|

시장보고서

상품코드

1687813

아세틸렌 : 시장 점유율 분석, 산업 동향, 성장 예측(2025-2030년)Acetylene - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

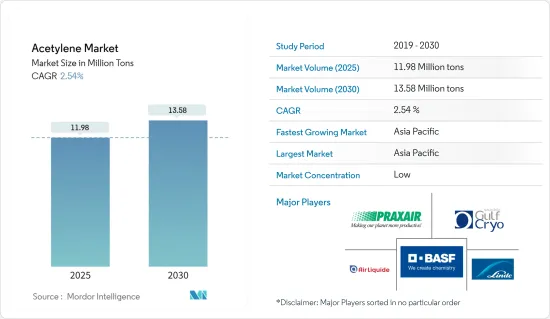

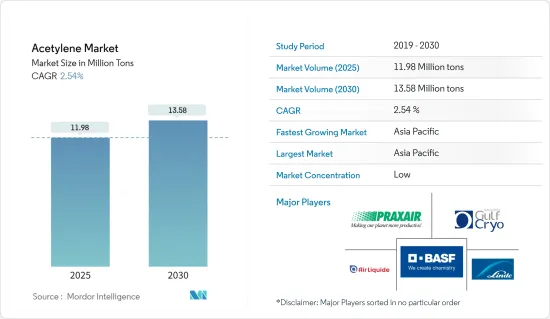

아세틸렌 시장 규모는 2025년에 1,198만 톤, 2030년에는 1,358만 톤에 이를 것으로 예측되며, 예측기간(2025-2030년)의 CAGR은 2.54%를 나타낼 전망입니다.

아세틸렌 시장은 COVID-19에 의한 어려움을 겪었습니다. 세계 봉쇄와 엄격한 정부 규정으로 인해 생산 기지가 광범위하게 폐쇄되었습니다. 그러나 시장은 2021년에 회복되어 향후 몇 년간은 큰 성장이 예상됩니다.

주요 하이라이트

- 단기적으로는 금속가공산업 수요 증가와 화학 부문 수요 증가가 조사 대상 시장 수요를 견인하는 주요 요인입니다.

- 그러나 아세틸렌의 유해한 영향으로 인한 엄격한 환경 규제와 용접 및 절단 용도에서의 아세틸렌의 대체가 시장 성장을 방해할 것으로 예상됩니다.

- 그럼에도 불구하고, 다양한 과학 연구에 아세틸렌 가스의 응용은 조사 대상 시장에 새로운 기회를 가져올 것으로 예상됩니다.

- 아시아태평양은 중국과 인도 수요가 대부분을 차지하며 전 세계적으로 시장을 독점할 것으로 예상됩니다.

아세틸렌 시장 동향

금속가공부문이 시장을 독점할 전망

- 매우 가연성이 높은 가스인 아세틸렌은 다양한 금속 가공 공정에서 매우 중요합니다. 그 명확한 특성으로 인해 많은 산업 용도에 최적의 연료 가스가 되었습니다.

- 주로 아세틸렌은 옥시 아세틸렌 절단, 열처리 및 용접에 사용됩니다. 또한 화학가공산업에서는 아세트알데히드, 아세트산, 무수아세트산 등의 유기 화합물을 합성하는 원료로서 벌크 아세틸렌이 사용됩니다.

- 아세틸렌은 삼중 결합 구조를 가지므로 가스에서 가장 높은 연소 온도를 가지고 있습니다. 산소와 함께 연소하면 아세틸렌의 화염 온도는 3090℃에 도달하여 54.8kJ/리터의 에너지를 방출합니다. 이 높은 화염 온도는 절단, 용접, 납땜, 납땜 등의 금속 가공 작업에 아세틸렌을 빼놓을 수 없는 것으로 하고 있습니다.

- 이러한 금속 가공 용도는 자동차, 항공우주, 금속 가공, 제약, 유리 등 다양한 최종 사용자 산업에서 유용합니다.

- 세계철강협회(worldsteel)의 데이터에 따르면 2023년 12월 세계의 조강 생산량은 1억 3,570만톤(Mt)으로 11월에서 6.3% 감소했습니다. 2024년 7월까지의 생산량은 1억 5,280만톤(Mt)으로 회복했지만, 이는 2023년 7월부터 4.7% 감소했습니다. 이 수치는 업계의 과제를 부각하고 있지만, 신흥국이 인프라 프로젝트를 활발하게 하고 있으며, 철강 수요의 회복이 전망되고 있습니다.

- Ambattur Industrial Estate Manufacturers Association(AIEMA)의 보고서에 따르면 인도의 공작기계 산업은 2023년 전년 대비 14-15% 성장할 것으로 추정되고 있습니다. AIEMA는 향후 3년간 공작기계 부문의 성장률을 12-17%로 예측했습니다. 이러한 성장은 금속 가공 용도 수요를 증폭시켜 시장 확대를 촉진합니다.

- 또한 중국과 미국과 같은 국가에서 철강 생산 능력을 강화하면 세계 철강 생산을 강화하고 금속 가공 응용 분야에 대한 수요를 더욱 촉진하며 시장 성장을 지원합니다.

- 세계철강협회에 따르면 2024년 7월 일본의 철강 생산량은 7.1톤으로 전년 동월 대비 3.8% 감소했습니다. 누계에서는 49.8톤으로 전년 동월 대비 2.8%의 감소가 되었습니다.

- 세계 4위의 조강 생산국인 미국은 2024년 7월 생산량을 6.9Mt로 보고하여 2.1%의 소폭 증가했습니다. 그러나 세계철강협회에 따르면 연간 누계 생산량은 4,690만톤으로 1.8% 감소를 보였습니다.

- AMT(미국제조기술협회)의 미국제조기술 수주 보고에서 강조된 바와 같이, 2023년 12월에는 공작기계의 신규 수주가 급증했습니다. 제조업체는 금속 절삭 및 금속 성형/가공 기계에 4억 9,103만 달러를 투자하여 2023년 11월보다 21.7%, 2022년 12월보다 11.9% 증가했습니다. 2024년 2월의 제조기술(공작기계)의 수주액은 3억 4,330만 달러에 달하고, 2024년 1월부터 2.1% 증가했습니다. 게다가 2024년 2월 제조기술(공작기계) 수주는 3억 4,330만 달러에 이르렀으며 2024년 1월에 비해 2.1% 증가했습니다.

- 2024년 7월 독일의 철강 생산량은 3.1Mt로 추정되어 4.8% 증가를 보였습니다. 세계철강협회의 데이터에 따르면 독일의 연간 생산량은 2,250만 톤에 이르렀고, 4.5%의 현저한 성장을 보였습니다.

- 2024년 7월 브라질 생산량은 3.1톤으로 11.6% 증가했습니다. 세계철강협회의 보고에 따르면 브라질의 연간 생산량은 19.4Mt로 3.3% 증가했습니다.

- 금속 가공에 있어서의 아세틸렌의 용도가 증가하고 있기 때문에 아세틸렌 시장은 예측 기간 중에 성장할 것으로 보입니다.

아시아태평양이 시장을 독점할 전망

- 아시아태평양은 아세틸렌 시장을 선도하고 예측 기간 동안 가장 급성장하는 지역이 될 전망입니다. 이 급성장의 주요 요인은 중국, 인도, 한국, 일본, 동남아시아 국가를 중심으로 금속 가공 및 화학 원료 등 다양한 용도에 대한 수요 증가입니다.

- 아세틸렌은 염화비닐 단량체, 아크릴로니트릴, 비닐 아세테이트, 비닐 에테르, 아세트알데히드, 1,2-디클로로에탄, 1,4-부틴 디올, 아크릴산 에스테르, 폴리아세틸렌, 폴리디아세틸렌 등 필수 화학물질의 생산에 있어 매우 중요한 역할을 합니다. 아시아태평양이 화학산업에서 가장 큰 시장이라는 점을 감안할 때 아세틸렌 시장에는 큰 가능성이 있습니다.

- 세계의 화학 가공 허브인 중국은 세계의 화학제품 생산을 지배하고 있습니다. 다양한 화학물질에 대한 세계 수요가 증가함에 따라, 아세트산과 같은 중간체에 대한 이 섹터의 요구는 예측 기간 동안 크게 상승할 것으로 예상됩니다.

- 중국은 화학 분야의 가장 큰 손으로서뿐만 아니라 가장 급성장하는 시장 중 하나로도 두드러집니다. VCI(Association of the Chemical Industry eV)의 데이터는 중국이 2023년 세계 석유화학제품 수출의 12.8%를 차지하는 등 중국의 역할이 큽니다.

- 세계 유수의 철강 생산국인 중국 역시 친환경 철강 생산방법을 조종하고 있습니다. 중국의 철강 생산량은 2024년 7월에 9.0% 감소하여 8,290만 톤이 되었습니다. 세계철강협회에 따르면 누계생산량은 6억 1,370만톤으로 2023년부터 2.2% 감소했습니다.

- 인베스트 인디아의 데이터에 따르면 2022-23년의 화학 및 화학제품(의약품 및 비료 제외)의 수출은 수출 전체의 10.5%를 차지하고 2021-22년의 11.7%에서 감소했습니다. 2023년 12월 현재 이 분야는 2023-24 회계 연도의 총 수출에 10% 기여하고 있습니다.

- BigMint에 따르면 인도의 철강 생산량은 전년대비 6% 가까이 증가하고 2024, 2025년 말(2025년 3월기)에는 1억 5,200만 톤에 달할 것으로 예측되고 있습니다. 이 예측 생산량의 대부분은 고로를 이용하는 제철소에 의한 것으로 예상되고 있습니다.

- 또한 경제복합관측소(OEC)의 데이터는 한국의 유기화학제품 수출의 대폭적인 증가를 강조하고 있습니다. 2023년 5월부터 2024년 5월까지 수출은 7,660만 달러로 급증하여 17억 3,000만 달러에서 18억 1,000만 달러로 4.42% 증가했습니다. 이 성장은 이 부문의 주목도가 높아지고 있음을 강조하고 시장 수요 증가의 무대를 정비하고 있습니다.

- 또한 말레이시아 통계국(DOSM)의 보고에 따르면 말레이시아의 화학 및 화학제품 수출은 2024년 5월에 전년 동월 대비 0.8% 증가한 63억 1,000만 MYR(약 13억 4,000만 달러)에 달했습니다. 이 성장은 말레이시아 전체 무역의 침체가 바닥을 쳤다는 것을 보여줍니다. 2024년 5월 전체 화학제품 수출은 전년 동월 대비 7.3% 증가한 1,282억 MYR(약 272억 2,000만 달러)으로 급증했으며, 수입은 13.8% 증가한 1,181억 MYR(약 250억 8,000만 달러)이 되었습니다. 이러한 화학 분야의 견고한 성장은 아세틸렌 시장 수요를 높일 것으로 보입니다.

- 이 지역의 산업이 급성장하고 있기 때문에 아세틸렌 시장은 앞으로 몇 년동안 크게 성장할 것으로 보입니다.

아세틸렌 산업 개요

아세틸렌 시장은 세분화되어 있습니다. 주요 기업(특별한 순서 없이)에는 BASF SE, Praxair Technology Inc., Gulf Cryo, Linde PLC, Air Liquide 등이 있습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 성장 촉진요인

- 금속가공산업에서의 수요확대

- 화학 분야로부터 수요 증가

- 기타 촉진요인

- 억제요인

- 아세틸렌의 유해한 영향에 의한 엄격한 환경 규제

- 용접 및 절단 용도에 있어서의 아세틸렌의 대체 물질

- 기타 억제요인

- 산업 밸류체인 분석

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁도

제5장 시장 세분화

- 용도

- 금속가공

- 화학 원료

- 기타 용도

- 지역

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 말레이시아

- 태국

- 인도네시아

- 베트남

- 기타 아시아태평양

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 북유럽 국가

- 터키

- 러시아

- 기타 유럽

- 남미

- 브라질

- 아르헨티나

- 콜롬비아

- 기타 남미

- 중동 및 아프리카

- 사우디아라비아

- 카타르

- 아랍에미리트(UAE)

- 나이지리아

- 이집트

- 남아프리카

- 기타 중동 및 아프리카

- 아시아태평양

제6장 경쟁 구도

- M&A, 합작사업, 제휴, 협정

- 시장 점유율(%)**, 랭킹 분석

- 주요 기업의 전략

- 기업 프로파일

- Air Liquide

- Air Products And Chemicals Inc.

- Asia Technical Gas Co Pte Ltd.

- Axcel Gases

- BASF SE

- Butler Gas Products

- Denka Company Limited

- Gruppo SIAD

- Gulf Cryo

- Jinhong Gas Co. Ltd.

- Koatsu Gas Kogyo Co. Ltd.

- Linde PLC

- Nippon Sanso Holdings Corporation

- NOL Group

- Pune Air Products

- TOHO ACETYLENE Co.

- Transform Materials

제7장 시장 기회와 앞으로의 동향

- 다양한 과학 연구에 아세틸렌 가스의 응용

- 기타 기회

The Acetylene Market size is estimated at 11.98 million tons in 2025, and is expected to reach 13.58 million tons by 2030, at a CAGR of 2.54% during the forecast period (2025-2030).

The acetylene market faced setbacks due to COVID-19. Global lockdowns and stringent government regulations led to widespread shutdowns of production hubs. However, the market rebounded in 2021 and is projected to see significant growth in the upcoming years.

Key Highlights

- Over the short term, growing demand from the metalworking industry and increasing demand from the chemical sector are the major factors driving the demand for the market studied.

- However, stringent environmental regulations due to the harmful effects of acetylene and alternatives of acetylene in welding and cutting applications are expected to hinder the market's growth.

- Nevertheless, the application of acetylene gas for various scientific research is expected to create new opportunities for the market studied.

- Asia-Pacific region is expected to dominate the market across the world, with the majority of demand coming from China and India.

Acetylene Market Trends

Metalworking Segment is Expected to Dominate the Market

- Acetylene, a highly flammable gas, is pivotal in various metalworking processes. Its distinct properties render it an optimal fuel gas for numerous industrial applications.

- Primarily, acetylene is utilized in oxyacetylene cutting, heat treating, and welding. Additionally, the chemical processing industry employs bulk acetylene as a raw material to synthesize organic compounds like acetaldehyde, acetic acid, and acetic anhydride.

- Acetylene's triple-bond structure grants it the highest flame temperature among gases. When combusted with oxygen, acetylene reaches a flame temperature of 3090°C (5594°F), releasing an energy of 54.8 kJ/liter. This elevated flame temperature is what makes acetylene indispensable for metalworking tasks such as cutting, welding, soldering, and brazing.

- These metalworking applications find utility across diverse end-user industries, including automotive, aerospace, metal fabrication, pharmaceuticals, and glass.

- As per the data from the World Steel Association (worldsteel), global crude steel production was 135.7 million tonnes (Mt) in December 2023, down 6.3% from November. By July 2024, production rebounded to 152.8 million tonnes (Mt), though this was a 4.7% dip from July 2023. These figures highlight the industry's challenges, but with emerging economies ramping up infrastructure projects, a steel demand recovery is anticipated.

- As reported by the Ambattur Industrial Estate Manufacturers Association (AIEMA), India's machine tools industry was estimated to grew by 14-15% in 2023 compared to the previous year. Looking ahead, AIEMA forecasts a growth rate of 12-17% for the machine tools sector over the next three years. Such growth is set to amplify the demand for metalworking applications, subsequently propelling the market's expansion.

- Additionally, enhanced steel production capacities in countries like China and the United States have bolstered global steel output, further driving the demand for metalworking applications and supporting the market's growth.

- As per the World Steel Association, Japan's steel production in July 2024 stood at 7.1 Mt, marking a 3.8% decline from the same month in 2023. Year-to-date figures show a production of 49.8 Mt, reflecting a 2.8% year-on-year drop.

- The United States, ranked as the fourth-largest producer of crude steel globally, reported a production of 6.9 Mt in July 2024, witnessing a modest increase of 2.1%. However, the year-to-date production figures were at 46.9 Mt, indicating a decline of 1.8%, as per the World Steel Association.

- As highlighted in the United States Manufacturing Technology Orders report by AMT-the Association For Manufacturing Technology-December 2023 saw a surge in new machine tool orders. Manufacturers invested USD 491.03 million in metal-cutting and metal-forming/fabricating machinery, reflecting a 21.7% rise from November 2023 and an 11.9% increase from December 2022. In February 2024, orders for manufacturing technology (machine tools) reached USD 343.3 million, marking a 2.1% uptick from January 2024. Furthermore, in February 2024, manufacturing technology (machine tools) orders reached USD 343.3 million, indicating an increase of 2.1% compared to January 2024.

- Germany's steel production in July 2024 was estimated at 3.1 Mt, showcasing a 4.8% increase. Year-to-date, Germany's production reached 22.5 Mt, marking a notable 4.5% rise, according to World Steel Association data.

- Brazil led with the most significant growth, producing 3.1 Mt in July 2024, an impressive 11.6% increase. Year-to-date, Brazil's production stood at 19.4 Mt, up by 3.3%, as reported by the World Steel Association.

- Given the rising applications of acetylene in metalworking, the market for acetylene is set to witness growth over the forecast period.

The Asia-Pacific Region is Expected to Dominate the Market

- Asia-Pacific is poised to lead the acetylene market, emerging as the region with the fastest growth during the forecast period. This surge is primarily fueled by rising demands in diverse applications, including metalworking and as a chemical raw material, particularly in nations like China, India, South Korea, Japan, and several Southeast Asian countries.

- Acetylene plays a pivotal role in producing essential chemicals, including vinyl chloride monomer, acrylonitrile, vinyl acetate, vinyl ether, acetaldehyde, 1,2-dichloroethane, 1,4-butynediol, acrylate esters, polyacetylene, and polydiacetylene. Given that Asia-Pacific boasts the largest market for the chemical industry, there's vast potential for the acetylene market to flourish.

- China, a global chemical processing hub, dominates worldwide chemical production. As global demand for various chemicals rises, this sector's need for intermediates, such as acetic acid, is projected to see a significant uptick during the forecast period.

- China stands out not only as the largest player in the chemical arena but also as one of its fastest-growing markets. Data from VCI (Association of the Chemical Industry e.V.) highlights China's significant role, with the nation accounting for 12.8% of global petrochemical exports in 2023.

- China, the world's leading iron and steel producer, is also pivoting towards eco-friendly steel production methods. While serving both domestic and international markets, China's steel output saw a 9.0% decline in July 2024, totaling 82.9 million tonnes (Mt). Year-to-date figures indicate a production of 613.7 Mt, marking a 2.2% drop from 2023, as per the World Steel Association.

- Data from Invest India highlights that exports of chemicals and chemical products (excluding pharmaceuticals and fertilizers) accounted for 10.5% of total exports in 2022-23, down from 11.7% in 2021-22. As of December 2023, this segment contributed 10% to total exports for the 2023-24 fiscal year.

- According to BigMint, India's steel production is projected to grow by nearly 6% year-on-year, reaching 152 million tons by the close of FY2024/2025 (ending March 2025). The bulk of this projected output is anticipated to stem from steel mills utilizing blast furnaces.

- Furthermore, data from the Observatory of Economic Complexity (OEC) highlights a significant rise in South Korea's organic chemical exports. From May 2023 to May 2024, exports jumped by USD 76.6 million, a 4.42% increase from USD 1.73 billion to USD 1.81 billion. This growth underscores the sector's rising prominence and sets the stage for increased market demand.

- Additionally, the Department of Statistics Malaysia (DOSM) reports that Malaysia's chemical and chemical product exports grew by 0.8% year-on-year to MYR 6.31 billion (~USD 1.34 billion) in May 2024. This growth comes as signs indicate a bottoming out of the nation's overall trade weakness. Overall chemicals exports surged by 7.3% year-on-year to MYR 128.2 billion (~USD 27.22 billion) in May 2024, while imports rose by 13.8% to MYR 118.1 billion (~USD 25.08 billion). Such robust growth in the chemical sector is set to bolster demand in the acetylene market.

- Given the burgeoning industries in the region, the acetylene market is poised for significant growth in the coming years.

Acetylene Industry Overview

The acetylene market is fragmented in nature. The major players (not in any particular order) include BASF SE, Praxair Technology Inc., Gulf Cryo, Linde PLC, and Air Liquide, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand from the Metalworking Industry

- 4.1.2 Increasing Demand from the Chemical Sector

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Stringent Environmental Regulations Due to the Harmful Effects of Acetylene

- 4.2.2 Alternatives of Acetylene in Welding And Cutting Applications

- 4.2.3 Other Restraints

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Application

- 5.1.1 Metal Working

- 5.1.2 Chemical Raw Materials

- 5.1.3 Other Applications

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Malaysia

- 5.2.1.6 Thailand

- 5.2.1.7 Indonesia

- 5.2.1.8 Vietnam

- 5.2.1.9 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 France

- 5.2.3.4 Italy

- 5.2.3.5 Spain

- 5.2.3.6 Nordic Countries

- 5.2.3.7 Turkey

- 5.2.3.8 Russia

- 5.2.3.9 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Colombia

- 5.2.4.4 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 Qatar

- 5.2.5.3 United Arab Emirates

- 5.2.5.4 Nigeria

- 5.2.5.5 Egypt

- 5.2.5.6 South Africa

- 5.2.5.7 Rest of Middle-East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Air Liquide

- 6.4.2 Air Products And Chemicals Inc.

- 6.4.3 Asia Technical Gas Co Pte Ltd.

- 6.4.4 Axcel Gases

- 6.4.5 BASF SE

- 6.4.6 Butler Gas Products

- 6.4.7 Denka Company Limited

- 6.4.8 Gruppo SIAD

- 6.4.9 Gulf Cryo

- 6.4.10 Jinhong Gas Co. Ltd.

- 6.4.11 Koatsu Gas Kogyo Co. Ltd.

- 6.4.12 Linde PLC

- 6.4.13 Nippon Sanso Holdings Corporation

- 6.4.14 NOL Group

- 6.4.15 Pune Air Products

- 6.4.16 TOHO ACETYLENE Co.

- 6.4.17 Transform Materials

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Application of Acetylene Gas for Various Scientific Research

- 7.2 Other Opportunities