GNSS spoofing and electronic warfare disruption

- 4.3.4 Growing ethical and legal scrutiny of autonomous lethal systems

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Buyers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product

- 5.1.1 Smart Missiles

- 5.1.2 Smart Bombs

- 5.1.3 Guided Rockets and Projectiles

- 5.1.4 Loitering Munitions

- 5.1.5 Directed Energy Weapons

- 5.2 By Technology

- 5.2.1 Satellite/GNSS Guidance

- 5.2.2 Laser Guidance

- 5.2.3 Radar Guidance

- 5.2.4 Infra-Red/Imaging Guidance

- 5.2.5 Multi-mode and AI-enabled Guidance

- 5.3 By Platform

- 5.3.1 Land

- 5.3.2 Airborne

- 5.3.3 Naval

- 5.4 By End-User

- 5.4.1 Military

- 5.4.2 Homeland Security

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Lockheed Martin Corporation

- 6.4.2 RTX Corporation

- 6.4.3 The Boeing Company

- 6.4.4 BAE Systems plc

- 6.4.5 Northrop Grumman Corporation

- 6.4.6 Israel Aerospace Industries Ltd.

- 6.4.7 Rafael Advanced Defense Systems Ltd.

- 6.4.8 Rheinmetall AG

- 6.4.9 MBDA

- 6.4.10 Safran SA

- 6.4.11 Thales Group

- 6.4.12 Saab AB

- 6.4.13 L3Harris Technologies, Inc.

- 6.4.14 Elbit Systems Ltd.

- 6.4.15 Hanwha System (Hanwha Group)

- 6.4.16 AeroVironment, Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment