|

시장보고서

상품코드

1444909

세계 가축 구충제 시장 : 점유율 분석, 업계 동향과 통계, 성장 예측(2024-2029년)Livestock Dewormers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

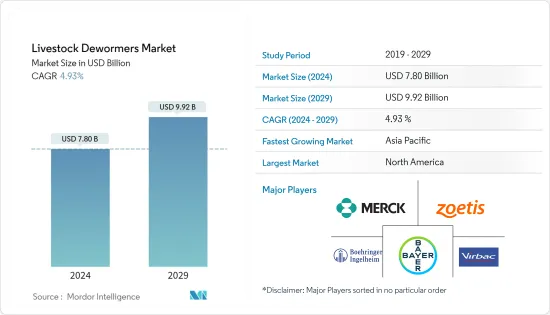

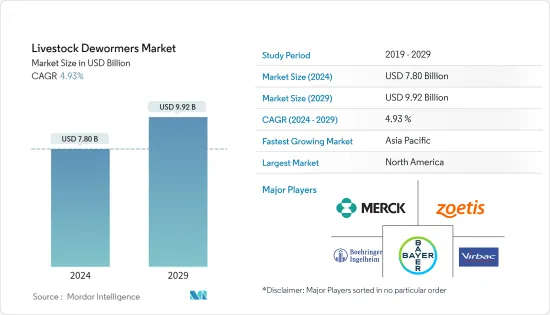

가축 구충제 시장 규모는 2024년에 78억 달러로 추정되며, 2029년까지 99억 2,000만 달러에 이를 것으로 예측되며, 예측 기간(2024-2029년) 동안 4.93%의 연평균 복합 성장률(CAGR)에서 자랍니다.

전 세계적으로 수의사가 부족하여 정기적인 구충 활동이 지연되거나 중단되었기 때문에 COVID-19는 가축 구충제 시장에 심각한 영향을 미쳤습니다. 미국 수의사회는 2021년 9월에 COVID-19의 영향으로 동물병원은 18개월 이상에 걸쳐 어려운 날을 보내고 많은 수의사가 신형 코로나 바이러스 감염이 일으키는 변화에 적응해야 한다고 보고했습니다. 감염 확대의 초기 몇 달 동안 동물 병원은 필요한 업무를 수행했기 때문에 긴급 사례만을 수용했습니다. 이것은 가축 구충제 시장에 큰 영향을 미쳤습니다. 그러나 규제가 해제되면 가축 구충제 시장이 회복되고 가축 기생충증 증가로 향후 수년간 성장할 것으로 예상됩니다.

동물의 고기와 우유를 포함한 동물 유래 식품 수요가 세계적으로 증가하고 있으며, 동물의 고기와 우유의 소비가 모든 동물의 치료 및 치료 수요와 직접 관련되어 시장 성장을 가속 예상됩니다. 질병. 예를 들어 유로스타트에 따르면 유럽 시장에서는 소, 가금류, 돼지, 양 등 연간 육류 생산량이 계속 증가하고 있다고 합니다. 유럽연합위원회의 데이터에 따르면 유럽연합의 돼지고기 생산은 2021년 첫 5개월 동안 증가했습니다. 유럽연합(EU)의 5월 돼지고기 생산량은 188만톤으로 4월부터는 1% 감소했지만 전년 대비 5%(9만6,600톤) 증가했습니다. 이 달에 도살된 청결한 돼지는 1,987만 마리로 1년 전보다 5%(94만 9,500마리) 증가했습니다. 이는 주로 소비자의 건강 의식이 높아짐에 따라 세계적으로 단백질이 풍부한 식품에 대한 수요가 높아지고 있기 때문입니다.

기생충병은 세계 동물에서 매우 흔합니다. 예를 들어, 2022년 6월에 힌다위 잡지에 게재된 기사에 따르면, 최근 농가의 광범위한 항기생충제의 사용에도 불구하고, 동물에는 여전히 기생충 감염이 존재하고 있습니다. 이 상황은 농부가 유충 감염 관리 프로그램을 효과적으로 수행하지 못했음을 나타냅니다. 이러한 연구는 농부들에게 적절한 교육을 제공할 필요성을 밝혀내어 세계에서 벌레제 수요를 증가시킵니다.

시장은 발전할 것으로 보이지만 구충제와 관련된 부작용이 시장 성장을 억제할 것으로 예상됩니다.

가축 구충제 시장 동향

암소 부문은 예측 연도에 걸쳐 더 나은 성장을 보여줄 것으로 기대됩니다.

암소 부문의 성장은 주로 세계에서 암소의 수가 많고 많은 국가 사람들의 주요 수입원으로 축산업이 지배적이기 때문입니다. 예를 들어, 농무부의 가축 및 제품 반기 보고서 - 2022년에 따르면 FAS 뉴델리(포스트)는 2021년 3억 550만 마리에 대해 3억 690만 마리의 가축 총 재고 수를 추정했습니다.

게다가 아일랜드 중앙통계국에 따르면 소의 총두수는 2021년부터 37,300마리 증가했고, 2022년에는 7,396,200마리가 되었습니다.

게다가 암소 구충에 대한 조사 연구는 이 분야의 성장을 가속할 것으로 기대됩니다. 2022년 10월에 PubMed에 게재된 논문에 따르면, 육우의 대변란수의 감소에는 에플리노멕틴과 옥스펜다졸을 동시에 투여한 경우에만 효과가 있었습니다. 모델 시뮬레이션과 살아있는 동물의 실험에 따르면 구충제의 동시 사용은 매우 효과적이며 내성을 방지합니다.

북미는 예측 기간 동안 가축 구충제 시장에서 상당한 시장 점유율을 유지할 것으로 예상

북미는 전 세계에서 가축과 동물 건강 관리 혜택을 실시하는 데 크게 기여하는 국가 중 하나입니다. 이 시장은 가축 기생충 감염의 확산과 동물 제품 수요 증가에 따른 수의학 질환 계발 프로그램 증가로 빠르게 성장하고 있습니다. 예를 들어, 2022년 10월, 캐나다 수의사 협회(CVMA)는 캐나다 전역의 수의사가 주최하는 '동물 건강 주간(AHW)'으로 명명된 연례 전국적인 계발 캠페인을 실시했습니다. 매년 AHW를 통해 수의학계는 건강에 관한 중요한 메시지에 주목을 받고 있습니다. 2022년 캠페인의 주제는 캐나다 수의사 전문가들이 전국 One Health 커뮤니티 내에서 동물의 건강을 보호하는 데 있어 자신의 입장을 차지했고, 따라서 모든 사람의 건강을 보호한다는 것을 보여주었습니다.

또한 2022년 8월에 발표된 USDA의 최신 정보에 따르면 USDA는 가금 수입이 2031년까지 1,750만 톤으로 증가할 것으로 예측했습니다. 이에 비해 돼지고기 수입은 2031년까지 1,480만 톤으로 증가할 것으로 예상되며, 쇠고기 수입은 2031년까지 1,480만 톤으로 증가할 것으로 예상됩니다. 1,430만톤. 가금류와 가축 사업의 이러한 증가에 따라 가축의 곤충 수요도 증가하여 예측 기간 동안 시장 성장을 가속합니다.

또한 2021년 3월 발행된 농무성 가축제품 반기 보고서에 따르면 2021년 멕시코 돼지 수확량은 2,080만 마리, 송아지 수확량은 2021년 816만 마리로 예측 있습니다. 이러한 가축의 식량 생산량을 높이려면 적절한 벌레가 필요합니다. 이를 통해 예측 기간 동안 시장 성장을 가속합니다.

가축 구충제 산업 개요

가축 구충제 시장은 적당히 경쟁적이며 시장에는 여러 국제 기업이 있습니다. 가축 구충제 시장의 세계 기업은 Bayer AG, Boehringer Ingelheim GmbH, Durvet Inc, Elanco, First Priority Inc, Jeffers Inc, Manna Pro Products, LLC, Merck & Co Inc, Virbac 및 Zoetis Inc입니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인

- 가축에서 기생충증의 유병률 증가

- 동물 유래 식품 수요 증가

- 시장 성장 억제요인

- 구충제에 수반하는 부작용

- Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자의 협상력

- 공급기업의 협상력

- 대체 제품의 위협

- 경쟁 기업간 경쟁 관계의 격렬

제5장 시장 세분화

- 동물 유형별

- 소

- 돼지

- 가금류

- 기타 동물 유형

- 투여 방법별

- 경구

- 국소

- 기타 투여 방법

- 지역

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 기타 아시아태평양

- 중동 및 아프리카

- GCC

- 남아프리카

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 경쟁 구도

- 기업 프로파일

- Bayer AG

- Boehringer Ingelheim GmbH

- Durvet, Inc.

- Elanco

- First Priority, Inc.

- Jeffers, Inc.

- Manna Pro Products, LLC

- Merck & Co Inc.

- Virbac

- Zoetis Inc.

제7장 시장 기회와 미래 동향

JHS 24.03.20The Livestock Dewormers Market size is estimated at USD 7.80 billion in 2024, and is expected to reach USD 9.92 billion by 2029, growing at a CAGR of 4.93% during the forecast period (2024-2029).

COVID-19 had a significant impact on the livestock dewormers market since routine deworming activities were delayed or canceled due to the unavailability of veterinary doctors around the globe. The American Veterinary Medical Association reported that in September 2021, due to COVID-19, veterinary clinics had a challenging 18+ months, and many veterinarians were forced to adapt to the changes it caused. In the early months of the outbreak, veterinary clinics only received urgent cases because they were operating as required businesses. This significantly impacted the livestock dewormers market. However, as the restrictions were lifted, the livestock dewormers market bounced back and is expected to witness growth in the coming years due to an increase in parasitic diseases in livestock animals.

The rise in demand for animal-based food products, including animal meat and milk, all across the globe is expected to fuel the market growth, owing to the direct association of animal meat and milk consumption with the demand for treatment and cure of any animal disease. For instance, according to Eurostat, the annual meat production, such as bovine, poultry, pigs, and sheep, has constantly been increasing in the European market. European Union pork production grew in the first five months of 2021, according to data from the European Union Commission. The European Union produced 1.88 million tonnes of pork in May, down 1% from April but up 5% (96,600 tonnes) year-on-year. 19.87 million clean pigs were slaughtered during the month, 5% (949,500 head) more than a year ago. This is due to the growing demand for protein-rich food, primarily driven by the rise in health consciousness among consumers, globally.

Parasitic diseases are quite common in animals around the world. For instance, as per an article published in June 2022 in Hindawi, helminthic infections were still present in the animals despite the widespread use of broad-spectrum antiparasitic medications by farmers in recent years. This circumstance demonstrated the farmers' failure to effectively implement helminthic infection management programs. Such studies throw light on the need to provide proper education to farmers and thereby increase the demand for dewormers across the globe.

While the market looks to develop, side effects associated with dewormers are expected to restrain the market growth.

Livestock Dewormers Market Trends

The Cattle Segment is Expected to Show Better Growth Over the Forecast Years

The growth of the cattle segment is mainly attributed to the high population of cattle across the world and the dominance of cattle farming as a major income source for people in many countries. For instance, as per the Livestock and Products Semi-annual - 2022 by USDA, FAS New Delhi (Post) estimated the total cattle stock number to be 306.9 million head, as compared to 305.5 million heads in 2021.

Furthermore, per the Central Statistics Office Ireland Crops and Livestock, the total cattle numbers were up by 37,300 from 2021 to 7,396,200 in 2022.

Moreover, research studies involving cattle deworming are expected to boost segment growth. As per an article published in October 2022 in PubMed, only the concurrent application of both eprinomectin and oxfendazole was effective at reducing fecal egg counts in beef cattle. The simultaneous use of anthelmintics is extremely effective and prevents resistance, according to model simulations and experiments on live animals.

North America is Anticipated to Hold a Significant Market Share in the Livestock Dewormers Market Over the Forecast Period

North America is among the major contributors to livestock and the implementation of animal healthcare benefits across the globe. The market is growing rapidly due to the increasing prevalence of livestock worm infection and the rise in veterinary disease awareness programs coupled with the growing demand for animal products. For instance, in October 2022, the Canadian Veterinary Medical Association (CVMA) conducted an annual national public awareness campaign named 'Animal Health Week (AHW)' hosted by veterinarians across Canada. Each year, through AHW, the veterinary community draws attention to an important health-related message. The 2022 campaign's theme displayed how Canada's veterinary professionals occupy unique positions within the national One Health community in protecting animal health which, in turn, protects everyone's health.

Furthermore, per the USDA update published in August 2022, USDA projects poultry imports to grow to 17.5 million metric tons by 2031. In comparison, pork imports are projected to increase to 14.8 million metric tons by 2031, and beef imports are expected to rise to 14.3 million metric tons. With such an increase in poultry and livestock businesses, demand for deworming livestock also rises and thereby boosting the market growth over the forecast period.

Moreover, as per the USDA Livestock and Products semi-annual report published in March 2021, Mexico's pig crop for 2021 stands at 20.8 million heads and calf crop was projected at 8.16 million heads in 2021. Such a rise in livestock food production demands proper deworming and thereby drives the market growth over the forecast period.

Livestock Dewormers Industry Overview

The market for livestock dewormers is moderately competitive, and there are several international companies in the market. The global players in the livestock dewormers market are Bayer AG, Boehringer Ingelheim GmbH, Durvet Inc, Elanco, First Priority Inc, Jeffers Inc, Manna Pro Products, LLC, Merck & Co Inc, Virbac, and Zoetis Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rise in Prevalence of Parasitic Diseases in Livestock Animals

- 4.2.2 Growth in Demand for Animal-based Food Products

- 4.3 Market Restraints

- 4.3.1 Side Effects Associated with Dewormers

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD Million)

- 5.1 By Animal Type

- 5.1.1 Cattle

- 5.1.2 Swine

- 5.1.3 Poultry

- 5.1.4 Other Animal Types

- 5.2 By Mode of Administration

- 5.2.1 Oral

- 5.2.2 Topical

- 5.2.3 Other Modes of Administration

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Bayer AG

- 6.1.2 Boehringer Ingelheim GmbH

- 6.1.3 Durvet, Inc.

- 6.1.4 Elanco

- 6.1.5 First Priority, Inc.

- 6.1.6 Jeffers, Inc.

- 6.1.7 Manna Pro Products, LLC

- 6.1.8 Merck & Co Inc.

- 6.1.9 Virbac

- 6.1.10 Zoetis Inc.