|

시장보고서

상품코드

1849843

웨어러블 의료기기 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Wearable Medical Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

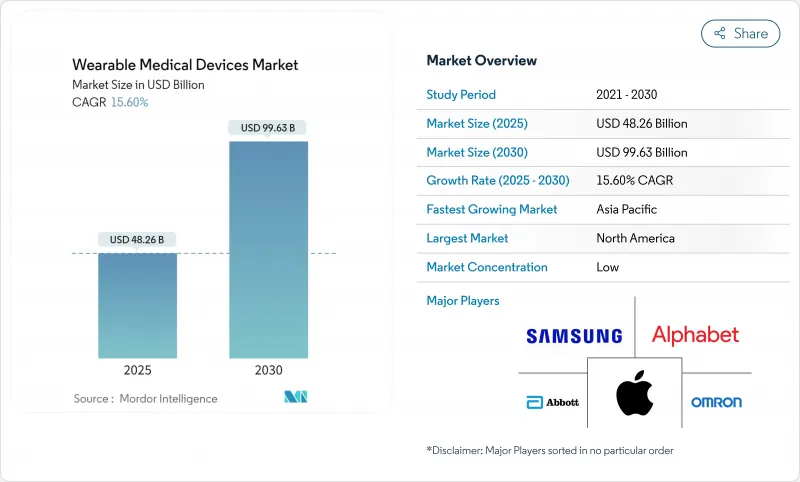

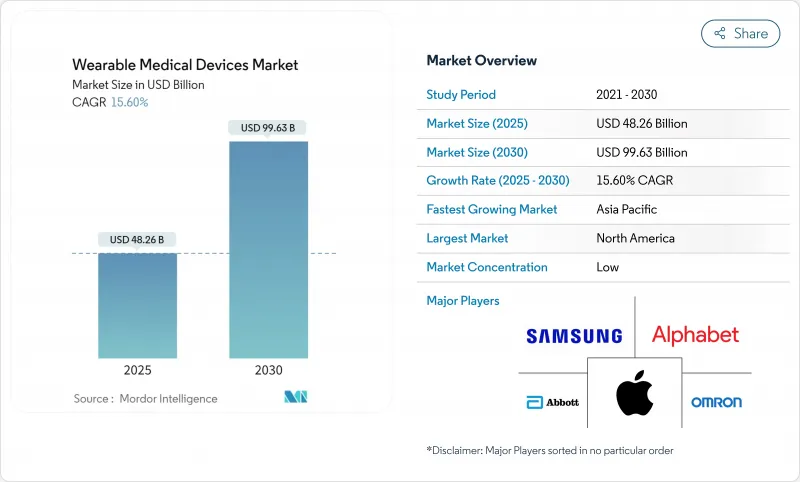

웨어러블 의료기기 시장 규모는 2025년에 482억 6,000만 달러로 추정되고, 2030년에는 996억 3,000만 달러에 이를 것으로 예상되며, 예측 기간 중의 CAGR은 15.60%를 나타낼 전망입니다.

규제기관이 커넥티드 다이아그노스틱스를 위한 패스트 트랙 패스웨이를 구축하고 임상 의사결정 지원 속에서 웨어러블 데이터를 인식하는 메디케어 상환이 확대됨에 따라 성장이 가속화되고 있습니다. 바이오센서, 배터리 소형화, 클라우드 상호 운용성의 끊임없는 기술 혁신이 임상 채택을 강화하고 Apple HealthKit과 같은 소비자용 하이테크 에코시스템이 사용자 참여를 확대합니다. 전통적인 의료 기술 기업과 소프트웨어 리더와의 전략적 파트너십은 새로운 개입 가능한 제품 라인을 개척하고, 아시아태평양 제조 클러스터는 더 넓은 지역으로의 배포를 가능하게 하는 제조 비용 절감을 지원합니다. 사이버 보안 의무와 소비자 등급의 정확성에 대한 의사의 회의적인 견해가 기세를 꺾고 있지만, 보다 명확한 규제 지침과 지불자의 수락으로 파일럿 프로젝트는 광범위한 병원 프로그램으로 전환하고 있습니다.

세계의 웨어러블 의료기기 시장 동향과 인사이트

만성 질환의 만연과 재택 건강 관리 수요 증가

인구 고령화와 가치 기반 케어 상환으로 예정되지 않은 입원을 줄이기 위해 지속적인 모니터링에 의존하는 만성 질환 프로그램이 가속화되고 있습니다. Abbott의 Freestyle Libre와 같은 상업적으로 이용 가능한 지속적인 혈당 모니터는 당뇨병 환자의 자기 관리를 허용하는 동시에 임상의에게 실시간 동향 데이터를 제공합니다. 각국 정부는 24시간 바이탈 측정에 유효한 바이오센서를 필요로 하는 '재택병원' 모델을 추진하고 있으며, 웨어러블 의료기기 시장은 비용 억제에 필수적인 시장이 되고 있습니다. 조기 비정상 경고는 치료 결과를 개선하고 응급실의 이용률을 감소시킵니다. 노인 인구가 가장 빠르게 증가하고 있는 아시아태평양에서는 전도 감지 패치와 심장 리듬 패치에 대한 수요가 왕성합니다. 이러한 구조적 힘은 예측 CAGR의 약 3.5포인트의 장기적인 상승을 지원합니다.

질병 특이적 모니터링을 위한 AI 탑재 바이오센서 채용 증가

플렉서블 일렉트로닉스에 내장된 AI는 웨어러블을 일반적인 웰니스 트래커에서 FDA가 승인한 알고리즘으로 98%의 부정맥 검출 감도를 실현하는 진단 플랫폼으로 변화시킵니다. Nanowear의 SimpleSense-BP는 섬유 기판에 수십 가지 바이오마커를 포착하여 임상 수준의 혈압 측정을 제공합니다. 홍콩 대학의 엣지 컴퓨팅 디자인은 데이터를 로컬로 처리하고, 프라이버시를 보호하며, 클라우드 대기 시간을 줄입니다. 머신러닝이 광전식 혈압계를 개선하고 SpO2와 혈압을 임상에 가까운 정밀도로. 예측 분석은 증상 발현의 몇 시간 전에 악화 플래그를 설정하여 케어 패러다임을 반응성에서 사전 활성으로 전환시킵니다. 이러한 기능은 의사의 신뢰성을 높이고 순환기과 및 신경과의 전체 단위 조달에 박차를 가합니다.

사이버 보안 및 데이터 프라이버시 컴플라이언스 비용

헬스케어는 랜섬웨어의 표적으로 가장 목표를 두고 있는 분야 중 하나이며, 규제 당국이 요구사항을 강화하도록 촉구하고 있습니다. FDA는 현재 시판 전 신청에서 소프트웨어 부품표의 공개와 라이프사이클 패치 플랜을 의무화하고 있으며, 복잡한 웨어러블 제품의 개발비가 100만 달러도 증가하고 있습니다. EU의 GDPR(EU 개인정보보호규정) 규칙은 명시적인 동의와 잊을 권리의 프로토콜을 요구하며, 공급업체는 암호화, 키 관리 및 감사 추적에 대한 투자를 강요합니다. 소규모 혁신자들은 기술적으로 민첩하지만 엔터프라이즈급 보안 벤치마크를 충족할 때 자본적 제약에 흔히 발생합니다. 인증 지연은 상용화를 늦추고 경쟁의 위치를 낮출 수 있습니다.

부문 분석

진단 및 모니터링 장비는 2024년 웨어러블 의료기기 시장 규모의 63.78%를 차지하며 보험 상환 가능한 만성기 의료 패스웨이를 충족하는 심박수, 혈압, 지속 포도당 모니터의 보급에 지지되었습니다. 이 부문의 리더십은 성숙한 센서 정확도와 광범위한 규제 클리어런스를 반영합니다. 바이탈 사인 패치는 여전히 순환기 병동에서 선호되고 있으며, 야간 옥시메트리 웨어러블은 수면 무호흡 스크리닝을 지원합니다. 폐쇄형 루프 포도당 시스템은 CMS가 적용 범위를 확대한 후 강력한 지지를 받아 내분비과 전체에서 지속적인 성장을 지원합니다.

치료 웨어러블은 패시브 패치에서 액티브 약물전달 및 신경 변조 장치로 폼 팩터가 진화함에 따라 현재는 작은 것, 예측 CAGR 15.93%로 진보하고 있습니다. AI 가이드와 함께 운동 라이브러리를 갖춘 온열 치료 패드는 물리치료와 소비자의 편의성의 융합을 보여줍니다. Epiminder의 Minder와 같은 이식형 EEG 모니터는 발작의 지속적인 추적을 임상 환경 밖으로 확장하여 시장이 개입으로 이동하고 있음을 나타냅니다. 이러한 혁신은 알고리즘이 실시간으로 복용량과 자극 강도를 개별화함에 따라 치료제의 웨어러블 의료기기 시장 규모가 2030년까지 현저하게 확대된다는 것을 뒷받침합니다.

18-60세의 성인은 2024년의 웨어러블 의료기기 시장 점유율의 61.45%를 차지하고, 노동 인구 집단에서의 만성 질환 발생률과 고용자의 웰니스 인센티브가 그 원동력이 되었습니다. 이 장치는 라이프스타일에 대한 인사이트와 FDA 인가 메트릭의 균형을 맞추고 예방 의료와 임상 모니터링을 모두 충족합니다. 고령자는 간소화된 사용자 인터페이스와 천연 소재에 모션 센서를 통합한 전도 감지 스마트웨어를 받아들이고 있어 기술에 희박한 사용자의 컴플라이언스를 높이고 있습니다.

소아과에서의 채용은 적은 것으로 예측 CAGR은 16.46%를 나타낼 전망입니다. 12세 이상의 소아를 대상으로 한 약물을 사용하지 않는 코 막힘 치료기 Sonu Band의 FDA 인가는 소아에 특화된 디자인에 대한 규제 당국의 관용을 예증하는 것입니다. 학부모는 스마트폰에 알림을 보내 통원 횟수를 줄이는 비침습적인 바이탈 패치 키트를 높이 평가합니다. 게임 스타일 피드백과 다채로운 폼 팩터는 청소년 사용자를 매료시키고 학교 원격 의료 파일럿 시험은 초기 성공을 보여줍니다. 이를 종합하면 젊은층에 초점을 맞춘 혁신은 기존 의료 기술이 충분한 서비스를 제공하지 못한 부문에서 시장 세분화 시장 규모를 확대하고 있습니다.

지역 분석

북미는 2024년 세계매출의 34.57%를 창출했는데 이는 상업화를 앞당기는 견고한 상환제도와 합리화된 FDA의 경로 때문입니다. CMS가 승인한 원격 환자 모니터링 코드의 보급은 병원이 퇴원 시 인증된 센서를 배포하도록 촉구하고 1차 케어 네트워크로의 추가 침투를 촉진합니다. 미국의 선도적인 하이테크 기업은 타사 용도에서 장비의 기능을 확장하는 활기찬 개발자 생태계를 개발하고 있습니다. 캐나다는 국가의 원격 의료 의무화를 통해 유사한 모델을 확대하고 있으며, 멕시코는 국경을 넘는 공급망을 활용하여 인증된 장치를 저렴한 비용으로 사용할 수 있도록 합니다.

유럽은 CAGR 15.32%로 기세를 유지하고 환자의 신뢰를 높이는 GDPR(EU 개인정보보호규정)에 따른 프라이버시 보증에 지지되고 있습니다. 독일의 DiGA 프로그램은 법정 보험을 통해 심장 리듬 패치를 포함한 디지털 치료제를 상환합니다. 프랑스에서는 장치 주문을 자동화하는 전국적인 전자 처방 서비스가 채택되어 이탈리아에서는 고령자 간호 시설에 전도 감지 웨어러블을 통합하기 위한 관민 파트너십을 시험적으로 도입하고 있습니다. 의료기기 규제의 시판 후 조사 의무에 의해 벤더의 설명 책임이 높아지고, CE 마크 제품의 평가가 웨어러블 의료기기 시장 전체에서 높아집니다.

아시아태평양은 CAGR 16.42%로 가장 급성장하는 지역으로 예측됩니다. 중국의 의료기기 부문은 2025년까지 2,100억 달러 시장 규모에 이를 것으로 예측됩니다. 일본 보건부의 지침은 예비 트리어지에 스마트 워치 유래의 심전도 데이터를 추천하고 있으며, 한국은 바이오헬스케어 2030 계획 하에 스마트 의류 공장에 보조금을 내고 있습니다. 인도의 디지털 헬스 미션은 농촌의 진료소에서 블루투스 대응 바이탈 측정 디바이스를 추진하여 접근성을 향상시킵니다. 지역 계약 제조업체는 세계 브랜드에 제품을 공급하고 아시아태평양의 생산 규모와 비용 리더십에 대한 영향력을 웨어러블 의료기기 시장 내에서 강화하고 있습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 만성 질환의 이환율의 상승과 재택치료 수요

- 질병 특이적 모니터링을 위한 AI 대응 바이오센서의 채용 증가

- 원격 환자 모니터링 프로그램으로의 상환 증가

- 소비자 테크놀로지 에코시스템과의 통합에 의해 유저 인게이지먼트를 향상

- 배터리 기술의 소형화에 의해 폼 팩터의 제약이 저감

- 디지털 치료제와 커넥티드 디바이스를 위한 규제의 신속화

- 시장 성장 억제요인

- 사이버 보안 및 데이터 프라이버시의 컴플라이언스 비용

- 상호 운용성을 방해하는 단편화된 디바이스 데이터 표준

- 소비자용 데이터의 정확성에 대한 의사의 낮은 신뢰도

- 배터리 수명과 전자 폐기물의 우려

- 공급망 분석

- 규제 상황

- 기술 전망

- Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자의 협상력/소비자

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업 간 경쟁 관계

제5장 시장 규모와 성장 예측

- 디바이스 유형별

- 진단 및 모니터링 장치

- 바이탈 사인 모니터링 디바이스

- 수면 모니터링 장치

- 연속 혈당 모니터

- 혈압 모니터

- 기타 진단 및 모니터링 장치

- 치료 기기

- 통증 관리 기기

- 재활 기기

- 호흡 치료 기기

- 인슐린 투여 기기

- 기타 치료 기기

- 진단 및 모니터링 장치

- 연령층별

- 18세 미만

- 18-60세

- 60세 이상

- 유통 채널별

- 온라인

- 오프라인

- 용도별

- 스포츠 및 피트니스

- 원격 환자 모니터링

- 재택 헬스케어

- 최종 사용자별

- 소비자

- 병원 및 클리닉

- 장기 케어 센터

- 외래 수술 센터(ASC)

- 기타

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 호주

- 한국

- 기타 아시아태평양

- 중동 및 아프리카

- GCC

- 남아프리카

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 경쟁 구도

- 시장 집중도

- 경쟁 벤치마킹

- 시장 점유율 분석

- 기업 프로파일

- Abbott Laboratories

- AIQ Smart Clothing Inc.

- Alphabet Inc.

- Apple Inc.

- Biobeat Technologies Ltd.

- Dexcom Inc.

- Garmin Ltd.

- Huawei Technologies Co., Ltd.

- imec

- Intelesens Ltd.

- Koninklijke Philips NV

- Lifesense Group

- Masimo Corporation

- Medtronic plc

- MINTTI Health

- Omron Corporation

- ResMed Inc.

- Samsung Electronics Co., Ltd.

- Withings SA

- Xiaomi Corporation

제7장 시장 기회와 향후 전망

KTH 25.11.03The wearable medical devices market size is estimated to be USD 48.26 billion in 2025 and is projected to reach USD 99.63 billion by 2030, registering a 15.60% CAGR over the forecast period.

Growth accelerates as regulatory bodies create fast-track pathways for connected diagnostics and expand Medicare reimbursement that recognizes wearable data within clinical decision support. Continuous innovation in biosensors, battery miniaturization, and cloud interoperability strengthens clinical adoption, while consumer-tech ecosystems such as Apple HealthKit amplify user engagement. Strategic partnerships between traditional med-tech firms and software leaders unlock new intervention-capable product lines, and Asia-Pacific manufacturing clusters support lower production costs that enable wider geographic reach. Cyber-security mandates and physician skepticism about consumer-grade accuracy temper momentum, yet clearer regulatory guidance and payer acceptance continue to translate pilot projects into broad hospital programs.

Global Wearable Medical Devices Market Trends and Insights

Rising Prevalence of Chronic Diseases & Home-Healthcare Demand

Population aging and value-based care reimbursement accelerate chronic-disease programs that rely on continuous monitoring to reduce unplanned admissions. Commercial continuous glucose monitors such as Abbott's Freestyle Libre allow diabetes patients to self-manage while providing clinicians with real-time trend data. Governments promote "hospital-at-home" models that require validated biosensors for round-the-clock vitals, making the wearable medical devices market essential to cost containment. Early anomaly alerts improve therapeutic outcomes and lower emergency department utilization. Asia-Pacific, where the elderly population rises fastest, demonstrates strong demand for fall-detection and cardiac-rhythm patches. These structural forces underpin a long-run uplift of roughly 3.5 percentage points in projected CAGR.

Increasing Adoption of AI-Enabled Biosensors for Disease-Specific Monitoring

AI embedded in flexible electronics shifts wearables from generic wellness trackers to diagnostic platforms capable of 98% arrhythmia-detection sensitivity in FDA-cleared algorithms. Nanowear's SimpleSense-BP captures dozens of biomarkers on a textile substrate to deliver clinical-grade blood-pressure readings. Edge-computing designs from the University of Hong Kong process data locally, preserving privacy and cutting cloud latency. Machine learning refines photoplethysmography to near-clinical accuracy for SpO2 and blood pressure. Predictive analytics flag exacerbations hours before symptomatic onset, transitioning care paradigms from reactive to proactive. These capabilities raise physician confidence and spur procurement across cardiology and neurology units.

Cyber-Security & Data-Privacy Compliance Costs

Healthcare ranks among the most targeted sectors for ransomware, prompting regulators to tighten requirements. The FDA now mandates software bill-of-materials disclosures and lifecycle patch plans in pre-market submissions, adding as much as USD 1 million in extra development outlays for complex wearables. EU GDPR rules require explicit consent and right-to-forget protocols, forcing vendors to invest in encryption, key management, and audit trails. Smaller innovators, though technically agile, often encounter capital constraints when meeting enterprise-grade security benchmarks. Delays in certification can defer commercialization and erode competitive positioning.

Other drivers and restraints analyzed in the detailed report include:

- Growing Reimbursement for Remote Patient-Monitoring Programs

- Integration with Consumer-Tech Ecosystems Boosting User Engagement

- Fragmented Device-Data Standards Hindering Interoperability

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Diagnostic and monitoring devices accounted for 63.78% of the wearable medical devices market size in 2024, buoyed by widespread heart-rate, blood-pressure, and continuous glucose monitors that satisfy reimbursable chronic-care pathways. The segment's leadership reflects mature sensor accuracy and broad regulatory clearances. Vital-sign patches remain preferred in cardiology wards, while overnight oximetry wearables support sleep-apnea screening. Closed-loop glucose systems received strong uptake after CMS broadened coverage, anchoring continued growth across endocrinology departments.

Therapeutic wearables, although smaller today, are advancing at a projected 15.93% CAGR as form factors evolve from passive patches to active drug-delivery or neuromodulation devices. Heat-therapy pads equipped with AI-guided exercise libraries illustrate convergence between physiotherapy and consumer convenience. Implantable EEG monitors such as Epiminder's Minder extend continuous seizure tracking outside clinical settings, signalling the market's shift toward intervention. These breakthroughs underscore how the wearable medical devices market size for therapeutics will expand markedly through 2030 as algorithms personalize dosage or stimulus intensity in real time.

Adults aged 18-60 represented 61.45% of the wearable medical devices market share in 2024, driven by chronic-disease incidence in working populations and employer wellness incentives. Devices balance lifestyle insights with FDA-cleared metrics, satisfying both preventive health and clinical monitoring. Seniors embrace simplified user interfaces and fall-detection smart clothing that embed motion sensors in natural fabrics, boosting compliance among less tech-savvy users.

Pediatric adoption, though smaller, carries a 16.46% forecast CAGR. FDA clearance for the Sonu Band, a drug-free nasal-congestion therapy for children over 12, exemplifies regulatory openness to child-specific designs. Parents value non-invasive vitals patch kits that transmit alerts to smartphones, reducing clinic visits. Gaming-style feedback and colorful form factors entice younger users, while school tele-health pilots showcase early success. Taken together, youth-focused innovation enlarges the wearable medical devices market size in segments traditionally underserved by medical technology.

The Wearable Medical Devices Market Report is Segmented by Device Type (Diagnostic & Monitoring Devices [Vital-Sign Monitoring Devices and More] and More), Age Group (Under 18 and More), Distribution Channel (Online and Offline), Application (Sports & Fitness and More), End-User (Consumers and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 34.57% of global revenue in 2024 owing to robust reimbursement frameworks and streamlined FDA pathways that hasten commercialization. Uptake of CMS-approved remote patient-monitoring codes encourages hospitals to distribute certified sensors at discharge, driving further penetration across primary-care networks. U.S. tech giants foster vibrant developer ecosystems that enrich device functionality with third-party applications. Canada scales similar models through provincial tele-health mandates, while Mexico leverages cross-border supply chains to make certified devices accessible at lower cost.

Europe maintains momentum with a 15.32% CAGR, anchored by GDPR-aligned privacy assurance that elevates patient trust. Germany's DiGA program reimburses digital therapeutics, including cardiac-rhythm patches, through statutory insurance. France adopts nationwide electronic prescription services that automate device ordering, and Italy pilots public-private partnerships to integrate fall-detection wearables in elderly-care homes. The Medical Device Regulation's post-market surveillance obligations heighten vendor accountability, elevating the reputation of CE-marked products across the wearable medical devices market.

Asia-Pacific is forecast to be the fastest-growing territory at 16.42% CAGR. China's broader medical-device sector is trending toward USD 210 billion by 2025 as local champions secure National Medical Products Administration clearance for glucose monitors and AI-aided arrhythmia patches. Japan's health-ministry guidance endorses smartwatch-derived ECG data for preliminary triage, while South Korea subsidizes smart-clothing factories under its Bio-Healthcare 2030 plan. India's digital-health mission promotes Bluetooth-enabled vitals devices in rural clinics, enhancing accessibility. Regional contract manufacturers supply global brands, reinforcing Asia-Pacific's influence on production scale and cost leadership within the wearable medical devices market.

- Abbott Laboratories

- AIQ Smart Clothing Inc.

- Alphabet Inc.

- Apple

- Biobeat Technologies Ltd.

- Dexcom

- Garmin

- Huawei Technologies

- imec

- Intelesens

- Koninklijke Philips

- Lifesense Group

- Masimo

- Medtronic

- MINTTI Health

- OMRON

- Resmed

- Samsung Group

- Withings SA

- Xiaomi Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising prevalence of chronic diseases & home-healthcare demand

- 4.2.2 Increasing adoption of AI-enabled biosensors for disease-specific monitoring

- 4.2.3 Growing reimbursement for remote patient-monitoring programs

- 4.2.4 Integration with consumer-tech ecosystems boosting user engagement

- 4.2.5 Miniaturization of battery technology lowering form-factor constraints

- 4.2.6 Regulatory fast-track pathways for digital therapeutics & connected devices

- 4.3 Market Restraints

- 4.3.1 Cyber-security & data-privacy compliance costs

- 4.3.2 Fragmented device-data standards hindering interoperability

- 4.3.3 Low physician trust in consumer-grade data accuracy

- 4.3.4 Battery-longevity and e-waste concerns

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Device Type

- 5.1.1 Diagnostic & Monitoring Devices

- 5.1.1.1 Vital-sign Monitoring Devices

- 5.1.1.2 Sleep-monitoring Devices

- 5.1.1.3 Continuous-Glucose Monitors

- 5.1.1.4 Blood-pressure Monitors

- 5.1.1.5 Other Diagnostic & Monitoring Devices

- 5.1.2 Therapeutic Devices

- 5.1.2.1 Pain-management Devices

- 5.1.2.2 Rehabilitation Devices

- 5.1.2.3 Respiratory-therapy Devices

- 5.1.2.4 Insulin-delivery Devices

- 5.1.2.5 Other Therapeutic Devices

- 5.1.1 Diagnostic & Monitoring Devices

- 5.2 By Age Group

- 5.2.1 Under 18

- 5.2.2 18 - 60

- 5.2.3 Above 60

- 5.3 By Distribution Channel

- 5.3.1 Online

- 5.3.2 Offline

- 5.4 By Application

- 5.4.1 Sports & Fitness

- 5.4.2 Remote Patient Monitoring

- 5.4.3 Home Healthcare

- 5.5 By End-User

- 5.5.1 Consumers

- 5.5.2 Hospitals & Clinics

- 5.5.3 Long-term Care Centres

- 5.5.4 Ambulatory Surgical Centres

- 5.5.5 Others

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 Australia

- 5.6.3.5 South Korea

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East and Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Competitive Benchmarking

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Abbott Laboratories

- 6.4.2 AIQ Smart Clothing Inc.

- 6.4.3 Alphabet Inc.

- 6.4.4 Apple Inc.

- 6.4.5 Biobeat Technologies Ltd.

- 6.4.6 Dexcom Inc.

- 6.4.7 Garmin Ltd.

- 6.4.8 Huawei Technologies Co., Ltd.

- 6.4.9 imec

- 6.4.10 Intelesens Ltd.

- 6.4.11 Koninklijke Philips N.V.

- 6.4.12 Lifesense Group

- 6.4.13 Masimo Corporation

- 6.4.14 Medtronic plc

- 6.4.15 MINTTI Health

- 6.4.16 Omron Corporation

- 6.4.17 ResMed Inc.

- 6.4.18 Samsung Electronics Co., Ltd.

- 6.4.19 Withings SA

- 6.4.20 Xiaomi Corporation

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment