|

시장보고서

상품코드

1444391

풍력 터빈 - 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2024-2029년)Wind Turbine - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

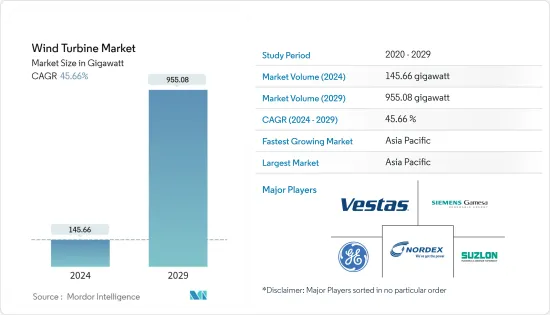

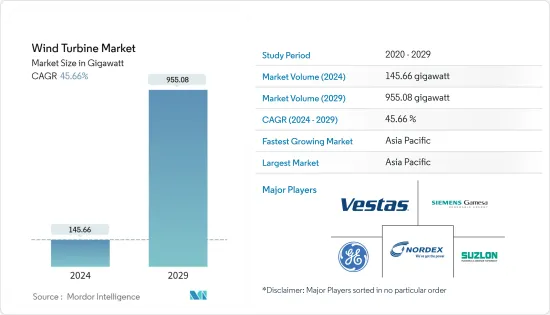

풍력 터빈 시장 규모는 2024년 145.66기가와트로 추정됩니다. 2029년까지 955.08기가와트에 달할 것으로 예상되며, 예측 기간(2024-2029년) 동안 45.66%의 연평균 복합 성장률(CAGR)을 나타낼 것으로 예상됩니다.

2020년, 코로나19는 시장에 악영향을 끼쳤습니다. 현재 시장은 전염병이 발생하기 전의 수준에 도달했습니다.

주요 하이라이트

- 중기적으로 발전 구성에서 재생 가능 에너지원, 특히 풍력 발전에 대한 수요 증가, 화석 연료 기반 발전에 대한 의존도를 줄이기 위한 노력, 에너지 효율에 대한 규제 등의 요인이 풍력 터빈의 보급을 촉진할 것으로 예상됩니다. 예측 기간 동안 시장.

- 한편, 태양광 및 기타 대체 에너지원과 같은 대체 청정 에너지원의 도입은 시장 성장을 저해할 수 있습니다.

- 그럼에도 불구하고 세계풍력에너지위원회는 전 세계적으로 2030년까지 380GW, 2050년까지 2,000GW의 해상풍력발전을 달성할 것을 약속하고 있으며, 이는 가까운 미래에 풍력터빈 도입에 큰 기회를 가져올 것으로 보입니다.

- 아시아태평양은 풍력 발전의 가장 큰 점유율과 중국, 인도, 일본 등의 국가에 제조 및 기술 거점이 존재하여 가장 크고 빠르게 성장하는 시장이 될 것으로 예상됩니다.

주요 시장 동향

해상 풍력 터빈이 큰 폭의 성장세를 보이고 있습니다.

- 에너지 수요가 증가함에 따라 주요 국가와 기업들은 청정 에너지를 제공할 수 있는 재생 가능 에너지원, 특히 풍력에너지의 도입에 주목하고 있습니다. 첨단 기술을 갖춘 해상 풍력에너지의 도입은 많은 국가와 기업이 많은 투자를 유치하고 있습니다.

- 설치 장소별로 보면, 해상 산업은 비용 감소, 기술 향상, 전 세계 해상 풍력에너지 프로젝트 개발 및 투자 증가로 인해 예측 기간 동안 전 세계 풍력 터빈 산업에 대한 투자가 크게 증가할 것으로 예상됩니다.

- 영국 정부는 탄소 배출량을 줄이면서 영국의 저렴한 에너지 공급을 크게 늘리기 위해 영국 정부는 해상 풍력 산업과 정부 간의 분야 협정의 일환으로 해상 풍력에서 전력의 최소 3분의 1을 공급하기 위한 장기 전략을 수립했습니다. 영국 기후 변화위원회 보고서는 영국이 2050년까지 '실질적 제로' 배출량 목표를 법제화한 최초의 대규모 경제국이 될 수 있음을 시사했습니다.

- 2022년 5월, 영국의 부유식 해상풍력 투자 계획(FLOWMIS)이 최근 발표되면서 스코틀랜드, 웨일즈 등 영국 전역의 해상풍력 발전 프로젝트가 시작될 예정입니다. 정부는 제조업체를 지원하고 민간 투자자에게 향후 과잉 성장이 예상되는이 신흥 분야에 대한 투자에 대한 확신을 제공함으로써 이러한 프로젝트에 자금을 지원할 계획입니다.

- 노르웨이 정부는 2022년 5월, 노르웨이 정부는 2040년까지 30GW 용량을 목표로 해상 풍력 발전 개발에 해역을 할당하는 투자 계획을 발표했습니다.

- 재생에너지법(EEG)에 따라 독일은 해상 풍력에너지를 대규모로 확대할 계획을 세우고 있습니다. 연정 합의의 일환으로 독일은 2030년까지 해상 풍력 발전 목표를 30GW로 늘릴 것이라고 밝혔습니다.

- 세계풍력에너지위원회(GWEC)의 통계에 따르면 2022년 세계 해상풍력 발전 용량은 64.3GW에 달할 것이며, 2022년에는 8.8GW의 용량이 추가될 것으로 예상됩니다.

- 이 외에도 두 회사는 풍력 터빈의 재료를 개선하여 더 높은 풍력 터빈을 설치할 수 있고, 터빈이 더 높은 고도의 바람을 이용할 수 있도록 했습니다. 또한 이 새로운 터빈은 블레이드가 더 커서 소형 터빈보다 더 넓은 범위를 청소할 수 있습니다. 풍력 터빈의 대형화는 풍력에너지의 비용 절감에 기여하고 미국, 독일, 프랑스 등 일부 지역에서는 풍력에너지가 화석 연료 대체 추세와 경제적으로 경쟁력이 있음을 보여줍니다. 예측 기간 동안 해상 풍력 터빈 시장.

아태지역이 시장을 독점

- 아시아태평양에서 풍력에너지는 가장 풍부한 에너지 자원 중 하나이며, 이 지역의 에너지 수요를 충족시키는 이상적인 공급원이 되고 있습니다. 풍력에너지의 큰 성장 잠재력을 고려하여 중국, 인도, 일본 등 아시아 국가들은 현재 이 에너지 자원을 광범위하게 도입하는 데 초점을 맞추었습니다.

- 지속가능한 발전과 온실가스 감축에 대한 관심이 높아지면서 해상 풍력에너지가 인기 있는 에너지원으로 떠오르고 있습니다. 발전용 주류 에너지원으로서 해상풍력에너지는 대체 에너지원에서 주류 에너지원으로 크게 변화했습니다. 해상 풍력에너지 기술은 아시아 국가에서 빠르게 발전하고 있으며, 최근 터빈 기술의 발전과 정부의 장려책으로 인해 풍력에너지에 대한 의존도가 높아지고 있습니다.

- 중국풍력에너지협회(CWEA)에 따르면, 2022년까지 44.7GW의 육상 풍력 발전 설비가 설치될 것으로 예상됩니다. 그러나 국가에너지국(NEA)이 발표한 최신 통계에 따르면 새로 계통에 도입된 육상 풍력 발전 설비는 32.6GW에 불과합니다. 같은 해에 이어졌습니다.

- GWEC에 따르면, 세계 해상풍력 산업은 2022년 8.7GW의 신규 설비를 도입했습니다. 중국은 신규 설비에서 계속 세계 선두를 달리고 있으며, 2022년에는 5GW 이상의 해상풍력 발전망이 연결될 것으로 예상됩니다.

- 인도는 2022년 한 해 동안 약 1.8GW의 풍력발전을 새로 설치하여 같은 해 말까지 총 설치 용량이 41.9GW에 달할 것으로 예상됩니다. 이 프로젝트들은 주로 북부, 남부, 서부에 분포되어 있습니다.

- 지난 5월 인도 정부는 해상 풍력 발전 개발의 첫 번째 단계를 발표하며 경매 시작 전략과 일정에 대한 개요를 발표했습니다. 향후 몇 달 내로 예정된 첫 번째 경매를 위해 최소 10-12GW의 해상 풍력 터빈을 건설하겠다는 초기 전략의 윤곽이 제시됐습니다. 최근 발표된 계획에 따르면, 첫 번째 경매는 두 개의 지역에서 진행될 예정입니다. 하나는 타밀 나두와 구자라트 주입니다. 이 분야의 첫 번째 경매는 4GW 용량을 목표로 하고 있습니다.

- 세계은행 그룹에 따르면 필리핀의 EEZ에는 약 178GW의 해상 풍력 발전 기술 자원 잠재력이 있으며, 주로 부유식 풍력 발전과 18GW의 고정식 해상 풍력 발전이 있습니다. 이는 필리핀의 총 발전 설비 용량의 7배 이상이라는 점을 감안하면 탈탄소화와 에너지 안보 목표를 달성할 수 있는 기회가 큽니다.

- 필리핀 에너지부는 세계은행 그룹의 ESMAP-IFC 해상풍력 개발 프로그램과 협력하여 해상풍력 로드맵을 작성하고 있습니다. 로드맵 초안에는 해상풍력 개발을 위한 6개 구역을 지정하여 2030년까지 총 2.8GW, 2050년까지 58GW의 해상풍력 프로젝트를 개발할 계획이며, 대부분 부유식 해상풍력 프로젝트가 될 것입니다.

- 이러한 전망은 예측 기간 동안 풍력 터빈 사업에 종사하는 시장 관계자들에게 아시아태평양이 우수한 비즈니스 목적지로 제시될 것으로 예상됩니다.

경쟁 구도

풍력 터빈 시장은 상당히 세분화되어 있습니다. 시장의 주요 기업으로는 Vestas Wind Systems AS, Siemens Gamesa Renewable Energy SA, General Electric Company, Nordex SE, Suzlon Energy Limited 등이 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간 애널리스트 지원

목차

제1장 서론

- 조사 범위

- 시장의 정의

- 조사의 전제조건

제2장 주요 요약

제3장 조사 방법

제4장 시장 개요

- 서론

- GW 풍력 터빈 설치용량과 2028년까지 예측

- 최근 동향과 발전

- 정부 정책과 규제

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 공급망 분석

- Porter의 Five Forces 분석

- 공급 기업의 교섭력

- 소비자의 교섭력

- 신규 진출업체의 위협

- 대체 제품 및 서비스의 위협

- 경쟁 기업간 경쟁도

제5장 시장 세분화

- 전개 장소

- 온쇼어

- 오프쇼어

- 용량

- 소

- 중

- 대

- 지역

- 북미

- 미국

- 캐나다

- 멕시코

- 기타 북미

- 유럽

- 독일

- 영국

- 프랑스

- 기타 유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 기타 아시아태평양

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 중동 및 아프리카

- 아랍에미리트(UAE)

- 사우디아라비아

- 기타 중동 및 아프리카

- 북미

제6장 경쟁 구도

- 인수합병(M&A)/합작투자(JV)/협업/계약

- 유력 기업이 채택한 전략

- 기업 개요

- Vestas Wind Systems AS

- Siemens Gamesa Renewable Energy SA

- General Electric Company

- Nordex SE

- Suzlon Energy Limited

- Xinjiang Goldwind Science &Technology Co. Ltd.

- Eaton Corporation PLC

- Enercon GmbH

- Hitachi Ltd.

- Vergnet

제7장 시장 기회와 향후 동향

LSH 24.03.19The Wind Turbine Market size is estimated at 145.66 gigawatt in 2024, and is expected to reach 955.08 gigawatt by 2029, growing at a CAGR of 45.66% during the forecast period (2024-2029).

In 2020, COVID-19 had a detrimental effect on the market. Presently, the market has reached pre-pandemic levels.

Key Highlights

- Over the medium period, factors such as increasing demand for renewable energy sources, especially wind power, in the power generation mix, efforts to reduce the reliance on fossil fuel-based power generation, and regulations on energy efficiency are expected to drive the wind turbine market during the forecast period.

- On the other hand, the adoption of alternative clean energy sources like solar and other alternatives is likely to hinder the market's growth.

- Nevertheless, the global wind energy council committed to achieving 380 GW of offshore wind by 2030 and 2,000 GW by 2050 worldwide, which is likely to provide significant opportunities for the deployment of wind turbines soon.

- The Asia-Pacific region is expected to be the largest and fastest-growing market, owing to the largest share in terms of wind power generation and the presence of manufacturing and technology hubs in countries like China, India, Japan, etc.

Key Market Trends

Offshore Wind Turbine to Witness a Significant Growth

- As energy demand is rising, major countries and companies are turning toward the adoption of renewable energy sources, especially wind energy, as they can provide clean energy. The adoption of offshore wind energy with advanced technologies has attracted many countries and companies with high investments.

- By location of deployment, the offshore industry is expected to witness significant growth in global wind turbine industry investments during the forecast period, owing to declining costs, improved technology, and increased developments and investments in offshore wind energy projects worldwide.

- To significantly increase the United Kingdom's affordable energy supply while reducing carbon emissions, the UK government developed a long-term strategy to deliver at least one-third of its electricity from offshore wind as part of a sector deal between the offshore wind industry and the government. A report by the UK's Committee on Climate Change indicates the country could become the first large economy to legislate a "net zero" emissions target for 2050.

- In May 2022, in a recent announcement, the Floating Offshore Wind Manufacturing Investment Scheme (FLOWMIS) of the United Kingdom announced that it would provide the government with GBP 160 million to boost floating offshore wind capability around the UK at locations in Scotland, Wales, and elsewhere. By supporting manufacturers and providing private investors with the confidence to invest in this emerging sector, which is expected to overgrow in the future, the government is going to provide funding for these projects.

- In May 2022, the Government of Norway launched an investment plan to allocate sea areas for offshore wind development by 2040, targeting 30 GW of capacity.

- Following the Renewable Energy Act (EEG), Germany plans to boost offshore wind energy massively. As part of the Coalition Agreement, Germany stated it would increase its offshore wind target to 30 GW by 2030.

- According to Global Wind Energy Council (GWEC) statistics, in 2022, the global offshore wind capacity reached 64.3 GW and the new 8.8 GW of capacity was added in 2022.

- Besides this, the companies have been able to install taller wind turbines due to improvements in the wind turbine materials used, which allow the turbines to exploit higher-altitude winds. Also, these new turbines have larger blades and, hence, can sweep a larger area than the smaller turbines. The growing size of the wind turbines helped lower the cost of wind energy, indicating that it is economically competitive with fossil fuel alternatives in some locations such as the United States, Germany, France, etc. Therefore, these recent trends are expected to drive the offshore wind turbine market during the forecast period.

Asia-Pacific to Dominate the Market

- In the Asia-Pacific region, wind energy is one of the most abundant energy resources, making it an ideal source for fulfilling the region's energy needs. In view of wind energy's tremendous growth potential, Asian countries, including China, India, Japan, and others, are currently focusing on implementing a widespread deployment of this energy resource.

- As a result of an increasing focus on sustainable development and a commitment to reducing greenhouse gas emissions, offshore wind energy has become a popular source of energy. As a mainstream energy source for power generation, offshore wind energy has significantly changed from being a source of alternative energy. Offshore wind energy technology is being developed at a rapid pace in Asian countries, which has contributed to the growing reliance on wind energy due to recent advancements in turbine technology and government incentives.

- According to the Chinese Wind Energy Association (CWEA), 44.7 GW of onshore wind capacity was installed in 2022. However, the most recent statistics released by the National Energy Administration (NEA) indicate that only 32.6 GW of new onshore wind capacity was grid-connected in the same year.

- According to GWEC, the global offshore wind industry installed a new capacity of 8.7 GW in 2022. China consecutively led the world in new installations, with more than 5 GW of offshore wind grid-connected in 2022.

- During 2022, India installed around 1.8 GW of new wind power, making 41.9 GW of total installed capcity by end of the same year. These projects are mostly spread in the northern, southern, and western parts of the country.

- In May 2022, the Indian government announced the first steps in offshore wind power development and outlined a strategy and timetable for starting auctions. An initial strategy of building at least 10 to 12 GW of offshore wind turbines is outlined for the first auctions, which are expected to take place in the coming months. There are going to be two regions targeted for the first auctions in the recently released plan. One is going to be Tamil Nadu and Gujarat. The first auctions in this area will target 4 GW of capacity.

- According to the World Bank Group, the Philippines' EEZ has around 178 GW of technical resource potential for offshore wind, primarily floating wind with 18 GW of fixed-bottom offshore wind. Considering that this is more than seven times the country's total installed electricity generation capacity, the opportunity to meet decarbonization and energy security goals is significant.

- In partnership with the World Bank Group's ESMAP-IFC Offshore Wind Development Program, the Philippine Department of Energy is developing an offshore wind roadmap. A draft roadmap identifies six different zones for offshore wind development, totaling 2.8 GW by 2030 and 58 GW by 2050, with mostly floating offshore wind projects.

- This, in turn, is expected to present Asia-Pacific as an excellent business destination for market players involved in the wind turbine business during the forecast period.

Competitive Landscape

The wind turbine market is moderately fragmented. Some of the major players in the market (in no particular order) include Vestas Wind Systems AS, Siemens Gamesa Renewable Energy SA, General Electric Company, Nordex SE, and Suzlon Energy Limited.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Wind Turbine Installed Capacity and Forecast in GW, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Location of Deployment

- 5.1.1 Onshore

- 5.1.2 Offshore

- 5.2 Capacity

- 5.2.1 Small

- 5.2.2 Medium

- 5.2.3 Large

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of the North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Rest of the Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 Rest of the Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of the South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Rest of the Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Vestas Wind Systems AS

- 6.3.2 Siemens Gamesa Renewable Energy SA

- 6.3.3 General Electric Company

- 6.3.4 Nordex SE

- 6.3.5 Suzlon Energy Limited

- 6.3.6 Xinjiang Goldwind Science & Technology Co. Ltd.

- 6.3.7 Eaton Corporation PLC

- 6.3.8 Enercon GmbH

- 6.3.9 Hitachi Ltd.

- 6.3.10 Vergnet