|

시장보고서

상품코드

1637740

메가 데이터센터 시장 : 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Mega Data Center - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

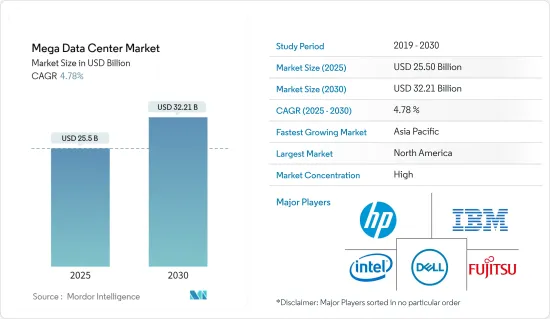

메가 데이터센터 시장 규모는 2025년에 255억 달러로 추정되고, 예측기간(2025-2030년)의 CAGR은 4.78%를 나타낼 전망이며, 2030년에는 322억 1,000만 달러에 달할 것으로 예측됩니다.

주요 하이라이트

- 데이터센터 업계는 가상화가 수년에 걸쳐 견인해 왔습니다. 엔터프라이즈는 IT 운영을 더 적은 사용률을 가진 머신에 집중함으로써 인프라를 줄이려고 노력해 왔습니다. 이 프로세스는 데이터센터 전반에 대한 견해를 넓혔습니다. 여러 데이터센터를 운영하는 기업은 복잡성과 비용을 줄이기 위해 더 적은 수의 대규모 구현에 장비를 집중하도록 선택할 수 있습니다.

- 위치에 따라 메가 데이터센터의 수를 줄이면 세제 우대, 낮은 에너지 가격, 기후, 대체 에너지원의 가용성 등 특정 지역의 이점을 누릴 수 있습니다. 이러한 방식으로 메가 데이터센터는 비용을 최소화하고 이익을 극대화하려는 시도에서 나옵니다.

- 소프트웨어 주도로 업계와 관련하여 적절하게 설정된 메가 데이터센터를 선택하는 이점은 현재와 비교하여 IT 관리 비용이 낮고, 로컬 데이터센터의 속도와 대역폭에서 엄청난 양의 인터넷 및 산업용 인터넷 데이터에 액세스할 수 있다는 점입니다. 이 능력은 세계 IT 지출에 박차를 가할 가능성이 높습니다. 조기 도입 기업은 전반적인 비즈니스 비용을 줄이고 수익을 높이기 위해 새로운 IT 기술에 투자할 수 있는 큰 기회를 얻을 수 있기 때문입니다.

- 클라우드 및 코로케이션 서비스 증가, 그에 따른 비용 이점, 스케일 메리트 향상 등의 요인이 메가 데이터센터 시장을 견인하고 있습니다. 마이크로소프트, 구글, 아마존 웹 서비스(AWS), 페이스북 데이터센터는 그 자체로 별개입니다. 그들은 모든 노드에 여러 경로가 있기 때문에 특정 데이터센터의 모든 노드에 액세스할 수 있는 패브릭을 만들기 위해 광섬유 속도로 작동하는 완전 자동 자가 복구형 네트워크화 메가 데이터센터를 작동시켜야 합니다.

- 그러나 초기 투자가 높고 자원 가용성이 낮다는 것이이 시장의 과제입니다. 이러한 과제에도 불구하고 다양한 조직이 이미 메가 데이터센터를 도입했거나 도입을 시작하고 있습니다.

메가 데이터센터 시장 동향

은행 및 금융 부문의 데이터센터 수요 증가

- 은행 및 금융 부문은 가장 큰 데이터 소스 중 하나이며 운영 비용을 조정하기 위한 데이터센터의 필요성이 주요 홍보 요인이 되었습니다. 금융 및 은행 기구는 고객 기록, 직원 관리, 거래, 원격 뱅킹, 텔레뱅킹, 자기 조회 등의 전자 뱅킹 서비스의 보존에 데이터센터를 이용하고 있으며, 이러한 서비스를 기능시키기 위해서는 데이터센터가 필요합니다.

- 인프라로서의 데이터센터는 금융의 미래를 담당할 것으로 예상됩니다. 많은 금융 기관이 사설 클라우드 시스템을 구축하고 대규모 네트워크, 스토리지 및 서버 용량을 수용하여 소매 금융 센터, ATM 및 활성 온라인 계좌를 지원합니다.

- 많은 은행들이 자체 데이터센터를 유지하고 있지만 은행의 수익이 변동되어 동향이 바뀌고 있음이 확인되었습니다. 또한 데이터센터를 유지하려면 적절한 냉각, 보안, 전력 장비가 필요하기 때문에 IT, 부동산 및 운영 비용이 많이 듭니다. 이것은 예측 기간 동안 BFSI 업계에 과제가 될 수 있습니다.

아시아태평양 수요 증가가 시장을 견인

- 중국 전역에서 고밀도로 이중화된 시설에 대한 수요가 높아지고 있는 것으로, 이 나라의 데이터센터의 설계 및 개발에 변화를 가져오고 있습니다. 중국의 인터넷 사용자 수는 인구 100명당 50명으로 많은 개발 여지가 있음을 보여주며, 연결 생태계는 73개의 코로케이션 데이터센터, 52개의 클라우드 서비스 제공업체, 0개의 네트워크 패브릭으로 구성되어 있습니다.

- 그러나 중국은 전력, 공간 및 IP 전송 모두에 비용이 들고 데이터센터를 유지하기가 어렵다는 것을 강조합니다. 마찬가지로 인도에서는 디지털 경제가 GDP의 9.5%를 차지합니다. 디지털 경제에는 255억 1,800만 달러의 유선전화 계약과 10억 1,105만 4,000개의 휴대전화 계약이 포함되어 데이터센터 개발 여지가 크다는 것을 보여줍니다.

- 또한 인도의 많은 조직, 특히 BFSI 부문은 규제 및 보안상의 이유로 국가 외부의 데이터센터에서 데이터를 호스팅하는 것을 금지합니다. 그 결과 데이터센터 제공업체는 인도에 데이터센터를 설치하고 인도에서 메가 데이터센터 시설이 증가하고 있음을 보여줍니다.

메가 데이터센터 산업 개요

메가 데이터센터 시장은 초기 투자가 높고 자원 공급이 적기 때문에 집중도가 높아 이 시장의 과제가 되고 있습니다. 이 시장의 주요 기업으로는 Cisco Systems Inc., Dell Software Inc., Fujitsu Ltd, and Hewlett-Packard Enterprise 등이 있습니다. 시장의 최근 동향은 다음과 같습니다.

2022년 9월-Microsoft는 카타르에 새로운 데이터센터 지역을 개설해, 이 나라에서 엔터프라이즈급 서비스를 제공하는 최초의 하이퍼스케일 클라우드 프로바이더가 되었습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건 및 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 업계의 매력도-Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자 및 소비자의 협상력

- 신규 진입업자의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

- 시장 성장 촉진요인 및 억제요인 서문

- 시장 성장 촉진요인

- 데이터센터 통합 수요 증가

- 은행 및 금융 분야에서 데이터센터 수요 증가

- 시장 성장 억제요인

- 높은 투자와 설치 비용

- 기술 스냅샷

제5장 시장 세분화

- 솔루션별

- 스토리지

- 네트워크

- 서버

- 보안

- 기타 솔루션

- 최종 사용자별

- BFSI

- 통신 및 IT

- 정부기관

- 미디어 및 엔터테인먼트

- 기타 최종 사용자

- 지역별

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

제6장 경쟁 구도

- 기업 프로파일

- Cisco Systems Inc.

- Dell Software Inc.

- Fujitsu Ltd

- Hewlett-Packard Enterprise

- IBM Corporation

- Intel Corporation

- Juniper Networks Inc.

- Verizon Wireless

제7장 투자 분석

제8장 시장 기회 및 향후 동향

AJY 25.02.12The Mega Data Center Market size is estimated at USD 25.50 billion in 2025, and is expected to reach USD 32.21 billion by 2030, at a CAGR of 4.78% during the forecast period (2025-2030).

Key Highlights

- Virtualization has driven the data center industry over the years. Companies have sought to reduce infrastructure by focusing IT operations on fewer, more highly utilized machines. This process has led to a wider view of data centers in general. Companies operating multiple data centers can choose to focus their facilities on fewer and larger implementations to decrease complexity and costs.

- Implementing fewer mega data centers, depending on their locations, can allow a company to enjoy advantages of certain local benefits, such as tax incentives, low energy prices, climate, or availability of alternative energy sources. Thus, mega data centers result from attempts to minimize cost and maximize profit.

- The merits of choosing a software-led, industry-relevant, and adequately set-up mega data center are lower costs of IT management compared to the present, as well as the ability to access a vast amount of internet and industrial Internet data at local data center speed and bandwidth. This capability is likely to spur IT spending worldwide, as early adopters will have substantial opportunities to invest in new IT techniques to reduce overall business costs and increase revenues.

- Factors including increasing cloud and colocation services, associated cost benefits, and improved economies of scale drive the market for mega data centers. Microsoft, Google, Amazon Web Services (AWS), and Facebook data centers are in a class by themselves. They have to function fully automatic, self-healing, networked mega data centers that operate at fiber optic speeds to make a fabric that can access any node in any particular data center, as there are multiple pathways to every node.

- However, higher initial investments and low resource availability are some factors presenting challenges to this market. Despite such challenges, various organizations have already adopted or are initiating the adoption of mega data centers.

Mega Data Centers Market Trends

Rising Demand of Data Centers in Banking and Finance Sectors

- The banking and finance sector is one of the largest generators of data, and the need for a data center to regulate the cost of operations is a primary driver. Finance and banking structures use data centers to store customer records, employee management, transactions, and electronic banking services, such as remote banking, telebanking, and self-inquiry, which need data centers to function.

- Data centers, as infrastructure, are believed to be the future of finance. Many institutions have created private cloud systems to accommodate massive network, storage, and server capacities to support their retail financial centers, ATMs, and active online accounts.

- Many banks maintain their own data centers, but it has been observed that the trend is changing due to fluctuations in the banks' profits. Also, maintaining a data center is cumbersome, owing to the cost drain on IT, real estate, and operations, as it requires proper cooling, security, and power facilities. This can act as a challenge for the BFSI industry during the forecast period.

Growing Demand from Asia-Pacific to Drive the Market

- The growing demand for high-density, redundant facilities throughout China is precipitating a shift in the design and development of the country's data centers. China has 50 internet users per 100 population, indicating scope for a lot of development, and the connectivity ecosystem comprises 73 colocation data centers, 52 cloud service providers, and 0 network fabrics.

- However, power, space, and IP transit all cost more in China, emphasizing the difficulties in maintaining a data center. Similarly, in India, the digital economy contributes 9.5% of the GDP. The digital economy includes USD 25,518 million fixed-line telephone subscriptions and 1,011.054 million mobile telephone subscriptions, indicating a lot of scope for the development of data centers.

- Moreover, owing to regulatory and security reasons, a number of organizations in India, especially from the BFSI sector, are not allowed to host their data in a data center that is out of the country. As a result, the data center providers are setting up local data centers in India, indicating the growing mega data center facilities in India.

Mega Data Centers Industry Overview

The mega data center market is highly concentrated due to higher initial investments and low availability of resources, which present challenges to this market. Some of the key players in the market are Cisco Systems Inc., Dell Software Inc., Fujitsu Ltd, and Hewlett-Packard Enterprise. Some recent developments in the market include:

In September 2022, Microsoft launched its new data center region in Qatar, becoming the first hyper-scale cloud provider to offer enterprise-grade services in the nation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Introduction to Market Drivers and Restraints

- 4.4 Market Drivers

- 4.4.1 Increasing Demand for Data Center Consolidation

- 4.4.2 Rising Demand of Data Centers in Banking and Finance Sectors

- 4.5 Market Restraints

- 4.5.1 High Investment and Installation Costs

- 4.6 Technology Snapshot

5 MARKET SEGMENTATION

- 5.1 By Solution

- 5.1.1 Storage

- 5.1.2 Networking

- 5.1.3 Server

- 5.1.4 Security

- 5.1.5 Other Solutions

- 5.2 By End-user

- 5.2.1 BFSI

- 5.2.2 Telecom and IT

- 5.2.3 Government

- 5.2.4 Media and Entertainment

- 5.2.5 Other End-users

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East & Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Cisco Systems Inc.

- 6.1.2 Dell Software Inc.

- 6.1.3 Fujitsu Ltd

- 6.1.4 Hewlett-Packard Enterprise

- 6.1.5 IBM Corporation

- 6.1.6 Intel Corporation

- 6.1.7 Juniper Networks Inc.

- 6.1.8 Verizon Wireless