|

시장보고서

상품코드

1444438

아페레시스 시장 : 점유율 분석, 산업 동향 및 통계, 성장 예측(2024-2029년)Apheresis - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

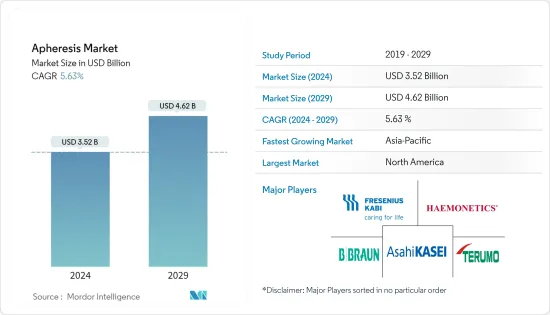

세계의 아페레시스(채혈, Apheresis) 시장 규모는 2024년 35억 2,000만 달러에 이르고, 2024-2029년의 예측 기간 동안 CAGR 5.63%로 성장하며 2029년까지 46억 2,000만 달러에 달할 것으로 예측됩니다.

COVID-19 팬데믹은 COVID-19에 감염된 환자를 치료하기 위한 혈장 치료의 광범위한 적용으로 인해 아페리시스 시장의 성장에 큰 영향을 미쳤습니다. 2021년 12월 임상채혈학회지에 발표된 연구에 따르면, COVID-19 팬데믹 기간 동안 채혈 시설에서 환자 치료의 주요 문제 중 하나는 공급 부족, 특히 RBC 장치와 채혈 키트 부족이었습니다. "집에 머물러라"는 지침과 SARS CoV2 감염에 대한 우려로 인해 헌혈자 수가 급격히 감소했습니다. 따라서 연구 대상 시장은 초기에 팬데믹의 영향을 받았습니다. 게다가 COVID-19를 치료할 백신이나 치료제가 없었기 때문에 대부분의 의사들은 COVID-19 중증 환자에게 회복기 혈장 요법을 선택했습니다. 이 치료법에서는 완치된 환자의 혈액에서 혈장 분리 기술로 추출한 혈장을 치료 중인 환자에게 수혈했습니다. 따라서 COVID-19 환자 치료에 혈장채집기가 널리 사용되고 미국 식품의약국(FDA)의 제품 승인이 증가함에 따라 COVID-19 팬데믹 기간 동안 혈장채집기 시장은 긍정적인 성장을 보였으나 현재는 팬데믹이 진정되면서 시장이 다소 위축되었지만 연구 예측 기간 동안 안정적인 성장을 할 것으로 예상됩니다.

아페레시스 시장의 성장을 촉진하는 요인으로는 질병 부담 증가, 혈액 성분 및 관련 안전성에 대한 수요 증가, 새로운 채혈 기술 개발의 기술 발전, 채혈 절차에 대한 환급 정책 및 자금 지원 증가 등이 있습니다. 예를 들어, 2022년 6월 영국 NHS 잉글랜드는 NHS 의료기술 자금 지원 의무(MTFM)를 통해 겸상 적혈구 질환 치료를 위해 이 회사의 스펙트라 옵티아 아페리시스 시스템에서 실시하는 자동 적혈구 교환(RBCX) 시술을 선택했습니다. 이번 선택으로 영국 전역의 병원에서 스펙트라 옵티아를 더 자주 사용할 수 있게 되었습니다. 겸상 적혈구 질환을 앓고 있는 환자들은 이제 이 치료법에 더 쉽게 접근할 수 있게 될 것입니다. 따라서 적혈구 채취와 관련된 자금 지원 이니셔티브가 증가하면서 시장 성장에 박차를 가하고 있습니다.

임상 환자에서 아페리시스 사용은 날로 증가하고 있으며 혈전 성 혈소판 감소 성 자반증, 용혈성 요독 증후군, 약물 독성, 자가 면역 질환, 패혈증 및 전격성 간부전과 같은 다양한 질병의 일차 치료 또는 다른 치료의 보조제로 널리 사용되었습니다.

이러한 요인과 함께 제품 혁신 및 승인 증가가 시장 성장을 주도하고 있습니다. 예를 들어, 2021년 7월, Terumo 혈액 및 세포 기술은 의사가 환자의 침대 옆에서 체외 광동화 면역 요법(ECP) 시술을 직접 수행할 수 있는 제품을 발표했습니다. 이 회사는 스펙트라 옵티아의 기능을 확장했습니다. 이제 이러한 장치를 사용하여 단일 핵 세포 수집 (MNC) 및 연속 단일 핵 세포 수집 (CMNC) 프로토콜을 갖춘 기능적으로 폐쇄 된 온라인 다단계 시스템으로 UVA PIT 시스템 ECP를 수행 할 수 있으며, 따라서 앞서 언급 한 요인으로 인해 천자 시장은 예측 기간 동안 건강한 성장을 목격 할 것으로 예상됩니다. 그러나 숙련 된 전문가 부족, 혈액 오염 및 천자 절차와 관련된 비용은 시장 성장을 제한합니다.

아페레시스 시장 동향

혈액 질환 부문은 예측 기간 동안 상당한 성장이 예상

혈액 질환은 적혈구, 백혈구, 혈소판, 골수, 림프절, 비장 등의 문제를 포함하는 혈액 및 혈액 형성 기관의 장애를 말합니다. 혈액 질환은 전 세계적으로 개인의 이환율과 사망률에 상당한 기여를 하고 있습니다. 미국 질병통제예방센터의 2022년 5월 업데이트에 따르면 겸상 적혈구 질환(SCD)은 약 10만 명의 미국인에게 영향을 미칩니다. 흑인 또는 아프리카계 미국인 출생아 365명 중 약 1명에게서 발생합니다. 조기 진단과 치료는 혈액 세포 질환 환자의 생명을 보호하는 가장 좋은 방법입니다. 따라서 혈액 질환 발생의 부담이 증가하고 혈액 질환의 치료 방법으로 천자법의 적용이 증가함에 따라 연구 된 부문는 예측 기간 동안 성장할 것으로 예상됩니다.

지난 몇 년 동안 치료용 아페레시스가 증가했습니다. 예를 들어, 면역 흡착, 이중 여과 및 세포 채집은 일차 및 이차자가 면역 신장 질환의 치료에 쉽게 사용됩니다. 또한 ClinicalTrails.gov에 따르면 2022년 11월 현재 혈액 악성 종양에 대한 채혈에 대한 51건의 연구가 보고되었으며, 이 중 약 27건의 연구가 완료되었고 현재 전 세계적으로 다양한 혈액 질환에 대한 채혈을 위해 8건의 연구가 모집 중입니다.

또한, 겸상 적혈구 빈혈 질환의 관리에도 적혈구 채집술이 중요한 역할을 합니다. 2021년 11월 세이지 저널에 발표된 연구에 따르면, 겸상 적혈구 빈혈 치료 과정에서 적혈구 교환술 장비가 더 나은 관리를 제공하는 것으로 밝혀졌습니다. 따라서 앞서 언급 한 요인으로 인해 다양한 혈액 질환 치료에 천자법을 적용하면 궁극적으로 부문 성장을 주도 할 것입니다.

북미는 예측기간 동안 건전한 성장을 이룰 것으로 예상

북미는 신장병, 대사성 질환, 암, 신경질환 등 혈액과 관련된 다양한 질병의 부담 증가, 확립된 건강 관리 인프라의 존재, 환자의 의식 수준의 높이로 예측 기간 중 성장할 것으로 예상됩니다. 2021년 백혈병 림프종 협회(LLS)에 따르면 미국에서는 약 3분에 한 명이 혈액암으로 진단되고 있습니다. 백혈병, 림프종, 골수종의 신규 사례는 2021년 미국에서 새롭게 암으로 진단된 총 1,898,160건의 9.8%를 차지했습니다. 대상 질환의 높은 발생률이 조사 대상 시장의 성장을 가속하고 있습니다.

국내에서는 아페레시스 처치나 기구에 대한 상환 정책이 강화되고 있어, 아페레시스 수요가 높아지고 있습니다. 2022년 1월, United Healthcare Group은 United Healthcare Commercial Medica Policy라는 문서를 발행했습니다. 이 문서는 골수/줄기세포 이식에 사용되는 줄기세포의 수집 또는 수집을 제외한 여러 적응증에 대해 수행되는 병원절차 절차에 대한 의료 정책을 규정합니다. 이러한 처치에 대해 이용가능한 정책은 대상자들 사이에서 처치에 대한 수요를 증가시키고 있으며, 이는 궁극적으로 국내 아페레시스 시장을 촉진하고 있습니다.

게다가 미국 아페레시스 협회(ASFA)는 2021년 9월 21일을 아페레시스 계몽의 날로 선언했으며, 향후 매년 9월 셋째 화요일에 개최한다고 발표했습니다. 이것은 증거 기반의 실천을 채택하여 타인을 구하기 위해 인생을 바친 다수의 기증자, 환자 및 아페레시스 전문가를 표창하여 근본적인 의식을 촉진하고 근본적인 의료 의식을 높이기 위해 목적으로 했습니다. 그러므로 앞서 언급한 요인들로 인해 예측기간 동안 북미시장은 아페레시스의 보급이 크게 촉진될 것으로 기대됩니다.

아페레시스 산업 개요

조사 대상 시장은 적당히 경쟁적이며 소수의 대기업에 의해 지배되고 있습니다. 현재 이 시장은 많은 분야에서 확립되어 있으며 초기 성공을 거두고 있습니다. 다만, 개발도상지역에서는 그 가능성을 최대한 발휘할 수 있는지는 아직 알 수 없습니다. 정부의 이니셔티브가 진행됨에 따라 사람들의 의식도 높아지고 조사 대상 시장의 성장이 더욱 촉진되고 있습니다. 또한 대기업의 전략적 제휴 및 제품 출시가 시장 성장을 가속할 것으로 예상됩니다. 시장의 주요 기업으로는 B. Braun SE, Asahi Kasei Corporation, Fresenius SE&Co. KGAA, Terumo Corporation(Terumo BCT Inc.) 등이 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 서론

- 조사 전제 조건 및 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진 요인

- 질병 부담 증가로 혈액 성분과 그와 관련된 안전성 수요가 증가

- 새로운 아페레시스 기술의 개발에서 기술 진보

- 상환정책과 아페레시스 절차에 대한 자금 제공 증가

- 시장 성장 억제 요인

- 아페레시스 절차와 관련된 엄청난 설비 투자 및 비용

- 숙련된 전문가 부족

- 혈액오염의 위험

- Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자의 협상력

- 공급기업의 협상력

- 대체 제품의 위협

- 경쟁 기업간 경쟁 관계

제5장 시장 세분화

- 제품별

- 디바이스

- 소모품

- 아페레시스 절차별

- 백혈구 제거 요법

- 혈장 교환

- 혈소판 페레시스

- 적혈구 제거 요법

- 기타 아페레시스 절차

- 기술별

- 원심 분리

- 막 분리

- 용도별

- 신장 질환

- 혈액 질환

- 신경학적 장애

- 자가 면역 질환

- 기타 용도

- 지역

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아 태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 기타 아시아 태평양

- 중동 및 아프리카

- GCC

- 남아프리카공화국

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 경쟁 구도

- 기업 개요

- Asahi Kasei Corporation

- B. Braun SE

- Fresenius SE &Co. KGAA(Fresenius Kabi AG)

- Haemonetics Corporation

- Terumo Corporation(Terumo BCT Inc.)

- Kaneka Corporation

- Sumitomo Bakelite Company Limited(Kawasumi Laboratories Inc.)

- Medica SPA

- Baxter International

- Cerus Corporation

- Macopharma SA

- Otsuka Holdings Co. Ltd(JIMRO Co., Ltd)

제7장 시장 기회 및 향후 동향

LYJ 24.03.15The Apheresis Market size is estimated at USD 3.52 billion in 2024, and is expected to reach USD 4.62 billion by 2029, growing at a CAGR of 5.63% during the forecast period (2024-2029).

The COVID-19 pandemic had a profound impact on the growth of the Apheresis market, due to the extensive application of plasma therapy to treat patients infected with COVID-19. According to the study published in the Journal of Clinical Apheresis in December 2021, the Lack of supplies, notably RBC units and apheresis kits, was one of the main problems with patient treatment in the apheresis facility during the COVID-19 pandemic. Due to "stay home" instructions and concern about SARS CoV2 infection, the number of blood donors drastically reduced. Thus the studied market was initially impacted by the pandemic. Moreover, there were no vaccines or drugs to treat COVID-19, and most doctors opted for convalescent plasma therapy in patients who were severely affected by COVID-19. In this treatment, the plasma extracted from the blood of cured patients by the plasmapheresis technique was transfused into the patient who underwent treatment. Thus, given the wide usage of apheresis units in treating COVID-19 patients and increasing product approvals by the United States Food and Drug Administration (FDA), the apheresis market marked a positive growth during the pandemic, however currently as the pandemic subsided, the market lost some traction, however it is expected to have a stable growth during the forecast period of the study.

The propelling factors for the growth of the apheresis market include the increasing burden of diseases, a rise in the demand for blood components and their associated safety, technological advancements in the development of new apheresis techniques, and an increase in the reimbursement policies and funding for apheresis procedures. For instance, in June 2022, through the NHS MedTech Funding Mandate (MTFM), NHS England in the United Kingdom has chosen the automated red blood cell exchange (RBCX) treatment carried out on the business's Spectra Optia Apheresis System to treat sickle cell disease. Due to this choice, Spectra Optia will be used more frequently in hospitals all around England. Patients with sickle cell illness will now have better access to this therapy. Thus, the increasing funding initiatives related to apheresis are propelling the market growth.

The use of apheresis in clinically ill patients is increasing day by day, and it has been widely used as the primary therapy or as an adjunct to other treatments for various diseases, such as thrombotic thrombocytopenic purpura, hemolytic uremic syndrome, drug toxicities, autoimmune disease, sepsis, and fulminant hepatic failure.

Along with these factors, the increasing product innovations and approvals have been driving the market growth. For instance, in July 2021, Terumo Blood and Cell Technologies announced a direct offering for physicians to perform extracorporeal photopheresis immunotherapy (ECP) procedures at the patient's bedside. The company has expanded the functionality of Spectra Optia. The UVA PIT System ECP can now be performed using these devices as a functionally closed, online, multistep system with mononuclear cell collection (MNC) and continuous mononuclear cell collection (CMNC) protocols.Thus, owing to the aforementioned factors, the apheresis market is expected to witness healthy growth over the forecast period. However, lack of skilled professionals, blood contamination and cost associated with apheresis procedures restrain the market growth.

Apheresis Market Trends

Hematological Disorders Segment is Expected to Witness Significant Growth During the Forecast Period

Hematologic disorders are the disorders of blood and blood-forming organs which include problems with red blood cells, white blood cells, platelets, bone marrow, lymph nodes, and spleen. Hematological disorders make a substantial contribution to the morbidity and mortality of individuals across the globe. As per the May 2022 update by the CDC, sickle cell disease (SCD) affects approximately 100,000 Americans. It occurs among about 1 out of every 365 Black or African American births. Early diagnosis and treatment are the best ways to protect the life of a patient with a blood cell disorder. Hence, owing to the increasing burden of hematological incidences and growing applications of apheresis as a treatment method for hematological disorders, the studied segment is expected to experience growth in the forecast period.

There has been a rise in therapeutic aphereses over the past few years; for instance, immunoadsorption, double filtration, and cytapheresis are readily used in the treatment of both primary and secondary autoimmune renal diseases. Additionally, as per ClinicalTrails.gov, as of November 2022, there are 51 studies reported on apheresis for hematological malignancy among which about 27 studies that were completed and 8 studies are currently recruiting for apheresis for different hematological disease development across the globe.

Furthermore, apheresis has a vital role in the management of sickle cell anemia disease. As per the study published in Sage Journal in November 2021, apheresis equipment was found to provide better management in red cell exchange therapeutic procedures being performed in sickle cell. Thus, owing to the aforementioned factors, the application of apheresis in treating various hematological disorders will ultimately drive the segment growth.

North America is Expected to Witness Healthy Growth Over the Forecast Period

North America is expected to grow over the forecast period due to the growing burden of various ailments related to blood, such as kidney diseases, metabolic diseases, cancer, and neurological disorders, the presence of established healthcare infrastructure, and high patient awareness levels. According to the Leukemia & Lymphoma Society (LLS) 2021, approximately every three minutes, one person in the United States is diagnosed with blood cancer. The new cases of leukemia, lymphoma, and myeloma accounted for 9.8% of the total 1,898,160 new cancer cases diagnosed in the United States in 2021. The high incidence of target diseases is driving the growth of the market studied.

The increasing reimbursement policies in the country for apheresis procedures and devices is increasing the demand for apheresis. In January 2022, United Healthcare Group issued a document UnitedHealthcare Commercial Medica Policy, the document provides a medical policy for apheresis procedures which are performed for multiple indications except for stem cell collection or harvesting for use in bone marrow/stem cell transplantation. These, available policies for the procedures are increasing demand for the procedures among the target population, which is ultimately driving the market for apheresis in the country.

Furthermore, the American Society for Apheresis (ASFA) declared September 21, 2021, to be Apheresis Awareness Day, and stated that it would take place every year on the third Tuesday in September moving forward. This was intended to recognize numerous donors, patients, and apheresis professionals who have dedicated their lives to saving others by employing evidence-based practice to promote apheresis medicine and raise awareness of apheresis medicine.Thus, these aforementioned factors are expected to significantly boost the apheresis market in North America over the forecast period.

Apheresis Industry Overview

The market studied is moderately competitive and dominated by a few major players. Currently, the market is well established in many areas and has shown nascent success. However, its full potential is yet to be determined in developing regions. With increasing government initiatives, awareness among people is also increasing, which is further driving the growth of the market studied. Additionally, strategic alliances and product launches by major companies are expected to drive market growth. Some of the major players in the market are B. Braun SE, Asahi Kasei Corporation, Fresenius SE & Co. KGAA and Terumo Corporation (Terumo BCT Inc.) among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Disease Burden Resulting in Rise in Demand for Blood Components and Associated Safety

- 4.2.2 Technological Advancements in Development of New Apheresis Techniques

- 4.2.3 Rise in Reimbursement Policies and Funding for Apheresis Procedures

- 4.3 Market Restraints

- 4.3.1 High Capital Investment and Costs Associated with Apheresis Procedures

- 4.3.2 Shortage of Skilled Professionals

- 4.3.3 Risk of Blood Contamination

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD Million)

- 5.1 By Product

- 5.1.1 Devices

- 5.1.2 Disposables

- 5.2 By Apheresis Procedure

- 5.2.1 Leukapheresis

- 5.2.2 Plasmapheresis

- 5.2.3 Plateletpheresis

- 5.2.4 Erythrocytapheresis

- 5.2.5 Other Apheresis Procedures

- 5.3 By Technology

- 5.3.1 Centrifugation

- 5.3.2 Membrane Separation

- 5.4 By Application

- 5.4.1 Renal Disorders

- 5.4.2 Hematological Disorders

- 5.4.3 Neurological Disorders

- 5.4.4 Autoimmune Disorders

- 5.4.5 Other Applications

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Asahi Kasei Corporation

- 6.1.2 B. Braun SE

- 6.1.3 Fresenius SE & Co. KGAA (Fresenius Kabi AG)

- 6.1.4 Haemonetics Corporation

- 6.1.5 Terumo Corporation (Terumo BCT Inc.)

- 6.1.6 Kaneka Corporation

- 6.1.7 Sumitomo Bakelite Company Limited (Kawasumi Laboratories Inc.)

- 6.1.8 Medica SPA

- 6.1.9 Baxter International

- 6.1.10 Cerus Corporation

- 6.1.11 Macopharma SA

- 6.1.12 Otsuka Holdings Co. Ltd (JIMRO Co., Ltd)