|

시장보고서

상품코드

1686660

바이오에탄올 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Bioethanol - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

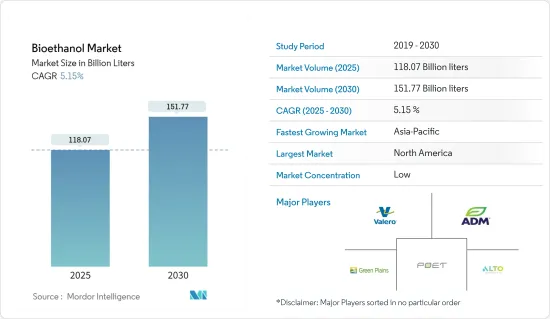

바이오에탄올 시장 규모는 2025년에 1,180억 7,000만 리터에 달할 것으로 추정됩니다. 예측기간(2025-2030년)의 CAGR은 5.15%를 나타낼 것으로 예상되고, 2030년에는 1,517억 7,000만 리터에 이를 것으로 전망됩니다.

바이오에탄올 시장은 공급망의 혼란으로 인해 COVID-19의 악영향을 받았습니다. 그러나 2021년에는 시장이 회복되었습니다. 시장을 견인하는 주요 요인은 정부 이니셔티브 증가와 미국에서 에탄올 비율이 높은 가솔린 판매 규제가 강화되었습니다는 것입니다.

주요 하이라이트

- 단기적으로는 유리한 이니셔티브 증가, 규제기관의 혼합 의무화, 화석연료의 사용과 바이오연료의 필요성에 대한 환경문제 증가가 시장성장의 요인이 되고 있습니다.

- 전기자동차 수요 증가로 인한 연료 자동차 폐지와 바이오부탄올로의 전환은 시장 성장의 저해 요인입니다.

- 2세대 바이오에탄올 생산의 개발과 항공 산업에서 바이오에탄올과 같은 바이오연료 소비 증가는 향후 시장에 기회를 가져올 것으로 보입니다.

- 북미는 세계 시장을 독점하고 미국은 가장 큰 소비를 차지하고 있습니다.

바이오에탄올 시장 동향

자동차·운수 분야에서의 용도 확대

- 바이오에탄올의 가장 광범위한 용도는 자동차 및 운송 산업에서 연료 및 연료 첨가제입니다. 바이오에탄올은 기존의 가솔린과 함께 자동차용 가솔린 엔진의 연료로 사용됩니다. 또한 많은 유형의 가솔린에 사용되는 옥탄가 향상제인 ETBE(에틸-터셔리 부틸-에테르)를 생산할 수도 있습니다.

- 바이오에탄올을 기존 연료에 혼합하면 재생 가능성이 향상됩니다. E10 에너지는 에탄올이 10% 포함되어 있기 때문에 이러한 이름을 붙였습니다. 바이오에탄올은 저탄소 연료로 운송 산업의 탈탄소화에 기여할 수 있습니다.

- 미국에서는 지난 30년간 바이오에탄올을 옥탄가 향상제나 가스 익스텐더로 사용했을 경우 가솔린 판매업자에게 세제상 우대 조치가 마련되어 왔습니다. 이것은 이 분야에서 바이오에탄올의 이용을 촉진했습니다.

- 미국의 바이오연료 제조업자는 저탄소 연료 제조를 위한 자금 지원과 중요한 세액 공제를 포함한 최신 법률을 뒷받침했습니다. 에탄올과 바이오디젤의 혼합연료를 위한 저장탱크와 관련설비를 설치하는 바이오연료 인프라 정비를 위해 5억 달러의 자금이 할당되었습니다.

- OICA의 데이터에 따르면 2022년 자동차 생산 대수는 2021년 대비 6% 증가했습니다. 2022년 세계 자동차 생산 대수는 약 8,502만대였습니다.

- 2022년 자동차 생산 대수는 아시아·오세아니아 지역이 5,002만대, 아메리카 지역이 1,775만대로 각각 2020년 대비 7% 가까이, 10% 가까운 증가를 기록했습니다. 그러나 유럽의 2022년 생산 대수는 1,621만대로 2021년 생산 대수에서 1% 감소했습니다.

- 게다가 미국 에너지부는 2021년에 2050년까지 순 배출량을 0으로 하는 미국의 헌신을 강화하기 위해 항공기와 같은 대형 수송수단용 화석연료 대체가되는 저비용 바이오연료 생산에 특화된 연구개발 프로젝트에 6,470만 달러의 자금을 제공할 것이라고 발표했습니다.

- 다양한 경제권이 바이오에탄올의 연료소비량을 늘릴 계획을 발표하고 있으며, 바이오에탄올 수요는 예측기간 동안 급증할 가능성이 높습니다.

시장을 독점하는 북미

- 북미는 바이오에탄올 시장 점유율을 독점하고 있습니다. 미국은 세계 최대의 바이오에탄올 생산국으로 브라질, 중국, 인도, 캐나다가 이에 이어집니다. 또한 바이오에탄올의 최대 소비국이기도합니다.

- 최근 바이오에탄올의 생산량은 재생가능연료기준(RFS)의 목표치 인상과 국내 가솔린 소비량 증가에 따라 증가하고 있으며, 현재는 거의 모두에 10%의 에탄올이 혼합되어 있습니다.

- 2022년 북미의 자동차 생산량은 2021년 1,346만대에 비해 약 1,479만대였습니다.

- 이 나라의 등록자동차 2억 6,300만대 중 약 93%가 E15로 주행 가능합니다. 또한 미국에서는 약 2,200만 대의 플렉스 연료차(FFV)가 E85까지의 에탄올 혼합 연료로 주행할 수 있습니다.

- 캐나다의 청정연료 기준은 액체연료(가솔린, 디젤, 가정용 난방유) 공급업체에 대해 캐나다 국내에서 사용하기 위해 생산·판매하는 연료의 탄소강도를 시간에 걸쳐 단계적으로 삭감하도록 요구하고 있으며, 그 결과 2030년까지 캐나다에서 사용되는 액체연료의 탄소강도를 약 13%로 낮추는 것(2016년 수준)을 요구합니다.

- 캐나다 정부가 최근 저탄소 및 제로 방출 연료 기금에 15억 달러를 투자함으로써 수소 및 바이오연료와 같은 저탄소 연료의 현지 생산 및 도입에 대한 지원이 강화될 수 있습니다.

- 위와 같은 요인으로부터 조사 대상 시장 수요는 북미에서 증가할 것으로 예상됩니다.

바이오에탄올 산업 개요

바이오에탄올 시장은 적당히 단편화됩니다. 이 시장의 주요 기업(특별한 순서 없음)에는 POET LLC, Valero, ADM, Green Plains Inc., Alto Ingredients Inc. 등이 있습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트·지원

목차

제1장 서론

- 조사의 전제

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 성장 촉진요인

- 규제 기관의 우호적인 이니셔티브 및 혼합 의무 강화

- 화석연료 사용에 의한 환경문제 고조와 바이오연료의 필요성

- 성장 억제요인

- 전기차 수요 증가에 따른 연료차 폐지

- 바이오부탄올로의 변화

- 산업 밸류체인 분석

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업 간 경쟁 강도

제5장 시장 세분화

- 원료 유형

- 사탕수수

- 옥수수

- 밀

- 기타 원료 유형

- 용도

- 자동차 및 수송

- 음식

- 의약품

- 화장품 및 퍼스널케어

- 기타 용도

- 지역

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 기타 아시아태평양

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 기타 유럽

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카

- 기타 중동 및 아프리카

- 아시아태평양

제6장 경쟁 구도

- M&A, 합작사업, 제휴, 협정

- 시장 점유율(%)**/랭킹 분석

- 주요 기업의 전략

- 기업 프로파일

- Abengoa

- ADM

- Alto Ingredients Inc.

- Blue Bio Fuels Inc.

- Cenovus Inc.

- Cristalco

- Cropenergies AG

- Ethanol Technologies

- Granbio Investimentos SA

- Green Plains Inc

- Henan Tianguan Group Co. Ltd

- Jilin Fuel Ethanol Co. Ltd

- KWST

- Lantmannen

- Poet LLC

- Raizen

- Sekab

- Suncor Energy Inc.

- Tereos

- Valero

- Verbio Vereinigte Bioenergie AG

제7장 시장 기회와 앞으로의 동향

- 제2세대 바이오에탄올 생산 개발

- 항공 업계에서의 바이오연료 소비 증가

The Bioethanol Market size is estimated at 118.07 billion liters in 2025, and is expected to reach 151.77 billion liters by 2030, at a CAGR of 5.15% during the forecast period (2025-2030).

The Bioethanol Market was adversely affected by COVID-19 due to disruptions in the supply chain. However, the market rebounded in 2021. The major factors driving the market were the increasing government initiatives and the increased restrictions on marketing gasoline containing a higher percentage of ethanol in the United States.

Key Highlights

- Over the short term, increasing favorable initiatives, blending mandates by regulatory bodies, and rising environmental concerns about the use of fossil fuels and the need for biofuels are the factors driving the market's growth.

- Phasing out of fuel-based vehicles due to rising demand for electric cars and shifting focus to bio-butanol are the factors hindering the market's growth.

- Developing second-generation bio-ethanol production and increasing consumption of biofuels like bioethanol in the aviation industry is likely to create opportunities for the market in the future.

- North America dominated the global market, with the United States having the most significant consumption.

Bioethanol Market Trends

Increasing Usage in the Automotive and Transportation Sector

- The most extensive bioethanol applications are fuel and fuel additives in the automotive and transportation industries. It is used alongside conventional petrol to fuel petrol engines in road vehicles. It can also produce ETBE (ethyl-tertiary-butyl-ether), an octane booster used in many types of petrol.

- Blending bioethanol with conventional fuels improves its renewability. E10 energy is so named because it contains 10% ethanol. Bioethanol is a low-carbon fuel that may help to decarbonize the transport industry.

- In the United States, tax incentives have been provided to gasoline marketers for using bio-ethanol as an octane enhancer and gas extender over the past three decades. This has driven boosted the usage of bio-ethanol in this sector.

- Biofuel producers in the United States received a boost from the latest legislation, which encompasses funding and critical tax credits for producing low-carbon fuels. Funding of USD 500 million was allocated for biofuel infrastructure improvements by installing storage tanks and related equipment for ethanol-biodiesel blends.

- In 2022, according to OICA data, the overall production of automobiles increased by 6% compared to 2021. The global automotive production in 2022 was around 85.02 million units.

- The Asia-Oceania and Americas regions recorded automotive production of 50.02 million and 17.75 million units in 2022, registering an increase of nearly 7% and 10%, respectively, compared to 2020. However, Europe recorded a production of 16.21 million units in 2022, a decrease of 1% from the production achieved in 2021.

- Furthermore, in 2021, the United States Department of Energy announced to provide USD 64.7 million in funds for research and development projects dedicated to producing low-cost biofuels as fossil-fuel replacements for heavy-duty transportation like airplanes to bolster America's commitment to reaching net-zero emissions by 2050.

- With various economies announcing their plans to increase bio-ethanol consumption in fuels, the demand for bio-ethanol will likely surge during the forecast period.

North America Region to Dominate the Market

- The North American region is dominating the bioethanol market share. The United States is the largest producer of bioethanol globally, followed by Brazil, China, India, and Canada. It is also the largest consumer of bioethanol.

- In recent years, bioethanol production has increased due to higher renewable fuel standard (RFS) targets and growth in domestic motor gasoline consumption, almost all of which is now blended with 10% ethanol by volume.

- In 2022, the overall production of automobiles in North America was around 14.79 million units compared to 13.46 million units in 2021.

- Around 93% of the country's 263 million registered automobiles may operate on E15. Furthermore, around 22 million flex-fuel vehicles (FFVs) in the United States can run on ethanol blends up to E85.

- The Canadian Clean Fuel Standard requires liquid fuel (gasoline, diesel, and home heating oil) suppliers to gradually reduce the carbon intensity of the fuels they produce and sell for use in Canada over time, resulting in a reduction in the carbon intensity of liquid fuels used in Canada of approximately 13% (below 2016 levels) by 2030.

- Some initiatives include the Canadian government's recent USD 1.5 billion investment in a Low-carbon and Zero-Emissions Fuels Fund, which may enhance support for local production and adoption of low-carbon fuels like hydrogen and biofuels.

- Due to all the factors mentioned above, the demand in the market studied is expected to increase in the North American region.

Bioethanol Industry Overview

The Bioethanol Market is moderately fragmented. Some major players in the market (not in any particular order) include POET LLC, Valero, ADM, Green Plains Inc., and Alto Ingredients Inc., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Report

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Favorable Initiatives and Blending Mandates by Regulatory Bodies

- 4.1.2 Rising Environmental Concerns by the Use of Fossil Fuels and Need for the Bio-fuels

- 4.2 Restraints

- 4.2.1 Phasing out of Fuel-based Vehicles Due to Rising Demand for Electric Vehicles

- 4.2.2 Shifting Focus to Bio-butanol

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Feedstock Type

- 5.1.1 Sugarcane

- 5.1.2 Corn

- 5.1.3 Wheat

- 5.1.4 Other Feedstock Types

- 5.2 Application

- 5.2.1 Automotive and Transportation

- 5.2.2 Food and Beverage

- 5.2.3 Pharmaceutical

- 5.2.4 Cosmetics and Personal Care

- 5.2.5 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Abengoa

- 6.4.2 ADM

- 6.4.3 Alto Ingredients Inc.

- 6.4.4 Blue Bio Fuels Inc.

- 6.4.5 Cenovus Inc.

- 6.4.6 Cristalco

- 6.4.7 Cropenergies AG

- 6.4.8 Ethanol Technologies

- 6.4.9 Granbio Investimentos SA

- 6.4.10 Green Plains Inc

- 6.4.11 Henan Tianguan Group Co. Ltd

- 6.4.12 Jilin Fuel Ethanol Co. Ltd

- 6.4.13 KWST

- 6.4.14 Lantmannen

- 6.4.15 Poet LLC

- 6.4.16 Raizen

- 6.4.17 Sekab

- 6.4.18 Suncor Energy Inc.

- 6.4.19 Tereos

- 6.4.20 Valero

- 6.4.21 Verbio Vereinigte Bioenergie AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of Second-generation Bio-ethanol Production

- 7.2 Increasing Consumption of Bio-fuels in the Aviation Industry