|

시장보고서

상품코드

1851641

생명과학 분야 AI 시장 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)AI In Life Sciences - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

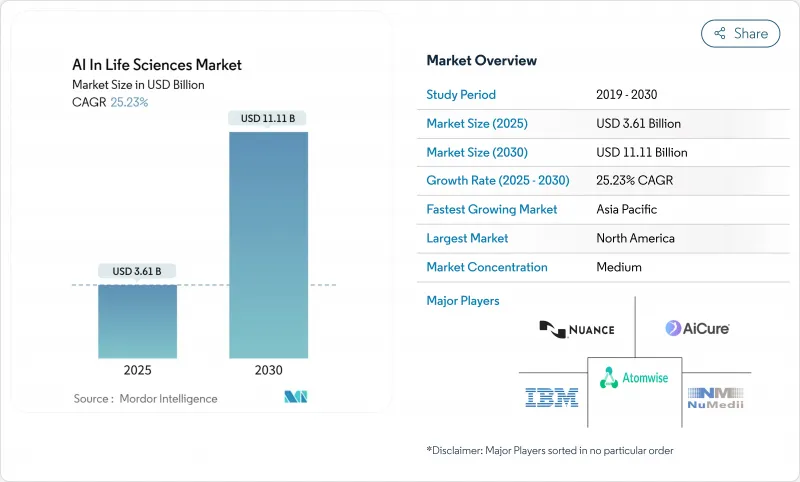

생명과학 분야 AI 시장의 2025년 시장 규모는 36억 1,000만 달러로 추정되고, 2030년에는 111억 1,000만 달러로 확대될 것으로 예측되며, CAGR 25.23%로 성장할 전망입니다.

규제 당국이 AI 유래 바이오마커를 정당한 근거로 간주하게 되었거나, 데이터 네트워크 연계에 의해 과거에는 사일로화되어 있던 임상 데이터 세트를 모델 트레이닝에 이용할 수 있게 되었기 때문에 도입이 가속하고 있습니다. 하이퍼스케일러와 제약회사의 제휴로 분자당 계산 비용이 70% 저하됨에 따라 대규모 시뮬레이션에 대한 액세스가 확대되는 반면, 제너레이터 프로테인 디자인 플랫폼에 대한 벤처 캐피탈로부터의 자금 유입은 2024년 이후 3배로 증가하고 있습니다. 동시에 바이오 의약품 데이터 중 FAIR 기준을 충족하는 것은 불과 6%에 불과하며, 데이터 품질 솔루션의 병행적인 비즈니스 기회가 부각되고 있습니다. 지역별로는 북미가 인재와 인프라에서 우위를 유지하고 있지만, 아시아 정부 프로그램이 가장 빠른 성장 전망으로 이어지고 있습니다.

세계의 생명과학 분야 AI 시장 동향 및 인사이트

FDA의 RTOR를 활용한 AI 바이오마커 승인

미국 FDA의 Real-Time Oncology Review는 AI 바이오마커의 심사주기를 최대 40% 단축하여 종양학 프로그램이 기존 경로보다 훨씬 빨리 시장에 투입되도록 했습니다. 암 영역에서 성공한 전례는 2024년에는 신경퇴행성 질환 및 희소질환의 적응에도 확대되어 AI가 생성하는 엔드포인트에 대한 규제 당국의 신뢰를 보여주었습니다. 유효성이 확인된 바이오마커는 다른 파이프라인에서도 재사용할 수 있으므로 새로운 승인이 나올 때마다 노크 온 가치가 생겨 포트폴리오 전체의 생산성이 가속화됩니다. FDA가 세계적인 벤치마크를 확립함에 따라, 다른 기관들도 이미 유사한 신속화 트럭을 이미 평가하고 있으며, 이 기회는 사실상 세계화되고 있습니다.

EU 건강 데이터 공간, 연합 AI 모델 교육 잠금 해제

2025년 1월부터 유럽 의료 데이터 공간(EHDS)은 생명 과학 개발자에게 27개 회원국에 걸쳐 일관된 임상, 유전체 및 이미지 데이터 세트에 대한 API 기반 액세스를 제공합니다. 중요한 것은 연합 학습 규칙을 사용하면 물리적 데이터 전송 없이 모델을 교육할 수 있어 개인 정보를 보호할 뿐만 아니라 단편화라는 역사적인 장벽이 없어진다는 것입니다. 예측은 중복 감소 및 신속한 증거 작성을 통해 10년 동안 110억 유로의 효율 감소를 예상하고 있습니다. 초기 도입 공급업체는 알고리즘이 현장에서 학습하고 중앙 집중식으로 업데이트할 수 있도록 파이프라인을 재구성합니다. 이것은 유럽의 까다로운 개인정보 보호 자세를 준수 공급업체의 경쟁적 차별화 요인으로 바꾸는 접근 방식입니다.

임상 AI 시스템의 CE 마크 취득 시기를 지연시키는 EU의 AI법

2024년 8월부터 시행된 EU AI법은 대부분의 임상 알고리즘을 '고위험'으로 분류하고 CE 마크 취득 프로세스에 추가적인 적합성 평가 심사를 추가합니다. 벤처기업인 경우가 많은 중소의 이노베이터는 사내에 약사팀을 가지지 않기 때문에 가장 큰 타격을 받고 있어, 화상 진단이나 의사 결정 지원 툴의 발매가 6-12개월 늦을 것으로 추산되고 있습니다. 선도적인 제조업체는 비용을 흡수할 수 있지만 병목 현상은 유럽 AI 장비의 퍼널을 일시적으로 줄이고 알고리즘을 개선하는 데 필요한 다운스트림 데이터 생성을 지연시킵니다.

부문 분석

소프트웨어 컴포넌트는 2024년 수익 기반의 55%를 창출했으며, 코드 라이브러리 및 알고리즘 제품군이 생명과학 분야 AI 시장의 주요 가치 촉진요인임을 입증했습니다. 주요 플랫폼은 오믹스 데이터를 분석하고, 후보 분자를 제안하고, 임상시험의 실행 가능성을 예측하며, 의약품 파이프라인에 직접 통합합니다. 공급업체는 감사자를 위해 모델 계통을 문서화하는 설명 가능성 모듈을 통해 점차 차별화를 추진하고 있습니다. 서비스 부문은 슬라이스가 작은 것으로, 2025-2030년 CAGR 23%로 확대될 전망입니다. 소프트웨어 라이선스에 검증 프로토콜 및 시판 후 성능 모니터링을 번들로 제공하는 관리형 서비스 계약은 스폰서에서 공급업체로 컴플라이언스 오버헤드를 이전하기 위해 지지를 받고 있습니다.

하드웨어는 판매 점유율이 작고 전략적으로 중요합니다. 확률 미분 방정식 솔버와 높은 처리량 도킹을 위해 설계된 전용 가속기 보드는 현재 GPU 공급 제약을 지원합니다. 기업은 기밀성이 높은 데이터에는 온프레미스 클러스터를, 대규모 스크리닝 작업에는 버스트 투 클라우드 용량이라는 혼합 인프라 전략을 채택하여 공급 변동에 대한 헤지와 데이터 거주 규칙을 철저히 도모하고 있습니다. 하드웨어 부문와 관련된 생명과학 분야 AI 시장 규모는 신규 진입 반도체가 도메인 특화된 아키텍처를 출시함에 따라 10%대 중반의 성장률로 확대될 것으로 예측됩니다.

2024년에는 클라우드 도입이 지출의 51%를 차지했는데, 이는 탄력적인 컴퓨팅과 분산 협업이 초기 보안 문제를 능가한다는 부문의 인식을 반영합니다. 하이퍼스케일러는 현재 21 CFR Part 11 및 GDPR(EU 개인정보보호규정)의 검증 사이클을 단축하고 사전 구성된 감사 로그가 있는 상태 데이터 준수 환경을 제공합니다. 멀티 테넌트 샌드박스를 통해 학술 컨소시엄 및 생명공학 기업은 비식별 코호트를 공유하고 외부 혁신을 가속화할 수 있습니다. 그러나 하이브리드 아키텍처가 기본이 되고 있습니다. 조직은 초고감도의 유전체 아카이브를 온프레미스로 유지하면서 협력적인 분석 워크로드를 클라우드에서 실행함으로써 주권을 희생하지 않고 이용률을 향상시키고 있습니다. 온프레미스 솔루션은 소블린 클라우드 규제와 대기 시간이 중요한 이용 사례에 의해 뒷받침되며 기간 동안 17%의 연평균 복합 성장률(CAGR)을 달성할 것으로 예측됩니다.

조사 대상 기업의 81%는 단일 환경 내에서 EHR, 이미지 및 오믹스 데이터를 조정하는 어려움을 꼽았습니다. 따라서 플랫폼 공급업체는 추출 변환 로드 유틸리티와 온톨로지 매퍼를 통합합니다. 이러한 움직임은 소프트웨어 라이선스 구독 수수료를 보완하는 서비스 중심의 수익 스트림을 지원하며 생명과학 분야 AI 시장의 장기 갱신률을 지원합니다.

생명과학 분야 AI 시장 보고서는 제품별(소프트웨어, 하드웨어, 기타), 전개 모드별(클라우드 및 온프레미스), 분석 유형별(기술형, 예측형, 기타), 용도별(창약, 임상시험 최적화, 기타), 최종 사용자별(의료기기 제조업체, 의료 제공자, 지불자, 기타), 기술별(머신러닝, 컴퓨터 비전, 기타), 지역별

지역 분석

북미는 2024년 세계 매출의 49%를 차지했으며, 벤처 캐피탈의 기반이 두껍고 디지털 진단에 유리한 상환 코드, 규제 당국의 조기 관여에 지지되고 있습니다. 미국의 생명과학 분야 AI 시장 규모는 FDA의 RTOR 프로그램에 의해 밀어 올랐습니다. 여러 주에 걸친 의료 정보 교환은 보다 풍부한 교육 세트를 가능하게 하지만, 주간 프라이버시 규칙은 데이터 이식성을 여전히 복잡하게 합니다. 클라우드 서비스의 도입이 다른 지역을 능가하는 이유는 HIPAA를 준수하는 설계도가 컴플라이언스 감사를 단축하고 중견 생명 공학 기업이 내부에 클러스터를 구축하지 않고 하이퍼스케일 컴퓨터를 활용할 수 있기 때문입니다.

유럽은 여전히 2위의 지역이며 EHDS의 연계 네트워크가 규모를 확대하면 더욱 가속할 전망입니다. 학술의료센터와 제약 스폰서를 잇는 업계 컨소시엄은 프라이버시를 보호하는 국경을 넘은 트레이닝을 시험적으로 실시하고 있으며, 자국의 규제 당국에 익숙한 유럽의 벤더가 획득하는 생명과학 분야 AI 시장 점유율이 확대될 가능성이 높습니다. 이러한 기세와 상반되는 바와 같이, AI법의 고위험 분류는 제품 사이클을 길게 하는 여분의 문서 계층을 도입합니다. 기업은 규제 체크포인트를 애자일 스프린트에 통합하여 대응하고 있습니다. 이것은 초기 반복 작업을 늘리는 반면, 후기 수정 비용을 줄이는 기술입니다.

아시아는 2025-2030년 CAGR 22%로 가장 높은 성장 궤도를 보일 전망입니다. 중국은 AI를 활용한 창약 메가 프로젝트에 자금을 제공하기 위해 협력적인 산업 정책을 활용하고 있습니다. 지방 바이오 파크는 세금 혜택과 국가 수준의 슈퍼 컴퓨팅에 대한 액세스를 제공합니다. 일본과 한국은 로봇공학 및 오토메이션에 특화되어 있지만, AI가 생성한 분자에 대한 지적재산의 모호함이 남아 있기 때문에 라이선싱의 리스크 프리미엄이 발생하고 있습니다. 인도의 위탁 연구 생태계는 방대한 영어 의료 기록을 활용하고 이 나라를 알고리즘 훈련 및 검증의 아웃소싱 거점으로 자리잡고 있습니다. 국가별 규칙이 다르기 때문에 시장 개척은 국가별로 이루어져야 하지만, 지역화된 클라우드 지역이나 소블린 AI 이니셔티브를 활용함으로써 이전에는 세계 기업이 액세스할 수 없었던 새로운 데이터 세트를 이용할 수 있게 되므로 전체적으로는 매력적인 기회가 됩니다.

남미와 중동, 아프리카는 현재는 작지만 중요한 프론티어 부문을 구성하고 있습니다. 브라질의 국가 유전체 프로그램과 사우디아라비아의 유전체 프로젝트는 트레이닝 입력의 다양성을 요구하는 AI 개발자를 끌어들이는 집단 고유의 데이터 세트를 창출하고 있습니다. 각국 정부는 다국적 기업과의 파트너십을 유치하기 위해 혁신 보조금을 할당하고 있으며, 이러한 추세는 인프라와 기술의 성숙에 따라 향후 10년간 양 지역 시장 점유율을 합계로 높일 수 있습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건 및 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- FDA의 RTOR 대응 AI 바이오마커 승인 증가(미국)

- EU의 건강 데이터 공간이 통합 AI 모델 트레이닝 잠금 해제

- GenAI 단백질 설계 플랫폼에의 VC 급증(2024년 이후 3배)

- 14개국에서 AI의 환자층별화를 추진하는 분산형 임상시험 의무화

- 시장 성장 억제요인

- 임상 AI 시스템의 CE 마크 취득 시기를 늦추는 EU의 AI법

- 바이오 의약품 데이터 FAIR 준거 제한 모델 정밀도는 6%에 불과

- 밸류체인 분석

- 규제 및 기술의 전망

- 규제 상황(미국, EU, 중국, 일본, MEA)

- 기술 스냅샷(GenAI, 기반 모델, 엣지 AI)

- Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업 간 경쟁 관계

- 가격 분석(베이스라인의 경우)

- COVID-19의 업계에 대한 영향

- 투자 분석

제5장 시장 규모 및 성장 예측

- 제공별

- 소프트웨어

- 서비스

- 하드웨어

- 전개 모델별

- 클라우드 및 온디맨드

- 온프레미스

- 분석 유형별

- 기술적

- 예측

- 처방적

- 생성형 AI

- 용도별

- 창약

- 의료 진단 및 이미징

- 임상시험 최적화

- 생명공학 및 바이오프로세스

- 정밀의료 및 맞춤형 의료

- 환자 모니터링 및 실세계에서의 근거

- 최종 사용자별

- 제약 및 바이오테크놀러지 기업

- CRO(의약품 개발 업무 수탁 기관)

- 의료기기 제조업체

- 학술연구기관

- 의료 제공자 및 지불자

- 기술별

- 머신러닝

- 자연언어처리

- 컴퓨터 비전

- 딥러닝 및 신경망

- AI 생성 모델

- 지역별

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 북유럽 국가

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 기타 아시아태평양

- 남미

- 브라질

- 기타 남미

- 중동 및 아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

- 남아프리카

- 기타 중동 및 아프리카

- 북미

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율 분석

- 기업 프로파일

- IBM Corporation

- IQVIA

- Oracle Corporation

- Atomwise Inc.

- Insilico Medicine Inc.

- NuMedii Inc.

- AiCure LLC

- Nuance Communications Inc.

- Insitro

- SOPHiA GENETICS SA

- Enlitic Inc.

- Valo Health

- Generate Biomedicines

- Recursion Pharmaceuticals

- Exscientia plc

- Owkin

- BenevolentAI

- Deep Genomics

- Generate Biomedicines

- CluePoints

제7장 시장 기회 및 향후 전망

AJY 25.11.24The AI in life sciences market is valued at USD 3.61 billion in 2025 and is forecast to expand to USD 11.11 billion by 2030, registering a 25.23% CAGR.

Adoption is accelerating because regulators now regard AI-derived biomarkers as legitimate evidence, and because federated data networks are making once-siloed clinical datasets available for model training. A 70% drop in compute cost per molecule achieved through hyperscaler-pharma alliances is widening access to large-scale simulation, while venture capital inflows into generative protein-design platforms have tripled since 2024. At the same time, only 6% of biopharma data meet FAIR standards, highlighting a parallel opportunity for data-quality solutions. Regionally, North America maintains scale advantages in talent and infrastructure, but Asian government programs are translating into the fastest growth outlook.

Global AI In Life Sciences Market Trends and Insights

FDA RTOR-Enabled AI Biomarker Approvals

The US FDA's Real-Time Oncology Review has shortened review cycles for AI-enabled biomarkers by up to 40%, allowing oncology programmes to reach market far sooner than under legacy pathways. Successful precedent in oncology broadened to neuro-degenerative and rare-disease indications in 2024, signalling regulator confidence in AI-generated endpoints. Each new approval creates knock-on value because the validated biomarker can be reused across separate pipelines, accelerating overall portfolio productivity. With the FDA establishing the global benchmark, other agencies are already evaluating similar expedited tracks, effectively globalising the opportunity.

EU Health Data Space Unlocking Federated AI Model Training

Effective January 2025, the European Health Data Space (EHDS) is giving life-sciences developers API-based access to harmonised clinical, genomic and imaging datasets across 27 member states. Crucially, federated-learning rules permit model training without physical data transfer, preserving privacy but eliminating a historic barrier of fragmentation. Forecasts point to EUR 11 billion in ten-year efficiency savings via reduced duplication and faster evidence generation. Early adopters are re-architecting pipelines so that algorithms can learn on-site and update centrally-an approach that turns Europe's stringent privacy stance into a competitive differentiator for compliant vendors.

EU AI Act Delaying CE-Mark Timelines for Clinical AI Systems

Classifying most clinical algorithms as "high-risk," the EU AI Act, in force since August 2024, layers additional conformity-assessment audits onto the CE-mark process. Smaller innovators, often venture-backed, are hardest hit because they lack in-house regulatory teams, leading to launch delays estimated at 6-12 months for imaging and decision-support tools. Although large manufacturers can absorb the cost, the bottleneck is temporarily reducing the funnel of European AI devices, which in turn slows downstream data generation needed for algorithm refinement.

Other drivers and restraints analyzed in the detailed report include:

- China's 17th Five-Year Bio-AI Plan Fueling above 200 Pilot Programs

- Hyperscaler Partnerships Cutting Compute Cost per Molecule by 70%

- Only 6% of Biopharma Data Are FAIR-Compliant

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The software component generated 55% of the 2024 revenue base, establishing code libraries and algorithm suites as the primary value driver within the AI in life sciences market. Leading platforms analyse omics data, suggest candidate molecules and predict trial enrolment feasibility, embedding directly into pharmaceutical pipelines. Vendors increasingly differentiate through explainability modules that document model lineage for auditors. Services, though representing a smaller slice, are expanding at a 23% CAGR across 2025-2030 as clients seek integration specialists who can align AI outputs with regulated workflows. Managed-service contracts that bundle software licences with validation protocols and post-market performance monitoring are gaining traction because they transfer compliance overhead from sponsors to vendors.

Hardware, while modest in revenue share, is strategically important. Specialised accelerator boards designed for stochastic differential-equation solvers and high-throughput docking address current GPU supply constraints. Enterprises are adopting mixed infrastructure strategies-on-premise clusters for sensitive data and burst-to-cloud capacity for large screening jobs-to hedge against supply volatility and enforce data-residency rules. The AI in life sciences market size attached to hardware segments is forecast to grow at a mid-teens rate as new semiconductor entrants release domain-specific architectures.

Cloud deployments captured 51% of spending in 2024, reflecting the sector's recognition that elastic computing and distributed collaboration outweigh initial security concerns. Hyperscalers now offer health-data-compliant environments with pre-configured audit logs, reducing validation cycles for 21 CFR Part 11 and GDPR. Multi-tenant sandboxing allows academic consortia and biotechs to share de-identified cohorts, accelerating external innovation. Hybrid architectures, however, are becoming the default. Organisations retain ultra-sensitive genomic archives on-premise but run federated analytic workloads in the cloud, improving utilisation rates without sacrificing sovereignty. On-premise solutions, boosted by sovereign-cloud regulations and latency-critical use cases, are projected to deliver a 17% CAGR through the period.

Persistent data silos remain a barrier: 81% of surveyed firms cite difficulty reconciling EHR, imaging and omics data within a single environment. Consequently, platform vendors are packaging built-in extract-transform-load utilities and ontology mappers. This dynamic supports service-led revenue streams that complement subscription fees from software licences, anchoring long-run renewal rates within the AI in life sciences market.

The AI Life Sciences Market Report is Segmented by Offering (Software. Hardware, and More), Deployment Model (Cloud /And On-Premise), Analytics Type (Descriptive, Predictive, and More), Application (Drug Discovery, Clinical Trials Optimisation, and More), End User (Medical Device Manufacturers, Healthcare Providers and Payers, and More), Technology (Machine Learning, Computer Vision, and More), and Geography.

Geography Analysis

North America commanded 49% of 2024 global revenue, anchored by a deep venture capital base, favourable reimbursement codes for digital diagnostics and early regulator engagement. The AI in life sciences market size in the US alone is boosted by the FDA's RTOR programme, which validates AI-enabled biomarkers that become reusable across multiple development programmes. Multistate health-information exchanges enable richer training sets, although interstate privacy rules still complicate data portability. Cloud-service adoption outpaces other regions because HIPAA-aligned blueprints shorten compliance audits, letting mid-tier biotechs leverage hyperscale compute without building in-house clusters.

Europe remains the second-largest region, poised to accelerate once the EHDS federated networks scale. Industry consortia linking academic medical centres with pharmaceutical sponsors are piloting privacy-preserving cross-border training, likely to increase the AI in life sciences market share captured by European vendors as they leverage home-market regulatory familiarity. Counterbalancing this momentum, the AI Act's high-risk classification introduces extra documentation layers that can elongate product cycles. Companies are responding by integrating regulatory checkpoints into agile sprints, a practice that, while lengthening early iterations, reduces late-stage remediation costs.

Asia shows the highest growth trajectory at a 22% CAGR between 2025-2030. China exploits coordinated industrial policy to fund AI-enabled drug-discovery megaprojects; provincial biotech parks provide tax holidays and access to national-level supercomputing. Japan and South Korea specialise in robotics and automation, yet lingering IP ambiguity for AI-generated molecules creates a licensing risk premium. India's contract-research ecosystem leverages large English-language medical records, positioning the country as an outsourcing hub for algorithm training and validation. Divergent national rules dictate a country-by-country go-to-market, but the aggregate opportunity is compelling, with localised cloud regions and sovereign-AI initiatives unlocking new datasets previously inaccessible to global players.

South America and the Middle East and Africa are smaller today but constitute important frontier segments. Brazil's national genomics programmes and Saudi Arabia's genome project are generating population-specific datasets that draw AI developers seeking diversity in training inputs. Governments are allocating innovation grants to attract multinational partnerships, a trend that could raise the regions' combined market share over the next decade as infrastructure and skills mature.

- IBM Corporation

- IQVIA

- Oracle Corporation

- Atomwise Inc.

- Insilico Medicine Inc.

- NuMedii Inc.

- AiCure LLC

- Nuance Communications Inc.

- Insitro

- SOPHiA GENETICS SA

- Enlitic Inc.

- Valo Health

- Generate Biomedicines

- Recursion Pharmaceuticals

- Exscientia plc

- Owkin

- BenevolentAI

- Deep Genomics

- Generate Biomedicines

- CluePoints

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing FDA RTOR-enabled AI Biomarker Approvals (US)

- 4.2.2 EU Health Data Space Unlocking Federated AI Model Training

- 4.2.3 VC Surge for GenAI Protein Design Platforms (3 x since 2024)

- 4.2.4 Decentralised-Trial Mandates Driving AI Patient Stratification in 14 Countries

- 4.3 Market Restraints

- 4.3.1 EU AI Act Delaying CE-Mark Timelines for Clinical AI Systems

- 4.3.2 Only 6 % of Biopharma Data FAIR-Compliant Limiting Model Accuracy

- 4.4 Value Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.5.1 Regulatory Landscape (US, EU, China, Japan, MEA)

- 4.5.2 Technology Snapshot (GenAI, Foundation Models, Edge AI)

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

- 4.7 Pricing Analysis (If in baseline)

- 4.8 Impact of COVID-19 on the Industry

- 4.9 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Offering

- 5.1.1 Software

- 5.1.2 Services

- 5.1.3 Hardware

- 5.2 By Deployment Model

- 5.2.1 Cloud / On-Demand

- 5.2.2 On-Premise

- 5.3 By Analytics Type

- 5.3.1 Descriptive

- 5.3.2 Predictive

- 5.3.3 Prescriptive

- 5.3.4 Generative AI

- 5.4 By Application

- 5.4.1 Drug Discovery

- 5.4.2 Medical Diagnosis and Imaging

- 5.4.3 Clinical Trials Optimisation

- 5.4.4 Biotechnology and Bioprocessing

- 5.4.5 Precision and Personalised Medicine

- 5.4.6 Patient Monitoring and Real-World Evidence

- 5.5 By End User

- 5.5.1 Pharmaceutical and Biotechnology Companies

- 5.5.2 Contract Research Organisations (CROs)

- 5.5.3 Medical Device Manufacturers

- 5.5.4 Academic and Research Institutes

- 5.5.5 Healthcare Providers and Payers

- 5.6 By Technology

- 5.6.1 Machine Learning

- 5.6.2 Natural Language Processing

- 5.6.3 Computer Vision

- 5.6.4 Deep Learning and Neural Networks

- 5.6.5 Generative AI Models

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.2 Europe

- 5.7.2.1 Germany

- 5.7.2.2 United Kingdom

- 5.7.2.3 France

- 5.7.2.4 Nordics

- 5.7.2.5 Rest of Europe

- 5.7.3 Asia Pacific

- 5.7.3.1 China

- 5.7.3.2 Japan

- 5.7.3.3 India

- 5.7.3.4 South Korea

- 5.7.3.5 Rest of Asia Pacific

- 5.7.4 South America

- 5.7.4.1 Brazil

- 5.7.4.2 Rest of South America

- 5.7.5 Middle East and Africa

- 5.7.5.1 Saudi Arabia

- 5.7.5.2 United Arab Emirates

- 5.7.5.3 South Africa

- 5.7.5.4 Rest of Middle East and Africa

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 IBM Corporation

- 6.4.2 IQVIA

- 6.4.3 Oracle Corporation

- 6.4.4 Atomwise Inc.

- 6.4.5 Insilico Medicine Inc.

- 6.4.6 NuMedii Inc.

- 6.4.7 AiCure LLC

- 6.4.8 Nuance Communications Inc.

- 6.4.9 Insitro

- 6.4.10 SOPHiA GENETICS SA

- 6.4.11 Enlitic Inc.

- 6.4.12 Valo Health

- 6.4.13 Generate Biomedicines

- 6.4.14 Recursion Pharmaceuticals

- 6.4.15 Exscientia plc

- 6.4.16 Owkin

- 6.4.17 BenevolentAI

- 6.4.18 Deep Genomics

- 6.4.19 Generate Biomedicines

- 6.4.20 CluePoints

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment