|

시장보고서

상품코드

1850259

주사기 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Syringes - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

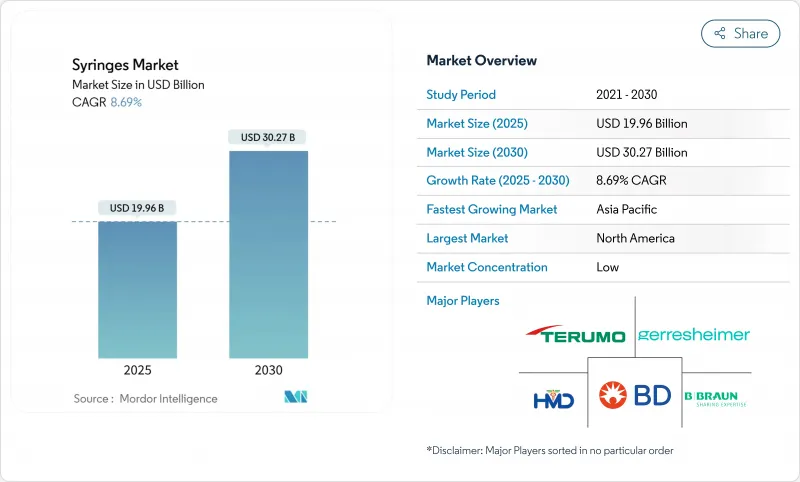

주사기 시장의 2025년 시장 규모는 199억 6,000만 달러로 평가되었고, 2030년에는 302억 7,000만 달러에 이를 것으로 예측되며, 이 기간의 CAGR은 8.69%를 나타낼 전망입니다.

성장 동력은 세 가지 수렴하는 힘에 기인합니다. 빈번한 주사가 필요한 만성 질환의 꾸준한 증가, 대규모 백신 접종 역량에 대한 구조적 의지, 그리고 정밀하고 사각지대가 적은 전달이 필요한 생물학적 제제로의 제약 산업 전환입니다. 2026년 2월부터 미국에서 시행되는 ISO 13485 표준을 중심으로 한 규제 수렴은 품질 시스템을 시장 진입의 전제 조건으로 삼음으로써 경쟁 구도를 재조정하고 있습니다. 한편, 불량 수입품과 연계된 지속적인 공급 차질은 4억 달러 이상의 국내 생산 능력 확대로 이어졌으며, BD가 코네티컷과 네브래스카 공장을 확장하기 위해 추진 중인 2년간 4천만 달러 규모의 프로그램이 이를 주도하고 있습니다. 지역별로는 북미가 구매력을 주도하며 주사기 출하량의 10개 중 거의 4개를 차지하는 반면, 아시아태평양 지역은 공중 보건 투자와 만성 질환 발생률 증가에 힘입어 연평균 9.32%의 가장 빠른 단위 성장률을 보이고 있습니다. 감염 관리 프로토콜이 병원 업무 효율성과 부합함에 따라 일회용 주사기가 사용을 주도하고 있으나, 생물학적 제제 파이프라인이 길어지고 단위 경제성이 프리미엄 가격 책정을 가능하게 함에 따라 사전 충전형, 안전 설계형, 저데드스페이스 설계형 등 특수 주사기의 성장세가 가장 강력합니다.

세계의 주사기 시장 동향 및 인사이트

만성 질환과 감염의 부담 증가

전 세계 당뇨병 환자는 2045년까지 7억 8,300만 명에 달할 것으로 예상되며, 이는 하루 여러 번 주사를 지원하는 인슐린 전달 시스템 수요를 증가시킬 것입니다. 점성이 높은 생물학적 제제는 잔여 폐기물을 최소화하는 저데드스페이스 배럴이 필요하므로 정밀성 요구로 인해 물량 효과가 증폭됩니다. 고령화 인구로 환자당 주사 빈도가 증가함에 따라 약물 안정성을 유지하고 용량 정확성을 보장하는 고급 주사기 조달이 촉진됩니다. 특수 형식 생산이 가능한 제조사는 생물학적 제제 개발사와의 긴밀한 협력을 통해 가격 프리미엄을 확보합니다. 제약사들은 복합 치료법도 모색 중이며, 이는 치료 과정당 단위 가치를 높이고 만성 질환 치료에서 특수 주사기의 역할을 공고히 합니다. 예측 기간 동안 만성 질환 요인은 고소득 지역에서 꾸준하고 예측 가능한 물량 성장을 강화하는 동시에 신흥 시장에서 프리미엄 디자인 채택을 가속화할 것입니다.

집단 예방 접종 프로그램의 성장

팬데믹 이후 보건 정책은 대규모 예비 재고 확보를 제도화하고 있으며, 유니세프가 향후 캠페인을 위해 재고로 보관 중인 10억 개의 주사기 구매가 이를 입증합니다. 가비의 2026-2030 로드맵은 긴급 예방접종 비축을 위해 5억 달러를 배정하여 WHO 사전 인증 기준을 준수하는 자동 폐기 장치에 대한 기본 수요를 확고히 합니다. 아프리카, 동남아시아, 라틴아메리카 정부들은 수입 의존도를 완화하기 위해 현지 조립 라인에 투자하며, 기존 공급업체에게 기술 이전 기회를 제공하고 있습니다. 조달 모델은 장기 프레임워크 계약을 점점 더 강조하여 생산 일정을 안정화하고 공급업체가 대량 생산 공정을 활용할 수 있도록 합니다. 표준화된 배럴 용량과 루어-락(Luer-Lock) 디자인이 기본 사양으로 부상하며, 주요 일회용 카테고리 내 판매량이 더욱 집중되고 있습니다. 이러한 추세의 중기적 영향은 안정적인 재고 보충 주기와 안전 설계 변형 제품의 점진적 단가 상승으로 이어집니다.

안전 주사기 고비용 및 바늘 찔림 사고 우려

안전 설계 모델은 기존 제품 대비 2-3배의 가격으로 유통되어, 예산 제약이 있는 의료 기관들은 규정이 안전 장치 사용을 권장하더라도 전환을 꺼리게 됩니다. 중하위 소득 국가의 중앙 의료 물자 입찰에서는 장기적 부상 배상 책임보다 품목별 비용을 우선시하여 광범위한 도입이 지연되고 있습니다. 제조 규모 확대와 폴리머 자동화로 단위 프리미엄이 점차 축소되고 있으나, 대부분의 저소득 환경에서는 가격 균형 달성에 수년이 소요될 전망입니다. 잠재적 소송 비용 절감분으로 기기 비용을 상쇄하는 혁신적 조달 메커니즘이 가치 제안을 재구성하는 데 기여하고 있습니다. 임상 결과 데이터와 교육 패키지를 제공하는 공급업체들은 총소유비용(TCO) 이점을 입증하여 가격 장벽을 완화합니다. 중기적으로 규제 압박과 점진적 비용 수렴이 결합되어 이러한 제약 요인의 영향이 제한될 것으로 예상됩니다.

부문 분석

2024년 일회용 주사기 시장 점유율은 89.23%를 기록하며 감염 관리의 중요성과 일회용 재고 주기의 물류적 이점을 부각시켰습니다. 재사용 가능한 주사기 통이 교차 오염 위험과 연관된다는 증거가 확인된 후 병원 프로토콜은 일회용 기기로 표준화되었으며, FDA의 불량 수입품 경고 이후 이러한 전환은 가속화되었습니다. 대량 성형으로 금형 비용을 빠르게 상각할 수 있는 반면, 재사용 제품의 중앙 멸균은 여전히 노동 집약적이어서 단위 비용 경제성 측면에서 일회용이 유리합니다. BD의 국내 확장만으로도 연간 생산량이 6억 개 증가하여 일회용 공급 기반을 강화할 것입니다.

재사용 주사기는 현재 수의학 수술이나 멸균 오토클레이브가 이미 사용 중인 일부 저자원 환경과 같은 틈새 역할을 차지하고 있습니다. 이러한 분야에서도 기부자들이 더 엄격한 안전 기준을 적용함에 따라 보조금 지원으로 일회용 기기로의 전환이 진행 중입니다. 교육 자료, 규제 감사, 전자 재고 관리 플랫폼은 점점 더 일회용 워크플로우를 전제로 합니다. 그 결과 공급업체는 일회용 혁신을 우선시하고 의료진은 일회용 프로토콜에 익숙해지는 자기강화적 순환이 발생하며, 이는 주사기 시장 전반에 걸쳐 해당 카테고리의 리더십을 더욱 공고히 합니다.

범용 기기는 일상적 주사, 백신 접종 캠페인, 저점도 치료제 공급을 통해 2024년 매출 점유율 65.25%를 유지했습니다. 프리필러형, 안전 설계형, 저데드스페이스 모델 등 특수 주사기는 전체 제품군 중 가장 빠른 연평균 복합 성장률(CAGR) 9.43%를 기록할 전망입니다. 이 부문 성장은 제약업계의 생물학적 제제 투자와 맞물려 있으며, GLP-1 작용제, mRNA 치료제, CAR-T 주입제 등이 고정밀 용기에 의존하고 있습니다. SCHOTT Pharma의 노스캐롤라이나 3억 7,100만 달러 규모 시설은 이러한 첨단 제형 수요를 충족하기 위한 생산 능력 확장의 사례입니다.

특수 용기는 일반 배럴형 제품 대비 20-150%의 프리미엄 가격을 형성하여 공급업체가 수지 원자재 가격 변동성으로부터 보호받게 합니다. 내장형 바늘 안전 커버 및 RFID 태그 등 장치의 복잡성은 지적 재산권 장벽을 구축합니다. 계약 제조업체는 각 분자별 맞춤형 플런저 스토퍼 및 실리콘 오일 코팅을 제공함으로써 공급업체를 제약 가치 사슬에 더욱 깊이 연동시킵니다. 결과적으로 특수 형식은 비례하지 않는 가치를 창출하며 주사기 시장의 기술 로드맵을 주도합니다.

지역 분석

북미는 2024년 주사기 시장 매출의 39.44%를 차지했으며, 이는 높은 1인당 의료비 지출, 조기 생물학적 제제 도입, 대부분의 임상 워크플로우에서 의무화된 안전 장치 사용에 힘입은 결과입니다. BD가 미국 내 다수 공장을 업그레이드하며 리쇼어링이 가속화되고, 생산 능력 증대로 리드 타임이 40% 단축되며 FDA의 강화된 추적 관리 규정을 충족합니다. 팬데믹 대비와 연계된 연방 자금 인센티브는 충전-완성 인프라 확장을 추가로 지원하여 특수 주사기에 대한 하류 수요를 보장합니다.

아시아태평양 지역은 급속히 확대되는 중산층 인구와 만성질환 약품 지원을 위한 정부 의료 개혁에 힘입어 9.32%의 가장 빠른 지역 연평균 성장률(CAGR)을 기록할 전망입니다. 일본과 한국은 고부가가치 생물학적 제제 충전 및 완성 활동을 주도하는 반면, 인도와 베트남은 예방접종 프로그램을 위한 대량의 일반 일회용 제품을 흡수할 것입니다. FDA 품질 경고로 촉발된 중국 공장 규제 심사는 다국적 제약사들이 더 높은 규정 준수 역량을 가진 아세안 공급업체로 다각화하도록 유도합니다. 이 다각화 전략은 주문 재분배를 촉진하고 지역 품질 기대치의 기준을 높입니다.

유럽은 안전성과 지속가능성을 보상하는 포괄적 보상 체계에 힘입어 특수 형식 및 친환경 설계 리더십 분야에서 우위를 유지합니다. 게레샤이머의 독일 생산 라인은 엄격한 EU 재활용 함량 기준을 충족하는 사이클로올레핀 폴리머 배럴을 제공하여 유럽 구매자들이 소재 등급 변경 없이도 규정을 준수하는 옵션을 선택할 수 있게 합니다. 중동 및 아프리카와 남미는 백신 보급 확대와 병원 인프라 개선으로 주사기 수요가 꾸준히 증가하는 신흥 기회 지역입니다. 그러나 통화 변동성과 느린 규제 조화로 인해 해당 지역의 투자 속도는 다소 주춤하고 있습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 만성질환과 감염증의 부담증대

- 집단 백신접종 프로그램 증가

- 자가 투여 트렌드 및 용량 정밀도 요구

- 안전성 및 스마트 주사기에 대한 규제 추진

- 세포 및 유전자 치료를 위한 저사각 주사기의 급속한 채택

- RFID 기반 폐기물 추적성 강화로 스마트 주사기 도입 촉진

- 시장 성장 억제요인

- 안전 주사기 및 바늘 찔림 사고 우려에 따른 높은 비용

- 대체 약물 전달 방식(패치, 펌프, 흡입기)

- 플라스틱 의료 폐기물 규정 준수 비용

- 프리필드용 붕규산 유리관의 부족

- 규제 상황

- 기술의 전망

- Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

제5장 시장 규모와 성장 예측

- 용도별

- 재사용 주사기

- 일회용 주사기

- 제품 유형별

- 일반용

- 특수용

- 재료별

- 유리

- 플라스틱

- 기타

- 최종 사용자별

- 병원

- 외래수술센터(ASC)

- 홈케어

- 기타

- 용도별

- 당뇨병

- 백신접종과 예방접종

- 보톡스/미용

- 골관절염

- 인간 성장 호르몬

- 기타

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 기타 아시아태평양

- 중동 및 아프리카

- GCC

- 남아프리카

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 경쟁 구도

- 시장 집중도

- 시장 점유율 분석

- 기업 프로파일

- Becton Dickinson & Co.

- Terumo Corp.

- B. Braun Melsungen AG

- Nipro Corp.

- Gerresheimer AG

- Hindustan Syringes & Medical Devices

- Cardinal Health Inc.

- Schott AG

- West Pharmaceutical Services

- Stevanato Group

- Retractable Technologies Inc.

- Smiths Medical(ICU Medical)

- Sol-Millennium Medical

- Baxter International Inc.

- Owen Mumford Ltd.

- Catalent Pharma Solutions

- MC Johnson Co.

- Changzhou Mingle Medical

- Hi-Tech Syringes

- West(Daikyo)

제7장 시장 기회와 장래의 전망

HBR 25.11.17The syringes market is valued at USD 19.96 billion in 2025 and is forecast to reach USD 30.27 billion by 2030, translating into an 8.69% CAGR over the period.

Growth momentum is rooted in three converging forces: a steady rise in chronic illnesses that require frequent injections, a structural commitment to mass-vaccination capacity, and the pharmaceutical industry's pivot toward biologics that need precise, low-dead-space delivery. Regulatory convergence around ISO 13485 standards, effective in the United States from February 2026, is recalibrating competitive stakes by making quality systems a prerequisite for market access. Meanwhile, sustained supply disruptions tied to sub-standard imports have prompted more than USD 400 million in domestic capacity expansions, led by BD's two-year USD 40 million program to scale Connecticut and Nebraska plants. Across geographies, North America commands purchasing power and accounts for nearly 4 in 10 syringe shipments, while Asia-Pacific delivers the fastest unit growth at 9.32% CAGR, supported by public-health investments and rising chronic-disease incidence. Disposable formats dominate usage because infection-control protocols align with hospital workflow efficiencies, yet specialized syringes-prefillable, safety-engineered, and low-dead-space designs-post the strongest growth as biologics pipelines lengthen and unit economics allow premium pricing.

Global Syringes Market Trends and Insights

Rising Burden of Chronic & Infectious Diseases

Global diabetes cases are projected to reach 783 million by 2045, intensifying demand for insulin delivery systems that support multiple daily injections. The volume effect is amplified by precision needs because viscous biologics require low-dead-space barrels that limit residual waste . Aging demographics raise injection frequency per patient, driving procurement of advanced syringes that maintain drug stability and ensure dose accuracy. Manufacturers capable of producing specialized formats command price premiums, benefiting from tight alignment with biologics developers. Pharma companies also explore combination therapies, increasing unit value per treatment episode and cementing the role of specialty syringes in chronic-disease care. Over the forecast horizon, the chronic-disease driver will reinforce steady, predictable volume growth across high-income regions while accelerating adoption of premium designs in emerging markets.

Growth in Mass-Vaccination Programs

Post-pandemic health policy now institutionalizes large buffer inventories, evidenced by UNICEF's purchase of 1 billion syringes that remain in stock for future campaigns. Gavi's 2026-2030 roadmap earmarks USD 500 million for emergency immunization reserves, anchoring baseline demand for auto-disable devices that conform to WHO pre-qualification standards. Governments in Africa, Southeast Asia, and Latin America invest in local assembly lines to mitigate import dependence, presenting technology-transfer opportunities for established suppliers. Procurement models increasingly emphasize long-term framework agreements, stabilizing production schedules and enabling suppliers to leverage high-volume tooling. Standardized barrel volumes and luer-lock designs emerge as default specifications, further concentrating volume in dominant disposable categories. The driver's medium-term influence translates into reliable replenishment cycles and incremental unit-price uplift for safety-engineered variants.

High Cost of Safety Syringes & Needlestick-Injury Concerns

Safety-engineered models retail at 2-3 times the price of conventional variants, making budget-constrained facilities reluctant to switch even when regulations recommend safer devices. Central-medical-store tenders in lower-middle-income countries line-item cost above long-term injury liabilities, delaying widespread adoption. Manufacturing scale and polymer automation are gradually compressing unit premiums, but price parity remains several years away for most low-income settings. Innovative procurement mechanisms that amortize device cost against potential litigation savings help reframe the value proposition. Suppliers offering clinical-outcome data and training bundles demonstrate total cost-of-ownership benefits, easing affordability barriers. Over the medium term, combined regulatory pressure and gradual cost convergence are expected to limit the restraint's impact.

Other drivers and restraints analyzed in the detailed report include:

- Self-Administration Trend & Dose Precision Demand

- Regulatory Push for Safety & Smart Syringes

- Alternative Drug-Delivery Technologies

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Disposable formats held 89.23% of syringes market share in 2024, underscoring infection-control imperatives and the logistical advantage of single-use inventory cycles. Hospital protocols standardized on disposable devices after evidence linked reusable barrels to cross-contamination risks, and the shift accelerated following FDA notices on sub-standard imports . Unit-cost economics favor disposables because high-volume molding amortizes tooling quickly, while central sterilization of reusables remains labor-intensive. BD's domestic expansion alone will boost annual output by 600 million units, reinforcing the disposable supply backbone.

Reusable syringes now occupy niche roles such as veterinary surgeries and select low-resource settings where sterilization autoclaves are already in use. Even in those arenas, grant-funded upgrades to single-use devices are progressing as donors apply stricter safety metrics. Training materials, regulatory audits, and electronic inventory platforms increasingly presume disposable workflows. The result is a self-reinforcing cycle where suppliers prioritize disposable innovation and clinicians build familiarity with single-use protocols, further entrenching category leadership across the syringes market.

General-purpose devices retained 65.25% revenue share in 2024 by supplying routine injections, vaccine campaigns, and low-viscosity therapies. Specialized syringes-prefillable, safety-engineered, and low-dead-space models-are projected to post a 9.43% CAGR, the fastest among all product categories. The segment's expansion mirrors pharma's biologics investment, with GLP-1 agonists, mRNA therapeutics, and CAR-T infusions depending on high-precision containers. SCHOTT Pharma's USD 371 million facility in North Carolina exemplifies capacity added to satisfy these advanced formats.

Specialized units command price premiums of 20-150% over commoditized barrels, cushioning suppliers from resin cost volatility. Device complexity, including built-in needle-safety sheaths and RFID tags, also creates intellectual-property moats. Contract manufacturers tailor plunger stoppers and silicone-oil coatings to each molecule, embedding suppliers deeper into pharma value chains. Consequently, specialized formats capture disproportionate value and shape the technology roadmap for the syringes market.

The Syringes Market is Segmented by Usage (Reusable Syringes and Disposable Syringes), Product Type (General Purpose and Specialized ), Material (Glass, Plastic, and More), End User (Hospitals, Ambulatory Surgery Centers, and More), Application (Diabetes and More) and Geography (North America, Europe, Asia-Pacific, and More). The Market and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America controlled 39.44% of syringes market revenue in 2024, propelled by high per-capita healthcare spending, early biologic adoption, and mandatory safety-device use in most clinical workflows. Domestic reshoring accelerates as BD upgrades multiple U.S. plants, adding capacity that cuts lead times by 40% and meets stricter FDA track-and-trace mandates. Federal funding incentives, tied to pandemic preparedness, further underwrite expansion of fill-finish infrastructure, ensuring downstream demand for specialized syringes.

Asia-Pacific delivers the fastest regional CAGR at 9.32%, underpinned by rapidly expanding middle-class populations and government healthcare reforms that subsidize chronic-disease medications. Japan and South Korea anchor high-value biologic fill-finish activities, while India and Vietnam absorb large volumes of commodity disposables for immunization programs. Regulatory scrutiny of Chinese plants-sparked by FDA quality alerts-drives multinational pharma to diversify toward ASEAN suppliers with higher compliance credentials. This diversification strategy redistributes orders and sets a higher baseline for regional quality expectations.

Europe retains a stronghold in specialized formats and eco-design leadership, buoyed by comprehensive reimbursement frameworks that reward safety and sustainability. Gerresheimer's German production lines offer cyclo-olefin-polymer barrels that meet stringent EU recyclable-content thresholds, giving European buyers compliant options without switching material classes. Middle East and Africa, along with South America, represent emerging opportunity corridors where vaccination rollouts and improving hospital infrastructures drive steady syringe demand. Nevertheless, currency volatility and slower regulatory harmonization temper investment speed in those regions.

- Becton Dickinson & Co.

- Terumo Corp.

- B. Braun

- Nipro Corp.

- Gerresheimer

- Hindustan Syringes & Medical Devices

- Cardinal Health

- SCHOTT

- West Pharmaceutical Services

- Stevanato Group

- Retractable Technologies

- Smiths Group

- Sol-Millennium Medical

- Baxter

- Owen Mumford

- Catalent Pharma Solutions

- M.C. Johnson Co.

- Changzhou Mingle Medical

- Hi-Tech Syringes

- West (Daikyo)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising burden of chronic & infectious diseases

- 4.2.2 Growth in mass-vaccination programs

- 4.2.3 Self-administration trend & dose-precision demand

- 4.2.4 Regulatory push for safety & smart syringes

- 4.2.5 Rapid uptake of low-dead-space syringes for cell & gene therapy

- 4.2.6 RFID-enabled waste-traceability boosting smart syringes adoption

- 4.3 Market Restraints

- 4.3.1 High cost of safety syringes & needlestick-injury concerns

- 4.3.2 Alternative drug-delivery (patches, pumps, inhalers)

- 4.3.3 Plastic-medical-waste compliance costs

- 4.3.4 Borosilicate glass-tubing shortages for prefillable formats

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porters Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Usage

- 5.1.1 Reusable Syringes

- 5.1.2 Disposable Syringes

- 5.2 By Product Type

- 5.2.1 General Purpose

- 5.2.2 Specialized

- 5.3 By Material

- 5.3.1 Glass

- 5.3.2 Plastic

- 5.3.3 Others

- 5.4 By End User

- 5.4.1 Hospitals

- 5.4.2 Ambulatory Surgery Centers

- 5.4.3 Home-care

- 5.4.4 Others

- 5.5 By Application

- 5.5.1 Diabetes

- 5.5.2 Vaccination & Immunization

- 5.5.3 Botox / Aesthetic

- 5.5.4 Osteoarthritis

- 5.5.5 Human Growth Hormone

- 5.5.6 Others

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 Australia

- 5.6.3.5 South Korea

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East and Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Becton Dickinson & Co.

- 6.3.2 Terumo Corp.

- 6.3.3 B. Braun Melsungen AG

- 6.3.4 Nipro Corp.

- 6.3.5 Gerresheimer AG

- 6.3.6 Hindustan Syringes & Medical Devices

- 6.3.7 Cardinal Health Inc.

- 6.3.8 Schott AG

- 6.3.9 West Pharmaceutical Services

- 6.3.10 Stevanato Group

- 6.3.11 Retractable Technologies Inc.

- 6.3.12 Smiths Medical (ICU Medical)

- 6.3.13 Sol-Millennium Medical

- 6.3.14 Baxter International Inc.

- 6.3.15 Owen Mumford Ltd.

- 6.3.16 Catalent Pharma Solutions

- 6.3.17 M.C. Johnson Co.

- 6.3.18 Changzhou Mingle Medical

- 6.3.19 Hi-Tech Syringes

- 6.3.20 West (Daikyo)

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment