|

시장보고서

상품코드

1685952

휴대용 X선 장치 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Portable X-ray Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

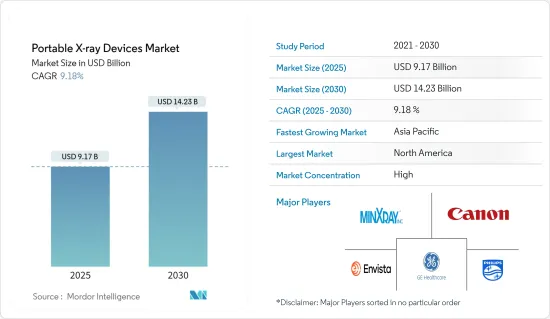

휴대용 X선 장치 시장 규모는 2025년에 91억 7,000만 달러로 추정되고, 2030년에는 142억 3,000만 달러에 달할 것으로 예측되며, 예측기간(2025-2030년)의 CAGR은 9.18%를 나타낼 전망입니다.

팬데믹의 발발은 시장에 영향을 미쳤습니다. 팬데믹 기간 동안 휴대용 X선 장치는 코로나19 의심 또는 확진 환자의 증상을 평가하는 데 널리 사용되었습니다. 예를 들어, 2020년 11월에 발표된 한 연구에 따르면 흉부 X선를 통한 코로나19의 정확한 진단율은 57.0%에서 89.0%에 이르는 것으로 나타났습니다. 또한 코로나19 이후(10-16주차)에는 모든 환자 서비스 위치에서 영상 촬영량이 더 큰 폭으로 감소(28.1%)했다고 보고했습니다. 또한 같은 자료에 따르면 16주차 외래 환자 영상 촬영은 88.0% 감소했으며, X선는 22.0% 가까이 감소한 것으로 나타났습니다. 따라서 팬데믹 초기에는 시장이 완만한 성장세를 보였습니다. 그러나 팬데믹 후반기에 봉쇄령 해제, 코로나 사례 감소, 병원 내 환자 방문 증가로 인해 시장이 탄력을 받았으며 예측 기간 동안 상승 추세를 이어갈 것으로 예상됩니다.

기술 발전, 노인 인구 증가, 혈관 질환 유병률 증가, 민간 기업과 정부의 휴대용 기술 R&D에 대한 막대한 자금이 시장 성장을 이끄는 주요 요인입니다. 또한 정부는 X선에 대한 다양한 연구 프로젝트에 보조금을 제공하고 있으며, 이는 시장 성장을 주도하고 있습니다. 예를 들어, 2021년 6월 영국 정부와 보건사회복지부는 국민건강서비스 의료 혁신을 위해 AI 기술 활성화를 위해 4,403만 달러를 지원했습니다. 또한 의료 서비스를 혁신하고 진단을 가속화하는 데 도움이 될 수 있는 약 38개의 새로운 선구적인 AI 프로젝트가 시작되었다고 보고했습니다. 따라서 이러한 노력은 기술적으로 진보된 휴대용 X선의 도입으로 이어질 수 있기 때문에 시장에 새로운 기회를 창출할 수 있습니다.

시장의 주요 업체들도 시장 지위를 유지하기위한 전략으로 기술 개발을 채택하고 있습니다. 예를 들어, 2021년 9월 GE 헬스케어는 최대 70.0%까지 리프팅 힘을 줄이고 기술자 부상을 줄이는 것을 목표로 하는 동력 보조 프리모션 텔레스코핑 컬럼이 장착된 새로운 휴대용 디지털 X선 시스템인 AMX 내비게이트를 출시했습니다. 이 새로운 장비에는 워크플로우를 자동화하고 사용자 인터페이스 상호작용을 줄여 효율성을 높여주는 제로 클릭 검사 기능도 탑재되어 있습니다. 따라서 이러한 사례로 인해 예측 기간 동안 상당한 시장 성장이 예상됩니다.

그러나 엄격한 규제 시나리오와 방사선 노출의 높은 위험은 예측 기간 동안 시장 성장을 제한 할 것으로 예상됩니다.

휴대용 X선 장비 시장 동향

디지털 X선 부문은 예측 기간 동안 상당한 성장을 보일 전망

휴대용 디지털 X선 시스템은 비정질 셀레늄 또는 실리콘과 같은 고체 검출기 배열을 사용하여 전송된 X선 방사선을 디지털 이미지로 직접 변환하고 이미지를 컴퓨터에 직접 표시합니다. 디지털 X선는 아날로그(기존) X선보다 방사선을 거의 방출하지 않으므로 매우 안전합니다. 디지털 시스템에서 생성되는 이미지는 고품질입니다. 촬영 후 즉시 결과물이 나오기 때문에 대기 시간이 단축됩니다.

전 세계적으로 휴대용 디지털 X선 시스템의 채택이 증가하고 있는 것이 이 부문의 주요 동인입니다. 또한 주요 업체들이 기술적으로 진보된 제품을 출시하는 것도 이 부문의 성장을 견인하고 있습니다. 예를 들어, 2021년 3월 후지필름 홀딩스 코퍼레이션의 자회사인 후지필름 인디아 프라이빗 리미티드는 의료 환경에서 낮은 X선 선량으로 고해상도 이미지를 제공하는 모바일 디지털 방사선 시스템인 FDR 나노를 출시했습니다. 이 회사에 따르면 FDR nano는 노이즈 감소 회로를 통해 저밀도 영역의 세분성을 개선하고 높은 이미지 품질을 구현할 수 있습니다. 또한 2020년 8월, 캐논 메디컬은 미국 시장에 모바일 디지털 X선 시스템 SOLTUS 500을 출시했습니다. 이 새로운 시스템은 향상된 사용 편의성, 생산성 향상, 향상된 안전 기능, 간소화된 디텍터 충전, 늘어난 저장 용량을 제공합니다. 따라서 새로운 첨단 제품을 출시하면 새로운 기회가 창출되고 시장의 경쟁력이 높아져 해당 부문의 성장을 견인할 수 있습니다.

노인 인구의 증가도 이 부문의 성장을 이끄는 또 다른 요인입니다. 예를 들어, 2021년에 발간된 Knoema 저널에 따르면 아르헨티나의 65세 이상 인구는 2021년 11.5%를 기록했습니다. 아르헨티나의 노인 인구는 2021년에 11.5%로 증가했으며, 연평균 0.95%의 성장률을 보이고 있습니다. 노인 인구는 다양한 질병에 걸리기 쉽습니다.

따라서 이러한 요인으로 인해 예측 기간 동안 상당한 성장이 예상됩니다.

북미는 예측 기간 동안 상당한 성장을 목격 할 것으로 예상

북미는 예측 기간 동안 전체 휴대용 X선 장치 시장을 지배 할 것으로 예상됩니다. 2020 보고서에 따르면 미국에서는 2020년에 228만 1,658명이 새롭게 암으로 진단되었고 61만 2,390명이 사망했습니다. 2021년 8월에 발표한 보고서에 따르면 600만 명 이상의 캐나다인, 15세 이상 5명 중 1명이 관절염을 앓고 있습니다. 만성 질환의 유병률이 증가함에 따라 의료 서비스 제공자의 정확한 진단과 효율적이고시기 적절한 치료 계획에 대한 수요가 증가하고 그 결과 휴대용 X선 장치에 대한 수요가 증가하여 북미 지역의 시장 성장을 촉진 할 것으로 예상됩니다.

주요 제품 출시, 시장 참여자 또는 제조업체의 높은 집중도, 주요 업체 간의 인수 및 파트너십, 미국 내 만성 질환 사례 증가는 미국에서 무릎 교체 시장의 성장을 이끄는 요인 중 일부입니다.예를 들어, 2021년 9월 GE 헬스케어는 최대 70.0%까지 리프팅 힘을 줄이고 기술자의 부상을 줄이기 위해 최초의 동력 보조 프리모션 텔레스코핑 컬럼으로 설계된 새로운 휴대용 디지털 X선 시스템인 AMX Navigate를 출시했습니다. 마찬가지로 2021년 5월, KA 이미징은 알파 이미징과 미국 내 유통 계약을 체결했습니다. 14개 주의 병원, 의료 시설 및 진료소는 알파 이미징을 통해 단일 노출, 휴대용 디지털 이중 에너지 감산 디지털 방사선 촬영(DR) X선 장치인 Reveal 35C를 이용할 수 있습니다. 따라서 혁신적인 솔루션의 개발로 인해 시장은 미국에서 엄청난 성장을 경험할 것으로 예상됩니다.

따라서 앞서 언급 한 요인으로 인해 연구 된 시장의 성장은 북미 지역에서 예상됩니다.

휴대용 X선 장비 산업 개요

시장은 적당히 세분화되어 있으며, 여러 주요 업체가 인수 및 협업을 통해 휴대용 X선 장치 포트폴리오를 확장하는 데 주력하고 있어 시장 경쟁이 심화될 전망입니다. 이 시장의 주요 업체로는 Canon Medical Systems, General Electric Company, Koninklijke Philips NV, Shimadzu Corporations 등이 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 성장 촉진요인

- 기술 발전

- 노인 인구 증가 및 혈관 질환 유병률 증가

- 민간 기업 및 정부의 휴대용 기술 R&D를 위한 막대한 자금 지원

- 시장 성장 억제요인

- 엄격한 규제 시나리오

- 방사선 노출의 높은 위험

- 포터 Five Forces

- 신규 참가업체의 위협

- 구매자 및 소비자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

제5장 시장 세분화

- 기술별

- 아날로그 X선

- 디지털 X선

- 용도별

- 치과용 X선

- 유방 조영

- 흉부 X선

- 복부 X선

- 모달리티별

- 핸드헬드 X선 장치

- 모바일 X선 장치

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 기타 아시아태평양

- 중동 및 아프리카

- GCC

- 남아프리카

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 경쟁 구도

- 기업 프로파일

- Envista Holdings Corporation(KaVo Dental GmbH)

- Canon Medical System

- GE Healthcare

- Koninklijke Philips NV

- MinXray

- FUJIFILM Holdings Corporation

- Shimadzu Corporations

- Siemens Healthineers AG

- Carestream Health Inc.

제7장 시장 기회와 앞으로의 동향

HBR 25.04.24The Portable X-ray Devices Market size is estimated at USD 9.17 billion in 2025, and is expected to reach USD 14.23 billion by 2030, at a CAGR of 9.18% during the forecast period (2025-2030).

The outbreak of the pandemic impacted the market. Portable X-ray devices were widely used during the pandemic to evaluate symptomatic patients with suspected or confirmed COVID-19 disease. For instance, according to a research study published in November 2020, accurate diagnosis of COVID-19 with chest X-rays ranged from 57.0% to 89.0%. X-ray devices played an essential role in detecting such visual responses associated with COVID-19 infection. Thus, owing to the efficiency of portable X-ray devices in detecting COVID infection, these devices were rapidly adopted in diagnosing lungs during the pandemic. However, a decrease in imaging volumes during the pandemic imposed a slight short-term negative impact on the market. For instance, according to the research journal published by the American College of Radiology in May 2020, the total imaging volume in 2020 (weeks 1-16) declined by 12.3% compared to 2019. It also reported that post-COVID-19 (weeks 10-16) revealed a greater decrease (28.1%) in imaging volumes across all patient service locations. The same source also reported an 88.0% decline in week 16 in outpatient imaging, and X-rays contributed to a nearly 22.0% decline. Thus, during the initial days of the pandemic, the market witnessed moderate growth. However, the upliftments of lockdowns, declining corona cases, and increasing in-clinic patient visits during the later times of the pandemic helped the market to gain momentum and are expected to continue the upward trend over the forecast period.

Technological advancements, the growing geriatric population, the increasing prevalence of vascular diseases, and huge funding for R&D of portable technologies by private players and governments are the major factors driving the market growth. In addition, the government is providing grants for various research projects for X-rays, which is also driving the market growth. For instance, in June 2021, the UK government and the Department of Health and Social Care issued USD 44.03 million to boost AI technologies to revolutionize the National Health Service care. It also reported that nearly 38 new pioneering AI projects were started that may help to revolutionize care and accelerate diagnosis. Therefore, such initiatives may create new opportunities for the market as they may lead to the introduction of technologically advanced portable X-rays. Thus, such favorable initiatives from the government may help to boost the market growth over the forecast period.

Major players in the market are also adopting technological developments as strategies to maintain their market positions. The companies are also investing in R&D activities for technologically advanced products. For instance, in September 2021, GE Healthcare launched AMX Navigate, a new portable, digital X-ray system equipped with a power-assisted free motion telescoping column that aims to reduce lift force by up to 70.0% and decrease technologist injury. The new device is also equipped with Zero Click Exam, which increases efficiency by automating workflow and reducing user interface interactions. Therefore, owing to such instances, considerable market growth is anticipated over the forecast period.

However, stringent regulatory scenarios and the high risk of radiation exposure are expected to restrain the market growth over the forecast period.

Portable X-ray Devices Market Trends

Digital X-ray Segment is Expected to Witness Significant Growth Over the Forecast Period

Portable digital X-ray systems directly convert the transmitted X-ray radiation into a digital image using an array of solid-state detectors, such as amorphous selenium or silicon and display the image directly on the computer. The digital X-ray emits very little radiation than analog (traditional) X-rays, making it highly safer. The images produced by the digital system are of high quality. They are produced immediately after the procedure, thus reducing the waiting time.

The increasing adoption of portable digital X-ray systems across the globe is the major driver for the segment. In addition, the launch of technologically advanced products by the key players is also driving segment growth. For instance, in March 2021, Fujifilm India Private Limited, a subsidiary of Fujifilm Holdings Corporation, launched a mobile digital radiology system called FDR nano, which provides high-resolution images with low X-ray doses in healthcare settings. As per the company, FDR nano enables noise reduction circuits that improve the granularity of low-density regions and achieve high image quality. Furthermore, in August 2020, Canon Medical launched SOLTUS 500 Mobile Digital X-ray system in the U.S. market. This new system offers enhanced ease of use, increased productivity, enhanced safety features, simplified detector charging, and increased storage capacity. Therefore, launching new advanced products may create new opportunities and increase the market's competitiveness, thereby driving the segment growth.

The rising geriatric population is also another factor driving the segment growth. For instance, according to the Knoema journal published in 2021, Argentina's population aged 65 years and above was 11.5 % in 2021. The geriatric population in Argentina increased to 11.5 % in 2021, and it is growing at an average annual rate of 0.95%. The geriatric population is prone to various diseases. Thus, owing to the increasing geriatric population, the demand for portable digital X-ray devices is anticipated to increase as diagnostic imaging equipment is one of the essential requirements for diagnosing various diseases.

Thus, considerable segment growth is anticipated over the forecast period owing to such factors.

North America is Expected to Witness Considerable Growth Over the Forecast Period

North America is expected to dominate the overall portable X-ray devices market over the forecast period. The growth is due to factors such as rapidly advancing healthcare infrastructure, rising chronic disorders, and the presence of technologically advanced players in this region. For instance, according to GLOBOCAN 2020 report, 2,281,658 new cancer cases were diagnosed in the United States in 2020, with 612,390 fatalities. Similarly, as per the report published by Arthritis in Canada in August 2021, more than 6.0 million Canadians, 1 in 5 aged 15 or above, had arthritis. In addition, as per the same source, around 1 in 2 seniors over 65 had arthritis. The increased prevalence of chronic diseases increases the demand for accurate diagnosis and a treatment plan that is efficient and timely from healthcare providers, and as a result, the demand for portable X-ray devices is expected to increase, thereby propelling the market growth in the North American region.

Key product launches, high concentration of market players or manufacturer's presence, acquisition & partnerships among major players, and increasing cases of chronic diseases in the United States are some of the factors driving the growth of the knee replacement market in the country. For instance, in September 2021, GE Healthcare introduced the AMX Navigate, a new portable, digital X-ray system designed with a first-of-its-kind power-assisted Free Motion telescoping column that aims to reduce lift force by up to 70.0% and decrease technologist injury. Similarly, in May 2021, KA Imaging signed a distribution agreement in the United States with Alpha Imaging. Hospitals, medical facilities, and practices from 14 states have access to the Reveal 35C single exposure, portable, digital dual-energy subtraction digital radiography (DR) X-ray detector through Alpha Imaging. Thus, due to the development of innovative solutions, the market is expected to experience tremendous growth in the country.

Therefore, owing to the aforesaid factors, the growth of the studied market is anticipated in the North America Region.

Portable X-ray Devices Industry Overview

The market is moderately fragmented, and competition in the market is set to intensify as several key players are focusing on expanding their portable X-ray device portfolios through acquisitions and collaborations. The market is expected to offer several opportunities for new players and currently established market leaders. The key players in the market include Canon Medical Systems, General Electric Company, Koninklijke Philips NV, and Shimadzu Corporations, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Technological Advancements

- 4.1.2 Growing Geriatric Population and Increasing Prevalence of Vascular Diseases

- 4.1.3 Huge Funding for R&D of Portable Technologies by Private Players and Governments

- 4.2 Market Restraints

- 4.2.1 Stringent Regulatory Scenario

- 4.2.2 High Risk of Radiation Exposure

- 4.3 Porter Five Forces

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market size in USD Million)

- 5.1 By Technology

- 5.1.1 Analog X-ray

- 5.1.2 Digital X-ray

- 5.2 By Application

- 5.2.1 Dental X-ray

- 5.2.2 Mammography

- 5.2.3 Chest X-ray

- 5.2.4 Abdomen X-ray

- 5.3 By Modality

- 5.3.1 Handheld X-ray Devices

- 5.3.2 Mobile X-ray Devices

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle-East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Envista Holdings Corporation (KaVo Dental GmbH)

- 6.1.2 Canon Medical System

- 6.1.3 GE Healthcare

- 6.1.4 Koninklijke Philips NV

- 6.1.5 MinXray

- 6.1.6 FUJIFILM Holdings Corporation

- 6.1.7 Shimadzu Corporations

- 6.1.8 Siemens Healthineers AG

- 6.1.9 Carestream Health Inc.