|

시장보고서

상품코드

1687273

옵토커플러 시장 : 점유율 분석, 산업 동향과 통계, 성장 예측(2025-2030년)Optocouplers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

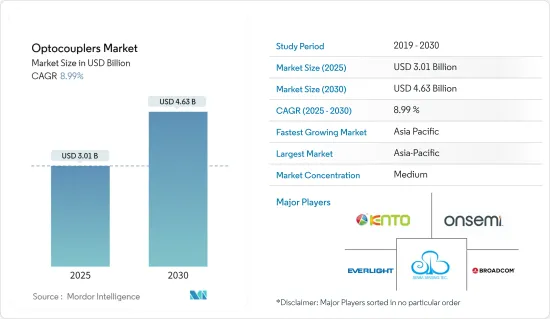

세계의 옵토커플러 시장 규모는 2025년 30억 1,000만 달러로 추정되며 예측 기간 중(2025-2030년) CAGR 8.99%로 확대되어, 2030년에는 46억 3,000만 달러에 달할 것으로 예측되고 있습니다.

산업 자동화의 확대와 많은 최종 사용자 산업에서 신호 분리 솔루션의 채용이 증가하고 있는 것이 예측 기간 중 시장 조사의 주요 촉진요인입니다.

주요 하이라이트

- 옵토커플러 시장은 자동차, 통신, 산업 부문 수요 증가에 의해 급증하고 있습니다.

- 옵토커플러는 보통 디지털 신호를 전송하지만 특정 상황에서는 아날로그 신호를 전송할 수 있습니다.

- 옵토커플러 시장은 무선 기기, 전기자동차 수요 증가, 자동화 등의 산업 동향에 따라 성장하고 있습니다.

- 산업 자동화의 확대나 신호 절연 솔루션의 인기 상승 등, 몇 가지 주요인에 의해 시장의 성장이 전망되고 있습니다.

- 옵토커플러는 신뢰성에서 고전하고 있습니다. LED의 고장이 주요 문제일지도 모르지만, 인터페이스의 오염이나 흡습에 의한 열기계적 스트레스 등 다른 문제에도 언급하고 있습니다.

옵토커플러 시장 동향

산업 자동화 증가가 시장을 견인

- 산업 부문은 전통적으로 첨단 기술을 솔선하여 채용해 왔습니다. 「인더스트리 4.0」 컨셉이 이 부문의 디지털 전환을 추진해, 산업이 실시간의 의사 결정, 생산성의 향상, 유연성, 민첩성을 실현하는 것을 가능하게 하고 있습니다.

- 이러한 인프라를 지원하기 위해 많은 전기 및 전자기기나 회로를 설치할 필요가 있기 때문에 이러한 동향의 변화는 연구시장의 성장에 유리한 시장 전망을 만들어내고 있습니다. 또한, 옵토커플러는 서보 오토메이션 시스템이나 산업용 로봇의 모터 제어 회로, 전원, 태양광 발전(PV) 인버터로부터 데이터 통신이나 디지털 로직 인터페이스 회로에 이르기까지 산업용도의 절연도 가능하게 합니다.

- 또한 산업용 자동화 용도에서 광커플러는 불필요한 노이즈를 필터링하면서 절연 배리어를 넘어 데이터를 전송하는 역할을 담당하고 있습니다. CMR의 정의와 관련된 요인은 공통 모드 전압(VCM)과 과도 신호의 상승 시간과 하강 시간(dv/dt)입니다.

- 산업 자동화 통신에서는 인도, 중국 등의 개발도상국에서 옵토커플러 수요가 증가하고 있습니다.

- 설치대수가 가장 많은 지역은 아시아와 호주로 2020년까지 이미 26만 6,000대가 설치된 것으로 추정되고 있습니다.

- 산업용 로봇은 로봇 암, 휴먼 머신 인터페이스(HMI) 패널, 제어반으로 구성되므로 로봇 시스템 전체의 안전한 동작을 확보하기 위해서는 다양한 로봇 컴포넌트와 인터페이스를 절연해야 합니다.

아시아태평양이 급성장 시장이 될 전망

- 옵토커플러는 국내와 국제적인 규제 요건을 준수하기 위한 안전절연을 제공하기 위해 가장 일반적으로 이용되고 있습니다.

- 동아시아는 혁신적인 에너지 효율이 높은 제품과 자동차 부문에 크게 기여하고 있습니다. 중국은 반도체 시장에서 강력한 골격으로 인해 이 지역의 주요 영향요인 중 하나가 되고 있습니다.

- 인도 정부는 제조업에 대한 관심을 높여 동국 경제를 활성화하기 위한 적절한 이니셔티브를 취하고 있습니다. 이에 대한 수요 증가는 반도체 산업에 대한 다액의 투자와 함께 이 지역에서의 옵토커플러의 판매를 강화할 것으로 추정되고 있습니다.

- 인도에서는 전자 제조 클러스터를 창출하기 위해 정부가 19개의 EMC(전자 제조 클러스터)를 발표하고 있으며, 그 중 3개가 안드라 프라데시 주 정부에 할당되어 있습니다.

- 중국국가통계국에 따르면 2023년까지 공업부문은 중국의 국내총생산의 약 31.7%를 차지했습니다.

- 옵토커플러는 스위칭 장치로 사용하거나 저전압 회로와 고전압 회로를 절연하기 위해 다른 전자 장치와 함께 사용할 수 있습니다. 옵토커플러에 의존하는 경우가 많습니다. 인도 정부는 최근 노트북, 태블릿 단말, 퍼스널 컴퓨터, 서버의 국내 제조업체를 대상으로 4년간 7,325클로(8억 8,820만 달러)의 PLI 스킴(Production Linked Incentive)를 발표했습니다. 이 PLI 방식은 향후 4년간 생산으로 3조 2,600억 루피(395억 달러), 수출로 2조 4,500억 루피(2,97억 달러)를 획득할 가능성이 있습니다.

광커플러 산업 개요

옵토커플러 시장은 Shenzhen Kento Electronic, Everlight Electronics, Senba Sensing Technology, ON Semiconductor Corporation, Broadcom Inc. 등 대기업이 존재하는 반고정 시장입니다.

2022년 11월, Vishay IntertechnologyInc.(VSH)는 급성장하는 옵토커플러 시장에서의 포지션을 강화하기 위해 이산 제품 라인의 다양화에 크게 노력하고 있습니다.

2022년 8월, Toshiba Electronic Devices & Storage Corporation는 스마트 게이트 드라이버 및 포토커플러의 라인 업을 확충했습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 산업의 매력 - Porter's Five Forces

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

- 산업 밸류체인 분석

- 시장에 대한 COVID-19의 영향

- 옵토커플러의 세계 출하 수

제5장 시장 역학

- 시장 성장 촉진요인

- 하이브리드 전기자동차 수요 증가

- 산업 자동화 증가

- 시장 성장 억제요인

- 본질적인 마모

- 규제 환경

제6장 시장 세분화

- 제품 유형별

- 포토 트랜지스터 기반 광 커플러

- 포토 달링턴 트랜지스터 기반 옵토커플러

- 포토 TRIAC 기반 옵토커플러

- 포토 SCR 옵토커플러

- 기타

- 최종 사용자 산업별

- 자동차

- 소비자용 전자 기기

- 통신 기기

- 산업용

- 기타

- 지역별

- 북미

- 유럽

- 아시아

- 호주 및 뉴질랜드

- 라틴아메리카

- 중동 및 아프리카

제7장 경쟁 구도

- 기업 프로파일

- Shenzhen Kento Electronic Co. Ltd

- Everlight Electronics Co. Ltd

- Senba Sensing Technology Co. Ltd

- ON Semiconductor Corporation

- Broadcom Inc.

- Vishay Intertechnology Inc.

- Renesas Electronics Corporation

- Toshiba Electronic Devices & Storage Corporation(Toshiba Corp.)

- Isocom Components Ltd

- Panasonic Corporation

- Standex Electronics Inc.

- Skyworks Solutions Inc.

- Sharp Devices Europe

- LITE-ON Technology Inc.(Lite-On Technology Corporation)

제8장 투자 분석

제9장 시장의 미래

JHS 25.05.02The Optocouplers Market size is estimated at USD 3.01 billion in 2025, and is expected to reach USD 4.63 billion by 2030, at a CAGR of 8.99% during the forecast period (2025-2030).

The growing industrial automation and increasing adoption of signal isolation solutions across many end-user industries are major factors driving the market studied over the forecast period. Rapid advancements in optical wireless systems, the increasing demand for electric and hybrid vehicles, and the emergence of the digital optocoupler are likely to create more opportunities for optocoupler manufacturers.

Key Highlights

- The optocoupler market is expanding at a rapid rate due to large part to rising demand from the automotive, telecommunication, and industrial sectors. The optocoupler market is expanding due to the growing applications of optocouplers in the communication industry.

- The optocoupler typically transmits digital signals, though it can also transmit analog signals in a few specific circumstances. Consumer electronics, smart home appliances, and computer auxiliary devices are to blame for the rise in demand for optocouplers.

- The optocouplers market is growing due to trends in industries like wireless equipment, rising demand for electric vehicles, and automation. To enhance the performance of the products based on optocouplers, businesses have been investing in them.

- The market is expected to grow due to several key factors, including expanding industrial automation and the rising popularity of signal isolation solutions. There will probably be more opportunities for optocoupler manufacturers due to the quick development of optical wireless systems, the increasing demand for electric and hybrid vehicles, and the emergence of the digital optocoupler.

- Optocouplers struggle with reliability. The failure of the LED may be the main issue, but it mentions other issues like interface contamination and thermo-mechanical stress brought on by moisture absorption. These factors lead to early intrinsic wear-out of optocouplers..

Optocouplers Market Trends

Increasing Industrial Automation to Drive the Market

- The industrial sector has traditionally been among the leading adopters of advanced technologies. As the industry is going through another technological shift, the adoption of advanced technologies such as AI, IoT, ML, automation, and robotics has grown significantly. The "Industry 4.0" concept is driving the digital transformation of the field, enabling industries to deliver real-time decision-making, enhanced productivity, flexibility and agility.

- As many electrical and electronic devices and circuits need to be installed to support this infrastructure, this shift in trend is creating a favorable market outlook for the growth of the studied market. Optocouplers are designed to protect sensitive control circuitry from voltage fluctuations and unwanted noise or electromagnetic interference. Additionally, optocouplers also enable isolation in industrial applications ranging from the motor control circuit of servo automation systems and industrial robots, power supply, and photovoltaic (PV) inverters to data communication and digital logic interface circuits, the growing adoption of automation solutions is expected to drive their demand during the forecast period.

- Furthermore, in industrial automation applications, the optocoupler is responsible for transmitting data across the isolation barrier while filtering out unwanted noise. Failure of the component to reject unwanted noise can lead to data-transmission errors. The factors involved in defining CMR are the common-mode voltage (VCM ) and the rise and fall times of the transient signal (dv/dt). The failure point is determined by increasing either VCM or the dv/dt until the optocoupler's output signal crosses into the opposite logic state.

- Industrial automation communication is witnessing increased demand for optocouplers in developing nations such as India, China, and others. Additionally, the increased adoption of automation in the manufacturing sector is also driving the market as optocouplers forms an integral part of the automation process.

- The region with the most installations was Asia and Australia; an estimated 266,000 units had already been installed by 2020. In Asia and Australia, it is expected that there will be 370,000 Industrial Robots installed by 2024.

- As an industrial robot consists of a robot arm, a Human Machine Interface (HMI) panel, and a control cabinet, different robot components and interfaces must be isolated to ensure the safe operation of the complete robot systems. As optocouplers are among the effective solutions to impart isolation among electrical isolation between two circuits and help the robotic systems facilitate effective communication among various functional units, the increasing adoption of robotics and other automation solutions is expected to drive their demand during the forecast period.

Asia Pacific is Expected to be the Fastest Growing Market

- Optocouplers have most commonly been utilized to provide safety isolation for compliance with domestic and international regulatory requirements. Significant investments in the semiconductor industry, coupled with the increasing demand for efficient optoelectronic components in the industrial sector, bolstered the growth of optocouplers in the Asia-Pacific region.

- East Asia significantly contributes to innovative energy-efficient products and the automotive sector. However, optocouplers also offer another often-overlooked benefit: isolation from electrical noise. China is one of the major influencing factors in the region, owing to its strong foothold in the semiconductor market. The region is also one of the significant contributors to the global automotive sector and the smart energy-efficient products market.

- The Government of India has the right initiatives to boost the country's economy through deluging interest in manufacturing. In terms of export and production, the electronic industry in India is making remarkable growth. The increasing demand for efficient optoelectronic components in the industrial sector, coupled with substantial investments in the semiconductor industry, is estimated to bolster the sales of optocouplers in the region. Moreover, government initiatives encouraging the growth of the local semiconductor market are projected to attract new players.

- In India, To create electronic manufacturing clusters, the government has announced 19 EMCs (electronic manufacturing clusters), three of which have been allotted to the Andhra Pradesh government.

- According to the National Bureau of Statistics of China, The industrial sector accounted for around 31.7 % of China's gross domestic product by 2023. Industry 4.0, also known as the Fourth Industrial revolution, is the manufacturing automation and upgrading industry practices, thus driving the demand for optocouplers in the industrial sector.

- Optocouplers can either be used as a switching device or with other electronic devices to isolate low and high-voltage circuits. In electronics, embedded systems often rely on optocouplers to receive input signals from external sensors or switches. The Indian government has recently announced an INR 7,325 crore (USD 888.2 million) PLI Scheme (Production Linked Incentive) for domestic manufacturers of laptops, tablets, personal computers, and servers for four years. This PLI scheme may get INR 3.26 lakh crore (USD 39.5 billion) in production and INR 2.45 lakh crore (USD 29.7 million) in exports over the next four years.

Optocouplers Industry Overview

The Optocouplers Market is Semi-Consolidated with the presence of major players like Shenzhen Kento Electronic Co. Ltd, Everlight Electronics Co. Ltd, Senba Sensing Technology Co. Ltd, ON Semiconductor Corporation, and Broadcom Inc. Players in the market are adopting strategies such as partnerships, innovations, and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

In November 2022 - Vishay IntertechnologyInc. (VSH) is making significant efforts to diversify its discrete product line to strengthen its position in the burgeoning optocouplers market. The company introduced the linear optocoupler VOA300. The automotive-grade VOA300 device has a 5300 Vrmsisolation voltage, among the highest in the industry.

In August 2022 - Toshiba Electronic Devices & Storage Corporation expanded its smart gate driver photocouplers lineup. "TLP5222," a 2.5A output smart gate driver photocoupler, has a built-in automatic recovery function from protective operations. The lineup also includes TLP5212, TLP5214, and TLP5214A, which do not have a built-in automatic recovery function but reset to their normal operation by a signal input to their LED.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter Five Forces

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the Market

- 4.5 Global Optocoupler Shipments

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Hybrid Electric Vehicles

- 5.1.2 Increasing Industrial Automation

- 5.2 Market Restraints

- 5.2.1 Intrinsic Wear-out

- 5.3 Regulatory Environment

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Phototransistor-based Optocoupler

- 6.1.2 Optocoupler based on the Photo Darlington Transistor

- 6.1.3 Optocoupler based on Photo TRIAC

- 6.1.4 Optocoupler with Photo SCR

- 6.1.5 Other Types

- 6.2 By End-user Industry

- 6.2.1 Automotive

- 6.2.2 Consumer Electronics

- 6.2.3 Communication

- 6.2.4 Industrial

- 6.2.5 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Shenzhen Kento Electronic Co. Ltd

- 7.1.2 Everlight Electronics Co. Ltd

- 7.1.3 Senba Sensing Technology Co. Ltd

- 7.1.4 ON Semiconductor Corporation

- 7.1.5 Broadcom Inc.

- 7.1.6 Vishay Intertechnology Inc.

- 7.1.7 Renesas Electronics Corporation

- 7.1.8 Toshiba Electronic Devices & Storage Corporation (Toshiba Corp.)

- 7.1.9 Isocom Components Ltd

- 7.1.10 Panasonic Corporation

- 7.1.11 Standex Electronics Inc.

- 7.1.12 Skyworks Solutions Inc.

- 7.1.13 Sharp Devices Europe

- 7.1.14 LITE-ON Technology Inc. (Lite-On Technology Corporation)