|

시장보고서

상품코드

1444261

세계 생체 흡수성 스텐트 시장 : 시장 점유율 분석, 업계 동향과 통계, 성장 예측(2024-2029년)Global Bioabsorbable Stents - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

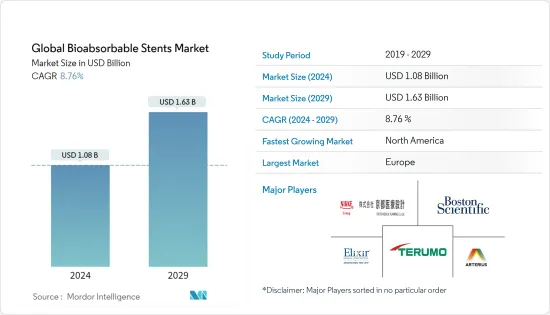

세계 생체 흡수성 스텐트 시장 규모는 2024년에 10억 8,000만 달러로 추정되고, 2029년까지 16억 3,000만 달러에 이를 것으로 예측되며, 예측 기간(2024년부터 2029년) 동안 복합 연간 성장률(CAGR) 8.76%로 성장할 전망입니다.

2019년 코로나 바이러스 감염(COVID-19)의 유행은 의료 및 심장 수술에 전례 없는 영향을 미쳤습니다. 2021년 2월 흉부외과 의사 협회(STS) 데이터베이스에 따르면 COVID-19 감염 팬데믹의 첫 번째 파도에서 미국의 심장 수술 건수는 절반 이하로 감소했으며 가장 큰 감소가 보인 것은 뉴잉글랜드 지역 그리고 중부 대서양 지역이었습니다. COVID-19의 초기 몇 주 및 몇 달을 조사한 다른 연구에서는 병원 서비스가 폐쇄되거나 상당히 제한되어 환자가 도움을 요청하는 것을 망설이면 ST 상승이 보이지 않는 심근 경색(STEMI)와 같은 광범위한 심장에 영향을 미친 것으로 밝혀졌습니다., 심정지 비율이 높고 진단 및 선택적 조치가 적습니다. 따라서 심장 수술의 감소는 시장 성장에 큰 영향을 미쳤습니다.

시장을 견인하는 요인으로는 심혈관 질환의 높은 유병률, 고령화 인구의 급격한 증가, 비만 인구의 밑단 확대 등이 있습니다. 예를 들어, 2021년 7월에 발표된 세계보건기구의 기사에 따르면 세계에서 매년 추정 1,790만명이 심장병으로 사망하고 있습니다. 이것은 세계 사망의 31%에 해당하며, 이러한 사망의 85%는 주로 심장병과 뇌졸중이 원인입니다. 이 심혈관 질환의 유병률의 높이와 관련 사망은 조기 진단 및 치료 수요를 촉진할 것으로 예상되며, 이에 따라 조사 대상 시장의 범위가 확대되고 예측 기간 중 시장의 성장 가 촉진된다고 생각됩니다.

더욱이 심장병과 같은 만성질환에 걸리기 쉬운 노인 인구 증가로 시장 수요가 증가할 것으로 예상됩니다. 2021년 10월 세계보건기구의 사실에 따르면 세계 인구에서 차지하는 60세 이상의 인구 비율은 2015년에서 2050년 사이에 12%에서 22%로 거의 두 배로 증가합니다. 2050년까지 세계 노인의 80%는 저소득자를 위한 주택에서 살게 됩니다. 중소득 국가. 인구의 고령화는 과거에 비해 훨씬 빠른 속도로 진행되고 있습니다. 모든 국가는 이 인구 역학의 변화를 활용하기 위한 의료 및 사회 시스템의 준비를 보장하는 데 중대한 문제에 직면하고 있습니다.

또한 비만 인구 증가로 생체 흡수성 스텐트에 대한 수요가 높아지고 예측 기간 동안 시장 성장이 촉진됩니다. 2021년 6월에 발표된 세계보건기구의 보고서에 따르면 2020년에는 5세 미만의 3,900만 명의 어린이가 과체중 또는 비만이었습니다. 비만 발생률은 지난 수십년동안 맹렬하게 증가하고 있으며, 비만은 종종 세계 풍토병으로 알려져 있습니다. 특히 선진국에서는 불안, 스트레스, 흡연, 음주 등 생활 습관병이 더욱 확산되고 있습니다. 따라서 비만의 유병률이 증가하면 환자는 심장병에 걸리기 쉬워 시장 성장이 촉진될 것으로 기대됩니다.

그러나 주요 시장 선수의 제품 출시 증가로 시장 성장이 촉진될 것으로 예상됩니다. 예를 들어, 2021년 12월에 Svelte Medical Systems는 관상동맥 치료용 SLENDER IDS 고정 와이어 및 DIRECT RX 생체 흡수성 신속 교환 약물 용출 스텐트(DES) 시스템의 상용화에 대한 미국 식품의약국(FDA) 승인을 획득 했습니다. 미국의 질병.

따라서 앞서 언급한 모든 요인들은 예측 기간 동안 시장 성장을 가속할 것으로 예상됩니다. 그러나 엄격한 규제 시나리오, 장치의 고비용 및 안전 문제로 인해 예측 기간 동안 시장이 제한됩니다.

생체 흡수성 스텐트 시장 동향

폴리머 기반 생체 흡수성 스텐트 하위 부문은 제품 유형 부문에서 높은 시장 점유율을 유지할 것으로 예상

생체 흡수성 고분자 기반 스텐트 부문은 시장의 다른 부문을 지배할 것으로 예상됩니다. 그 요인으로는 다양한 지역에서 폴리머 기반 스텐트 승인 수가 증가하고 폴리머 스텐트 개발에 대한 관심이 높아지고 있습니다.

생체 흡수성 스텐트(BAS)/폴리머 기반 생체 흡수성 스텐트는 신체에서 완전히 용해되거나 흡수되는 소재로 만들어집니다. 이들은 말초 동맥 질환과 관상 동맥 질환 모두에 사용됩니다. 대부분의 생체 흡수성 스텐트는 자연적으로 용해되는 재료인 폴리유산으로 만들어집니다. 그러나, 폴리카보네이트, 폴리에스테르, 부식성 금속, 박테리아 유래 폴리머 등의 폴리머 재료는 차세대 생체 흡수성 스텐트의 개발을 위해 연구되고 있습니다.

2020년 5월 Catheterization and Cardiovascular Intervention 잡지에 게재된 “PCI를 받고 있는 고위험 환자에서의 생체 흡수성 폴리머 에베롤리무스 용출 스텐트와 내구성 폴리머 약제 용출 스텐트의 안전성과 효능: TWILIGHT-SYNERGY” 표제된 연구에 따르면, 경피적 관상동맥 인터벤션(PCI)을 받는 환자의 위험을 고려하면, 생체 흡수성 폴리머(BP) 약물 용출 스텐트(DES)의 안전성 및 효능은 여전히 내구성 중합체( DP) DES보다 우수합니다. 따라서, 고분자계 생체 흡수성 스텐트의 높은 안전성과 효능은 예측 기간 동안 부문의 성장을 가속할 것으로 예상됩니다.

그러나 주요 시장 관계자는 새로운 폴리머 기반 생체 흡수성 스텐트 시장 출시에 중점을 두었습니다. 예를 들어, 2021년 9월 Biotronik은 Orsiro Mission 생체 흡수성 고분자 관상 동맥 약물 용출 스텐트 시스템이 식품 의약국에 의해 승인되었습니다고보고했습니다. 이 장치의 첫 번째 임베디드와 미국에서의 완전한 상업적 사용도 회사에 의해 보고되었습니다. 이 회사에 따르면 Orsiro Mission BP-DES는 2020년 2월 유럽 CE 마크 승인을 받았다고 합니다.

따라서 앞서 언급한 모든 요인들은 예측 기간 동안 시장 성장을 가속할 것으로 예상됩니다.

북미가 시장을 독점하고 있으며 예측기간 동안에도 비슷한 것으로 예상

현재 생체 흡수성 스텐트 시장은 북미가 독점하고 있으며, 향후 몇 년간 그 아성이 계속 될 것으로 예상되고 있습니다. 북미는 세계 시장에 존재하는 최고 기업의 이점을 통해 생체 흡수성 스텐트의 가장 큰 시장 점유율을 보유하고 있습니다. 이 지역에서는 고령화 인구 증가, 심장병의 유병률 증가, 기술의 진보도 볼 수 있습니다. 또한, 적절한 상환 시나리오와 같은 다른 요인들도 북미의 생체 흡수성 스텐트 시장을 견인하고 있습니다.

미국 심장협회에 따르면, 2019년에는 미국 성인 약 1억 2,150만명이 어떠한 심혈관 질환을 앓고 있었습니다. 또한 질병관리예방센터에 따르면 2019년 미국 성인 약 1,820만명이 관상동맥질환을 앓고 있으며, 매년 80만5,000명의 미국인이 심장발작을 일으키고 있습니다. 환자 수가 증가하면 이 지역 시장 성장이 촉진되고 있습니다.

또한 미국에서 기술적으로 고급 제품의 가용성도 시장 성장을 가속합니다. 예를 들어, 2021년 4월에 BIOTRONIK은 Orsiro 약물 용출 스텐트(DES) 시스템의 캐나다 보건부의 승인을 받았습니다. 이것은 이전 임상 표준인 Xience DES1을 능가하는 최초의 유일한 초박형 스트럿 DES입니다. Orsiro는 지금까지 세계 약 300만 명의 환자를 치료하는 데 사용되었습니다. 또한 2019년 4월에 Diagnostics and Interventional Cardiologist(DIAC)가 발표한 뉴스에 따르면, 미국에서는 연간 800,000건이 넘는 경피적 관상동맥 인터벤션(PCI) 처치가 진행되고 있으며, 커버드 스텐트가 필요한 수술 는 8,000건 미만입니다. 따라서 스텐트의 필요성이 미국의 성장을 가속할 것으로 예상됩니다.

따라서 앞서 언급한 모든 요인들은 예측 기간 동안 시장 성장을 가속할 것으로 예상됩니다.

생체 흡수성 스텐트 산업 개요

생체 흡수성 스텐트 시장은 경쟁이 치열하고 여러 선도 기업으로 구성되어 있습니다. 시장 점유율 측면에서 현재 시장을 독점하는 대기업은 거의 없습니다. 그러나 기술의 진보와 제품의 혁신에 따라 중소기업부터 중소기업은 저렴한 가격의 신제품을 도입함으로써 시장에서의 존재감을 높이고 있습니다. Boston Scientific Corporation, Arterius Limited, Elixir Medical Corporation, Kyoto Medical Planning Co. Ltd, Terumo Corporation 등의 기업이 시장에서 큰 점유율을 차지하고 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인과 제약 요인의 소개

- 시장 성장 촉진요인

- 세계적으로 심혈관 질환의 유병률이 높다

- 고령화 인구의 급증

- 확대하는 비만 인구의 밑단

- 시장 성장 억제요인

- 엄격한 규제 시나리오

- 디바이스 비용이 높다

- 생체 흡수성 스텐트와 관련된 안전성 문제

- 업계의 매력 - Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자의 협상력

- 공급기업의 협상력

- 대체 제품의 위협

- 경쟁 기업간 경쟁 관계의 격렬

제5장 시장 세분화

- 제품별

- 폴리머계 생체 흡수성 스텐트

- 금속 기반의 생체 흡수성 스텐트

- 용도별

- 관상동맥질환

- 말초동맥질환

- 흡수율별

- 느린 흡수 속도

- 빠른 흡수 속도

- 최종 사용자별

- 병원

- 기타 최종 사용자

- 지역

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 기타 아시아태평양

- 중동 및 아프리카

- GCC

- 남아프리카

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 경쟁 구도

- 기업 프로파일

- Boston Scientific Corporation

- Arterius Limited

- Elixir Medical Corporation

- Kyoto Medical Planning Co. Ltd

- Terumo Corporation

- Abbott Laboratories Inc.

- Amaranth Medical

- Biotronik

- Meril Life Sciences Pvt. Ltd

- Reva Medical

- Svelte Medical Systems

- Lepu Medical Technology Co. LTD

제7장 시장 기회와 미래 동향

BJH 24.03.15The Global Bioabsorbable Stents Market size is estimated at USD 1.08 billion in 2024, and is expected to reach USD 1.63 billion by 2029, growing at a CAGR of 8.76% during the forecast period (2024-2029).

The coronavirus disease 2019 (COVID-19) pandemic has had an unprecedented impact on health care and cardiac surgery. As per the Society of Thoracic Surgeons (STS) database in February 2021, Cardiac surgery volumes in the United States fell by more than half during the COVID-19 pandemic's first wave, with the biggest drops observed in the New England and mid-Atlantic regions. Other studies that looked at the early weeks and months of COVID-19 found that when hospitals' services were shut down or severely limited and patients were hesitant to seek help there were widespread cardiac effects such as missed ST-segment elevation myocardial infarction (STEMIs), higher rates of cardiac arrest, and fewer diagnostic and elective procedures. Thus, the decline in the cardiac surgery volume significantly impacted the market growth.

Factors that are driving the market include a high prevalence of cardiovascular diseases, steep increase in the aging population, and the expanding base of the obese population. For instance, according to a World Health Organization article published July 2021, an estimated 17.9 million people worldwide die from heart disease each year. This represents 31% of deaths worldwide, and 85% of these deaths are mainly caused by heart disease and stroke. This high prevalence of cardiovascular diseases and deaths associated to it are expected to drive demand for early diagnosis and treatment, which will expand the scope of the market studied and boost its market growth over the forecast period.

Furthermore rise in geriatric population who are more prone towards the chronic diseases such as heart diseases anticipated to boost the market demand. According to the World Health Organization Facts of October 2021, the proportion of the global population aged 60 and up will nearly double from 12% to 22% between 2015 and 2050. By 2050, 80% of the world's elderly will live in low- and middle-income countries. The population is ageing at a much faster rate than in the past. Every country faces significant challenges in ensuring that its health and social systems are prepared to take advantage of this demographic shift.

In addition, growing base of obese population bolster the bioabsorbable stent demand boost the market growth over the forecast period. According to the World Health Organization's report published in June 2021, 39 million children under the age of 5 years were overweight or obese in 2020. Incidences of obesity have been increasing fiercely over the past decades, and it is often described as a global endemic, especially in developed countries where lifestyle-related disorders, such as anxiety, stress, smoking, and drinking, are more prevalent. Thus, increasing in the prevalence of obesity makes patients more prone towards the heart diseases thereby expected to boosting the market growth.

However, growing product launches by the key market players anticipated to boost the market growth. For Instance, in December 2021, Svelte Medical Systems received United States Food and Drug Administration (FDA) approval to commercialize the SLENDER IDS fixed-wire and DIRECT RX bioabsorbable rapid-exchange drug-eluting stent (DES) systems for the treatment of coronary artery disease in the United States.

Thus, all aforementioned factors anticipated to boost the market growth over the forecast period. However, stringent regulatory scenario, high cost of devices as well as safety issues restraint the market over the forecast period.

Bioabsorbable Stents Market Trends

Polymer-based Bioabsorbable Stents Sub-segment is Expected to hold its High Market Share in the Product Type Segment

The Bioresorbable Polymer-Based Stents segment is expected to dominate the other segment of the market. The factors can be attributed to the increasing number of approvals for polymer-based stents in different regions, as well as the increased focus on developing polymeric stents.

Bioabsorbable stents (BAS)/polymer-based bioabsorbable stents are made of materials that can completely dissolve or be absorbed in the body. These are used both in peripheral and coronary artery disease. Most bioabsorbable stents are made of polylactic acid, a naturally dissolvable material. However, the polymer materials, such as polycarbonates, polyesters, corrodible metals, and bacterial-derived polymers are under investigation for developing the next-generation bioabsorbable stents.

According to the study titled "Safety and efficacy of the bioabsorbable polymer everolimus-eluting stent versus durable polymer drug-eluting stents in high-risk patients undergoing PCI: TWILIGHT-SYNERGY" published in the Catheterization and Cardiovascular Intervention in May 2020, In high-risk patients undergoing percutaneous coronary intervention (PCI), the safety and efficacy of bioabsorbable polymer (BP) drug-eluting stents (DES) remain superior to durable polymer (DP) DES. Thus, high safety and efficacy of the polymerbased bioabsorbable stent anticipated to boost the segment growth over the forecast period.

However, key market players focused on the launch of the new polymer-based bioabsorbable stent in the market. For instance, in September 2021, Biotronik reported that its Orsiro Mission bioabsorbable polymer coronary drug-eluting stent system has been approved by the Food and Drug Administration. The device's first implantation and full commercial availability in the United States were also reported by the company. The Orsiro Mission BP-DES received European CE Mark approval in February 2020, according to the company.

Thus, all aforementioned factors anticipated to boost the market growth over the forecast period.

North America Dominates the Market and is Expected to do the Same in the Forecast Period

North America currently dominates the market for bioabsorbable stents and is expected to continue its stronghold for a few more years. North America holds the largest market share for bioabsorbable stents due to the dominance of the top companies present in the global market. There is also an increase in the aging population, an increase in the prevalence of heart diseases, and technological advancements found in the region. In addition, other factors, such as a good reimbursement scenario, have been driving the North American bioabsorbable stent market.

According to the American Heart Association, in 2019, approximately 121.5 million United States adults had some form of cardiovascular disease. Also, according to the Centers for Disease Control and Prevention, 2019, approximately 18.2 million United States adults have coronary artery disease, and 805,000 Americans have a heart attack each year. The increasing patient pool is boosting the market growth in the region.

Furthermore, the availability of technologically advanced products in the United States also drives the market growth. For instance, in April 2021,BIOTRONIK received Health Canada approval of the Orsiro drug-eluting stent (DES) system. It is the first and only ultrathin strut DES to outperform the former clinical standard, Xience DES1. Orsiro has been used to treat almost three million patients worldwide to date. Also, as per the news published by Diagnostics and Interventional Cardiologist (DIAC) in April 2019, more than 800,000 percutaneous coronary intervention (PCI) procedures are performed annually in the United States and fewer than 8,000 require a covered stent. Hence, the need for stents is likely to drive the growth in the United States.

Thus, all aforementioned factors anticipated to boost the market growth over the forecast period.

Bioabsorbable Stents Industry Overview

The bioabsorbable stents market is highly competitive and consists of several major players. In terms of market share, few of the major players currently dominate the market. However, with technological advancements and product innovations, mid-size to smaller companies are increasing their market presence by introducing new products at affordable prices. Companies, like Boston Scientific Corporation, Arterius Limited, Elixir Medical Corporation, Kyoto Medical Planning Co. Ltd, and Terumo Corporation, hold the substantial share in the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 High Prevalence of Cardiovascular Diseases Globally

- 4.3.2 Steep Increase in Aging Population

- 4.3.3 Expanding Base of Obese Population

- 4.4 Market Restraints

- 4.4.1 Stringent Regulatory Scenario

- 4.4.2 High Device Cost

- 4.4.3 Safety Issues Related to Bioabsorbable Stents

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD Million)

- 5.1 By Product

- 5.1.1 Polymer-based Bioabsorbable Stents

- 5.1.2 Metal-based Bioabsorbable Stents

- 5.2 By Application

- 5.2.1 Coronary Artery Disease

- 5.2.2 Peripheral Artery Disease

- 5.3 By Absorption Rate

- 5.3.1 Slow Absorption Rate

- 5.3.2 Fast Absorption Rate

- 5.4 By End User

- 5.4.1 Hospitals

- 5.4.2 Other End Users

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Boston Scientific Corporation

- 6.1.2 Arterius Limited

- 6.1.3 Elixir Medical Corporation

- 6.1.4 Kyoto Medical Planning Co. Ltd

- 6.1.5 Terumo Corporation

- 6.1.6 Abbott Laboratories Inc.

- 6.1.7 Amaranth Medical

- 6.1.8 Biotronik

- 6.1.9 Meril Life Sciences Pvt. Ltd

- 6.1.10 Reva Medical

- 6.1.11 Svelte Medical Systems

- 6.1.12 Lepu Medical Technology Co. LTD