|

시장보고서

상품코드

1687157

배터리 관리 시스템 시장 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Battery Management System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

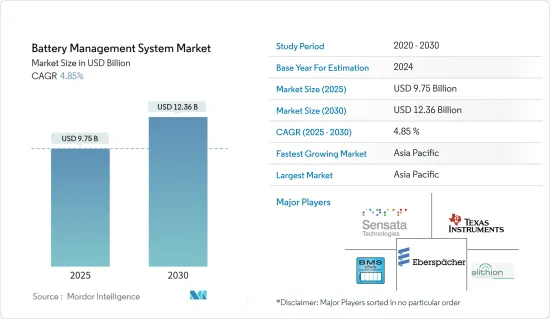

배터리 관리 시스템 시장 규모는 2025년에 97억 5,000만 달러로 추정되고, 예측 기간인 2025-2030년 CAGR 4.85%로 성장할 전망이며, 2030년에는 123억 6,000만 달러에 달할 것으로 예측됩니다.

시장은 COVID-19에 의해 부정적인 영향을 받았습니다. 현재 시장은 팬데믹 이전 수준에 도달했습니다.

주요 하이라이트

- 중기적으로는 배터리 관리 시스템에 대한 수요가 높아지면 배터리 관리 시스템 시장 성장을 자극할 것으로 예상됩니다. 아울러 전기차 보급 확대, 견고한 충전 인프라 필요성, 배터리 에너지 효율 향상 주력도 조사 대상 시장 성장을 촉진할 것으로 예상됩니다.

- 한편, 기성품의 배터리 관리 시스템이나 표준적인 배터리 관리 시스템에 대한 기술적인 제약은 시장의 주요 억제요인의 하나입니다.

- 복잡성 완화, 효율 향상, 신뢰성 개선 등의 이점을 가진 배터리 관리 시스템의 기술적 진보는 예측 기간 동안 성장 기회를 가져올 것으로 기대되고 있습니다.

- 아시아태평양이 시장을 독점하고 있으며, 예측 기간 동안 가장 높은 CAGR로 추이할 가능성도 높습니다. 이러한 성장은 중국이나 일본 등의 국가에서 전기 자동차의 판매가 급증하고 있는 것에 기인하고 있습니다. 이 성장은 온실가스 배출을 줄이기 위한 정부의 광범위한 노력에 의한 것입니다.

배터리 관리 시스템 시장 동향

시장을 독점할 것으로 예상되는 운송 부문

- 이전에는 내연 기관차(ICE)만이 사용되고 있었습니다. 그러나, 환경 문제에 대한 관심의 고조로부터, 기술은 전기자동차(EV)에 시프트하고 있습니다. 그 때문에 배터리 매니지먼트 시스템은 ICE 부문에서는 시장을 갖지 않습니다.

- 작년 세계의 EV 판매 대수는 약 660만 대(배터리 EV와 플러그인 하이브리드 EV 포함)였습니다. 세계 각국의 다양한 EV 시책의 채택에 의해, 판매 대수는 한층 더 증가할 것으로 생각됩니다.

- 리튬 이온 배터리는 높은 에너지 밀도, 저자기 방전, 경량, 낮은 유지 보수를 실현하기 위해 EV에 주로 사용되고 있습니다. 내연기관차에서는 납 기반 배터리가 널리 사용되고 있어 당분간 유일한 양산 가능한 배터리 시스템으로 계속 유지될 것으로 예상됩니다. 리튬이온 배터리는 SLI 용도로 납 배터리를 대체할 양산 가능한 배터리로 사용되려면 더 높은 비용 절감이 필요합니다.

- 리튬 이온 배터리 시스템은 플러그인 하이브리드 자동차 및 전기자동차를 추진합니다. 고에너지 밀도, 고속 충전 능력, 고방전 전력으로 인해 리튬이온 배터리는 자동차의 주행거리와 충전시간에 대한 OEM 요건을 충족하는 유일한 이용 가능한 기술입니다. 납 기반의 트랙션 배터리는 비교적 에너지가 낮고 무게가 크기 때문에 풀 하이브리드 전기차나 전기차에 사용하기에는 경쟁하지 않습니다.

- 전기자동차 배터리의 세계 생산은 주로 아시아태평양에 집중하고 있으며, 중국, 일본, 한국의 기업이 이 부문을 지배하고 그 패권을 지키기 위해 유럽 공장을 건설하고 있습니다. 리튬이온 배터리의 중하류 밸류체인에서 중국의 시장 점유율은 크고, 중국은 세계 최대의 리튬이온배터리 생산국이 되고 있습니다. 또, 이 나라는 대기오염 레벨의 삭감에 임하고 있어 전기 자동차의 판매 대수가 높은 신장율을 기록해, EV용 배터리의 높은 수요로 이어질 것으로 예상됩니다.

- 게다가, 중국은 전기자동차 배터리 제조의 세계의 핫스팟입니다. 중국에는 93개의 기가 공장이 있으며 2030년까지 약 130개의 공장이 건설될 것으로 예측되고 있습니다. 이 때문에, 이 나라에서는 배터리 관리 시스템의 수요 확대가 전망되고 있습니다.

- 또한 인도의 주정부는 국내에서 전기자동차를 보급하기 위해 몇 가지 이니셔티브를 취하고 있습니다. 예를 들면, 델리 정부는 EV 시책을 취하고 있으며, 배터리의 1Kwh 당이나 EV 1대 당에 장려금을 지급하고 있습니다. 예를 들면, 이 주는 배터리 용량 1 KWh 당 약 120달러, EV 1대 당 약 1,850달러의 장려금을 지급하고 있습니다. 이러한 제도의 주요 목적은 인도 자동차 시장에서 전기차와 하이브리드차의 보급을 촉진하는 것입니다.

- 최근 아시아태평양이 전기 배터리 제조 시장을 독점하고 있으며, 예측 기간 중에도 그 경향이 계속될 것으로 예상됩니다. 유럽은 다양한 민간기업의 전기차 프로젝트 투자 증가 등의 요인으로 인해 예측 기간 동안 큰 성장이 예상됩니다.

- 예를 들어 Volkswagen은 2022년 7월 독일에 Power Co라는 새로운 회사를 설립하여 EV 배터리 개발에 약 200억 달러의 투자를 계획하고 있습니다. 공장의 생산은 2025년까지 개시될 전망이며, 향후 수년간 50만 대에 가까운 EV의 수요에 부응하게 될 것으로 생각됩니다.

- 따라서, 상기 요인으로부터, 예측 기간중, 수송 부문이 배터리 관리 시스템 시장을 독점할 가능성이 높습니다.

아시아태평양이 시장을 독점할 전망

- 아시아태평양은 예측 기간 중 배터리 관리 시스템의 주요 시장이 될 가능성이 높습니다. 아시아 태평양에서는 EV 시장의 급성장으로 중국이 강력한 성장을 이룰 것으로 예상됩니다.

- 소비자용 전자 기기에 대한 수요의 높아지는 안전성을 목적으로 한 소비자용 전자 기기에의 BMS의 통합 증가에 의해 BMS 수요에 박차를 가할 가능성이 높습니다.

- 중국은 전기자동차(EV)의 최대 시장이며, 작년은 333만대 이상의 EV가 판매되었습니다. 중국은 2021년 전 세계 전기차 판매량의 거의 40%를 차지합니다.

- 이전에는 외국 자동차 제조업체는 25%의 수입관세에 직면하거나 50%의 소유자를 상한으로 중국에 공장을 건설할 필요가 있었습니다. 현재 승용차의 경우 50% 출자 규칙은 완화되어 있습니다. 또 외국 기업이 국내에서 비슷한 자동차를 생산하는 합작회사를 2개 이상 설립하는 것을 제한하는 규칙도 철폐됩니다.

- 중국 정부는 국내 전기자동차 산업이 성공을 거두고 있기 때문에 전기자동차에 대한 보조금을 2022년에 30% 삭감하고 연말까지 폐지하는 것 같습니다. 계획된 보조금 삭감은 제조사가 신기술이나 신차를 개발하기 위한 정부 자금에 대한 의존도를 낮추는 것을 목적으로 하고 있습니다.

- 또한, India Brand Equity Foundation(IBEF)에 의하면, 인도의 소비자용 전자기기 및 내구 소비재 시장은 CAGR 9%까지 증가해, 올해는 3조 1,500억 루피를 차지할 것으로 예상되고 있습니다. 또한 인도 정부는 인도의 전자기기 제조 부문이 미래에 3,000억 달러에 이를 것으로 예측하고 있습니다. 이처럼 소비자용 전자기기의 수요 증가는 예측 기간 동안 인도의 배터리 관리 시스템 수요를 증가시킬 가능성이 높습니다.

- 자동차 산업은 인도에서 배터리 관리 시스템의 주요 최종 사용자 중 하나입니다. 자동차 산업에서 BMS는 리튬 이온 배터리의 온도, 전압, 전류 모니터링, 배터리 충전 상태(SoC) 및 셀 밸런싱과 같은 중요한 용도에 사용되고 있습니다. 또, 인도에서는 전기자동차의 보급이 진행되고 있어 안전성, 성능 최적화, 배터리의 건전성 모니터링과 진단, 다른 전자제어장치(ECU)과의 통신을 제공하는 자동차 배터리 관리 시스템 시장이 확대되고 있습니다.

- 2022년 6월 EV신흥기업인 맥윈 India는 인도의 카르나타카 주에 EV 모터, 컨트롤러, BMS 시스템의 제조 공장을 설립하기 위해 약 638만 달러를 투자할 가능성이 있다고 발표했습니다. 이 공장의 초기 제조 능력은 Nissan 2,000대로 EV 주문자 상표 부착 생산(OEM) 수요에 대응할 예정입니다. 따라서 이러한 향후 프로젝트는 예측 기간 동안 인도의 BMS 시스템 수요를 증가시킬 가능성이 높습니다.

- 따라서 위의 요인은 예측 기간 중 시장이 성장할 것으로 예상되는 이 지역에서의 배터리 관리 시스템의 주요 촉진요인으로 생각할 수 있습니다.

배터리 관리 시스템 산업 개요

배터리 관리 시스템 시장은 적당히 세분화되어 있습니다. 이 시장의 주요 기업으로는, Eberspaecher Vecture Inc., Elithion Inc., BMS Powerasfe, Texas Instruments Incorporated, Sensata Technologies Inc. 등이 있습니다.(순부동)

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사 범위

- 시장의 정의

- 조사의 전제

제2장 주요 요약

제3장 조사 방법

제4장 시장 개요

- 서문

- 시장 규모 및 수요 예측(-2027년)

- 최근 동향 및 개발

- 정부 규제 및 시책

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 공급망 분석

- Porter's Five Forces 분석

- 공급기업의 협상력

- 소비자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

제5장 시장 세분화

- 용도별

- 거치형

- 휴대용

- 수송용

- 지역별

- 북미

- 미국

- 캐나다

- 기타 북미

- 유럽

- 독일

- 프랑스

- 이탈리아

- 영국

- 러시아 연방

- 기타 유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 기타 아시아태평양

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 중동 및 아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

- 남아프리카

- 기타 중동 및 아프리카

- 북미

제6장 경쟁 구도

- M&A, 합작사업, 제휴 및 협정

- 주요 기업의 전략

- 기업 프로파일

- Eberspaecher Vecture Inc.

- Elithion Inc.

- Leclanche SA

- Renesas Electronics Corporation

- LION Smart GmbH

- Sensata Technologies Inc.

- RCRS Innovations Pvt. Ltd

- Nuvation Energy

- Texas Instruments Incorporated

- BMS Powersafe

제7장 시장 기회 및 향후 동향

AJY 25.05.02The Battery Management System Market size is estimated at USD 9.75 billion in 2025, and is expected to reach USD 12.36 billion by 2030, at a CAGR of 4.85% during the forecast period (2025-2030).

The market was negatively impacted by COVID-19. Presently the market has now reached pre-pandemic levels.

Key Highlights

- Over the medium term, the growing demand for battery management systems is expected to stimulate the market growth of battery management systems. Furthermore, the increasing adoption of electric vehicles, the need for robust charging infrastructure, and the focus on increasing the energy efficiency of batteries are also expected to drive the growth of the market studied.

- On the other hand, technological limitation on off-the-shelf battery management systems or standard battery management systems is one of the major restraints for the market.

- Nevertheless, technological advancements in battery management systems with advantages, such as reduced complexity, better efficiency, and improved reliability, among others, are expected to provide growth opportunities in the forecast period.

- The Asian-Pacific region dominates the market and is also likely to witness the highest CAGR during the forecast period. This growth is attributed to the rapid rise in sales of electric vehicles in countries like China and Japan. This rise has been due to the extensive efforts of the governments to reduce greenhouse gas emissions.

Battery Management System Market Trends

Transportation Segment Expected to Dominate the Market

- Vehicles with internal combustion engines (ICE) were the only types used earlier. However, technology has been shifting toward electric vehicles (EVs) due to growing environmental concerns. Therefore, due to these reasons, battery management systems do not have any market in the ICE sector.

- Last year's global EV sales stood at around 6.6 million (including battery electric vehicles and plug-in hybrid electric vehicles). The sales are likely to increase further with various EV policy adoption by different countries globally.

- Lithium-ion batteries are mostly used in EVs as they provide high energy density, low self-discharge, less weight, and low maintenance. For ICE vehicles, the lead-based battery is widely used and is expected to continue to be the only viable mass-market battery system for the foreseeable future. Lithium-ion batteries still require higher cost reductions for use in SLI applications to be considered a viable mass-market alternative to lead-based batteries.

- Lithium-ion battery systems propel plug-in hybrid and electric vehicles. Due to their high energy density, fast recharge capability, and high discharge power, lithium-ion batteries are the only available technology that meets OEM requirements for the vehicle driving range and charging time. The lead-based traction batteries are not competitive for use in full hybrid electric vehicles or electric vehicles because of their lower specific energy and higher weight.

- The global production of batteries for electric vehicles is mainly concentrated in the Asian-Pacific region, with Chinese, Japanese, and South Korean companies dominating the sector and building European factories to conserve their supremacy. China's significant market share in the midstream and downstream value chain of li-ion batteries makes it the largest producer of li-ion batteries globally. The country is also making efforts to reduce air pollution levels, which is expected to register a high growth rate in the sales of electric vehicles and lead to high demand for EV batteries.

- Additionally, China is the global hotspot for electric vehicle battery manufacturing. There are 93 Giga factories in China, and the country is projected to have around 130 by 2030; the country is expected to dominate the market during the forecast period. This, in turn, is expected to create tremendous demand scope for battery management systems in the country.

- Furthermore, the Indian state government has taken several initiatives to promote electric vehicles in the country. For instance, the Delhi government has an EV policy that provides incentives per Kwh of battery and per EV. For instance, the state provides about USD 120 as incentives per KWh battery capacity and about USD 1,850 incentives per EV. The main objective of such a scheme is to promote faster adoption of electric and hybrid vehicles in the Indian automotive market.

- In recent years, the Asian-Pacific region dominated the electric battery manufacturing market, and it is expected to continue to do so during the forecast period. Europe is expected to witness significant growth during the forecast period owing to factors like increasing investment in electric vehicle projects by various private players.

- For instance, in July 2022, Volkswagen planned to invest nearly USD 20 billion in developing EV batteries in a new company named Power Co in Germany. The plant production is expected to begin by 2025 and will likely cater to the demand for nearly 500,000 EVs in the upcoming years.

- Hence, based on the factors mentioned above, the transportation segment is likely to dominate the battery management systems market during the forecast period.

Asia-Pacific is Expected to Dominate the Market

- Asia-Pacific is likely to be a major market for battery management systems during the forecast period. In Asia-Pacific, China is expected to witness strong growth due to the rapid growth in the EV market.

- The rising demand for consumer electronics is likely to add to the demand for BMS, owing to the increasing integration of BMS in consumer electronics for safety purposes.

- China is the largest market for electric vehicles (EVs), with over 3.33 million EVs sold last year, and it is expected to remain the largest global electric car market. China accounted for almost 40% of global electric car sales in 2021.

- Earlier, foreign automakers faced a 25% import tariff or were required to build a factory in China with a cap of 50% ownership. Currently, the 50% ownership rule is relaxed for passenger cars. The rules restricting a foreign company from establishing more than two joint ventures producing similar vehicles in the country are also removed.

- The Government of China is likely to cut subsidies on electric vehicles by 30% in 2022 and eliminate it by the end of the year, as the electric vehicle industry in the country is now successful. The planned subsidy cut is aimed at reducing manufacturers' reliance on government funds for developing new technologies and vehicles.

- Furthermore, according to the Indian Brand Equity Foundation (IBEF), the Indian appliance and consumer durables market is expected to increase to a CAGR of 9%, accounting for INR 3.15 trillion in the current year. Furthermore, the Indian government anticipates that the Indian electronics manufacturing sector is likely to reach USD 300 billion in the future. Thus, the increasing demand for consumer electronics is likely to increase the demand for battery management systems in India during the forecast period.

- The automotive industry is one of India's major end users of battery management systems. In the automobile industry, BMS is used for critical applications such as temperature, voltage, current monitoring, battery state of charge (SoC), and cell balancing for lithium-ion batteries. In addition, the rising adoption of electric vehicles in India is driving the market for the automotive battery management system to provide safety, performance optimization, health monitoring and diagnostic of battery, and communication with other electronic control units (ECU).

- In June 2022, EV startup Mecwin India announced that it is likely to invest approximately USD 6.38 million to set up an EV motor, controller, and BMS systems manufacturing plant in Karnataka, India. The factory will likely have an initial manufacturing capacity of 2,000 units per day and will likely cater to the demand for EV Original Equipment Manufacturers (OEMs). Thus, such upcoming projects are likely to increase the demand for BMS systems in India during the forecast period.

- Therefore, the above-stated factors can be considered the major driving factors for battery management systems in the region, where the market is expected to grow during the forecast period.

Battery Management System Industry Overview

The battery management system market is moderately fragmented. Some of the major players in the market (in no particular order) include Eberspaecher Vecture Inc., Elithion Inc., BMS Powersafe, Texas Instruments Incorporated, and Sensata Technologies Inc., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Application

- 5.1.1 Stationary

- 5.1.2 Portable

- 5.1.3 Transportation

- 5.2 By Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 Francy

- 5.2.2.3 Italy

- 5.2.2.4 United Kingdom

- 5.2.2.5 Russian Federation

- 5.2.2.6 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 India

- 5.2.3.3 Japan

- 5.2.3.4 South Korea

- 5.2.3.5 Rest of Asia-Pacific

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 United Arab Emirates

- 5.2.5.3 South Africa

- 5.2.5.4 Rest of Middle-East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Eberspaecher Vecture Inc.

- 6.3.2 Elithion Inc.

- 6.3.3 Leclanche SA

- 6.3.4 Renesas Electronics Corporation

- 6.3.5 LION Smart GmbH

- 6.3.6 Sensata Technologies Inc.

- 6.3.7 RCRS Innovations Pvt. Ltd

- 6.3.8 Nuvation Energy

- 6.3.9 Texas Instruments Incorporated

- 6.3.10 BMS Powersafe