|

시장보고서

상품코드

1907319

리튬 시장 : 점유율 분석, 업계 동향, 통계, 성장 예측(2026-2031년)Lithium - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

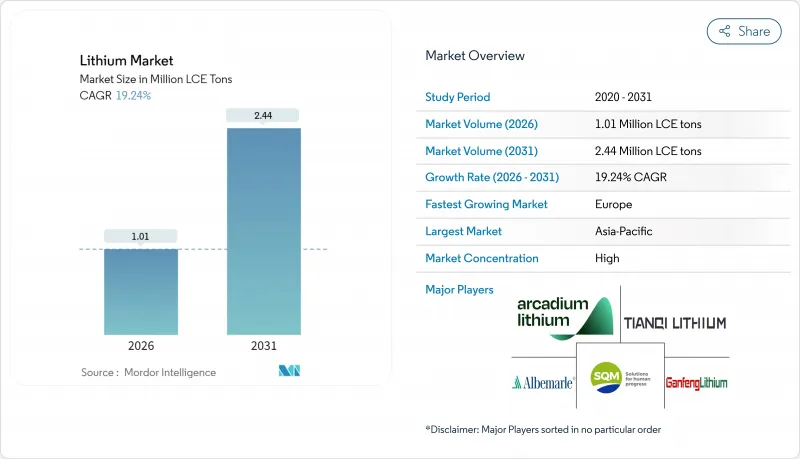

2026년 리튬 시장 규모는 101만 LCE톤으로 추정되며, 2025년 85만 LCE톤에서 성장한 수치입니다.

2031년 예측치는 244만 LCE톤으로 2026년부터 2031년까지 연평균 복합 성장률(CAGR) 19.24%로 성장할 전망입니다.

배터리 수요가 추가 공급량의 대부분을 차지하고 있으며, 전기자동차 판매 의무화 정책과 대규모 축전 설비가 수요의 장기적인 전망을 명확히 하고 있습니다. 고니켈 양극재가 프리미엄 전기자동차의 주류 화학 조성이 되는 가운데, 탄산염보다 수산화리튬의 소비가 급속히 확대되고 있습니다. 새로운 직접 리튬 추출(DLE) 프로젝트는 프로젝트의 리드 타임을 단축하고 물 사용량을 줄이기 위해 광산 회사가 수요의 급증에 신속하게 대응할 수 있도록 하고 있습니다. 지역간의 생산과 소비의 격차는 여전히 존재하고 있으며, 중국은 가공을 지배하고 있는 것의 매장량은 한정되어 있는 한편, 유럽은 장래공급 쇼크를 회피하기 위해, 하류에 대한 투자를 가속하고 있습니다. Tier 1 생산자와 기술 기업 간의 통합이 진행됨에 따라 경쟁 압력이 강화되고 보다 대규모 설비 투자 계획이 지원되고 있습니다.

세계 리튬 시장 동향과 전망

EV 보급 목표와 배터리 비용의 가격 병렬화

100달러/kWh를 목표로 하는 배터리 팩의 가격 하락으로 전기자동차와 내연 기관차의 가격 차이가 해소되고 보조금 감소 후에도 보급이 가속화됩니다. 테슬라가 라이온 타운 리소시즈 사로부터 연간 15만 톤(DMT)의 스포줌 광석을 조달한 사례는 자동차 제조업체가 업스트림 원료를 수년 앞까지 확보하는 현상을 나타내고 있습니다. 스텔란티스는 2035년 유럽 내연기관 폐지에 대비하여 발칸에너지사로부터 최대 9만9천톤의 수산화리튬을 5년간 공급하는 계약을 체결했습니다. NMC811과 같은 고 니켈 양극재는 탄산염이 아닌 수산화물이 필요하기 때문에 화합물 전환이 더욱 가속화되고 있습니다. 중국의 신에너지 자동차 보급률은 2024년 35%에 달했으며 정책과 비용 수렴이 지속 가능한 수요주기를 낳고 있음을 보여줍니다. 연방의 제로 방출 목표가 주 규제와 일치하는 미국에서도 비슷한 기세가 형성되고 있으며, 리튬 시장에서

미국, EU 및 중국에 있어서의 그리드 규모 축전 의무화(4시간 이상)

법적 구속력이 있는 축전 요건은 자동차 사이클 이외의 분야에서 리튬 수요의 최저 수준을 보장합니다. 미국 인플레이션 억제법에서는 독립형 축전설비에 대해 30%의 투자세액 공제를 적용. 캘리포니아는 2026년까지 11.5GW의 증설이 의무화되어 있습니다. 중국의 제14차 5개년 계획에서는 2025년까지 30GW의 축전 목표를 설정해, 각 성에서는 풍력 및 태양광 발전 프로젝트에 대해 10-20%의 축전 비율을 의무화하고 있습니다. 유럽의 송전 사업자는 재생에너지의 균형을 조정하기 위해 2030년까지 200GW의 축전 용량이 필요하다고 추정하고 있습니다. 리튬 이온 기술이 주류가 되는 이유는 4시간의 지속시간 기준을 충족하면서 라이프사이클 비용이 가장 낮기 때문입니다. 이러한 의무는 수산화리튬 및 탄산리튬 생산자의 수익 변동을 억제하고 리튬 시장 전체에서 장기 가격 전망의 기반을 확립합니다.

중국 제2선급 컨버터에 의한 단기 공급 과잉

중국의 컨버터 기업은 2024년 탄산리튬 생산 능력을 연간 120만 톤으로 확대해 국내 수요의 연간 80만 톤을 크게 웃돌았습니다. 장기 계약이 제한되어 있기 때문에 이들 기업은 잉여 제품을 스팟 시장에 방출하고 있으며, 전지용 등급의 탄산리튬 가격은 톤당 9,000-1만 2,000달러까지 하락해 전년 대비 65% 저렴합니다. 가격 변동은 다른 지역의 투자 의욕을 깎아 고비용 기반의 생산자를 압박하고 있습니다. 환경 규제 대응 비용과 에너지 집약적인 프로세스의 비용 상승으로, 가장 비효율적인 사업자는 점차 도태될 전망입니다. 업계 개편이 진행됨에 따라 리튬 시장 전체에서 가격 결정력이 안정화될 것으로 예측됩니다.

부문 분석

수산화리튬은 높은 니켈 양극재가 보다 높은 반응성을 필요로 하기 때문에 2031년까지 연평균 복합 성장률(CAGR) 23.02%의 전망을 나타냅니다. 한편, 탄산리튬은 확립된 산업 공정으로 2025년 시점에서 64.78% 시장 점유율을 유지했습니다. 배터리 제조업체는 현재 비용이 많이 드는 탄산염 전환을 피하기 위해 수산화물을 직접 지정하고 있으며, 테슬라는 4680 셀에 수산화물만을 채택하고 있습니다. 수산화리튬의 프리미엄 가격(1,000-2,000달러/톤)은 공급 박박과 가공의 복잡성을 반영합니다. 유럽의 재활용 규제는 여러 라이프사이클에 걸쳐 순도 유지가 가능한 수산화리튬 제법을 지지하고 있어 수요를 더욱 끌어 올리고 있습니다. 염화리튬 기타 화합물은 공기처리, 의약품, 특수화학제품 등 틈새 시장용으로 공급되고 있어 꾸준히 비교적 완만한 확대를 계속하고 있습니다.

수산화리튬 수요의 확대는 탄산염에 최적화된 공급망에 도전을 제기하고 있습니다. 호주 및 미국 프로젝트에서는 물류 비용 절감을 위해 광산 인접 지역에서 수산화 리튬 정제를 계획하고 있습니다. 중국에서는 컨버터 기업이 스포지메인으로부터 수산화물 수율 향상을 위한 병목 현상 제거에 투자하고 있습니다. 고순도 원료 용액을 공급하는 DLE 파일럿의 성공으로 수산화물 생산에 적합한 자원 기반이 확대되고 있습니다. 자동차 제조업체의 고니켈 화학 조성으로의 이행이 진행되고 있는 가운데, 계약량은 수산화물을 우대해, 리튬 시장 내에서의 화합물 이행을 가속시키고 있습니다.

본 리튬 시장 보고서는 화합물별(탄산염, 염화물 등), 용도별(전지, 윤활유 및 그리스, 공기 처리, 의약품 등), 최종 사용자 산업별(산업용, 소비자용 전자기기, 에너지 저장, 의료, 자동차 등), 지역별(아시아태평양, 북미, 유럽, 남미, 중동 및 아프리카)으로 분류되어 있습니다. 시장 예측은 수량(톤) 단위로 제공됩니다.

지역별 분석

2025년 시점에서 아시아태평양은 리튬 시장 규모의 61.65%를 차지하고 있습니다. 이는 중국이 세계 공급량의 약 70%를 정제하고 있기 때문입니다만, 지역의 정책 입안자는 집중 리스크를 주시하고 있습니다. 일본과 한국은 첨단적인 전지 제조를 주도하고 니켈 리치 캐소드용 고순도 수산화리튬을 필요로 하고 있습니다. 인도의 승용차 전동화 프로그램과 생산 연동형 인센티브(PLI)는 셀 제조업체를 끌어들여 리튬 수요 증가를 가져오고 있습니다. 호주는 경암광석 생산에서 우위를 유지하는 한편, 농축광석의 대부분을 가공을 위해 수출할 수밖에 없고, 부가가치 창출의 기회가 충분히 활용되고 있지 않습니다. 지역 수입국은 중국 제련업체에 대한 의존도를 줄이기 위해 남미 염수 프로젝트 및 북미 수산화물 플랜트와의 새로운 제휴 협상을 진행하고 있습니다.

유럽은 2031년까지 연평균 복합 성장률(CAGR) 25.33%로 가장 빠른 성장세를 보일 것으로 예상됩니다. 유럽 전지연합은 연간 550GWh의 생산능력을 목표로 하며, 중요원재료법은 조달처의 다양화를 의무화하고 있습니다. 독일은 자동차산업 클러스터를 기반으로 수요를 지지해 북유럽 국가들은 재생가능에너지를 활용해 에너지 집약적인 정제 시설을 유치하고 있습니다. 프랑스, 이탈리아, 스페인에서는 기가팩토리 투자가 모여 현지 화학 중간체 산업 성장을 촉진하고 있습니다. 전략적 비축과 리사이클 의무에 의해 지역가공 리튬의 고정 수요가 창출되어 현지 가격은 세계평균을 웃도는 수준을 유지하고 있습니다.

북미에서는 국내 생산을 중시하는 인플레이션 억제법의 우대조치를 활용하고 있습니다. 미국은 축구패스에서의 채굴과 노스캐롤라이나주에서의 정제능력을 증강하고, 캐나다는 중요한 광물 전략 하에서 배터리 등급의 프로젝트를 추진하고, 멕시코는 미국, 멕시코, 캐나다 협정(USMCA)의 우대 무역의 혜택을 받고 있습니다. 남미는 아르헨티나와 칠레가 캐소드 및 배터리 공장을 모색하는 동안 수출국에서 파트타임 소비국으로 변화하고 있습니다. 브라질은 더 큰 가치를 얻기 위한 다운스트림 옵션을 연구하고 있습니다. 중동 및 아프리카는 여전히 발전의 초기 단계이지만, 걸프 협력 회의(GCC) 회원국과 남아프리카 유틸리티 회사에서 재생에너지와 그리드 스토리지가 확대됨에 따라 그 중요성이 커질 수 있습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

자주 묻는 질문

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- EV 보급 목표와 배터리 비용의 가격 병렬화

- 미국, EU 및 중국에 있어서의 그리드 규모 에너지 저장 장치 의무화(4시간 이상)

- OEM 지원에 의한 공급 확보를 위한 오프 테이크 계약

- 직접 리튬 추출(DLE) 기술의 대두와 파일럿 시험의 성공 사례

- 인플레이션 억제법에 근거한 다운스트림 세액 공제

- 시장 성장 억제요인

- 중국계 Tier 2 컨버터에 의한 단주기 제품 공급 과잉

- 금리 급등에 의한 ESS 조달 페이스의 예상치 못한 감속

- 나트륨 이온 배터리의 초기 상용화 단계

- 밸류체인 분석

- Porter's Five Forces

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁도

- 가격 분석

- 기술 개요

제5장 시장 규모와 성장 예측

- 화합물별

- 탄산리튬

- 염화리튬

- 수산화리튬

- 기타

- 용도별

- 배터리

- 윤활유 및 그리스

- 공기처리

- 의약품

- 유리 및 세라믹(프릿 포함)

- 폴리머

- 기타 용도

- 최종 사용자 업계별

- 산업

- 소비자 전자 기기

- 에너지 저장

- 의료

- 자동차

- 기타 최종 사용자 산업

- 지역별

- 생산량 및 매장량 분석

- 호주

- 칠레

- 중국

- 아르헨티나

- 짐바브웨

- 미국

- 기타 지역

- 소비 분석

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 호주 및 뉴질랜드

- 기타 아시아태평양

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 북유럽 국가

- 기타 유럽

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카

- 기타 중동 및 아프리카

- 아시아태평양

- 생산량 및 매장량 분석

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율(%)**/순위 분석

- 기업 프로파일

- Albemarle Corporation

- Arcadium Lithium(Rio Tinto)

- Avalon Advanced Materials Inc.

- Ganfeng Lithium Group Co., Ltd.

- Lithium Americas Corp.

- Lithium Australia

- Mineral Resources

- Morella Corporation Limited

- Pilbara Minerals

- Sichuan Yahua Industrial Group Co. Ltd

- SQM

- Tianqi Lithium Corporation Limited

제7장 시장 기회와 장래의 전망

SHW 26.01.22Lithium market size in 2026 is estimated at 1.01 Million LCE tons, growing from 2025 value of 0.85 Million LCE tons with 2031 projections showing 2.44 Million LCE tons, growing at 19.24% CAGR over 2026-2031.

Battery demand accounts for most incremental volumes, with policies that mandate electric-vehicle sales and grid-scale storage creating long-term visibility on offtake. Hydroxide consumption is expanding faster than carbonate as high-nickel cathodes become the preferred chemistry for premium electric cars. New direct-lithium-extraction (DLE) projects shorten project lead times and lowering water use, helping miners respond more quickly to demand spikes. Regional production-consumption gaps persist: China dominates processing yet owns limited reserves, while Europe accelerates downstream investments to avoid future supply shocks. Consolidation among tier-1 producers and technology companies intensifies competitive pressure and supports larger capital-spending plans.

Global Lithium Market Trends and Insights

EV Penetration Targets and Battery-Cost Parity

Battery packs moving toward USD 100/kWh enable price parity between electric and combustion vehicles, accelerating adoption even when subsidies fade. Tesla's 150,000 DMT annual spodumene offtake from Liontown Resources demonstrates how automakers now secure upstream inputs years in advance. Stellantis signed a five-year agreement for up to 99,000 MT of lithium hydroxide from Vulcan Energy to prepare for the 2035 European engine phase-out. Higher-nickel cathodes such as NMC 811 demand hydroxide rather than carbonate, reinforcing the compound shift. China's new-energy-vehicle penetration reached 35% in 2024, indicating that policy and cost convergence create self-sustaining demand cycles. Similar momentum is building in the United States as federal zero-emission targets align with state mandates, in the lithium market

Grid-Scale Storage Mandates (>=4 h) in US, EU and China

Legally binding storage requirements guarantee a minimum level of lithium demand outside the vehicle cycle. The U.S. Inflation Reduction Act offers a 30% investment tax credit for standalone storage, while California must add 11.5 GW by 2026. China's 14th Five-Year Plan sets a 30 GW storage target by 2025, and provinces enforce 10-20% storage ratios on wind and solar projects. Europe's transmission operators estimate 200 GW of storage will be needed by 2030 to balance renewables. Lithium-ion technology dominates because it meets the four-hour duration standard at the lowest life-cycle cost. These mandates reduce revenue volatility for hydroxide and carbonate producers and anchor long-run pricing expectations across the lithium market.

Short-Cycle Oversupply from Tier-2 Chinese Converters

Chinese converters expanded lithium carbonate capacity to 1.2 million tpy in 2024, overshooting domestic demand of 800,000 tpy. With limited long-term contracts, these firms dump excess product on spot markets, pushing battery-grade carbonate to USD 9,000-12,000/t, 65% lower than a year earlier. Price volatility deters investment elsewhere and squeezes producers with higher cost bases. Environmental compliance costs and energy-intensive processes are rising, which will gradually remove the least efficient operators. Once consolidation progresses, pricing power is expected to stabilise across the lithium market.

Other drivers and restraints analyzed in the detailed report include:

- OEM-Backed Off-take Agreements Securing Supply

- Rise of Direct-Lithium-Extraction (DLE) Pilot Successes

- Slower-than-Expected ESS Procurement due to Interest-Rate Spikes

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Lithium hydroxide posted a 23.02% CAGR outlook through 2031 because high-nickel cathodes need higher reactivity, while lithium carbonate maintained 64.78% market share in 2025 through well-established industrial routes. Battery manufacturers now specify hydroxide directly to avoid costly carbonate conversion, and Tesla employs only hydroxide in its 4680 cells. The hydroxide premium of USD 1,000-2,000/t reflects tighter supply and higher processing complexity. Recycling mandates in Europe favour hydroxide pathways because they preserve purity across multiple life cycles, further lifting demand. Lithium chloride and other compounds serve niche air-treatment, pharmaceutical and specialty-chemical markets with steady but comparatively slow expansion.

Growing hydroxide demand challenges supply chains optimised for carbonate. Projects in Australia and the United States plan hydroxide refining adjacent to mines to cut logistics costs. In China, converters invest in debottlenecking to raise hydroxide yield from spodumene. Successful DLE pilots broaden the resource base suitable for hydroxide production by delivering high-purity feed solutions. As more automakers shift to high-nickel chemistries, contract volumes favour hydroxide, sharpening the compound transition inside the lithium market.

The Lithium Market Report is Segmented by Compound (Carbonate, Chloride, and More), Application (Battery, Lubricants and Grease, Air Treatment, Pharmaceuticals, and More), End-User Industry (Industrial, Consumer Electronics, Energy Storage, Medical, Automotive, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Volume (Tons).

Geography Analysis

Asia-Pacific retained 61.65% of the Lithium market size in 2025 because China refines about 70% of global supply, yet regional policymakers watch concentration risk closely. Japan and South Korea lead advanced battery manufacturing, demanding high-purity hydroxide for nickel-rich cathodes. India's passenger-vehicle electrification program and PLI incentives attract cell makers, creating incremental lithium pull. Australia dominates hard-rock production but must ship most concentrate for processing, leaving value-addition opportunities underexploited. Regional importers negotiate new partnerships with South American brine projects and North American hydroxide plants to reduce reliance on Chinese converters.

Europe expands fastest, recording a 25.33% CAGR to 2031. The European Battery Alliance targets 550 GWh annual capacity, and the Critical Raw Materials Act mandates diversified sourcing. Germany anchors demand through automotive clusters, while Nordic nations deploy renewable power to host energy-intensive refining. France, Italy and Spain attract gigafactory investment, stimulating local chemical intermediates. Strategic stockpiling and recycling quotas create captive demand for regionally processed lithium, supporting local prices above global averages.

North America leverages Inflation Reduction Act incentives that value domestic content. The United States adds extraction at Thacker Pass and refinery capacity in North Carolina, Canada promotes battery-grade projects under its Critical Minerals Strategy, and Mexico benefits from the United States-Mexico-Canada Agreement (USMCA) preferential trade. South America evolves from exporter to part-time consumer as Argentina and Chile explore cathode and cell plants. Brazil studies downstream options to capture greater value. The Middle East and Africa remain nascent but could gain prominence as renewables and grid storage scale across Gulf Cooperation Council states and South African utilities.

- Albemarle Corporation

- Arcadium Lithium (Rio Tinto)

- Avalon Advanced Materials Inc.

- Ganfeng Lithium Group Co., Ltd.

- Lithium Americas Corp.

- Lithium Australia

- Mineral Resources

- Morella Corporation Limited

- Pilbara Minerals

- Sichuan Yahua Industrial Group Co. Ltd

- SQM

- Tianqi Lithium Corporation Limited

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 EV Penetration Targets and Battery-cost Parity

- 4.2.2 Grid-scale Storage Mandates (>=4 h) in U.S., EU and China

- 4.2.3 OEM-backed Off-take Agreements Securing Supply

- 4.2.4 Rise of Direct-lithium-extraction (DLE) Pilot Successes

- 4.2.5 Inflation-Reduction-Act Downstream Tax Credits

- 4.3 Market Restraints

- 4.3.1 Short-cycle Oversupply from Tier-2 Chinese Converters

- 4.3.2 Slower-than-expected ESS Procurement due to Interest-rate Spikes

- 4.3.3 Nascent Sodium-ion Battery Commercialization

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

- 4.6 Pricing Analysis

- 4.7 Technology Snapshot

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Compound

- 5.1.1 Carbonate

- 5.1.2 Chloride

- 5.1.3 Hydroxide

- 5.1.4 Others

- 5.2 By Application

- 5.2.1 Battery

- 5.2.2 Lubricants and Grease

- 5.2.3 Air Treatment

- 5.2.4 Pharmaceuticals

- 5.2.5 Glass and Ceramics (Including Frits)

- 5.2.6 Polymer

- 5.2.7 Other Applications

- 5.3 By End-user Industry

- 5.3.1 Industrial

- 5.3.2 Consumer Electronics

- 5.3.3 Energy Storage

- 5.3.4 Medical

- 5.3.5 Automotive

- 5.3.6 Other End-user Industries

- 5.4 By Geography

- 5.4.1 Production and Reserve Analysis

- 5.4.1.1 Australia

- 5.4.1.2 Chile

- 5.4.1.3 China

- 5.4.1.4 Argentina

- 5.4.1.5 Zimbabwe

- 5.4.1.6 United States

- 5.4.1.7 Other Regions

- 5.4.2 Consumption Analysis

- 5.4.2.1 Asia-Pacific

- 5.4.2.1.1 China

- 5.4.2.1.2 Japan

- 5.4.2.1.3 India

- 5.4.2.1.4 South Korea

- 5.4.2.1.5 Australia and New Zealand

- 5.4.2.1.6 Rest of Asia-Pacific

- 5.4.2.2 North America

- 5.4.2.2.1 United States

- 5.4.2.2.2 Canada

- 5.4.2.2.3 Mexico

- 5.4.2.3 Europe

- 5.4.2.3.1 Germany

- 5.4.2.3.2 United Kingdom

- 5.4.2.3.3 France

- 5.4.2.3.4 Italy

- 5.4.2.3.5 Nordic Countries

- 5.4.2.3.6 Rest of Europe

- 5.4.2.4 South America

- 5.4.2.4.1 Brazil

- 5.4.2.4.2 Argentina

- 5.4.2.4.3 Rest of South America

- 5.4.2.5 Middle East and Africa

- 5.4.2.5.1 Saudi Arabia

- 5.4.2.5.2 South Africa

- 5.4.2.5.3 Rest of Middle East and Africa

- 5.4.2.1 Asia-Pacific

- 5.4.1 Production and Reserve Analysis

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)**/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Albemarle Corporation

- 6.4.2 Arcadium Lithium (Rio Tinto)

- 6.4.3 Avalon Advanced Materials Inc.

- 6.4.4 Ganfeng Lithium Group Co., Ltd.

- 6.4.5 Lithium Americas Corp.

- 6.4.6 Lithium Australia

- 6.4.7 Mineral Resources

- 6.4.8 Morella Corporation Limited

- 6.4.9 Pilbara Minerals

- 6.4.10 Sichuan Yahua Industrial Group Co. Ltd

- 6.4.11 SQM

- 6.4.12 Tianqi Lithium Corporation Limited

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment