|

시장보고서

상품코드

1444845

전투기 시장 : 점유율 분석, 산업 동향 및 통계, 성장 예측(2024-2029년)Fighter Aircraft - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

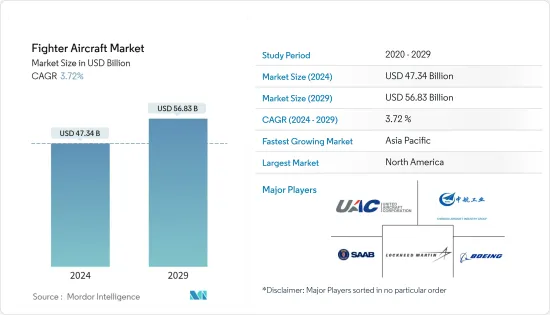

세계의 전투기(Fighter Aircraft) 시장 규모는 2024년 473억 4,000만 달러로 추정되며, 2029년 568억 3,000만 달러에 달할 것으로 예상되며, 예측 기간 중(2024-2029년) CAGR 3.72%로 추이하며 성장 할 것으로 예측됩니다.

주요 하이라이트

- COVID-19 팬데믹은 전투기 시장에 부정적인 영향을 미쳐 납품과 생산에 영향을 미쳤습니다. 바이러스 확산을 줄이기 위한 엄격한 규제로 인해 여러 국가에 대한 전투기 납품이 지연되었습니다. 또한 팬데믹으로 인해 여러 회사에서 해고가 발생하여 생산 공정에 차질을 빚었습니다. 그러나 팬데믹이 감소하면서 제한이 완화되고 전 세계적으로 전투기 생산 및 납품이 증가하면서 시장은 성장세를 보였습니다.

- 국가 간 지정학적 긴장이 고조되면서 기존 전투기를 현대화하고 영공 방어 능력을 강화하기 위해 첨단 전투기를 도입하는 움직임이 활발해졌습니다. 스텔스 및 정밀 무기와 같은 기술의 발전은 각국이 전투 능력을 최신 상태로 유지하기 위해 노력함에 따라 전투기 시장의 발전을 더욱 뒷받침하고 있습니다.

- 그러나 예산 제약은 시장 성장을 저해할 수 있으며, 특히 차세대 전투기에 투자하는 대신 비용 절감을 위해 기존의 노후 전투기를 업그레이드하는 개발도상국의 경우 더욱 그러합니다.

전투기 시장 동향

이착륙 부문에서는 전통적인 이착륙에 예측 기간 동안 상당한 성장이 예상

- 기존의 이착륙 부문은 무기 및 장비의 보다 높은 적재 능력과 보다 넓은 전투 범위를 탑재할 수 있기 때문에 예측 기간 중에 대폭적인 성장이 예상되고 있습니다. 이 성장은 중국의 J-20, Su-37, Mig-35, Su57 및 노후화된 4세대 전투기를 4.5세대, 5세대, 6세대 항공기로 대체하는 인도 TejasMK2와 같은 새로운 전투기 프로그램의 개발에 의해 촉진될 것으로 예상됩니다.

- 또한 각국은 항공기의 능력을 향상시키고 수명을 늘리기 위해 F-16, F-15, F/A-18 등 현대화 프로그램에 임하고 있습니다. 세계 주요 국가들은 군함 노후화에 대한 우려를 해결하기 위해 새로운 전투기 조달을 계획하고 있거나 조달을 시작하고 있습니다.

- 예를 들어, 브라질 공군은 2022년 4월 47억 달러의 계약의 일환으로 2014년에 구입한 36대 이외에 서브 엠브라엘 F-39E 제트기 4대를 주문했습니다. 이 나라는 또한 그리펜 NG 항공기의 현지 지정을 수반하는 적어도 30대의 F-39E 전투기의 다른 배치를 주문하는 것을 고려하고 있습니다.

- 또한 기술의 급속한 진보에 따라 각국은 차세대 수송기의 조달 등에 의해 항공부대 지원 능력을 강화하기 위해 노력하고 있습니다. 그 결과 항공기 제조업체와 계약을 체결하고 있습니다. 예를 들어, 2021년 6월, Airbus는 아시아 태평양의 비공개 국가와 C-295 운송협약을 체결 한 것으로 보도되었습니다. 이러한 개발은 예측 기간 동안 기존 이착륙 항공기의 긍정적인 전망에 기여할 것으로 예상됩니다.

북미는 예측기간 중 상당한 성장이 예상

북미는 예측 기간 동안 상당한 성장이 예상될 것으로 예상됩니다. 미국 군사 지출은 2020년 7,782억 3,000만 달러에서 2021년 거의 2.9% 증가하여 8,010억 달러에 달했습니다. 미국은 2021년에도 여전히 최대의 국방 지출국이며 세계 지출의 38%를 차지하고 있습니다.

또한, 미국 공군은 차세대 제트기 납품과 함께 항공기 노후화 문제에 서서히 노력하고 있습니다. 재고가 감소함에 따라 항공기의 평균 사용 연수는 지난 10년간 증가했습니다. 미국 공군의 함대의 평균 연령은 25년을 넘고 폭격기의 평균 연령은 50세를 넘고 있습니다. 또한 미국 국방부는 전투기 계약을 체결하고 있습니다. 예를 들어, 2022년 7월, 미국 국방부는 Lockheed Martin과 공동으로 3년간 약 375대의 F-35 전투기를 제조할 것을 약속합니다. 또한 국방부에 따르면 이 협정의 대상이 되는 항공기의 최종 수는 미국 의회의 2023 회계연도 예산 변경 및 외국 파트너의 주문에 따라 변경될 수 있습니다.

고정날개 수송기와는 별도로 미국군은 다용도 헬리콥터 부대도 현대화하고 있습니다. 미국 해군은 CMV-22B Osplay를 납품하기 시작했으며 2024년까지 모든 C-2 항공기를 퇴역할 계획입니다. 미국 해군과 해병대는 지난 몇 년동안 오스 플레이를 주문했습니다. 게다가 2022년 6월에는 미국에서 H-60M 블랙호크 헬리콥터 120기의 조달과 2022년부터 2026년도의 관련 지원으로서 스트랫퍼드의 시콜스키 에어크래프트사에 22억 7,000만 달러의 계약이 체결되어 네., 추가 135 기 항공기 옵션이 있습니다.

그러므로 이러한 개발은 예측 기간 동안 전투기 시장을 크게 증가시킬 수 있습니다.

전투기 산업 개요

항공우주 및 방위 산업에는 Lockheed Martin Corporation, The Boeing Company, United Aircraft Corporation, Chengdu Aircraft Industrial (Group) Co. Ltd., Saab AB 등 여러 주요 기업이 있습니다. 그러나 Lockheed Martin은 F-35 전투기의 납품량이 많기 때문에 시장에서 중요한 지위를 차지하고 있습니다. 이 회사의 지속적인 연구개발 노력은 공수부대, 지상부대, 적대적인 해군부대와 교전하여 무력화할 수 있는 뛰어난 능력을 제공하는 고성능 전투기와 기술 개발에 중점을 둔 회사 시장 지배력을 더욱 강화하고 있습니다.

Lockheed Martin의 광범위한 제품 포트폴리오는 여러 가지 변형과 지속적인 제품 개발 사이클을 특징으로 하며 항공 자산의 운영 수명을 연장할 수 있습니다. 이 견고한 R&D 프레임워크는 항공 자산의 높은 성능 신뢰성과 업그레이드 가능성을 요구하는 잠재적인 구매자까지도 매료하고 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 서론

- 조사 전제 조건 및 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진 요인

- 시장 성장 억제 요인

- 산업 매력도-Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자의 협상력

- 공급기업의 협상력

- 대체 제품의 위협

- 경쟁 기업간 경쟁 관계

제5장 시장 세분화

- 이착륙

- 기존 이착륙

- 단거리 이착륙

- 수직 이착륙

- 유형

- 약공격

- 전자전

- 멀티롤 전투기

- 훈련기

- 기타 유형

- 지역

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 러시아

- 기타 유럽

- 아시아 태평양

- 중국

- 인도

- 일본

- 한국

- 기타 아시아 태평양

- 남미

- 브라질

- 기타 남미

- 중동 및 아프리카

- 아랍에미리트(UAE)

- 사우디아라비아

- 이집트

- 기타 중동 및 아프리카

- 북미

제6장 경쟁 구도

- 벤더의 시장 점유율

- 기업 개요

- Lockheed Martin Corporation

- Saab AB

- The Boeing Company

- Airbus SE

- United Aircraft Corporation

- Chengdu Aircraft Industrial(Group) Co. Ltd

- Hindustan Aeronautics Limited

- BAE Systems PLC

- Dassault Aviation SA

- Mitsubishi Heavy Industries

- Aero Vodochody Aerospace AS

- Embraer SA

- Textron Aviation(Textron Systems)

- Korea Aerospace Industries

- Turkish Aerospace Industries

제7장 시장 기회 및 향후 동향

LYJ 24.03.22The Fighter Aircraft Market size is estimated at USD 47.34 billion in 2024, and is expected to reach USD 56.83 billion by 2029, growing at a CAGR of 3.72% during the forecast period (2024-2029).

Key Highlights

- The COVID-19 pandemic negatively impacted the fighter aircraft market, affecting delivery and production. Stringent regulations aimed at reducing the spread of the virus caused delays in the delivery of fighter aircraft to various countries. Furthermore, the pandemic led to layoffs in various companies, hampering the production process. However, with the decline in the pandemic, the market witnessed growth due to the ease in restrictions and increased production and delivery of fighter aircraft worldwide.

- The growing geopolitical tensions between nations have prompted the adoption of advanced fighter aircraft to modernize existing fleets and enhance their aerial defense capabilities. Advancements in technology, such as stealth and precision weapons, are further supporting the development of the fighter aircraft market as nations strive to keep their combat capabilities up-to-date.

- However, budget constraints may hinder market growth, particularly for developing countries that may opt for upgrading existing old fighters to cut costs rather than investing in next-generation fighter jets.

Fighter Aircraft Market Trends

By Take-Off and Landing Segmentation, the Conventional Take-Off and Landing is Expected to Witness Significant Growth During the Forecast Period

- The conventional take-off and landing segment is expected to experience significant growth during the forecast period due to its ability to carry a higher payload capacity for weapons and equipment, as well as its greater battle range. This growth is anticipated to be fueled by the development of new fighter aircraft programs such as China's J-20, Su-37, Mig-35, Su57, and India's TejasMK2, which will replace aging fourth-generation fighter aircraft with 4.5th, 5th, and 6th generation aircraft.

- Additionally, countries are engaging in modernization programs such as the F-16, F-15, and F/A-18 to improve aircraft capabilities and life extension. Some prominent countries across the globe are also planning or have started procuring new fighter aircraft to address concerns about their aging military fleets.

- For example, in April 2022, the Brazilian air force ordered four Saab-Embraer F-39E jets in addition to the 36 purchased in 2014 as part of a USD 4.7 billion contract. The country is also considering ordering another batch of at least 30 F-39E fighters with a local designation of Gripen NG aircraft.

- Furthermore, with the rapid advancement of technology, countries are striving to enhance their aerial troop support capabilities by procuring next-generation transport aircraft. As a result, they are awarding contracts to aircraft manufacturing companies. For instance, in June 2021, Airbus reportedly secured a contract with an undisclosed nation in the Asia-Pacific region for its C-295 transport aircraft. These developments are expected to contribute to a positive outlook for conventional take-off and landing aircraft during the forecast period.

The Region of North America is Expected to Witness Significant Growth During the Forecast Period

The region of North America is expected to witness significant growth during the forecast period. The United States military expenditure increased by almost 2.9% in 2021 to reach USD 801 billion from USD 778.23 billion in 2020. The United States remained the largest defense-spending country in 2021 and represented 38% of global spending.

Moreover, the United States Air Force is gradually addressing its aging aircraft problem, as it takes delivery of newer generation jets. As inventories decreased, the average aircraft age increased over the past decade. The average age of the United States Air Force fleet is over 25 years, and bombers have an average age of over 50 years. Moreover, the United States Department of Defense is awarding contracts for fighter aircraft. For instance, in July 2022, The United States Department of Defense is committed to manufacturing around 375 F-35 fighter jets over a three-year period With Lockheed Martin Corp. Additionally, according to the Pentagon, the final number of aircraft covered by this agreement could change depending on any alterations made by the United States Congress to the budget for the Fiscal Year 2023 and any orders put in by foreign partners.

Apart from the fixed-wing transport aircraft, the United States armed forces are also modernizing its fleet of utility helicopters. The United States Navy plans to retire all its C-2 aircraft by 2024, as it has started taking deliveries of CMV-22B Osprey. Both the United States Navy and Marine Corps have placed orders for Ospreys in the past few years. Moreover, in June 2022, a contract of USD 2.27 billion has been awarded to Sikorsky Aircraft Corp., Stratford, by the United States department of defense for procurement of 120 H-60M Black Hawk helicopters and associated support for the fiscal years 2022-2026, with options for an additional 135 aircraft.

Thus, such developments will lead to the fighter aircraft witnessing significant increase during the forecast period.

Fighter Aircraft Industry Overview

The aerospace and defense industry boasts several leading players, including Lockheed Martin Corporation, The Boeing Company, United Aircraft Corporation, Chengdu Aircraft Industrial (Group) Co. Ltd., and Saab AB. However, Lockheed Martin Corporation holds a prominent position in the market due to its high delivery volumes of F-35 fighter aircraft. Its ongoing research and development efforts further reinforce the company's market dominance focus on creating high-performance fighter aircraft and technologies that provide superior capabilities for engaging and neutralizing airborne, ground, and hostile naval forces.

Lockheed Martin Corporation's extensive product portfolio, featuring several variants, and continuous product development cycles, enable enhanced operating life of aerial assets. This robust research and development framework also attracts potential buyers seeking higher performance reliability and upgrade potential from their aerial assets.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Dynamics

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 Market Segmentation

- 5.1 Take-off and Landing

- 5.1.1 Conventional Take-off and Landing

- 5.1.2 Short Take-off and Landing

- 5.1.3 Vertical Take-off and Landing

- 5.2 Type

- 5.2.1 Light Attack

- 5.2.2 Electronic Warfare

- 5.2.3 Multi-Role Fighter

- 5.2.4 Trainers

- 5.2.5 Other Types

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Russia

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Latin America

- 5.3.4.1 Brazil

- 5.3.4.2 Rest of Latin America

- 5.3.5 Middle East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Egypt

- 5.3.5.4 Rest of Middle East and Africa

- 5.3.1 North America

6 Competitive Landscape

- 6.1 Vendor Market Share

- 6.2 Company Profile

- 6.2.1 Lockheed Martin Corporation

- 6.2.2 Saab AB

- 6.2.3 The Boeing Company

- 6.2.4 Airbus SE

- 6.2.5 United Aircraft Corporation

- 6.2.6 Chengdu Aircraft Industrial (Group) Co. Ltd

- 6.2.7 Hindustan Aeronautics Limited

- 6.2.8 BAE Systems PLC

- 6.2.9 Dassault Aviation SA

- 6.2.10 Mitsubishi Heavy Industries

- 6.2.11 Aero Vodochody Aerospace A.S

- 6.2.12 Embraer SA

- 6.2.13 Textron Aviation (Textron Systems)

- 6.2.14 Korea Aerospace Industries

- 6.2.15 Turkish Aerospace Industries