|

시장보고서

상품코드

1687055

유방암 스크리닝 검사 시장 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Global Breast Cancer Screening Test - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

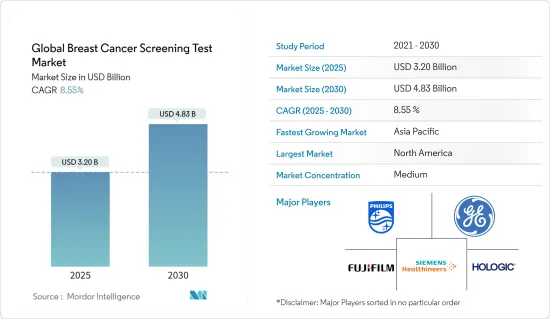

세계의 유방암 스크리닝 검사 시장 규모는 2025년에 32억 달러로 추정되고, 예측 기간 2025년부터 2030년까지 CAGR 8.55%로 성장할 전망이며, 2030년에는 48억 3,000만 달러에 달할 것으로 예측됩니다.

COVID-19의 대유행은 감염 확대를 최소화하기 위해 유방암 검진을 중단했기 때문에 유방암 검진 검사 시장에 큰 영향을 미쳤습니다. 예를 들어, Journal of Medical Screening이 2021년 10월에 발표한 연구에 따르면, COVID-19 팬데믹 동안 많은 유방 영상 진단 클리닉이 환자와 직원의 바이러스에 대한 노출을 줄이기 위해 유방 조영술을 의도적으로 중단했습니다. 이것은 팬데믹 시 시장 성장에 큰 영향을 미쳤습니다. 그러나 유방암 검진은 COVID-19 팬데믹 기간 동안에도 중요하며, 이를 위해 다양한 의료기관이 COVID-19 기간 중에 유방암을 관리하기 위한 가상 웨비나나 원격의료 상담을 실시했습니다. 유방암 계발 월간은 영상 진단 검사와 조기 검진의 중요성을 여성에게 계발하기 위해 세계 수준에서 매년 10월에 기념되고 있습니다. 매년 진행되는 국제 건강 캠페인은 질병에 대한 인식을 높이고 그 원인, 예방, 진단, 치료 및 치유에 대한 조사에 자금을 제공하는 것을 목표로 합니다. COVID-19 팬데믹은 초기 단계에서는 시장에 큰 영향을 미쳤지만, 규제가 해제되고 진단센터가 스크리닝 검사를 재개했기 때문에 스크리닝 검사 장비에 대한 수요가 증가하여 지난 2년간 시장이 회복되었습니다.

이 시장의 성장 요인으로는 유방암 조기 발견에 대한 의식의 고조, 유방암 이환율 증가, 정부의 대처 및 지원 증가 등을 들 수 있습니다. 유방암 조기 발견은 생존율의 향상, 치료 선택 증가, 생활의 질 향상 등, 바람직한 결과로 이어집니다. 유방암 이환율 증가는 예측 기간 동안 시장 성장에 기여합니다. 2022년 7월에 갱신된 Breastcancer.org에 따르면, 미국에서는 287,850건의 침윤성 유방암 증례가 새롭게 진단되고, 51,400건의 비침윤성(in situ) 유방암 증례도 새롭게 진단되었습니다. 유방암 스크리닝 검사에 대한 요구는 신흥국, 선진국을 불문하고 높아지고 있기 때문에 시장은 예측 기간 중에 성장할 것으로 예상됩니다.

게다가 혁신적인 전략 개발에 있어 주요 기업의 이니셔티브가 증가함에 따라 예측 기간 동안 시장 성장이 촉진될 것으로 예상됩니다. 예를 들어, 2022년 3월 LifeCell은 여성 유방암 위험을 평가하는 종합적인 유전자 스크리닝 검사인 Breast Screen Panel을 출시했습니다. 이러한 노력은 유방암 검진의 도입 확대로 이어져 시장 성장을 가속합니다.

그러나 유방 조영술에 대한 논쟁 및 높은 스크리닝 검사 비용이 시장 성장을 방해할 것으로 예상됩니다.

유방암 스크리닝 검사 시장 동향

유방 조영술 부문이 유방암 스크리닝 검사 시장을 독점할 전망

이미지 검사는 유방암의 스크리닝 검사로 가장 일반적으로 사용되며 가장 신뢰할 수 있는 것으로 간주됩니다. 유방 조영술은 유방암의 스크리닝 검사로 가장 널리 사용되는 검사입니다. 유방 조영술은 유방암 검진의 표준 기술이기 때문에 세계 각국의 정부 및 기타 건강 관리 기관은 50-75세 여성에 대한 액세스를 개선하기 위한 노력을 하고 있습니다. 예를 들어, 2021년 10월에 갱신된 미국 국립암 연구소(NCI)에 따르면, NCI는 토모신세시스 유방 화상 스크리닝 시험(TMIST)에 자금을 제공합니다. TMIST는 3D 유방촬영에서 5년간 검진을 받은 여성에서 발견된 진행 암의 수를 2D 유방촬영으로 검진을 받은 여성에서 발견된 수와 비교하는 대규모 무작위 유방 검진 시험입니다.

또한, 디지털 유방 토모신세시스는 유방 조영술의 진단 정확도를 향상시킬 수 있으며, 유방 조영술의 발견이 불분명하거나 의심스러운 경우를 평가하는 데 사용됩니다. 유방 토모신세시스로 알려진 3D 유방 조영술은 새로운 기술입니다. 이 과정은 유방 주변의 다양한 각도에서 사진을 결합하여 3D와 같은 이미지를 만듭니다. 이 기술은 클리닉에서 널리 사용할 수 있습니다. 이러한 진보는 전 세계적으로 도입이 진행되고 있기 때문에 시장 성장의 원동력이 될 것으로 보입니다.

유방 조영술과 관련된 유리한 노력도 이 분야의 성장을 뒷받침할 것으로 예상됩니다. 예를 들어, 호주 정부의 전국 검진 프로그램인 Breast Screen Australia에서는 50-74세 여성은 2년마다 무료 유방 X선 검사를 받아야 합니다. 2020년 9월 호주 암 협회(Cancer Australia)는 유방암 초기 단계에서 조기 진단을 위한 유방 영상 진단이 논의된 일련의 규제를 발표했습니다.

2022년 5월 VolparaHealth는 SBI/ACR Breast Imaging Symposium 2022에서 개별화 유방 케어를 제공하는 통합 플랫폼의 최신 제품을 발표했습니다. Volpara의 AI 구동형 유방 소프트웨어 도구는 유방 조영술의 품질과 보고, 부피 유방 밀도 측정, 암 위험 평가를 개선합니다. 시장 기업의 이러한 개발은 시장 성장의 가속을 지원합니다.

북미가 시장을 독점, 예측 기간 동안도 마찬가지로 전망

북미에서는 미국이 가장 큰 시장 점유율을 차지합니다. 이것은 유방암의 이환율이 증가하고 있는 것과 암의 조기 발견에 대한 국민의 의식이 높아지고 있는 것이 주된 요인입니다. 의료 인프라가 발달하고 있는 것도 미국 시장을 촉진할 것으로 예상됩니다.

2022년 5월 발표된 뉴스에 따르면 2030년까지 '유방암에 의한 사망자 제로'를 달성하겠다는 목표의 일환으로 미국 국립유방암재단(NBCF)은 20개 연구 이니셔티브에 1,240만 달러를 넘는 자금제공을 발표했습니다. 이러한 유방암 감소의 목표는 이 지역의 예측기간 동안 연구 시장의 성장을 가속할 것으로 기대되고 있습니다.

또한 Canadian Medical Association Journal, May 2022의 보고서에 따르면 2022년 캐나다에서 새롭게 발생하는 것으로 추정되는 유방암 증례는 28,600건으로, 2022년 캐나다에서 새롭게 진단되는 여성의 암 전체의 25%를 차지했습니다.

또한 이 지역의 계발 캠페인과 무료 유방암 검진 캠프도 예측 기간 동안 시장 성장을 가속할 것으로 기대되고 있습니다. 예를 들어, 2022년 10월, 펜실베니아 병원은 미국 암 협회, 재 필라델피아 멕시코 영사관 및 Univision 65와 제휴하여 필라델피아 커뮤니티에서 무보험 및 저보험 여성에게 무료 유방 촬영을 제공함으로써 매년 연례 유방암 검진 행사를 개최했습니다.

따라서 위의 요인에 따라 유방암 검진 시장은 예측 기간에 걸쳐 북미에서 견인할 것으로 예상됩니다.

유방암 스크리닝 검사 업계 개요

유방암 스크리닝 검사 시장은 중간 정도의 경쟁이며 여러 대형 기업으로 구성되어 있습니다. 현재 여러 회사의 대기업이 시장 점유율로 시장을 독점하고 있습니다. 주민의 의식이 높아지고 스크리닝 검사가 진행됨에 따라 다른 소수의 소규모 기업이 시장에 진입할 것으로 예상되어 상당한 점유율을 차지할 수 있습니다. 유방암 검진 검사 시장에서 큰 점유율을 차지하는 주요 시장 기업으로는 Koninklijke Philips NV, GE Healthcare, Fujifilm Holdings, Hologic Inc. 등이 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사 전제조건 및 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인

- 유방암 조기 발견에 대한 의식 증가

- 유방암 이환율 증가

- 정부의 대처 및 지원 증가

- 시장 성장 억제요인

- 유방 조영술에 관한 논쟁

- 신흥 국가에서의 스크리닝 검사의 고비용

- Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자 및 소비자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

제5장 시장 세분화

- 검사별

- 유전체 검사

- 화상 검사

- 맘모그램

- 초음파 검사

- MRI 검사

- 단층 촬영

- 기타 화상 검사

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 기타 아시아태평양

- 중동 및 아프리카

- GCC

- 남아프리카

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 경쟁 구도

- 기업 프로파일

- F. Hoffmann-La Roche Ltd

- Myriad Genetics, Inc.

- Koninklijke Philips NV

- Carestream Health

- GE Healthcare

- Fujifilm Holdings Corporation

- NanoString Technologies, Inc.

- Siemens Healthineers

- Hologic Inc.

- Quest Diagnostics Incorporated

제7장 시장 기회 및 향후 동향

AJY 25.04.04The Global Breast Cancer Screening Test Market size is estimated at USD 3.20 billion in 2025, and is expected to reach USD 4.83 billion by 2030, at a CAGR of 8.55% during the forecast period (2025-2030).

The COVID-19 pandemic significantly impacted the breast cancer screening test market due to the halt of breast cancer screening to minimize the spread of infection. For instance, according to the study published in October 2021 by the Journal of Medical Screening, many breast imaging practices purposely stopped mammograms to reduce patient and staff exposure to the virus during the COVID-19 pandemic. This significantly impacted the market growth during the pandemic. However, breast cancer screening remained important during the COVID-19 pandemic, for which various healthcare institutions conducted virtual webinars and telehealth consultations to manage breast cancer during COVID-19. Breast cancer awareness month is celebrated in October every year on a global level to educate women about diagnostic imaging tests and the importance of early screening. The annual international health campaign aims to raise disease awareness and fund research into its cause, prevention, diagnosis, treatment, and cure. Though the COVID-19 pandemic substantially impacted the market in its initial phases, the market recovered in the last two years since the restrictions were lifted and diagnostic centers resumed screening tests leading to a higher demand for screening machines.

Factors responsible for the growth of this market include the increasing awareness about the early detection of breast cancer, the growing incidence of breast cancer, and the increasing government initiatives and support. Early detection of breast cancer can lead to desired outcomes, including increased survival rate, number of treatment options, and improved quality of life. The rising incidence of breast cancer is helping the market to grow in the forecast period. As per Breastcancer.org, updated in July 2022, 287,850 new cases of invasive breast cancer are expected to be diagnosed in the United States, along with 51,400 new cases of non-invasive (in situ) breast cancer cases. Since there is a rising need for breast cancer screening tests across developing and developed nations, the market is expected to grow during the forecast period.

Furthermore, the rising initiative of key players in developing innovative strategies is expected to drive market growth over the forecast period. For instance, in March 2022, LifeCell launched Breast Screen Panel, a comprehensive genetic screening test assessing women's risk of breast cancer. Such initiatives will lead to increased adoption of breast cancer screening, driving the market growth.

However, controversies related to mammography and the high cost of screening tests are expected to hinder the market growth.

Breast Cancer Screening Test Market Trends

Mammograms segment is Expected to Dominate in the Breast Cancer Screening Test Market

The imaging test is the most commonly used screening test for breast cancer, which is considered the most reliable. Mammograms are the most widely used tests to screen for breast cancer. Since mammography is the standard technique for screening breast cancer, governments and other healthcare organizations worldwide are taking initiatives to improve access to women between 50 and 75. For instance, according to the National Cancer Institute (NCI), Updated in October 2021, The NCI is funding the tomosynthesis mammographic imaging screening trial (TMIST), a large-scale randomized breast screening trial that will compare the number of advanced cancers detected in women screened for five years with 3-D mammography to the number detected in women screened with 2-D mammography.

Furthermore, digital breast tomosynthesis can increase mammography's diagnostic accuracy and is used to assess equivocal or suspicious mammography findings. 3-D mammography, often known as breast tomosynthesis, is a new technology. This process combines photos from various angles around the breast to create a 3-D-like image. This technology is becoming more widely available in clinics. Such advancements will drive market growth due to higher adoption across the world.

The favorable initiatives related to mammograms are also expected to boost segment growth. For instance, as per the government's national screening program in Australia, Breast Screen Australia, women aged 50-74 need to undergo free mammograms every two years. Cancer Australia, in September 2020, released a set of regulations where breast imaging for early diagnosis in the initial stages of breast cancer was discussed.

In May 2022, VolparaHealth introduced updated products for its integrated platform to deliver personalized breast care at the SBI/ACR Breast Imaging Symposium 2022. Volpara's AI-driven breast software tools improve mammography quality and reporting, volumetric breast density measurements, and cancer risk assessment. Such developments by market players assist in accelerating market growth.

North America Dominates the Market and Expected to do Same in the Forecast Period

In the North American region, the United States holds the largest market share. This can be majorly attributed to the increasing incidence rates of breast cancer and rising awareness among the population for the early detection of cancer. The presence of the developed healthcare infrastructure is expected to propel the market in the United States.

According to the news published in May 2022, as part of a goal to achieve "zero fatalities from breast cancer" by 2030, the United States National Breast Cancer Foundation (NBCF) announced funding of over USD 12.4 million for 20 research initiatives. Such goals to reduce breast cancer are expected to drive the growth of the market studied over the forecast period in this region.

Also, as per Canadian Medical Association Journal, May 2022 report, an estimated 28,600 new breast cancer cases were estimated to occur in Canada in 2022, accounting for 25% of total new cancer diagnosed in women in Canada in 2022.

Moreover, awareness campaigns and free breast cancer screening camps in the region are also expected to propel the market growth during the forecast period. For instance, in October 2022, Pennsylvania Hospital partnered with the American Cancer Society, the Consulate of Mexico in Philadelphia, and Univision 65 to host an annual breast cancer screening event, by providing free mammograms to uninsured and underinsured women in the Philadelphia community.

Therefore, owing to the above-mentioned factors, the breast cancer screening market is expected to drive in North America over the forecast period.

Breast Cancer Screening Test Industry Overview

The breast cancer screening test market is moderately competitive and consists of several major players. A few major players currently dominate the market in terms of market share. With the increasing awareness among the population and rising advances in screening tests, a few other smaller players are expected to enter the market and may come to hold a substantial share. The key market players that hold significant shares in the breast cancer screening test market include Koninklijke Philips NV, GE Healthcare, Fujifilm Holdings, and Hologic Inc., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Awareness about Early Detection of Breast Cancer

- 4.2.2 Growing Incidence of Breast Cancer

- 4.2.3 Increasing Government Initiatives and Support

- 4.3 Market Restraints

- 4.3.1 Controversies Related to Mammography

- 4.3.2 High Cost of Screening Tests in the Developing Countries

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Test

- 5.1.1 Genomic Tests

- 5.1.2 Imaging Test

- 5.1.2.1 Mammograms

- 5.1.2.2 Ultrasound

- 5.1.2.3 MRI

- 5.1.2.4 Tomography

- 5.1.2.5 Other Imaging Tests

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Mexico

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 United Kindgom

- 5.2.2.3 France

- 5.2.2.4 Italy

- 5.2.2.5 Spain

- 5.2.2.6 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 Japan

- 5.2.3.3 India

- 5.2.3.4 Australia

- 5.2.3.5 South Korea

- 5.2.3.6 Rest of Asia-Pacific

- 5.2.4 Middle East & Africa

- 5.2.4.1 GCC

- 5.2.4.2 South Africa

- 5.2.4.3 Rest of Middle East & Africa

- 5.2.5 South America

- 5.2.5.1 Brazil

- 5.2.5.2 Argentina

- 5.2.5.3 Rest of South America

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 F. Hoffmann-La Roche Ltd

- 6.1.2 Myriad Genetics, Inc.

- 6.1.3 Koninklijke Philips N.V.

- 6.1.4 Carestream Health

- 6.1.5 GE Healthcare

- 6.1.6 Fujifilm Holdings Corporation

- 6.1.7 NanoString Technologies, Inc.

- 6.1.8 Siemens Healthineers

- 6.1.9 Hologic Inc.

- 6.1.10 Quest Diagnostics Incorporated