|

시장보고서

상품코드

1850162

호흡기기 시장 : 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Respiratory Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

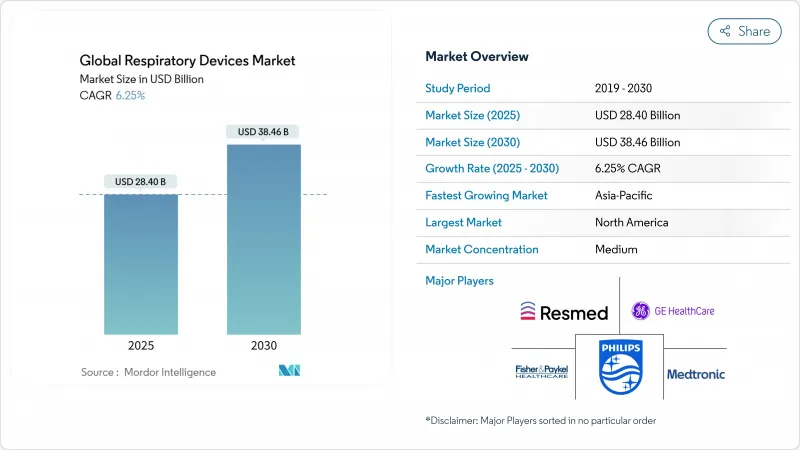

호흡기기 세계 시장 규모는 2025년에 284억 달러, 예측 기간(2025-2030년)의 CAGR은 6.25%를 나타내고, 2030년에는 384억 6,000만 달러에 달할 것으로 예측됩니다.

천식과 COPD의 진단이 가속되고 있는 것, 휴대용 산소 흡입기와 지속기도 양압(CPAP) 시스템이 급속히 보급되고 있는 것, 의료 보험의 적용 범위가 넓어지고 있는 것 등이 수요를 강화하고 있습니다. 기류 설정을 개인화하는 인공지능 알고리즘, 청정한 공기에 대한 정책적 주목의 높아짐, 센서, 소프트웨어, 소모품을 통합해 통일된 치료 에코시스템으로 하는 멀티 벤더 제휴에 의해 기세는 더욱 증폭되고 있습니다. 경쟁의 초점은 제품의 폭에서 데이터 대응의 어드히어런스 플랫폼으로 옮겨, 신흥 시장에서의 입찰 활동에 의해 유지관리의 쉬운 농축기나 인공 호흡기기와 농축기의 하이브리드형 유닛 등, 가격 중시 시장 규모가 확대되고 있습니다. 결과적으로 호흡기기 시장은 병원의 능력을 대체하는 대신 보완하는 가정용 의료 이용 사례를 중심으로 발전하고 있습니다.

세계 호흡기기 시장 동향과 통찰

호흡기기 질환의 급증

COPD와 천식 환자의 지속적인 증가는 지속적인 장비 수요를 지원합니다. 미국 폐협회는 2023년 미국 주민의 천식 이환율은 4,420만 명으로, 18-55세의 성인의 평생 이환율이 16.8%로 가장 높다고 보고했습니다. 여성 천식 이환율은 남성보다 높으며, 흡입기, 스파이로미터, 스마트 피크 유량계의 대응 가능한 사용자층이 넓어지고 있습니다. 한편, 세계보건기구(WHO)의 데이터에서 COPD는 중저소득국가에 집중하는 사일런트 킬러입니다. 이러한 이유로 기증자의 자금 지원으로 합리적인 가격의 농축기와 이동 진단 차량이 구입되었습니다.

기술 진보

제조업체는 현재 CPAP 유닛에 적응 압력 알고리즘을 통합하여 마스크 누출의 불편함을 줄이고 치료 어드히어런스를 높이고 있습니다. NovaResp는 2024년에 이러한 AI 엔진을 개선하기 위해 300만 달러를 획득했습니다. 신시내티 대학의 엔지니어는 VortexPAP를 발표했습니다. VortexPAP는 볼텍스 기류를 활용하여 안면을 밀폐하지 않고도 필요한 기도압을 공급하여 환자의 편의성 향상을 약속합니다. 경량 가습기, 클라우드 연동 옥시미터, 블루투스 지원 분무기는 완벽한 데이터 수집과 임상의의 대시보드를 지향하는 파이프라인을 보여줍니다.

비싼 기기

비싼 인공호흡기기, CPAP 플랫폼, 실험실 등급 진단 장비는 5자리 가격표와 정기적인 서비스 계약을 수반하여 자원에 제약이 있는 환경에서의 확산을 제한합니다. 세계보건기구(WHO)는 COPD에 의한 사망자의 90% 이상이 충분한 의료기기에 접근할 수 없는 저소득 지역에서 발생하고 있음을 강조합니다. 연구자들은 산소 발생과 환기를 결합한 모듈식 시스템을 저비용으로 제공함으로써 대응하고 있으며, 2025년에는 이러한 휴대형 솔루션을 급성 폐 손상 치료에 유효하다고 하는 크로스오버 시험이 실시될 예정입니다.

부문 분석

치료 플랫폼은 2024년 매출의 45.33%를 차지했으며 급성기 및 만성기 의료에서 인공호흡기기, CPAP, 산소 농축기의 정착된 사용을 반영합니다. 치료 시스템의 호흡기기 시장 규모는 선택적 수술 건수 증가와 만성 질환 감시 프로그램에 의해 지원되고 한 자리 대 중반의 속도로 확대될 것으로 예측됩니다. 집중 치료 병동에서는 압축 공기의 필요량을 삭감하는 터빈 기반의 인공 호흡기기가 점점 선호되고 있으며, 광열비가 억제되어 야전 병원에서의 도입이 확대되고 있습니다. 가습기의 소형화와 클로즈드 루프 산소 제어의 진보도 병행하여 진행되어 환자의 쾌적성이 향상되어 수요가 높아지고 있습니다.

스파이로미터, 카프노그래프, 무선 산소포화도 측정기를 포함한 진단·모니터링 기기는 가장 급성장하고 있는 분야이며, 2030년까지의 CAGR은 8.53%입니다. 직업성 폐 질환의 집단 검진 캠페인과 가정용 수면 검사 키트가 주요 기폭제가 됩니다. 유량 루프의 인공지능 분석은 현재 더 높은 특이성으로 조기 폐색에 플래그를 지정하고 증상 전 개입을 촉진합니다. 이러한 도구가 원격 의료 포털에 통합됨에 따라 지불자는 예방적 가치를 인식하고 보험 상환 채택을 뒷받침하고 호흡기기 시장을 확대하고 있습니다.

COPD는 분무기, 장기 산소 요법 및 NIV를 필요로하는 만성 질환과 빈번한 악화를 반영하여 2024년매출의 42.25%를 차지합니다. 신흥 시장에서는 흡연자 고령화와 바이오매스 연기에 장시간 노출되는 것이 장비 수요를 뒷받침하고 있습니다. 1차 케어에 스파이로메트리를 포함한 프로그램에 의해 진단 대상이 확대되고, 복용량을 확인할 수 있는 디지털 흡입기에 의해 어드히어런스 지표가 리셋되고 있습니다.

수면 무호흡 요법은 가장 기세가 많으며 2025-2030년 CAGR은 8.93%를 나타낼 전망입니다. 비만 증가, 심혈관 위험에 대한 인식 증가, 가정용 수면 무호흡 검사의 광범위한 마케팅이 성장을 지원합니다. 2025년 4월에 도입된 FDA 인증 NightOwl HSAT는 자체 관리형 진단 시프트를 강조합니다. CPAP의 디자인은 현재 패브릭 마스크와 조용한 터빈 하우징을 통합하여 환자의 편안함을 높이고 있습니다.

지역 분석

북미는 2024년 매출의 39.35%를 차지했으며, 장비 보급률의 높이, 체계적인 상환, 왕성한 연구자금에 지지되고 있습니다. 미국 국립위생연구소(National Institutes of Health)는 COPD 연구에 2024년에 1억 4,800만 달러, 2025년에 1억 4,900만 달러의 예산을 계상하고 차세대 인공호흡기기 알고리즘을 낳는 트랜스레이셔널 프로그램을 지원하고 있습니다. 시장 역학은 Philips의 CPAP 양식 저하 사고(2023-2024년)와 같은 리콜 사이클에도 영향을 받습니다. 사이버 보안 및 소프트웨어 업데이트에 대한 FDA의 기대가 증가함에 따라 호흡기기 시장에서 공급업체의 전략이 더욱 형성되고 있습니다.

아시아태평양의 2030년까지의 CAGR은 8.47%를 나타낼 전망입니다. 급속한 도시화, 중간소득층 증가, 산소흡입기에 대한 보조금 정책이 수요를 높이고 있습니다. WHO의 데이터에 따르면 세계 COPD 사망자의 90% 이상이 저·중소득국에서 발생하고 있으며, 그 대부분이 이 지역에 위치하고 있습니다. 진단되지 않은 COPD는 여전히 만연하고 있으며, 일본에서는 정기적으로 폐 검사를 실시하고 있음에도 불구하고 진단률은 8.4%입니다. 이 진단 갭은 계몽 캠페인과 저렴한 스파이로메트리에 의해 해결되면 호흡기기 시장에 큰 볼륨을 초래할 수 있습니다.

유럽은 강력한 공중 보건 인프라와 엄격한 임상 프로토콜을 통해 큰 점유율을 유지하고 있습니다. 영국에서는 2023-2024년도에 240만 명의 천식 환자가 보고되어 흡입기, 스페이서, 긴급용 분무기의 지속적인 수요가 강화되고 있습니다. 예산 급박은 선행 비용과 수명 주기 가치의 균형을 맞추는 조달 프레임워크를 촉진하고 예측 유지보수 분석을 제공하는 장치를 지원합니다. 재사용 가능한 수실 및 재활용 가능한 마스크 부품과 같은 환경 설계에 대한 관심 증가가 제품 개발 파이프라인을 점차적으로 형성하고 있습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 호흡기기 질환의 유병률의 급증

- 기술적 진보

- 재택치료에서의 호흡기기의 급속한 침투

- 비침습적 인공호흡기기(NIV)의 도입 증가

- 정부의 대처와 상환 확대

- 디지털 건강 기술의 통합

- 시장 성장 억제요인

- 기기의 고비용

- 엄격한 규제 요건

- 숙련된 헬스케어 전문가의 부족

- 공급망의 혼란

- 규제 전망

- 기술의 전망

- Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

제5장 시장 규모와 성장 예측

- 기기 유형별

- 진단 및 감시 장치

- Spirometers

- 수면검사장치

- 피크 유량계

- 산소포화도 측정기

- Capnographs

- 기타 진단 및 모니터링 장치

- 치료기기

- CPAP 기기

- BiPAP 기기

- 가습기

- 분무기

- 산소 농축기

- 인공 호흡 기기

- 흡입 기기

- 기타 치료 기기

- 소모품과 일회용품

- 마스크(코 마스크, 풀 페이스 마스크, 소아용)

- 호흡회로와 튜브

- 필터, 밸브, 기타 일회용품

- 진단 및 감시 장치

- 적응증별

- COPD

- 천식

- 수면 무호흡증후군

- 감염증

- 기타 호흡기기 질환

- 환자 연령층별

- 성인

- 소아/신생아

- 최종 사용자별

- 병원

- 호흡기 및 수면 클리닉

- 기타 최종 사용자(외래 수술 및 응급 센터, 재택치료)

- 지리적 세분화

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 기타 아시아태평양

- 중동 및 아프리카

- GCC

- 남아프리카

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 경쟁 구도

- 시장 집중도

- 시장 점유율 분석

- 기업 프로파일

- Koninklijke Philips NV

- ResMed

- Fisher & Paykel Healthcare Limited.

- Medtronic plc

- GE HealthCare

- Dragerwerk AG

- Getinge

- Baxter

- VYAIRE

- Hamilton Medical

- Beijing Aeonmed Co. Ltd.

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- React Health

- Medical Depot, Inc.

- Asahi Kasei Corporation(ZOLL Medical Corporation)

- AirLife

- Flexicare(Group)Limited(Allied Medical LLC)

- Teleflex Incorporated

- OMRON Healthcare, Inc

- ICU Medical, Inc.

- Medikro Oy

제7장 시장 기회와 장래의 전망

SHW 25.11.17The global respiratory devices market size is estimated at USD 28.40 billion in 2025, and is expected to reach USD 38.46 billion by 2030, at a CAGR of 6.25% during the forecast period (2025-2030).

Accelerating diagnoses of asthma and COPD, rapid uptake of portable oxygen solutions and continuous-positive-airway-pressure (CPAP) systems, and widening health-insurance coverage are reinforcing demand. Momentum is further amplified by artificial-intelligence algorithms that personalize airflow settings, stronger policy attention to clean air, and multi-vendor collaborations that integrate sensors, software, and consumables into unified therapy ecosystems. Competitive focus has shifted from product breadth to data-enabled adherence platforms, while emerging-market tender activity is unlocking price-sensitive volumes for low-maintenance concentrators and hybrid ventilator-concentrator units. As a result, the respiratory devices market is evolving around home-health use cases that complement hospital capacity rather than replace it.

Global Respiratory Devices Market Trends and Insights

Surge in Prevalence of Respiratory Disorders

Continuing growth in COPD and asthma cases is underpinning sustained equipment demand. The American Lung Association reported that 44.2 million U.S. residents had asthma diagnoses in 2023, with adults aged 18-55 recording the highest lifetime incidence at 16.8%. Females faced higher asthma prevalence than males, widening the addressable user base for inhalers, spirometers, and smart peak-flow meters. Meanwhile, World Health Organization data frames COPD as a silent killer concentrated in low- and middle-income economies. This pattern spurs donor-funded purchases of affordable concentrators and mobile diagnostic vans.

Technological Advancements

Manufacturers now embed adaptive pressure algorithms into CPAP units, cutting mask-leak discomfort and elevating therapy adherence. NovaResp clinched USD 3 million to refine such AI engines in 2024. University of Cincinnati engineers introduced VortexPAP, which uses vortex airflow to supply the required airway pressure without a tight facial seal, promising greater patient convenience. Lightweight humidifiers, cloud-linked oximeters, and Bluetooth-enabled nebulizers illustrate a pipeline oriented toward seamless data capture and clinician dashboards.

High Cost of Devices

Premium ventilators, CPAP platforms, and lab-grade diagnostic gear carry five-figure price tags and recurring service contracts, limiting penetration in resource-constrained settings. The World Health Organization underscores that more than 90% of COPD fatalities occur in low-income regions lacking sufficient device access, magnifying the affordability gap. Researchers have responded with modular systems combining oxygen generation and ventilation at lower cost, exemplified by a cross-over trial validating such a portable solution for acute-lung-injury care in 2025.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Penetration of Respiratory Devices in Home-Healthcare

- Rising Adoption of Non-Invasive Ventilation (NIV)

- Stringent Regulatory Requirements

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Therapeutic platforms held 45.33% of 2024 sales, reflecting entrenched use of ventilators, CPAPs, and oxygen concentrators for acute and chronic care. The respiratory devices market size for therapeutic systems is forecast to advance at a mid-single-digit rate, supported by rising elective-surgery volumes and chronic-disease surveillance programs. Intensive-care wards increasingly prefer turbine-based ventilators that reduce compressed-air requirements, curbing utility costs and broadening deployment in field hospitals. Parallel progress in humidifier miniaturization and closed-loop oxygen control enhances patient comfort, reinforcing demand.

Diagnostic and monitoring equipment, including spirometers, capnographs, and wireless pulse oximeters, is the fastest-growing branch, charting an 8.53% CAGR through 2030. Population-screening campaigns for occupational lung disease and at-home sleep-test kits are key catalysts. Artificial-intelligence analysis of flow-volume loops now flags early obstruction with greater specificity, encouraging pre-symptomatic intervention. As these tools converge with telemedicine portals, payers recognize their preventive value, boosting reimbursement adoption and widening the respiratory devices market.

COPD accounted for 42.25% of revenue in 2024, reflecting its chronicity and frequent exacerbations that necessitate nebulizers, long-term oxygen therapy, and NIV. An aging smoker population and prolonged exposure to biomass smoke in emerging markets sustain device demand. Programs integrating spirometry into primary care are widening diagnostic catchment, and digital inhalers that confirm dose delivery are resetting adherence metrics.

Sleep-apnea therapies are projected to record the strongest momentum, with an 8.93% CAGR over 2025-2030. Rising obesity prevalence, heightened cardiovascular-risk recognition, and extensive marketing of home sleep-apnea tests underpin growth. The FDA-cleared NightOwl HSAT, introduced in April 2025, underscores a self-administered diagnostic shift. CPAP designs now incorporate fabric masks and quiet turbine housings to elevate patient comfort, a critical variable in long-term adherence, thereby expanding the respiratory devices market.

The Respiratory Devices Market Report is Segmented by Device Type (Diagnostic and Monitoring Devices, Therapeutic Devices, and Consumables and Disposables), Indication (COPD, Asthma, and More), Patient Age Group (Adult and Pediatric/Neonatal), End User (Hospitals, Respiratory and Sleep Clinics and More), and Geography (North America, Europe and More). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

North America contributed 39.35% of 2024 revenue, anchored by high device penetration, structured reimbursement, and robust research funding. The National Institutes of Health earmarked USD 148 million for COPD research in 2024 and USD 149 million for 2025, supporting translational programs that spawn next-generation ventilator algorithms. Market dynamics are also influenced by recall cycles, such as Philips' 2023-2024 CPAP foam-degradation event, which spurred replacement demand and intensified regulatory scrutiny. Evolving FDA expectations regarding cybersecurity and software updates further shape supplier strategies within the respiratory devices market.

Asia-Pacific is projected to log an 8.47% CAGR through 2030. Rapid urbanization, growing middle-class incomes, and policy measures that subsidize oxygenic devices elevate demand. WHO data indicate that over 90% of global COPD deaths occur in low- and middle-income economies, many situated in this region. Undiagnosed COPD remains widespread, exemplified by Japan's 8.4% diagnostic rate despite regular pulmonary tests. This diagnostic gap, once addressed through awareness campaigns and affordable spirometry drives, can unlock substantial volumes for the respiratory devices market.

Europe sustains a sizeable share through strong public-health infrastructure and stringent clinical protocols. The United Kingdom reported 2.4 million asthma patients in fiscal year 2023-2024, reinforcing recurring demand for inhalers, spacers, and emergency nebulizers. Budget pressures are prompting procurement frameworks that balance upfront cost with life-cycle value, favoring devices offering predictive-maintenance analytics. Growing focus on eco-design, such as reusable water chambers and recyclable mask components, is gradually shaping product-development pipelines.

- Koninklijke Philips

- Resmed

- Fisher & Paykel Healthcare

- Medtronic

- GE Healthcare

- Dragerwerk AG

- Getinge

- Baxter

- Vyaire Medical

- Hamilton Medical

- Beijing Aeonmed Co. Ltd.

- Mindray

- React Health

- Medical Depot, Inc.

- Asahi Kasei

- AirLife

- Flexicare (Group) Limited (Allied Medical LLC)

- Teleflex

- OMRON Healthcare, Inc

- ICU Medical

- Medikro Oy

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in Prevalence of Respiratory Disorders

- 4.2.2 Technological Advancements

- 4.2.3 Rapid Penetration of Respiratory Devices in Home-Healthcare

- 4.2.4 Rising Adoption of Non-Invasive Ventilation (NIV)

- 4.2.5 Government Initiatives & Reimbursement Expansion

- 4.2.6 Inegration of Digital Health Technologies

- 4.3 Market Restraints

- 4.3.1 High Cost of Devices

- 4.3.2 Stringent Regulatory Requirements

- 4.3.3 Shortage of Skilled Healthcare Professionals

- 4.3.4 Supply Chain Disruptions

- 4.4 Regulatory Outlook

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value/Volume)

- 5.1 By Device Type

- 5.1.1 Diagnostic and Monitoring Devices

- 5.1.1.1 Spirometers

- 5.1.1.2 Sleep Test Devices

- 5.1.1.3 Peak Flow Meters

- 5.1.1.4 Pulse Oximeters

- 5.1.1.5 Capnographs

- 5.1.1.6 Other Diagnostic and Monitoring Devices

- 5.1.2 Therapeutic Devices

- 5.1.2.1 CPAP Devices

- 5.1.2.2 BiPAP Devices

- 5.1.2.3 Humidifiers

- 5.1.2.4 Nebulizers

- 5.1.2.5 Oxygen Concentrators

- 5.1.2.6 Ventilators

- 5.1.2.7 Inhalers

- 5.1.2.8 Other Therapeutic Devices

- 5.1.3 Consumables and Disposables

- 5.1.3.1 Masks (Nasal, Full-Face, Pediatric)

- 5.1.3.2 Breathing Circuits and Tubing

- 5.1.3.3 Filters, Valves and Other Disposables

- 5.1.1 Diagnostic and Monitoring Devices

- 5.2 By Indication

- 5.2.1 COPD

- 5.2.2 Asthma

- 5.2.3 Sleep Apnea

- 5.2.4 Infectious Diseases

- 5.2.5 Other Respiratory Disorders

- 5.3 By Patient Age Group

- 5.3.1 Adult

- 5.3.2 Pediatric / Neonatal

- 5.4 By End User

- 5.4.1 Hospitals

- 5.4.2 Respiratory and Sleep Clinics

- 5.4.3 Other End Users (Ambulatory Surgical and Emergency Centers, Home Settings)

- 5.5 Geographic Segmentation

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Koninklijke Philips N.V.

- 6.3.2 ResMed

- 6.3.3 Fisher & Paykel Healthcare Limited.

- 6.3.4 Medtronic plc

- 6.3.5 GE HealthCare

- 6.3.6 Dragerwerk AG

- 6.3.7 Getinge

- 6.3.8 Baxter

- 6.3.9 VYAIRE

- 6.3.10 Hamilton Medical

- 6.3.11 Beijing Aeonmed Co. Ltd.

- 6.3.12 Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- 6.3.13 React Health

- 6.3.14 Medical Depot, Inc.

- 6.3.15 Asahi Kasei Corporation (ZOLL Medical Corporation)

- 6.3.16 AirLife

- 6.3.17 Flexicare (Group) Limited (Allied Medical LLC)

- 6.3.18 Teleflex Incorporated

- 6.3.19 OMRON Healthcare, Inc

- 6.3.20 ICU Medical, Inc.

- 6.3.21 Medikro Oy

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment