|

시장보고서

상품코드

1850232

광 전송망(OTN) : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Optical Transport Network - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

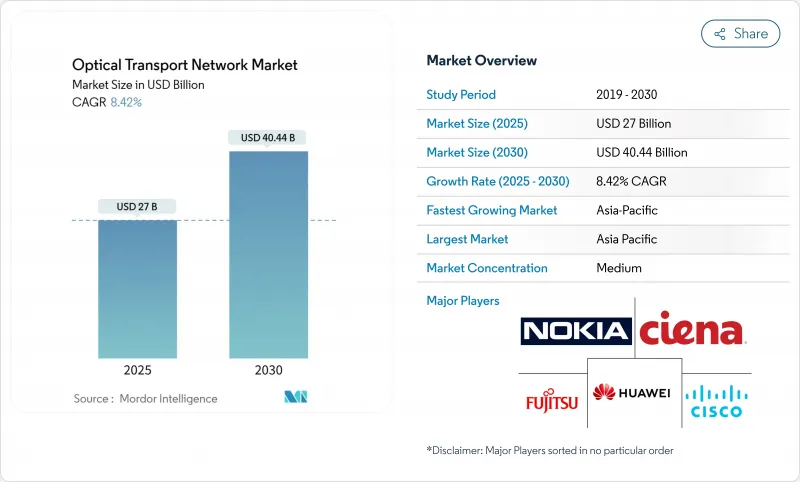

광 전송망 시장의 2025년 시장 규모는 270억 달러로 평가되었고, 2030년에는 404억 4,000만 달러에 이를것으로 예측되며, CAGR은 8.42%를 나타낼 전망입니다.

데이터센터 간 연결 대역폭 증가, 400ZR/ZR+ 코히어런트 플러그어블의 상용화, 정부 지원 광섬유 구축이 이러한 확장을 주도하고 있습니다. 하이퍼스케일러 기업들만 해도 2025년까지 디지털 인프라에 2,150억 달러를 투자할 것으로 예상되며, 이는 고용량 고밀도 파장분할다중화(DWDM) 시스템에 대한 수요를 가속화할 것입니다. 6인치 인듐 인화물 웨이퍼로의 전환 이후 실리콘 포토닉스 비용 곡선이 하락하고 있으며, 오픈라인 아키텍처는 통신사의 자본 지출을 낮추고 있습니다. 이러한 요소들이 종합적으로 작용하여 광 전송망 시장은 인공지능 클러스터, 클라우드 상호연결, 광대역 포용을 위한 핵심 백본으로 자리매김하고 있습니다.

세계의 광 전송망 시장 동향 및 인사이트

DCI를 위한 400 ZR/ZR+의 급속한 채택

표준화된 400ZR 및 ZR+ 플러그형 제품의 상용화로 이제 통신 사업자는 코히어런트 광학 장치를 라우터에 직접 연결할 수 있어 독립형 트랜스폰더가 불필요해지고 장비 비용이 절감됩니다. 코히어런트의 산업용 온도 100G ZR QSFP28-DCO는 단 5.5W 전력 소모로 출하되어 엣지 위치에서도 코히어런트 링크를 실현합니다. 사업자들은 IP-광학 통합으로 총소유비용(TCO)을 20-39% 절감하고 있으며, 하이퍼스케일러들은 이미 이러한 비용 절감을 활용하기 위해 네트워크 패브릭을 재설계 중입니다. 시엔아(Ciena)의 1.6T 코히어런트-라이트(Coherent-Lite)와 신규 448Gb/s PAM4 광학 솔루션은 2030년까지 예상되는 DCI(데이터 센터 간) 처리량 6배 증가에 대응합니다. 단기적 성과는 대부분 북미와 아시아태평양(APAC) 지역에서 나타날 전망인데, 해당 지역의 하이퍼스케일러 캠퍼스 클러스터가 버스트성 및 지연 시간 민감형 트래픽을 생성하기 때문입니다.

하이퍼스케일러 AI 클러스터 트래픽 붐

머신러닝 훈련 클러스터에 연결된 대역폭은 기존 워크로드보다 훨씬 빠르게 확장되고 있습니다. AI 패브릭용 광 트랜시버 매출은 2028년까지 연평균 30% 성장할 것으로 예상되며, 이는 비(非) AI 전개의 9% 성장률을 훨씬 능가합니다. 루멘 테크놀로지스는 2024년 마이크로소프트와의 대규모 계약을 포함해 총 80억 달러 규모의 신규 광섬유 계약을 체결했으며, 이는 AI 주도 광 수요의 규모를 잘 보여줍니다. 코히어런트의 300포트 광회로 스위치와 구글의 TPUv4 포드에 유사 기술 적용 사례는 파장 선택형 재구성 가능 패브릭으로의 아키텍처 전환을 보여줍니다. 이 촉진요인은 특히 북미와 유럽연합(EU)의 하이퍼스케일 캠퍼스 확장에 힘입어 중기 성장을 뒷받침할 전망입니다.

2차 통신사들의 자본 지출 동결(2024-2025년)

소규모 통신사들은 2024년 지출을 급격히 축소했으며, 노키아는 유럽 및 아시아 고객사들의 업그레이드 연기 때문에 광네트워크 매출이 23% 하락했다고 밝혔습니다. 시에나의 광통신 매출도 26억 4천만 달러로 감소했는데, 이는 유럽의 예산 긴축과 낮은 사용자당 평균 수익을 반영한 것입니다. 에키놉스(Ekinops)는 광 전송 매출이 41% 감소했다고 공개하며 광범위한 경계심을 강조했습니다. 이러한 지출 억제는 광망 구축을 가속화하는 현금 유동성이 풍부한 하이퍼스케일러와 현대화를 연기하는 전통적 통신사 간의 격차를 확대하고 있습니다.

부문 분석

DWDM은 2024년 광 전송망 시장에서 62%의 점유율을 유지하며 장거리 및 도시 간 연결의 중추적 역할을 재확인했습니다. 800G 지원 DWDM 링크는 통신사들이 AI 클러스터 및 5G 백홀 트래픽을 더 적은 파장으로 통합하여 스펙트럼 효율성을 높임에 따라 2030년까지 연평균 14.5% 성장할 전망입니다.

지속적인 DSP 혁신이 이러한 변화를 주도하고 있습니다. 시에나의 WaveLogic 6은 파장당 1.6Tb를 달성했으며, 노키아의 PSE-6s는 800G 속도에서 도달 거리를 확장했습니다. 이러한 혁신은 광 전송망 시장을 유연한 그리드 운영으로 이끌고 있으며, 인피네라의 83.6Tbps 현장 테스트는 상한선이 여전히 상승 중임을 보여줍니다. DWDM과 패킷-광 기능의 융합은 이제 통신사와 클라우드 환경 모두에서 조달 결정을 주도하며, 통합 플랫폼을 기본 선택지로 자리매김하고 있습니다.

다음 목표는 C+L 밴드 확장 및 기존 미사용 파장 대역 활용으로, 일본의 402Tbps 현장 기록이 이를 입증했습니다. 중국 브로드넷의 화웨이 기반 400G OTN 구축은 고밀도 스위칭 추세를 강조하며, C+L 통합으로 랙당 용량이 100Tbit/s로 향상되었습니다. 이러한 움직임은 채널당 데이터 속도가 1Tb를 넘어설 때에도 광 전송망 시장이 미래에 대비할 수 있도록 보장합니다.

2024년 광 전송망 시장 규모에서 부품이 54%를 차지했으며, 코히어런트 트랜시버, ROADM, 광회로 스위치가 주도했습니다. 표준화된 플러그형 제품의 매출은 400ZR 사양 하의 다중 벤더 상호운용성에 힘입어 2024년 6억 달러에서 두 배로 증가할 전망입니다.

엣지-ROADM 장치는 네트워크 분산화 덕분에 통신사와 하이퍼스케일러가 집선 사이트에 직접 파장 선택적 스위칭을 삽입할 수 있게 되면서 연평균 13.2% 성장률을 기록할 전망입니다. 동시에 네트워크 설계 및 통합 서비스는 의도 기반 자동화로 전환되며, 고객이 애플리케이션 수준 요구사항을 광 경로 프로비저닝으로 전환하는 데 도움을 주고 있습니다.

장비 및 수명주기 관리를 묶은 ‘서비스형 대역폭(BaaS)’ 모델 아래 관리형 네트워크 서비스가 부활하고 있습니다. 광 플랫폼 구성 요소, 특히 무색-무방향-무경합(CDC) 아키텍처의 신속한 도입으로 유연한 스펙트럼 할당이 가능해졌습니다. 이에 서비스 제공업체들은 운영 모델을 장비 중심 조달에서 성과 중심 계약으로 전환하며, 내부 역량을 소프트웨어 오케스트레이션 중심으로 재편하고 있습니다.

광 전송망 시장 보고서는 기술별(WDM, DWDM, 기타), 제품별(서비스 및 컴포넌트), 최종 사용자별(IT 및 통신 사업자, 클라우드 및 코로케이션 데이터센터, 헬스케어, 기타), 용도별(장거리 DWDM, 메트로 네트워크, 기타), 데이터 속도/파장(100-400Gbit/s, 400-800Gbit/s 등), 지역별로 분류됩니다.

지역 분석

아시아태평양 지역은 2024년 매출의 35%를 차지했으며, 지역 중 가장 빠른 연평균 성장률(CAGR) 10.8%로 확장될 전망입니다. 중국 당국은 10G 광대역 시범 사업에 20개 이상의 도시를 선정했으며, 중국 모바일(China Mobile)만 해도 2억 7,200만 개의 광대역 회선을 제공하며 그중 1/3이 기가비트 등급입니다. 일본은 정부 지원 광학 반도체 개발을 위해 NTT와 인텔(Intel)과 협력 중이며, 한국의 K-네트워크 2030은 6G 연구 및 저궤도 위성 링크에 4억 8,100만 달러를 배정했습니다. ALPHA 해저 케이블은 광섬유 쌍당 18Tbit/s의 대역폭으로 지역 간 연결성을 강화합니다.

북미는 성숙한 인프라를 보유했으나, 424억 5천만 달러 규모의 BEAD 프로그램이 중간 구간(middle-mile) 건설에 자금을 투입하며 새로운 성장 동력을 얻고 있습니다. 루멘(Lumen)의 80억 달러 규모 광섬유 계약과 자요(Zayo)의 40억 달러 장거리 확장 계획은 AI 기반 엣지 컴퓨팅이 경로 수요를 재편하고 있음을 보여줍니다. 인력 부족은 여전히 심각합니다. 20만 5천 명의 추가 기술자가 필요해 통신사, 벤더, 광대역 협회 간 교육 협력체 결성이 촉진되고 있습니다.

유럽은 야심찬 디지털 주권 목표와 통신사의 타이트한 현금 흐름 사이에서 균형을 맞추고 있습니다. 유럽투자은행의 도이체 글라스파저(Deutsche Glasfaser)에 대한 3억 5천만 유로 대출은 농촌 기가비트 커버리지를 목표로 하며, CEF 디지털 계획은 초고용량 네트워크에 2천억 유로가 필요함을 제시합니다. 통신사 ARPU는 여전히 부진하여 공공 공동 자금 조달이 여전히 중요합니다. 오렌지 폴란드의 15만 5천 가구 구축 사례는 혼합 금융에 대한 의존도를 보여줍니다. 영국과 유럽 본토 간 계획된 48쌍 해저 케이블은 특정 경로에서 최대 5.5ms의 지연 시간 단축 효과를 낼 것입니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- DCI(데이터 센터 간 연결)를 위한 400 ZR/ZR+의 급속한 채택

- 하이퍼스케일러 AI 클러스터 트래픽 급증

- 정부 광섬유 백홀 지원 정책(미국 BEAD, EU CEF-2)

- 자본 지출(Capex)을 낮추는 오픈라인 시스템

- 실리콘 포토닉스의 가격 변동

- 해저 그린 필드 케이블(>20 Tb/s)

- 시장 성장 억제요인

- 2차 통신사 자본 지출 동결(2024-2025년)

- 코히어런트 DSP에 대한 미중 수출 통제

- 광섬유 설치 숙련 노동력 부족

- 인듐 포스파이드(InP) 에피택시 의존도

- 밸류체인 분석

- 규제 상황

- 기술의 전망

- Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

제5장 시장 규모와 성장 예측

- 기술별

- WDM

- DWDM

- O-밴드 및 기타 기술

- 제공별

- 서비스

- 네트워크 유지보수 및 지원

- 네트워크 설계 및 통합

- 컴포넌트

- 광 전송 장치

- 광 스위치

- 광 플랫폼/엣지-ROADM

- 서비스

- 최종 사용자별

- IT 및 통신 사업자

- 클라우드 및 공동 위치 데이터센터

- 정부 및 방위

- 헬스케어

- 은행 및 금융 서비스

- 기타(공공 요금, 교육)

- 용도별

- 장거리 DWDM

- 데이터센터 상호 연결(DCI)

- 메트로 네트웍스

- 엔터프라이즈 네트워크

- 데이터 속도/파장별

- 100-400Gbit/s

- 400-800Gbit/s

- 800Gbit/s 초과

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 기타 유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- ASEAN

- 기타 아시아태평양

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 중동

- 사우디아라비아

- 아랍에미리트(UAE)

- 튀르키예

- 기타 중동

- 아프리카

- 남아프리카

- 나이지리아

- 기타 아프리카

- 북미

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율 분석

- 기업 프로파일

- Nokia

- Ciena

- Cisco Systems

- Huawei

- Fujitsu

- ZTE

- Infinera

- Ericsson

- NEC

- Coriant(Infinera)

- ADVA Optical Networking

- Ribbon Communications

- Tejas Networks

- ECI Telecom(Ribbon)

- Juniper Networks

- Sterlite Technologies

- NativeWave

- Ciena-Photonera

- Padtec

- FiberHome

제7장 시장 기회와 장래의 전망

HBR 25.11.17The optical transport network market is valued at USD 27 billion in 2025 and is on track to reach USD 40.44 billion by 2030, translating into an 8.42% CAGR.

Rising data-center-interconnect bandwidth, the commercialization of 400ZR/ZR+ coherent pluggables, and government-funded fiber rollouts are guiding this expansion. Hyperscalers alone expect to channel USD 215 billion into digital infrastructure in 2025, intensifying demand for high-capacity dense-wavelength-division multiplexing (DWDM) systems. Silicon photonics cost curves are falling after the shift to 6-inch indium-phosphide wafers, while open-line architectures are lowering capital outlays for carriers. Taken together, these forces position the optical transport network market as an essential backbone for artificial-intelligence clusters, cloud interconnects, and broadband inclusion.

Global Optical Transport Network Market Trends and Insights

Rapid 400 ZR/ZR+ Adoption for DCI

Commercial availability of standardized 400ZR and ZR+ pluggables now lets operators plug coherent optics directly into routers, eliminating standalone transponders and trimming equipment cost. Coherent's industrial-temperature 100G ZR QSFP28-DCO ships at only 5.5 W power draw, making coherent links viable in edge locations. Operators are logging 20-39% total-cost-of-ownership reductions from IP-optical convergence, and hyperscalers are already redesigning network fabrics to exploit these savings. Ciena's 1.6T Coherent-Lite and new 448 Gb/s PAM4 optics answer a sixfold rise in DCI throughput expected by 2030. Most short-term gains will materialize in North America and APAC, where hyperscaler campus clusters generate bursty, latency-sensitive traffic.

Hyperscaler AI-Cluster Traffic Boom

Bandwidth tied to machine-learning training clusters is scaling much faster than traditional workloads. Fiber-optical transceiver revenue for AI fabrics is forecast to compound at 30% through 2028, dwarfing the 9% pace for non-AI deployments. Lumen Technologies signed USD 8 billion in new fiber deals during 2024, including a large order with Microsoft that underlines the scale of AI-driven optical demand. Coherent's 300-port optical-circuit switch and Google's deployment of similar technology in TPUv4 pods illustrate the architectural shift toward wavelength-selective, reconfigurable fabrics. This driver supports medium-term growth, especially in North America and the European Union as their hyperscale campuses expand.

Capex Freeze at Tier-2 Telcos (2024-25)

Smaller operators curtailed spending sharply in 2024, with Nokia citing a 23% slide in optical-network revenue because European and Asian customers deferred upgrades. Ciena's optical revenue also fell to USD 2.64 billion, mirroring tight budgets and low average revenue per user in Europe. Ekinops disclosed a 41% decline in optical-transport sales, underscoring widespread caution. This restraint widens the gap between cash-rich hyperscalers advancing optical rollouts and traditional carriers postponing modernization.

Other drivers and restraints analyzed in the detailed report include:

- Government Fibre-Backhaul Stimulus (US BEAD, EU CEF-2)

- Silicon Photonics Price Inflection

- US-China Export Controls on Coherent DSPs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

DWDM retained a 62% share of the optical transport network market in 2024, confirming its status as the backbone for long-haul and metro connections. 800G-ready DWDM links are set to grow at 14.5% CAGR to 2030 as operators consolidate traffic from AI clusters and 5G backhaul into fewer wavelengths, boosting spectral efficiency.

Continuous DSP innovation anchors this shift. Ciena's WaveLogic 6 pushes 1.6 Tb per wavelength, and Nokia's PSE-6s raises reach at 800G speeds. These breakthroughs keep the optical transport network market moving toward flexible-grid operation, while Infinera's 83.6 Tbps field test shows the upper ceiling is still rising. Convergence of DWDM and packet-optical functions now guides procurement decisions in both carrier and cloud settings, embedding integrated platforms as default choices.

The next horizon is C + L band expansion and the inclusion of previously unused wavelength windows, as Japan's 402 Tbps field record revealed. China Broadnet's Huawei-based 400G OTN deployment underscores high-density switching trends, and C+L integration lifts per-rack capacity to 100 Tbit/s. These moves ensure the optical transport network market remains future-proof as data rates climb beyond 1 Tb per channel.

Components accounted for 54% of the optical transport network market size in 2024, led by coherent transceivers, ROADMs, and optical circuit switches. Sales of standardized pluggables are projected to double from USD 600 million in 2024, propelled by multi-vendor interoperability under the 400ZR specification.

Edge-ROADM units grow at a 13.2% CAGR because network disaggregation lets carriers and hyperscalers insert wavelength-selective switching directly at aggregation sites. At the same time, network-design and integration services are pivoting toward intent-based automation, helping customers translate application-level requirements into optical-path provisioning.

Managed network offerings are reviving under bandwidth-as-a-service models that bundle equipment and lifecycle management. Swift rollout of optical platform components, especially colorless-directionless-contentionless (CDC) architectures, is unlocking flexible spectrum allocation. Service providers thus shift operating models away from box-centric procurement to outcome-oriented contracts, realigning internal skill sets around software orchestration.

The Optical Transport Network Market Report is Segmented by Technology (WDM, DWDM, and More), Offering (Services and Components), End-User Vertical (IT and Telecom Operators, Cloud and Colocation Data Centers, Healthcare, and More), Application (Long-Haul DWDM, Metro Networks, and More), Data Rate / Wavelength (100-400 Gbit/S, 400-800 Gbit/S, and More), and Geography.

Geography Analysis

Asia-Pacific controlled 35% of 2024 revenue and is projected to expand at a 10.8% CAGR, the fastest across regions. Chinese authorities selected over 20 cities for 10 G broadband pilots; China Mobile alone serves 272 million broadband lines, with one-third on gigabit tiers. Japan partners NTT and Intel on government-funded optical semiconductors, while South Korea's K-Network 2030 allocates USD 481 million for 6 G research and low-orbit satellite links. The ALPHA subsea cable, with 18 Tbit/s per fiber pair, fortifies regional interconnectivity.

North America sits on mature infrastructure yet sees renewed momentum as the USD 42.45 billion BEAD program funnels capital into middle-mile construction. Lumen's USD 8 billion fiber contracts and Zayo's USD 4 billion long-haul expansion reveal how AI-driven edge compute is reconfiguring route demand. Workforce shortages remain acute: 205,000 additional technicians are needed, spurring training alliances among carriers, vendors, and the Fiber Broadband Association.

Europe balances ambitious digital-sovereignty goals with tight operator cash flow. The European Investment Bank's EUR 350 million loan to Deutsche Glasfaser targets rural gigabit coverage, while the CEF Digital scheme outlines EUR 200 billion requirements for very-high-capacity networks. Operator ARPU remains muted, so public co-funding remains critical. Orange Poland's build for 155,000 homes highlights reliance on blended finance. Planned 48-pair subsea links between the UK and mainland Europe will trim latency by up to 5.5 ms for certain routes.

- Nokia

- Ciena

- Cisco Systems

- Huawei

- Fujitsu

- ZTE

- Infinera

- Ericsson

- NEC

- Coriant (Infinera)

- ADVA Optical Networking

- Ribbon Communications

- Tejas Networks

- ECI Telecom (Ribbon)

- Juniper Networks

- Sterlite Technologies

- NativeWave

- Ciena-Photonera

- Padtec

- FiberHome

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid 400 ZR/ZR+ adoption for DCI

- 4.2.2 Hyperscaler AI-cluster traffic boom

- 4.2.3 Government fibre-backhaul stimulus (US BEAD, EU CEF-2)

- 4.2.4 Open-line systems lowering capex

- 4.2.5 Silicon photonics price inflection

- 4.2.6 Under-sea green-field cables (>20 Tb/s)

- 4.3 Market Restraints

- 4.3.1 Capex freeze at Tier-2 telcos (2024-25)

- 4.3.2 US-China export controls on coherent DSPs

- 4.3.3 Skilled-labour shortage for fibre installation

- 4.3.4 Supply-chain dependency on InP epitaxy

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Technology

- 5.1.1 WDM

- 5.1.2 DWDM

- 5.1.3 O-band and Other Technologies

- 5.2 By Offering

- 5.2.1 Services

- 5.2.1.1 Network Maintenance and Support

- 5.2.1.2 Network Design and Integration

- 5.2.2 Components

- 5.2.2.1 Optical Transport Equipment

- 5.2.2.2 Optical Switch

- 5.2.2.3 Optical Platform/Edge ROADM

- 5.2.1 Services

- 5.3 By End-user Vertical

- 5.3.1 IT and Telecom Operators

- 5.3.2 Cloud and Colocation Data Centres

- 5.3.3 Government and Defence

- 5.3.4 Healthcare

- 5.3.5 Banking and Financial Services

- 5.3.6 Others (Utilities, Education)

- 5.4 By Application

- 5.4.1 Long-Haul DWDM

- 5.4.2 Data-Center-Interconnect (DCI)

- 5.4.3 Metro Networks

- 5.4.4 Enterprise Networks

- 5.5 By Data Rate / Wavelength

- 5.5.1 100-400 Gbit/s

- 5.5.2 400-800 Gbit/s

- 5.5.3 Beyond 800 Gbit/s

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 UK

- 5.6.2.3 France

- 5.6.2.4 Rest of Europe

- 5.6.3 Asia Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 South Korea

- 5.6.3.5 ASEAN

- 5.6.3.6 Rest of Asia Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Rest of South America

- 5.6.5 Middle East

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 United Arab Emirates

- 5.6.5.3 Turkey

- 5.6.5.4 Rest of Middle East

- 5.6.6 Africa

- 5.6.6.1 South Africa

- 5.6.6.2 Nigeria

- 5.6.6.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Nokia

- 6.4.2 Ciena

- 6.4.3 Cisco Systems

- 6.4.4 Huawei

- 6.4.5 Fujitsu

- 6.4.6 ZTE

- 6.4.7 Infinera

- 6.4.8 Ericsson

- 6.4.9 NEC

- 6.4.10 Coriant (Infinera)

- 6.4.11 ADVA Optical Networking

- 6.4.12 Ribbon Communications

- 6.4.13 Tejas Networks

- 6.4.14 ECI Telecom (Ribbon)

- 6.4.15 Juniper Networks

- 6.4.16 Sterlite Technologies

- 6.4.17 NativeWave

- 6.4.18 Ciena-Photonera

- 6.4.19 Padtec

- 6.4.20 FiberHome

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment