|

시장보고서

상품코드

1851648

자연어 처리(NLP) 시장 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Natural Language Processing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

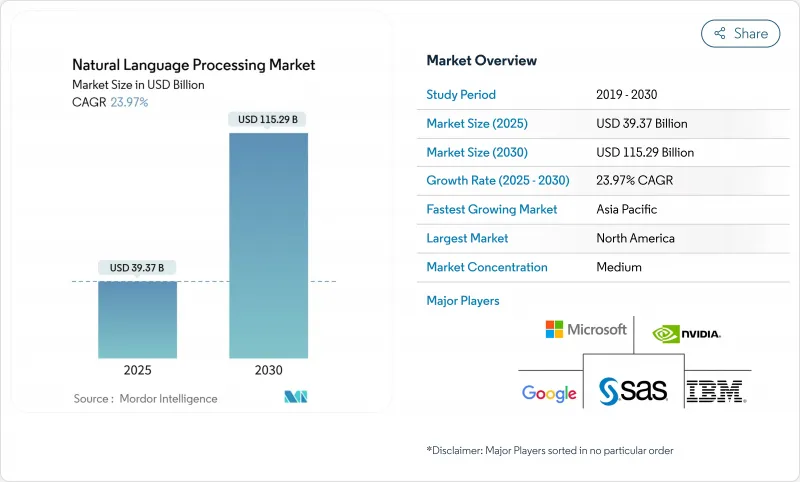

자연어 처리(NLP) 시장 규모는 2025년에 393억 7,000만 달러로 추정되고, 예측 기간(2025-2030년) CAGR 23.97%로 성장할 전망이며, 2030년에는 1,152억 9,000만 달러에 달할 것으로 예측됩니다.

생성형 AI의 정확성 향상과 대화형 배치에 대한 기업의 지속적인 지출로 수요는 견조하게 추진하고 있으며, 기술 대기업은 2025년 AI 투자에 3,000억 달러를 투자하여 장기적인 자본 가용성을 강화하고 있습니다. 클라우드 도입은 NLP 시장의 63.40%를 차지하고 조직이 확장 가능한 추론 인프라를 선호하기 때문에 이 부문은 2030년까지 24.95%의 연평균 복합 성장률(CAGR)을 보일 것으로 예측됩니다. 대기업에 의한 도입이 전체의 57.80%를 차지는데, 중소기업에 의한 도입은 연률 25.01% 상승할 것으로 예측되고 있으며, 액세스 가능한 클라우드 API가 도입 장벽을 낮추고 있음을 나타냅니다. 소프트웨어가 46.00%의 점유율에서 가장 큰 구성요소임에 변함이 없지만, CAGR 26.08%로 확대되는 구현 서비스는 전문가의 모델 통합에 대한 수요 증가를 반영하고 있습니다. 북미는 세계 매출의 33.30%를 차지하고 있고, 아시아태평양이 CAGR 25.85%에서 가장 급성장하고 있으며, 이는 현지 언어 모델에 대한 대처 및 공적 자금의 지원에 의한 것입니다.

세계의 자연어 처리(NLP) 시장 동향 및 인사이트

생성형 AI로 모델 정확도 향상

새로운 대규모 언어 모델은 복잡한 작업에서 훨씬 낮은 오류율을 유지할 수 있어 기업은 더 많은 워크로드를 프로덕션으로 전환하고 있습니다. Anthropic의 Claude 가족은 그 약속을 이야기하고 있습니다. 코드 생성 도입이 기업 내에서 확대됨에 따라 연간 환산 매출은 2024년 12월 10억 달러에서 2025년 5월 30억 달러로 증가했습니다. 헬스케어에서는 CHECK 프레임워크가 임상 언어 모델의 환각을 31%에서 0.3%로 삭감해 위험이 높은 환경에서의 컴플라이언스 대응의 자동화에 대한 길을 열었습니다. 금융 기관에서는 Baichuan4-Finance와 같은 분야별로 조정된 옵션을 선호합니다. Baichuan4-Finance는 광범위한 추론 능력을 유지하면서 인증 시험에서 일반적인 모델을 능가합니다. 정확도는 규제 당국의 승인과 ROI를 모두 촉진하기 때문에 기업은 미세 조정 및 평가 파이프라인에 예산을 할당하고 있습니다.

고객 지원에서 대화형 AI 도입 급증

자동화된 에이전트가 프론트 라인 쿼리의 대부분을 해결하고, 대폭적인 절력화를 실현하고 있습니다. Intercom은 지원 스택에 Claude AI를 통합한 후 45개 언어로 86%의 완전한 해결책을 보고합니다. 아시아태평양의 대화형 AI 시장은 2032년까지 24.1%의 연평균 복합 성장률(CAGR)로 확대되어, 다국어 고객 기반에 대응하는 알리바바와 HDFC 은행에서의 전개가 뒷받침되고 있습니다. Teneo.ai는 95%의 자연어 이해 정확도를 유지하면서 자동화된 통화당 5.60달러의 비용 절감을 기록합니다. 번역 품질이 향상됨에 따라 기업은 사일로화된 언어 팀을 운영하는 대신 지역 전체에서 단일 봇을 전개하여 보다 신속한 전개를 위한 비즈니스 사례를 강화하고 있습니다.

고품질의 편향없는 교육 데이터 부족

제한된 도메인별 데이터 세트로 인해 전문적인 용도로 성능이 저하됩니다. 베트남은 ViGPT를 출시하여 현지 언어 격차를 해결했습니다. EU의 인공지능법은 또한 고위험 시스템의 바이어스 모니터링을 의무화하고 있으며 컴플라이언스 업무의 부하를 증가시키고 있습니다. 의료 및 금융은 프라이버시 규정에 따라 사용 가능한 데이터 풀이 제한되고 독점 데이터 세트를 가진 기업이 유리하게 되므로 가장 까다로운 상황에 처해 있습니다.

부문 분석

2024년 NLP 시장 점유율은 클라우드가 63.40%를 차지하였고, 2030년까지 연평균 복합 성장률(CAGR) 24.95%로 성장이 예측됩니다. 기업이 온프레미스 하드웨어에 투자하지 않고 생성형 워크로드를 시도하는 동안 클라우드 기반의 가격 및 탄력적인 컴퓨팅을 통해 선도하고 있습니다. Microsoft의 Azure AI 서비스는 전년 대비 157% 증가한 연간 매출액 130억 달러를 돌파했습니다. 하이브리드 모델은 로컬 클러스터와 퍼블릭 클라우드 간에 추론을 분할하고 데이터 잔여 규칙이 지속되는 규제 산업에 기여합니다. Edge 배포는 지연에 영향을 받기 쉬운 작업을 위해 클라우드를 보완해 컴퓨트 총량이 연간 25% 증가한 스마트폰을 활용하고 있습니다. 이러한 조합은 NLP 시장이 단일 지배적인 모드가 아니라 워크로드에 특화된 배치를 중심으로 조직화된다는 것을 시사합니다.

대기업은 2024년 NLP 시장 점유율의 57.80%를 차지했으며, 데이터 자산과 사내 AI 직원이 지원합니다. 그러나 중소기업은 턴키 API를 통해 고급 모델에 액세스할 수 있게 되기 때문에, 2030년까지 CAGR 25.01%로 성장이 전망되며, 중소기업을 상회할 것으로 예상되고 있습니다. 설문 조사에 따르면 중소기업은 고급 분석으로 확장하기 전에 먼저 고객 지원 및 문서 처리에 중점을 둡니다. API 기반 종량 과금은 선행 투자가 필요 없기 때문에 중소기업은 ROI를 신속하게 증명할 수 있습니다. 반대로 대기업은 커스텀 미세 조정에 리소스를 부어 컴플라이언스 및 보안을 수용하기 위해 내부에 LLM 센터를 설치했습니다. 이 괴리로 인해 NLP 업계는 중소기업의 양적 성장과 대기업의 고가치 맞춤형 프로젝트 간의 균형을 유지하게 됩니다.

자연어 처리(NLP) 시장 보고서는 전개 모드별(온프레미스, 클라우드), 조직 규모별(대기업, 중소기업), 컴포넌트별(하드웨어, 소프트웨어, 서비스), 처리 유형별(텍스트, 음성/보이스, 이미지 및 비전), 최종 사용자 산업별(은행, 금융서비스 및 보험(BFSI), 헬스케어 및 생명과학, IT 및 텔레콤, 소매 및 전자상거래, 제조, 기타), 지역별로 구분되어 있습니다.

지역 분석

북미는 2024년 33.30%의 매출을 기록했으며, 여전히 가장 규모가 큰 지역 공헌자입니다. Microsoft의 클라우드 수익은 2025년 3분기에 전년 동기 대비 20% 증가한 424억 달러에 이르렀으며 AI 서비스가 주요 견인 역할을 했습니다. 벤처기업의 자금조달 및 규제 환경의 정비가 결합되어 기업에 대한 도입이 가속화되고 있습니다.

아시아태평양의 CAGR은 25.85%로 성장할 것으로 예측되며, 이는 정부에 의한 AI 프로그램과 현지어 모델의 개발이 뒷받침하고 있습니다. 동남아의 LLM 능력을 지원하는 일본의 헌신은 외국 제공업체에 대한 의존을 줄이기 위한 노력을 보여줍니다. 지역의 대화형 AI 수익은 2032년까지 연평균 복합 성장률(CAGR) 24.1%로 추이할 전망이며, 다국어 고객 참여 도구에 대한 수요가 지속되고 있음을 나타냅니다.

유럽에서는 EU AI법이 시행되어 기술 혁신 및 엄격한 컴플라이언스의 양립이 진행됩니다. 독일의 AI 시장은 2025년 1분기에 전년 동기 대비 25% 증가한 100억 유로에 달할 것으로 추정되고, 지멘스 등의 기업이 문서 워크플로우의 90% 자동화를 달성했습니다. 이 규제의 상세한 위험 계층은 프로세스를 문서화할 수 있는 공급업체에게 유리하며 신중하면서도 꾸준한 성장을 지원합니다. 남미와 MEA는 아직 발전도상이지만 퍼블릭 클라우드의 보급과 스마트 디바이스 도입이 진행되어 NLP 시장의 미개척 가능성을 예감시킵니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건 및 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 생성형 AI에 의한 모델 정밀도의 향상

- 고객지원에 있어서 대화형 AI 도입의 급증

- 임베디드 및 에지 디바이스에서 NLP 통합

- 규제 산업용 도메인 특화형 LLM의 보급

- 자동차 및 스마트 디바이스에서 실시간 음성 인식 수요 증가

- 멀티모달 기반 모델이 새로운 수직 시장 개척

- 시장 성장 억제요인

- 고품질 바이어스가 없는 트레이닝 데이터의 부족

- 대규모 모델의 추론 비용의 증대

- 크로스보더 데이터 레지던시의 컴플라이언스 장벽

- 대규모 트레이닝 및 컴퓨팅 환경 실적

- 밸류체인 및 공급망 분석

- 규제 상황

- 기술의 전망

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업 간 경쟁 관계

- COVID-19 및 매크로 감속의 영향

- 투자 분석

제5장 시장 규모 및 성장 예측

- 전개 모드별

- 온프렐미스

- 클라우드

- 조직 규모별

- 대기업

- 중소기업

- 컴포넌트별

- 하드웨어

- 소프트웨어

- 서비스

- 가공 유형별

- 텍스트

- 음성 및 보이스

- 이미지 및 비전

- 최종 사용자 업계별

- BFSI

- 헬스케어 및 생명과학

- IT 및 통신

- 소매 및 전자상거래

- 제조업

- 미디어 및 엔터테인먼트

- 교육

- 기타

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 기타 아시아태평양

- 중동 및 아프리카

- 중동

- 사우디아라비아

- 아랍에미리트(UAE)

- 튀르키예

- 기타 중동

- 아프리카

- 남아프리카

- 나이지리아

- 기타 아프리카

- 북미

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율 분석

- 기업 프로파일

- Microsoft Corp.

- Google LLC(Alphabet)

- Amazon Web Services

- IBM Corp.

- NVIDIA Corp.

- OpenAI LP

- Meta Platforms Inc.

- SAP SE

- Oracle Corp.

- Baidu Inc.

- Intel Corp.

- Qualcomm Inc.

- SAS Institute Inc.

- Adobe Inc.

- Salesforce Inc.

- Apple Inc.

- Verint Systems Inc.

- Nuance Communications(Microsoft)

- Cohere Inc.

- Hugging Face

- Grammarly Inc.

제7장 시장 기회 및 향후 전망

AJY 25.11.24The Natural Language Processing Market size is estimated at USD 39.37 billion in 2025, and is expected to reach USD 115.29 billion by 2030, at a CAGR of 23.97% during the forecast period (2025-2030).

Continued enterprise spending on generative AI accuracy gains and conversational deployments keeps demand strong, with technology majors committing USD 300 billion to AI investments in 2025, reinforcing long-term capital availability. Cloud deployment holds 63.40% of the NLP market, and the segment is expected to post a 24.95% CAGR to 2030 as organizations favor scalable inference infrastructure. Large enterprises account for 57.80% of overall adoption, yet SME uptake is projected to climb 25.01% annually, signaling that accessible cloud APIs are lowering adoption barriers. Software remains the largest component at 46.00% share, while implementation services, expanding at 26.08% CAGR, reflect growing demand for expert model integration. North America contributes 33.30% of global revenues, though Asia Pacific is the fastest-growing region at 25.85% CAGR, thanks to local language model initiatives and supportive public funding.

Global Natural Language Processing Market Trends and Insights

Generative-AI-powered model accuracy gains

Enterprises are moving more workloads into production because newer large language models can now sustain far lower error rates in complex tasks. Anthropic's Claude family illustrates the jump: annualized revenue rose from USD 1 billion in December 2024 to USD 3 billion by May 2025 as code-generation deployments scaled inside corporations. In healthcare, the CHECK framework cut hallucinations in clinical language models from 31% to 0.3%, opening a path for compliance-ready automation in high-risk settings. Financial institutions prefer sector-tuned options such as Baichuan4-Finance, which outperforms general models on certification exams while preserving broad reasoning ability. Because accuracy drives both regulatory acceptance and ROI, firms continue allocating budgets toward fine-tuning and evaluation pipelines that squeeze incremental gains from every new model release.

Surge in conversational AI adoption in customer support

Automated agents are now resolving a majority of frontline queries, unlocking sizable labor savings. Intercom reports 86% full resolution across 45 languages after embedding Claude AI into its support stack. The Asia-Pacific conversational AI market is expanding at a 24.1% CAGR through 2032, helped by rollouts at Alibaba and HDFC Bank that serve multilingual customer bases. Teneo.ai documents USD 5.60 cost reduction for every call it automates while maintaining 95% natural-language understanding accuracy. As translation quality improves, enterprises deploy a single bot across regions rather than running siloed language teams, strengthening the business case for faster uptake.

Shortage of High-Quality, Bias-Free Training Data

Limited domain-specific datasets impede performance for specialized uses. Vietnam responded by releasing ViGPT to address local linguistic gaps. The EU AI Act further mandates bias monitoring for high-risk systems, raising compliance workloads. Healthcare and finance feel the squeeze hardest, as privacy regulations restrict usable data pools, giving firms with proprietary datasets a head start.

Other drivers and restraints analyzed in the detailed report include:

- Integration of NLP in embedded/edge devices

- Proliferation of domain-specific LLMs for regulated industries

- Escalating Inference Costs for Large Models

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cloud accounts for 63.40% of the NLP market share in 2024, and the segment is projected to log a 24.95% CAGR to 2030. Usage-based pricing and elastic compute underpin its lead as enterprises experiment with generative workloads without investing in on-prem hardware. Microsoft Azure AI services grew 157% year-over-year to surpass USD 13 billion annualized revenue. Hybrid models serve regulated industries where data residency rules persist, splitting inference between local clusters and public clouds. Edge deployments now supplement cloud for latency-sensitive tasks, leveraging smartphones whose aggregate compute rises 25% yearly. This mix suggests the NLP market will organize around workload-specific deployment rather than a single dominant mode.

Large enterprises held 57.80% of the NLP market share in 2024, sustained by data assets and in-house AI staff. Yet SMEs are expected to outpace with a 25.01% CAGR through 2030 as turnkey APIs make advanced models accessible. Studies note SMEs pivot first on customer support and document processing before scaling to advanced analytics. API-based pay-as-you-go removes upfront capital, allowing SMEs to prove ROI quickly. Conversely, large firms pour resources into custom fine-tuning, spinning internal LLM centers of excellence to navigate compliance and security. This divergence will keep the NLP industry balanced between volume growth from SMEs and high-value bespoke projects at larger corporations.

The Natural Language Processing Market Report is Segmented by Deployment (On-Premise and Cloud), Organization Size (Large Organizations and Small and Medium Enterprises [SMEs]), Component (Hardware, Software, and Services), Processing Type (Text, Speech/Voice, and Image/Vision), End-User Industry (BFSI, Healthcare and Life Sciences, IT and Telecom, Retail and E-Commerce, Manufacturing, and More), and Geography.

Geography Analysis

North America commanded 33.30% revenue in 2024 and remains the largest regional contributor. Microsoft Cloud revenue reached USD 42.4 billion in FY 2025 Q3, up 20% year-over-year, with AI services a key driver. Venture funding and an enabling regulatory setting combine to accelerate enterprise rollouts.

Asia Pacific is projected to post a 25.85% CAGR, propelled by sovereign AI programs and local-language model development. Japan's commitment to support Southeast Asian LLM capacity showcases efforts to cut reliance on foreign providers. Regional conversational AI revenue tracks at 24.1% CAGR to 2032, indicating sustained demand for multilingual customer engagement tools.

Europe advances under the EU AI Act, balancing innovation with stringent compliance. Germany's AI market climbed 25% year-on-year to EUR 10 billion in Q1 2025, with companies like Siemens achieving 90% automation in document workflows. The regulation's detailed risk tiers favor vendors able to document processes, and this supports steady though measured growth. South America and MEA remain nascent, yet rising public-cloud footprints and smart-device adoption foreshadow untapped potential for the NLP market.

- Microsoft Corp.

- Google LLC (Alphabet)

- Amazon Web Services

- IBM Corp.

- NVIDIA Corp.

- OpenAI LP

- Meta Platforms Inc.

- SAP SE

- Oracle Corp.

- Baidu Inc.

- Intel Corp.

- Qualcomm Inc.

- SAS Institute Inc.

- Adobe Inc.

- Salesforce Inc.

- Apple Inc.

- Verint Systems Inc.

- Nuance Communications (Microsoft)

- Cohere Inc.

- Hugging Face

- Grammarly Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Generative-AI-powered model accuracy gains

- 4.2.2 Surge in conversational AI adoption in customer support

- 4.2.3 Integration of NLP in embedded/edge devices

- 4.2.4 Proliferation of domain-specific LLMs for regulated industries

- 4.2.5 Rising demand for real-time speech recognition in automotive and smart devices

- 4.2.6 Multimodal foundation models unlocking new verticals

- 4.3 Market Restraints

- 4.3.1 Shortage of high-quality, bias-free training data

- 4.3.2 Escalating inference costs for large models

- 4.3.3 Cross-border data residency compliance barriers

- 4.3.4 Environmental footprint of large-scale training compute

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of COVID-19 and Macro Slowdown

- 4.9 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Deployment

- 5.1.1 On-premise

- 5.1.2 Cloud

- 5.2 By Organization Size

- 5.2.1 Large Enterprises

- 5.2.2 Small and Medium Enterprises (SMEs)

- 5.3 By Component

- 5.3.1 Hardware

- 5.3.2 Software

- 5.3.3 Services

- 5.4 By Processing Type

- 5.4.1 Text

- 5.4.2 Speech/Voice

- 5.4.3 Image/Vision

- 5.5 By End-user Industry

- 5.5.1 BFSI

- 5.5.2 Healthcare and Life Sciences

- 5.5.3 IT and Telecom

- 5.5.4 Retail and E-commerce

- 5.5.5 Manufacturing

- 5.5.6 Media and Entertainment

- 5.5.7 Education

- 5.5.8 Others

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 United Kingdom

- 5.6.3.2 Germany

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Saudi Arabia

- 5.6.5.1.2 United Arab Emirates

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Microsoft Corp.

- 6.4.2 Google LLC (Alphabet)

- 6.4.3 Amazon Web Services

- 6.4.4 IBM Corp.

- 6.4.5 NVIDIA Corp.

- 6.4.6 OpenAI LP

- 6.4.7 Meta Platforms Inc.

- 6.4.8 SAP SE

- 6.4.9 Oracle Corp.

- 6.4.10 Baidu Inc.

- 6.4.11 Intel Corp.

- 6.4.12 Qualcomm Inc.

- 6.4.13 SAS Institute Inc.

- 6.4.14 Adobe Inc.

- 6.4.15 Salesforce Inc.

- 6.4.16 Apple Inc.

- 6.4.17 Verint Systems Inc.

- 6.4.18 Nuance Communications (Microsoft)

- 6.4.19 Cohere Inc.

- 6.4.20 Hugging Face

- 6.4.21 Grammarly Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment